Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Accounting: Recording Business Transactions

Caricato da

irma makharoblidze0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

69 visualizzazioni64 pagineTitolo originale

150_Harrison_FAIFRS11e_inppt_02.pptx

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

69 visualizzazioni64 pagineFinancial Accounting: Recording Business Transactions

Caricato da

irma makharoblidzeCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 64

Financial Accounting

Eleventh Edition

Global Edition

Chapter 2

Recording

Business

Transactions

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Learning Objectives

2.1 Explain what a business transaction is

2.2 Keep track of financial statement items

2.3 Analyze the impact of business transactions on accounts

2.4 Record (journalize and post) transactions in the books

2.5 Construct and use a trial balance

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Learning Objective 2.1

Explain what a transaction is

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Explain What a Transaction Is

A transaction is any event that has a financial impact

on the business and can be measured reliably.

• Provides objective information about the financial

impact on an exchange

– Gives something

– Receives something

• Accounting records both sides of the transaction

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Learning Objective 2.2

Keep track of financial statement items.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Define Account (1 of 2)

The accounting equation expresses the basic relationship of

accounting.

Assets = Liabilities + Owners’ (Shareholders’) Equity

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Define Account (2 of 2)

• An account is the record of all the changes in a particular

asset, liability, or shareholders’ equity during a period.

– Basic summary device.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

List and Differentiate Between

Different Types of Accounts (1 of 5)

Assets: economic resources that provide a future benefit.

• Cash

– Money including bank account balances, paper currency, coins,

certificates of deposits and checks.

• Accounts Receivable

– Promise for future cash for goods or service.

• Notes Receivable

– Promissory note, specifying an interest rate, signed by a customer

to pay on a certain day.

• Inventory

– Goods the company sells customers.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

List and Differentiate Between

Different Types of Accounts (2 of 5)

Assets: economic resources that provide a future benefit.

• Prepaid expenses

– Expenses paid in advance, as insurance or rent.

• Property, plant and equipment (PPE)

– Cost of the land, buildings and equipment owner by a

company.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

List and Differentiate Between

Different Types of Accounts (3 of 5)

Liabilities: a debt or payable.

• Accounts payable

– Promise to pay debt.

• Notes payable

– Signed notes promising to pay a future amount.

• Accrued liabilities

– Liability for an expense you have not yet paid.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

List and Differentiate Between

Different Types of Accounts (4 of 5)

Equity: the owner’s claims to the assets of the company

• Share capital

– Owner’s investment in the corporation through shares.

• Retained earnings

– Cumulative net income minus net losses and dividends

over the company’s life.

• Dividends

– Distribution of the company’s earnings to its

shareholders.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

List and Differentiate Between

Different Types of Accounts (6 of 6)

Stockholders’ Equity: the stockholders’ claims to the

assets of the company.

• Income

– Increase in shareholder’s equity from delivering goods

or services to customers.

• Expenses

– Decrease in shareholder’s equity due to the cost of

operating a business.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Learning Objective 2.3

Analyze the impact of business transactions on the

accounting equation

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Analyze the Impact of Business

Transactions on the Accounting Equation

Example: RedLotus Travel, Inc.

To illustrate the accounting for transactions, we will

consider 11 transactions and analyze each in terms of

its effect on RedLotus Travel.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 1

On, April 1, Starr Williams and a few friends invest $50,000

to open RedLotus Travel, Inc., and the business issues

common stock to the stockholders.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 2

RedLotus purchases land for a new location and pays cash

of $40,000.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 3

The business buys supplies on account, agreeing to pay

$3,700 within 30 days.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 4

RedLotus earns $7,000 of service revenue by providing

services for customers.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 5

RedLotus performs services on account, which means that

RedLotus lets some customers pay later.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 6

During the month, RedLotus Travel, Inc., pays $2,700 for the

following expenses: rent $1,100; employee salaries, $1,200;

and utilities, $400.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 7

RedLotus pays $1,900 on account, which means to make a

payment toward an account payable.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 8

Starr Williams, the major stockholder of RedLotus Travel,

paid $30,000 out of his personal bank account to remodel

his home.

No Entry

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 9

In transaction 5, RedLotus performed services for UPS on

account. The business now collects $1,000 from UPS.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 10

RedLotus sells some land for $22,000, which is the same

amount RedLotus paid for the land and makes a $2,000

gain.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 11

RedLotus Travel, Inc., declares a dividend and pays the

stockholders $2,100 cash.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-1 Transaction Analysis:

RedLotus Travel, Inc.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-2 Financial Statements of

RedLotus Travel, Inc. (1 of 2)

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-2 Financial Statements of

RedLotus Travel, Inc. (2 of 2)

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Analyze the Impact of Business

Transactions on Accounts (1 of 2)

Accounting:

• Double-entry system

• Records dual effects of each transaction

– At least two accounts in each transaction

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Analyze the Impact of Business

Transactions on Accounts (2 of 2)

The T-Account

• Record of increases and decreases in a specific

asset, liability, equity, revenue, or expense

• Left side = “Debit”

• Right side = “Credit”

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-3 Accounting Equation and

the Rules of Debit and Credit

The type of account determines how to record increases and

decreases.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-4 The Accounting Equation after

RedLotus Travel, Inc.'s, First Transaction

To illustrate, RedLotus Travel, Inc., received $50,000 and

issued (gave) share. What is the effect on the accounts?

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-5 The Accounting Equation after

RedLotus Travel, Inc.’s, First Two Transactions

RedLotus’ second transaction is a $40,000 cash purchase of

land. What is the effect on the accounts?

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Additional Shareholders’ Equity

Accounts: Income and Expenses

Two categories of income statement accounts:

• Income increase shareholders’ equity

result from delivering goods/services

• Expenses decrease shareholders equity

cost of operating the business

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-6 Expansion of the

Accounting Equation

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-7 Final Form of the Rules of

Debit and Credit

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Learning Objective 2.4

Record (journalize and post) transactions in the books

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Record (Journalize and Post)

Transactions in the Books (1 of 2)

Journal

• Chronological record of transactions

• Three steps:

1. Specify each account affected by the transaction and

classify by type

2. Determine if each account is increased or decreased

(debit or credit)

3. Record in the journal

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Record (Journalize and Post)

Transactions in the Books (2 of 2)

Steps to journalize the first transaction of RedLotus Travel, Inc.

Step 1 Business receives $50,000 cash and issues stock

Step 2 Both Cash and Common Stock increase

Step 3 Journalize the transaction:

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-8 The Ledger (Asset, Liability,

and Shareholders’ Equity Accounts)

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-9 Journal Entry and Posting

to the Accounts

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-10 Flow of Accounting Data

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 1 Analysis

(1) Received $50,000 cash and issued stock to the owners

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 2 Analysis

(2) Paid $40,000 cash for land

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 3 Analysis

(3) Purchased supplies for $3,700 on account

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 4 Analysis

(4) Performed services and received cash of $7,000

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 5 Analysis

(5) Performed services for UPS on account, $3,000

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 6 Analysis

(6) Paid cash expenses: rent, $1,100; employee salary,

$1,200; utilities, $400

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 7 Analysis

(7) Paid $1,900 on the payable created in transaction 3

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 8 Analysis

(8) Stockholder of RedLotus remodeled her home with

personal funds

No Entry

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 9 Analysis

(9) Received $1,000 on account

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 10 Analysis

(10) Sold land for cash at the land’s cost of $22,000 and a

gain of $2,000 is recognized

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Transaction 11 Analysis

(11) Declared and paid a dividend of $2,100 to shareholders

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-11 Alladin Travel, Inc.’s,

Ledger Accounts after Posting

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Learning Objective 2.5

Construct and use a trial balance

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Construct and Use a Trial Balance

Trial Balance

• Lists all accounts with their balances

• Assets listed first, then liabilities and shareholders’

equity

• Shows that debits equal credits

• Usually prepared at the end of the period

• Facilitates preparation of the financial statements

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-12 Trial Balance

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Analyzing Accounts (1 of 3)

Suppose RedLotus’ began May with cash of $33,000. During

May, RedLotus’ received cash of $8,000 and ended the

month with a cash balance of $35,000.

You can compute total cash payments by analyzing

RedLotus’ Cash account:

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Analyzing Accounts (2 of 3)

You can compute either sales on account or cash collections

on account by analyzing the Accounts Receivable account

(using assumed amounts):

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Analyzing Accounts (3 of 3)

You can determine how much you paid on account by

analyzing Accounts Payable (using assumed amounts):

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Correcting Accounting Errors

First compute the difference between debits and

credits in the trial balance.

• Search for missing accounts

• Divide the out-of-balance amount by 2

• Divide the out-of-balance amount by 9

– Slide

– Transposition

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-13 Chart of Accounts—

RedLotus Travel, Inc.

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-14 Normal Balances of the

Accounts

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Exhibit 2-15 Account in Four-Column

Format

Copyright © 2018 Pearson Education, Inc. All Rights Reserved.

Potrebbero piacerti anche

- Summary of Richard A. Lambert's Financial Literacy for ManagersDa EverandSummary of Richard A. Lambert's Financial Literacy for ManagersNessuna valutazione finora

- Chapter 2 PPT (To Students)Documento64 pagineChapter 2 PPT (To Students)歩美桜井Nessuna valutazione finora

- Financial Accounting: Cash FlowsDocumento69 pagineFinancial Accounting: Cash FlowsRachel TamNessuna valutazione finora

- Financial Accounting: Cash FlowsDocumento61 pagineFinancial Accounting: Cash FlowsMaggie ShekNessuna valutazione finora

- Investing and Financing Decisions and The Balance SheetDocumento42 pagineInvesting and Financing Decisions and The Balance SheetNahla Ali HassanNessuna valutazione finora

- Chapter2 Recording+Business+Transactions 2022Documento24 pagineChapter2 Recording+Business+Transactions 2022gjemiljesyla1Nessuna valutazione finora

- CH 13Documento77 pagineCH 13Mohammed SamyNessuna valutazione finora

- 150 Harrison FAIFRS11e Inppt 03Documento55 pagine150 Harrison FAIFRS11e Inppt 03irma makharoblidzeNessuna valutazione finora

- Lecture 3 PDFDocumento64 pagineLecture 3 PDFRachel TamNessuna valutazione finora

- Harrison Fa11 STPPT 02Documento119 pagineHarrison Fa11 STPPT 02gizem akçaNessuna valutazione finora

- CH 17Documento77 pagineCH 17Nasim Rosin100% (1)

- Financial Accounting: LiabilitiesDocumento90 pagineFinancial Accounting: Liabilitiesirma makharoblidzeNessuna valutazione finora

- 1.business EnviironmentDocumento48 pagine1.business EnviironmentAbdelmajid JamaneNessuna valutazione finora

- 1 LectureDocumento42 pagine1 LectureVall HallaNessuna valutazione finora

- Chapter 1 & 2Documento33 pagineChapter 1 & 2ENG ZI QINGNessuna valutazione finora

- Financial Accounting: Conceptual FrameworkDocumento50 pagineFinancial Accounting: Conceptual Frameworkirma makharoblidzeNessuna valutazione finora

- Chapter 1Documento28 pagineChapter 1Gazi JayedNessuna valutazione finora

- Ch1 4e Acc in Action.Documento54 pagineCh1 4e Acc in Action.Phương NguyễnNessuna valutazione finora

- Financial Accounting: LiabilitiesDocumento46 pagineFinancial Accounting: LiabilitiesRachel TamNessuna valutazione finora

- Chapter 1 IntroductionDocumento34 pagineChapter 1 IntroductionLinda LiongNessuna valutazione finora

- CH 01Documento56 pagineCH 01thucnhi.2003hnntNessuna valutazione finora

- Chapter 2Documento67 pagineChapter 2Galata NugusaNessuna valutazione finora

- CH 02Documento59 pagineCH 0263D-026-Md Golam Muktadir AsifNessuna valutazione finora

- Fa PPT CH 2 - 7eDocumento59 pagineFa PPT CH 2 - 7eMaria GomezNessuna valutazione finora

- 2-Accounting Equation & Journal Entries, Posting To LedgersDocumento12 pagine2-Accounting Equation & Journal Entries, Posting To LedgershattarvapeNessuna valutazione finora

- CH 01Documento54 pagineCH 01Ngân Hà ĐỗNessuna valutazione finora

- CH 03Documento60 pagineCH 03Dr. Murad SalehNessuna valutazione finora

- Chapter 5 PPT (To Students)Documento48 pagineChapter 5 PPT (To Students)Heidi ChanNessuna valutazione finora

- CH 01Documento53 pagineCH 01Ismadth2918388Nessuna valutazione finora

- CH 02Documento53 pagineCH 02Hoàng Lâm NguyễnNessuna valutazione finora

- Chapter 3-Adjusting The AccountsDocumento69 pagineChapter 3-Adjusting The AccountsMahmud Al HasanNessuna valutazione finora

- 1.1 Evolution of Accounting 1.2 Accounting Concepts and PrinciplesDocumento5 pagine1.1 Evolution of Accounting 1.2 Accounting Concepts and PrinciplesNawaz AhamedNessuna valutazione finora

- Accounting Principles: The Recording ProcessDocumento55 pagineAccounting Principles: The Recording ProcessSayed Farrukh AhmedNessuna valutazione finora

- Accounting Principles Volume 1 Canadian 7th Edition Geygandt Test BankDocumento48 pagineAccounting Principles Volume 1 Canadian 7th Edition Geygandt Test BankJosephWilliamsostmdNessuna valutazione finora

- CH 01Documento53 pagineCH 01Triệu Nguyễn MinhNessuna valutazione finora

- Lecture NoteDocumento30 pagineLecture NoteHana YusriNessuna valutazione finora

- Topic 1 2Documento16 pagineTopic 1 2lala lianNessuna valutazione finora

- FDIFA - Chapter 1Documento61 pagineFDIFA - Chapter 121073045 Nguyễn Thị Thu TrangNessuna valutazione finora

- FDIFA - Chapter 1Documento61 pagineFDIFA - Chapter 1Nguyễn Thu TrangNessuna valutazione finora

- 11 Concepts of Accounting (Hashi)Documento9 pagine11 Concepts of Accounting (Hashi)mohamedNessuna valutazione finora

- CH 07Documento52 pagineCH 07Rabie HarounNessuna valutazione finora

- Financial Accounting 4th Edition. Chapter 1 SummaryDocumento13 pagineFinancial Accounting 4th Edition. Chapter 1 SummaryJoey TrompNessuna valutazione finora

- Accounting Eng 5+6 المحاضرة الخامسة والسادسةDocumento26 pagineAccounting Eng 5+6 المحاضرة الخامسة والسادسة01326567536mNessuna valutazione finora

- ch01 WFRDocumento54 paginech01 WFRXII MIPA 5 Adinda pNessuna valutazione finora

- Ch01 Note in ClassDocumento50 pagineCh01 Note in ClassThanh ThủyNessuna valutazione finora

- ACCT6174 - Introduction To Financial Accounting: Week 1 Accounting in ActionDocumento24 pagineACCT6174 - Introduction To Financial Accounting: Week 1 Accounting in ActionFatimatuz ZahroNessuna valutazione finora

- ch01 - ST - Principle of AccountingDocumento46 paginech01 - ST - Principle of AccountingKaseyNessuna valutazione finora

- Chapter 1 Accounting in ActionDocumento35 pagineChapter 1 Accounting in ActionRuslan AdibNessuna valutazione finora

- Financial StatementDocumento84 pagineFinancial StatementssdjyfkhglgkfjugliNessuna valutazione finora

- Lecture 9 - Statement of Cash FlowsDocumento51 pagineLecture 9 - Statement of Cash FlowsTabassum Sufia Mazid100% (1)

- Week 1 OneslideperpageDocumento73 pagineWeek 1 OneslideperpageBarry AuNessuna valutazione finora

- # 2 Assignment On Financial and Managerial Accounting For MBA StudentsDocumento7 pagine# 2 Assignment On Financial and Managerial Accounting For MBA Studentsobsa alemayehuNessuna valutazione finora

- FinanceDocumento48 pagineFinanceMimi Adriatico JaranillaNessuna valutazione finora

- Learning Outcome and Programme Learning Objectives (Plos)Documento64 pagineLearning Outcome and Programme Learning Objectives (Plos)ANGEL ROBIN RCBSNessuna valutazione finora

- Summary of Wayne Label's Accounting for Non-AccountantsDa EverandSummary of Wayne Label's Accounting for Non-AccountantsNessuna valutazione finora

- Mastering REIT Investments - A Comprehensive Guide to Wealth Building: Real Estate Investing, #3Da EverandMastering REIT Investments - A Comprehensive Guide to Wealth Building: Real Estate Investing, #3Nessuna valutazione finora

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsDa EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsNessuna valutazione finora

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersDa EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNessuna valutazione finora

- 5.1 Rates of Return: Holding-Period Return (HPR)Documento31 pagine5.1 Rates of Return: Holding-Period Return (HPR)irma makharoblidzeNessuna valutazione finora

- Efficient Diversification: Bodie, Kane, and Marcus Eleventh EditionDocumento39 pagineEfficient Diversification: Bodie, Kane, and Marcus Eleventh Editionirma makharoblidzeNessuna valutazione finora

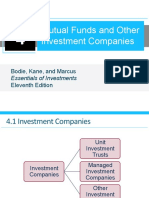

- Mutual Funds and Other Investment Companies: Bodie, Kane, and Marcus Eleventh EditionDocumento23 pagineMutual Funds and Other Investment Companies: Bodie, Kane, and Marcus Eleventh Editionirma makharoblidzeNessuna valutazione finora

- 137 - Avoidance of Double TaxationDocumento7 pagine137 - Avoidance of Double Taxationirma makharoblidzeNessuna valutazione finora

- Accounts Receivable and Inventory ManagementDocumento54 pagineAccounts Receivable and Inventory Managementirma makharoblidzeNessuna valutazione finora

- 279 - Fin Management 8 NPV and InvestmentDocumento17 pagine279 - Fin Management 8 NPV and Investmentirma makharoblidzeNessuna valutazione finora

- 137 - Gatt, Gats, TripsDocumento6 pagine137 - Gatt, Gats, Tripsirma makharoblidze100% (1)

- 150 Harrison FAIFRS11e Inppt 04Documento43 pagine150 Harrison FAIFRS11e Inppt 04irma makharoblidzeNessuna valutazione finora

- Treaty of GiorgievskDocumento1 paginaTreaty of Giorgievskirma makharoblidzeNessuna valutazione finora

- Financial Accounting: Internal Control, Cash, and ReceivablesDocumento75 pagineFinancial Accounting: Internal Control, Cash, and Receivablesirma makharoblidzeNessuna valutazione finora

- Financial Accounting: Conceptual FrameworkDocumento50 pagineFinancial Accounting: Conceptual Frameworkirma makharoblidzeNessuna valutazione finora

- 150 Harrison FAIFRS11e Inppt 03Documento55 pagine150 Harrison FAIFRS11e Inppt 03irma makharoblidzeNessuna valutazione finora

- 150 Harrison FAIFRS11e Inppt 04Documento43 pagine150 Harrison FAIFRS11e Inppt 04irma makharoblidzeNessuna valutazione finora

- Financial Accounting: LiabilitiesDocumento90 pagineFinancial Accounting: Liabilitiesirma makharoblidzeNessuna valutazione finora

- FSA Tutorial 1Documento2 pagineFSA Tutorial 1KHOO TAT SHERN DEXTONNessuna valutazione finora

- Irctc Ipo PPT FM PDFDocumento12 pagineIrctc Ipo PPT FM PDFAnshita JainNessuna valutazione finora

- Fundamentals of Financial Accounting Canadian Canadian 4th Edition Phillips Solutions ManualDocumento17 pagineFundamentals of Financial Accounting Canadian Canadian 4th Edition Phillips Solutions ManualJacobFloresxbpcn100% (51)

- SE Penalities - Jan 22, 2020Documento12 pagineSE Penalities - Jan 22, 2020G V KrishnakanthNessuna valutazione finora

- CFE - SNL Bank Valuation BrochureDocumento5 pagineCFE - SNL Bank Valuation BrochureFahad MirNessuna valutazione finora

- Massmart 2019Documento111 pagineMassmart 2019tmNessuna valutazione finora

- Capital Budgeting and Basic Appraisal Techniques: Margarita KouloumbriDocumento23 pagineCapital Budgeting and Basic Appraisal Techniques: Margarita KouloumbriInga ȚîgaiNessuna valutazione finora

- Chapter 4 Investments in Debt Securities and Other Long-Term InvestmentDocumento11 pagineChapter 4 Investments in Debt Securities and Other Long-Term Investmentpapajesus papaNessuna valutazione finora

- Project Selection and Portfolio ManagementDocumento20 pagineProject Selection and Portfolio ManagementGhaleb SweisNessuna valutazione finora

- Bartrop FullDocumento635 pagineBartrop FullDavid Esteban Meneses RendicNessuna valutazione finora

- CMA - Volume 1Documento181 pagineCMA - Volume 1Abdul QaviNessuna valutazione finora

- Corporate Finance Asia Global 1st Edition Ross Test BankDocumento22 pagineCorporate Finance Asia Global 1st Edition Ross Test Bankburke.bedrugi2878100% (25)

- Cash Flows Chap-13Documento52 pagineCash Flows Chap-13nina0301100% (1)

- Financial Statement Anaysis-Cat1 - 2Documento16 pagineFinancial Statement Anaysis-Cat1 - 2cyrusNessuna valutazione finora

- African Bank 13/03/2023 Branch Code 430000: StatementDocumento23 pagineAfrican Bank 13/03/2023 Branch Code 430000: StatementKosie Smith100% (1)

- Dividend Policy Multiple Choice: True/FalseDocumento28 pagineDividend Policy Multiple Choice: True/FalseRica RegorisNessuna valutazione finora

- Lesson 7 - Financial Analysis and Accounting Basics-1Documento34 pagineLesson 7 - Financial Analysis and Accounting Basics-1Khatylyn MadroneroNessuna valutazione finora

- AOM 2023-002 Cash in Bank - Abuyog (Reviewed)Documento4 pagineAOM 2023-002 Cash in Bank - Abuyog (Reviewed)Kean Fernand BocaboNessuna valutazione finora

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocumento7 pagineAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNessuna valutazione finora

- Atmos Energy Corporation Consolidated Balance Sheets: September 30Documento7 pagineAtmos Energy Corporation Consolidated Balance Sheets: September 30Betty M. VargasNessuna valutazione finora

- Junaid Ass 3Documento3 pagineJunaid Ass 3Junaid AhmadNessuna valutazione finora

- Rane HoldingsDocumento204 pagineRane HoldingsReTHINK INDIANessuna valutazione finora

- 9706 Accounting: MARK SCHEME For The May/June 2014 SeriesDocumento6 pagine9706 Accounting: MARK SCHEME For The May/June 2014 SeriesDanny DrinkwaterNessuna valutazione finora

- Chapter 2 Financial Statement and Cash Flow AnalysisDocumento15 pagineChapter 2 Financial Statement and Cash Flow AnalysisKapil Singh RautelaNessuna valutazione finora

- M/S. Sri Lakshmi Srinivasa Electricals HNO 11 40 145 1 1St Main Road Ponnur GUNTUR - 522124 Andhra Pradesh, IndiaDocumento3 pagineM/S. Sri Lakshmi Srinivasa Electricals HNO 11 40 145 1 1St Main Road Ponnur GUNTUR - 522124 Andhra Pradesh, Indiabhanu yellapuNessuna valutazione finora

- 2023.03.01 - Entain - Annual ReportDocumento240 pagine2023.03.01 - Entain - Annual ReportLexi EisenbergNessuna valutazione finora

- Mixed CasesDocumento6 pagineMixed CasesTesmon MathewNessuna valutazione finora

- TB 15Documento82 pagineTB 15Hasan100% (2)

- Annexure J TDS Declaration Format Under Rule 37BADocumento2 pagineAnnexure J TDS Declaration Format Under Rule 37BASusovan SirNessuna valutazione finora

- Macrs TableDocumento3 pagineMacrs Tableeimg20041333Nessuna valutazione finora