Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Irs

Caricato da

abinashnayak1Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Irs

Caricato da

abinashnayak1Copyright:

Formati disponibili

INDEX OF RETAIL SATURATION

PRESENTED BY ,

P . GOUTHAM ,

HARISH ,

M . SABITA ,

M . SUDHAKAR

1

Theory of retail saturation index is calculated to determine the saturation index of retail shopping district within a particular retail store types assumed potential demand per square meter of the potential demand for Wang Chen. Index of Retail Saturation (IRS) is a measure of the potential sales per square foot of store space for a given product within a specific trading area: ratio of a trading areas sales potential for a product or service to its sales capacity

2

It is the ratio of demand for a product

(households in the geographic area multiplied by annual retail expenditures for a particular line of trade per household) divided by available supply (the square footage of retail facilities of a particular line of trade in a geographic area). = H x RE RF

IRS

Where IRS is the index of retail saturation

3

l l l l l

RE is the annual retail expenditures for a particular line of trade per household in the area RF is the square footage of retail facilities of a particular line of trade in the area (including square footage of the proposed store). Retail marketing : a real combat Peking University Press , 2008 . 1 . view "[ M ].

The theory from the Harvard Business School Harvard Business School in the 80s of the 20th century. Retail saturation index theory (The Index of Retail Saturation Theory) What is the theory of retail and retail saturation index saturation index theory is the retail market by calculating the saturation index

4

l l l

compares the level of retail expenditures in an area with the level of supply of retail selling space lIt is strategically sound to access how deeply competitors are entrenched in a given market area lIRS theory helps the retailer to access the level of demand and supply in various trading areas lA trading area in which supply and demand are in equilibrium shows retail saturation lRetail saturation means consumer needs are just being met with the existing retail facilities

l

5

When that trading area has too few stores, the area is said to be under stored If IRS high, the area is under stored; if it is low, the area is over stored If too many stores/ selling space is devoted, the area is said to be over stored IRS is simply the sales per sq. ft. of retail space for a trading area for a given product line Trading areas or markets may be classified as overstores,understored or saturated.

7

The interaction between demand and supply and the effect of creating market opportunities. The formula is: IRS = demand / store area Retailers must choose the area of the proposed comparative assessment of the level observed saturation index. In general, the saturation index is high, meaning that the retail potential, and means that the retail potential of the low saturation index small.

8

l l

When the IRS takes on a high value in comparision the line of trade in other cities,it indicates that the market is understood ,and therefore a potentially attractive opportunity exists. When it takes on a low value it indicates an over stored market,which precludes the potential of a significant opportunity. The home depot,for eg., monitors its sales per square foot for a store because it recognizes that if this ratio istoo high,customers may not be well solved and comptetion may be invited in to the market.

9

Although this cannibalizes the existing store, it better serves customers and discourages competition from entering the market. As nonstore based retailing continues to grow retailers to recognize and that the IRS may become less useful Because incorporates only store-based retailing in the supply component of index the most. The impact of retail competition can be reproduced on a local map that shows the

10

It measures of level of demand in a market based on the population,consumer expenditure,competing retail space and a particular product or product area. It measures in a market that the retailer is hoping to break in to or perhaps already committed to. When the above calculation has been performed,it provides some measure or index of attractiveness of trading area for a particular product line or product area. The higher the index the better the chances

11

THANKYOU

12

Potrebbero piacerti anche

- 3705 0901 84 CS14 CrawlerDocumento34 pagine3705 0901 84 CS14 Crawleredwin100% (2)

- Irish Spring ReportDocumento11 pagineIrish Spring ReportAri EngberNessuna valutazione finora

- Cyclical and Conflict TheoryDocumento2 pagineCyclical and Conflict TheoryMalathi Meenakshi SundaramNessuna valutazione finora

- Case Study III - Sears - Death of A LegendDocumento4 pagineCase Study III - Sears - Death of A LegendJoshua Lail100% (2)

- International Business ManagemnetDocumento12 pagineInternational Business ManagemnetPramod GowdaNessuna valutazione finora

- Present Simple Present Continuous - Leisure Time Activities - Consolidation WorksheetDocumento4 paginePresent Simple Present Continuous - Leisure Time Activities - Consolidation WorksheetblogswebquestsNessuna valutazione finora

- Godrej PPT FinalDocumento39 pagineGodrej PPT FinalHardik Shah67% (6)

- Segmentation Targeting and PositioningDocumento45 pagineSegmentation Targeting and PositioningMayank BhardwajNessuna valutazione finora

- RetailingDocumento53 pagineRetailingvipinNessuna valutazione finora

- Coach Inc. Case SummaryDocumento12 pagineCoach Inc. Case Summarymuhammad aldjaidiNessuna valutazione finora

- Visual MerchandisingDocumento49 pagineVisual MerchandisingsubbugssNessuna valutazione finora

- 12 - Global Brands & Local MarketsDocumento16 pagine12 - Global Brands & Local MarketsManish ParasharNessuna valutazione finora

- Levis PresenceDocumento26 pagineLevis Presencesangram96100% (1)

- Role of Manufacturer's Salespeople in Inducing Brand Advocacy by Retail Sales AssociatesDocumento15 pagineRole of Manufacturer's Salespeople in Inducing Brand Advocacy by Retail Sales AssociatesAtri RoyNessuna valutazione finora

- Egyptian Retail IndustryDocumento16 pagineEgyptian Retail IndustryJosef WasinskiNessuna valutazione finora

- Retail Industry Scenario, Globally and in India - Anisha KirpalaniDocumento13 pagineRetail Industry Scenario, Globally and in India - Anisha KirpalaniAnisha Kirpalani0% (1)

- Retail Market Stratetegy Final 5th July PDFDocumento40 pagineRetail Market Stratetegy Final 5th July PDFmayur6790Nessuna valutazione finora

- Malls in India-Issues, Challenges & SuggestionsDocumento11 pagineMalls in India-Issues, Challenges & SuggestionsashashyamNessuna valutazione finora

- FentimansDocumento0 pagineFentimanszhenglin0620_2205311Nessuna valutazione finora

- Consumer BehaviourDocumento119 pagineConsumer Behaviourpomh0% (1)

- Retail Strategy: Prof. Sandeep HegdeDocumento57 pagineRetail Strategy: Prof. Sandeep HegdeSanil YadavNessuna valutazione finora

- Cage ModelDocumento25 pagineCage ModelLaura GómezNessuna valutazione finora

- Analysis of Retail IndustryDocumento11 pagineAnalysis of Retail IndustryVipul ThapaNessuna valutazione finora

- Retail Challenges & OppurtunitiesDocumento12 pagineRetail Challenges & OppurtunitiesAbhiram MudunuriNessuna valutazione finora

- Project On Parag MilkDocumento74 pagineProject On Parag MilkraisNessuna valutazione finora

- Measuring and Managing Franchisee Satisfaction: A Study of Academic FranchisingDocumento9 pagineMeasuring and Managing Franchisee Satisfaction: A Study of Academic FranchisingfairusNessuna valutazione finora

- Retail ManagementDocumento34 pagineRetail Managementjai bakliyaNessuna valutazione finora

- Retail Management - (All Units) DZ - 459Documento20 pagineRetail Management - (All Units) DZ - 459Sidharth HansdaNessuna valutazione finora

- Indian Retailing Sector - Prospects and ChallengesDocumento4 pagineIndian Retailing Sector - Prospects and Challengesijr_journalNessuna valutazione finora

- Mission:: Al-Fatah Is HavingDocumento4 pagineMission:: Al-Fatah Is Havingbint e zainabNessuna valutazione finora

- Brand Assessment Through ResearchDocumento4 pagineBrand Assessment Through ResearchYadu YadavNessuna valutazione finora

- H&M MatricaDocumento3 pagineH&M MatricaIvan NikolicNessuna valutazione finora

- Retail Question Bank Mid TermDocumento2 pagineRetail Question Bank Mid TermAbhishek Shekhar100% (1)

- Impact of Gender On Electronic Goods PurchaseDocumento13 pagineImpact of Gender On Electronic Goods PurchaseAbhinav DhutNessuna valutazione finora

- Capital Investment Appraisal in Retail Business Management: Sainsbury's As A Case StudyDocumento6 pagineCapital Investment Appraisal in Retail Business Management: Sainsbury's As A Case StudyIOSRjournalNessuna valutazione finora

- Synopsis For Luxury MarketDocumento10 pagineSynopsis For Luxury MarketAtman ShahNessuna valutazione finora

- Costco Example 1Documento12 pagineCostco Example 1Fernando Gonzalez Rodriguez Jr.100% (1)

- Footwear MarketDocumento8 pagineFootwear MarketKomal AroraNessuna valutazione finora

- Retail OrganizationsDocumento5 pagineRetail Organizationsvkvikash2250% (2)

- Merger of Bharti Airtel With ZainDocumento4 pagineMerger of Bharti Airtel With ZainDarshan VaghelaNessuna valutazione finora

- Sales ForecastingDocumento15 pagineSales ForecastingHari KrishnanNessuna valutazione finora

- Chalhoub Group White Paper 2013 EnglishDocumento9 pagineChalhoub Group White Paper 2013 EnglishFahad Al MuttairiNessuna valutazione finora

- International Marketing Research ExplanationDocumento3 pagineInternational Marketing Research ExplanationAngelie Shan NavarroNessuna valutazione finora

- 1 Malaysia InitiativesDocumento12 pagine1 Malaysia InitiativesJamilah EdwardNessuna valutazione finora

- A Discount StoreDocumento7 pagineA Discount StoreJaya KumaresanNessuna valutazione finora

- Additional Note 1 - Chapter 2 - Resident Buying OfficesDocumento3 pagineAdditional Note 1 - Chapter 2 - Resident Buying OfficeswaniNessuna valutazione finora

- Chapter 2, Market SegmentationDocumento6 pagineChapter 2, Market SegmentationMuthusamy SenthilkumaarNessuna valutazione finora

- Revised Syllabus W.E.F. 2016-17 Retail Management: Dr. Rupali Jain Nagindas Khandwala CollegeDocumento22 pagineRevised Syllabus W.E.F. 2016-17 Retail Management: Dr. Rupali Jain Nagindas Khandwala Collegeansari naseem ahmadNessuna valutazione finora

- Chapter OneDocumento55 pagineChapter OneWILLMORE PRINCE DUBENessuna valutazione finora

- Zara CaseDocumento2 pagineZara CaseE100% (1)

- Kmart CaseDocumento22 pagineKmart CaseDamiano SciutoNessuna valutazione finora

- Surveying The Transaction Cost Foundations of New Institutional Economics: A Critical InquiryDocumento29 pagineSurveying The Transaction Cost Foundations of New Institutional Economics: A Critical InquiryBlue Wortel100% (1)

- 2018 Top BrandsDocumento48 pagine2018 Top BrandsKelvin SumNessuna valutazione finora

- Economies of ScaleDocumento2 pagineEconomies of ScaleMilanBahel100% (1)

- Economic Significance of Retailing in India & WorldwideDocumento15 pagineEconomic Significance of Retailing in India & WorldwideModassar Nazar91% (11)

- Subhiksha - Decision AnalysisDocumento22 pagineSubhiksha - Decision AnalysisPriyanthgkNessuna valutazione finora

- 6 Feasibility Assessment ToolDocumento5 pagine6 Feasibility Assessment Toolalibaba1888Nessuna valutazione finora

- Ch.2 - Introduction To Retail Store OperationsDocumento23 pagineCh.2 - Introduction To Retail Store OperationsVikram AiranNessuna valutazione finora

- Second Hand ShoppingDocumento68 pagineSecond Hand ShoppingKim TanNessuna valutazione finora

- Assignment Module On Chapter 3. E-CommerceDocumento18 pagineAssignment Module On Chapter 3. E-CommerceJohn Richard RiveraNessuna valutazione finora

- Sales ManagementDocumento15 pagineSales ManagementSiddharth puriNessuna valutazione finora

- Nanz-A Lesson To Learn From - UpdatedDocumento7 pagineNanz-A Lesson To Learn From - UpdatedLavanya ChandiniNessuna valutazione finora

- Value Chain Management Capability A Complete Guide - 2020 EditionDa EverandValue Chain Management Capability A Complete Guide - 2020 EditionNessuna valutazione finora

- Montessori - Practical Life - Care of The Environment - Dust MoppingDocumento2 pagineMontessori - Practical Life - Care of The Environment - Dust MoppinghenzejulyNessuna valutazione finora

- Blue Nile CompanyDocumento23 pagineBlue Nile CompanyNur IkhsanNessuna valutazione finora

- Story of KhadiDocumento8 pagineStory of Khadivkjha623477Nessuna valutazione finora

- Container Tracking PrintDocumento4 pagineContainer Tracking Printabdoulkarim koneNessuna valutazione finora

- The Times - Patek Philippe Interview - June 2011Documento2 pagineThe Times - Patek Philippe Interview - June 2011Claire AdlerNessuna valutazione finora

- Prepositions of Place Interactive GamesDocumento17 paginePrepositions of Place Interactive GamescytronNessuna valutazione finora

- Iso en 20345 2004 FirefightersDocumento6 pagineIso en 20345 2004 FirefightersPhilip Geddes100% (1)

- Copy of باستيل 1Documento10 pagineCopy of باستيل 1Osaama AlshamiNessuna valutazione finora

- Brita Fill and Go Active Instruction Manual INTDocumento2 pagineBrita Fill and Go Active Instruction Manual INTAnonymous iNxLvwNessuna valutazione finora

- Bearings Product ListDocumento124 pagineBearings Product ListAnonymous pm1hDaNessuna valutazione finora

- Preventing Rope SpoilageDocumento2 paginePreventing Rope SpoilageNhật Nguyễn SĩNessuna valutazione finora

- PW Trail Beaver Valley Oct 25Documento63 paginePW Trail Beaver Valley Oct 25Pennywise PublishingNessuna valutazione finora

- Safety Work ProcedureDocumento2 pagineSafety Work ProcedureRahmat BudimanNessuna valutazione finora

- Coyle Chapter 2Documento48 pagineCoyle Chapter 2BilalPervezNessuna valutazione finora

- Executive Summary: Description of The BusinessDocumento8 pagineExecutive Summary: Description of The Businessjoms NeptunoNessuna valutazione finora

- Supply Chain Case StudyDocumento7 pagineSupply Chain Case StudyP Singh KarkiNessuna valutazione finora

- Drypers Corporation Case Study: Name: Sukriti Grover Roll No: 2014HRLP006Documento2 pagineDrypers Corporation Case Study: Name: Sukriti Grover Roll No: 2014HRLP006Sukriti GroverNessuna valutazione finora

- Unit 9: Main Aim Subsidiary Aims Assumptions: Anticipated Problems Possible SolutionsDocumento3 pagineUnit 9: Main Aim Subsidiary Aims Assumptions: Anticipated Problems Possible SolutionsAlex LugoNessuna valutazione finora

- F 011cDocumento5 pagineF 011capi-310328489Nessuna valutazione finora

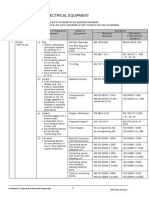

- List of Regulated Electrical Equipment 250718Documento15 pagineList of Regulated Electrical Equipment 250718Ali AkbarNessuna valutazione finora

- Maclaren Quest - GLOBALDocumento14 pagineMaclaren Quest - GLOBALEddy WadeNessuna valutazione finora

- Fabric SoftenerDocumento2 pagineFabric SoftenerIbnu BakriNessuna valutazione finora

- Lahore 0 PDFDocumento84 pagineLahore 0 PDFIsrar Anwar Qadri100% (1)

- Marginal UtilityDocumento27 pagineMarginal UtilityfransiskaNessuna valutazione finora

- AAU Micro II ModuleDocumento245 pagineAAU Micro II Moduleyiho83% (6)

- Hotel ServicesDocumento19 pagineHotel ServicesVaishnaviReddyAragonda100% (1)