Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1962 01 24

Caricato da

neo2690 valutazioniIl 0% ha trovato utile questo documento (0 voti)

9 visualizzazioni11 pagineTitolo originale

1962.01.24

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

9 visualizzazioni11 pagine1962 01 24

Caricato da

neo269Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 11

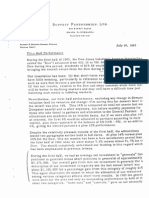

Burretr Partwersuip, LTD.

omama o1,xrnmanca

Wannan B,Borrert, Gormat Parra January 24, 1962

Wirt Seorr

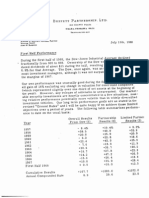

Our Performance in 1961

Lhave consistently told partners that it is my expectation and hope (it's alwa;

hard to tell which is which) that we will do relatively well compared to the g¢

era] market in down or static markets, but that we may not look 60. good in e

vancing markets. In strongly advancing markets I expect to have real difficy

keeping up with the general market.

‘Although 1961 was certainly a good year for the general market and, in addi

a very good year for us on both an absolute and relative basis, the expectati

in the previous paragraph remain unchanged.

During 1961, the general market a6 measured by the Dow-Jonee Industrial /

age (hereinafter called the “Dow") showed an over-all gain of 22.2% includir

dividends received through ownership of the Dow. The gain for all partners

operating throughout the entire year, after all expenses of operation, but be

payments to limited partners or accrual to the general partner, averaged 4

‘The details of thie gain by partnership are shown in the appendix along with

sults for the partnershipa started during the year.

We have now completed five full years of partnership operation, and the ret

of these five years are shown below on a year-by-year basis and elso on 4 «

lative or compounded basis. These results are stated on the basis describ:

the preceding paragraph; after expenses, but before divieion of gains amon;

partners or payments to partners.

Partnerships Dow-Jones

Operating Partnership Industrials

Year Entire Year Gain Gain *

1957 3 10.4% -8.4%

1958 5 40.8 38.5

1958 6 25.9 19.8

1960 7 22.8 -6.3

1961 1 45.8 22.2

* Including dividends received through ownership of the Dow. ‘

On a compounded basis, the cumulative results have been:

Partnership Dow-Jones

Year Gain Industrials Gain

1957 10.4% 8.4%

1957-8 55.6 26.9

1957-8 95.9 52.2

1957-60 140.6 42.6

1957-61 251.0 14.3

These results do not measure the gain to the limited partner, which of course,

is the figure in which you are most interested. Because of the varying partner

ship arrangemente that have existed in the past, I have used the over-all net

gain (based on market values at the beginning and end of the year) to the partne

ship as being the fairest measure of over-all performance.

On a pro-forma basis adjusted to the division of gains entailed in our present

Buffett Partnership, Ltd. agreement, the reeulte would have been:

Year Limited Partners' Gain Dow Gain

1987 9.3% -8.4%

1958 32.2 38.5

+ 1959 20.8 19.9

1960 c 18.6 6.3

1961 35.9 22.2

COMPOUNDED

1957 9.3% 8.4%

1957-8 44.5 26.9

1957-8 TA 52.2

1957-60 107.2 42.6

1957-61 181.6 74.3

A Word About Par

‘The outstanding {tem of importance in my selection of partners, as well as in

my subsequent relations with them, has been the determination thet we use th

sarhe yardstick. Lf my performance is poor, Il expect partners to withdraw,

and indeed, I should look for a new source of investment for my own funds. 1

performance 1s good, ] am assured of doing splendidly, a state of affairs to

which Iam sure I can adjust.

The rub, then, is in being sure that we all have the same ideas of what is goc

and what is poor. I believe in establishing yardaticke prior to the act; retro

spectively, almost anything can be made to look good in relation to somethin;

or other.

T have continuously used the Dow-Jones Industrial Average as our measure of

par. lt 1s my feeling that three years is @ very minimal test of performance,

pee the best test consists of a period at least that long where the terminal leve

of the Dow is reasonably close to the initial level

Be foe vn retire feet (er sere ny ining cee) moleeneercleuren onan

W hag the advantage of being widely known, has a long period of continuity. ane

* tects with reagonable accuracy the experience of investors generally with tt

reirket, [have no objection to any other method of measurement of general

fnarket performance being used, such as other stock market averages, leadiny

diversified mutual stock funde, bank common trust funds, etc.

You may feel I have established an unduly short yardetick in that it perhaps ap

pears quite simple to do better than an unmanaged index of 30 leading common

peetee. Actually, this index he generally proven to be a reasonably tough co

petitor. Arthur Wiesenberger's classic book on investment companies Hsts

performance for the 15 years, 1046-60, for all leading mutual funds, There 3

presently over $20 billion invested in mutual funds, 80 the experience of these

funds represents, collectively, the experience of many million investors. My

tan Let, though the figures are not obtainable, 12 that portfolios of most Je

fag investment counsel organizations and bank trust departments have achieve

results similar to these mutual funds

Wiesenberger lists 70 funds in his “Charts & Statistice" with continuous reco:

pince 1946. Ihave excluded 32 of these funds for various reasons since they

vince jelanced funds (therefore not participating fully in the general market F’

Specialized industry funds, etc. Of the 32 excluded because 1 felt a compari

seid not be fair, 31 did poorer than the Dow, 60 they were certainly not ex-

cluded to slant the conclusions below.

Of the remaining 38 mutual funds whose method of operation 1 felt was such &

make @ comparison with the Dow reasonable, 32 did poorer than the Dow, on

Tha better, ‘The 6 doing better at the end of, 1960 had aseets of about $1 billie

sed the 32 doing poorer had assets of about $6-1/2 billion, None of the six tt

were cuperior beat the Dow by more than @ few percentage points @ year.

Below I present the year-by-year results for our period of operation (excludi

196) for which I don't have exact data, although rough figures indicate no var

from the 1957-60 figures) for the two largest common stock open-end investr

companies (mutual funds) and the two largest closed-end investment compani

Mass. Inv.

Investors

Limitee

Year Trust Stock Lehman = Tri-Cont. Dow Partner)

1987 12.0% © -12.4% w11.4% = 2.4% BAG + 8.3%

1988 444.1 +47.6 +40.8 433.2 438.5 432.2,

1959 + 8.2 +10,3 + 8.1 + 8.4 +19.8 +20.9

1960 - 0.8 - 0.1 + 2.6 + 2.8 = 6.35 +18.6

(From Moody's Banke & Finance Manual, 1961)

Potrebbero piacerti anche

- 1969 01 22Documento9 pagine1969 01 22neo269Nessuna valutazione finora

- 1968 01 24Documento7 pagine1968 01 24Alex PutuhenaNessuna valutazione finora

- 1967 07 12Documento4 pagine1967 07 12neo269Nessuna valutazione finora

- 1967 11 01Documento2 pagine1967 11 01neo269Nessuna valutazione finora

- 1968 07 11Documento5 pagine1968 07 11neo269Nessuna valutazione finora

- 1968 11 01Documento2 pagine1968 11 01neo269Nessuna valutazione finora

- 1969 05 29Documento4 pagine1969 05 29neo269Nessuna valutazione finora

- 1967 10 09Documento6 pagine1967 10 09neo269Nessuna valutazione finora

- 1967 01 25Documento11 pagine1967 01 25neo269Nessuna valutazione finora

- 1966 01 20Documento14 pagine1966 01 20neo269Nessuna valutazione finora

- 1966 07 12Documento6 pagine1966 07 12neo269Nessuna valutazione finora

- 1964 07 08Documento5 pagine1964 07 08valueinvestinghqNessuna valutazione finora

- 1966 11 01Documento3 pagine1966 11 01neo269Nessuna valutazione finora

- 1965 11 01Documento2 pagine1965 11 01neo269Nessuna valutazione finora

- 1965 07 09Documento5 pagine1965 07 09neo269Nessuna valutazione finora

- 1965 01 18Documento14 pagine1965 01 18neo269Nessuna valutazione finora

- 1963 07 10Documento7 pagine1963 07 10neo269Nessuna valutazione finora

- 1963 01 18Documento13 pagine1963 01 18neo269Nessuna valutazione finora

- 1961 07 22Documento3 pagine1961 07 22neo269Nessuna valutazione finora

- 1963 12 26Documento2 pagine1963 12 26neo269Nessuna valutazione finora

- 1964 01 18Documento15 pagine1964 01 18neo269Nessuna valutazione finora

- 1963 11 06Documento2 pagine1963 11 06neo269Nessuna valutazione finora

- 1962 12 24Documento2 pagine1962 12 24neo269Nessuna valutazione finora

- 1961 01 30Documento8 pagine1961 01 30neo269Nessuna valutazione finora

- 1959 02 11Documento4 pagine1959 02 11neo269Nessuna valutazione finora

- 1960 02 20Documento3 pagine1960 02 20neo269Nessuna valutazione finora

- 1962 07 06Documento7 pagine1962 07 06neo269Nessuna valutazione finora