Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ifrs - Introduction

Caricato da

Arockia Sagayaraj T0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

63 visualizzazioni28 pagineTitolo originale

1. IFRS - INTRODUCTION

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

63 visualizzazioni28 pagineIfrs - Introduction

Caricato da

Arockia Sagayaraj TCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 28

GAAP

Accounting is the language of business.

It records the business transactions and communicates the

result of the business.

To make the language understandable to all the groups

interested in accounting, it should be based on certain

uniform, scientifically and universally accepted principles.

AICPA termed such principle as, ‘Generally Accepted

Accounting Principles’ (GAAP).

AICPA was started in 1887, now has more that 4,30,000

members

GAAP

The accounting principles are classified into two

categories such as Accounting Concepts and Accounting

Conventions.

Accounting Concepts are the assumptions or ideas or

conditions upon which the science of accounting is based.

These are essential to prepare the financial statements

The term “Conventions” denotes customs or traditions

or usage which guide the accountant for the preparation

of accounting statements. These are also known as

doctrine.

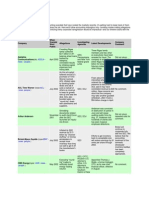

GAAP

ACCOUNTING PRINCIPLES

Accounting Concepts Accounting Conventions

• 1. Business Entity Concept 1. Convention of full disclosure

• 2. Money Measurement Concept 2. Convention of Consistency

• 3. Going Concern Concept 3. Convention of Materiality

• 4. Cost Concept 4. Convention of Conservatism

• 5. Dual Aspect Concept

• 6. Accounting Period Concept

• 7. Revenue Realization Concept

• 8. Matching Concept

• 9. Objective Evidence Concept

• 10. Accrual concept.

INTERNATIONAL ACCOUNTING STANDARDS (IAS)

In parallel with the US GAAP, UK developed

International Accounting Standards.

• International Accounting Standards (IAS) were

the first international accounting standards that

were issued by the International Accounting

Standards Committee (IASC), formed in 1973.

• The goal of IAS was to make it easier to

compare businesses around the world,

increase transparency and trust in financial

reporting, and foster global trade and

investment.

INTERNATIONAL ACCOUNTING STANDARDS (IAS)

• Globally comparable accounting standards

promote transparency, accountability, and

efficiency in financial markets around the world.

• This enables investors and other market

participants to make informed economic

decisions about investment opportunities and

risks and improves capital allocation.

• Universal standards also significantly reduce

reporting and regulatory costs, especially for

companies with international operations and

subsidiaries in multiple countries.

IAS

There has been significant progress towards developing a single

set of high-quality global accounting standards since the IASC

was replaced by the IASB

International Accounting Standards (IAS) are older accounting

standards issued by the International Accounting Standards

Board (IASB), an independent international standard-setting

body based in London.

The IAS were replaced in 2001 by International Financial

Reporting Standards (IFRS).

The U.S. accounting standards body has been collaborating with

the Financial Accounting Standards Board since 2002 to improve

and converge American accounting principles (GAAP) and IFRS

Currently, the United States, Japan, and China are the only major

capital markets without an IFRS mandate

NEED FOR IFRS

Eventhough, US-GAAP and UK-IAS were

already in practice, a number of accounting

scandals occurred in the last two decades.

Billions of dollars were lost as a result of

these financial disasters, which destroyed

companies and ruined peoples’ lives.

This necessitated a single set of high-quality

global accounting standards, resulted in

IFRS.

NEED FOR IFRS

Let us have a glance over the top accounting scandals.

1. Waste Management Scandal (1998)

• Waste Management Inc. is a publicly-traded US waste

management company. In 1998, the company’s new

CEO, A Maurice Meyers, and his management team

discovered that the company had reported over $1.7

billion in fake earnings.

• The Securities and Exchange Commission (SEC) found

the company’s owner and former CEO, Dean L Buntrock,

guilty, along with several other top executives. In addition,

the SEC fined Waste Management’s auditors, Arthur

Andersen, over $7 million. Waste Management eventually

settled a shareholder class-action suit for $457 million.

NEED FOR IFRS

2. Enron Scandal (2001)

• Enron Corporation was a US energy, commodities,

and services company based out of Houston, Texas.

• It was discovered in 2001 that the company had been

using accounting loopholes to hide billions of

dollars of bad debt, while simultaneously inflating

the company’s earnings.

• The scandal resulted in shareholders losing over $74

billion as Enron’s share price collapsed from around

$90.75 in the mid of 2001 to under $0.26 in

November 2001. About 20,000 employees had lost

their jobs

NEED FOR IFRS

2. Enron Scandal (2001)

Enron employed an accounting method known as mark-to-market

(MTM) accounting. Under MTM accounting, assets can be

recorded on a company’s balance sheet at their fair market value

(as opposed to their book values). With MTM, companies can also

list their profits as projections, rather than actual numbers. In the

case, the actual cash flows that resulted from their assets were

substantially less than the cash flows that they initially reported to

the Securities and Exchange Commission (SEC) under the MTM

method.

In an attempt to hide the losses, Enron set up a number of special shell

corporations known as Special Purpose Entities (SPEs). The

majority of the SPEs were private corporations that only existed on

paper. The losses were reported under more traditional cost

accounting methods and not consolidated with the accounts of Enron.

NEED FOR IFRS

3. WorldCom Scandal (2002)

• WorldCom was an American telecommunications company

based out of Ashburn, Virginia. In 2002, just a year after the

Enron scandal, it was discovered that WorldCom had inflated

its assets by almost $11 billion, making it by far one of the

largest accounting scandals ever.

• The company had underreported line costs by capitalizing

instead of expensing them and had inflated its revenues by

making false entries. The scandal first came to light when the

company’s internal audit department found almost $3.8 billion

in fraudulent accounts. The company’s CEO, Bernie Ebbers,

was sentenced to 25 years in prison for fraud, conspiracy, and

filing false documents. The scandal resulted in over 30,000 job

losses and over $180 billion in losses by investors.

NEED FOR IFRS

4. Tyco Scandal (2002)

• Tyco International was an American blue-chip security systems

company based out of Princeton, New Jersey. In 2002, it was

discovered that CEO, Dennis Kozlowski, and CFO, Mark Swartz,

had stolen over $150 million from the company and had inflated

the company’s earnings by over $500 million in their reports.

• Kozlowski and Swartz had siphoned off money using unapproved

loans and stock sales.

• The scandal was discovered when the SEC and the office of the

District Attorney of Manhattan carried out investigations related to

certain questionable accounting practices by the company. Kozlowski

and Swartz were both sentenced to 8 to 25 years in prison. A class-

action suit forced them to pay $2.92 billion to investors.

NEED FOR IFRS

5. HealthSouth Scandal (2003)

HealthSouth Corporation is a top US publicly traded

healthcare company based out of Birmingham,

Alabama. In 2003, it was discovered that the company

had inflated earnings by over $1.8 billion.

The SEC had previously been investigating HealthSouth’s

CEO, Richard Scrushy, after he sold $75 million in

stock a day before the company posted a huge loss.

Although charged, Scrushy was acquitted of all 36

counts of accounting fraud. However, he was found

guilty of bribing then Alabama Governor, Don

Siegelman, and was sentenced to seven years in prison.

NEED FOR IFRS

6. Freddie Mac Scandal (2003)

The Federal Home Loan Mortgage Corporation, also

known as Freddie Mac, is a US federally-backed

mortgage financing giant based out of Fairfax County,

Virginia. In 2003, it was discovered that Freddie Mac

had misstated over $5 billion in earnings.

COO David Glenn, CEO Leland Brendsel, former CFO

Vaughn Clarke, and former Senior Vice Presidents

Robert Dean and Nazir Dossani had intentionally

overstated earnings in the company’s books. The scandal

came to light due to an SEC investigation into Freddie

Mac’s accounting practices. Glenn, Clarke, and Brendsel

were all fired and the company was fined $125 million.

NEED FOR IFRS

7. American International Group (AIG) Scandal (2005)

• American International Group (AIG) is a US multinational

insurance firm with over 88 million customers across 130

countries. In 2005, CEO Hank Greenberg was found guilty of

stock price manipulation. The SEC’s investigation into

Greenberg revealed a massive accounting fraud of almost $4

billion.

• It was found that the company had booked loans as revenue in

its books and forced clients to use insurers with whom the

company had pre-existing payoff agreements. The company

had also asked stock traders to inflate the company’s share

price. AIG was forced to pay a $1.64 billion fine to the SEC.

The company also paid $115 million to a pension fund in

Louisiana and $725 million to three pension funds in Ohio.

NEED FOR IFRS

8. Lehman Brothers Scandal (2008)

• Lehman Brothers was a global financial services firm

based out of New York City, New York. It was one of the

largest investment banks in the United States. During the

2008 financial crisis, it was discovered that the company

had hidden over $50 billion in loans. These loans had

been disguised as sales using accounting loopholes.

• According to an SEC investigation, the company had sold

toxic assets to banks in the Cayman Islands on a short-term

basis. It was understood that Lehman Brothers would buy

back these assets. This gave the impression that the company

had $50 billion more in cash and $50 billion less in toxic

assets. In the aftermath of the scandal, Lehman Brothers

went bankrupt.

NEED FOR IFRS

9. Bernie Madoff Scandal (2008)

• Bernie Madoff is a former American stockbroker

who ran Bernard L. Madoff Investment

Securities LLC. After the 2008 financial crisis, it

was discovered that Madoff had tricked investors

out of over $64.8 billion.

• Madoff, his accountant, David Friehling, and

second in command, Frank DiPascalli, were all

convicted of the charges filed against them. The

former stockbroker received a prison sentence of

150 years and was also ordered to pay $170 billion

in restitution.

NEED FOR IFRS

10. Satyam Scandal (2009)

• Satyam Computer Services was an Indian IT services and

back-office accounting firm based out of Hyderabad, India.

In 2009, it was discovered that the company had inflated

revenue by $1.5 billion, marking one of the largest

accounting scandals.

• An investigation by India’s Central Bureau of Investigation

revealed that Founder and Chairman, Ramalinga Raju, had

falsified revenues, margins, and cash balances.

• During the investigation, Raju admitted to the fraud in a letter

to the company’s board of directors. Although Raju and his

brother were charged with breach of trust, conspiracy, fraud,

and falsification of records, they were released when the

Central Bureau of Investigation failed to file charges on time.

IFRS

Moving Toward New Global Accounting Standards

• As of 2018, 144 jurisdictions required the use of IFRS

for all or most publicly listed companies, and a further 12

jurisdictions permit its use. As of 2020 more than 150

jurisdictions use IFRS.

• The United States is exploring adopting international

accounting standards. Since 2002, America's accounting-

standards body, the Financial Accounting Standards

Board (FASB) and the IASB have collaborated on a

project to improve and converge the U.S. generally

accepted accounting principles (GAAP) and IFRS.

• IFRS is thought to be a more principles-based accounting

system, while GAAP is more rules-based.

IFRS

• International Accounting Standards (IAS) are

now renamed as International Financial

Reporting Standards (IFRS), and are gaining

acceptance worldwide.

• In the last few years, the international

accounting standard-setting process has been

able to claim a number of successes in

achieving greater recognition and use of IFRS.

IFRS

• A major breakthrough came in 2002 when the European

Union (EU) adopted legislation that requires listed

companies in Europe to apply IFRS in their consolidated

financial statements.

• The legislation came into effect in 2005 and applies to

more than 8,000 companies in 30 countries, including

countries such as France, Germany, Italy, Spain, and the

United Kingdom.

• The adoption of IFRS in Europe means that IFRS has

replaced national accounting standards and requirements

as the basis for preparing and presenting group financial

statements for listed companies in Europe.

IFRS

• Outside Europe, many other countries also have been

moving to IFRS. IFRS had become mandatory in

many countries in Africa, Asia, and Latin America.

• In addition, countries such as Australia, Hong Kong,

New Zealand, Philippines, and Singapore had adopted

national accounting standards that mirror IFRS.

• According to one estimate, about 80 countries

required their listed companies to apply IFRS in

preparing and presenting financial statements in 2008.

• Many other countries permit companies to apply

IFRS.

IFRS

• Countries that have Adopted IFRS

• Countries in which some or all companies are required to

apply IFRS or IFRS-based standards are listed below.

• Africa:

• Botswana, Egypt, Ghana, Kenya, Malawi, Mauritius,

Mozambique, Namibia, South

• Africa, Tanzania

• Americas:

• Bahamas, Barbados, Brazil (2010), Canada (2011), Chile

(2009), Costa Rica, Dominican

• Republic, Ecuador, Guatemala, Guyana, Haiti, Honduras,

Jamaica, Nicaragua, Panama,

• Peru, Trinidad and Tobago, Uruguay, Venezuela

IFRS

Countries that have Adopted IFRS

• Asia:

• Armenia, Bahrain, Bangladesh, Georgia, Hong Kong, India (2011), Israel, Jordan,

• Kazakhstan, Kuwait, Kyrgyzstan, Lebanon, Nepal, Oman, Philippines, Qatar,

Singapore,

• South Korea (2011), Sri Lanka (2011), Tajikistan, United Arab Emirates

• Europe:

• Austria, Belarus, Belgium, Bosnia and Herzegovina, Bulgaria, Croatia, Cyprus,

Czech

• Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary,

Iceland,

• Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Macedonia, Malta,

• Montenegro, Netherlands, Norway, Poland, Portugal, Romania, Russia, Serbia,

Slovakia,

• Slovenia, Spain, Sweden, Turkey, Ukraine, United Kingdom

• Oceania:

• Australia, Fiji, New Zealand, Papua New Guinea

IFRS

• The adoption of standards that require high-quality,

transparent, and comparable information is welcomed by

investors, creditors, financial analysts, and other users of

financial statements.

• Without common standards, it is difficult to compare

financial information prepared by entities located in

different parts of the world.

• In an increasingly global economy, the use of a single set

of high-quality accounting standards facilitates investment

and other economic decisions across borders, increases

market efficiency, and reduces the cost of raising capital.

• IFRS are increasingly becoming the set of globally

accepted accounting standards that meet the needs of the

world’s increasingly integrated global capital markets.

IFRS

Abbreviations

• ARC Accounting Regulatory Commission

• ASAF Accounting Standards Advisory Forum

• DP Discussion Paper

• EC European Commission

• ED Exposure Draft

• EFRAG European Financial Reporting Advisory

Group

IFRS

Abbreviations

• GAAP Generally Accepted Accounting Principles

• IAS International Accounting Standard

• IASB International Accounting Standards Board

• IASC International Accounting Standards

Committee (predecessor to the IASB)

• IFRIC Interpretation issued by the IFRS

Interpretations Committee

• IFRS International Financial Reporting Standard

IFRS

Abbreviations

• IFRS Standards All Standards and Interpretations issued

by the IASB (i.e. the set comprising every IFRS, IAS, IFRIC

and SIC)

• PIR Post-implementation Review

• SEC US Securities and Exchange Commission

• SIC Interpretation issued by the Standing Interpretations

Committee of the IASC

• SMEs Small and Medium-sized Entities

• XBRL Extensible Business Reporting Language

• XML Extensible Markup Language

Potrebbero piacerti anche

- Creative AccountingDocumento5 pagineCreative Accountingvikas_nair_2Nessuna valutazione finora

- Motives and Consequences of Fraudulent Financial ReportingDocumento8 pagineMotives and Consequences of Fraudulent Financial ReportingAndreea VioletaNessuna valutazione finora

- Value Creation Through Corporate GovernanceDocumento11 pagineValue Creation Through Corporate GovernanceAbdel AyourNessuna valutazione finora

- Accounting Scandals © Rajkumar S AdukiaDocumento14 pagineAccounting Scandals © Rajkumar S Adukiasarvjeet_k100% (1)

- Assignment - 5: International Finance and Forex ManagementDocumento8 pagineAssignment - 5: International Finance and Forex ManagementAnika VarkeyNessuna valutazione finora

- Accounting ScandalsDocumento4 pagineAccounting Scandalsyakubu I saidNessuna valutazione finora

- Daniels Fund Ethics Initiative University of New Mexico HTTPDocumento12 pagineDaniels Fund Ethics Initiative University of New Mexico HTTPMuhammad TariqNessuna valutazione finora

- Major Corporate Scams PresentationDocumento24 pagineMajor Corporate Scams PresentationGanesh Prasad PandaNessuna valutazione finora

- The Worldcom Scandal: How Worldcom Shuffled Its BooksDocumento2 pagineThe Worldcom Scandal: How Worldcom Shuffled Its BooksAaditya ManojNessuna valutazione finora

- The Rise and Fall of EnronDocumento22 pagineThe Rise and Fall of EnronDhanwantri SharmaNessuna valutazione finora

- The Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallyDocumento2 pagineThe Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallySi Reygie Rojas KoNessuna valutazione finora

- Fraud at Waste Management: © 2003, 2005 by The AICPADocumento25 pagineFraud at Waste Management: © 2003, 2005 by The AICPAKamran AbdullahNessuna valutazione finora

- Corporate and Accounting ScandalsDocumento2 pagineCorporate and Accounting ScandalsJewel GonzalesNessuna valutazione finora

- 3 A Brief History of CGDocumento27 pagine3 A Brief History of CGM YounasNessuna valutazione finora

- Summary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionDa EverandSummary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionNessuna valutazione finora

- The Enron Scandal - A Case Study in Business Ethics and Corporate GovernanceDocumento4 pagineThe Enron Scandal - A Case Study in Business Ethics and Corporate GovernanceShiney BenjaminNessuna valutazione finora

- Worldcom - Executive Summary Company BackgroundDocumento3 pagineWorldcom - Executive Summary Company BackgroundYosafat Hasvandro HadiNessuna valutazione finora

- Accounting Scandal & Sarbanes OxleyDocumento41 pagineAccounting Scandal & Sarbanes OxleyMd. Jabed Ali ShaonNessuna valutazione finora

- Contemporary Issues On International Financial Standards and Reporting1Documento19 pagineContemporary Issues On International Financial Standards and Reporting1Sikiru SalamiNessuna valutazione finora

- WorldCom CaseDocumento9 pagineWorldCom CaseunjustvexationNessuna valutazione finora

- Red Flags of Enron's of Revenue and Key Financial MeasuresDocumento24 pagineRed Flags of Enron's of Revenue and Key Financial MeasuresJoshua BailonNessuna valutazione finora

- Accounting Info - Updated partHDTASTF - RoldanDocumento16 pagineAccounting Info - Updated partHDTASTF - RoldanRyan Joseph Agluba DimacaliNessuna valutazione finora

- World Com ScandalDocumento7 pagineWorld Com ScandalAddis FikruNessuna valutazione finora

- Introduction To Financial Reporting: Analysis of Financial StatementDocumento9 pagineIntroduction To Financial Reporting: Analysis of Financial StatementMalik Mughees AwanNessuna valutazione finora

- Case Study On WorldComDocumento8 pagineCase Study On WorldComsateybanik100% (4)

- Accounting Basics: Bob SchneiderDocumento17 pagineAccounting Basics: Bob SchneiderChandravadan CvNessuna valutazione finora

- WORLDCOM SCANDAL Audit PresentationDocumento11 pagineWORLDCOM SCANDAL Audit PresentationDeepanshu 241 KhannaNessuna valutazione finora

- Ethical Financial Reporting ArticleDocumento5 pagineEthical Financial Reporting ArticleCarl BurchNessuna valutazione finora

- American Accounting Standards: L2 CfaDocumento7 pagineAmerican Accounting Standards: L2 CfaErdeniz sigicNessuna valutazione finora

- Corporate America and SarbanesDocumento2 pagineCorporate America and SarbanesMohammad Nowaiser MaruhomNessuna valutazione finora

- Collaborative Review Task IDocumento3 pagineCollaborative Review Task IAbdullah AlGhamdiNessuna valutazione finora

- Enron Scandal PresentationDocumento11 pagineEnron Scandal PresentationYujia JinNessuna valutazione finora

- Waste Management Scandal 1998Documento6 pagineWaste Management Scandal 1998ABNER JUNONessuna valutazione finora

- Worldcom - Executive Summary Company BackgroundDocumento4 pagineWorldcom - Executive Summary Company BackgroundYosafat Hasvandro HadiNessuna valutazione finora

- Enron Case StudyDocumento23 pagineEnron Case StudyJayesh Dubey100% (1)

- Acct 201 - Chapter 4Documento24 pagineAcct 201 - Chapter 4Huy TranNessuna valutazione finora

- Case Study GovDocumento5 pagineCase Study GovSucreNessuna valutazione finora

- Assignment - Busiiness EthicsDocumento6 pagineAssignment - Busiiness EthicsEmad BelalNessuna valutazione finora

- Report On WorldcomDocumento153 pagineReport On WorldcomAhber ShahNessuna valutazione finora

- The Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallyDocumento3 pagineThe Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallySi Reygie Rojas KoNessuna valutazione finora

- The Worldcom ScandalDocumento10 pagineThe Worldcom ScandalAssignemntNessuna valutazione finora

- Joy of Management Assignment: Presentation On: Why Do Business Organizations Exists?Documento14 pagineJoy of Management Assignment: Presentation On: Why Do Business Organizations Exists?Harshit KanchanNessuna valutazione finora

- Accounting SpeachohiocouncilDocumento134 pagineAccounting SpeachohiocouncilKamran AbdullahNessuna valutazione finora

- Aj Ibañez - Assignment 2Documento19 pagineAj Ibañez - Assignment 2AJ Louise IbanezNessuna valutazione finora

- Earnings Management & Different ScandalsDocumento16 pagineEarnings Management & Different ScandalsHasnain MinhasNessuna valutazione finora

- WorldCom ScandalDocumento2 pagineWorldCom ScandalKerry1201Nessuna valutazione finora

- Financial ShenanigansDocumento13 pagineFinancial ShenanigansCLEO COLEEN FORTUNADONessuna valutazione finora

- Accounting in Action 12eDocumento65 pagineAccounting in Action 12eMd Shawfiqul Islam0% (1)

- Aj Ibañez - Assignment 2Documento19 pagineAj Ibañez - Assignment 2AJ Louise IbanezNessuna valutazione finora

- Fulfilling All National Obligations Under Various LawsDocumento22 pagineFulfilling All National Obligations Under Various Lawsrohit7485Nessuna valutazione finora

- Case Study Session 1 Group 7Documento4 pagineCase Study Session 1 Group 7rifqi salmanNessuna valutazione finora

- Business Judgment RuleDocumento15 pagineBusiness Judgment RuleSAI SUVEDHYA RNessuna valutazione finora

- ZERO TO MASTERY IN CORPORATE GOVERNANCE: Become Zero To Hero In Corporate Governance, This Book Covers A-Z Corporate Governance Concepts, 2022 Latest EditionDa EverandZERO TO MASTERY IN CORPORATE GOVERNANCE: Become Zero To Hero In Corporate Governance, This Book Covers A-Z Corporate Governance Concepts, 2022 Latest EditionNessuna valutazione finora

- Enron Case StudyDocumento6 pagineEnron Case Studyali goharNessuna valutazione finora

- Arthur AndersonDocumento14 pagineArthur Andersonridhi6294Nessuna valutazione finora

- The Corporate Scandal SheetDocumento4 pagineThe Corporate Scandal SheetAngelo LincoNessuna valutazione finora

- A Brief History of Corporate GovernanceDocumento28 pagineA Brief History of Corporate GovernanceMehboob EllahiNessuna valutazione finora

- The Rise and Fall of Worldcom: The World'S Largest Accounting FraudDocumento14 pagineThe Rise and Fall of Worldcom: The World'S Largest Accounting FraudkanabaramitNessuna valutazione finora

- The Essentials of Finance and Accounting for Nonfinancial ManagersDa EverandThe Essentials of Finance and Accounting for Nonfinancial ManagersValutazione: 5 su 5 stelle5/5 (1)

- Accounting for Derivatives: Advanced Hedging under IFRSDa EverandAccounting for Derivatives: Advanced Hedging under IFRSNessuna valutazione finora

- Matemáticas y Música (Síndrome de Williams)Documento24 pagineMatemáticas y Música (Síndrome de Williams)Raquel Fraile RodríguezNessuna valutazione finora

- Acc 110 Practice SetDocumento42 pagineAcc 110 Practice SetAndrea Marie P. GarinNessuna valutazione finora

- Guidelines For Determining Severity of Wet h2sDocumento4 pagineGuidelines For Determining Severity of Wet h2sse1007Nessuna valutazione finora

- Factbook 2019 Indesign Halaman 2 PDFDocumento180 pagineFactbook 2019 Indesign Halaman 2 PDFerlangga suryarahmanNessuna valutazione finora

- Capacity ManagementDocumento17 pagineCapacity ManagementJohn AlbateraNessuna valutazione finora

- First Exam - System Analysis and DesignDocumento2 pagineFirst Exam - System Analysis and DesignRod S Pangantihon Jr.0% (1)

- Emotional IntelligenceDocumento25 pagineEmotional IntelligenceKhushi DaveNessuna valutazione finora

- Monhas University - Course Details PDFDocumento1 paginaMonhas University - Course Details PDFKartika WeningtyasNessuna valutazione finora

- Allotment of Shares: Syed Iftikhar-Ul-Hassan ShahDocumento17 pagineAllotment of Shares: Syed Iftikhar-Ul-Hassan ShahAyman KhalidNessuna valutazione finora

- Meet Yogesh Patel First Report SipDocumento11 pagineMeet Yogesh Patel First Report SipMeet PatelNessuna valutazione finora

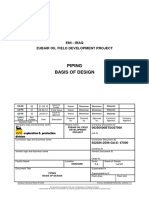

- Piping Basis of DesignDocumento19 paginePiping Basis of DesignMajid DixonNessuna valutazione finora

- Marketing Analytics For Data-Rich Environments: Michel Wedel & P.K. KannanDocumento25 pagineMarketing Analytics For Data-Rich Environments: Michel Wedel & P.K. KannanAbhinandan ChatterjeeNessuna valutazione finora

- M Information Systems 3rd Edition Baltzan Test Bank DownloadDocumento172 pagineM Information Systems 3rd Edition Baltzan Test Bank DownloadJoyce Leonard100% (17)

- Nikitas Chronas: Professional ProfileDocumento2 pagineNikitas Chronas: Professional Profilemiki ignatNessuna valutazione finora

- OPSS - MUNI 1440 Nov2014Documento6 pagineOPSS - MUNI 1440 Nov2014P ScribedNessuna valutazione finora

- Business Plan RevisedDocumento39 pagineBusiness Plan RevisedBrennan Roi DuagNessuna valutazione finora

- 5.a Study On Utilization and Convenient of Credit CardDocumento11 pagine5.a Study On Utilization and Convenient of Credit CardbsshankarraviNessuna valutazione finora

- Lone Pine Café: Transaction Sheet For 1st Nov 05Documento6 pagineLone Pine Café: Transaction Sheet For 1st Nov 05Dhanu ArunNessuna valutazione finora

- Powerful Techniques of Social MediaDocumento3 paginePowerful Techniques of Social MediaTIGER CHEETANessuna valutazione finora

- Activity 2 PDFDocumento2 pagineActivity 2 PDFJOHN PAUL LAGAO100% (1)

- Invest Gombe - Gombe State Investment Summit 2022Documento1 paginaInvest Gombe - Gombe State Investment Summit 2022Adamu DawakiNessuna valutazione finora

- Omicron/Tekton Construction Joint VentureDocumento3 pagineOmicron/Tekton Construction Joint VentureRalph GalvezNessuna valutazione finora

- Updates On HDMF Housing Loan Program: Juanito V. Eje Task Force Head Business Development SectorDocumento28 pagineUpdates On HDMF Housing Loan Program: Juanito V. Eje Task Force Head Business Development SectorcehsscehlNessuna valutazione finora

- Annual Report 2021-22 (English)Documento186 pagineAnnual Report 2021-22 (English)DaveNessuna valutazione finora

- Ppt-Advertisements 1Documento28 paginePpt-Advertisements 1Raunofficial100% (1)

- Smart Locker - A Sustainable Urban Last-Mile Delivery Solution: Benefits and Challenges in Implementing in VietnamDocumento14 pagineSmart Locker - A Sustainable Urban Last-Mile Delivery Solution: Benefits and Challenges in Implementing in VietnamQuynh LeNessuna valutazione finora

- Accounting For Islamic FinanceDocumento459 pagineAccounting For Islamic Financecepi juniarNessuna valutazione finora

- Project Report On Partnership FirmDocumento3 pagineProject Report On Partnership FirmSiddhant Sah0% (1)

- CCI vs. FASTWAYDocumento4 pagineCCI vs. FASTWAYAkashdeep SenguptaNessuna valutazione finora

- Urkund Report - Rohan Chandna BM-019138 SIP REPORT 2019-21.pdf (D76353960) PDFDocumento31 pagineUrkund Report - Rohan Chandna BM-019138 SIP REPORT 2019-21.pdf (D76353960) PDFrohanNessuna valutazione finora