Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1966 07 12

Caricato da

neo2690 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni6 pagineTitolo originale

1966.07.12

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni6 pagine1966 07 12

Caricato da

neo269Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 6

Borrett PaArtnersuip, Lrp.

kiawir riaza

OMAMA.WEDRASKA 08101

Sous

1B. Borvare. Oremus Parres

Soorr

Baxoiro

July 12, 1866

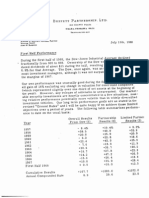

First Half Performance

During the first half of 1966, the Dow-Jones Industrial Average (hereinafter

called the "Dow") declined from 968. 26 to 870.10. If one had owned the

Dow during this perlod, dividends of approxtmately 14.70 would have been

received, reducing the overall loss of the Dow to about 8.7%.

It is my objective and my hope (but not my prediction|) that we achieve over

a long period of time, an average yearly advantage of ten percentage points -

relative to the Dow. During the first half we did considerably better than

expected with an overall gain of approximately 8.2%. Such results should

be regarded as decidedly abnormal, I have previously complimented partners

onthe good-natured tolerance they display in shrugging off such unexpected

positive variances. The nature of our business Is such that, over the years,

we will not disappoint the many of you who must also desire a test of your

capacity for tolerance of negative variances.

The following summarizes the year-by-year performance of the Dow, the

performance of the Partnership before allocation to the general partner, and

the results for Mmited partners:

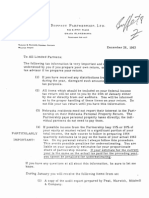

Overall Results Partnership Limited Partners’

Year From Dow (1) _Results (2) Results (3)

1957 = 8.4% +10. 4% + 9.3%

1988 438.5 440.9 432.2

1959 +20.0 425.9 +20.9

1960 - 6.2 422.8 +18.6

1961 “422.4 445.8 +35.9

1962 - 7.6 413.9 +119

1963 +20.6 +38.7 +30.5

1964 +16.7 427.8 422.3

1965 414.2 44702 +36.8°

Firat half 1966 - 87 + 8.2 U7

Cumulative results +1411 +1028, 7 4641.5 +

Annual compounded rate 8.7

29.0 23.5

“2+

(1) Based on yearly changes in the value of the Dow plus dividends that

would have been received through ownership of the Dow during that

year. The table includes all complete yeare of partnership activity.

(2) For 1957-61 consists of combined results of all predecessor limited

partnerships operating throughout the entire year after all expenses

ee —_—————

partner.

(3) For 1957-61 computed on the basié of the preceding column of partner-

ship results allowing for allocation to the general partner based upon

the present partnership agreement, but before monthly withdrawals by

lmited partners.

Even Samson gets clipped occasionally. If you had Invested $100,000 on

January 1 equally among -

the world's largest auto company (General Motors);

"the world's largest oil company (Standard of New Jersey):

the world's largest retailing company (Seara Roebuck);

the world's largest chemical company (duPont);

the world's largest steel company (U. 5. Steel);

the world's largest stockhold:

a

b,

©

4

e

f

er-owned insurance company (Aetna);

g. the world's largest public utility (American Telephone & Telegraph);

hh. the world's largest bank (Bank of America);

your total portfolio (including dividends received) would have been worth

$83, 370 on June 30 for a loss of 16.6%. The total market value on January 1

of these eight giants was well over $100 billion, Every one of them wae

selling lower on June 30.

Investment Companies

On the next page we bring up to date our regular comparison with the resulte

of the two largest open-end investment companies (mutual funds) that follow

a policy of being, typically, 95-100% invested in common stocks, and the two

Jargest diversified closed-end investment companies.

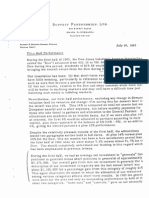

Mass Inv. Investors

Limitec

Year Trust (1) Stock (1) Lehman (2) Tri-Cont. (2) Dow Partner

1997 -11.4% 12.4% 11% 2.4% - 0.4% + 9.37

1958 442.7 447.5 +40.0 +33.2 +30.5 442.2

agne +90 410.3 +o + B.4 +20.0 420.9

19%. > 1.0 - 0.6 + 2.5 + 2.8 - 6.2 418.6

1961 +25.6 424.0 +23.6 #22.5 422.4 $35.9

1962 > 9.8 713.4 14.4 10.0 77.6 +118

1953 +20.0 +16.5 423.7 +187 #20.6 +30.5

1964 +15.9 414.3 +14.0 413.6 +18.7 422.3

1965 +10.2 + 9.8 +19.0 +11 414.2 +36.8

First half

1966 - 7.8 - 72.8 - 1.0 - 5.2 - 8.7 chy

Cumulative

results +118.1 +106.3 +142.8 4126.9 +1411 $641.5,

Annual

compounded

8.6 1.9 9.8 9.0 9.7 23.5

(1) Computed from changes in asset value plus any distributions to holders

of record during year.

(2)

| However, I believe that cons

From 1966 Moody's Bank & Finance Manual for 1957-1965.

for first half of 1966.

Estimated

Proponents of institutional

investing frequently cite Its conservative nature.

If "conservative"

{s interpreted to mean “productive of results varying only

Slightly from average experience" I,believe the characterization te proper.

Such results are almost bound to flow from wide diversifleation Among high

Brade Securities. Since, over a long period, “average experience" is likely

to be good experience, there is nothing wrong with the typical investor

utilizing this form of investment medium. >

ervatism is more properly interpreted to mean

“subject to Substantially less temporary or permanent shrinkage in value than

Hee ccuy ciloelinply,hasinoilbeen achieved Waele? re ceraisiiine

four largest funds (presently managing over $5 billion) illustrates. Specifically,

the Dow declined in 1957, 1960, 1962 and the firetshalf of 1966. Cumulating the

shrinkage in the Dow during the three full year periods produces a decline of

20.6%. "Following a similar technique for the feur largest funds produces

declines of 9.7%, 20.9%, 22.3

Je and 24.6%. Including the interim performance

for the first half of 1966 results ina decline in the Dew of 27 5% and forthe +

funds declines of 14.4%, 23.1%, 27.1% and 30.6%, Such funds (and I believe

heir results are quite typical of institutional experience in comonn stocks)

Seem to meet the first definition of conservatism but not the second one,

Potrebbero piacerti anche

- 1969 01 22Documento9 pagine1969 01 22neo269Nessuna valutazione finora

- 1968 01 24Documento7 pagine1968 01 24Alex PutuhenaNessuna valutazione finora

- 1967 07 12Documento4 pagine1967 07 12neo269Nessuna valutazione finora

- 1967 11 01Documento2 pagine1967 11 01neo269Nessuna valutazione finora

- 1968 07 11Documento5 pagine1968 07 11neo269Nessuna valutazione finora

- 1968 11 01Documento2 pagine1968 11 01neo269Nessuna valutazione finora

- 1969 05 29Documento4 pagine1969 05 29neo269Nessuna valutazione finora

- 1967 10 09Documento6 pagine1967 10 09neo269Nessuna valutazione finora

- 1967 01 25Documento11 pagine1967 01 25neo269Nessuna valutazione finora

- 1965 11 01Documento2 pagine1965 11 01neo269Nessuna valutazione finora

- 1966 01 20Documento14 pagine1966 01 20neo269Nessuna valutazione finora

- 1964 01 18Documento15 pagine1964 01 18neo269Nessuna valutazione finora

- 1966 11 01Documento3 pagine1966 11 01neo269Nessuna valutazione finora

- 1965 07 09Documento5 pagine1965 07 09neo269Nessuna valutazione finora

- 1965 01 18Documento14 pagine1965 01 18neo269Nessuna valutazione finora

- 1964 07 08Documento5 pagine1964 07 08valueinvestinghqNessuna valutazione finora

- 1963 01 18Documento13 pagine1963 01 18neo269Nessuna valutazione finora

- 1962 12 24Documento2 pagine1962 12 24neo269Nessuna valutazione finora

- 1961 07 22Documento3 pagine1961 07 22neo269Nessuna valutazione finora

- 1963 11 06Documento2 pagine1963 11 06neo269Nessuna valutazione finora

- 1963 12 26Documento2 pagine1963 12 26neo269Nessuna valutazione finora

- 1963 07 10Documento7 pagine1963 07 10neo269Nessuna valutazione finora

- 1962 07 06Documento7 pagine1962 07 06neo269Nessuna valutazione finora

- 1961 01 30Documento8 pagine1961 01 30neo269Nessuna valutazione finora

- 1959 02 11Documento4 pagine1959 02 11neo269Nessuna valutazione finora

- 1960 02 20Documento3 pagine1960 02 20neo269Nessuna valutazione finora

- 1962 01 24Documento11 pagine1962 01 24neo269Nessuna valutazione finora