Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Hofers Cell Matrix

Caricato da

Bliss HeavenDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Hofers Cell Matrix

Caricato da

Bliss HeavenCopyright:

Formati disponibili

Prepared By Mohsin Mohammed Ali MBA/7017/10

The business portfolio is the collection of businesses and products that make up the company. The best business portfolio is one that fits the company's strengths and helps exploit the most attractive opportunities.

Business

portfolio analysis as an organizational strategy formulation technique is based on the philosophy that organizations should develop strategy much as they handle investment portfolios. Just as sound financial investments should be supported and unsound ones discarded, sound organizational activities should be emphasized and unsound ones deemphasized.

Charles

W. Hofer and Dan Schendel, they described seven stages of the life cycle, each with certain characteristics by which the position of the market can be identified.

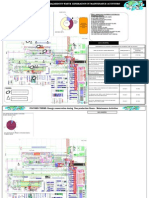

A significant contribution in the field of strategic business portfolio analysis belongs to Charles W. Hofer. The specialty literature mentions in under the name of Hofer Matrix or "Product/Market Evolution Matrix. He proposed a new assessment matrix of business portfolio of a company, organized into 15 quadrants. The picture below displays the matrix where strategic business units are graphically represented according to two basic indicators: competitive position on the market and the stage corresponding to the product/market evolution.

He took series of research studies showing that the stage of the life cycle of the product represents a factor that influences to greater or smaller extent the success of a strategy

Charles W. Hofer described seven stages of the life cycle, each with certain characteristics by which the position of the market can be identified.

Hofer matrix implies the division of the company into strategic business units. Assessing the competitive position of business units. The position occupied by the strategic business unit is graphically represented by using the two axes of the matrix. Thus, on the vertical axis the competitive position of strategic business units is set and on the vertical axis the stage of the life cycle specific to the market where these operate is set.

Further on, strategic business units are outlined, from a graphical point of view, under the form of circles.

The size of each circle is proportional to the size of the

market where the strategic business unit carries out its activity (measured on the basis of total income resulted on the mentioned markets), while the hatched areas, inside the circle, represent the market shares held by the strategic business units.

HOFERS MATRIX EXAMPLE

A B D E F G C

Business unit A It would to be a developing winner. Its relatively large share of the market combined with its being at the development stage of product- market evolution and its potential for being in a strong competitive position make it a good candidate for receiving more corporate resources. Business unit B It is somewhat similar to A. However, it has a relatively small share of the market given its strong competitive position. A strategy would have to be developed to overcome this low market share in order to justify more investments.

Business unit C It might be classified as a potential loser. A strategy must be developed to overcome the low market share and weak competitive position in order to justify future investments.

Business unit D It is in a shakeout period, has a relatively large share of the market, and is in a relatively strong position. Investment should be made to maintain that position.

Business units E and F They have relatively large market share and has strong competitive position. It should be used for cash generation. Business unit G It has low market share and weak competitive position. It should be managed to generate cash in the short run, if possible; however, the long-run strategy will more the likely be divestment or liquidation.

o o o o

o

o o o o

Set objective and allocate resources Use of externally oriented data Cash flow availability Graphical communication of business mix Identify developing winners Illustrates distribution of business in an industry Encourages promotion of competitive analysis Selective earmarking of financial resources Reduce risks, increases concentration and involvement in competitive world.

o o o

Difficulty in defining product/market segment. Suggests impractical standard strategies. Naively following portfolio prescriptions may reduce profit. No clear idea what makes an industry attractive.

steconomice.uoradea.ro/anale/volume/2008/v4.../166.pdf

THANK YOU

Potrebbero piacerti anche

- Hoffers ModelDocumento10 pagineHoffers ModelPradnya SurwadeNessuna valutazione finora

- Hofer's Product Market EvolutionDocumento18 pagineHofer's Product Market EvolutionAthira Soman100% (1)

- Interpretation of FieldsDocumento3 pagineInterpretation of FieldsbagumaNessuna valutazione finora

- Are Profit Maximizers Wealth CreatorsDocumento36 pagineAre Profit Maximizers Wealth Creatorskanika5985Nessuna valutazione finora

- BCGTM: Analyze Products Using Growth-Share MatrixDocumento31 pagineBCGTM: Analyze Products Using Growth-Share MatrixAshirbad NayakNessuna valutazione finora

- Ratio NandiDocumento71 pagineRatio NandiAnonymous 22GBLsme1100% (1)

- Consumer Behavior StagesDocumento16 pagineConsumer Behavior StagesPriyanka Zalpuri100% (1)

- Project Financial Appraisal and SelectionDocumento5 pagineProject Financial Appraisal and SelectionAbhishek KarekarNessuna valutazione finora

- Corporate Level Strategy - Types and ExamplesDocumento21 pagineCorporate Level Strategy - Types and ExamplesSuraj RajbharNessuna valutazione finora

- The Core QuestionsDocumento616 pagineThe Core QuestionsbortycanNessuna valutazione finora

- Chapter 3Documento5 pagineChapter 3Mariya BhavesNessuna valutazione finora

- Case Study No.1Documento2 pagineCase Study No.1MarjonNessuna valutazione finora

- Internal Environment Analysis of OptusDocumento3 pagineInternal Environment Analysis of OptusArifHossainNessuna valutazione finora

- Organization Behavior Solved Subjective QuestionsDocumento6 pagineOrganization Behavior Solved Subjective QuestionsRaheel KhanNessuna valutazione finora

- Unit IV Budgets & Budgetory ControlDocumento19 pagineUnit IV Budgets & Budgetory ControlyogeshNessuna valutazione finora

- Business Intelligence Unit 1 Chapter 2Documento13 pagineBusiness Intelligence Unit 1 Chapter 2vivekNessuna valutazione finora

- POLICIES GUIDE MANAGERS IN FUNCTIONAL AREASDocumento4 paginePOLICIES GUIDE MANAGERS IN FUNCTIONAL AREASMonali Dravid100% (1)

- Mastercard HRP ProjectDocumento8 pagineMastercard HRP ProjectkritikaNessuna valutazione finora

- Ponds TalcumDocumento37 paginePonds TalcumSaravan VictoryNessuna valutazione finora

- Project Management Group Work 8: The Bathtub PeriodDocumento3 pagineProject Management Group Work 8: The Bathtub Periodpalak mohodNessuna valutazione finora

- A Study On The Influence of Packaging in Brand Selection in Toothpaste IndustryDocumento12 pagineA Study On The Influence of Packaging in Brand Selection in Toothpaste IndustryAshish Garg100% (1)

- Compare ROI and EVA as Performance Measurement ToolsDocumento11 pagineCompare ROI and EVA as Performance Measurement ToolsJasleen KaurNessuna valutazione finora

- STRATEGIC PLANNING FOR OMAN CEMENTDocumento20 pagineSTRATEGIC PLANNING FOR OMAN CEMENTajish808Nessuna valutazione finora

- Competitive Landscape of the Energy Drink IndustryDocumento11 pagineCompetitive Landscape of the Energy Drink IndustryShakti Shivanand0% (1)

- Chapter 5Documento37 pagineChapter 5Mohamed A. TawfikNessuna valutazione finora

- IR Definitions, Aspects, CausesDocumento18 pagineIR Definitions, Aspects, CausesShivani Nileshbhai PatelNessuna valutazione finora

- Ia - Bs Matrix & Ad Little Life Cycle Approach: K.Chitra 11TM03Documento22 pagineIa - Bs Matrix & Ad Little Life Cycle Approach: K.Chitra 11TM03Treesa Chitra JosNessuna valutazione finora

- Luchetti FullDocumento35 pagineLuchetti FullRohith GirishNessuna valutazione finora

- CenturyDocumento54 pagineCenturySagar BansalNessuna valutazione finora

- Innovative Approaches To Supply Chain Risk Research SCM WorldDocumento24 pagineInnovative Approaches To Supply Chain Risk Research SCM WorldAli Mohd100% (1)

- PESTEL Analysis of Pharmaceutical Industry in PakistanDocumento7 paginePESTEL Analysis of Pharmaceutical Industry in PakistanzenerdiodeNessuna valutazione finora

- MS-06 IGNOU MBA Solved Assignment 2011Documento48 pagineMS-06 IGNOU MBA Solved Assignment 2011Sandy SiddarthNessuna valutazione finora

- Marketing Mix Strategies Using Methods of 4ps, 7ps, 4cs and Indian Cement SectorDocumento9 pagineMarketing Mix Strategies Using Methods of 4ps, 7ps, 4cs and Indian Cement SectorIAEME PublicationNessuna valutazione finora

- Financial Analysis Report Fauji Fertilizer Bin Qasim LTDDocumento15 pagineFinancial Analysis Report Fauji Fertilizer Bin Qasim LTDwaqarshk91Nessuna valutazione finora

- Strategic ManagementDocumento4 pagineStrategic ManagementA CNessuna valutazione finora

- Rushil Decor LTD-1Documento20 pagineRushil Decor LTD-1santhosh GowdaNessuna valutazione finora

- Organizational Culture - Final ProjectDocumento85 pagineOrganizational Culture - Final ProjectMBA19 DgvcNessuna valutazione finora

- FM Sheet 4 (JUHI RAJWANI)Documento8 pagineFM Sheet 4 (JUHI RAJWANI)Mukesh SinghNessuna valutazione finora

- Presentation On Employee RelationsDocumento10 paginePresentation On Employee RelationsNikhil ThakurNessuna valutazione finora

- Mandvi Master ThesisDocumento19 pagineMandvi Master ThesisMandvi ShuklaNessuna valutazione finora

- Case Study - Nilgai Foods: Positioning Packaged Coconut Water in India (Cocofly)Documento6 pagineCase Study - Nilgai Foods: Positioning Packaged Coconut Water in India (Cocofly)prathmesh kulkarniNessuna valutazione finora

- Break Even Analysis NotesDocumento11 pagineBreak Even Analysis NotesAbhijit PaulNessuna valutazione finora

- Advantages of DiversificationDocumento4 pagineAdvantages of DiversificationbijayNessuna valutazione finora

- Kuliah Evaluating Network Design Decisions Using Decision TreesDocumento33 pagineKuliah Evaluating Network Design Decisions Using Decision Treessigit f100% (1)

- CH 03 ImDocumento27 pagineCH 03 Imjacklee1918Nessuna valutazione finora

- HEC Project Report1Documento52 pagineHEC Project Report1r_bhushan62100% (1)

- Factors Influencing Job Satisfaction of Employees at Kesoram Cement IndustryDocumento45 pagineFactors Influencing Job Satisfaction of Employees at Kesoram Cement IndustryMeka Raju MekaNessuna valutazione finora

- Categorization of Msmes, Ancillary IndustriesDocumento3 pagineCategorization of Msmes, Ancillary IndustriesGaurav kumarNessuna valutazione finora

- Entrepreneurship ProjectDocumento5 pagineEntrepreneurship Projectneha bagrechaNessuna valutazione finora

- 3.3.4 Normal Profits, Supernormal Profits and LossesDocumento3 pagine3.3.4 Normal Profits, Supernormal Profits and LossesThanujiNessuna valutazione finora

- New Model of CSR PDFDocumento21 pagineNew Model of CSR PDFbayo4toyin100% (1)

- Corporate Strategies: What Is Corporate Strategy?Documento3 pagineCorporate Strategies: What Is Corporate Strategy?Reynaldi Satria Aryudhika100% (1)

- New Invt MGT KesoramDocumento69 pagineNew Invt MGT Kesoramtulasinad123Nessuna valutazione finora

- Rise of Temporary and Contingent Workers in HRDocumento4 pagineRise of Temporary and Contingent Workers in HRsajid bhattiNessuna valutazione finora

- GE 9 Cell MatrixDocumento10 pagineGE 9 Cell MatrixMr. M. Sandeep Kumar0% (1)

- Chapter 3 Strategic Planning Process (The External EnvironmeDocumento28 pagineChapter 3 Strategic Planning Process (The External EnvironmeShanizam Mohamad Poat100% (1)

- Balance ScorecardDocumento21 pagineBalance Scorecardfixs2002100% (1)

- Assignment of SMDocumento15 pagineAssignment of SMPari KarrhaNessuna valutazione finora

- Hofer's ModelDocumento5 pagineHofer's ModelManavi PurohitNessuna valutazione finora

- BCG MatrixDocumento34 pagineBCG MatrixSaurabGhimireNessuna valutazione finora

- Reduce Hazardous Waste from Maintenance ActivitiesDocumento11 pagineReduce Hazardous Waste from Maintenance ActivitiesBliss HeavenNessuna valutazione finora

- A Study On Campaign ManagementDocumento20 pagineA Study On Campaign ManagementBliss HeavenNessuna valutazione finora

- Life in Dhofar RegionDocumento10 pagineLife in Dhofar RegionBliss HeavenNessuna valutazione finora

- Attitudes and ScalingDocumento63 pagineAttitudes and ScalingBliss HeavenNessuna valutazione finora

- TrainingDocumento46 pagineTrainingBliss HeavenNessuna valutazione finora

- Stress ManagementDocumento28 pagineStress ManagementBliss Heaven100% (4)

- Chapter 2 - Human Resource PlanningDocumento46 pagineChapter 2 - Human Resource PlanningDee KimNessuna valutazione finora

- Manu CVDocumento3 pagineManu CVsupriyaNessuna valutazione finora

- HR BenchmarkingDocumento8 pagineHR Benchmarkingmugdha_kolhatkarNessuna valutazione finora

- Bussnes ManagmentDocumento949 pagineBussnes ManagmentMd FaridujjamanNessuna valutazione finora

- BM - Group 5A - The Case of Pricing PredicamentDocumento11 pagineBM - Group 5A - The Case of Pricing PredicamentEsha SharmaNessuna valutazione finora

- IiG OxREP Adam DerconDocumento21 pagineIiG OxREP Adam DerconSamson SeiduNessuna valutazione finora

- Hector Beverages TzingaDocumento21 pagineHector Beverages TzingaAman Bajaj100% (2)

- SamsungDocumento10 pagineSamsungGrosaru FlorinNessuna valutazione finora

- Alok Industries Final Report 2010-11.Documento117 pagineAlok Industries Final Report 2010-11.Ashish Navagamiya0% (1)

- Strategic HumanresourcepdfDocumento14 pagineStrategic HumanresourcepdfDanishNessuna valutazione finora

- B2b Sales of A CompanyDocumento6 pagineB2b Sales of A CompanyPRANAV GOYAL100% (1)

- Strategic Cost ManagementDocumento3 pagineStrategic Cost ManagementShubakar ReddyNessuna valutazione finora

- Principles of MARKETING NOTES Student NotesDocumento16 paginePrinciples of MARKETING NOTES Student NotesdenisNessuna valutazione finora

- ACCO435 - Course Outline - Winter Term 2022BDocumento14 pagineACCO435 - Course Outline - Winter Term 2022BHugh MyronNessuna valutazione finora

- Marketing ManagementDocumento226 pagineMarketing ManagementAnand KumarNessuna valutazione finora

- Strategic Information Technology and Portfolio Management (IGI Global 2009)Documento467 pagineStrategic Information Technology and Portfolio Management (IGI Global 2009)Alexandru.Rosioru100% (1)

- Port Competition Revisited: Hilde Meersman, Eddy Van de Voorde & Thierry VanelslanderDocumento23 paginePort Competition Revisited: Hilde Meersman, Eddy Van de Voorde & Thierry VanelslanderPhileas FoggNessuna valutazione finora

- Retrenchment StrategyDocumento14 pagineRetrenchment Strategyomkar_bond199090% (20)

- Eight Steps For Organizational Development InterventionsDocumento6 pagineEight Steps For Organizational Development InterventionsArvin Anthony Sabido AranetaNessuna valutazione finora

- An Overview of TT and TT ModelsDocumento28 pagineAn Overview of TT and TT ModelsVaidyanathan VenkataramanNessuna valutazione finora

- ITIL 2011 Mind MapsDocumento14 pagineITIL 2011 Mind MapsNguyen Hung100% (2)

- The Role of Project Management and Governance in Strategy ImplementationDocumento23 pagineThe Role of Project Management and Governance in Strategy ImplementationRexrgisNessuna valutazione finora

- MBA Student Handbook GuideDocumento15 pagineMBA Student Handbook Guidezero3ightNessuna valutazione finora

- Services MarketingDocumento26 pagineServices MarketingJohn MichaelNessuna valutazione finora

- Digital Marketing Module Guide FinalDocumento7 pagineDigital Marketing Module Guide FinalMichelleNessuna valutazione finora

- Group C PDFDocumento31 pagineGroup C PDFJoy KhetanNessuna valutazione finora

- Integrated Reporting Closing The Loop of StrategyDocumento16 pagineIntegrated Reporting Closing The Loop of StrategyFrancisco Javier Magallón RojasNessuna valutazione finora

- HRM 305 Module 2Documento14 pagineHRM 305 Module 2Le ZymNessuna valutazione finora

- Analyze strategies with the SPACE matrixDocumento20 pagineAnalyze strategies with the SPACE matrixWaseem Mateen100% (1)

- Chapter 01 Long-Term Investing and Financial DecisionsDocumento30 pagineChapter 01 Long-Term Investing and Financial DecisionsdungphuongngoNessuna valutazione finora