Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

W 000793

Caricato da

aptureinc100%(3)Il 100% ha trovato utile questo documento (3 voti)

44 visualizzazioni7 pagineTitolo originale

w000793

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

100%(3)Il 100% ha trovato utile questo documento (3 voti)

44 visualizzazioni7 pagineW 000793

Caricato da

aptureincCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 7

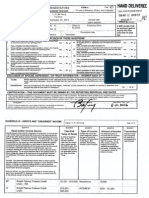

FORMA Page 1017

For use by Members, officers, and employees

“HAND DELIVERE

HeGrStA

Herre 15 AMIG: 38

Gree Use ony,

'8 $200 penalty shal!

be assessed against

anyone who files

more than 30 days

UNITED STATES HOUSE OF REPRESENTATIVES

FINANCIAL DISCLOSURE STATEMENT FOR CALENDAR YEAR 2007

VE RESAUTTE CeWrPY

2022250855

(Daytime Telephane)

David Wu

(GullName}

@ Member ofthe US. State: OR [ Officer or Employing Office:

House of Representatives Dystace gf | Embovee

‘Termination Date:

| Amendment Q Termination

PRELIMINARY INFORMATION -- ANSWER EACH OF THESE QUESTIONS.

‘Did you or your spouse haveeamned" com fog saaras ofa] oF S100 ‘ia you, your spouse, ora GependanT ow

‘ormore fom any toute inthe reprtng panod? Yeo Cl Nog Vi hefner pn, aggregate

sreomplote and attach Schedule Vie

(yu, your spouse, ofa dependent hid recive “aneamed™ income of or before the date of ing inthe

\W. mare than $2001 he eportng pean area any reponse sete wor Yes fy} No {-]/ Yes Mi NOL]

—___ttyes, complete and attach Sched

‘Bid you nave any ropenabe agreement or rangarin wih an oie

wing Yes fj No [7], ME entity? Yes J No i

Ityes, complete and attach Schedule 1X.

_—Hiyes, complete and atach Schedule. ____ ye,

id ou, your spouse, of a epondent ci have ay foporabie abi)

V. mote hun $1660) dig the reporting pend? Yes {@ No (J) Each question in this part must be answered and the appropriate

yes, complete and attach Schedule V. schedule attached for each “Yes” response.

EXCLUSION OF SPOUSE, DEPENDENT, OR TRUST INFORMATION -- ANSWER EACH OF THESE QUESTIONS

“Qualified Blind Trusts” approved by the Committe on Standards of Official Conduct and certain other “excepted

benefiting you, your spouse, or dependent Yes NoL)

Trusts- ate rogaraing

5" need not be disclosed. Have you excluded from this report details of such

spadeEReaSCE edt ee oe -

Exemptions-- Have you excluded from this report any other assets, “unearned” Income, transactions, or fables ofa spouse or dependent child

because they mest all three tests for exemption?

Yes [) Noi)

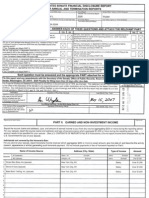

SCHEDULE

BLOCK A

Asset and/or Income Source

than §200 in “unearned” income during the ye

land, provide a complete address. Provide

stitution nofding the account

1¢ end ofthe reporting period, For an active business.

raded, state the name of the business,

In Block A. For adational

- ASSETS AND "UNEARNED" INCOME

Name David Wu

Page zt 7

‘BLOCK 6 BLOCK C BLOCK E

Year-End Type of Income Transaction

Value of Asset | check Indicate if asset

pal h

atclose of reporting | asset did not gene:

exceeding

$1,000 in

‘eporting year.

should be

me. Check

"None" if no income was,

earned.

the value should be

Farm income)

“None.”

ro ot

SP 1602 SE Flavel St, Portland, $100,001 - RENT $5,001 - $15,000

OR - rental home $250,000 }

: eee eee eee EEE

| Agere Systems SEP-IRA $1-$1,000 | None NA

i gegGE | Pe gee SEE eg _ - Hat 7 eee ee eee tt eee

| Ameritrade Money Market $1,001 - | DIVIDENDS | $4- $200 ip

IRA - reinvested dividends from | $15,000 | | \

—— —__IRA stocks pected eee Sesser erect

SP None Sales of custom | Gross: $30,000 =|

| design, Washington, DC) cabinetry and Net: $0

sera eae ges : __ design services i

~ | Cisco Systems Stock SEP-IRA | $1,001 - DIVIDENDS | NONE

| $15,000 {

Fog Cutter Capital Group SEP- $1-$1,000 | DIVIDENDS $4 - $200 |

|

| IRA

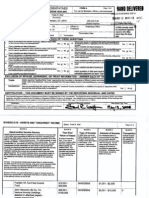

SCHEDULE III - ASSETS AND "UNEARNED" INCOME

Name David Wu

| Page 3 of 7

| General Electric Co. Stock $1-$1,000 | DIVIDENDS. $1 - $200

| SEPARA I L

| Hershey Stock SEP-IRA $1,001 - DIVIDENDS $201 - $1,000 |

$15,000 }

eee EE - gE gee eee

Intel Stock SEP-IRA $1,001 - DIVIDENDS $1 - $200

| $15,000

Tan to David Wu for Congress | None Loan Repayment | $1,001 - $50,000 's

Se BSS Bee ee Pee sate eeetaee Be eee

| Merrill Lynch Cash Acct IRA $1 - $1,000 DIVIDENDS $1 - $200 |

y! '

aan na eget een ae anaes nee ete el ee eee eee eased ese need ete eee teeel (eset eeeeeeeeaetastasiae

| Microsoft Corp Stock SEP-IRA $15,001 - ) DIVIDENDS $201 - $1,000

$50,000 (

| NVR Inc Stock SEP-IRA $15,001 - | DIVIDENDS NONE

| $50,000

Pfizer Inc Stock SEPARA $1,001 - IDENDS $201 - $1,000

| $15,000 }

Vanguard Health Care Fund | $15,001 - IDENDS/CAPI | $2,501 - $5,000

SEP-IRA | $50,000 TAL GAINS i

sP Wright-Patman Congressional | None None $1,001 - $2,500

| Federal Credit Union IRA (not

deere te ine cto) ase eae ee eee geese seve esese eee ceeSe ree :

Not known Not known }

| trust)

| Not known

Potrebbero piacerti anche

- Y 000033Documento6 pagineY 000033aptureinc100% (5)

- Y 000031Documento2 pagineY 000031aptureinc100% (5)

- Y 000031Documento7 pagineY 000031aptureinc100% (4)

- K 000148Documento92 pagineK 000148aptureinc100% (7)

- Y 000031Documento2 pagineY 000031aptureinc100% (5)

- Y 000062Documento7 pagineY 000062aptureinc100% (3)

- Y 000033Documento6 pagineY 000033aptureinc100% (6)

- Y 000033Documento7 pagineY 000033aptureinc100% (6)

- Y 000062Documento6 pagineY 000062aptureinc100% (3)

- W 000738Documento5 pagineW 000738aptureinc100% (1)

- W 000784Documento4 pagineW 000784aptureinc100% (4)

- W 000784Documento4 pagineW 000784aptureinc100% (7)

- W 000784Documento10 pagineW 000784aptureinc100% (4)

- W 000779Documento5 pagineW 000779aptureinc100% (3)

- W 000793Documento9 pagineW 000793aptureinc100% (3)

- W 000779Documento4 pagineW 000779aptureinc100% (1)

- W 000793Documento6 pagineW 000793aptureinc100% (2)

- W 000795Documento8 pagineW 000795aptureincNessuna valutazione finora

- W 000738Documento6 pagineW 000738aptureinc100% (3)

- W 000672Documento17 pagineW 000672aptureinc100% (2)

- W 000672Documento15 pagineW 000672aptureinc100% (4)

- W 000738Documento8 pagineW 000738aptureinc100% (3)

- W 000795Documento7 pagineW 000795aptureinc100% (2)

- W 000672Documento10 pagineW 000672aptureinc100% (3)

- W 000795Documento9 pagineW 000795aptureincNessuna valutazione finora

- W 000804Documento6 pagineW 000804aptureinc100% (5)

- W 000801Documento6 pagineW 000801aptureincNessuna valutazione finora

- W 000801Documento12 pagineW 000801aptureincNessuna valutazione finora

- W 000789Documento34 pagineW 000789aptureincNessuna valutazione finora