Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

International Trade Theories

Caricato da

trustme77Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

International Trade Theories

Caricato da

trustme77Copyright:

Formati disponibili

Theories of International Trade

Learning Objectives

To understand the traditional arguments of how and why international trade improves the welfare of all countries To review the history and compare the implications of trade theory from the original work of Adam Smith to the contemporary theories of Michael Porter To examine the criticisms of classical trade theory and examine alternative viewpoints of which business and economic forces determine trade patterns between countries

Evolution of Trade Theories

Mercantilism Absolute advantage (Classical) Comparative advantage Factor Proportions Trade International Product Cycle New Trade Theory National competitive advantage

Mercantilism: mid-16th century

A nations wealth depends on accumulated treasure

Gold and silver are the currency of trade Maximize export through subsidies. Minimize imports through tariffs and quotas

Theory says you should have a trade surplus.

Flaw: restrictions, impaired growth

Defining mercantilism

trade theory holding that nations should accumulate financial wealth, usually in the form of gold (forget things like living standards or human development) by encouraging exports and discouraging imports

4-6

Criticism

Its a zero sum game gain by one country and loss of another.. Gold and silver are no longer exist as standard for measuring the wealth..

Theory of absolute advantage

Adam Smith: Wealth of Nations (1776) argued: Capability of one country to produce more of a product with the same amount of input than another country A country should produce only goods where it is most efficient, and trade for those goods where it is not efficient Trade between countries is, therefore, beneficial Assumes there is an absolute balance among nations

Theory of absolute advantage

destroys the mercantilist idea since there are gains to be had by both countries party to an exchange questions the objective of national governments to acquire wealth through restrictive trade policies measures a nations wealth by the living standards of its people

Theory of comparative advantage

David Ricardo: Principles of Political Economy (1817)

Extends free trade argument Efficiency of resource utilization leads to more productivity Should import even if country is more efficient in the products production than country from which it is buying. Look to see how much more efficient. If only comparatively efficient, than import.

Makes better use of resources Trade is a positive-sum game

Comparative advantage and the gains from trade

Assumptions and limitations

Driven only by maximization of production and consumption Only 2 countries engaged in production and consumption of just 2 goods? What about the transportation costs? Only resource labour (that too, nontransferable) No consideration for learning theory

Factor proportions theory

Heckscher (1919) - Olin (1933) Theory Export goods that intensively use factor endowments which are locally abundant Corollary: import goods made from locally scarce factors

Note: Factor endowments can be impacted by government policy - minimum wage

Patterns of trade are determined by differences in factor endowments - not productivity Remember, focus on relative advantage, not absolute advantage

Factor proportions theory

trade theory holding that countries produce and export those goods that require resources (factors) that are abundant (and thus cheapest) and import those goods that require resources that are in short supply Example:

Australia lot of land and a small population (relative to its size) So what should it export and import?

Factor Proportions Trade Theory Considers Two Factors of Production

Labor

Capital

Factor Proportions Trade Theory

A country that is relatively labor abundant (capital abundant) should specialize in the production and export of that product which is relatively labor intensive (capital intensive)

The Leontief Paradox

The Test:

Could Factor Proportions Theory be used to explain the types of goods the United States imported and exported?

The Method:

Input-output analysis

The Leontief Paradox

The Findings:

The U.S. exported labor-intensive products and imported capital-intensive products.

The Controversy:

Findings were the opposite of what was generally believed to be true!

Product life-cycle Theory

R.Vernon (1966)

trade theory holding that a company will begin by exporting its product and later undertake foreign direct investment as the product moves through its lifecycle As products mature, both location of sales and optimal production changes Affects the direction and flow of imports and exports Globalization and integration of the economy makes this theory less valid

Product life cycle theory

Fig 4.5

The Product Cycle and Trade Implications Increased emphasis on technologys impact on product cost Explained international investment Limitations

Most appropriate for technology-based products Some products not easily characterized by stages of maturity Most relevant to products produced through mass production

New trade theory

In industries with high fixed costs:

Specialization increases output, and the ability to enhance economies of scale increases Learning effects are high. These are cost savings that come from learning by doing

New trade theory - applications

Typically, requires industries with high, fixed costs

World demand will support few competitors

Competitors may emerge because of Firstmover advantage

Economies of scale may preclude new entrants Role of the government becomes significant

Some argue that it generates government intervention and strategic trade policy

Theory of national competitive advantage

The theory attempts to analyze the reasons for a nations success in a particular industry Porter studied 100 industries in 10 nations

postulated determinants of competitive advantage of a nation based on four major attributes

Factor

endowments Demand conditions Related and supporting industries Firm strategy, structure and rivalry

Porters diamond

Success occurs where these attributes exist. More/greater the attribute, the higher chance of success The diamond is mutually reinforcing

Factor endowments

Factor endowments:- A nations position in factors of production such as skilled labor or infrastructure necessary to compete in a given industry Basic factor endowments Advanced factor endowments

Basic factor endowments

Basic factors: Factors present in a country

Natural resources Climate Geographic location Demographics

While basic factors can provide an initial advantage they must be supported by advanced factors to maintain success

Advanced factor endowments

Advanced factors: Are the result of investment by people, companies, government and are more likely to lead to competitive advantage If a country has no basic factors, it must invest in advanced factors

Advanced factor endowments

communications skilled labor research Technology education

Demand conditions

Demand: creates capabilities creates sophisticated and demanding consumers Demand impacts quality and innovation

Related and supporting industries

Creates clusters of supporting industries that are internationally competitive Must also meet requirements of other parts of the Diamond

Firm Strategy, Structure and Rivalry

Long term corporate vision is a determinant of success Management ideology and structure of the firm can either help or hurt you Presence of domestic rivalry improves a companys competitiveness

Determinants of Competitive Advantage in nations

Fig 4.8

Chance

Company Strategy, Structure, and Rivalry

Two external factors that influence the four determinants.

Factor Conditions Related and Supporting Industries

Demand Conditions

Government

Porters Theory-predictions

Porters theory should predict the pattern of international trade that we observe in the real world

Countries should be exporting products from those industries where all four components of the diamond are favorable, while importing in those areas where the components are not favorable

Implications for business

Location implications:

Disperse production activities to countries where they can be performed most efficiently

First-mover implications:

Invest substantial financial resources in building a first-mover, or early-mover advantage

Promoting free trade is in the best interests of the home-country, not always in the best interests of the firm, even though, many firms promote open markets

Policy implications:

India in the global competitiveness report

Potrebbero piacerti anche

- International Trade Theories ExplainedDocumento11 pagineInternational Trade Theories Explainedesha bansalNessuna valutazione finora

- International Trade TheoriesDocumento33 pagineInternational Trade TheoriesMandeep Raj100% (1)

- Theories of Internatinal TradeDocumento8 pagineTheories of Internatinal TradejijibishamishraNessuna valutazione finora

- CHAPTER 1 International EconomicsDocumento48 pagineCHAPTER 1 International EconomicsToulouse18Nessuna valutazione finora

- International Trade TheoriesDocumento15 pagineInternational Trade TheoriesJaya Shree100% (1)

- Theories of TradeDocumento21 pagineTheories of TradePawan Lad100% (3)

- IB Theories of TradeDocumento42 pagineIB Theories of TradevijiNessuna valutazione finora

- International Trade TheoriesDocumento6 pagineInternational Trade TheoriesQueenie Gallardo AngelesNessuna valutazione finora

- The Instruments of Trade Policy: Arun Mishra 9893686820Documento13 pagineThe Instruments of Trade Policy: Arun Mishra 9893686820Arun MishraNessuna valutazione finora

- Protectionism: Logic and Illogic: Arguments For Protectionism Include: Arguments For Protectionism IncludeDocumento21 pagineProtectionism: Logic and Illogic: Arguments For Protectionism Include: Arguments For Protectionism IncludeSuresh Babu0% (1)

- Modern Theories of International TradeDocumento15 pagineModern Theories of International TradeCasie Mack100% (2)

- Balance of PaymentsDocumento22 pagineBalance of PaymentsPranav D. Potekar100% (2)

- Multiplier EffectDocumento25 pagineMultiplier EffecteuwillaNessuna valutazione finora

- Classical Theories of International Trade-1Documento22 pagineClassical Theories of International Trade-1Mahender TewatiaNessuna valutazione finora

- International Trade TheoriesDocumento46 pagineInternational Trade Theoriespratiraval100% (1)

- IFM5 Exc Rate Theories Parity ConditionsDocumento42 pagineIFM5 Exc Rate Theories Parity Conditionsashu khetan100% (1)

- Theories of International Trade: Absolute Advantage, Comparative Advantage, and BeyondDocumento44 pagineTheories of International Trade: Absolute Advantage, Comparative Advantage, and BeyondArjun Mk100% (2)

- Commodity AgreementsDocumento8 pagineCommodity AgreementsshamshamanthNessuna valutazione finora

- FOREX TITLEDocumento30 pagineFOREX TITLEBharat SinghNessuna valutazione finora

- Lectures 4 and 5 Modern Trade TheoriesDocumento33 pagineLectures 4 and 5 Modern Trade TheoriesChenxi LiuNessuna valutazione finora

- Measuring GDP and Economic Growth: Chapter 4 LectureDocumento33 pagineMeasuring GDP and Economic Growth: Chapter 4 LectureIfteakher Ibne HossainNessuna valutazione finora

- Indian Fiscal PolicyDocumento2 pagineIndian Fiscal PolicyBhavya Choudhary100% (1)

- Classical Theory of International Trade Gipe 2Documento14 pagineClassical Theory of International Trade Gipe 2Sajal SinghNessuna valutazione finora

- Heckscher Ohlin TheoryDocumento10 pagineHeckscher Ohlin TheoryApoorv SrivastavaNessuna valutazione finora

- Student International Marketing 15th Edition Chapter 6Documento15 pagineStudent International Marketing 15th Edition Chapter 6Malik YasirNessuna valutazione finora

- An Overview of International TradeDocumento4 pagineAn Overview of International TradeMark Russel Sean LealNessuna valutazione finora

- Daniels15 06 Governmental Influence On TradeDocumento13 pagineDaniels15 06 Governmental Influence On TradeLaraine Shawa100% (1)

- Theory of International TradeDocumento67 pagineTheory of International Tradeapi-3735029100% (10)

- Regional Economic Integration ExplainedDocumento32 pagineRegional Economic Integration Explainedਹਰਸ਼ ਵਰਧਨNessuna valutazione finora

- Market Structure & AnalysisDocumento18 pagineMarket Structure & Analysisrahulgupta123467Nessuna valutazione finora

- Meaning and Nature of Public ExpenditureDocumento3 pagineMeaning and Nature of Public ExpenditureMuhammad Shifaz Mamur100% (1)

- International Business: by Charles W.L. HillDocumento17 pagineInternational Business: by Charles W.L. HillAnoushey FatimaNessuna valutazione finora

- Ch02 HH RevisedDocumento24 pagineCh02 HH RevisedȠƛǝǝm KĦáń100% (1)

- Definition: The General Agreement On Tariffs and Trade Was The First Worldwide Multilateral Free Trade Agreement. It WasDocumento17 pagineDefinition: The General Agreement On Tariffs and Trade Was The First Worldwide Multilateral Free Trade Agreement. It WasRizza Mae EudNessuna valutazione finora

- CANALISATIONDocumento34 pagineCANALISATIONPiyushVarmaNessuna valutazione finora

- Heckscher-Ohlin TheoryDocumento7 pagineHeckscher-Ohlin TheoryrajkumarkvNessuna valutazione finora

- International Economic EnvironmentDocumento24 pagineInternational Economic EnvironmentRocKstar AbhiNessuna valutazione finora

- Hec Ohlin TheoryDocumento13 pagineHec Ohlin TheoryPavithra PRabhuNessuna valutazione finora

- CHP 1 Intro To International BusinessDocumento45 pagineCHP 1 Intro To International BusinessAsyrafAlifNessuna valutazione finora

- Heckscher OhlinDocumento4 pagineHeckscher OhlinSidNessuna valutazione finora

- IMF PPT MbaDocumento14 pagineIMF PPT MbaBabasab Patil (Karrisatte)Nessuna valutazione finora

- Balance of PaymentsDocumento16 pagineBalance of PaymentsShipra SinghNessuna valutazione finora

- Effect of Wto On India: AssignmentDocumento6 pagineEffect of Wto On India: AssignmentDarpan BhattNessuna valutazione finora

- Structure of Indian EconomyDocumento18 pagineStructure of Indian Economykartii_123Nessuna valutazione finora

- Daniels IBT 16e Final PPT 05Documento16 pagineDaniels IBT 16e Final PPT 05Ola FathallaNessuna valutazione finora

- Early international trade routes using animalsDocumento6 pagineEarly international trade routes using animalsGian Paul JavierNessuna valutazione finora

- Fiscal PolicyDocumento19 pagineFiscal PolicyShreya SharmaNessuna valutazione finora

- Implications of Wto On Indian Agriculture SectorDocumento55 pagineImplications of Wto On Indian Agriculture Sectorveronica_rachnaNessuna valutazione finora

- Effects of Foreign Exchange Rates On Indian EconomyDocumento43 pagineEffects of Foreign Exchange Rates On Indian EconomyMohamed Rizwan0% (1)

- IE GA Notes - 1 PDFDocumento113 pagineIE GA Notes - 1 PDFsurajdhunnaNessuna valutazione finora

- Types of Custom DutyDocumento3 pagineTypes of Custom DutyKarina ManafNessuna valutazione finora

- Fiscal Policy MeaningDocumento27 pagineFiscal Policy MeaningVikash SinghNessuna valutazione finora

- Capital FormationDocumento20 pagineCapital FormationNupoorSharmaNessuna valutazione finora

- Unit Iii. Economic Development and Economic PlanningDocumento29 pagineUnit Iii. Economic Development and Economic PlanningErman GaraldaNessuna valutazione finora

- The Foreign Exchange MarketDocumento29 pagineThe Foreign Exchange MarketChamiNessuna valutazione finora

- TRADE BARRIERS: TYPES AND IMPACTSDocumento7 pagineTRADE BARRIERS: TYPES AND IMPACTSRaju YadavNessuna valutazione finora

- Chapter 4 International Trade Theory and Factor MovementsDocumento43 pagineChapter 4 International Trade Theory and Factor MovementsJungsuk KimNessuna valutazione finora

- International Trade Theories ExplainedDocumento12 pagineInternational Trade Theories ExplainedAinee DisaNessuna valutazione finora

- The Benefit of Trade: Great Strength With Their Theory WasDocumento6 pagineThe Benefit of Trade: Great Strength With Their Theory WasladipmaNessuna valutazione finora

- Chapter 6 Theories of International TradeDocumento8 pagineChapter 6 Theories of International TradealimithaNessuna valutazione finora

- MIS NotesDocumento17 pagineMIS Notestrustme77Nessuna valutazione finora

- Con Buying Behav - BHVDocumento102 pagineCon Buying Behav - BHVtrustme77Nessuna valutazione finora

- It Act 2000Documento22 pagineIt Act 2000trustme77Nessuna valutazione finora

- Final Bba MIS Notes PDFDocumento24 pagineFinal Bba MIS Notes PDFSejatiMuslimah50% (6)

- ETHICS AT THE CORE OF PUBLIC RELATIONSDocumento65 pagineETHICS AT THE CORE OF PUBLIC RELATIONSVlad VolosciucNessuna valutazione finora

- AdvertisingDocumento114 pagineAdvertisingDeepesh JainNessuna valutazione finora

- The Indian Partnership Act of 1932Documento42 pagineThe Indian Partnership Act of 1932trustme77Nessuna valutazione finora

- Introduction To MISDocumento1 paginaIntroduction To MIStrustme77Nessuna valutazione finora

- MKTDocumento15 pagineMKTtrustme77Nessuna valutazione finora

- Product and Brand Management A Concise Note On Everything About Product and Brand ManagementDocumento16 pagineProduct and Brand Management A Concise Note On Everything About Product and Brand ManagementAnuranjanSinha93% (14)

- The New Business Environment Demands ForesightDocumento3 pagineThe New Business Environment Demands Foresighttrustme77Nessuna valutazione finora

- 13IMCDocumento24 pagine13IMCtrustme77Nessuna valutazione finora

- Profile of renowned journalist Ashok WankhadeDocumento2 pagineProfile of renowned journalist Ashok Wankhadetrustme77100% (1)

- Forms of Business OrganizationDocumento26 pagineForms of Business Organizationtrustme77Nessuna valutazione finora

- AdvertisingDocumento114 pagineAdvertisingDeepesh JainNessuna valutazione finora

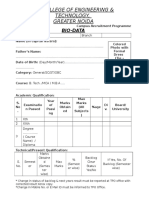

- Format For Research SupervisorDocumento4 pagineFormat For Research Supervisortrustme77Nessuna valutazione finora

- AssignmentDocumento2 pagineAssignmenttrustme77Nessuna valutazione finora

- MIS - 01 - (Application For Short Leave) : Name SignatureDocumento1 paginaMIS - 01 - (Application For Short Leave) : Name SignatureAnonymous wvS9gYxNessuna valutazione finora

- Mba New SyllabusDocumento38 pagineMba New Syllabustrustme77Nessuna valutazione finora

- Bio Data Form 2016Documento3 pagineBio Data Form 2016trustme77Nessuna valutazione finora

- Computers 1st Sem NotesDocumento26 pagineComputers 1st Sem NotesSugandha Agarwal88% (26)

- Exit ApplicationDocumento2 pagineExit Applicationtrustme77Nessuna valutazione finora

- Syllabus MAMDocumento28 pagineSyllabus MAMtrustme77Nessuna valutazione finora

- Lecture Wise Plan IRLEDocumento4 pagineLecture Wise Plan IRLEtrustme77Nessuna valutazione finora

- Unit 1Documento15 pagineUnit 1trustme77Nessuna valutazione finora

- Unit 2Documento13 pagineUnit 2trustme77Nessuna valutazione finora

- Rural Development SyllabusDocumento2 pagineRural Development Syllabustrustme77Nessuna valutazione finora

- Revised Mam Dual II Revised 03082015Documento46 pagineRevised Mam Dual II Revised 03082015trustme77Nessuna valutazione finora

- Productn & Operatn Mgmt11-12Documento24 pagineProductn & Operatn Mgmt11-12trustme77Nessuna valutazione finora

- MBA New Syllabus 2016-17Documento37 pagineMBA New Syllabus 2016-17trustme77Nessuna valutazione finora

- Display TFT SPI ST7735Documento6 pagineDisplay TFT SPI ST7735Adlene DenniNessuna valutazione finora

- CD1 ISO/IEC 17000 Conformity Assessment - Vocabulary and General PrinciplesDocumento26 pagineCD1 ISO/IEC 17000 Conformity Assessment - Vocabulary and General PrinciplesMAC CONSULTORESNessuna valutazione finora

- RB450G Trouble ShootingDocumento9 pagineRB450G Trouble Shootingjocimar1000Nessuna valutazione finora

- Tomas Del Rosario College: Department: EDUCATIONDocumento12 pagineTomas Del Rosario College: Department: EDUCATIONveehneeNessuna valutazione finora

- Understanding Logistics and Supply Chain Management ConceptsDocumento12 pagineUnderstanding Logistics and Supply Chain Management Conceptsarfat kabraNessuna valutazione finora

- CalculationDocumento24 pagineCalculationhablet1100% (1)

- IPA Assignment Analyzes New Public AdministrationDocumento8 pagineIPA Assignment Analyzes New Public AdministrationKumaran ViswanathanNessuna valutazione finora

- Adb Wind ConeDocumento4 pagineAdb Wind ConeSulistyo WidodoNessuna valutazione finora

- Media Effects TheoriesDocumento6 pagineMedia Effects TheoriesHavie Joy SiguaNessuna valutazione finora

- The Truth of Extinction: 7.1 Nietzsche's FableDocumento2 pagineThe Truth of Extinction: 7.1 Nietzsche's FableGraciela Barón GuiñazúNessuna valutazione finora

- AWS D1.5 PQR TitleDocumento1 paginaAWS D1.5 PQR TitleNavanitheeshwaran SivasubramaniyamNessuna valutazione finora

- Language Culture and ThoughtDocumento24 pagineLanguage Culture and ThoughtLý Hiển NhiênNessuna valutazione finora

- Pnas 1703856114Documento5 paginePnas 1703856114pi. capricorniNessuna valutazione finora

- Column and Thin Layer ChromatographyDocumento5 pagineColumn and Thin Layer Chromatographymarilujane80% (5)

- Teodorico M. Collano, JR.: ENRM 223 StudentDocumento5 pagineTeodorico M. Collano, JR.: ENRM 223 StudentJepoyCollanoNessuna valutazione finora

- Dewatering Well PointsDocumento4 pagineDewatering Well Pointssalloum3Nessuna valutazione finora

- Design and Simulation of Programmable AC-DC Converter Using Pulse Width Modulation (PWM) Techniques in MATLABDocumento5 pagineDesign and Simulation of Programmable AC-DC Converter Using Pulse Width Modulation (PWM) Techniques in MATLABJeannot MpianaNessuna valutazione finora

- Amber ToolsDocumento309 pagineAmber ToolshkmydreamsNessuna valutazione finora

- Production of Formaldehyde From MethanolDocumento200 pagineProduction of Formaldehyde From MethanolSofia Mermingi100% (1)

- J05720020120134026Functions and GraphsDocumento14 pagineJ05720020120134026Functions and GraphsmuglersaurusNessuna valutazione finora

- The Godfather Term One Sample Basic Six Annual Scheme of Learning Termly Scheme of Learning WEEK 1 - 12Documento313 pagineThe Godfather Term One Sample Basic Six Annual Scheme of Learning Termly Scheme of Learning WEEK 1 - 12justice hayfordNessuna valutazione finora

- 2002 AriDocumento53 pagine2002 AriMbarouk Shaame MbaroukNessuna valutazione finora

- (Math 6 WK 5 L9) - Problems Involving Addition and or Subtraction of DecimalsDocumento43 pagine(Math 6 WK 5 L9) - Problems Involving Addition and or Subtraction of DecimalsRhea OciteNessuna valutazione finora

- TCBE - Conversation Skills TemplateDocumento10 pagineTCBE - Conversation Skills TemplateAryoma GoswamiNessuna valutazione finora

- The Effects of Self-Esteem On Makeup InvolvementDocumento9 pagineThe Effects of Self-Esteem On Makeup InvolvementMichelle Nicole Tagupa SerranoNessuna valutazione finora

- ResumeDocumento5 pagineResumeSaeed SiriNessuna valutazione finora

- What Is A Lecher AntennaDocumento4 pagineWhat Is A Lecher AntennaPt AkaashNessuna valutazione finora

- Tithi PRAVESHADocumento38 pagineTithi PRAVESHAdbbircs100% (1)

- Be3000 Manual 2016Documento77 pagineBe3000 Manual 2016Itzel JuárezNessuna valutazione finora

- Information HandoutsDocumento6 pagineInformation HandoutsPooja Marwadkar TupcheNessuna valutazione finora