Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

W 000793

Caricato da

aptureinc100%(2)Il 100% ha trovato utile questo documento (2 voti)

48 visualizzazioni6 pagineTitolo originale

w000793

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

100%(2)Il 100% ha trovato utile questo documento (2 voti)

48 visualizzazioni6 pagineW 000793

Caricato da

aptureincCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 6

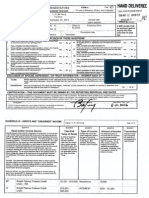

LEGISLATIVE RESOURCE CENTER

2007HAY 15 PM Iz 1h

UNITED STATES HOUSE OF REPRESENTATIVES FORMA eee

FINANCIAL DISCLOSURE STATEMENT FOR CALENDAR YEAR 2006 For use by Members, officers, and employees ae

OE. OF THE gLety

David Wu 5. MOUSE GP ALERESEN Aves

a

2890 Rayburn HOB_ Washington,DC 20515 202226-0885 Non

7 i . rie ene — (CS R.DEHYERE:

Member of the U.S. State: OR [ Officer Or Employing Office: ‘A$200 penalty shall

House of Representative istict 4 ~~ Employee be assessed against

Termination Date more than 30 days

lato.

Tidyou or your spouse have "earned" Tncome fog slaron oes] PATO Tid you your spouse or 8 dependent ch receive any roporabie Tne

rmore from any sree nthe reporting parlod? Yes (11 No (yj VE reporingperod(ie, sgrenating more than S305 and rot oherwise Yog. (-| No Gy

. Pamlenn coraenen

‘Wyse; compraté ane aach Schule Fem comblote a ata Sched

(Did any individual or organization make 2 donation to charity in lieu of paying

‘id you, your spouse, or a dependent child receive any roporable Wave o

you tala tprochsappeceanesor sel inte teportng pera? Yor [No gy Vib ribursemets er tovin te epring pres worhmmre an S58" Ys [) Wo)

yes, complete and attach Schedule Il oe _lf yes, compote and attach Schedule Vi _

Did you, your spouse, Fa dependent child recelre “unearned” income of Did you hod any reportable posons on or bafore the date of fing in the

more tan $200 nthe reporting period orld ary parable asset wordt Yes (Gj No (-] Vill curventealndor your? Yos No C]

tore than $1,000 atthe and ofthe period?

ityes, complete and attach Schedule

‘you, your epovee, or dopandent child purchae

|. reportable assatina tensacton exceeding 1,00

eto?

_ltyes, complete and attach Schedule Vi e -

‘ichange any ‘i you nave any ropertable agreement a arrangement with an outside

reporting” Yes fy) No []. % ently? Yes (Now)

ITyes, complete and attach Schedule Iv. Hes, complete and attach Schedule 1. Zi

y,_ Didyou your spouse, or» dependent hid have any reportable Fait (more

eee eee Yes @ No T] Each question in this part must be answered and the appropriate

complete and attach Schedule V. schedule attached for each "Yes" response.

EXCLUSION OF SPOUSE, DEPENDENT, OR TRUST INFORMATION -- ANSWER EACH OF THESE QUESTIONS

Trusts. Oetals regarding “Guaied Bind Trusts" approved bythe Committe ov Standards of Oficial Ganduct and certain oer “orceptod

trusts" need not be discoued. Have you excided rom tis port deals of such ast benefiting you, Your spouse, or daperent Ye8 C] NO}

ce? ai ait “ ae

Exemptions-- jaye you excluded trom thi report any ater asses, “unearned incom, transactions, or altos ofa spouse or dependent child

‘ecause they moot al tives tests for exemption? Yes @ WoO}

CERTIFICATION -- THIS DOCUMENT MUST BE SIGNED BY THE REPORTING INDIVIDUAL AND DATED

“This Financial Dlscosure Statement is required by the Ettis in Governmant Act of 1878, as amended. The Statement wil be available to any requesting person upon wren

application and wil be reviewed by the Committe on Standards of Oficial Conduct or its desigoge. Any individual whe knowingly and willy flats, or who knowingly and wilfully

{als to fle this report may be subject fo cul penaltes and criminal sanctions (See 5 U.S.C. app. 4, §104 and U.S.C. § 100%).

Catiicaton ‘Signals of Reportng maNaceT Date onth, Day, Year)

| CERTIFY that he statements | nave made on is fom anal atoched schedules

tre tue. complete and conect tothe best of ny Krowedge and bee a slix/t :

i

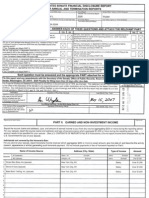

SCHEDULE Ill - ASSETS AND "UNEARNED" INCOME

Name Davic Wu

‘BLOCK A

Asset and/or Income Source

'dontity (a) each asset held for investment or production of income with

afair market value exceeding $1,000 at the end of the reporting period,

‘and (b) any other asset oF source of income which generated more than

$200 in “unearned” Income during the year. For rental property or land,

Provide an address. Provide full names of any mutual funds. For a solf

‘irected IRA (i. one where you have the power to select the specific

Investments) provide information on each asset in the account that

‘exceeds the reporting threshold and the income earned forthe account.

For an IRA or retirement plan that is not selfrected, name the

Institution holding the account and provide its value atthe end of the

‘eporting period. For an active business that is not publicly traded, in

val

year.

‘than

‘BLOCK

Year-End

lue of Asset

at close of reporting

you use a

‘Valuation method other

air market value,

please specity the

fethod used. fan

BLOCK ¢

Type of Income

‘check all columns that

‘apply, Check "None" if

asset cid not generate any

income during the

calendar year. Ifothor

‘han one ofthe listed

categories, specify the

‘pe of income by weting

{brief description in this

Block. (For example:

Partnership Income or

BLOCK D

Amount of Income

For retirement plans or

Accounts tat do not allow

youto choose specific

Investments, you may write

SNA" for income, Far al

ther acca, naicate the

tategory of Income by

Checking the appropriate

box below Dividends, even

ifreinvested, shouldbe

Page 2of 6

BLOCK E

Transaction

Indicate H asset

hhad purchases

@), sales (8), or

exchanges )

‘exceeding

4,000 in

reporting year.

| Cisco Systems Stock SEP-IRA

$1,001 - $15,090

design services

NONE

Block A state the nature of th business and ls geographic location. For Farm income)

‘ditional Information, see instruction booklet forthe reporting Year

Exclude: Your persona residences) (unless there is rntal income}; any

‘debt owed to you by your spouse, or By your or your spouse's chit,

ny deposits totaling $5,000 or les in personal

{Savings account; any financla Interest nor Income derived rom U.S.

Government retirement programs.

{tyou so choose, you may indicate that an asset or income source is that

‘of your spouse (8P) oF dependent child (0G) ors jointly hel (JT, n tho

‘optional column onthe fr let.

sP 1602 SE Flavel St. "$100,001 - RENT $5,001 -$15,000 |

Portland, OR - rental house | $250,000

Agere Systems SEP-IRA $1 - $1,000 NONE, NIA

Ameritrade cash acct SEP-IRA $1 - $1,000 INTEREST $1,001 - $2,500 8

(formerly Bidwell & Co.)

sP Capitol Hill Kitchens (Interior $15,001 - Sales of custom Gross: $52,001

design, Washington, DC) $50,000 cabinetry and Net:$o

Fog Cutter Capital Group SEP-

IRA

$1 - $1,000

DIVIDENDS

$1-$200

.

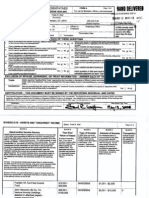

‘SCHEDULE III - ASSETS AND "UNEARNED" INCOME

Name David wu i Page 30 5

General Electric Co. Stock SEP- $1 - $1,000 DIVIDENDS | $1-$200

IRA

Hershey Stock SEP-IRA $1,001 - $15,000 DIVIDENDS $201-$1,000

| Intel Stock SEP-IRA | $1,001 - $15,000, DIVIDENDS $1 - $200 cae

| Loan to David Wu for Congress "$15,001 - Loan Repayment | $2,501-$5,000

1 $50,000 -

Merrill Lynch Cash Acct IRA | $1,001 - $15,000 DIVIDENDS. $1 -$200

}

i

Microsoft Corp Stock SEP-IRA $15,001 - DIVIDENDS $201 - $1,000

$50,000

NVR Inc Stock SEP-IRA $15,001 - NONE ; NONE P

$50,000

Pfizer Inc Stock SEP-IRA $15,001 - DIVIDEND: $201 - $1,000

$50,000 j

Vanguard Health Care Fund $15,001 - DIVIDENDS —_—_—$201 - $1,000

SEP-IRA $60,000

SP Wright-Patman Congressional $1,001 - $15,000 INTEREST | $201 - $1,000

Federal Credit Union IRA (not

self directed)

Potrebbero piacerti anche

- Y 000033Documento6 pagineY 000033aptureinc100% (5)

- Y 000031Documento2 pagineY 000031aptureinc100% (5)

- Y 000031Documento7 pagineY 000031aptureinc100% (4)

- K 000148Documento92 pagineK 000148aptureinc100% (7)

- Y 000031Documento2 pagineY 000031aptureinc100% (5)

- Y 000062Documento7 pagineY 000062aptureinc100% (3)

- Y 000033Documento6 pagineY 000033aptureinc100% (6)

- Y 000033Documento7 pagineY 000033aptureinc100% (6)

- Y 000062Documento6 pagineY 000062aptureinc100% (3)

- W 000738Documento5 pagineW 000738aptureinc100% (1)

- W 000784Documento4 pagineW 000784aptureinc100% (4)

- W 000784Documento4 pagineW 000784aptureinc100% (7)

- W 000784Documento10 pagineW 000784aptureinc100% (4)

- W 000779Documento5 pagineW 000779aptureinc100% (3)

- W 000793Documento9 pagineW 000793aptureinc100% (3)

- W 000779Documento4 pagineW 000779aptureinc100% (1)

- W 000793Documento7 pagineW 000793aptureinc100% (3)

- W 000795Documento8 pagineW 000795aptureincNessuna valutazione finora

- W 000738Documento6 pagineW 000738aptureinc100% (3)

- W 000672Documento17 pagineW 000672aptureinc100% (2)

- W 000672Documento15 pagineW 000672aptureinc100% (4)

- W 000738Documento8 pagineW 000738aptureinc100% (3)

- W 000795Documento7 pagineW 000795aptureinc100% (2)

- W 000672Documento10 pagineW 000672aptureinc100% (3)

- W 000795Documento9 pagineW 000795aptureincNessuna valutazione finora

- W 000804Documento6 pagineW 000804aptureinc100% (5)

- W 000801Documento6 pagineW 000801aptureincNessuna valutazione finora

- W 000801Documento12 pagineW 000801aptureincNessuna valutazione finora

- W 000789Documento34 pagineW 000789aptureincNessuna valutazione finora