Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FAP18e Ch014

Caricato da

Thalia SandersDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

FAP18e Ch014

Caricato da

Thalia SandersCopyright:

Formati disponibili

Chapter 14

Long-Term Liabilities

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

Conceptual Learning Objectives

C1: Explain the types and payment patterns of notes C2: Appendix 14A: Explain and compute the present value of an amount to be paid at a future date C3: Appendix 14C: Describe the accrual of bond interest when bond payments do not align with accounting periods C4: Appendix 14D: Describe the accounting for leases and pensions

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

Analytical Learning Objectives

A1: Compare bond financing with stock financing A2: Assess debt features and their implications A3: Compute the debt-to-equity ratio and explain its use

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

Procedural Learning Objectives

P1: Prepare entries to record bond issuance and bond interest expense P2: Compute and record amortization of bond discount P3: Compute and record amortization of bond premium P4: Record the retirement of bonds P5: Prepare entries to account for notes

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

A1

Advantages of Bonds

Bonds do not affect stockholder control. Interest on bonds is tax deductible. Bonds can increase return on equity.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

A1

Disadvantages of Bonds

Bonds require payment of both periodic interest and par value at maturity. Bonds can decrease return on equity when the company pays more in interest than it earns on the borrowed funds.

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

A2

Bond Trading

Bond market values are expressed as a percent of their par value.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

A1

Bond Issuing Procedures

A company sells the bonds to. . .

. . .an investment firm called an underwriter. The underwriter sells the bonds to. . .

. . . investors

McGraw-Hill/Irwin

A trustee monitors the bond issue.

The McGraw-Hill Companies, Inc., 2007

A1

Basics of Bonds

Corporation

Bond Selling Price

Investors

Bond Certificate at Par Value

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

A1

Basics of Bonds

Bond Interest Payments

Corporation

Bond Interest Payments

Investors

Bond Issue Date

McGraw-Hill/Irwin

Interest Payment = Bond Par Value Stated Interest Rate

The McGraw-Hill Companies, Inc., 2007

A2

Basics of Bonds

Bond Par Value at Maturity Date

Corporation

Investors

Bond Issue Date

McGraw-Hill/Irwin

Bond Maturity Date

The McGraw-Hill Companies, Inc., 2007

P1

Issuing Bonds at Par

King Co. issues the following bonds on January 1, 2008 Par Value = $1,000,000 Stated Interest Rate = 10% Interest Dates = 6/30 and 12/31 Bond Date = Jan. 1, 2008 Maturity Date = Dec. 31, 2027 (20 years)

Jan. 1

Cash Bonds payable

DR 1,000,000

Issued bonds at par

CR 1,000,000

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

P1

Issuing Bonds at Par

The entry on June 30, 2008, to record the first semiannual interest payment is . . .

June 30 Bond interest expense Cash DR 50,000 CR 50,000

Paid semi-annual interest

$1,000,000 10% year = $50,000 This entry is made every six months until the bonds mature.

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

P1

Issuing Bonds at Par

On Dec. 31, 2027, the bonds mature, King Co. makes the following entry . . .

DR 1,000,000 CR 1,000,000

Dec. 31

Bonds payable Cash

Paid bond principal at maturity

The debt has now been extinguished.

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

P1

Bond Discount or Premium

Contract rate is: Bond sells: Above market rate At a premium Equal to market rate At par value Below market rate At a discount

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

P2

Issuing Bonds at a Discount

Prepare the entry for Jan. 1, 2008, to record the following bond issue by Rose Co. Par Value = $1,000,000 Issue Price = 92.6405% of par value Stated Interest Rate = 10% Bond will sell at a discount. Market Interest Rate = 12% Interest Dates = 6/30 and 12/31 Bond Date = Jan. 1, 2008 Maturity Date = Dec. 31, 2012 (5 years)

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

P2

Issuing Bonds at a Discount

Par Value $1,000,000 Discount - $ 926,405 = $ 73,595 Cash Proceeds

$1,000,000 92.6405% Amortizing the discount increases Interest Expense over the outstanding life of the bond.

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

P2

Issuing Bonds at a Discount

On Jan. 1, 2008, Rose Co. would record the bond issue as follows.

DR 926,405 73,595 CR

Jan. 1

Cash Discount on bonds payable Bonds payable

1,000,000

Sold bonds at a discount on issue date

Contra-Liability Account

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

P2

Issuing Bonds at a Discount

Partial Balance Sheet as of Jan. 1, 2008 DR $ 1,000,000 73,595 CR $ 926,405

Long-term Liabilities: Bonds Payable Less: Discount on Bonds Payable

Maturity Value Using the straight-line method, the discount amortization will be $7,360 every six months. $73,595 10 periods = $7,360*

McGraw-Hill/Irwin

Carrying Value

*(rounded)

The McGraw-Hill Companies, Inc., 2007

P2

Issuing Bonds at a Discount

Make the following entry every six months to record the cash interest payment and the amortization of the discount.

June 30

Bond interest expense Discount on bonds payable Cash

DR 57,360

CR 7,360 50,000

Paid semi-annual interest and amortized discount

$73,595 10 periods = $7,360 (rounded) $1,000,000 10% = $50,000

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

P2

Date 1/1/2008 6/30/2008 12/31/2008 6/30/2009 12/31/2009 6/30/2010 12/31/2010 6/30/2011 12/31/2011 6/30/2012 12/31/2012

* Rounded.

McGraw-Hill/Irwin

Straight-Line Amortization Table Interest Interest Discount Unamortized Carrying Payment Expense Amortization* Discount Value $ 73,595 $ 926,405 $ 50,000 $ 57,360 $ 7,360 66,235 933,765 50,000 57,360 7,360 58,875 941,125 50,000 57,360 7,360 51,515 948,485 50,000 57,360 7,360 44,155 955,845 50,000 57,360 7,360 36,795 963,205 50,000 57,360 7,360 29,435 970,565 50,000 57,360 7,360 22,075 977,925 50,000 57,360 7,360 14,715 985,285 50,000 57,360 7,360 7,355 992,645 50,000 57,355 7,355 0 1,000,000 $ 500,000 $ 573,595 $ 73,595

The McGraw-Hill Companies, Inc., 2007

P2

Straight-Line and Effective Interest Methods

Both methods report the same amount of interest expense over the life of the bond.

60,000 59,000 58,000 57,000 12/31/2008 12/31/2009 56,000 Straight-Line Method 57,360 57,360 55,000 Effective Interest Method 55,919 56,650 54,000 2008 2009 2010 2011 2012

Straight-Line Method

12/31/2010 12/31/2011 Effective Interest

Method 57,360

57,472

57,360 58,396

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

P3

Issuing Bonds at a Premium

Prepare the entry for Jan. 1, 2008, to record the following bond issue by Rose Co. Par Value = $1,000,000 Issue Price = 108.1145% of par value Stated Interest Rate = 10% Bond will sell at a premium. Market Interest Rate = 8% Interest Dates = 6/30 and 12/31 Bond Date = Jan. 1, 2008 Maturity Date = Dec. 31, 2012 (5 years)

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

P3

Issuing Bonds at a Premium

Par Value Premium $1,081,145 - $ 1,000,000 = $ 81,145 Cash Proceeds

$1,000,000 108.1145% Amortizing the premium decreases Interest Expense over the life of the bond.

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

P3

Issuing Bonds at a Premium

On Jan. 1, 2008, Rose Co. would record the bond issue as follows.

DR CR

81,145 1,000,000

Jan. 1

Cash Premium on bonds payable Bonds payable

1,081,145

Issued bonds at a premium on issue date

Adjunct-Liability Account

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

P3

Issuing Bonds at a Premium

Partial Balance Sheet as of Jan. 1, 2008 DR $ 1,000,000 81,145 CR $ 1,081,145

Long-term Liabilities: Bonds Payable Add: Premium on Bonds Payable

Using the straight-line method, the premium amortization will be $8,115 every six months.

$81,145 10 periods = $8,115 (rounded)

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

P3

Issuing Bonds at a Premium

This entry is made every six months to record the cash interest payment and the amortization of the premium.

Premium on bonds payable Cash 8,115 50,000

Paid semi-annual interest and amortized premium

$81,145 10 periods = $8,115 (rounded) $1,000,000 10% = $50,000

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

P3

Date 1/1/2008 6/30/2008 12/31/2008 6/30/2009 12/31/2009 6/30/2010 12/31/2010 6/30/2011 12/31/2011 6/30/2012 12/31/2012

* Rounded.

McGraw-Hill/Irwin

Straight-Line Amortization Table Interest Interest Premium Unamortized Carrying Payment Expense Amortization* Premium Value $ 81,145 $ 1,081,145 $ 50,000 $ 41,885 $ 8,115 73,030 1,073,030 50,000 41,885 8,115 64,915 1,064,915 50,000 41,885 8,115 56,800 1,056,800 50,000 41,885 8,115 48,685 1,048,685 50,000 41,885 8,115 40,570 1,040,570 50,000 41,885 8,115 32,455 1,032,455 50,000 41,885 8,115 24,340 1,024,340 50,000 41,885 8,115 16,225 1,016,225 50,000 41,885 8,115 8,110 1,008,110 50,000 41,890 8,110 0 1,000,000 $ 500,000 $ 418,855 $ 81,145

The McGraw-Hill Companies, Inc., 2007

C3

Accruing Bond Interest Expense

End of accounting Interest Payment Dates period Apr. 1 Oct. 1 Dec. 31 3 months accrued interest

Jan. 1

At year-end, an adjusting entry is necessary to recognize bond interest expense accrued since the most recent interest payment.

The McGraw-Hill Companies, Inc., 2007

McGraw-Hill/Irwin

C2

Present Value of a Discount Bond

Calculate the issue price of Rose Inc.s bonds. Par Value = $1,000,000 Issue Price = ? Stated Interest Rate = 10% Market Interest Rate = 12% Interest Dates = 6/30 and 12/31 Bond Date = Jan. 1, 2008 Maturity Date = Dec. 31, 2012 (5 years)

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

C2

Present Value of a Discount Bond

Cash Flow Par value of the bond Interest (annuity) Price of bond Table PV of $1 PV of an Annuity of $1 Table Present Value Amount Value 0.5584 $ 1,000,000 $ 558,400 7.3601 50,000 368,005 $ 926,405

1. Semiannual rate = 6% (Market rate 12% 2) 2. Semiannual periods = 10 (Bond life 5 years 2) $1,000,000 10% = $50,000

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

P4

Bond Retirement

Dec. 31

At Maturity

Bonds payable Cash

DR 1,000,000

CR 1,000,000

Retirement of bonds at maturity

Before Maturity

Carrying Value > Retirement Price = Gain Carrying Value < Retirement Price = Loss

The McGraw-Hill Companies, Inc., 2007

McGraw-Hill/Irwin

A2

Types of Bonds

Secured and Unsecured Term and Serial Registered and Bearer

Convertible and Callable

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

Bond Retirement

The carrying value of the bond at maturity should equal its par value. Sometimes bonds are retired prior to their maturity. Two common ways to retire bonds are through the exercise of a callable option or through purchasing them on the open market. Callable bonds present several accounting issues including calculating gains and losses.

The McGraw-Hill Companies, Inc., 2007

McGraw-Hill/Irwin

C1

Long-Term Notes Payable

Are you ready to discuss longterm notes payable?

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

C1

Long-Term Notes Payable

Cash

Company

Note Payable

Lender

When is the repayment of the principal and interest going to be made?

Note Date

McGraw-Hill/Irwin

Note Maturity Date

The McGraw-Hill Companies, Inc., 2007

C1

Long-Term Notes Payable

Single Payment of Principal plus Interest

Company Lender

Single Payment of Principal plus Interest

Note Date

McGraw-Hill/Irwin

Note Maturity Date

The McGraw-Hill Companies, Inc., 2007

C1

Long-Term Notes Payable

Regular Payments of Principal plus Interest

Company

Lender

Regular Payments of Principal plus Interest

Note Date

McGraw-Hill/Irwin

Payments can either be equal principal payments plus interest or equal payments.

Note Maturity Date

The McGraw-Hill Companies, Inc., 2007

C1

Installment Notes with Equal Principal Payments

$16,000 $14,000 $12,000 $10,000 $8,000 $6,000 $4,000 $2,000 $Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Annual payments decrease.

Interest Principal

The principal payments are $10,000 each year. Interest expense decreases each year.

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

C1

Installment Notes with Equal Payments

Annual payments are constant.

Interest Principal

$14,000 $12,000 $10,000 $8,000 $6,000 $4,000 $2,000 $Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

The principal payments increase each year. Interest expense decreases each year.

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

C1

Mortgage Notes and Bonds

A legal agreement that helps protect the

lender if the borrower fails to make the required payments.

Gives the lender the right to be paid out of

the cash proceeds from the sale of the borrowers assets specifically identified in the mortgage contract.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

A3

Debt-to-Equity Ratio

Debt-toEquity Ratio

Total Liabilities Total Equity

This ratio helps investors determine the risk of investing in a company by dividing its total liabilities by total equity.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

C3

Issuing Bonds Between Interest Dates

Apr. 1, 2008 Bond Issue Date June 30, 2008 First Interest Payment

Jan. 1, 2008 Bond Date

Accrued interest Investor pays bond purchase price + accrued interest.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

C3

Issuing Bonds Between Interest Dates

Apr. 1, 2008 Bond Issue Date June 30, 2008 First Interest Payment

Jan. 1, 2008 Bond Date

Accrued interest

Earned interest

Investor receives 6 months interest.

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2007

C3

Issuing Bonds Between Interest Dates

Prepare the entry to record the following bond issue by King Co. on Apr. 1, 2008. Par Value = $1,000,000 Stated Interest Rate = 10% Market Interest Rate = 10% Interest Dates = 6/30 and 12/31 Bond Date = Jan. 1, 2008 Maturity Date = Dec. 31, 2012 (5 years)

Issue Price of Bonds Accrued Interest $1,000,000 10% 3/12 = Total Cash Received

McGraw-Hill/Irwin

$ 1,000,000 25,000 $ 1,025,000

The McGraw-Hill Companies, Inc., 2007

C3

Issuing Bonds Between Interest Dates

DR 1,025,000 Interest payable Bonds payable CR 25,000 1,000,000

At the date of issue the following entry is made:

Apr. 1 Cash

Issued bonds at par plus accrued interest

The first interest payment on June 30, 2005 is:

June 30 Interest payable Bond interest expense Cash DR 25,000 25,000 CR

50,000

The McGraw-Hill Companies, Inc., 2007

Paid semi-annual interest

McGraw-Hill/Irwin

End of Chapter 14

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2007

Potrebbero piacerti anche

- Jackson Cert Opp Brief WesternSkyFinancial v. D.jacksonDocumento42 pagineJackson Cert Opp Brief WesternSkyFinancial v. D.jacksonThalia SandersNessuna valutazione finora

- Washington Post EXPRESS - 12032010Documento40 pagineWashington Post EXPRESS - 12032010Thalia SandersNessuna valutazione finora

- Coolidge v. New Hampshire - 403 U.S. 443 (1971)Documento49 pagineCoolidge v. New Hampshire - 403 U.S. 443 (1971)Thalia SandersNessuna valutazione finora

- W.O.W. Evite 5x7 v4 FINALDocumento1 paginaW.O.W. Evite 5x7 v4 FINALThalia SandersNessuna valutazione finora

- Daily Kos - Hey America! Can You Please Stop Killing Our (Usually) Innocent Black Male Children NowDocumento88 pagineDaily Kos - Hey America! Can You Please Stop Killing Our (Usually) Innocent Black Male Children NowThalia SandersNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- ArbitrageDocumento20 pagineArbitrageRishabYdvNessuna valutazione finora

- Warrant AgreementDocumento44 pagineWarrant Agreementlcdo1958Nessuna valutazione finora

- Account 1Documento3 pagineAccount 1Harshal JadhavNessuna valutazione finora

- Test Bank Managerial Economics 7th Edition KeatDocumento5 pagineTest Bank Managerial Economics 7th Edition KeatMeerim Bakirova100% (1)

- ACC117 Project 2Documento7 pagineACC117 Project 2Aliamaisara ZahiraNessuna valutazione finora

- p242-243 Distressed Investments in BrazilDocumento2 paginep242-243 Distressed Investments in BrazilgatotigreNessuna valutazione finora

- ASR3 Materials - Auditing Equity and Debt InvestmentsDocumento4 pagineASR3 Materials - Auditing Equity and Debt InvestmentsHannah Jane ToribioNessuna valutazione finora

- Closing EntriesDocumento3 pagineClosing EntriesAgatha AlcidNessuna valutazione finora

- Form PDF 308785760300722Documento42 pagineForm PDF 308785760300722Rishi KapoorNessuna valutazione finora

- Pengaruh Kualitas AuditDan KeefektifanKomite AuditTerhadap Manajemen LabaDocumento17 paginePengaruh Kualitas AuditDan KeefektifanKomite AuditTerhadap Manajemen LabaSiti Rosmayanty 260Nessuna valutazione finora

- Cash Flow 1Documento3 pagineCash Flow 1Percy JacksonNessuna valutazione finora

- Boyar Research Conduent Inc The Howard Hughes CorporationDocumento46 pagineBoyar Research Conduent Inc The Howard Hughes CorporationJeevan Parameswaran100% (1)

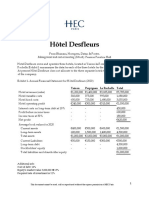

- S07 Desfelurs V3Documento2 pagineS07 Desfelurs V3Khushi singhalNessuna valutazione finora

- 11modelos de Valorización de AccionesDocumento46 pagine11modelos de Valorización de AccionesMario Zambrano CéspedesNessuna valutazione finora

- Turorial 9Documento2 pagineTurorial 9FaezFarhatNessuna valutazione finora

- f1 Answers Nov14Documento14 paginef1 Answers Nov14Atif Rehman100% (1)

- Hortifrut - Comprar - La Compañía Fortalece Su Presencia en Europa A Lo Largo de La Cadena de ValorDocumento2 pagineHortifrut - Comprar - La Compañía Fortalece Su Presencia en Europa A Lo Largo de La Cadena de ValorAndres UrrutiaNessuna valutazione finora

- BMMF5103: Managerial FinanceDocumento182 pagineBMMF5103: Managerial FinanceIam Abdiwali100% (1)

- 04 Homework - Answer KeyDocumento3 pagine04 Homework - Answer KeyVeralou UrbinoNessuna valutazione finora

- Vicente 2015Documento32 pagineVicente 2015Leonardo CunhaNessuna valutazione finora

- Financial Application: Portfolio SelectionDocumento16 pagineFinancial Application: Portfolio SelectionTeree ZuNessuna valutazione finora

- Nature & Scope of Invt MGMTDocumento65 pagineNature & Scope of Invt MGMTAishwarya ChoodamaniNessuna valutazione finora

- Charlie MungerDocumento43 pagineCharlie Mungerbrijesh007Nessuna valutazione finora

- Mbaproject - Kotak Sec PDFDocumento63 pagineMbaproject - Kotak Sec PDFNAWAZ SHAIKHNessuna valutazione finora

- 15 Minute Trader MethodDocumento14 pagine15 Minute Trader Methodmailtibi9720100% (1)

- Advanced Accounting: Consolidated Financial Statements-Date of AcquisitionDocumento52 pagineAdvanced Accounting: Consolidated Financial Statements-Date of AcquisitiongoerginamarquezNessuna valutazione finora

- SB (NZD/SGD) SB ($/SGD) X SB (NZD/$) .6135 X 1.3751 .8436Documento2 pagineSB (NZD/SGD) SB ($/SGD) X SB (NZD/$) .6135 X 1.3751 .8436Saffa AbidNessuna valutazione finora

- Fixed Income StrategyDocumento29 pagineFixed Income StrategyBryan ComandiniNessuna valutazione finora

- Life Insurance FlyerDocumento1 paginaLife Insurance FlyerMichelle StubbsNessuna valutazione finora

- ADVANCED CORPORATE FINANCE 3rd TermDocumento11 pagineADVANCED CORPORATE FINANCE 3rd TermdixitBhavak DixitNessuna valutazione finora