Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1965 07 09

Caricato da

neo2690 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni5 pagineTitolo originale

1965.07.09

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni5 pagine1965 07 09

Caricato da

neo269Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 5

Burretr Partwersuip, Lrp

Yateen E.Dorrary, Germut Parnes

winuian Seort

Jouy H:taenixo

July 8, 1965

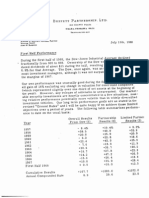

st Half Performance:

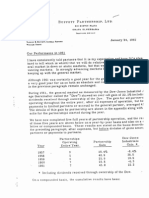

During the first half of 1965, the Dow Jones Industrial Average (hereinafter

called the Dow") declined from 874.13 to 868.03. This minor change was

accomplished in a decidedly non-Euclidian manner. The Dow instead took

the scenic route, reaching a high of 839.62 on May 14th. Adding back divi-

dends on the Dow of 13.49 gives an overall gain through ownership of the

Dow for the first half of 7.39 or 0.8%.

We had one of our better periods with an overall gain, before allocation to

the general partner, of 10.4% or a 8.6 percentage point advantage over the

Dow. To bring the record up to date, the following summarizes the year-b

year performance of the Dow, the performance of the Partnership before

allocation to the general partner, and the limited partners’ results:

Overall Results Partnership —_—Limited Partn

Year From Dow (1) Results (2) Results (3)

1957 = 8.4% +10.4%, + 8.3%

1958 438.5 +40.9 432.2

1959 +20.0 425.9 +20.9

1960 - 6.2 422.8 +18.6

1961 422.4 +45.9 #35.9

1962 - 1.6 +13.9 411.8

1963 420.6 438.7 +30.5

1964 +18.7 427.8 422.3

Ist half 1965 + 0.8 +1004 +93

Cumulative results 4133.2 +682. 4 4449.7

Annual compounded rate 10.5 27.4 22.2

(1) Based on yearly changes in the value of the Dow plus dividends that

would have been received through ownership of the Dow during that year

The table includes all complete years of partnership activity.

(2) For 1957-61 congists of combined results of all predecessor limited

partnerships operating throughout the entire year after all expenses but

before distributions to partners or allocations to the general partner.

(3) For 1957-61 computed on the basis of the preceding column of partner

ship resulls allowing for allocation to the general partner based upon the

present partnership agreement, but before monthly withdrawals by

limited partners.

Our constant admonitions have been: (1) that short-term results (less

than three years) have little meaning, particularly in reference to an in-

vestment operation such as ours that may devote a portion of resources

to control situations; and, (2) that our results, relative to the Dow and

other comimon-stock-form inedia usually will be better in declining mar-

kets and may well have a difficult time just matching such media in very

strong markets

With the latter point in mind, it might be Imagined that we struggled during

the first four months of the half to stay even with the Dow and then opened

up our margin as {t declined in May and June. Just the opposite occurred.

We actually achieved a wide margin during the upswing and then fell ata

rate fully equal to the Dow during the market decline.

I don't mention this because I am proud of such performance — on the con

trary, I would prefer it if we had achieved our gain in the hypothesized

manner, Rather, I mention it for two reasons: (1) you are always entitled

to know when I am wrong as well as right; and, (2) it demonstrates that al-

hough we deal with sand expectations, the actual results can

Xpectations, particularly ona short-term

chasis. As mentioned in the most recent annual letter, our long-term goal

is to achieve a ten percentage point per annum advantage over the Dow.

Our advantage of 8.6 points achieved during the first six months must be

regarded as substantially above average. The fortitude demonstrated by

our partners in tolerating such favorable variations is commendable. We

shall most certainly encounter periods when the variations are in the othe:

direction,

uring the first half, a series of purchases resulted in the acquisition of

controlling interest in one of the situations described in the "General-

Private Owner" section of the last annual letter, When such a controlling

interest is acquired, the assets and earning power of the business become

the immediate predominant factors tn.value. When a small minority inter

est in a company is held, earning power and assets are, of course, very

important, but they represent an indirect influence on value which, in the

short run, may or may not dominate the factors bearing on supply and

demand which result in price.

When a controlling interest {s held, we own a business rather than a stoch

and a business valuation le appropriate. We have carried our controlling

position at a conservative valuation at midyear and will reevaluate {t in

terme of assets and earning power at yearend, The annual letter, issued

in January, 1966, will carry a full story on this current control situation

Al this time it 18 enough to say that we are delighted with both the acquis!

cost and the business operation, and even happier about the people we have

managing the business.

Investment Companies

We regularly compare our results with the two largest open-end investment

companies (mutual funds) that follow a policy of being, typically, ®5-100%

invested in common slocks, and the two largest diversified closed-end in-

vestment companies. These four companies, Massachusetts Investors Trus

Investors Stock Fund, Tri-Continental Corp., and Lehman Corp., manage

over $4 billion and are probably typical of most of the $30 billion investment

company industry. Their resulls are shown in the following table. My

opinion is that this performance roughly parallels that of the overwhelming

majority of other investment advisory organizations which handle, in aggre

gate, vastly greater sums.

Mass. Inv, Investors

Lim

Year Trust (1) Stock 1) Lehman (2) Tri-Cont. (2) Dow Part

1987 -11.4% 12.4% 11.4% - 2.4% = 8.4% +

1958 442.7 447.5 +40.8 +33.2 +38.5 +3

1959 + 9.0 +103 + 8.1 + 8.4 +20.0 +2

1960 = 1.0 - 0.6 + 2.5 + 2.8 = 6.2 +1

1961 425.6 +24,.9 #23,6 $22.5 #22.4 +3

1962 = 9.8 713.4 7144 -10.0 - 1.6 +1

1963 +20.0 +16.5 423.7 418.7 +20.6 +3

1964 415.9 +143 414.0 413.6 +18,7 +2

isthalfi96s 0.0 - 0.6 42.7 0.0 + 0.8 +

Cumulative

results +114.6 +102.8 4111.7 +118.4 +133.2 +44

Annual com-

poundedrate 9.4 8.7 9.2 9.5 10,5 2

(1) Computed from changes in asset value plus any distributions to holders of rec

during year.

(2) From 1965 Moody's Bank & Finance Manual for 1957-64. Estimated for first

1965,

i

Last year I mentioned that the performance of these companies in some

ways resembles the activity of a duck sitting on a pond, When the water

(the market) rises, the duck rises; when {t falls, back goes the duck. The

water level waa virtually unchanged during the firat half of 1965. The duc

46 you can see from the table, are atlll sitting on the pond. ;

As | mentioned earlier in the letter, the ebb of the tide in May and June a

substantially affected us. Nevertheless, the fact we had flapped our wing

Potrebbero piacerti anche

- 1969 01 22Documento9 pagine1969 01 22neo269Nessuna valutazione finora

- 1968 01 24Documento7 pagine1968 01 24Alex PutuhenaNessuna valutazione finora

- 1967 07 12Documento4 pagine1967 07 12neo269Nessuna valutazione finora

- 1967 11 01Documento2 pagine1967 11 01neo269Nessuna valutazione finora

- 1968 07 11Documento5 pagine1968 07 11neo269Nessuna valutazione finora

- 1968 11 01Documento2 pagine1968 11 01neo269Nessuna valutazione finora

- 1969 05 29Documento4 pagine1969 05 29neo269Nessuna valutazione finora

- 1967 10 09Documento6 pagine1967 10 09neo269Nessuna valutazione finora

- 1967 01 25Documento11 pagine1967 01 25neo269Nessuna valutazione finora

- 1966 01 20Documento14 pagine1966 01 20neo269Nessuna valutazione finora

- 1966 07 12Documento6 pagine1966 07 12neo269Nessuna valutazione finora

- 1964 01 18Documento15 pagine1964 01 18neo269Nessuna valutazione finora

- 1966 11 01Documento3 pagine1966 11 01neo269Nessuna valutazione finora

- 1965 11 01Documento2 pagine1965 11 01neo269Nessuna valutazione finora

- 1965 01 18Documento14 pagine1965 01 18neo269Nessuna valutazione finora

- 1964 07 08Documento5 pagine1964 07 08valueinvestinghqNessuna valutazione finora

- 1963 01 18Documento13 pagine1963 01 18neo269Nessuna valutazione finora

- 1962 12 24Documento2 pagine1962 12 24neo269Nessuna valutazione finora

- 1961 07 22Documento3 pagine1961 07 22neo269Nessuna valutazione finora

- 1963 11 06Documento2 pagine1963 11 06neo269Nessuna valutazione finora

- 1963 12 26Documento2 pagine1963 12 26neo269Nessuna valutazione finora

- 1963 07 10Documento7 pagine1963 07 10neo269Nessuna valutazione finora

- 1962 07 06Documento7 pagine1962 07 06neo269Nessuna valutazione finora

- 1961 01 30Documento8 pagine1961 01 30neo269Nessuna valutazione finora

- 1959 02 11Documento4 pagine1959 02 11neo269Nessuna valutazione finora

- 1960 02 20Documento3 pagine1960 02 20neo269Nessuna valutazione finora

- 1962 01 24Documento11 pagine1962 01 24neo269Nessuna valutazione finora