Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Competition, Market Structures and Business Decisions

Caricato da

Nivedita SomaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Competition, Market Structures and Business Decisions

Caricato da

Nivedita SomaCopyright:

Formati disponibili

A market consists of all firms and individuals willing and able to buy or sell a particular product at a given time

and place.

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Market structures

The firm in competitive markets The firm in competitive markets

Non-perfect competition Non-perfect competition

Perfect Perfect competition competition

Monopoly Monopoly Oligopoly Oligopoly Monopolistic Monopolistic competition competition

Identical product Very small share of the market Price-taker Produces a homogeneous product Perfect information No barriers to entry (legal, technological, or resource) No technical progress Opportunity for normal profits in long run equilibrium ie. P= MC and P=AR=AC

Examples of Competitive Markets

Agricultural commodities. ( Milk market) Unskilled labor market. Restaurant business. ( in USA there are 900,000 restaurants brings about 45o billion $ in annual sales with an avg of 500000$ per year. There is a restaurant for every 300 people, with easy entry and exit and lots of buyer n sellers, good information and standard food quality, so it is next to impossible to make above normal profits)

Profit Maximization Imperative

Normal profit is return necessary to attract and maintain capital investment. Efficient firms can earn normal profit. Inefficient firms suffer losses.

Role of Marginal Analysis

Set M = MR MC = 0 to maximize profits. MR=MC when profits are maximized.

Market structures Market structures

Perfect competition competitive markets

Long Run Normal Profit Equilibrium With a horizontal market demand curve, MR=P. P=MR=MC=ATC. There are no economic profits. All firms earn a normal rate of return.

Market structures Market structures

Monopoly

One firm in industry Profit-maximiser Faces market demand curve One product No close substitutes Price-maker No restrictions on resources

Blockaded entry and/or exit Imperfect dissemination of information Opportunity for economic profits in long-run equilibrium.

Competition, market structures and business decisions Competition, market structures and business decisions Monopoly Market structures Market structures

Profit Maximization in Monopoly Markets

Price/Output Decisions A monopoly firm is the market. Market and firm demand curve slopes downward. Monopoly demand curve is always above the marginal revenue curve, P = AR > MR. Monopoly position allows above-normal profits. P > AC in long-run equilibrium. Set M = MR - MC = 0 to maximize profits. MR=MC at optimal output.

Competition, market structures and business decisions Competition, market structures and business decisions Monopoly Market structures Market structures

Economies of Scale Monopoly is sometimes the natural result of vigorous competitive forces. In natural monopoly, LRAC declines continuously and one firm is most efficient. Some real-world monopolies are government-created or government-maintained. Invention and Innovation Public policy sometimes confers explicit monopoly rights to spur productivity.

Competition, market structures and business decisions Competition, market structures and business decisions Monopoly Market structures Market structures

Dilemma of Natural Monopoly Monopoly has the potential for efficiency. Unregulated monopoly can lead to economic profits and underproduction.

Competition, market structures and business decisions Competition, market structures and business decisions Monopoly Market structures Market structures

Buyer Power Oligopsony exists when there are only a handful of buyers. Monopsony exists if there is only one buyer. Buyer power can be used to obtain less than competitive market prices.

Competition, market structures and business decisions Competition, market structures and business decisions Monopoly Market structures Market structures

Bilateral Monopoly Illustration Unrestrained monopoly gets higher than competitive market prices. Unrestrained monopsony gets lower than competitive market prices. Monopoly/monopso ny confrontation breeds compromise.

Competition, market structures and business decisions Competition, market structures and business decisions In the real life Market structures Market structures

A real firm in a market place (compare to the ideal one):

A typical firm, if it is not a small one, is not owner-managed Separation of ownership, long-term strategic and short-run current control (shareholders, board of directors, brunch managers) implies the segregation of objectives; Natural, economic and legal barriers Diversification (non-homogenous product, more than one kind of activity) Technical progress Different criteria for different time horizons (short-run operation vs long-run planning. Price-making Price/marketing strategies Imperfect information Investment lag

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Market structures Oligopoly and Monopolistic Competition

Monopolistic Competition

Large number of sellers that offer differentiated products.

Normal profit opportunity in long-run equilibrium. Oligopoly

Few sellers.

Economic profits are possible in long-run equilibrium. Dynamic Nature of Competition

Timely market structure information is required for managerial investment decisions

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Market structures onopolistic competition

The market consists of n mono-product firms; The products are viewed by the buyers as close though not perfect substitutes for one another; Therefore, each of the sellers is a monopolist of its particular product variant with a limited degree of monopoly power. Such a monopolist is enjoying a monopoly power and making economic profit during only a short period of time from the introduction of an unique product or technology until such a technology becomes available to rivals, or until a new more innovative product is introduced by a rival.

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Market structures onopolistic competition

Price Costs

MC

AC

Pm c

MR Qm c

Demand Quantity

Short-run Monopoly Equilibrium Monopolistically competitive firms take full advantage of short-run monopoly.

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Market structures onopolistic competition

Price Costs

MC

AC

Price Costs

MC

AC

Pm c D2 MR2 MR1 D1 Quantity MR Qm c Quantity D

Entry of new firms offering product substitutes shifts the demand

Long-run equilibrium same costs, lower demand and excess capacity low output high price decision With differentiated

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Market structures onopolistic competition

rice osts

MC

AC

Price Costs

MC

AC

Pm c Pac D2 MR2 MR1 D1 Quantity MR Qm Qac c D Quantity

Long-run equilibrium same costs, lower demand and excess capacity low output high price decision With differentiated products, P=AC at a point above minimum

Long-run equilibrium high output low price decision (corresponds to perfect Competition) With homogenous products, P=AC at minimum LRAC. This is a competitive market equilibrium with

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Oligipoly Market structures

Oligopoly Market Characteristics

Few sellers. Homogenous or unique products. Blockaded entry and exit. Imperfect dissemination of information.

Opportunity for above-normal (economic) profits in longrun equilibrium. Examples of Oligopoly

National markets for aluminum, cigarettes, electrical equipment, filmed entertainment, ready-to-eat cereals, etc. Local retail markets for gasoline, food, specialized services, etc.

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Oligipoly Market structures

Overt and Covert Agreements

Cartels operate under formal agreements.

Powerful cartels function as a monopoly.

Collusion exists when agreements. Enforcement Problem

firms

reach

secret,

covert

Cartels are typically rather short-lived coordination problems often lead to cheating. Cartel subversion can be extremely profitable.

because

Detecting the source of secret price concessions can be extremely difficult.

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Oligipoly Market structures

Cartels and Collusion

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Oligipoly Market structures

Oligopoly Output-Setting Models

Cournot Oligopoly Cournot equilibrium output is found by simultaneously solving output-reaction curves for both competitors. Cournot equilibrium output exceeds monopoly output but is less than competitive output.

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Oligipoly Market structures

Stackelberg Oligopoly

Stackelberg model posits a first-mover advantage. Price wars severely undermine profitability for both leading and following firms. Price signaling can reduce uncertainty in oligopoly markets. Price leadership occurs when firms follow the industry leaders pricing policy.

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Oligipoly Market structures

Stackelberg Oligopoly

Price leader sets the price at P2 Profit is maximised at Q1. The follower(s) will supply the combined output of Q4-Q1 At P3- Follows will supply everything At P1 the leader will supply everything at no economic profit

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Oligipoly Market structures

Oligopoly Price-Setting Models

Bertrand Oligopoly: Identical Products

The Bertrand model focuses upon the price reactions. The Bertrand model predicts a competitive market price/output solution in oligopoly markets with identical products.

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Oligipoly Market structures

Oligopoly Price-Setting Models

Bertrand Oligopoly: Identical Products

The Bertrand model focuses upon the price reactions. The Bertrand model predicts a competitive market price/output solution in oligopoly markets with identical products.

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Game Theory Basics Market structures

Types of Games

Zero-sum game: offsetting gains/losses. Positive sum game: potential for mutual gain. Negative-sum game: potential for mutual loss. Cooperative games: joint action is favored. Sequential games: moves in succession. Simultaneous-move game: coincident moves.

Role of Interdependence

Strategic Considerations

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Game Theory Basics Market structures

Classic Riddle

Rational behavior can give suboptimal result. Rationality can hamper beneficial cooperation. Dominant strategy gives best result regardless of moves by other players. Secure strategy gives best result assuming the worst possible scenario.

Business Application

Broad Implications

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Game Theory Basics Market structures

Nash Equilibrium Concept

Neither player can improve their payoff through a unilateral change in strategy. Nash equilibrium concept is broader than the concept of a dominant strategy equilibrium. Every dominant strategy equilibrium is also a Nash

equilibrium. Nash equilibrium can exist where there is no dominant strategy equilibrium.

Nash Bargaining

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Game Theory Basics Market structures

Role of Reputation

Infinitely repeated games occur over and over again without boundary or limit. Firms receive sequential payoffs that shape current and future strategies. Reputations for high quality give consumers confidence for repeat transactions. In a one-shot game, poor quality can fool customers. In an infinitely repeated game, poor quality is shunned by customers.

Product Quality Games

Competition, market structures and business decisions Competition, market structures and business decisions Market structures Game Theory Basics Market structures

Uncertain Final Period

Finitely repeated games have limited duration. With end point uncertainty, a finitely repeated game mirrors an infinitely repeated game. Enforcing end-of-game performance is difficult. Solution: simply extend the game! Benefits earned by the player able to make the initial move in a sequential move or multistage game.

End-of-game Problem

First-mover Advantages

Competition, market structures and business decisions Competition, market structures and business decisions Competitive strategies in Imperfectly competitive Competitive strategies in Imperfectly competitive markets markets

s Not all industries offer the same potential for sustained profitability; s Not all firms are equally capable of exploring the profit potential that is available. s An effective competitive strategy in imperfectly competitive markets must be founded on the firms competitive advantage.

Competition, market structures and business decisions Competition, market structures and business decisions Competitive strategies in Imperfectly competitive Competitive strategies in Imperfectly competitive markets markets

s A competitive advantage is a unique or rare ability to create, distribute or service valued by customers. s It is a business-world analogue to what economists call comparative advantage or when one nation or region of the country is better suited to the production of one product than to the production of some other product s Above-normal rate of return require a competitive advantage that cannot easily be copied In production; In distribution; or In marketing

Competition, market structures and business decisions Competition, market structures and business decisions Competitive strategies in Imperfectly competitive Competitive strategies in Imperfectly competitive markets markets

s Reasons for competitive advantage:

s Access to a unique resource

s (Exclusive) Access to a mineral deposit

s(Exclusive) Access to a material

s Efficient energy source s Unique climatic condition s Unique technology s Unique (specially qualified or very talented) labour force; or

s Access to a unique market

s A university bookshop s The rice market in Japan s etc

Competition, market structures and business decisions Competition, market structures and business decisions Non-price competition. Non-price competition. Product differentiation Product differentiation

increase in time of the number of product categories increase in time of the number of product categories supplied and the number of items in each category supplied and the number of items in each category

Product differentiation refers to the Product differentiation refers to the

s Historically, a step from oligopolistic to monopolistic competition

Competition, market structures and business decisions Competition, market structures and business decisions Non-price competition. Non-price competition. Product differentiation Product differentiation

A simple model of the reason for product differentiation Price

Considers constant quantity as well as nonchanging AC and MC corresponding to this quantity Producing a little bit different product a firm might hope to charge a higher price

P* P

Quantity

Competition, market structures and business decisions Competition, market structures and business decisions Non-price competition. Non-price competition. Barriers to entry Barriers to entry

Price

Absolute cost advantages: Ability of established firms to produce any given level of output at lower unit costs than potential entrants

P* P

LAC* LAC

Q* Q

Quantity

Competition, market structures and business decisions Competition, market structures and business decisions Non-price competition. Non-price competition. Barriers to entry Barriers to entry

Economies of scale:

Price LAC P D

Ability of established firms * To produce any given level of output greater than a certain level Q* at lower unit costs and * To restrict potential entrants who are not able to invest in that level of production

Q*

Quantity

Competition, market structures and business decisions Competition, market structures and business decisions Non-price competition. Non-price competition. Barriers to entry Barriers to entry

Product differentiation advantages:

Price LAC P* D1 D2 Q* D2 Quantity

Variety of demand curves and common LAC. Some firms have advantage of technology or specialisation and are facing demand curves to the right of the critical one.

Competition, market structures and business decisions Competition, market structures and business decisions Non-profit-maximising competition. Non-profit-maximising competition.

Appear as the result of Appear as the result of Ability to affect prices and Ability to affect prices and Separation of ownership and managerial control Separation of ownership and managerial control

Managers aim at stability and increase in salaries Stability may be achieved through the increase in the scale of operations Increase in sales (not in profit) affects managers remuneration Banks and retailers would prefer to deal with firms increasing the volume of sales

*

Competition, market structures and business decisions Competition, market structures and business decisions Non-profit-maximising Non-profit-maximising competition. competition.

P, Cost

MC

AC

MR

D Q

Profit maximising decision

Competition, market structures and business decisions Competition, market structures and business decisions Non-profit-maximising Non-profit-maximising competition. competition.

P, Cost

MR

D Q

Increasing sales, the firm is moving to the right and downward the demand curve and, therefore, decreases price, The limitation is AC curve. Some profit should be earned anyway

Profit Sales maximising maximising decision decision

Competition, market structures and business decisions Competition, market structures and business decisions Non-profit-maximising Non-profit-maximising competition. competition.

P, Cost

MC

AC

MR

D Q

Profit maximising decision

Competition, market structures and business decisions Competition, market structures and business decisions Non-profit-maximising Non-profit-maximising competition. competition.

P, Cost

MC

Old sales maximising decision is a profit maximising decision at a new level of average cost

AC

MR

D Q

Old profit maximisin g decision

New profit maximisin g decision

Competition, market structures and business decisions Competition, market structures and business decisions Measurement of market structures Measurement of market structures Seller concentration Seller concentration

refers to the degree to which production for a refers to the degree to which production for a particular market or or in a particular industry particular market or or in a particular industry is concentrated in the hand of few large firms is concentrated in the hand of few large firms

Seller concentration Seller concentration

Measurement of concentration

number of firms in the market size distribution of firms in the market

Competition, market structures and business decisions Competition, market structures and business decisions Measurement of market structures Measurement of market structures Seller concentration Seller concentration

The Australian Bureau of Statistics

8140.0.55.001 Industry Concentration Statistics

Competition, market structures and business decisions Competition, market structures and business decisions Measurement of market structures Measurement of market structures Seller concentration Seller concentration

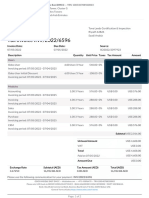

C2542 - Paint Manufacturing in Australia

KEY COMPETITORS (www.ibisworld.com.au/static/iwabout/SamIndPart.asp)

MAJOR PLAYERS

Table: Market Share Market Share Major Player Range - 25.00% 22.00% Orica Limited (2004) - 19.00% 17.00% Wattyl Limited (2004) - 11.00% 9.00% Barloworld Australia Pty Limited (2004) - 9.00% 7.00% Akzo Nobel Industries Limited (2003)

Competition, market structures and business decisions Competition, market structures and business decisions Measurement of market structures Measurement of market structures Seller concentration Seller concentration

Measurement of concentration

Tfm te dty eo d h i sn i u a sr e r i hn s r t r e aoig teiefhr uu c r nt hs o eop. cd o z t i t t X i -h uu fh im te t t ter op o f X - teuu fnsy h t t idt op o u r -tehefh imte dty hsa o er i hns r t f n iu r op uu tt Trtof lgt im te dty h a o a sf sn i u e i r e r i hn s r op uu tt

Xi X X X Cr = = 1 + 2 ++ r ... X X X i= X 1

r

Xi X

Concentration Ratios

Group market share data are called concentration ratios. CRi = Xi, where Xi is market share of the ith leading firm. CRi = 100 for monopoly. CRi 0 for a perfectly competitive industry.

Herfindahl-Hirschmann Index

Calculated in percentage terms, the HHI is the sum of squared market shares for all competitors. HHI = Xi2, where Xi2 is squared market share of the ith firm. HHI = 10,000 for monopoly. HHI 0 for a perfectly competitive industry.

Limitations of Census Information

Slow reports hinder usefulness. National statistics obscure local markets.

Competition, market structures and business decisions Competition, market structures and business decisions Measurement of market structures Measurement of market structures Seller concentration Seller concentration

Measurement of concentration

Diagrammatic approach 100%

Cumulative % of output

The curve of real (not equal distribution The curve of equal distribution of shares of the market among firms

This distance measures concentration

No of firms cumulated from the largest

Competition, market structures and business decisions Competition, market structures and business decisions Multinational companies. Vertical and horizontal coordination. Multinational companies. Vertical and horizontal coordination.

Diversification Diversification

Vertical coordination Vertical coordination

Multinational company Multinational company

Competition, market structures and business decisions Competition, market structures and business decisions Multinational companies. Vertical and horizontal coordination. Multinational companies. Vertical and horizontal coordination. Diversification Diversification

Invest in production facilities to produce a product D

A firm X producing a good A

Buys shares of a firm Y producing a good B

Invents a new product C

Competition, market structures and business decisions Competition, market structures and business decisions Multinational companies. Vertical and horizontal coordination. Multinational companies. Vertical and horizontal coordination. Vertical coordination Vertical coordination

A firm X producing a good A

Competition, market structures and business decisions Competition, market structures and business decisions Multinational companies. Vertical and horizontal coordination. Multinational companies. Vertical and horizontal coordination. Vertical coordination Vertical coordination

A firm X producing a good A

Invest in production facilities or buys shares of or coordinate activities with a firm producing an input D

Competition, market structures and business decisions Competition, market structures and business decisions Multinational companies. Vertical and horizontal coordination. Multinational companies. Vertical and horizontal coordination. Vertical coordination Vertical coordination

A firm X producing a good A

Invest in production facilities or buys shares of or coordinate activities with a firm producing an input D

Invest in facilities or buys shares of or coordinate activities with a firm providing professional training for employees

Competition, market structures and business decisions Competition, market structures and business decisions Multinational companies. Vertical and horizontal coordination. Multinational companies. Vertical and horizontal coordination. Vertical coordination Vertical coordination

Invest in production facilities or buys shares of or coordinate activities with a firm using A as an input A firm X producing a good A

Invest in production facilities or buys shares of or coordinate activities with a firm producing an input D

Invest in facilities or buys shares of or coordinate activities with a firm providing professional training for employees

Competition, market structures and business decisions Competition, market structures and business decisions Multinational companies. Vertical and horizontal coordination. Multinational companies. Vertical and horizontal coordination. Vertical coordination Vertical coordination

Invest in production facilities or buys shares of or coordinate activities with a firm using A as an input A firm X producing a good A

Invest in or buys shares of or coordinate activities with a firm specialising in the selling of product A

Invest in production facilities or buys shares of or coordinate activities with a firm producing an input D

Invest in facilities or buys shares of or coordinate activities with a firm providing professional training for employees

Competition, market structures and business decisions Competition, market structures and business decisions Multinational companies. Vertical and horizontal coordination. Multinational companies. Vertical and horizontal coordination. Multinational company Multinational company

Undertake vertical coordination measures abroad A firm producing a good A in a home country Conduct diversification practices abroad

Establishes branches in other countries

Buys share of analogous firms in other countries

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- WorldLink (Final)Documento15 pagineWorldLink (Final)Ronisha Shrestha100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- 3.4.3 Total, Average and Marginal ProductsDocumento29 pagine3.4.3 Total, Average and Marginal Productsadeelali849714Nessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Traders QuotesDocumento53 pagineTraders QuotesTaresaNessuna valutazione finora

- Exercise - Part 2Documento5 pagineExercise - Part 2lois martinNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Enabling Assessment: 4200 Case 2: With Defective UnitsDocumento2 pagineEnabling Assessment: 4200 Case 2: With Defective UnitsVon Andrei MedinaNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Marketing Reserach Paper II English VersionDocumento132 pagineMarketing Reserach Paper II English VersionMayukh.Nessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Pola Transaksi & Wholesale Transaction BoardDocumento50 paginePola Transaksi & Wholesale Transaction BoardArinda Pradandari100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Indian Stock Market Training PresentationDocumento40 pagineIndian Stock Market Training PresentationShakti Shukla100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- FII Investment Analysis Across Different Sectors of Indian EconomyDocumento30 pagineFII Investment Analysis Across Different Sectors of Indian EconomyAmit TiwariNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- DMC College Foundation: School of Business and Accountancy Bachelor of Science in Accountancy Sta. Filomena, Dipolog CityDocumento12 pagineDMC College Foundation: School of Business and Accountancy Bachelor of Science in Accountancy Sta. Filomena, Dipolog CityEarl Russell S PaulicanNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Baydoun Willett (2000) Islamic Corporate Reports PDFDocumento20 pagineBaydoun Willett (2000) Islamic Corporate Reports PDFAqilahAzmiNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Uber Porter's Five Forces Analysis PresentationDocumento12 pagineUber Porter's Five Forces Analysis PresentationAshish Singh100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Detailed Course Outline-B2B Marketing-Sachin LeleDocumento12 pagineDetailed Course Outline-B2B Marketing-Sachin LeleSaurabh JadhavNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Bank of America Merrill Lynch DossierDocumento5 pagineBank of America Merrill Lynch DossierJamesNessuna valutazione finora

- Nature and Scope of Managerial EconomicsDocumento25 pagineNature and Scope of Managerial EconomicsHibaNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- CMDM Module For NCFM ExamsDocumento261 pagineCMDM Module For NCFM ExamsmhussainNessuna valutazione finora

- Odoo INV - 2022 - 6596Documento2 pagineOdoo INV - 2022 - 6596Khurram ShahzadNessuna valutazione finora

- Barth & Sen On Freedom!Documento29 pagineBarth & Sen On Freedom!Ryan HayesNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Digital Marketing Is The Promotion of ProductsDocumento8 pagineDigital Marketing Is The Promotion of ProductsAkshat AgarwalNessuna valutazione finora

- Seppo Saario Presentation SlidesDocumento40 pagineSeppo Saario Presentation Slidestom168ELA100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Ordinary AEDocumento2 pagineThe Ordinary AERawa MalaNessuna valutazione finora

- Comprehensive Analysis of The Business Environment in China: Polytechnic University of The Philippines Sto. Tomas BranchDocumento26 pagineComprehensive Analysis of The Business Environment in China: Polytechnic University of The Philippines Sto. Tomas BranchErika ArandaNessuna valutazione finora

- Privatization of Public ServiceDocumento41 paginePrivatization of Public Servicedexie de guzmanNessuna valutazione finora

- Derivatives Test 3 SolnDocumento12 pagineDerivatives Test 3 SolnHetviNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Sr. Product Executive - Product Executive - Advanced Chemical Industries Limited (ACI)Documento3 pagineSr. Product Executive - Product Executive - Advanced Chemical Industries Limited (ACI)Md Raihan SarkarNessuna valutazione finora

- Lecture 3Documento49 pagineLecture 3Ridhtang DuggalNessuna valutazione finora

- ToyotaDocumento14 pagineToyotaLaiba MalikNessuna valutazione finora

- Cost Concepts and ClassificationsDocumento6 pagineCost Concepts and ClassificationsNailiah MacakilingNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- PGDM Syllabus NewDocumento66 paginePGDM Syllabus Newbkpanda20065753Nessuna valutazione finora

- Financial Accounting Reviewer - Chapter 61Documento11 pagineFinancial Accounting Reviewer - Chapter 61Coursehero PremiumNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)