Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Flexible Budgets, Overhead Cost Variances, and Management Control

Caricato da

Subha ManTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Flexible Budgets, Overhead Cost Variances, and Management Control

Caricato da

Subha ManCopyright:

Formati disponibili

Flexible Budgets,

Overhead Cost Variances,

and

Management Control

© 2012 Pearson Prentice Hall. All rights reserved.

Planning and Overhead

Variable overhead—as efficiently as possible, plan

only essential activities

Fixed overhead—as efficiently as possible, plan only

essential activities, especially because fixed costs are

predetermined well before the budget period begins

© 2012 Pearson Prentice Hall. All rights reserved.

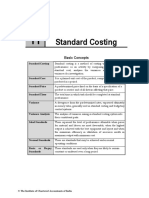

Standard Costing

Traces direct costs to output by multiplying the

standard prices or rate by the standard quantities of

inputs allowed for actual outputs produced

Allocates overhead costs on the basis of the standard

overhead-cost rates times the standard quantities of

the allocation bases allowed for the actual outputs

produced

© 2012 Pearson Prentice Hall. All rights reserved.

A Roadmap: Variable Overhead

Flexible Budget: Allocated:

Actual Costs

Budgeted Input Budgeted

Incurred: Actual Inputs

Allowed for Input Allowed for

Actual Input X

Actual Output Actual Output

X Budgeted Rate

X X

Actual Rate

Budgeted Rate Budgeted Rate

Spending Efficiency Never a

Variance Variance Variance

Flexible-Budget Never a

Variance Variance

Total Variable Overhead Variance

Over/Under Allocated Variable Overhead

© 2012 Pearson Prentice Hall. All rights reserved.

A Roadmap: Fixed Overhead

Same Budgeted Flexible Budget: Allocated:

Lump Sum Same Budgeted Budgeted

Actual Costs (as in Static Lump Sum (as in Input Allowed for

Incurred Budget) Static Budget) Actual Output

Regardless of Regardless of X

Output Level Output Level Budgeted Rate

Production-

Spending Never a Volume

Variance Variance Variance

Production-

Flexible-Budget

Volume

Variance

Variance

Total Fixed Overhead Variance

Over/Under Allocated Fixed Overhead

© 2012 Pearson Prentice Hall. All rights reserved.

Overhead Variances

Overhead is the most difficult cost to manage, and is

the least understood.

Overhead variances involve taking differences

between equations as the analysis moves back and

forth between actual results and budgeted amounts.

© 2012 Pearson Prentice Hall. All rights reserved.

Developing Budgeted Variable Overhead

Cost Rates

1. Choose the period to be used for the budget.

2. Select the cost-allocation bases to use in

allocating variable overhead costs to output

produced.

3. Identify the variable overhead costs associated

with each cost-allocation base.

4. Compute the rate per unit of each cost-allocation

base used to allocate variable overhead costs to

output produced.

© 2012 Pearson Prentice Hall. All rights reserved.

The Details: Variable OH Variances

Variable overhead flexible-budget variance

measures the difference between actual variable

overhead costs incurred and flexible-budget

variable overhead amounts.

Variable Overhead

flexible-budget variance = Actual Costs

Incurred - Flexible-budget

amount

(c) 2012 Pearson Prentice Hall. All rights reserved.

The Details: Variable OH Variances

Variable overhead efficiency variance is the

difference between actual quantity of the cost-

allocation base used and budgeted quantity of the

cost per unit of the cost-allocation base.

{ }X

Variable Actual quantity of Budgeted quantity of Budgeted variable

Overhead

Efficiency = variable overhead

cost-allocation base - variable overhead cost-

allocation based allowed

overhead cost

per unit of

Variance used for actual output for actual output cost-allocation base

(c) 2012 Pearson Prentice Hall. All rights reserved.

The Details: Variable OH Variances

Variable overhead spending variance is the

difference between actual and budgeted variable

overhead cost per unit of the cost-allocation base,

multiplied by actual quantity of variable overhead

cost-allocation base used for actual output.

{ }X

Variable Actual variable Budgeted variable Actual quantity of

Overhead

Spending = overhead cost

per unit of - overhead cost

per unit of

variable overhead

cost-allocation base

Variance cost-allocation base cost-allocation base used for actual output

(c) 2012 Pearson Prentice Hall. All rights reserved.

Developing Budgeted Fixed Overhead Cost

Rates

1. Choose the period to be used for the budget.

2. Select the cost-allocation bases to use in

allocating fixed overhead costs to output

produced.

3. Identify the fixed overhead costs associated with

each cost-allocation base.

4. Compute the rate per unit of each cost-allocation

base used to allocate fixed overhead costs to

output produced.

© 2012 Pearson Prentice Hall. All rights reserved.

The Details: Fixed OH Variances

Fixed overhead flexible-budget variance is the

difference between actual fixed overhead costs and

fixed overhead costs in the flexible budget.

This is the same amount for the fixed overhead

spending variance.

Fixed Overhead

flexible-budget variance = Actual Costs

Incurred - Flexible-budget

amount

(c) 2012 Pearson Prentice Hall. All rights reserved.

The Details: Fixed OH Variances

Production-volume variance is the difference between

budgeted fixed overhead and fixed overhead allocated

on the basis of actual output produced.

This variance is also known as the denominator-level

variance or the output-level overhead variance.

Production-Volume

Variance = Budgeted

Fixed Overhead - Fixed Overhead allocated using

budgeted input allowed for

actual output units produced

(c) 2012 Pearson Prentice Hall. All rights reserved.

Production-Volume Variance

Interpretation of this variance is difficult due to the nature

of the costs involved and how they are budgeted.

Fixed costs are by definition somewhat inflexible. While

market conditions may cause production to flex up or

down, the associated fixed costs remain the same.

Fixed costs may be set years in advance, and may be

difficult to change quickly.

Contradiction: Despite this, examination of the fixed

overhead budget formulae reveals that it is budgeted

similar to a variable cost.

© 2012 Pearson Prentice Hall. All rights reserved.

Variable Overhead

Variance Analysis Illustrated

© 2012 Pearson Prentice Hall. All rights reserved.

Fixed Overhead

Variance Analysis Illustrated

© 2012 Pearson Prentice Hall. All rights reserved.

Production-Volume Variance

© 2012 Pearson Prentice Hall. All rights reserved.

Integrated

Variance

Analysis

Illustrated

© 2012 Pearson Prentice Hall. All rights reserved.

© 2012 Pearson Prentice Hall. All rights reserved.

Potrebbero piacerti anche

- Chapter 08Documento18 pagineChapter 08Dr. Menna KadryNessuna valutazione finora

- Flexible Budgets, Overhead Cost Variances, and Management ControlDocumento14 pagineFlexible Budgets, Overhead Cost Variances, and Management ControlNoveliaNessuna valutazione finora

- CH 8Documento16 pagineCH 8emanmamdouh596Nessuna valutazione finora

- 08-Foh Cost VarianceDocumento21 pagine08-Foh Cost VariancePutri Dwi KartiniNessuna valutazione finora

- Flexible Budgets, Overhead Cost VariancesDocumento17 pagineFlexible Budgets, Overhead Cost VariancesReshu BediaNessuna valutazione finora

- Flexible Budgets, Overhead Cost Variances, and Management ControlDocumento30 pagineFlexible Budgets, Overhead Cost Variances, and Management ControlabeeraNessuna valutazione finora

- Flexible Budgets, Direct-Cost, Overhead Variances, and ManagementDocumento30 pagineFlexible Budgets, Direct-Cost, Overhead Variances, and ManagementAmit DeyNessuna valutazione finora

- Chapter 10 Flexible Budget OVHDocumento25 pagineChapter 10 Flexible Budget OVHhayin santosoNessuna valutazione finora

- Flexible Budgets, Direct-Cost, Overhead Variances, and Management-1Documento23 pagineFlexible Budgets, Direct-Cost, Overhead Variances, and Management-1Amit DeyNessuna valutazione finora

- Inventory Costing and Capacity Analysis: © 2009 Pearson Prentice Hall. All Rights ReservedDocumento22 pagineInventory Costing and Capacity Analysis: © 2009 Pearson Prentice Hall. All Rights Reserved2mrbunbunsNessuna valutazione finora

- Chapter 09finalDocumento22 pagineChapter 09finalmirandaleong2014Nessuna valutazione finora

- An Introduction To Cost Terms and PurposesDocumento82 pagineAn Introduction To Cost Terms and PurposesBlack TulipNessuna valutazione finora

- Mas: Variable and Absorption Costing Concept Summary: Comparison As To Treatment of Operating CostsDocumento3 pagineMas: Variable and Absorption Costing Concept Summary: Comparison As To Treatment of Operating CostsClyde RamosNessuna valutazione finora

- Chapter 9 Standard Costing - SynopsisDocumento8 pagineChapter 9 Standard Costing - SynopsissajedulNessuna valutazione finora

- An Introduction To Cost Terms and PurposesDocumento35 pagineAn Introduction To Cost Terms and Purposesoddi gigiihNessuna valutazione finora

- Cost Accounting 15e by Horngren Datar Rajan Chapter 02 An Introduction To Cost Terms and PurposesDocumento35 pagineCost Accounting 15e by Horngren Datar Rajan Chapter 02 An Introduction To Cost Terms and PurposesMuhammad Nabeel SafdarNessuna valutazione finora

- CH 10 NotesDocumento13 pagineCH 10 NotesmohamedNessuna valutazione finora

- CH 02 RevDocumento16 pagineCH 02 RevRoristua PandianganNessuna valutazione finora

- Chapter 2Documento42 pagineChapter 2Ashak Anowar MahiNessuna valutazione finora

- Chapter 07Documento13 pagineChapter 07Dr. Menna KadryNessuna valutazione finora

- CHAPTER 17 VarianceDocumento11 pagineCHAPTER 17 Varianceusama ahmadNessuna valutazione finora

- ACC2008 - Lec 3 - Flexible Budgeting and Analysis of Overhead CostsDocumento29 pagineACC2008 - Lec 3 - Flexible Budgeting and Analysis of Overhead CostsSu-Kym TanNessuna valutazione finora

- CHAPTER 02 Costs Concepts and Its PurposeDocumento29 pagineCHAPTER 02 Costs Concepts and Its PurposeGAMER GAMENessuna valutazione finora

- Cost Accounting E12 PPT ch02Documento22 pagineCost Accounting E12 PPT ch02Bharata H. BatahanNessuna valutazione finora

- AM Week 5 - Flexible Budget, Direct-Cost Variances, and Management ControlDocumento11 pagineAM Week 5 - Flexible Budget, Direct-Cost Variances, and Management ControlVenny LaurensiaNessuna valutazione finora

- Chapter-Ii (Cost Accounting)Documento40 pagineChapter-Ii (Cost Accounting)Zainab GamalNessuna valutazione finora

- Material VariancesDocumento2 pagineMaterial VariancestygurNessuna valutazione finora

- 09-IVENTORY COSTINgDocumento12 pagine09-IVENTORY COSTINgPutri Dwi KartiniNessuna valutazione finora

- An Introduction To Cost Terms and Purposes: © 2012 Pearson Prentice Hall. All Rights ReservedDocumento30 pagineAn Introduction To Cost Terms and Purposes: © 2012 Pearson Prentice Hall. All Rights ReservedSubha ManNessuna valutazione finora

- Bab 2 - Perilaku BiayaDocumento40 pagineBab 2 - Perilaku BiayaAndy ReynaldyyNessuna valutazione finora

- Bab 2 - Perilaku BiayaDocumento40 pagineBab 2 - Perilaku BiayaAndy ReynaldyyNessuna valutazione finora

- Variances SummaryDocumento17 pagineVariances SummaryDavieCDNessuna valutazione finora

- An Introduction To Cost Terms and PurposesDocumento33 pagineAn Introduction To Cost Terms and PurposesCarrie ChanNessuna valutazione finora

- Acctg10a Chapter 2Documento30 pagineAcctg10a Chapter 2annafuentesNessuna valutazione finora

- Standard Costing - UpdatedDocumento38 pagineStandard Costing - UpdatedChristian TanNessuna valutazione finora

- Materials From HBS and Text Book - Summary of Management AccountingDocumento145 pagineMaterials From HBS and Text Book - Summary of Management AccountingMuhammad Helmi FaisalNessuna valutazione finora

- DocDocumento6 pagineDocBanana QNessuna valutazione finora

- SummaryDocumento8 pagineSummarySittiehaina GalmanNessuna valutazione finora

- Variable Production Overhead Variance (VPOH)Documento9 pagineVariable Production Overhead Variance (VPOH)Wee Han ChiangNessuna valutazione finora

- Chap 4 MNGT Acctng PDFDocumento4 pagineChap 4 MNGT Acctng PDFRose Ann YaboraNessuna valutazione finora

- Profit Modelling Variable Costing Absorption CostingDocumento17 pagineProfit Modelling Variable Costing Absorption CostingLeslie Beltran ChiangNessuna valutazione finora

- Module - Absorption and Variable CostingDocumento10 pagineModule - Absorption and Variable CostingUchayya100% (1)

- Standard Costing BCom VI SemDocumento34 pagineStandard Costing BCom VI SemJay MahajanNessuna valutazione finora

- AH Accounting FormulaeSheetVarianceAnalysis PDFDocumento2 pagineAH Accounting FormulaeSheetVarianceAnalysis PDFAditi SInghNessuna valutazione finora

- Cost Volume Profit AnalysisDocumento63 pagineCost Volume Profit AnalysisJunaid KhalidNessuna valutazione finora

- 13 VariancesDocumento7 pagine13 VariancesJack PayneNessuna valutazione finora

- Lecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocumento6 pagineLecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoClouie Anne TogleNessuna valutazione finora

- Flexible Budgets, Direct-Cost Variances, and Management ControlDocumento22 pagineFlexible Budgets, Direct-Cost Variances, and Management ControlalanNessuna valutazione finora

- Costcon AnswersDocumento3 pagineCostcon AnswersIrah LouiseNessuna valutazione finora

- Module 11 - Standard Costing and Variance AnalysisDocumento10 pagineModule 11 - Standard Costing and Variance AnalysisAndrea Valdez100% (1)

- MAS 2023 Module 5 Standard Costing and Variance AnalysisDocumento20 pagineMAS 2023 Module 5 Standard Costing and Variance AnalysisDzulija Talipan100% (1)

- 09 Standard CostingDocumento5 pagine09 Standard CostingabcdefgNessuna valutazione finora

- Fundamental: Managerial Accounting ConceptsDocumento17 pagineFundamental: Managerial Accounting ConceptsRosh OtojanovNessuna valutazione finora

- Cost Behaviour & Decision Making - HodDocumento65 pagineCost Behaviour & Decision Making - Hodsrimant100% (2)

- F2-08 Absorption and Marginal CostingDocumento16 pagineF2-08 Absorption and Marginal CostingJaved ImranNessuna valutazione finora

- Summary FinalDocumento28 pagineSummary FinalJackNessuna valutazione finora

- Standard Costing and Variance AnalysisDocumento7 pagineStandard Costing and Variance AnalysisGian Carlo RamonesNessuna valutazione finora

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageDa EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageValutazione: 5 su 5 stelle5/5 (1)

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesDa EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNessuna valutazione finora

- Providing Value To Customers - HandoutsDocumento7 pagineProviding Value To Customers - HandoutsSubha ManNessuna valutazione finora

- Balance Sheet Template PDFDocumento2 pagineBalance Sheet Template PDFSubha ManNessuna valutazione finora

- The Role of Accounting in Business - HandoutsDocumento8 pagineThe Role of Accounting in Business - HandoutsSubha ManNessuna valutazione finora

- Legal and Regulatory Environment of Business - HandoutsDocumento9 pagineLegal and Regulatory Environment of Business - HandoutsSubha ManNessuna valutazione finora

- Financial Management - HandoutsDocumento7 pagineFinancial Management - HandoutsSubha ManNessuna valutazione finora

- Income Statement TemplateDocumento1 paginaIncome Statement TemplateSubha ManNessuna valutazione finora

- Financial Management - HandoutsDocumento7 pagineFinancial Management - HandoutsSubha ManNessuna valutazione finora

- Business Plan ProjectDocumento33 pagineBusiness Plan ProjectSubha ManNessuna valutazione finora

- Costing AccountDocumento18 pagineCosting AccountMaulik RadadiyaNessuna valutazione finora

- Financial Management - HandoutsDocumento7 pagineFinancial Management - HandoutsSubha ManNessuna valutazione finora

- Are The Prices of Given Products Similar, Do They Vary?Documento2 pagineAre The Prices of Given Products Similar, Do They Vary?Subha ManNessuna valutazione finora

- Chapter 1: The Foundations of Business: OwnersDocumento9 pagineChapter 1: The Foundations of Business: OwnersSubha ManNessuna valutazione finora

- Business in Global Environment - HandoutsDocumento11 pagineBusiness in Global Environment - HandoutsSubha ManNessuna valutazione finora

- Decision Making and Relevant Information: © 2012 Pearson Prentice Hall. All Rights ReservedDocumento32 pagineDecision Making and Relevant Information: © 2012 Pearson Prentice Hall. All Rights ReservedSubha ManNessuna valutazione finora

- Chapter 02Documento54 pagineChapter 02Subha ManNessuna valutazione finora

- Inventory Costing and Capacity Analysis: © 2012 Pearson Prentice Hall. All Rights ReservedDocumento22 pagineInventory Costing and Capacity Analysis: © 2012 Pearson Prentice Hall. All Rights ReservedSubha ManNessuna valutazione finora

- Chap. 7 - Flexible Budgeting - Direct Costs VariancesDocumento19 pagineChap. 7 - Flexible Budgeting - Direct Costs Variancesrprasad05Nessuna valutazione finora

- Job Costing PowerpointDocumento28 pagineJob Costing PowerpointAU SharmaNessuna valutazione finora

- Hca14 - PPT - CH06 Master Budgeting and Responsibility AccountingDocumento20 pagineHca14 - PPT - CH06 Master Budgeting and Responsibility AccountingNiizamUddinBhuiyan100% (1)

- The Manager and Management Accounting: © 2012 Pearson Prentice Hall. All Rights ReservedDocumento16 pagineThe Manager and Management Accounting: © 2012 Pearson Prentice Hall. All Rights ReservedSubha ManNessuna valutazione finora

- Cost-Volume-Profit Analysis: © 2012 Pearson Prentice Hall. All Rights ReservedDocumento18 pagineCost-Volume-Profit Analysis: © 2012 Pearson Prentice Hall. All Rights ReservedBartholomew SzoldNessuna valutazione finora

- An Introduction To Cost Terms and Purposes: © 2012 Pearson Prentice Hall. All Rights ReservedDocumento30 pagineAn Introduction To Cost Terms and Purposes: © 2012 Pearson Prentice Hall. All Rights ReservedSubha ManNessuna valutazione finora

- ACTG 360 Midterm Exam ReviewDocumento3 pagineACTG 360 Midterm Exam ReviewSubha ManNessuna valutazione finora

- Competitive Analysis - How To Conduct A Competitive AnalysisDocumento32 pagineCompetitive Analysis - How To Conduct A Competitive AnalysisHaroon AzizNessuna valutazione finora

- Accreditation Is Not:: Benefits of Accreditation To The Accredited Conformity Assessment BodyDocumento5 pagineAccreditation Is Not:: Benefits of Accreditation To The Accredited Conformity Assessment BodyFanilo RazafindralamboNessuna valutazione finora

- Case Study Analysis Graphic OrganizerDocumento3 pagineCase Study Analysis Graphic OrganizerAshwinKumarNessuna valutazione finora

- 2208PCDFCADocumento64 pagine2208PCDFCAPCB GatewayNessuna valutazione finora

- MNM CV June2023Documento3 pagineMNM CV June2023adarsh dNessuna valutazione finora

- Business Plan For Fertilizers DistributorsDocumento20 pagineBusiness Plan For Fertilizers DistributorsRanjan Shetty94% (17)

- Bajaj Quadricycles: Asm Assignment 2Documento17 pagineBajaj Quadricycles: Asm Assignment 2Arun KpNessuna valutazione finora

- Week 5 AssignmentDocumento1 paginaWeek 5 AssignmentSushmita Shivaram100% (1)

- CNOOCSuccess StoryDocumento3 pagineCNOOCSuccess StoryEfan PattiserlihoenNessuna valutazione finora

- SUMANTRA SENGUPTA - 7/1/2004: The Top Ten Supply Chain MistakesDocumento7 pagineSUMANTRA SENGUPTA - 7/1/2004: The Top Ten Supply Chain MistakesMohit LalchandaniNessuna valutazione finora

- Lesson 5 EBBADocumento152 pagineLesson 5 EBBAHuyền LinhNessuna valutazione finora

- A Comparative Study On One Time Investment and Systematic Investment Plans in Mutual Funds-Conceptual StudyDocumento6 pagineA Comparative Study On One Time Investment and Systematic Investment Plans in Mutual Funds-Conceptual StudySharon BennyNessuna valutazione finora

- Special Purpose Vehicle in Project Finance - Group 1-Batch 2Documento10 pagineSpecial Purpose Vehicle in Project Finance - Group 1-Batch 2Blesson PerumalNessuna valutazione finora

- PsuDocumento2 paginePsuManas KapoorNessuna valutazione finora

- Delta Group New Catalogue 2018Documento22 pagineDelta Group New Catalogue 2018AlmaNessuna valutazione finora

- Competency Model BooksDocumento4 pagineCompetency Model Bookshoa quynh anhNessuna valutazione finora

- Public Vs PrivateDocumento2 paginePublic Vs PrivateVishvasniya RatheeNessuna valutazione finora

- From Beds, To Burgers, To Booze - Grand Metropolitan and The Creation of A Drinks GiantDocumento13 pagineFrom Beds, To Burgers, To Booze - Grand Metropolitan and The Creation of A Drinks GiantHomme zyNessuna valutazione finora

- Verify Udyam Registration DetailDocumento3 pagineVerify Udyam Registration DetailFinance HubNessuna valutazione finora

- Training On Strategic and Action Planning For NGOsDocumento41 pagineTraining On Strategic and Action Planning For NGOsBarkulanka IbnukhalduunNessuna valutazione finora

- Performance ApprisalDocumento7 paginePerformance ApprisalSHERMIN AKTHER RUMANessuna valutazione finora

- CAF 3 CMA Autumn 2023Documento6 pagineCAF 3 CMA Autumn 2023Hammad ShahidNessuna valutazione finora

- Peachtree AccountingDocumento170 paginePeachtree AccountingKyaw Moe Hain100% (4)

- Human Resource Management (UST AY 2013-2014)Documento3 pagineHuman Resource Management (UST AY 2013-2014)Jie Lim Jareta100% (1)

- Alphasol International Group Profile: Tel: +251 114 701858 Fax: +251 114 702358 Mobile +251 920745948, EmailDocumento16 pagineAlphasol International Group Profile: Tel: +251 114 701858 Fax: +251 114 702358 Mobile +251 920745948, EmailsachinoilNessuna valutazione finora

- Collaboration Business Plan TemplateDocumento18 pagineCollaboration Business Plan TemplateThu A. PhamNessuna valutazione finora

- Demand For Arbitration of Collective Age-Discrimination Complaints Against IBMDocumento29 pagineDemand For Arbitration of Collective Age-Discrimination Complaints Against IBMJulie Vossler-HendersonNessuna valutazione finora

- Product Management Final ExamDocumento25 pagineProduct Management Final ExamAnthony OpesNessuna valutazione finora

- PM 5-6Documento7 paginePM 5-6Nguyễn UyênNessuna valutazione finora