Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1963 01 18

Caricato da

neo2690 valutazioniIl 0% ha trovato utile questo documento (0 voti)

34 visualizzazioni13 pagineTitolo originale

1963.01.18

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

34 visualizzazioni13 pagine1963 01 18

Caricato da

neo269Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 13

mE. Borrert.Garmat Pa

Rurretr Partwrrsnir, Ltn.

OM AMA 04, HED RABKA

January 18, 1963

The Ground Rules

Some partners have confeseed (that's the proper word) that they sometimes

find it difficult to wade through my entire annual letter.

Since I seem to be

getting more long-winded each year, I] have decided to emphasize certain

axioms on the first pages.

Everyone should be entirely clear on these points

To most of you this material will seem unduly repetitious, but I would rather

have nine partners out of ten mildly bored than have one out of ten with any

basic misconceptions

1.

In no sense is any rate of return guaranteed to partners. Partners

who withdraw one-half of 1% monthly are doing just that--with-

drawing. If we earn more than 6% per annum over a period of years

the withdrawals will be covered by earnings and the principal will

increase. If we don't earn 6%, the monthly payments are partially

or wholly a return of capital.

Any year in which we fail to achieve at least a plus 6% performance

will be followed by @ year when partners receiving monthly pay-

mente will find those payments lowered.

Whenever we talk of yearly gains or losses, we are talking about

market values; that {s, how we stand with assets valued at market

at yearend against how we stood on the same basis at the beginning

of the year, This may bear very little relationship to the realized

results for tax purposes in a given year,

Whether we do & good job or a poor job is not to be measured by

whether we are plus or minus for the year, It is instead to be

measured againel the general experience in securities as measured

by the Dow-Jones Industria) Average, leading investment compante

etc. Lf our record {s better than that of these yardsticks, we con-

sider it @ good year whether we are plus or minus.

If we do poore?

we deserve the tomatoes

While 1 much prefer @ five-year test, I feel three years is an abso

lute minimum for fudging performance. It te a certainty that we

will have years when the partnership performance {s poorer,

perhaps substantially 60, than the Dow. Mf any three-year or

longer period produces poor results, we all should start looking

around for other places to have our money. An exception to the

latter statement would be three years covering a speculative ex-

plosion in a bull market.

1 am not in the business of predicting general-stock market or

business fluctuations. If you think I can do this, or think it ts

essential to an investment program, you should not be in the

partnership.

7. L cannot promise results to partners, What I can and do promise

is that:

a. Our investments will be chosen on the basis of value,

not popularity;

b,

* ‘That we will attempt to bring risk of permanent capital

lose (not short-term quotational loss) to an absolute

minimum by obtaining a wide margin of safety in each

commitment end a diversity of commitments; and

My wife, children and I will have virtually our entire

net worth invested in the partnership.

Our Performance in 1962

Thave consistently told partners that we expect to shine on a relative basis

uring minus years for the Dow, whereas plus years of any magnitude may

find us blushing. This held true in 1062.

Because of a strong rally in the last few months, the general market a6

measured by the Dow really did not have euch a frightening decline as many

might think. From 731 at the beginning of the year, {t dipped to 536 in June,

but closed at 652. At the end of 1960, the Dow stood at 616, so you can see

that while there has been @ good deal of action the past few years, the invest-

ing public as a whole {6 not too far from where it wae in 1959 or 1960. If

one had owned the Dow last year (and I imagine there are a few people play~

ing the high flyere of 1961 who wish they had), they would have had @ shrink~

age in market value of 70.04 or 10.8%, Hcwever, dividends of epproximatels

23,30 would have been received to bring the over-all reeulte from the Dow

for the year to minus 7.6%. Our own over-all record was plus 13.8%. Be-

low we show the year-by-year performance of the Dow, the partnership be-

fore allocation to the general partner, and the limited partners! results for

all full yeare of Buffett Partnership, Ltd.'s and predeccasor partnerships!

activities:

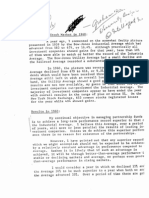

Over-all Results Partnership Limited Partner

Year {rom Dow Resulte (1) Results (2)

1957 + 8.4% +10. 4% + 8.3%

1956 438.5 440.8 +32.2

1959 #20.0 425.9 #20.9

1960 + 6.2 #22.8 +18.6

1961 #2204 445.8 435.8

1962 - 16 413.8 +118

(1) For 1957-61 consists of combined results of all predecessor limited pa

nerships operating throughout entire year after all expenses but before dist

butiona to partnere or allocations to the general partner.

(2) For 1957-61 computed on basie of preceding column of partnership res:

allowing for allocation to general partner based upon present partnership

agreement,

‘The following table shows the cumulative or compounded reeulte in the sar

three categories, as well as the average annual compounded rate:

Over-all Results Partnership Limited Partne

Year from Dow Results Results

1957 - 8.4% + 10.4% + 9.3%

1957-8 + 26.9 + 55.6 + 44.5

1957-8 + 62.3 + 95.8 +747

1957-60 + 42.9 4140.6 4107.2

1957-61 + 14,8 +251.0 #181.6

1957-62 + 61.6 +299.8 #215.1

Annual Com-

pounded Rate 8.3 26.0 aa

My (unscientific) opinion {e that a margin of ten percentage points per ann

over the Dow {s the very maximum that can be achieved with invested func

over any long period of years, so tt may be well to mentally modify some

the above figures.

‘Partners have sometimes expressed concern as to the effect of size upon

formance. Thia subject was reflected upon in last year's annual letter.

conclusion reached was that there were some situations where larger sur

helped and some where they hindered, put on balance, I did not fee} they

penalize performance. 1 promised to Inform partners if my conclusions

this ehould change. Al the beginning of 1957, combined limited partners!

aecete totaled $303, 7126 and grew to $7,178,500 at the beginning of 1062.

To date, anyway, our margin over the Dow has indicated no tendency to F

row ae funda increase

Potrebbero piacerti anche

- 1969 01 22Documento9 pagine1969 01 22neo269Nessuna valutazione finora

- 1968 01 24Documento7 pagine1968 01 24Alex PutuhenaNessuna valutazione finora

- 1967 07 12Documento4 pagine1967 07 12neo269Nessuna valutazione finora

- 1967 11 01Documento2 pagine1967 11 01neo269Nessuna valutazione finora

- 1968 07 11Documento5 pagine1968 07 11neo269Nessuna valutazione finora

- 1968 11 01Documento2 pagine1968 11 01neo269Nessuna valutazione finora

- 1969 05 29Documento4 pagine1969 05 29neo269Nessuna valutazione finora

- 1967 10 09Documento6 pagine1967 10 09neo269Nessuna valutazione finora

- 1967 01 25Documento11 pagine1967 01 25neo269Nessuna valutazione finora

- 1966 01 20Documento14 pagine1966 01 20neo269Nessuna valutazione finora

- 1966 07 12Documento6 pagine1966 07 12neo269Nessuna valutazione finora

- 1964 07 08Documento5 pagine1964 07 08valueinvestinghqNessuna valutazione finora

- 1966 11 01Documento3 pagine1966 11 01neo269Nessuna valutazione finora

- 1965 11 01Documento2 pagine1965 11 01neo269Nessuna valutazione finora

- 1965 07 09Documento5 pagine1965 07 09neo269Nessuna valutazione finora

- 1965 01 18Documento14 pagine1965 01 18neo269Nessuna valutazione finora

- 1963 07 10Documento7 pagine1963 07 10neo269Nessuna valutazione finora

- 1962 12 24Documento2 pagine1962 12 24neo269Nessuna valutazione finora

- 1961 07 22Documento3 pagine1961 07 22neo269Nessuna valutazione finora

- 1963 12 26Documento2 pagine1963 12 26neo269Nessuna valutazione finora

- 1964 01 18Documento15 pagine1964 01 18neo269Nessuna valutazione finora

- 1963 11 06Documento2 pagine1963 11 06neo269Nessuna valutazione finora

- 1962 07 06Documento7 pagine1962 07 06neo269Nessuna valutazione finora

- 1961 01 30Documento8 pagine1961 01 30neo269Nessuna valutazione finora

- 1959 02 11Documento4 pagine1959 02 11neo269Nessuna valutazione finora

- 1960 02 20Documento3 pagine1960 02 20neo269Nessuna valutazione finora

- 1962 01 24Documento11 pagine1962 01 24neo269Nessuna valutazione finora