Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FS

Caricato da

afroza lata0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

25 visualizzazioni8 pagineCopyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

25 visualizzazioni8 pagineFS

Caricato da

afroza lataCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 8

1.

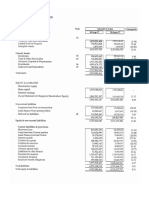

Current Ratio=Current assets/Current liability

Here,

Current asset= Inventories+ Trade & Other Receivables+ Advances, Deposits & Pre-

payments + Investments+ Cash & Cash Equivalents

=1,241,582,497+225,707,484+935,762,144+4,062,349,340+804,260,075

= 7,269,661,540

Current liability= Short-term Loans and Overdraft+ Long-term Loans-Current Portion+

Lease Finance-Current Portion+ Interest Payable Creditors for Goods+ Creditors for

Services+ Accrued Expenses+ Advance against Sales+ Liabilities for Other Finance

+Provision for Taxation +Unclaimed Dividend+ Employee Benefit Obligations

= 820,993,054+ 251,035,767 + 2,701,587+ 490,033 + 527,504,597 + 10,673,084+

155,508,752+ 241,732,325+ 138,501,893 + 232,079,826 + 205,576,988 + 273,041,895

= 2,859,839,801

So, Current ratio=7269661540/2859839801=2.5419:1

2.Quick ratio=Quick asset/Quick liability

Here, Quick asset=Current asset-Inventories- Advances, Deposits & Pre-

payments= =7,269,661,540-1,241,582,497-935,762,144

=5,092,316,899

Quick liability=Current liability- Short-term Loans and Overdraft

=2,859,839,801- 820,993,054

=2,038,846,747

So, Quick ratio=5,092,316,899/2,038,846,747

=2.498:1

3. Inventory Turnover Ratio=Cost of goods sold/Average inventory

Here, Cost of goods sold=2,644,903,536

Average inventory=(Opening inventory + closing inventory)/2

= (1,241,582,497 + 1,253,065,390 )/2

= 2,494,647,887/2= 1,247,323,943.5

So, Inventory Turn Over Ratio= 2,644,903,536/1,247,323,943.5=2.12 times

4.Debt –Equity Ratio=Long term debt/Shareholders' Equity

Here, Total debt=

Shareholders' Equity=Share Capital + Retained Earnings

=1,999,388,860 + 5,774,500,805

= 7,773,889,665

Long term debt=383,406,103

So, Debt-Equity ratio= 383,406,103/ 7,773,889,665

= 0.0493

5.Debt –Capital ratio=Long term debt/Share capital

Here, Share capital= 1,999,388,860

So, Debt- Capital ratio= 383,406,103 /1,999,388,860

=0.1918

6. Gross Profit ratio=(Gross profit/Net sale)*100

= (1,318,410,628/ 3,963,314,164 )*100

=33.27%

7.Net Profit ratio=(Net profit after tax/Net sale)*100

=( 557,581,039 /3,963,314,164)*100

=14.07%

8.Earning Per Share(EPS)=Total Comprehensive Income/Number of share

Here, Total Comprehensive Income=557,581,039

Number of share=199,938,886

So, EPS=557,581,039/199,938,886

=2.79 taka

9.Return On Equity(ROE)=Net Income/Equity Capital*100

=557,581,039/ 7,773,889,665*100

=7.17%

10.Return on Asset(ROA)= Net Income/Total Asset *100

=557,581,039/11,158,323,301 *100

=4.99%

11.Dividend Per Share(DPS)=Dividend/Number of share

Here, Dividend Paid =143,151

Number of share=199,938,886

So, DPS=143,151/199,938,886

=.000715 taka

12.Dvidend payout ratio=DPS /EPS

=0.000715/2.79*100

=.026%

Potrebbero piacerti anche

- 8.accounting Case Study G8 98Documento23 pagine8.accounting Case Study G8 98Hà GiangNessuna valutazione finora

- NBP Ratio Analysis 100% Sure Solved by Maha Shah Try To Understand First Then Solve.Documento14 pagineNBP Ratio Analysis 100% Sure Solved by Maha Shah Try To Understand First Then Solve.Wajahat MuneerNessuna valutazione finora

- ROEDocumento2 pagineROEshaeel ashrafNessuna valutazione finora

- Short Term Solvency, or Liquidity, Ratios: COGS / Inventory 14.117.080.050.134 / 3.719.405.670.574 3.8 4.8Documento4 pagineShort Term Solvency, or Liquidity, Ratios: COGS / Inventory 14.117.080.050.134 / 3.719.405.670.574 3.8 4.8Michael AldrianusNessuna valutazione finora

- Finance: Change in Inventories + Employee Benefit ExpensesDocumento8 pagineFinance: Change in Inventories + Employee Benefit ExpensesParav BansalNessuna valutazione finora

- Exercises For Chapter 23 EFA2Documento16 pagineExercises For Chapter 23 EFA2Thu LoanNessuna valutazione finora

- Finance Ratios GuideDocumento8 pagineFinance Ratios GuideParav BansalNessuna valutazione finora

- Chapter 17 - AnswerDocumento6 pagineChapter 17 - Answerwynellamae67% (3)

- Financial RatiosDocumento2 pagineFinancial RatiosAlexa Isobel TicarNessuna valutazione finora

- Key financial ratios of Jollibee Foods and WalmartDocumento4 pagineKey financial ratios of Jollibee Foods and WalmartValerie SantiagoNessuna valutazione finora

- Selected Solutions From Chapter 22: QuestionsDocumento6 pagineSelected Solutions From Chapter 22: QuestionsmimitayelNessuna valutazione finora

- Tugas (6) - ALK L23 - Rasio PerbankanDocumento5 pagineTugas (6) - ALK L23 - Rasio PerbankanEnzo 27Nessuna valutazione finora

- Rasio keuanganDocumento3 pagineRasio keuanganJORDAN WONG WongNessuna valutazione finora

- FM Unit 2 Lecture - Financial Statement Analysis - 2020Documento51 pagineFM Unit 2 Lecture - Financial Statement Analysis - 2020Tanice WhyteNessuna valutazione finora

- Maxis Berhad 2013 financial ratios analysisDocumento6 pagineMaxis Berhad 2013 financial ratios analysisNicholas LimNessuna valutazione finora

- CHIEDZA MARIME Financial Management ExamDocumento16 pagineCHIEDZA MARIME Financial Management Examchiedza MarimeNessuna valutazione finora

- The Baron Travel Corporation: Financial Ratios Formula Answer Significance/Interpretation Net Profit MarginDocumento4 pagineThe Baron Travel Corporation: Financial Ratios Formula Answer Significance/Interpretation Net Profit MarginSoriano DomsNessuna valutazione finora

- Lecture Common Size and Comparative AnalysisDocumento28 pagineLecture Common Size and Comparative AnalysissumitsgagreelNessuna valutazione finora

- Cash Flow AssignmentDocumento3 pagineCash Flow AssignmentAnonymous VrRc5PFbNessuna valutazione finora

- FM Unit 2 Lecture - Financial Statement AnalysisDocumento51 pagineFM Unit 2 Lecture - Financial Statement Analysistwanda bryanNessuna valutazione finora

- Nishat Balance Sheet and Income StatementDocumento56 pagineNishat Balance Sheet and Income StatementMohsin RasheedNessuna valutazione finora

- Tutorial IIIDocumento5 pagineTutorial IIINikhilaNessuna valutazione finora

- Assignment OF Accounting Principles IN Ratio Analysis & Fund Flow StatementDocumento10 pagineAssignment OF Accounting Principles IN Ratio Analysis & Fund Flow StatementIshu AroraNessuna valutazione finora

- SBL PBA4807 Assignment 1Documento11 pagineSBL PBA4807 Assignment 1Charmaine Tshamaano MasuvheNessuna valutazione finora

- Ratio AnalysisDocumento4 pagineRatio AnalysisKana jillaNessuna valutazione finora

- FOOT LOCKER Financial AnalysisDocumento4 pagineFOOT LOCKER Financial AnalysisreyesNessuna valutazione finora

- FM AssignmentDocumento7 pagineFM Assignmentkartika tamara maharaniNessuna valutazione finora

- SMChap 006Documento22 pagineSMChap 006Anonymous mKjaxpMaLNessuna valutazione finora

- Tushar Soni - 191259 - BDocumento3 pagineTushar Soni - 191259 - BtusharNessuna valutazione finora

- F.rep FormulasDocumento3 pagineF.rep Formulaswaseemabbas965Nessuna valutazione finora

- Financial Analysis Ratios Guide (FIN 1101Documento21 pagineFinancial Analysis Ratios Guide (FIN 1101YASH BATRANessuna valutazione finora

- Corporate Finance Chapter 4Documento15 pagineCorporate Finance Chapter 4Razan EidNessuna valutazione finora

- JP Morgan Chase Strategic AnalysisDocumento30 pagineJP Morgan Chase Strategic AnalysisSriSaraswathyNessuna valutazione finora

- Dde 321 - Solutions Exercise 5Documento3 pagineDde 321 - Solutions Exercise 5Foititika.netNessuna valutazione finora

- Amity University, Uttar PradeshDocumento10 pagineAmity University, Uttar Pradeshdiksha1912Nessuna valutazione finora

- Example Income Statements: Business Plan Financial ProjectionsDocumento3 pagineExample Income Statements: Business Plan Financial ProjectionsSUMANTO SHARANNessuna valutazione finora

- Chapter 3 Problems AnswersDocumento11 pagineChapter 3 Problems AnswersOyunboldEnkhzayaNessuna valutazione finora

- Full Download Fundamentals of Corporate Finance 7th Edition Ross Solutions ManualDocumento35 pagineFull Download Fundamentals of Corporate Finance 7th Edition Ross Solutions Manualempiercefibberucql19100% (35)

- Woof Junction Inc. Balance Sheet and Income Statement RatiosDocumento14 pagineWoof Junction Inc. Balance Sheet and Income Statement RatiosRNessuna valutazione finora

- Assignment CHPT 10Documento3 pagineAssignment CHPT 10Alexander Steven ThemasNessuna valutazione finora

- Analisis Rasio Dan Aktivitas Laporan Keuangan Pada PT. Unilever Indonesia TBK Tahun 2018Documento17 pagineAnalisis Rasio Dan Aktivitas Laporan Keuangan Pada PT. Unilever Indonesia TBK Tahun 2018rahmat SetiawanNessuna valutazione finora

- BALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityDocumento20 pagineBALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityAitzaz AliNessuna valutazione finora

- Bright Packaging Industry Berhad 2015 Financial RatiosDocumento2 pagineBright Packaging Industry Berhad 2015 Financial RatiosJoanna JacksonNessuna valutazione finora

- Lecture 2Documento23 pagineLecture 2helmy habsyiNessuna valutazione finora

- Financial Economic1Documento7 pagineFinancial Economic1biancaftw90Nessuna valutazione finora

- ChartDocumento1 paginaChartstefaqukorNessuna valutazione finora

- Corporate Finance Solution Chapter 6Documento9 pagineCorporate Finance Solution Chapter 6Kunal KumarNessuna valutazione finora

- Case 1 New (Signal Cable Company)Documento6 pagineCase 1 New (Signal Cable Company)nicole100% (2)

- MFCB Full Set 2Documento9 pagineMFCB Full Set 2Tian Xiang100% (1)

- Name-Ishwor Rijal LBU I'd - 77271300 Subject - Corporate FinanceDocumento10 pagineName-Ishwor Rijal LBU I'd - 77271300 Subject - Corporate FinanceIshwor RijalNessuna valutazione finora

- Accounts Financial Ratios of KFCDocumento20 pagineAccounts Financial Ratios of KFCMalathi Sundrasaigaran91% (11)

- Financial Statement Analysis: Chavez, Michellee Marie B. Diokno, Renee Angela P. Guballa, Czarina Mae CDocumento10 pagineFinancial Statement Analysis: Chavez, Michellee Marie B. Diokno, Renee Angela P. Guballa, Czarina Mae Cemchavez07Nessuna valutazione finora

- Ratio FormulasDocumento4 pagineRatio FormulasImran SarwarNessuna valutazione finora

- Financial Statement AnalysisDocumento28 pagineFinancial Statement AnalysissanyaNessuna valutazione finora

- Case 5 - What Are We Really WorthDocumento7 pagineCase 5 - What Are We Really WorthMariaAngelicaMargenApe100% (2)

- Solution - Financial Leverage and Capital StructureDocumento7 pagineSolution - Financial Leverage and Capital StructureEkjon DiptoNessuna valutazione finora

- Problem BankDocumento10 pagineProblem BankSimona NistorNessuna valutazione finora

- Financial Leverage Du Pont Analysis &growth RateDocumento34 pagineFinancial Leverage Du Pont Analysis &growth Rateahmad jamalNessuna valutazione finora

- Working With Financial StatementsDocumento27 pagineWorking With Financial StatementsYannah HidalgoNessuna valutazione finora

- MBA 6204 Production and Operation ManagementDocumento60 pagineMBA 6204 Production and Operation Managementafroza lata100% (1)

- PVJVB Dig: GVT Ave'yj GvbœvbDocumento2 paginePVJVB Dig: GVT Ave'yj Gvbœvbafroza lataNessuna valutazione finora

- MBA 6203 Entreprenureship DevelopmentDocumento59 pagineMBA 6203 Entreprenureship Developmentafroza lataNessuna valutazione finora

- Viva AnswerDocumento5 pagineViva Answerafroza lataNessuna valutazione finora

- Annual Report 2018 2019Documento146 pagineAnnual Report 2018 2019afroza lataNessuna valutazione finora

- Lota Recent WorkDocumento7 pagineLota Recent Workafroza lataNessuna valutazione finora

- Problem: To Produce A Juice It Is Necessary To Use 8 Units of Vitamin A, 14 Units of Vitamin BDocumento4 pagineProblem: To Produce A Juice It Is Necessary To Use 8 Units of Vitamin A, 14 Units of Vitamin Bafroza lataNessuna valutazione finora

- MBA Research Hypothesis GuideDocumento4 pagineMBA Research Hypothesis Guideafroza lataNessuna valutazione finora

- 1st Quarter Report 2017 18 1Documento7 pagine1st Quarter Report 2017 18 1afroza lataNessuna valutazione finora

- Name: Kimberly Anne P. Caballes Year and CourseDocumento12 pagineName: Kimberly Anne P. Caballes Year and CourseKimberly Anne CaballesNessuna valutazione finora

- Real Estate Service Act RA 9646Documento8 pagineReal Estate Service Act RA 9646Kyle LuNessuna valutazione finora

- Micro Insurance HDocumento46 pagineMicro Insurance HNirupa KrishnaNessuna valutazione finora

- Inner Circle Trader - Sniper Course, Escape & EvasionDocumento3 pagineInner Circle Trader - Sniper Course, Escape & EvasionKute HendrickNessuna valutazione finora

- Incometax Act 1961Documento22 pagineIncometax Act 1961Mohd. Shadab khanNessuna valutazione finora

- Professional Legal Services and Attorneys in ArmeniaDocumento17 pagineProfessional Legal Services and Attorneys in ArmeniaAMLawFirmNessuna valutazione finora

- Financial Modelling CIA 2Documento45 pagineFinancial Modelling CIA 2Saloni Jain 1820343Nessuna valutazione finora

- KKR Annual Review 2008Documento77 pagineKKR Annual Review 2008AsiaBuyoutsNessuna valutazione finora

- Chapter 5 and 6 Financial SystemDocumento7 pagineChapter 5 and 6 Financial SystemRemar22Nessuna valutazione finora

- Sailendra Yak TSA Presentation EnglishDocumento36 pagineSailendra Yak TSA Presentation EnglishInternational Consortium on Governmental Financial Management100% (1)

- Income TaxDocumento14 pagineIncome Taxankit srivastavaNessuna valutazione finora

- RTB Taxation II ReviewerDocumento59 pagineRTB Taxation II Reviewerdiazadie100% (1)

- Saura vs. DBP ruling on perfected contractDocumento1 paginaSaura vs. DBP ruling on perfected contractDarlyn BangsoyNessuna valutazione finora

- Chapter 3.auditing Princples and Tools RevDocumento122 pagineChapter 3.auditing Princples and Tools RevyebegashetNessuna valutazione finora

- SBD HPPWD Final2016Documento108 pagineSBD HPPWD Final2016KULDEEP KAPOORNessuna valutazione finora

- Pecson v. CADocumento2 paginePecson v. CAchappy_leigh118Nessuna valutazione finora

- Standard Promissory Note: 1. PAYMENTS: The Full Balance of This Note, Including All Accrued Interest and LateDocumento3 pagineStandard Promissory Note: 1. PAYMENTS: The Full Balance of This Note, Including All Accrued Interest and LateThalia Guerrero100% (1)

- New Challenges For Wind EnergyDocumento30 pagineNew Challenges For Wind EnergyFawad Ali KhanNessuna valutazione finora

- MBA (Financial Services)Documento36 pagineMBA (Financial Services)Prajwal BhattNessuna valutazione finora

- Welcome To First ReviewDocumento17 pagineWelcome To First Reviewkarthy143Nessuna valutazione finora

- Tax Comp ExampleDocumento115 pagineTax Comp ExampleJayjay FarconNessuna valutazione finora

- Ying Wa College Mid-Year Examination 2018 - 2019 S3 MathematicsDocumento15 pagineYing Wa College Mid-Year Examination 2018 - 2019 S3 Mathematics廖陞民(LEFT-2021) LIU SING MANNessuna valutazione finora

- Earnings Deductions: Eicher Motors LimitedDocumento1 paginaEarnings Deductions: Eicher Motors LimitedBarath BiberNessuna valutazione finora

- Revivalofairindia 1pp02Documento10 pagineRevivalofairindia 1pp02Quirking QuarkNessuna valutazione finora

- fn3092 Exc 13Documento26 paginefn3092 Exc 13guestuser1993Nessuna valutazione finora

- DTC REFERENCE SECURITIES Corporate and Municipal Issuers of DTC Eligible Securities Relying A Section 3 (C) (7) of The Investment Company ActDocumento310 pagineDTC REFERENCE SECURITIES Corporate and Municipal Issuers of DTC Eligible Securities Relying A Section 3 (C) (7) of The Investment Company Actjacque zidane100% (1)

- AOF Asaan Account (English)Documento4 pagineAOF Asaan Account (English)Rana UsmanNessuna valutazione finora

- Fixed Asset QuestionnaireDocumento37 pagineFixed Asset QuestionnaireJannpreet KaurNessuna valutazione finora

- Supplemental Budget Reso 2023Documento2 pagineSupplemental Budget Reso 2023Chin RiosNessuna valutazione finora

- Malaysian Code On Take-Overs and Mergers 2010Documento8 pagineMalaysian Code On Take-Overs and Mergers 2010MustaqimYusofNessuna valutazione finora