Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Wilkerson Case Study Final1

Caricato da

mayer_oferDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Wilkerson Case Study Final1

Caricato da

mayer_oferCopyright:

Formati disponibili

Wilkerson Case Study

1. The competitive situation is different between the products. Pumps are commodity products, produced in high volumes for a market with high price competition - price cutting by competitors led to a drop of Wilkersons pre -tax margin to under 3%, gross margin on sales for pump sales has fallen below 20%. Flow controllers are customized products, sold in a less competitive market with inelastic demand at the current price range. Valves are standard, produced and shipped in large lots - gross margins have been maintained at 35%. Wilkerson is a quality leader, but this leadership may soon be contested by several competitors. Although they are able to match Wilkerson's quality, there are no signs of price competition yet. Nevertheless, in the long-run Wilkerson should be prepared to compete on price. The price competition pushes Wilkerson to analyze its overhead costs, since no reserves of cost cutting are left in its supply chain (both customer and suppliers agreed to just-in-time delivery). 2. The problem in the current pricing method used by Wilkerson is that the real manufacturing cost of each product is not realistic because of the high proportion of overhead costs which are 806,000 of 1,535,250 (52.5%) The current method assumes the overhead costs are correlated to the labor costs at 300% rate, while many of the overhead activities are performed per product line regardless of the amount of units produced. The approach of treating the overhead expenses as a period expense, suggests that the product cost and profitability will be measured without overhead costs (by increasing the profitability margins). This means there is a correlation between the variable costs (labors and materials) to the product price. The method doesn't consider the different activities performed for each product line. Although in a lucky way better reflects the real cost of the products, giving more weight of the overhead costs to the Flow Controllers, just because their material price is higher, but not

from the real reason (higher activity costs), this solution is not good from similar reasons like the current method.

3. Wilkerson's existing cost system of is the traditional volume-based costing: Direct materials and labor costs are based on standard prices of materials and labor rates. In addition, the manufacturing overhead is also considered as cost and it is allocated in proportion to direct labor cost at the rate of 300% (Based on the assumption that theres a direct relationship between volume of production of individual products and level of overhead).

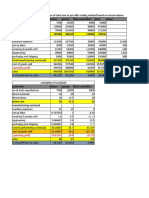

Product # of Units Direct Labor Direct Material Total Direct Costs Overhead Costs (300% of DL) Total Cost Allocation

Valves 7500 75000 120000 195000 225000 420000

Pumps 12500 156250 250000 406250 468750 875000

Flow Controllers 4000 40000 88000 128000 120000 248000

Total 24000 271250 458000 729250 813750 (806000) 1543000

4. As overhead costs are not in proportion with the volume of production output the cost system Wilkerson is using at the moment is an inappropriate method that leads to wrong assumptions when analyzing profitability and therefore leads to wrong pricing decisions and ineffective cost management. Activity based costing helps to find the real relationship between the volume of production of a product and the overhead. In a first step it is necessary to define cost pools and find the drivers of those costs. In Wilkersons case the different pools would be machine related expenses, set up labor, receiving and production control, packaging and shipping and engineering. The related cost drivers are machine hours, production runs, hours of engineering work and number of shipments. Table 1 - Cost Pools -> Cost Drivers -> Activity-Based Cost Rate

Cost Pool

Amount ($)

Cost Driver

Amount

Activity-Based Cost Rate

Machine Related Expenses Setup labour Receiving and production control Engineering Packaging and shipping

336,000 40,000 180,000

Machine hours Production runs Production runs Hours of engineering work Number of shipments

11,200 machine hours $30 per machine hour 160 production runs 160 production runs 1,250 engineering hours 300 shipments $250 per production run $1,125 per production run $80 per engineering hour $500 per shipment

100,000 150,000

Table 2 - Activity-Based Cost Calculation per product (using data from Exhibit 4)

Product Valves Units 7500 Direct Labour 75,000 Direct Material 120,000 Total Direct Costs 195,000 Manufacturing Overheads - Machine Related 112,500 Expenses - Setup labour 2,500 - Receiving and 11,250 production control - Engineering 20,000 - Packaging and 5,000 shipping Total Manufacturing 151,250 Overheads Total Cost Allocation 346,250

Pumps 12500 156,250 250,000 406,250

Flow Controllers 4000 40,000 88,000 128,000

187,500 12,500 56,250 30,000 35,000 321,250 727,500

36,000 25,000 112,500 50,000 110,000 333,500 461,500

From table 3 we can see that flow controllers are not contributing in a positive way as they have a negative gross margin of -9.90%. While Valves have a higher margin (46.3%) and also Pumps have a higher gross margin with 33.1%. Vales and Pumps are therefore actually much more attractive for the company than they had expected while Flow controllers contributes a negative gross margin.

Table 3 Comparing between costing methods

Method Product Unit Produced Standard Unit Cost Planned Gross Margin Target Selling Price Actual Selling Price Actual Gross Margin

Existing Cost System

Valves Pumps Flow Controllers

Activity-Based Cost System

Valves Pumps Flow Controllers

7500 $56.00 35%

12500 $70.00 35%

4000 $62.00 35%

7500 $46.17 35%

12500 $58.20 35%

4000 $115.38 35%

$86.15

$107.69

$95.38

$71.03

$89.54

$177.50

$86.00

$87.00

$105.00

$86.00

$87.00

$105.00

34.9%

19.5%

41.0%

46.3%

33.1%

-9.9%

Using cost drivers for the calculation gives much more accurate information about the actual production costs. When looking at the gross margins in Exhibit 2 in the case Valves had a margin of 34.9%, Pumps a margin of 19.5% and Flow controllers of 41%. Therefore you can deduct that Pumps and Valves are more attractive for the company than they actually thought. The shifts in costs and profitability are caused of the change of cost method, to a method which is more accurate.

5. The first thing to take care of is the Flow Controllers, as the Wilkerson's management team can take advantage of the favorable competitive situation in this market which is the inelastic demand and the lack of competition, and therefore raise their price up to the range between 116-177.5, depends on the market reaction (even if the previous 10% price raise didn't damaged the sales, a 50% raise may damage them). Also the management team can compete in the price competition on the valves and pumps to maintain and maybe increase their market share , although an exam should be made in order to check if the price decrease will harm the profit. 6. The cost calculations in question 4 are sensitive to the utilization of the product line. We based our numbers on the information of March 2000, which is mentioned as a typical month, but it is also mentioned that on months of high demand machines worked 12,000 hours, factory handled 180 production runs and 400 shipments The cost calculations would be best achieved if we based it on past years demands charts which include seasonal shifts in demands. The cost of the resources and labor can also change during time and should be updated for accurate cost calculation. 7. The current salespersons incentive system, based on volumes only, drives the salespersons to maximize their sales regardless Wilkerson's profit. There are 2 main problems1. The salespersons will want to sell for the lowest price they can, in order to increase their sales volume. 2. If the Company has several product lines, the salespersons do not necessarily have the incentive to sell the most profitable products, but only the products generating maximal volumes. I recommend on changing the incentive system to compensation on the profit generated from each sale, based on the known values of cost of each product using Activity-Based Costs. In this way the interests are similar and the salespersons will gain more when the company will profit more.

Potrebbero piacerti anche

- Solution Wilkerson CompanyDocumento10 pagineSolution Wilkerson CompanyHIMANSHU AGRAWAL67% (3)

- ABC Analysis Reveals Flow Controllers UnprofitableDocumento5 pagineABC Analysis Reveals Flow Controllers UnprofitableChinee Natividad100% (2)

- Euro4 vehicle diesel engines 199 - 397 kW (270 - 540 hpDocumento6 pagineEuro4 vehicle diesel engines 199 - 397 kW (270 - 540 hpBranislava Savic63% (16)

- Wilkerson Case Study FinalDocumento5 pagineWilkerson Case Study Finalmayer_oferNessuna valutazione finora

- Wilkerson Company 3Documento2 pagineWilkerson Company 3Mohammad RakivNessuna valutazione finora

- Whether Merck Should Take Licensing of DavanrikrugDocumento19 pagineWhether Merck Should Take Licensing of DavanrikrugratishmayankNessuna valutazione finora

- Wilkerson Company Analysis Using Activity Based CostingDocumento5 pagineWilkerson Company Analysis Using Activity Based CostingHardik Sanghavi100% (1)

- Management Accounting Wilkerson Company CasestudyDocumento3 pagineManagement Accounting Wilkerson Company CasestudysamacsterNessuna valutazione finora

- Wilkerson ABC Costing Case StudyDocumento8 pagineWilkerson ABC Costing Case StudyParamjit Singh100% (4)

- Wilkerson Company case submission 4: Activity-based costing improves profitability analysisDocumento4 pagineWilkerson Company case submission 4: Activity-based costing improves profitability analysisishan.gandhi1Nessuna valutazione finora

- Wilkerson Company ABCDocumento4 pagineWilkerson Company ABCrajyalakshmiNessuna valutazione finora

- Activity-Based Costing SystemDocumento35 pagineActivity-Based Costing SystemAhmad Tariq Bhatti100% (1)

- Case AnalysisDocumento3 pagineCase AnalysisBadri100% (2)

- SiemensDocumento7 pagineSiemensshshank pandeyNessuna valutazione finora

- WilkDocumento3 pagineWilkMohammed Maaz GabburNessuna valutazione finora

- Wilkerson Case Costing AnalysisDocumento5 pagineWilkerson Case Costing AnalysisSwapan Kumar Saha100% (1)

- Wilkerson Case Study Final1Documento5 pagineWilkerson Case Study Final1mayer_ofer95% (22)

- Assignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundDocumento5 pagineAssignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundRitika Sharma0% (1)

- Wilkerson Case SubmissionDocumento5 pagineWilkerson Case Submissiongangster91100% (2)

- Case Classic Pen Company Activity Based CostingDocumento20 pagineCase Classic Pen Company Activity Based CostingAlee Di Vaio83% (6)

- SiemensDocumento10 pagineSiemenssharadharjai100% (2)

- Waltham Oil Lube Centre Inc - FinalDocumento10 pagineWaltham Oil Lube Centre Inc - Finalerarun2267% (3)

- Siemens Electric Motor Works (A) Assignment QuestionsDocumento3 pagineSiemens Electric Motor Works (A) Assignment QuestionsDeana Chandler Jackson100% (2)

- Wilkerson - Case Study1 PDFDocumento2 pagineWilkerson - Case Study1 PDFPavanNessuna valutazione finora

- Group 8Documento20 pagineGroup 8nirajNessuna valutazione finora

- Case Study WilkersonDocumento2 pagineCase Study WilkersonHIMANSHU AGRAWALNessuna valutazione finora

- WilkersonDocumento4 pagineWilkersonVarun Gogia67% (3)

- Davey Brothers Watch Co. SubmissionDocumento13 pagineDavey Brothers Watch Co. SubmissionEkta Derwal PGP 2022-24 BatchNessuna valutazione finora

- Precision Motors Division CaseDocumento9 paginePrecision Motors Division CaseAliza Rizvi50% (2)

- Solution To Dakota Office Product ProblemDocumento3 pagineSolution To Dakota Office Product ProblemRehanBhagat0% (1)

- Wilkerson CompanyDocumento2 pagineWilkerson CompanyAnkit VermaNessuna valutazione finora

- Classic Pen Company: Case Analysis - Activity Based Cost System Group - 07Documento16 pagineClassic Pen Company: Case Analysis - Activity Based Cost System Group - 07Anupriya Sen100% (1)

- Wilkerson CompanyDocumento26 pagineWilkerson CompanyChris Vincent50% (2)

- Company CASE 4 Analyzes Activity-Based Costing to Improve Profit Margins/TITLEDocumento24 pagineCompany CASE 4 Analyzes Activity-Based Costing to Improve Profit Margins/TITLECik Beb Gojes100% (1)

- Color ScopeDocumento12 pagineColor Scopeprincemech2004100% (1)

- International Accounting Group Assignment WilkersonDocumento27 pagineInternational Accounting Group Assignment WilkersonToshimichi ItoNessuna valutazione finora

- Wilkerson Company Full ReportDocumento9 pagineWilkerson Company Full ReportFatihahZainalLim100% (1)

- Activity-Based Cost Systems: The Classic Pen Company A Case AnalysisDocumento14 pagineActivity-Based Cost Systems: The Classic Pen Company A Case AnalysisSarveshwar Sharma50% (2)

- Sippican A Case Study PDFDocumento9 pagineSippican A Case Study PDFAlex G. PichliavasNessuna valutazione finora

- Palgrave Handbook of Research in Historical Culture and EducationDocumento847 paginePalgrave Handbook of Research in Historical Culture and EducationGonzalo Garcia100% (1)

- IEC-60721-3-3-2019 (Enviromental Conditions)Documento12 pagineIEC-60721-3-3-2019 (Enviromental Conditions)Electrical DistributionNessuna valutazione finora

- Wllkerson Company operating results valves pumps flow controllersDocumento2 pagineWllkerson Company operating results valves pumps flow controllersdp14Nessuna valutazione finora

- Harmon Case - Group 6Documento8 pagineHarmon Case - Group 6Navodyuti DasNessuna valutazione finora

- EX 1 - WilkersonDocumento8 pagineEX 1 - WilkersonDror PazNessuna valutazione finora

- Little Book of Effective WritingDocumento44 pagineLittle Book of Effective Writingshalashvili100% (1)

- AC7114-2 Rev N Delta 1Documento34 pagineAC7114-2 Rev N Delta 1Vijay YadavNessuna valutazione finora

- Dakota Office ProductssDocumento17 pagineDakota Office ProductssSuzan Bakleh100% (5)

- 21PGDM152 - RACHIT MRINAL - Don't Bother Me, Can't Cope AssignmentDocumento6 pagine21PGDM152 - RACHIT MRINAL - Don't Bother Me, Can't Cope AssignmentRachit Mrinal100% (3)

- Destin BrassDocumento5 pagineDestin Brassdamanfromiran100% (1)

- Ch10solution ManualDocumento31 pagineCh10solution ManualJyunde WuNessuna valutazione finora

- Classic Pen Company Activity Based CostingDocumento16 pagineClassic Pen Company Activity Based CostingIndahKusumawardhaniNessuna valutazione finora

- WilkersonDocumento4 pagineWilkersonmayurmachoNessuna valutazione finora

- Wilkerson CompanyDocumento4 pagineWilkerson Companyabab1990Nessuna valutazione finora

- Wilkerson Company ABC Cost System Exhibit 1.a Cost Pool Cost DriverDocumento2 pagineWilkerson Company ABC Cost System Exhibit 1.a Cost Pool Cost DriverLeonardoGomez100% (1)

- Wilkerson Case Assignment Questions Part 1Documento1 paginaWilkerson Case Assignment Questions Part 1gangster91Nessuna valutazione finora

- Siemens CaseDocumento4 pagineSiemens Casespaw1108Nessuna valutazione finora

- MAC Davey Brothers - AkshatDocumento4 pagineMAC Davey Brothers - AkshatPRIKSHIT SAINI IPM 2019-24 BatchNessuna valutazione finora

- Symphony Theatre balance sheet and income statement for 2001Documento6 pagineSymphony Theatre balance sheet and income statement for 2001Prakash Iyer50% (2)

- How Does Wilkerson's Existing Cost System Operate? Develop A Diagram To Show How Costs Flow From Factory Expense Accounts To ProductsDocumento4 pagineHow Does Wilkerson's Existing Cost System Operate? Develop A Diagram To Show How Costs Flow From Factory Expense Accounts To ProductsKunal DhageNessuna valutazione finora

- CompanyDocumento4 pagineCompanyKomalVatsaNessuna valutazione finora

- Accounting 2Documento7 pagineAccounting 2vietthuiNessuna valutazione finora

- ACCY121FinalExamInstrManualchs9!11!13 16 AppendixDocumento115 pagineACCY121FinalExamInstrManualchs9!11!13 16 AppendixArun MozhiNessuna valutazione finora

- Case 1Documento6 pagineCase 1Oscar VilcapomaNessuna valutazione finora

- Milat TractorsDocumento10 pagineMilat TractorsUzair ShahNessuna valutazione finora

- Chapter 2. - Activity Based Costing PPT Dec 2011Documento5 pagineChapter 2. - Activity Based Costing PPT Dec 2011shemidaNessuna valutazione finora

- Cost 1 Chapt-3Documento43 pagineCost 1 Chapt-3Tesfaye Megiso BegajoNessuna valutazione finora

- Case OverviewDocumento9 pagineCase Overviewmayer_oferNessuna valutazione finora

- DELTA FinalDocumento7 pagineDELTA Finalmayer_oferNessuna valutazione finora

- Note On Behavioral Pricing PDFDocumento12 pagineNote On Behavioral Pricing PDFmayer_oferNessuna valutazione finora

- The Slave Trade and The British Empire An Audit of Commemoration in WalesDocumento133 pagineThe Slave Trade and The British Empire An Audit of Commemoration in WaleslegoarkeologNessuna valutazione finora

- Eudragit ReviewDocumento16 pagineEudragit ReviewlichenresearchNessuna valutazione finora

- Maximizing modular learning opportunities through innovation and collaborationDocumento2 pagineMaximizing modular learning opportunities through innovation and collaborationNIMFA SEPARANessuna valutazione finora

- Dr. Malik's Farms BrochureDocumento18 pagineDr. Malik's Farms BrochureNeil AgshikarNessuna valutazione finora

- Chapter 9-10 (PPE) Reinzo GallegoDocumento48 pagineChapter 9-10 (PPE) Reinzo GallegoReinzo GallegoNessuna valutazione finora

- A Systematic Scoping Review of Sustainable Tourism Indicators in Relation To The Sustainable Development GoalsDocumento22 pagineA Systematic Scoping Review of Sustainable Tourism Indicators in Relation To The Sustainable Development GoalsNathy Slq AstudilloNessuna valutazione finora

- Credit Risk Management Practice in Private Banks Case Study Bank of AbyssiniaDocumento85 pagineCredit Risk Management Practice in Private Banks Case Study Bank of AbyssiniaamogneNessuna valutazione finora

- T23 Field Weld Guidelines Rev 01Documento4 pagineT23 Field Weld Guidelines Rev 01tek_surinderNessuna valutazione finora

- Genre Worksheet 03 PDFDocumento2 pagineGenre Worksheet 03 PDFmelissaNessuna valutazione finora

- MVJUSTINIANI - BAFACR16 - INTERIM ASSESSMENT 1 - 3T - AY2022 23 With Answer KeysDocumento4 pagineMVJUSTINIANI - BAFACR16 - INTERIM ASSESSMENT 1 - 3T - AY2022 23 With Answer KeysDe Gala ShailynNessuna valutazione finora

- Front Cover Short Report BDA27501Documento1 paginaFront Cover Short Report BDA27501saperuddinNessuna valutazione finora

- Lesson Plan 2018-2019 Term 1Documento205 pagineLesson Plan 2018-2019 Term 1Athlyn DurandNessuna valutazione finora

- BMXNRPDocumento60 pagineBMXNRPSivaprasad KcNessuna valutazione finora

- Rakpoxy 150 HB PrimerDocumento1 paginaRakpoxy 150 HB Primernate anantathatNessuna valutazione finora

- Principles of Management NotesDocumento61 paginePrinciples of Management Notestulasinad123Nessuna valutazione finora

- OLA CAB MARKET ANALYSIS AND TRENDSDocumento55 pagineOLA CAB MARKET ANALYSIS AND TRENDSnitin gadkariNessuna valutazione finora

- Agricultural Sciences P1 Nov 2015 Memo EngDocumento9 pagineAgricultural Sciences P1 Nov 2015 Memo EngAbubakr IsmailNessuna valutazione finora

- Power Bi ProjectsDocumento15 paginePower Bi ProjectssandeshNessuna valutazione finora

- Chapter 1 - IntroductionDocumento42 pagineChapter 1 - IntroductionShola ayipNessuna valutazione finora

- 4 - Complex IntegralsDocumento89 pagine4 - Complex IntegralsryuzackyNessuna valutazione finora

- Daughters of The Storm by Kim Wilkins - Chapter SamplerDocumento32 pagineDaughters of The Storm by Kim Wilkins - Chapter SamplerHarlequinAustraliaNessuna valutazione finora

- Tugas B InggrisDocumento6 pagineTugas B Inggrisiqbal baleNessuna valutazione finora

- (App Note) How To Design A Programmable Gain Instrumentation AmplifierDocumento7 pagine(App Note) How To Design A Programmable Gain Instrumentation AmplifierIoan TudosaNessuna valutazione finora

- FINAL - Plastic Small Grants NOFO DocumentDocumento23 pagineFINAL - Plastic Small Grants NOFO DocumentCarlos Del CastilloNessuna valutazione finora

- Febrile SeizureDocumento3 pagineFebrile SeizureClyxille GiradoNessuna valutazione finora