Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1967 01 25

Caricato da

neo2690 valutazioniIl 0% ha trovato utile questo documento (0 voti)

17 visualizzazioni11 pagineTitolo originale

1967.01.25

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

17 visualizzazioni11 pagine1967 01 25

Caricato da

neo269Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 11

Burrezt Partnersuip, Lrp.

9 E.Dorverr, Onrmat Pastas

Jone 3

January 25, 1967

The First Decade

‘The Partnership had its tenth anniversary during 1966. The celebration

was appropriate - an all-time record (both past and future) was established

for our performance margin relative to the Dow. Our advantage was 36

points which resulted from a plus 20.4% for the Partnership and a minus

15, 6% for the Dow,

This pleasant but non-repeatable experience was partially due toa lackluster

performance by the Dow. Virtually all investment managers outperformed

it during the year, The Dow is weighted by the dollar price of the thirty

stocks involved. Several of the highest priced components, which thereby

carry disproportionate weight (duPont, General Motors), were particularly

poor performers in 1966. This, coupled with the general aversion to

conventional blue chips, caused the Dow to suffer relative to general invest-

ment experience, particularly during the last quarter.

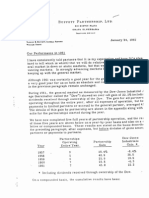

The following summarizes the year-by-year performance of the Dow, the

performance of the Partnership before allocation (one quarter of the excess

over 6%) to the general partner, and the results for limited partners:

Overall Results Partnership Limited Partners'

Year From Dow (1) Results (2) Results (3)

1857 > 8.4% +10.4% + 8.3%

1958 +38.5 +40.9 $32.2

1959 +20,0 +25.8 +20.9

1960 - 6.2 +22.8 +18.6

1961 #22.4 +45.9 $35.9

1962 = 1.6 +13.9 +11.8

1963, +20.6 +38.7 430.5

1964 +18.7 427.8 Gots

1965 414.2 +47,2 +36.8

1966 715.6 +20.4 +16.8

(See next page for footnotes to table.)

q)

(2)

a)

Based on yearly changes in the value of the Dow plus dividends

that would have been received through ownership of the Dow during

that year. The table includes all’ complete years of partnership

activity.

For 1957-61 consists of combined results of all predecessor

Limited partnerships operating throughout the entire year after all

expenses, but before distributions to partners or allocations to the

general partner.

For 1987-61 computed on the basis of the preceding column of

partnership results allowing for allocation to the general partner

based upon the present partnership agreement, but before monthly

withdrawals by limited partners.

On a cumulative or compounded basis, the reoults are:

Overall Results Partnership Limited Partners*

Year From Dow Results Results

1957 - 8.4% + 10.4% + 8.3%

1957-8 + 26.9 + 55.6 + 44.5

1957-8 + 52.3 + 95.9 +747

1857-60 + 42.8 + 140.6 +107,2

1957-61 +748 + 251.0 +181.6

1857-62 + 61.6 + 299.8 +215.1

1957-63 + 84.9 + 454.5 +311,2

1857-64 4131.3 + 608.7 +402.8

1957-65 +164.1 + 043.2 +588.5

1857-66 4122.9 +1156.0 +704.2

Annual Com-

pounded Rate 8.3 28.8 23,2

Investment Companies

On the following page {s the usual tabulation showing the resulte of the two

largest open-end investment compantes (mutual funds) that follow a policy

of being, typically, 85-100% invested in common stocks, and the two

largest diversified closed-end investment companies.

Mass Inv. Investors

Limite

Year Trust (1) Stock (1) Lehman (2) Tri-Cont. (2) Dow — Partner

1987 “11.4% w12.4% -11.4% = 2.4% = 8.4% + 9.3%

1958 442.7 +475 +40.8 $33.2 438.5 $32.2

1959 + 8.0 +10.3 +B. + 8.4 +20.0 #20.9

is6r -1.0 + 0.6 +25 + 2.8 = 6.2 +186

1961 425.6 424.9 +23.6 422.5 422.4 +35.9

1962 - 8.8 13.4 14.4 -10.0 +16 411.9

1963 +20.0 +16.5 +23.7 +18.7 +206 +30.5

1964 +15.9 414.3 414.0 +13.6 418.7 #22,3

1965 +10.2 + 9.8 +19.0 +L 414.2 436.9

1866 17 -10.0 - 2.6 - 6.9 -15.6 416.8

Cumulative

results 4118.6 +101.6 +138.9 4122.8 4122.9 © +704.2

Annual

compounded

rate 8.1 13 a1 8.3 8.3 23.2

Computed from changes in asset value plus any distributions to holders

of record during year.

From 1966 Moody's Bank & Finance Manual for 1957-1968. Estimated

for 1966.

These investment company performance figures have been regularly

reported here to show that the Dow {s no patsy as an investment standard,

It should again be emphasized that the companies were not selected on the

basis of comparability to Buffett Partnership, Ltd. There are important

differences including: (1) investment companies operate under both

internally and externally (mposed restrictions on their nvestment actions

that are not applicable to us; (2) investment companies diversify far more

than we do and, in all probability, thereby have less chance for a really

bad performance relative to the Dow in single year; and (3) their managers

have considerably less incentive for abnormal performance and greater

incentive for conventionality.

However, the records above do reveal what well-regarded, highly paid,

full-time professional investrnent managers have been able to accomplish

while working with common stocks, These managers have been favorites

of American investors (more than 600,000) making free choices among many

alternatives in the investment management field, It s probable that their

results are typical of the overwhelming majority of professional investment

managers.

Potrebbero piacerti anche

- 1969 01 22Documento9 pagine1969 01 22neo269Nessuna valutazione finora

- 1968 01 24Documento7 pagine1968 01 24Alex PutuhenaNessuna valutazione finora

- 1967 07 12Documento4 pagine1967 07 12neo269Nessuna valutazione finora

- 1967 11 01Documento2 pagine1967 11 01neo269Nessuna valutazione finora

- 1968 07 11Documento5 pagine1968 07 11neo269Nessuna valutazione finora

- 1968 11 01Documento2 pagine1968 11 01neo269Nessuna valutazione finora

- 1969 05 29Documento4 pagine1969 05 29neo269Nessuna valutazione finora

- 1967 10 09Documento6 pagine1967 10 09neo269Nessuna valutazione finora

- 1966 11 01Documento3 pagine1966 11 01neo269Nessuna valutazione finora

- 1965 11 01Documento2 pagine1965 11 01neo269Nessuna valutazione finora

- 1966 01 20Documento14 pagine1966 01 20neo269Nessuna valutazione finora

- 1964 01 18Documento15 pagine1964 01 18neo269Nessuna valutazione finora

- 1966 07 12Documento6 pagine1966 07 12neo269Nessuna valutazione finora

- 1965 07 09Documento5 pagine1965 07 09neo269Nessuna valutazione finora

- 1965 01 18Documento14 pagine1965 01 18neo269Nessuna valutazione finora

- 1964 07 08Documento5 pagine1964 07 08valueinvestinghqNessuna valutazione finora

- 1963 01 18Documento13 pagine1963 01 18neo269Nessuna valutazione finora

- 1962 12 24Documento2 pagine1962 12 24neo269Nessuna valutazione finora

- 1961 07 22Documento3 pagine1961 07 22neo269Nessuna valutazione finora

- 1963 11 06Documento2 pagine1963 11 06neo269Nessuna valutazione finora

- 1963 12 26Documento2 pagine1963 12 26neo269Nessuna valutazione finora

- 1963 07 10Documento7 pagine1963 07 10neo269Nessuna valutazione finora

- 1962 07 06Documento7 pagine1962 07 06neo269Nessuna valutazione finora

- 1961 01 30Documento8 pagine1961 01 30neo269Nessuna valutazione finora

- 1959 02 11Documento4 pagine1959 02 11neo269Nessuna valutazione finora

- 1960 02 20Documento3 pagine1960 02 20neo269Nessuna valutazione finora

- 1962 01 24Documento11 pagine1962 01 24neo269Nessuna valutazione finora