Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Y 000031

Caricato da

aptureinc100%(4)Il 100% ha trovato utile questo documento (4 voti)

66 visualizzazioni7 pagineTitolo originale

y000031

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

100%(4)Il 100% ha trovato utile questo documento (4 voti)

66 visualizzazioni7 pagineY 000031

Caricato da

aptureincCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 7

FORMA

For use by Members, officer

Page 1013

and employees

UNITED STATES HOUSE OF REPRESENTATIVES

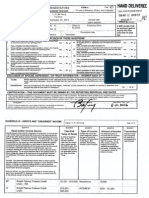

FINANCIAL DISCLOSURE STATEMENT FOR CALENDAR YEAR 2006

C.W. Bill Young

untamed

2407 Rayburn House Office Building Washington, DC 20515 202-226-5961

Daytine Telephone

Employing Otfice

1 Cine of TAD GLE

He

(Office Use Only)

‘$200 penalty shall

be assessed against

anyone who files

‘more than 30 days

late.

Member of the U.S. State: FL ~ Officer Or

House of Representative Device 40 Empioyee

Termination Date:

Crema _stver__rerot

‘id you, your spouse, ora dependent Ghd recale any eporaoT GAT

trmore om ay sree Toe rporing pores? ‘he reporting ered (ve, aggregating more than $206 and nother

we ms

yes, complete and atiach Schedule | Ifyes, complete and atiach Schedule Vi

‘a any indi! or organization make a donation to chary in feu of paying ‘id you, your spouse, ora dependent cid recave any rapertabe travel oF

{you ors apeech, appearance or arele nthe reporting period? ¥ trae oben repring pron wet mae an BS

_Iyes, completo and attach Schedule I yes, complete and attach Schedule Vil

‘id you, your spouse, ora dependent child recave “unearned income of id you hold any reportable positions on or before the date offing Inthe

WL more than $200 nthe reporting pero or hols any reportable anna wor ‘current calenda yar?

‘tore than $3,000 tte ond of te peed?

ifyee, complete and atach Schedule I. yes, complete and attach Schedule Vl

Did you, your spouse, oF dopenent ci purchase, sel, oF exchange any ‘id you have any reportabe agreement or arrangement with an ouaile

fmol ent ino amano ecg $1.80 ge epotng ong?

yee, complete and atiach Schedule WV. yes, complete and attach Schedule IX.

id you, your spouse, ora dependent chil have ony reportabaUabity (more

tan $1600) ring te reporting period? Each question in this part must be answered and the appropriate

schedule attached for each "Yes" response.

EXCLUSION OF SPOUSE, DEPENDENT, OR TRUST INFORMATION — ANSWER EACH OF THESE QUESTIONS,

Trusts- Details regarding "Gualified Blind Trusts" approved by the Committee on Standards of Oficial Conduct and certain other "excepted

trusts” need not be disclosed. Have you excluded from this report deals of such a rust berefling you, your spouse, or dependent Y@® NOY.

child? _ ~

Exemptions Have you excluded from this report any other assets, “unearned” Incone, transactions o ables of a spouse or dependent child

because they meet all three tests for exemption? Yes ~ Now

CERTIFICATION -- THIS DOCUMENT MUST BE SIGNED BY THE REPORTING INDIVIDUAL AND DATED

“This Financial Disclosure Statement e required by the Eihies In Goverment Act of 1978, a8 amended. The Statement wll be avaiable t any requesting paraon upon written

‘application and willbe reviewed by the Committee on Standards of Oficial Conductor is designee. Any individual who Knowingly and wilfulyfasfes, ot who knowingly anc willy

fate ote ts ropon may be subject to i perlies and crrna senctons (See 6 USC app. 4, 5 WALSEQUSC. § 1007)

Coriicaton Date (Worth, Day, Yea)

: ee =

CERTIFY mate stement ave made on hs form ara aachedecheules “IS

bretve compl a0 cae tothe bot ty know a oot S-IS-O7

LEGISt ATIVE RESOURCE CENTER

2007 MAY 1S PM 4: 02

US. WOUSE GF REPRESENTATIVES

+AND DELIVEREL

y )

‘SCHEDULE Il - PAYMENTS MADE TO CHARITY IN LIEU OF HONORARIA

Name C. W. Bil Young

Page 20f 3

[List the source, activity (Le., speech, appearance, or article), date, and amount of any payment made by the sponsor of an event to a charitable organization in leu

Jof an honorarium. separate confidential list of charities receiving such payments must be filed directly with the Committee on Standards of Official Conduct. A

loreen envelope for transmitting the list Is included in each Member's fling package. Employees may request a green envelope from the Clerk or use a plain

t

‘appropriately labeled.

pc Foundation

Veterans of Foreign Wars, Washington, Honorarium to the Armed Forces 3/6/06

BLOCK A ‘BLOCK ‘BLOCK ‘BLOCK D BLOCKE,

Asset and/or Income Source Year-End Type of Income | Amount of Income | Transaction

Identity (a) each asset hold for investment or production of income with | Value of Asset | Checkallcolumns that | For retirement plans or Indicate if asset

2 fair market value exceeding $1,000 at the end ofthe reporting period, ‘apply. Check "None it | accounts that do not allow | had purchases

‘and (b) any other aaset or source of income which generated more than | atclose of reporting | asset did not generate any| you to choose specific (P), sales (8), or

'$200 in “unearned” income during the year. For rental property or land, | year. Hyou use a income during Investments, you may write | exchanges (E)

provide an address. Provide full names of any mutual fonds. For a self | valuation method omer | calendar year. i other | NA" for income. For all ‘exceoding

irveted IRA (L.., one whore you have the power to select the specie | than fairmarket value, | than one ofthe istod | other assets, indicate the | $1,000n

investments) provige Information on each asset in the account that please specify tho categories, specify the | category of income by reporting yoar.

‘exceeds the reporting threshold and the Income earned forthe account. | method used. an | type of income by writing | checking the appropriate

For an IRA oF retirement plan that snot sel-directed, name the asset was sold ands | a briof description In this | box below. Dividends, even

Inettution holding the account and provide Its value at the end of the | included only because | block. (For exampl reinvested, should be

Teporting period, For an active business that ie not publicly traded, in| itis generated income, | Partnership income or | sted as income. Check.

Block A state the nature of the business and its geographic location. | the value shouldbe | Farm Income) “None” ifne Income was.

For additional information, see Instruction booklet forthe reporting “None. eared.

year,

ddabt owed to you by your spouse, or by your or your:

parent, oF sibling; any deposits totallng $5,000 or less in personal

‘savings accounts; any financial Intorest in or Income derived from U.S.

Government retirement programs.

you so choose, you may indicate that an asset or Income source is

that of your spouse (SP) or dependent child (OC) or is jointly held (JT), In

‘the optional column on the far left

Wright Patman Federal Credit $15,001 - INTEREST $201 - $1,000

Union $50,000

Wright Patman Federal Credit $1,001 - $15,000 None NONE

Union - IRA

Potrebbero piacerti anche

- Y 000062Documento6 pagineY 000062aptureinc100% (3)

- Y 000031Documento2 pagineY 000031aptureinc100% (5)

- Y 000031Documento2 pagineY 000031aptureinc100% (5)

- K 000148Documento92 pagineK 000148aptureinc100% (7)

- Y 000033Documento7 pagineY 000033aptureinc100% (6)

- W 000784Documento4 pagineW 000784aptureinc100% (4)

- Y 000033Documento6 pagineY 000033aptureinc100% (5)

- Y 000033Documento6 pagineY 000033aptureinc100% (6)

- Y 000062Documento7 pagineY 000062aptureinc100% (3)

- W 000738Documento5 pagineW 000738aptureinc100% (1)

- W 000784Documento4 pagineW 000784aptureinc100% (7)

- W 000784Documento10 pagineW 000784aptureinc100% (4)

- W 000779Documento5 pagineW 000779aptureinc100% (3)

- W 000779Documento4 pagineW 000779aptureinc100% (1)

- W 000793Documento6 pagineW 000793aptureinc100% (2)

- W 000793Documento9 pagineW 000793aptureinc100% (3)

- W 000793Documento7 pagineW 000793aptureinc100% (3)

- W 000795Documento8 pagineW 000795aptureincNessuna valutazione finora

- W 000738Documento6 pagineW 000738aptureinc100% (3)

- W 000672Documento17 pagineW 000672aptureinc100% (2)

- W 000672Documento15 pagineW 000672aptureinc100% (4)

- W 000738Documento8 pagineW 000738aptureinc100% (3)

- W 000795Documento7 pagineW 000795aptureinc100% (2)

- W 000672Documento10 pagineW 000672aptureinc100% (3)

- W 000795Documento9 pagineW 000795aptureincNessuna valutazione finora

- W 000804Documento6 pagineW 000804aptureinc100% (5)

- W 000801Documento6 pagineW 000801aptureincNessuna valutazione finora

- W 000801Documento12 pagineW 000801aptureincNessuna valutazione finora

- W 000789Documento34 pagineW 000789aptureincNessuna valutazione finora