Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Demand Forecasting

Caricato da

Bipin TiwariDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Demand Forecasting

Caricato da

Bipin TiwariCopyright:

Formati disponibili

1

Demand forecasting

What is a demand forecast?

A demand forecast is the prediction of what will happen to your company's existing product sales. It would be best to determine the demand forecast using a multifunctional approach. The inputs from sales and marketing, finance, and production should be considered. The final demand forecast is the consensus of all participating managers. You may also want to put up a Sales and Operations Planning group composed of representatives from the different departments that will be tasked to prepare the demand forecast.

Demand Management

Independent Demand: Finished Goods

A

B(4)

C(2)

Dependent Demand: Raw Materials, Component parts, Sub-assemblies, etc.

D(2)

E(1)

D(3)

F(2)

Types of Forecasts

Qualitative (Judgmental) Quantitative Time Series Analysis Causal Relationships Simulation

Qualitative Methods

Executive Judgment

Grass Roots

Historical analogy

Qualitative Methods

Market Research

Delphi Method

Panel Consensus

Time Series Analysis

Time series forecasting models try to predict the future based on past data You can pick models based on: 1. Time horizon to forecast 2. Data availability 3. Accuracy required 4. Size of forecasting budget 5. Availability of qualified personnel

Simple Moving Average Formula

The simple moving average model assumes an average is a good estimator of future behavior The formula for the simple moving average is:

A t-1 + A t-2 + A t-3 +...+A t- n Ft = n

Ft = Forecast for the coming period N = Number of periods to be averaged A t-1 = Actual occurrence in the past period for up to n periods

Simple Moving Average Problem (1)

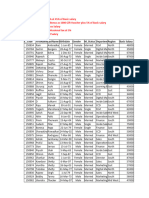

Week 1 2 3 4 5 6 7 8 9 10 11 12

Demand 650 678 720 785 859 920 850 758 892 920 789 844

A t-1 + A t-2 + A t-3 +...+A t- n Ft = n

Question: What are the 3week and 6-week moving average forecasts for demand? Assume you only have 3 weeks and 6 weeks of actual demand data for the respective forecasts

Calculating the moving averages gives us:

W eek 1 2 3 4 5 6 7 8 9 10 11 12

Demand 3-W eek 6-Week 650 F4=(650+678+720)/3 678 =682.67 720 F7=(650+678+720 +785+859+920)/6 785 682.67 859 727.67 =768.67 920 788.00 850 854.67 768.67 758 876.33 802.00 892 842.67 815.33 920 833.33 844.00 789 856.67 866.50 844 867.00 854.83

The McGraw-Hill Companies, Inc., 2004

10

Plotting the moving averages and comparing Plotting the moving averages and comparing them shows how the lines smooth out to reveal them shows how the lines smooth out to reveal the overall upward trend in this example the overall upward trend in this example

10 00 9 00 Demand 8 00 7 00 6 00 5 00 1 2 3 4 5 6 7 8 9 10 11 1 2 We e k Dema nd 3 -W e ek 6 -W e ek

Note how the Note how the 3-Week is 3-Week is smoother than smoother than the Demand, the Demand, and 6-Week is and 6-Week is even smoother even smoother

11

Weighted Moving Average Formula

While the moving average formula implies an equal While the moving average formula implies an equal weight being placed on each value that is being averaged, weight being placed on each value that is being averaged, the weighted moving average permits an unequal the weighted moving average permits an unequal weighting on prior time periods weighting on prior time periods The formula for the moving average is: The formula for the moving average is:

Ft = w 1A t-1 + w 2 A t-2 + w 3A t-3 +. ..+w n A t-n

wt = weight given to time period t wt = weight given to time period t occurrence (weights must add to one) occurrence (weights must add to one)

w

i=1

=1

12

Weighted Moving Average Problem (1) Data

Question: Given the weekly demand and weights, what is Question: Given the weekly demand and weights, what is the forecast for the 4th period or Week 4? the forecast for the 4th period or Week 4?

Week 1 2 3 4 Demand 650 678 720

Weights: t-1 .5 t-2 .3 t-3 .2

Note that the weights place more emphasis on the Note that the weights place more emphasis on the most recent data, that is time period t-1 most recent data, that is time period t-1

13

Weighted Moving Average Problem (1) Solution

Week 1 2 3 4

Demand Forecast 650 678 720 693.4

F4 = 0.5(720)+0.3(678)+0.2(650)=693.4

14

Weighted Moving Average Problem (2) Data

Question: Given the weekly demand information and Question: Given the weekly demand information and weights, what is the weighted moving average forecast weights, what is the weighted moving average forecast of the 5th period or week? of the 5th period or week?

Week 1 2 3 4 Demand 820 775 680 655

Weights: t-1 .7 t-2 .2 t-3 .1

15

Weighted Moving Average Problem (2) Solution

W eek 1 2 3 4 5 Demand Forecast 820 775 680 655 672

F5 = (0.1)(775)+(0.2)(680)+(0.7)(655)= 672

16

Exponential Smoothing Model

Ftt = Ft-1 + (At-1 - Ft-1 ) F = Ft-1 + (At-1 - Ft-1 )

Where : Ft = Forcast value for the coming t time period Ft - 1 = Forecast value in 1 past time period At - 1 = Actual occurance in the past t time period

= Alpha smoothing constant

Premise: The most recent observations might have the highest predictive value Therefore, we should give more weight to the more recent time periods when forecasting

17

Exponential Smoothing Problem (1) Data Question: Given the weekly demand data, what are the exponential smoothing forecasts for periods 2-10 using =0.10 and =0.60? Assume F =D 1 1

Week 1 2 3 4 5 6 7 8 9 10

Demand 820 775 680 655 750 802 798 689 775

18

Answer: The respective alphas columns denote the forecast values. Note Answer: The respective alphas columns denote the forecast values. Note that you can only forecast one time period into the future. that you can only forecast one time period into the future.

Week 1 2 3 4 5 6 7 8 9 10

Demand 820 775 680 655 750 802 798 689 775

0.1 820.00 820.00 815.50 801.95 787.26 783.53 785.38 786.64 776.88 776.69

0.6 820.00 820.00 793.00 725.20 683.08 723.23 770.49 787.00 728.20 756.28

19

Exponential Smoothing Problem (1) Plotting

Note how that the smaller alpha results in a smoother line in Note how that the smaller alpha results in a smoother line in this example this example

900 800 Demand 700 600 500 1 2 3 4 5 6 7 8 9 10 Demand 0 .1 0 .6

Week

20

The MAD Statistic to Determine Forecasting Error

MAD =

A

t=1

- Ft

1 M AD 0.8 standrd deviat a ion 1 standard deviation 1.25 M AD

The ideal MAD is zero which would mean there is no forecasting error The larger the MAD, the less the accurate the resulting model

21

MAD Problem Data Question: What is the MAD value given Question: What is the MAD value given the forecast values in the table below? the forecast values in the table below?

Month

1 2 3 4 5

Sales Forecast 220 n/a 250 255 210 205 300 320 325 315

22

MAD Problem Solution

Month 1 2 3 4 5 Sales 220 250 210 300 325 Forecast Abs Error n/a 255 5 205 5 320 20 315 10

40

MAD =

A

t=1

- Ft

40 = = 10 4

Note that by itself, the MAD Note that by itself, the MAD only lets us know the mean only lets us know the mean error in a set of forecasts error in a set of forecasts

23

Simple Linear Regression Model

The simple linear regression The simple linear regression model seeks to fit a line model seeks to fit a line through various data over through various data over time time

Y

a

0 1 2 3 4 5 x (Time)

Yt = a + bx

Is the linear regression model Is the linear regression model

Yt is the regressed forecast value or dependent variable in the model, a is the intercept value of the the regression line, and b is similar to the slope of the regression line. However, since it is calculated with the variability of the data in mind, its formulation is not as straight forward as our usual notion of slope.

24

Simple Linear Regression Formulas for Calculating a and b

a = y - bx

xy - n(y)(x) x - n(x )

2 2

b=

25

Simple Linear Regression Problem Data

Question: Given the data below, what is the simple linear Question: Given the data below, what is the simple linear regression model that can be used to predict sales in future regression model that can be used to predict sales in future weeks? weeks?

Week 1 2 3 4 5

Sales 150 157 162 166 177

26

Answer: First, using the linear regression formulas, we Answer: First, using the linear regression formulas, we can compute a and b can compute a and b

Week Week*Week Sales Week*Sales 1 1 150 150 2 4 157 314 3 9 162 486 4 16 166 664 5 25 177 885 3 55 162.4 2499 Average Sum Average Sum xy - n( y)(x) = 2499 - 5(162.4)(3) = 63 = 6.3 b= 55 5(9 ) 10 x 2 - n(x )2

a = y - bx = 162.4 - (6.3)(3) = 143.5

27

The resulting regression model is:

Yt = 143.5 + 6.3x

Now if we plot the regression generated forecasts against the actual sales we obtain the following chart: 180 175 170 165 Sales 160 155 Forecast 150 145 140 135 1 2 3 4 5 Period

Sales

28

Web-Based Forecasting: CPFR

Collaborative Planning, Forecasting, and Replenishment (CPFR) a Web-based tool used to coordinate demand forecasting, production and purchase planning, and inventory replenishment between supply chain trading partners. Used to integrate the multi-tier or n-Tier supply chain, including manufacturers, distributors and retailers. CPFRs objective is to exchange selected internal information to provide for a reliable, longer term future views of demand in the supply chain. CPFR uses a cyclic and iterative approach to derive consensus forecasts.

29

Web-Based Forecasting: Steps in CPFR

1. Creation of a front-end partnership agreement 2. Joint business planning 3. Development of demand forecasts 4. Sharing forecasts 5. Inventory replenishment

30

Thank you

Potrebbero piacerti anche

- Continuous Improvement A Complete Guide - 2019 EditionDa EverandContinuous Improvement A Complete Guide - 2019 EditionNessuna valutazione finora

- Implications of Predictive AnalyticsDocumento9 pagineImplications of Predictive AnalyticsAMIT PANDEYNessuna valutazione finora

- Disease Prediction Application Using Machine LearningDocumento12 pagineDisease Prediction Application Using Machine LearningIJRASETPublicationsNessuna valutazione finora

- Smart Disease Prediction Using Machine LearningDocumento5 pagineSmart Disease Prediction Using Machine LearningInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- Types of Analytics: What Is Descriptive Analytics?Documento3 pagineTypes of Analytics: What Is Descriptive Analytics?Edgar ElgortNessuna valutazione finora

- Presentation - Reinventing You Business ModelDocumento20 paginePresentation - Reinventing You Business Modelyunus_starkNessuna valutazione finora

- The Role of Kpis and Metrics in Digital Marketing: January 2019Documento7 pagineThe Role of Kpis and Metrics in Digital Marketing: January 2019Nora MedalyNessuna valutazione finora

- Case Tuscan LifestylesDocumento10 pagineCase Tuscan LifestyleskowillNessuna valutazione finora

- Demand forecasting methods and productivity analysisDocumento24 pagineDemand forecasting methods and productivity analysisnitish07singhNessuna valutazione finora

- Business AgilityDocumento201 pagineBusiness AgilityTrinh NgoNessuna valutazione finora

- Red Wine Quality Prediction Using Machine Learning TechniquesDocumento7 pagineRed Wine Quality Prediction Using Machine Learning TechniquesArina MihaelaNessuna valutazione finora

- Forecasting Methods for Production PlanningDocumento16 pagineForecasting Methods for Production PlanningHarshit YNessuna valutazione finora

- Prediction of Cervical Cancer Using Machine Learning and Deep Learning AlgorithmsDocumento5 paginePrediction of Cervical Cancer Using Machine Learning and Deep Learning AlgorithmsEditor IJTSRDNessuna valutazione finora

- Vietnam-Italy Steel's logistics enhancementDocumento89 pagineVietnam-Italy Steel's logistics enhancementPennyNessuna valutazione finora

- Cell2Cell Data DocumentationDocumento2 pagineCell2Cell Data DocumentationJayesh PatilNessuna valutazione finora

- MT416 - BCommII - Introduction To Business Analytics - MBA - 10039 - 19 - PratyayDasDocumento44 pagineMT416 - BCommII - Introduction To Business Analytics - MBA - 10039 - 19 - PratyayDasPratyay DasNessuna valutazione finora

- 2 Forecast AccuracyDocumento26 pagine2 Forecast Accuracynatalie clyde matesNessuna valutazione finora

- Benchmarking, Quality Costs, and Performance ManagementDocumento35 pagineBenchmarking, Quality Costs, and Performance Managementbj3326Nessuna valutazione finora

- Firm Expo Business Model DevelopmentDocumento22 pagineFirm Expo Business Model Developmentapi-255943481Nessuna valutazione finora

- 7s Model and Org StructureDocumento40 pagine7s Model and Org StructureMudit KumarNessuna valutazione finora

- SyscoDocumento6 pagineSyscoRohit Meena100% (1)

- MT416 - BCommII - Introduction To Business Analytics - MBA - 10039 - 19 - PratyayDasDocumento44 pagineMT416 - BCommII - Introduction To Business Analytics - MBA - 10039 - 19 - PratyayDasPratyay DasNessuna valutazione finora

- Economic Foundations of StrategyDocumento57 pagineEconomic Foundations of StrategyqunNessuna valutazione finora

- Management of Sales Territories and QuotasDocumento7 pagineManagement of Sales Territories and QuotasRavimohan RajmohanNessuna valutazione finora

- Development StandardsDocumento563 pagineDevelopment StandardsLeo Belec100% (2)

- Kanban From The Inside - Understand The Kanban Method - Connect It To What You Already Know - IntroduceDocumento223 pagineKanban From The Inside - Understand The Kanban Method - Connect It To What You Already Know - IntroduceElizabeth VillanuevaNessuna valutazione finora

- Entrepreneurship Development A4Documento44 pagineEntrepreneurship Development A4paroothiNessuna valutazione finora

- Market Basket AnalysisDocumento20 pagineMarket Basket Analysisabhinavsharma87Nessuna valutazione finora

- Sustainable Manufacturing in Industry 4 0 An Emerging Research AgendaDocumento24 pagineSustainable Manufacturing in Industry 4 0 An Emerging Research AgendaLeidy PardoNessuna valutazione finora

- Intorduction To Business - AnalyticsDocumento40 pagineIntorduction To Business - AnalyticsAbhimanyu ParmarNessuna valutazione finora

- UCI Machine Learning Repository - Heart Disease Data SetDocumento7 pagineUCI Machine Learning Repository - Heart Disease Data SetpriyankaNessuna valutazione finora

- Education Loan Prediction AnalysisDocumento5 pagineEducation Loan Prediction AnalysisInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- Homework 4Documento4 pagineHomework 4KevinNessuna valutazione finora

- Lecture 1-Data Analysis & InterpretationDocumento7 pagineLecture 1-Data Analysis & InterpretationAhmad HammasNessuna valutazione finora

- MFGPRO Introduction VOL01 UG v09Documento254 pagineMFGPRO Introduction VOL01 UG v09Budi ErnantoNessuna valutazione finora

- Generating Business Ideas from Existing ConceptsDocumento104 pagineGenerating Business Ideas from Existing ConceptsNebil AregaNessuna valutazione finora

- CCW331 Business Analytics Material Unit I Type2Documento43 pagineCCW331 Business Analytics Material Unit I Type2ultra BNessuna valutazione finora

- Data Analytics Reveals Factors Impacting National HappinessDocumento42 pagineData Analytics Reveals Factors Impacting National HappinessharipreetiNessuna valutazione finora

- ABB Electric Segmentation Case TEAM 4Documento11 pagineABB Electric Segmentation Case TEAM 4Rohini Runfola0% (1)

- A Research Study On Unsupervised Machine Learning Algorithms For Early Fault Detection in Predictive MaintenanceDocumento7 pagineA Research Study On Unsupervised Machine Learning Algorithms For Early Fault Detection in Predictive MaintenanceSayan BhattacharyaNessuna valutazione finora

- Cluster AnalysisDocumento38 pagineCluster AnalysisShiva KumarNessuna valutazione finora

- Revenue Predictor - Udit Ennam PDFDocumento30 pagineRevenue Predictor - Udit Ennam PDFNagaraj DanNessuna valutazione finora

- Employee payroll data with filters and calculationsDocumento178 pagineEmployee payroll data with filters and calculationsVinayak ShegarNessuna valutazione finora

- Assignment 1Documento7 pagineAssignment 1anuradha.chavan5Nessuna valutazione finora

- Based Business Models Tendencies and OpportunitiesDocumento40 pagineBased Business Models Tendencies and OpportunitiesMiquel Alabèrnia SeguraNessuna valutazione finora

- ForcastingDocumento85 pagineForcastingUcca AmandaNessuna valutazione finora

- Apple Inc: Productions & Operations ManagementDocumento10 pagineApple Inc: Productions & Operations ManagementHaytham HalawaNessuna valutazione finora

- Application of Naïve Bayes Classification in Fraud DetectionDocumento30 pagineApplication of Naïve Bayes Classification in Fraud Detectionneha doshiNessuna valutazione finora

- Regression in MarketingDocumento90 pagineRegression in Marketingmesay83Nessuna valutazione finora

- Employee Attrition Analytics ReportDocumento41 pagineEmployee Attrition Analytics ReportKrishna100% (1)

- STWS Business Model ArchetypesDocumento1 paginaSTWS Business Model ArchetypesManjit SinghNessuna valutazione finora

- Big Data Analytics: A Literature Review Paper: Lecture Notes in Computer Science August 2014Documento16 pagineBig Data Analytics: A Literature Review Paper: Lecture Notes in Computer Science August 2014ferbNessuna valutazione finora

- TATA Steels Sales ForecastDocumento30 pagineTATA Steels Sales ForecastVishalNessuna valutazione finora

- Business Strategy For The Digital WorldDocumento25 pagineBusiness Strategy For The Digital Worldhardseba100% (1)

- Viral Marketing and Social Media StatisticsDocumento16 pagineViral Marketing and Social Media Statisticsosama haseebNessuna valutazione finora

- Andrew Hayes (Process Macro)Documento9 pagineAndrew Hayes (Process Macro)Bilal JavedNessuna valutazione finora

- Why Good Matters Governance: Relevant Business KnowledgeDocumento78 pagineWhy Good Matters Governance: Relevant Business Knowledgeprameyak1100% (1)

- KNIME Data Analytics Platform TutorialDocumento43 pagineKNIME Data Analytics Platform TutorialJavier ValenciaNessuna valutazione finora

- Virtualization Pharma BR 1638314 PDFDocumento24 pagineVirtualization Pharma BR 1638314 PDFParth DesaiNessuna valutazione finora

- Questionaire EEBDocumento4 pagineQuestionaire EEBBipin TiwariNessuna valutazione finora

- Bank Customer Satisfaction QuestionnaireDocumento2 pagineBank Customer Satisfaction QuestionnaireBipin TiwariNessuna valutazione finora

- New Microsoft Office Word DocumentDocumento64 pagineNew Microsoft Office Word DocumentBipin TiwariNessuna valutazione finora

- Economic Outlook 2010-11Documento93 pagineEconomic Outlook 2010-11Aparna LaxmiNessuna valutazione finora

- Stanford University CS 229, Autumn 2014 Midterm ExaminationDocumento23 pagineStanford University CS 229, Autumn 2014 Midterm ExaminationErico ArchetiNessuna valutazione finora

- Change of Incisor Inclination Effects On Points A and B PDFDocumento6 pagineChange of Incisor Inclination Effects On Points A and B PDFAlvaro ChacónNessuna valutazione finora

- Remote Sensing: Continuous Monitoring of Cotton Stem Water Potential Using Sentinel-2 ImageryDocumento18 pagineRemote Sensing: Continuous Monitoring of Cotton Stem Water Potential Using Sentinel-2 ImageryKarem Meza CapchaNessuna valutazione finora

- Estimating Long-Run PD, Asset Correlation, and Portfolio Level PD by Vasicek ModelsDocumento13 pagineEstimating Long-Run PD, Asset Correlation, and Portfolio Level PD by Vasicek Modelsh_y02Nessuna valutazione finora

- UGBA 104 Prob Set CDocumento29 pagineUGBA 104 Prob Set CHenryNessuna valutazione finora

- Chapter 6 - 2020Documento62 pagineChapter 6 - 2020Nga Ying WuNessuna valutazione finora

- UAS Statistika Rahmadini Syakira PutriDocumento11 pagineUAS Statistika Rahmadini Syakira PutriRahmadiniputriNessuna valutazione finora

- Chapter 6 TutorialDocumento6 pagineChapter 6 TutorialCamila Miranda KandaNessuna valutazione finora

- Original PDF A Primer of Ecological Statistics 2nd Edition PDFDocumento41 pagineOriginal PDF A Primer of Ecological Statistics 2nd Edition PDFalice.bueckers152100% (34)

- Advanced Statistical Methods Project: Data Analysis Using SpssDocumento31 pagineAdvanced Statistical Methods Project: Data Analysis Using SpssDHWANI SONINessuna valutazione finora

- Survey Data Analysis Day 5Documento67 pagineSurvey Data Analysis Day 5Kiplimo Araap LagatNessuna valutazione finora

- BUS173 AssignmentDocumento19 pagineBUS173 Assignmentসাবাতুম সাম্যNessuna valutazione finora

- Cost Estimation Techniques and Cost BehaviorDocumento5 pagineCost Estimation Techniques and Cost BehaviorCamila Miranda KandaNessuna valutazione finora

- Impact of Leadership Style On Employee Motivation: A Study On The Employee Serving in Banking Organization in BangladeshDocumento7 pagineImpact of Leadership Style On Employee Motivation: A Study On The Employee Serving in Banking Organization in BangladeshInternational Journal of Business Marketing and ManagementNessuna valutazione finora

- Multivariate Statistical Inference and ApplicationsDocumento634 pagineMultivariate Statistical Inference and ApplicationsNaveen Kumar Singh57% (7)

- Seaborn Cheat Sheet for Python Data VisualizationDocumento1 paginaSeaborn Cheat Sheet for Python Data VisualizationFrâncio Rodrigues100% (1)

- Report of Profit PredictionDocumento15 pagineReport of Profit PredictionHarsh Garg 24601Nessuna valutazione finora

- Module 1Documento138 pagineModule 1Divjot SinghNessuna valutazione finora

- An Elegant L TEX Template For BooksDocumento21 pagineAn Elegant L TEX Template For BooksDesmond MacLeod CareyNessuna valutazione finora

- Econometrics Notes on Causal Relationships and Treatment EffectsDocumento12 pagineEconometrics Notes on Causal Relationships and Treatment Effects6doitNessuna valutazione finora

- Leisure Diversity As An Indicator of Cultural Capital: Glenn John StalkerDocumento23 pagineLeisure Diversity As An Indicator of Cultural Capital: Glenn John StalkerAna Maria Inostroza GarcesNessuna valutazione finora

- Vibrations from Blasting - A Review of Scaling LawsDocumento18 pagineVibrations from Blasting - A Review of Scaling LawsKristian Murfitt100% (1)

- Economic Impacts Due To Smoking-Ban.: A.Systematic ReviewDocumento4 pagineEconomic Impacts Due To Smoking-Ban.: A.Systematic ReviewHelen Rachel RejiNessuna valutazione finora

- 05 Diagnostic Test of CLRM 2Documento39 pagine05 Diagnostic Test of CLRM 2Inge AngeliaNessuna valutazione finora

- University of Michigan STATS 500 hw3 F2020Documento2 pagineUniversity of Michigan STATS 500 hw3 F2020wasabiwafflesNessuna valutazione finora

- Spark LabDocumento6 pagineSpark LabNistor GrozavuNessuna valutazione finora

- AI Project Cycle Question BankDocumento14 pagineAI Project Cycle Question BankOmshree PanigrahiNessuna valutazione finora

- Store24's "Ban BoredomDocumento5 pagineStore24's "Ban BoredomsnehalNessuna valutazione finora

- Estimation of Causal Relationships I: Illustration 1Documento11 pagineEstimation of Causal Relationships I: Illustration 1Dharshini RajkumarNessuna valutazione finora