Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FY 2006 Synopsis

Caricato da

Ewing Township, NJ0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

23 visualizzazioni3 pagineCopyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

23 visualizzazioni3 pagineFY 2006 Synopsis

Caricato da

Ewing Township, NJCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 3

SUMMARY OR SYNOPSIS OF AUDIT REPORT

FOR PUBLICATION

‘Summary or Synopsis of the 2006 Audit Report of the Township of Ewing

as required by NJ S.A. 405-7.

Township of Ewing

‘All Funds

Combined Comparative Balance Sheet

June 30,

ASSETS 2008, 2005

Cash and investments 3 16,362,835 “$15,003,082

Intergovernmental receivable 2,843,348 2,708,387

Due from grants 1,447,162 2,122,353

Taxes, assessments, liens and

sewer charges receivablo ATSa77 530,749

Property acquired for taxes 965,600 965,600

Municipal services not billed 4,908 -

Other assets 4,507 1,376

Interfunds 188,038 378,744

Doferred charges - current 161,000 2,879,951

Deferred charges - capital 27,031,425 28,056,962

General fixed assets 26,018,176 26,018,176

TOTAL ASSETS 375.50: S_ 78,750,379

LIABILITIES, DEFERRED REVENUES,

RESERVES AND FUND BALANCE.

Bond, notes, and loans payable $ 35,250,425 $ 33,808,037

ther labilties and special funds 1,828,234 2,765,345,

lnterfunds 188,938 375,744

Reserves for receivables 7,249,908 6,464,636

Other reserves 1,612,628 6,792,840

lavesiments in fied assets 26,018,176 26,018,176

Capital improvement fund 25,000 -

Fund balance 3,329,067 2,435,601

TOTAL LIABILITIES, DEFERRED

REVENUES, RESERVES AND

FUND BALANCE $_75,502,375 _$ 78,750,379

Township of Ewing

(Current Fund

Comparative Statement of Operations

and Changes in Fund Balance

Year Ended June 30,

2006 2005

Revenue and other income realized

Fund balance utilized S 513,625 $ 591,250

Miscellaneous revenues 8,076,364 7,519,008

State aid without offsetting appropriations 17,615,154 16,615,241

Special items with offsetting appropriations 789,835 1,584,794

Special items with consent of the director 4,037,769 2,701,272

Receipts from delinquent taxes 195,271 199,468,

‘Amount to be raised by taxes for support

Of municipal budget 12,655,754 9,983,074

Other credits to income 60,608,702 62,554,988

Total Revenue 704,749,092

Expenditures:

Budget Expenditures:

Appropriations within "CAPS" 19,819,993 18,999,337

Deferred charges and statutory

expenditures - municipel within "CAPS* 2,385,527 2,896,210

‘Appropriations excluded from "CAPS"

Operations 15,523,607 15,373,640

Capital improvements 238,355 327,725

Municipal debt service 3,724,606 3,513,753

Reserve for uncollected taxes 283,243 272,548

Deferred charges - excluded from "CAPS" 1,084,889 868,184

Other charges to income 60,081,834 62,377,674

Cash deficit - with prior written consent

of Local Finance Board 134,928 <

Total Expenditures 103,256,981 104,629,070

Excoss/(Defict) in revenue 4,235,492 (2,879,978)

Expenditures which are deferred charges

to budget of succeeding year 461,000 2,879,951

Fund balance, beginning 2,337,161 28 438

‘Sub-Total 3,733,653 2,928,411

Less: utilized as anticipated revenues (513,625) (591.250),

Fund balance, ending 53,220,028 “S__ 2,387,161

TOWNSHIP OF EWING

GENERAL COMMENTS AND RECOMMENDATIONS,

YEAR ENDED JUNE 30, 2006

The following recommendations were made for 2006:

- Budget should allocate sufficient funds for obligation to Ewing Lawrence

Sewerage Authority.

+ All grants need to be properly tracked.

- Compliance with Technical Accounting Directive #85

Governmental Fixed Assets,” should be enforced.

, “Accounting for

- An individual who is independent from both the cash receipt and cash

disbursement functions at the Municipal Court should prepare bank

reconciliations. Also, tickets eligible for destruction should be pulled and

disposed of in a timely manner.

- Computer software or manual records should be utilized for dog license

reports,

- The Construction Office should stamp all permits with authorized

signatures, maintain all construction files, and deposit all monies received

within 48 hours as requited.

- All wire transfers and bank reconciliations should be reviewed by

administration,

- A\ll resolution numbers should be indicated in the minutes.

The above summary or synopsis was prepared from the report of audit of the financial

statements and supplementary data of the Township of Ewing, County of Mercer, for the

year ended June 30, 2006. This report was submitted by Mercadien P.C., Certified Public

Accountants. It is on file at the Municipal Clerk’s office and may be inspected by any

interested person.

wing Township $00S4\ 2006 FinancilSttement'Surnary af Synopsis Findings and Recorsndatons'06 doe

Potrebbero piacerti anche

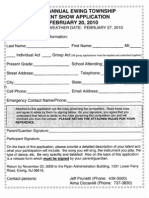

- 2010 Talent ShowDocumento3 pagine2010 Talent ShowEwing Township, NJNessuna valutazione finora

- 2010-03-03 ETRA Open HouseDocumento1 pagina2010-03-03 ETRA Open HouseEwing Township, NJNessuna valutazione finora

- 2010 Ewing Talent ShowDocumento3 pagine2010 Ewing Talent ShowEwing Township, NJNessuna valutazione finora

- 2010-03-03 ETRA Open HouseDocumento1 pagina2010-03-03 ETRA Open HouseEwing Township, NJNessuna valutazione finora

- TWWDocumento1 paginaTWWEwing Township, NJNessuna valutazione finora

- lRA NOIsDocumento3 paginelRA NOIsEwing Township, NJNessuna valutazione finora

- FY 2005 Synopsis FinalDocumento4 pagineFY 2005 Synopsis FinalEwing Township, NJNessuna valutazione finora