Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Real Estate Financing and Sukuk

Caricato da

ImranCureshiDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Real Estate Financing and Sukuk

Caricato da

ImranCureshiCopyright:

Formati disponibili

Sharia Coordination Department

Real Estate Financing and Sukuk

Mian Muhammad Nazir Senior Vice President

Dubai Islamic Bank PJSC

1

Sharia Coordination Department

Real Estate Financing and Sukuk

Overview Commonly used modes in Real Estate Financing

Murabaha ready property Ijara ready property Forward Ijara under construction property Istisna under construction property Mudaraba Agency Wakala Musharaka Sukuk

Sharia Coordination Department

Real Estate Financing and Sukuk

Sharia offers various structures for Real Estate Financing based on the requirements of the respective parties Each Sharia compliant mode of financing distinctly exemplifies the essential feature of ownership and risk Growth witnessing assets exceeding $1.7 trillion and expected to reach $2.7 trillion by 2010. In year 2007, 76% of corporations non-loan fundings were Sharia compliant in the MENA region.

3

Sharia Coordination Department

Real Estate Financing and Sukuk Commonly Used Modes

Murabaha

(ready property)

Sharia Coordination Department

Real Estate Financing and Sukuk

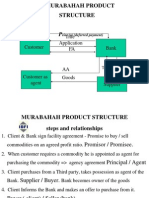

Murabaha (Only in case of ready property)

Step by Step

Customer

Title and Possession to the Property Step 1 Promise to Purchase

Step 5 Sale of Property to Customer on Murabaha basis Step 3 Purchase of Property through purchase agreement Step 4 Purchase Price Step 2 Purchase Offer

Owner/Developer

Step 6 Sale Price

Deferred

Title & Possession to the Property

Islamic Bank

Sharia Coordination Department

Real Estate Financing and Sukuk

Murabaha

Murabaha is widely used mode of finance in Islamic Finance Industry in general and for Real Estate Financing in particular. However, it can only be used for: ready property; for a shorter financing tenor for the reason of fixed return Involves less risks as it creates debt obligation on the customer No ownership risk.

6

Sharia Coordination Department

Real Estate Financing and Sukuk

Murabaha

The Bank buys the Property and sells it to the customer on Murabaha (cost + profit) basis. Murabaha sale price is paid normally on a deferred basis. Liability is known from day one No surprises or uncertain exposure.

7

Sharia Coordination Department

Real Estate Financing and Sukuk

Ijara

ready property

Sharia Coordination Department

Real Estate Financing and Sukuk

Purchase and Ijara

ready property

Step by Step

Customer

Step 5 Lease of the Property to the customer through Lease Agreement Step 1 Promise to lease Step 6 Lease Rental Step 3 Acquisition of the Property through purchase agreement Step 4 Purchase Price Step 2 Purchase Offer

Usufruct of the Property

Owner / Developer

Title & Possession to the Property

Islamic Bank

Sharia Coordination Department

Real Estate Financing and Sukuk

Ijara

Ijara is less risky as compared to other financing structures Strict compliance with Sharia and the applicable law is required for enforceability. Best suited for Islamic Financial Institutions conventional institutions may have some regulatory problems in Ijara It is generally perceived that notwithstanding Sharia requirements, the documentation should be in accordance with the applicable law which is not free from risk from Sharia compliance perspective.

10

Sharia Coordination Department

Real Estate Financing and Sukuk

Ijara

Liability is known from day one No surprises or uncertain exposure. Unlike conventional finance, Sharia has a special treatment to issues such as increased cost, mandatory cost, asset ownership, taxes, major maintenance, asset insurance and remedies in the event of total or partial loss.

11

Sharia Coordination Department

Real Estate Financing and Sukuk

Ijara

Ijara structure involves purchasing an asset from the customer or a third party and leasing the same to the customer. Care needs to be taken in order to ensure that the transaction does not become a conditional sale or a contract of Inah. Sharia requires extraordinary caution in putting together a rental framework for a lease transaction which involves a variable element of rental

12

Sharia Coordination Department

Real Estate Financing and Sukuk

Ijara

Ijara: Two types Ijara Muntahia Bittamleek (Finance lease) Operating Lease In Ijara Muntahia Bitammaleek, transfer of ownership at the expiry of lease term must be through a unilateral undertaking to be exercised at the expiry of the lease term and the transfer should either take the form of sale at nominal price or gift. Appropriate structure for all purpose financing

13

Sharia Coordination Department

Real Estate Financing and Sukuk

Forward Ijara

under construction property

14

Sharia Coordination Department

Real Estate Financing and Sukuk Forward Ijara

for under construction property

Step by Step

Customer

Delivery of Leased Property to Customer at completion Step 1

Promise to Lease on Forward Ijara basis

Step 5 Lease of Property on the basis of Forward Ijara Step 3 Purchase of the described Property through Istisna Agreement Step 6 Lease Rental Step 4 Istisna Purchase Price Step 2 Purchase Offer

Owner / Developer

Delivery of the described Property after completion

Islamic Bank

15

Sharia Coordination Department

Real Estate Financing and Sukuk

Ijara Mousoofa Fizzimma (Lease of specified item(s) which are to be delivered after manufacturing or construction)

Ijara in respect of an asset under construction takes the form of Ijara Mousoofa Fizzimma. Lease of the underlying assets starts on the date of delivery of the asset to the lessee and the lessees obligation to pay rental triggers with the commencement of the lease. An investor receives return on its investment out of the amount received from the lessee on account of 16

Sharia Coordination Department

Real Estate Financing and Sukuk

Ijara Mousoofa Fizzimma

Although investment in assets under construction through Ijara Mousoofa Fizzimma may not be free from certain downsides, it still has potential to serve both the parties, i.e. customer and financier addressing the Project Financing requirements. Appropriate structure for project financing. Example: QREIC Sukuk (Qatar)

17

Sharia Coordination Department

Real Estate Financing and Sukuk

Istisna

under construction property

18

Sharia Coordination Department

Real Estate Financing and Sukuk

Istisna

for under construction property

Step by Step

Customer

Delivery to the Customer after at completion Step 1

Promise to Purchase on Parallel Istisna basis

Step 5 Sale of the described Property on Parallel Istisna basis Step 3 Purchase of the described Property through Istisna Agreement Step 6

Parallel Istisna

Owner / Developer

Step 4 Istisna Purchase Price

Purchase Price

Step 2 Purchase Offer

Delivery of the described Property after completion

Islamic Bank

19

Sharia Coordination Department

Real Estate Financing and Sukuk

Istisna In Istisna sale, the seller sells a described property to be delivered to the purchaser once the same is completed.

Istisna requires combination of either lease of the purchased assets back to the seller or sale of the purchased assets to the customer, provided that the purchase is not from the same customer. Used in QREIC Sukuk involving purchase of the described assets by sukuk-holders and leasing back to the Seller.

20

Sharia Coordination Department

Real Estate Financing and Sukuk

Mudaraba

21

Sharia Coordination Department

Real Estate Financing and Sukuk

Mudaraba

Step by Step

Islamic Bank (Rab Al Mal)

Mudaraba Agreement

Step 1 Business Plan Rab al Mals Share Step 6 Mudaraba Capital Step 3

Project

Joint Capital (after commingling of

Mudaraba Capital with Net Assets Of Mudarib if any)

Developer (Mudarib)

Mudaribs Share

Mudarib Profit Net Profit Mudaraba Profit

22

Sharia Coordination Department

Real Estate Financing and Sukuk

Mudaraba

Mudaraba is a very flexible real estate financing structure.

Mudaraba can be of two types: Project basis no need for Sharia compliance of financial ratio, however, underlying activities must be Sharia compliant. Unrestricted Mudaraba on commingling basis which requires Sharia compliance of the customers business activities as well as the financial ratio. Mudaraba operates on trust which means a partnership in profit.

23

Sharia Coordination Department

Real Estate Financing and Sukuk

Mudaraba

Mudaraba financing is an investment, therefore, it requires an investment plan. Mudaribs performance is assessed on the basis of the Investment Plan it has provided to the financier in order to obtain financing. In 2007, Mudaraba was considered to be a preferable financing structure because it does not involve sale of the assets. (Example: DIFC Sukuk) However, recent discussions amongst Sharia scholars on redemption through purchase undertaking resulted in reduction of the use of Mudaraba structure.

24

Sharia Coordination Department

Real Estate Financing and Sukuk

Agency

25

Sharia Coordination Department

Real Estate Financing and Sukuk

Agency

Step by Step

Islamic Bank (Principal)

Agency Agreement

Step 1 Investment Plan

Agency Fee

Project

Step 3

Step 6 Investment Amount

Investment Amount

Developer (Agent)

Incentive

Profit

26

Sharia Coordination Department

Real Estate Financing and Sukuk

Agency (Wakala)

Investment agency structure for real estate financing is another flexible structure. It operates on the principal similar to Mudaraba except the Profit distribution. However, this structure is less used in real estate financing due to certain academic discussions amongst the Sharia scholars.

27

Sharia Coordination Department

Real Estate Financing and Sukuk

Musharaka

28

Sharia Coordination Department

Real Estate Financing and Sukuk

Musharaka (two structures)

Sharikatul Aqd (Contractual Partnership)

Musharaka Mutanaqisa (Diminishing Musharaka) Normal Musharaka (Example: JAFZA Sukuk)

Sharikatul Milk (Co-ownership). Volcano Sukuk, DIB Sukuk, and EIB Sukuk

29

Sharia Coordination Department

Real Estate Financing and Sukuk

Musharaka Mutanaqisa Step by Step

Purchase of Units in Musharaka Purchase Undertaking

Islamic Bank

Contribution Cash Profit Musharaka Agreement Contribution Cash + Kind

Customer / Developer

Profit + Incentive

Musharaka Entity

Profit

Investment

Project

30

Sharia Coordination Department

Real Estate Financing and Sukuk

Musharaka Bank leases its share in Musharaka to the Customer Step by Step

Lease of Banks Share Lease Rental

Islamic Bank

Contribution Cash Profit Musharaka Agreement Contribution Cash + Kind

Customer / Developer

Profit + Incentive

Musharaka Entity

Profit

Investment

Project

31

Sharia Coordination Department

Real Estate Financing and Sukuk

Musharaka Sharikatul Milk (Ready Property) Step by Step

Periodic Purchase of Undivided Share Purchase Undertaking

Islamic Bank

Contribution Cash Musharaka Agreement Lease Rental Purchase Price Contribution Cash

Customer / Developer

Lease Rental

Ready Property

32

Sharia Coordination Department

Real Estate Financing and Sukuk

Sukuk (Islamic Bonds)

33

Sharia Coordination Department

Real Estate Financing and Sukuk

Sukuk (Islamic Bonds)

Sukuk certificates represent ownership in the underlying assets, usufruct and services or the assets of particular projects or investment activities. The ownership must be real, not beneficial, i.e. economic benefits or entitlements. (AAOIFIs resolution). Provides viable alternative to conventional bonds and securities.

34

Sharia Coordination Department

Real Estate Financing and Sukuk

Sukuk (Islamic Bonds)

Global Sukuk issuance reaches $109 billion. Indicating impressive growth in MENA region.

Global Local Currency and Dollar Sukuk Issued by Country (2007)

MENA Bond issuance Sukuk vs. Conventional Bonds

35

Sharia Coordination Department

Real Estate Financing and Sukuk

Sukuk (Islamic Bonds)

Sukuks are issued on any of the foregoing Sharia contracts. For real estate, Sukuk can be issued using any of the Sharia contracts for the following: (i) the development of a particular real estate project; or (ii) the working capital or the construction cost

36

Sharia Coordination Department

Real Estate Financing and Sukuk

Sukuk (Islamic Bonds)

Choosing a structure for a Sukuk depends on the following: Purpose for which the money is required; Assets which will be used to raise money; Income stream and payment; and Tenor Using a right structure in view of the transaction requirements is a real Sharia issue. Examples: Al Dar, Nakheel, Tamweel, PCFC and DCA.

37

Sharia Coordination Department

Real Estate Financing and Sukuk

Sukuk (Islamic Bonds)

Sukuk are more economical than conventional financing Investor gets comfort from the fact that, being a public transaction, the structure, commercial issues and documentation may have gone through the eyes of experts (including Sharia scholars) Tradability of Sukuk depends on the assets ownership and the Sharia structures on which they are based.

38

Sharia Coordination Department

Real Estate Financing and Sukuk

Sukuk (Islamic Bonds) Increase in volume and popularity throughout the world would definitely make the Sukuk a better alternative for Project Financing.

However, in order to make Sukuk less expensive and preferable financing choice, standardization and regulation at local and industry level is very much required. Sukuk is also suitable for closely held family real estate development businesses. In view of the recent academic controversies, new structures such as Sharika tul Milk, Asset Purchase and

39

Sharia Coordination Department

Thank You

40

Potrebbero piacerti anche

- The Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesDa EverandThe Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesNessuna valutazione finora

- Unleashing Wealth: A Guide to BRRRR Real Estate Investing: Real Estate Investing, #13Da EverandUnleashing Wealth: A Guide to BRRRR Real Estate Investing: Real Estate Investing, #13Nessuna valutazione finora

- Islamic Financial ProductDocumento13 pagineIslamic Financial ProductKelvin Lim Wei QuanNessuna valutazione finora

- Bank Al Habib Car FinanceDocumento9 pagineBank Al Habib Car Financefatima rahimNessuna valutazione finora

- Diminishing Musharakah Presentation 02-06-08Documento32 pagineDiminishing Musharakah Presentation 02-06-08AlHuda Centre of Islamic Banking & Economics (CIBE)Nessuna valutazione finora

- Diminishing Musharakah: Mahmood ShafqatDocumento32 pagineDiminishing Musharakah: Mahmood ShafqatAli KhanNessuna valutazione finora

- Diminishing Musharaka IjarahBasedDocumento22 pagineDiminishing Musharaka IjarahBasedArsalan AqeeqNessuna valutazione finora

- Islamic Financial Accounting Standards To Ijarah by Ahmed AlDocumento23 pagineIslamic Financial Accounting Standards To Ijarah by Ahmed AlAsadZahidNessuna valutazione finora

- Accounting For InvestmentDocumento29 pagineAccounting For InvestmentSyahrul AmirulNessuna valutazione finora

- Financialservices: Kanika BhasinDocumento14 pagineFinancialservices: Kanika BhasinkanikaNessuna valutazione finora

- Merchant BankingDocumento20 pagineMerchant Bankingpranab paulNessuna valutazione finora

- Murabahah Product Structure: Title Application FADocumento26 pagineMurabahah Product Structure: Title Application FAUmair UddinNessuna valutazione finora

- Venture CapitalDocumento17 pagineVenture CapitalVidhyaBalaNessuna valutazione finora

- ISBF NotesDocumento13 pagineISBF Notesmuneebmateen01Nessuna valutazione finora

- Alinma BankDocumento4 pagineAlinma BankAnonymous bwQj7OgNessuna valutazione finora

- Chp4. Application of Islamic Lease FinancingDocumento35 pagineChp4. Application of Islamic Lease FinancingUsaama AbdilaahiNessuna valutazione finora

- Corporate Banking: Funded Services Lending /advances CB-CHPP07Documento40 pagineCorporate Banking: Funded Services Lending /advances CB-CHPP07Prakash SharmaNessuna valutazione finora

- Diminishing Musharakah ConceptDocumento26 pagineDiminishing Musharakah ConceptHasan Irfan SiddiquiNessuna valutazione finora

- All SlidesDocumento31 pagineAll SlidessinginiwizNessuna valutazione finora

- Lecture6 FinancingPart2Documento29 pagineLecture6 FinancingPart2Ry NielNessuna valutazione finora

- Procedure For Loan For Property Under The Master TitleDocumento17 pagineProcedure For Loan For Property Under The Master TitleKelvin PoptaniNessuna valutazione finora

- Difference and Similarities in Islamic ADocumento16 pagineDifference and Similarities in Islamic ASayed Sharif HashimiNessuna valutazione finora

- Substance Over Form-1Documento20 pagineSubstance Over Form-1Ashura ShaibNessuna valutazione finora

- If-1Documento27 pagineIf-1Asad MemonNessuna valutazione finora

- Introduction To Ijarah: Release DateDocumento21 pagineIntroduction To Ijarah: Release Datewafa shumailNessuna valutazione finora

- Investment Banking, Credit Rating, Leasing: Pradeep Kumar MishraDocumento25 pagineInvestment Banking, Credit Rating, Leasing: Pradeep Kumar Mishrasunit dasNessuna valutazione finora

- Bank Guarantees and Trade FinanceDocumento14 pagineBank Guarantees and Trade Finance1221Nessuna valutazione finora

- Vehicle Financing Products PDFDocumento22 pagineVehicle Financing Products PDFNurulhikmah RoslanNessuna valutazione finora

- Chapter 6 Application of Funds - Financing Facilities and The Underlying Shariah ConceptsDocumento94 pagineChapter 6 Application of Funds - Financing Facilities and The Underlying Shariah Conceptsamirol93Nessuna valutazione finora

- Uses of Bank Funds: The Lending FunctionDocumento21 pagineUses of Bank Funds: The Lending FunctionAKSHAY BHADAURIANessuna valutazione finora

- Valuation of CollateralDocumento24 pagineValuation of CollateralLuningning Carios100% (1)

- Loan SyndicationDocumento30 pagineLoan SyndicationMegha BhatnagarNessuna valutazione finora

- Islamic Sales Contracts StructureDocumento54 pagineIslamic Sales Contracts StructureFaisal Mir100% (1)

- First Slide Mortgage Market Second Slide Mortgage MarketDocumento6 pagineFirst Slide Mortgage Market Second Slide Mortgage MarketArlene GarciaNessuna valutazione finora

- Islamic Banking: Presented by Lakshmi and ShameemDocumento21 pagineIslamic Banking: Presented by Lakshmi and ShameemvidyaposhakNessuna valutazione finora

- Securitisation of Debt AssetsDocumento24 pagineSecuritisation of Debt AssetsANITTA M. AntonyNessuna valutazione finora

- Commercial Banking Lending Policies of BanksDocumento47 pagineCommercial Banking Lending Policies of Banksrahul8909Nessuna valutazione finora

- SYBBA Unit 4Documento40 pagineSYBBA Unit 4idea8433Nessuna valutazione finora

- Investment Banking UnderwritingDocumento25 pagineInvestment Banking UnderwritingGaurav GuptaNessuna valutazione finora

- House FinancingDocumento32 pagineHouse FinancingRowena YenXinNessuna valutazione finora

- SARFESI (Securitisation & Reconstruction and Enforcement of Security Interest)Documento22 pagineSARFESI (Securitisation & Reconstruction and Enforcement of Security Interest)BaazingaFeedsNessuna valutazione finora

- Indian Accounting Standard 23 - Borrowing CostDocumento10 pagineIndian Accounting Standard 23 - Borrowing CostSonali LadiNessuna valutazione finora

- Bank Credit - : Loans & AdvancesDocumento75 pagineBank Credit - : Loans & AdvancesNikhilrajsingh ShekhawatNessuna valutazione finora

- SecuritizationDocumento23 pagineSecuritizationHarshit NagpalNessuna valutazione finora

- FSA 4 Financing ActivitiesDocumento51 pagineFSA 4 Financing Activitiessubhrodeep chowdhuryNessuna valutazione finora

- FM LeasingDocumento15 pagineFM Leasingritam chakrabortyNessuna valutazione finora

- Dr. S.G. Rama Rao: Financial ServicesDocumento20 pagineDr. S.G. Rama Rao: Financial ServicesthensureshNessuna valutazione finora

- Chapter4. BankingDocumento38 pagineChapter4. BankingdhitalkhushiNessuna valutazione finora

- Borrowing Causes For Customers and Related Financing ProductsDocumento18 pagineBorrowing Causes For Customers and Related Financing Productssam30121989Nessuna valutazione finora

- Sarfaesi ActDocumento7 pagineSarfaesi ActBhakti Bhushan MishraNessuna valutazione finora

- Diminishing Musharakah - MBL - PpsDocumento17 pagineDiminishing Musharakah - MBL - Ppsgul_e_sabaNessuna valutazione finora

- Chapter 6 - Islamic Home LoansDocumento7 pagineChapter 6 - Islamic Home LoansVIDHYA A P PANIRSELVAM UnknownNessuna valutazione finora

- Corporate Banking Activities: Chapter Three DTG 3483Documento26 pagineCorporate Banking Activities: Chapter Three DTG 3483Nini MohamedNessuna valutazione finora

- Meezan Bank PresentationDocumento17 pagineMeezan Bank PresentationHussnain RazaNessuna valutazione finora

- Credit Mgt. - WEBILT - DeckDocumento287 pagineCredit Mgt. - WEBILT - Decksimran kaur100% (1)

- Final FMDocumento57 pagineFinal FMRuchi GandhiNessuna valutazione finora

- Financial Accounting and Reporting - InvestmentsDocumento10 pagineFinancial Accounting and Reporting - InvestmentsLuisitoNessuna valutazione finora

- Diminishing Musharakah MBLDocumento17 pagineDiminishing Musharakah MBLUbaid ArifNessuna valutazione finora

- Who Am I KiddingDocumento2 pagineWho Am I KiddingFarrah EmmylyaNessuna valutazione finora

- Reporting and Analysing LiabilitiesDocumento52 pagineReporting and Analysing LiabilitiesSuptoNessuna valutazione finora

- CUET 2022 General Test 6th October Shift 1Documento23 pagineCUET 2022 General Test 6th October Shift 1Dhruv BhardwajNessuna valutazione finora

- Forces L2 Measuring Forces WSDocumento4 pagineForces L2 Measuring Forces WSAarav KapoorNessuna valutazione finora

- Vintage Airplane - May 1982Documento24 pagineVintage Airplane - May 1982Aviation/Space History LibraryNessuna valutazione finora

- Pontevedra 1 Ok Action PlanDocumento5 paginePontevedra 1 Ok Action PlanGemma Carnecer Mongcal50% (2)

- SKF Shaft Alignment Tool TKSA 41Documento2 pagineSKF Shaft Alignment Tool TKSA 41Dwiki RamadhaniNessuna valutazione finora

- R15 Understanding Business CyclesDocumento33 pagineR15 Understanding Business CyclesUmar FarooqNessuna valutazione finora

- Mahatma Gandhi University: Priyadarshini Hills, Kottayam-686560Documento136 pagineMahatma Gandhi University: Priyadarshini Hills, Kottayam-686560Rashmee DwivediNessuna valutazione finora

- Thermodynamic c106Documento120 pagineThermodynamic c106Драгослав БјелицаNessuna valutazione finora

- Chapter 13Documento15 pagineChapter 13anormal08Nessuna valutazione finora

- Thesis On Retail Management of The Brand 'Sleepwell'Documento62 pagineThesis On Retail Management of The Brand 'Sleepwell'Sajid Lodha100% (1)

- Chunking Chunking Chunking: Stator Service IssuesDocumento1 paginaChunking Chunking Chunking: Stator Service IssuesGina Vanessa Quintero CruzNessuna valutazione finora

- Individual Daily Log and Accomplishment Report: Date and Actual Time Logs Actual AccomplishmentsDocumento3 pagineIndividual Daily Log and Accomplishment Report: Date and Actual Time Logs Actual AccomplishmentsMarian SalazarNessuna valutazione finora

- DLI Watchman®: Vibration Screening Tool BenefitsDocumento2 pagineDLI Watchman®: Vibration Screening Tool Benefitssinner86Nessuna valutazione finora

- Ged 102 Mathematics in The Modern WorldDocumento84 pagineGed 102 Mathematics in The Modern WorldKier FormelozaNessuna valutazione finora

- Ransomware: Prevention and Response ChecklistDocumento5 pagineRansomware: Prevention and Response Checklistcapodelcapo100% (1)

- Instruction Manual 115cx ENGLISHDocumento72 pagineInstruction Manual 115cx ENGLISHRomanPiscraftMosqueteerNessuna valutazione finora

- Barista Skills Foundation Curriculum enDocumento4 pagineBarista Skills Foundation Curriculum enCezara CarteșNessuna valutazione finora

- Level Swiches Data SheetDocumento4 pagineLevel Swiches Data SheetROGELIO QUIJANONessuna valutazione finora

- Ariba Collaborative Sourcing ProfessionalDocumento2 pagineAriba Collaborative Sourcing Professionalericofx530Nessuna valutazione finora

- Nse 2Documento5 pagineNse 2dhaval gohelNessuna valutazione finora

- What Are The Advantages and Disadvantages of UsingDocumento4 pagineWhat Are The Advantages and Disadvantages of UsingJofet Mendiola88% (8)

- Gmail - ICICI BANK I PROCESS HIRING FOR BACKEND - OPERATION PDFDocumento2 pagineGmail - ICICI BANK I PROCESS HIRING FOR BACKEND - OPERATION PDFDeepankar ChoudhuryNessuna valutazione finora

- Property House Invests $1b in UAE Realty - TBW May 25 - Corporate FocusDocumento1 paginaProperty House Invests $1b in UAE Realty - TBW May 25 - Corporate FocusjiminabottleNessuna valutazione finora

- CL200 PLCDocumento158 pagineCL200 PLCJavierRuizThorrensNessuna valutazione finora

- Process Description of Function For Every Unit OperationDocumento3 pagineProcess Description of Function For Every Unit OperationMauliduni M. AuniNessuna valutazione finora

- Mangement of Shipping CompaniesDocumento20 pagineMangement of Shipping CompaniesSatyam MishraNessuna valutazione finora

- BKNC3 - Activity 1 - Review ExamDocumento3 pagineBKNC3 - Activity 1 - Review ExamDhel Cahilig0% (1)

- Roland Fantom s88Documento51 pagineRoland Fantom s88harryoliff2672100% (1)

- Yarn HairinessDocumento9 pagineYarn HairinessGhandi AhmadNessuna valutazione finora

- Bin Adam Group of CompaniesDocumento8 pagineBin Adam Group of CompaniesSheema AhmadNessuna valutazione finora