Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Capital Asset Pricing Theory (1) Capem

Caricato da

Omar CampbellDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Capital Asset Pricing Theory (1) Capem

Caricato da

Omar CampbellCopyright:

Formati disponibili

MS 60:

Financial Markets & Investment Analysis Week VI:

The Capital Asset Pricing Model

Copyright Prentice Hall Inc. 1999. Author: Nick Bagley

Key Topics to Cover

-The Capital Asset Pricing Model in Brief

- Determining the Risk Premium on the Market

Portfolio

- Beta and Risk Premiums on Individual

Securities

-Using the CAPM in Portfolio Selection

-CAPM & Valuation

INTRODUCTION ( cont)

Key question it seeks to answer: What

would risk premiums on securities be in

equilibrium if people had the same set of

forecasts of expected returns and risks and

all chose their portfolios optimally according

to the principles of diversification

Market does not reward investors for holding

inefficient portfolios, hence rewards only a

securitys contribution to risk of an efficiently

diversified portfolio

BETA () & RISK PREMIUMS ON

SECURITIES (cont)

CAPM:

E(rj) = rf + j*( E(rm) rf ), rj = return on asset i, Rf is risk free rate, rm

is the return on the market and Bj is the correlation between the return

on asset j and the markets return.

Formula for risk premium in CAPM =

E(rj) rf = j*( E(rm) rf )

This is called the Security Market Line (SML)

Slope of the SML is the risk premium on the market portfolio. Hence if

the risk premium is 0.8 then E(rj) rf = 0.8* j

According the the CAPM, in equilibrium, the risk premium on any

asset is equal the product of

| (or Beta)

the risk premium on the market portfolio

Comment: | = 1

A security with a | = 1 on average rises

and falls with the market

a 10% (say) unexpected rise (fall) in the

market return premium will, on average, result

in a 10% rise (fall) in the securitys return

premium

Comment: | > 1

A security with a | > 1 on average rises

and falls more than the market

With a | = 1.3, a 10% (say) unexpected rise

(fall) in the market return premium will, on

average, result in a 13% rise (fall) in the

securitys return premium

Such a security is said to be aggressive

Comment: | s 1

A security with a | s 1 on average rises

and falls less than the market

With a | = 0.7, a 10% (say) unexpected rise

(fall) in the market return premium will, on

average, result in a 7% rise (fall) in the

securitys return premium

Such a security is said to be defensive

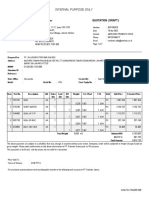

Security Market Line

The plot of a securitys risk premium (or sometimes

security returns) against security beta

Note that the slope of the security market line is the

market premium

By CAPM theory, all securities must fall precisely on

the SML (hence its name)

Security Market Line

With A Zero-Beta Portfolio

E(R)

E(R

m

)

|

i

SML

M

0.0 1.0

E(R

z

)

E(R

m

) - E(R

z

)

Security Market Line

Market

Portfolio

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

-2.0 -1.5 -1.0 -0.5 0.0 0.5 1.0 1.5 2.0

Beta (Risk)

E

x

p

e

c

t

e

d

R

i

s

k

P

r

e

m

i

u

m

Relationship Between

Systematic Risk and Return

Sharpe and Cooper: positive, but non-linear

Douglas: intercept higher than the risk-free rate

Miller and Scholes: possible error in Douglas

findings

Black, Jensen, and Scholes: positive linear

relationship between monthly excess return and

portfolio beta

Fama and McBeth: supported the CAPM with

the intercept equal to the RFR

Relationship Between

Systematic Risk and Return

Effect of skewness on the relationship

preference for high risk and returns

Effect of size, P/E and leverage

Effect of book-to-market value

The Fama-French Study

Observation

All securities, (not just efficient portfolios)

plot onto the SML, if they are correctly

priced according to the CAPM

The Beta of a Portfolio

When determining the risk of a portfolio

using standard deviation results in a formula

thats quite complex

using beta, the formula is linear

= + + + =

+ + +

i

r i r n r r r w r w r w

i n n n

w w w w | | | | | ...

2 1 2 2 1 1

2 1 ...

( ) ( )

2

1

,

, 1

2

...

2

2 2 1 1

|

|

.

|

\

|

+ =

> =

+ + +

j i

j i r r j i

n i

r i r w r w r w

j i i n n

w w w o o o o

Computing Beta

Here are some useful formulae for

computing beta

f M

f r

i

M

M i i

M

M i M i

M

M i

M i i

r

r

i

=

= = = =

|

o

o

o

o o

o

o

| |

,

2

,

2

,

,

CAPM & PORTFOLIO

SELECTION

CAPM provides a rationale for a simple passive portfolio

strategy:

Diversify your holdings of risky assets in the proportions of

the market portfolio

Mix this portfolio with the risk-free asset to achieve a

desired risk-reward combination

Provides a basis of determining, given a desired rate of return,

what is the necessary risk that an investor has to accept

Provides a risk-reward benchmark to evaluate investment

advisors, i.e. relate returns on portfolio to its riskiness. Use

SML

Using the CAPM in Portfolio

Selection

Whether or not CAPM is a valid theory,

indexing is attractive to investors because

historically it has performed better than most

actively managed portfolios

it costs less to implement that active

management

The Portfolio Manager

The further a well diversified portfolio

consistently lies above (below) the SML,

the better (worse) the fund managers

performance

Valuation Using CAPM

Beta may be used to obtain the discount factor/Required Return

on Capital for a new project as follows:

Assume Patty Shop is financed by 20% short-term debt, and

80% equity, and its | is 1.3 (assume debt is risk-free)

Its optimal capital structure is 40% (risk-free) debt, and 60%

equity

VALUATION & REGULATING RATES

OF RETURN -USES

From Discounted cash flow valuation models:

P0(Equity) = d1 / ( r g) where, r, can be expressed as: r = rf +

*((rm) rf)

Cost of equity capital: E(ri) = rf + i*(rm) rf)

CAPM can be used to determine a fair rate of return

Assume the market rate is 15%, and the risk-free rate is 5%

Lets First Compute the Beta for Patty Shop as follows:

04 . 1

0 * 20 . 0 3 . 1 * 80 . 0

bond

=

+ =

+ =

company

company

bond equity equity company

w w

|

|

| | |

Valuation Using CAPM

The Beta of Patty Shop is equal to the beta of the new

Project

To find the required return on the new project, apply the

CAPM

( )

( )

% 4 . 15

05 . 0 15 . 0 04 . 1 05 . 0

=

+ =

+ =

f m f

r r r Knew |

MODIFICATION & ALTERNATIVES

TO CAPM

Why deviations to simple CAPM model:

Poor data

Market imperfections

Need more realistic model ( Intertemporal CAPM )

Alternative models:Arbitrage Pricing Model(APT)

Use a number of variables, e.g. inflation, economic growth

etc. to derive a model based on more complex variables

Relaxing the Assumptions

of the CAPM

Heterogenous expectations

If all investors have different expectations about

risk and return, each would have a unique CML

and/or SML, and the composite graph would be

a band of lines with a breadth determined by the

divergence of expectations

Planning periods

CAPM is a one period model, and the period

employed should be the planning period for the

individual investor, which will vary by individual,

affecting both the CML and the SML

Criticism of CAPM by Richard Roll

Limits on tests: only testable implication

from CAPM is whether the market portfolio

lies on the efficient frontier

Range of SMLs - infinite number of

possible SMLs, each of which produces a

unique estimate of beta

Criticism of CAPM by Richard Roll

Market efficiency effects - substituting a

proxy, such as the S&P 500 creates two

problems

Proxy does not represent the true market

portfolio

Even if the proxy is not efficient, the market

portfolio might be

Criticism of CAPM by Richard Roll

Conflicts between proxies - different

substitutes may be highly correlated

even though some may be efficient and

others are not, which can lead to

different conclusions regarding beta

risk/return relationships

So, CAPM is not testable - but it still has

value and must be used carefully

Stephen Ross devised an alternative

way to look at asset pricing - APT

Arbitrage Pricing Theory - APT

Arbitrage is a process of buying a lower

priced asset and selling a higher priced

asset, both of similar risk, and capturing the

difference in arbitrage profits

The general arbitrage principle states that

two identical securities will sell at identical

prices

Price differences will immediately disappear

as arbitrage takes place

Arbitrage Pricing Theory- APT

Arbitrage Pricing Theory - APT

Three major assumptions:

1. Capital markets are perfectly

competitive

2. Investors always prefer more wealth

to less wealth with certainty

3. The stochastic process generating

asset returns can be expressed as a

linear function of a set of K factors or

indexes

Arbitrage Pricing Theory - APT

N i b b b E Ri

i k ik i i i

to 1 for

2 2 1 1

= e + + + + + = o o o

assets of number

error) (random return s ' asset on effect unique a

assets all of returns the influences mean that

zero a with indexes or factors common of set a

index or factor comon

a in movements to returns s ' asset in reaction

changes zero have indexes

or factors the all if asset for return expected

period time specified a during asset on return

=

= e

=

=

=

=

N

i

K K

i b

i E

i Ri

i

k

ik

i

o

Roll-Ross Study

1. Estimate the expected returns and the

factor coefficients from time-series data on

individual asset returns

2. Use these estimates to test the basic

cross-sectional pricing conclusion implied

by the APT

Extensions of the

Roll-Ross Study

Cho, Elton, and Gruber examined the

number of factors in the return-generating

process that were priced

Dhrymes, Friend, and Gultekin (DFG)

reexamined techniques and their

limitations and found the number of factors

varies with the size of the portfolio

The APT and Anomalies

Small-firm effect

Reinganum - results inconsistent with the APT

Chen - supported the APT model over CAPM

January anomaly

Gultekin - APT not better than CAPM

Burmeister and McElroy - effect not captured by

model, but still rejected CAPM in favor of APT

APT and inflation

Elton, Gruber, and Rentzler - analyzed real returns

The Shanken Challenge to

Testability of the APT

If returns are not explained by a model, it is not

considered rejection of a model; however if the factors do

explain returns, it is considered support

APT has no advantage because the factors need not be

observable, so equivalent sets may conform to different

factor structures

Empirical formulation of the APT may yield different

implications regarding the expected returns for a given

set of securities

Thus, the theory cannot explain differential returns

between securities because it cannot identify the relevant

factor structure that explains the differential returns

Alternative Testing Techniques

Jobson proposes APT testing with a

multivariate linear regression model

Brown and Weinstein propose using a

bilinear paradigm

Others propose new methodologies

Potrebbero piacerti anche

- CAPM Lecture NotesDocumento19 pagineCAPM Lecture NotesNaailah نائلة MaudarunNessuna valutazione finora

- Additional Risk Power PointDocumento19 pagineAdditional Risk Power PointOmar CampbellNessuna valutazione finora

- BPR ReportDocumento15 pagineBPR ReportOmar Campbell100% (1)

- GoetzmannDocumento26 pagineGoetzmannOmar CampbellNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- PW Department CodesDocumento19 paginePW Department CodesanilNessuna valutazione finora

- AdmissionDocumento23 pagineAdmissionPawan TalrejaNessuna valutazione finora

- Enron Case StudyDocumento14 pagineEnron Case Studyvlabrague6426Nessuna valutazione finora

- (Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in HedgingDocumento79 pagine(Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in Hedgingsarvesh dhatrakNessuna valutazione finora

- BPI v. IAC & ZshornackDocumento1 paginaBPI v. IAC & ZshornackRon DecinNessuna valutazione finora

- 04 QuestionsDocumento7 pagine04 QuestionsfaizthemeNessuna valutazione finora

- Engineering Econ - InterestDocumento37 pagineEngineering Econ - InterestNikolai VillegasNessuna valutazione finora

- A Guide To UK Oil and Gas TaxationDocumento172 pagineA Guide To UK Oil and Gas Taxationkalite123Nessuna valutazione finora

- Allux Indo 8301385679Documento2 pagineAllux Indo 8301385679Ardi dutaNessuna valutazione finora

- 1 - 1 Identifying Business TransactionsDocumento5 pagine1 - 1 Identifying Business TransactionsChristian Oliveros100% (1)

- Hhtfa8e ch01 SMDocumento83 pagineHhtfa8e ch01 SMkbrooks323Nessuna valutazione finora

- M Form 2019Documento4 pagineM Form 2019Kamille Ann RiveraNessuna valutazione finora

- Gamboa vs. TevesDocumento4 pagineGamboa vs. TevesAustine Clarese VelascoNessuna valutazione finora

- United States District Court Central District of California: 8:21-Cv-00403-Jvs-AdsxDocumento114 pagineUnited States District Court Central District of California: 8:21-Cv-00403-Jvs-Adsxtriguy_2010Nessuna valutazione finora

- Accounting Concepts and PrinciplesDocumento8 pagineAccounting Concepts and PrinciplesNikki BalsinoNessuna valutazione finora

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDocumento2 pagineCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsJyasmine Aura V. AgustinNessuna valutazione finora

- CHAPTER 6 - Handouts For StudentsDocumento4 pagineCHAPTER 6 - Handouts For StudentsErmiasNessuna valutazione finora

- Assignment 01-Fin421Documento11 pagineAssignment 01-Fin421i CrYNessuna valutazione finora

- Doing Business in BrazilDocumento164 pagineDoing Business in BrazilVarupNessuna valutazione finora

- Republic Act No. 7279Documento25 pagineRepublic Act No. 7279Sharmen Dizon GalleneroNessuna valutazione finora

- Chapter 11 Quiz Sect 903 SolutionsDocumento4 pagineChapter 11 Quiz Sect 903 Solutionsamu_scribdNessuna valutazione finora

- Vanguard CostsDocumento2 pagineVanguard CostsPardeep SinghNessuna valutazione finora

- Moody's Financial Metrics KeyDocumento48 pagineMoody's Financial Metrics KeyJoao SilvaNessuna valutazione finora

- Property Valuation: Valuation Number: 1021106693NHC UPI: 1/02/11/06/693Documento8 pagineProperty Valuation: Valuation Number: 1021106693NHC UPI: 1/02/11/06/693fido1983Nessuna valutazione finora

- Islamic Banking: Financial Institutions and Markets Final ProjectDocumento27 pagineIslamic Banking: Financial Institutions and Markets Final ProjectNaina Azfar GondalNessuna valutazione finora

- Why Investors Must Wring Out HIGH Beta From Portfolio?Documento4 pagineWhy Investors Must Wring Out HIGH Beta From Portfolio?Yogesh V GabaniNessuna valutazione finora

- Malaysian Government Budgeting MalaysianDocumento31 pagineMalaysian Government Budgeting MalaysianHanisah AbdulRahmanNessuna valutazione finora

- PRMG 6010 - Risk Management For Project Managers Uwi Exam Past Paper 2012Documento4 paginePRMG 6010 - Risk Management For Project Managers Uwi Exam Past Paper 2012tilshilohNessuna valutazione finora

- CFA Level I 2019 - 2020 Curriculum Changes: Subjects 2019 Reading No Reading NameDocumento20 pagineCFA Level I 2019 - 2020 Curriculum Changes: Subjects 2019 Reading No Reading NameVaibhav SarinNessuna valutazione finora

- Transaction History: NicknameDocumento4 pagineTransaction History: NicknameMerle AfricaNessuna valutazione finora