Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1964 01 18

Caricato da

neo2690 valutazioniIl 0% ha trovato utile questo documento (0 voti)

6 visualizzazioni15 pagineTitolo originale

1964.01.18

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

6 visualizzazioni15 pagine1964 01 18

Caricato da

neo269Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 15

eye

Bourrett Pantnerenir, Ltn.

oto xtewrr rears

OM AMA OL, NEBRASKA

20 B Noerarr.

January 18, 1964

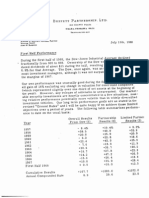

Qur Performance in 1963

1963 waa a good year. It was not a good year because we had an overall

gain of $3,637,167 or 38.7% on our beginning net assets, pleasant as that

experience may be to the pragmattats in our group, Rather it was a good

year because our performance was substantially better than that of our

fundamental yardstick -- the Dow-Jones Industrial Average (hereinafter

called the "Dow"). If we had been down 20% and the Dow had been down

30%, this letter would etill have begun "1963 was a good year." Regard-

less of whether we are plus or minus ina particular year, if we can main-

tain a satisfactory edge on the Dow over an extended period of time, our

long term results will be eatisfactory -- financially ae well as philosoph-

ically,

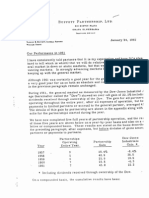

To bring the record upto date, the following summarizes the year-by-year

performance of the Dow, the performance of the Partnership before alloca-

tion to the general partner, and the Hmited partners' reeults for all full

years of BPL's and predecessor partnerships’ activities:

Overall Results Partnership Limited Partners!

Year From Dow (1) Results (2) Results (3)

1957 - 8.4% +10. 4% + 8.3%

1958 438.5 +40.9 432.2

1959 #20.0 425.9 +20.9

1960 - 6.2 422.8 418.6

1961 422.4 445.8 +35.9

1962 - 1.6 413.9 +119

1963 420.7 438.7 430.5

(1) Based on yearly changes in the value of the Dow plus dividends that

would have been received through ownership of the Dow during that year.

(2) For 1957-61 constete of combined results of all predecessor Hmited

partnerships operating throughout the entire year after all expenses but

before distributions to partners or allocations to the general partner.

(3) For 1857-61 computed on the basis of the preceding column of partner

ship resulte allowing for allocation to the general partner based upon

the present partnership agreement.

One wag among the limited partnere has suggested I add a fourth column

showing the results of the general partner -~ let's juat sey he, too, hes

an edge on the Dow.

‘The following table shows the cumulative or compounded results based

on the preceding table:

Overall Results Partnership Limited Partnera’

Year From Dow Results Results

1957 = 8.4% + 10.4% + 9.3%

1957-8 + 26.9 + 55.6 + 44.5,

1957-3 + 52.3 +.95.9 + 14.7

1957-60 + 42.8 4140.6 4107.2

1957-61 + 14.8 #251.0 +181,6

1957-62 + 61.6 +299.68 4215.1

1957-63 + 95.1 454.5 4311.2

Annual Com-

pounded Rate 10.0 27.7 22.3

It appears that we have completed seven fat years. With apologies to

Joseph we shall attempt to ignore the biblical script. (I've never gone

overboard for Noah's ideas on diversification either.)

In a more serious vein, 1 would like to emphasize that, in my judgment,

our 17.7 margin over the Dow shown above is unattainable over any long

period of time. A ten percentage point advantage would be a very satis-

factory accomplishment and even a much more modest edge would produce

impressive gains as will be touched upon later. This view (and it has to

be guesework -- informed or otherwise) carries with it the corollary that

we must expect prolonged periods of much narrower margins over the Dov

as well a6 at least occasional years when our record will be inferior

(perhaps substantially so) to the Dow.

Much of the above sermon is reflected in "The Ground Rules" sent to ever

one in November, but it can stand repetition.

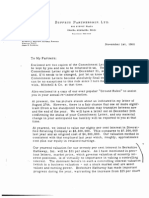

Investment Companies

We regularly compare our results with the two largest open-end invest-

ment companies (mutual funds) that follow a policy of being, typically,

85 - 100% invested in common stocks, and the two largest diversified

closed-end investment companies. ‘These four companies, Massachuset!

Investors Truet, Investors Stock Fund, Tri-Continental Corp. and Lehm

Corp. manage about $4 billion and are probably typical of most of the $2!

billion investment company industry. My opinion {e that their resulte

-3-

roughly parallel those of the vast majority of other investment advisory

organizations which handle, in aggregale, vaelly greater sums.

The purpose of this tabulation, which te shown below, Is to {lustrate that

the Dow ts no pushover as an index of investment achievement. The ad-

visory talent managing just the four companies shown commands annual

fees of over $7 million, and this represents @ very small fraction of the

industry. The public batting average of this highly -pald talent indicater

they achieved results slightly less favorable than the Dow.

Both our portfolio and method of operation differ substantially from the

investment companies in the table. However, most partners, as an aller-

native to their interest in the Partnership would probably have their funds

invested in media producing results comparable with investment companies,

and I, therefore, feel they offer a meaningful standard of performance.

YEARLY RESULTS

Mass. Inv. Investors

Limited

Year Trust (1) _Stock (1) Lehman (2) Tri-Cont. (2) ~ Dow Partnere

1957 “11.4% 712.4% 11.4% + 2.4% = 8.4% + 9.3%

1958 442.7 447.5 +40.8 433.2 $38.5 432.2

1959 + 9.0 410.3 +81 +84 420.0 420.9

1960 - 1.0 - 0.6 +25, + 2.8 - 6.2 418.6

1961 425.6 424.9 423.6 422.5 422.4 +35.9

1962 - 9.8 713.4 -14.4 =10.0 - 1.6 +119

1963 +20.0 +16.5 423.8 +19.5 420.7 +30.5

(1) Computed from changes in asset value plus any distributions to holders

of record during year.

(2) From 1963 Moody's Bank & Finance Manual for 1957-62.

Estimated for 1963.

COMPOUNDED

Mass. Inv. _ Investors Limitec

Year i__Trust Stock Lehman Tri-Cont, Dow Partner

1957 -11.4% 712.4% “11.4% ~ 2.4% = 8.4% + 8

1957-68 426.4 $29.2 424.7 +30.0 +26.9 + 44

1957-9 +37.8 442.5 434.8 440.9 452.3 + 14,

1857-60 436.4 441.6 438.2 444.8 442.9 #107.

1957-61 +113 +76.9 +70.8 +7704 474.8 +181,

1957-62 454.5 453.2 446.2 459.7 461.6 #215,

1987-63 485.4 +78.5 481.0 480.8 495.1 ail

Annual Com-

PoundedRate 9.2 8.6 8.8 9.7 10.0 aa

Potrebbero piacerti anche

- 1969 01 22Documento9 pagine1969 01 22neo269Nessuna valutazione finora

- 1968 01 24Documento7 pagine1968 01 24Alex PutuhenaNessuna valutazione finora

- 1967 07 12Documento4 pagine1967 07 12neo269Nessuna valutazione finora

- 1967 11 01Documento2 pagine1967 11 01neo269Nessuna valutazione finora

- 1968 07 11Documento5 pagine1968 07 11neo269Nessuna valutazione finora

- 1968 11 01Documento2 pagine1968 11 01neo269Nessuna valutazione finora

- 1969 05 29Documento4 pagine1969 05 29neo269Nessuna valutazione finora

- 1967 10 09Documento6 pagine1967 10 09neo269Nessuna valutazione finora

- 1967 01 25Documento11 pagine1967 01 25neo269Nessuna valutazione finora

- 1966 01 20Documento14 pagine1966 01 20neo269Nessuna valutazione finora

- 1966 07 12Documento6 pagine1966 07 12neo269Nessuna valutazione finora

- 1964 07 08Documento5 pagine1964 07 08valueinvestinghqNessuna valutazione finora

- 1966 11 01Documento3 pagine1966 11 01neo269Nessuna valutazione finora

- 1965 11 01Documento2 pagine1965 11 01neo269Nessuna valutazione finora

- 1965 07 09Documento5 pagine1965 07 09neo269Nessuna valutazione finora

- 1965 01 18Documento14 pagine1965 01 18neo269Nessuna valutazione finora

- 1963 01 18Documento13 pagine1963 01 18neo269Nessuna valutazione finora

- 1962 12 24Documento2 pagine1962 12 24neo269Nessuna valutazione finora

- 1961 07 22Documento3 pagine1961 07 22neo269Nessuna valutazione finora

- 1963 11 06Documento2 pagine1963 11 06neo269Nessuna valutazione finora

- 1963 12 26Documento2 pagine1963 12 26neo269Nessuna valutazione finora

- 1963 07 10Documento7 pagine1963 07 10neo269Nessuna valutazione finora

- 1962 07 06Documento7 pagine1962 07 06neo269Nessuna valutazione finora

- 1961 01 30Documento8 pagine1961 01 30neo269Nessuna valutazione finora

- 1959 02 11Documento4 pagine1959 02 11neo269Nessuna valutazione finora

- 1960 02 20Documento3 pagine1960 02 20neo269Nessuna valutazione finora

- 1962 01 24Documento11 pagine1962 01 24neo269Nessuna valutazione finora