Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Indigoairlinestrategypptbysuddhwasattwamukherjee 160824074945

Caricato da

Ishaan KumarTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Indigoairlinestrategypptbysuddhwasattwamukherjee 160824074945

Caricato da

Ishaan KumarCopyright:

Formati disponibili

IndiGo Airline: Strategy Presentation

Presentation by: Suddhwasattwa Mukherjee

Worked for Ernst & Young LLP for 8 years as a

management consultant professional in the Advisory

Services (2008 – 2016)

Working with ITC Infotech in the

Business Consulting Group (2016 onwards)

Associated to Indian Institute of Foreign Trade

(IIFT) and IIM-Lucknow through various

July 2016 programmes

Introduction to IndiGo Airline…Few key statistics

Air Costa Vistara

Air Asia Air Pegasus

0.9% 1.31%

1.72% 0.14%

GoAir

Introduction about IndiGo

8.55% Trujet

0.14%

IndiGo, headquartered in Spice Jet

Gurgaon, India is the largest India Domestic 11.63% IndiGo

airline in terms of passengers Passenger 2015 – 36.69%

flown with market share of 36.69% Annual Market

as of February 2016. Jet Group

share by Airlines Air India

22.48%

It was set up in early 2006 by 16.45%

Rahul Bhatia of InterGlobe

Enterprises and Rakesh Gangwal, IndiGo Air India Jet Group SpiceJet GoAir

a United States-based NRI.

Air Asia Air Costa Vistara Air Pegasus Trujet

InterGlobe holds 51.12% stake in

On Time Performance in 4 Metro Cities (%)

IndiGo and 48% is held by Passenger Load Factor (%) Year: 2015

Year: 2015

Gangwal's company Caelum

Investments. 100 87

85.2 82.4 87.4 76.5 76.3 SpiceJet 49.6

80 80 79.2

IndiGo began its operations on 4th Air India (Dom) 52.1

60 45.4

August 2006 with a service from Jet Group 63.7

40

New Delhi to Imphal via Guwahati.

20 Go Air 65.8

The airline currently operates a 0 IndiGo 73.3

fleet of 109 planes and offers 679 IndiGo Air India Jet JetLite SpiceJet GoAir Air Air Asia Vistara

flights a day. Airways Costa 0 20 40 60 80

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

Our understanding about IndiGo Airline…The Growth journey

2011 - 2012 2013 - 2014 2015 - 2016

IndiGo replaced the state run IndiGo was the second fastest growing In 2015, IndiGo placed an order of 250

2011:

flag carrier Air India as the top

Market share

17.3% low-cost carrier in Asia behind Airbus A320 Neo aircraft worth $27 billion,

third airline in India. Indonesian airline Lion Air. making

it the largest single order ever in Airbus

In 2011, IndiGo placed an Indonesian history.

order for 180 Airbus Fastest 2015:

2011: US$27

320 Neos aircraft in a deal Growing 250 Airbus

Billion

worth US$15 billion which 180 A-320 US$15 A-320 Neos

pushed up the percentage of Deal

Airbus Neos Billion Aircraft

Airbus aircraft in India to 73% Deal 2nd

Fastest

As of 2012, IndiGo was expanding rapidly and was the only profitable airline in

Growing

India. Largest single order

in Airbus history

Replaced Kingfisher as the 2nd largest airline in India in terms of market share. Took delivery of 9 Aircrafts in 2013

IndiGo strongly adheres to a low-cost model, buying only one type of aircraft and

keeping operational costs as low as possible along with an emphasis on In August 2013, the Center for Asia 37% IndiGo’s Market share in Feb

punctuality. Pacific Aviation ranked IndiGo among 2015

the 10 biggest Low-cost carriers in the

IndiGo added a new plane every six weeks and sometimes even world.

faster.

Largest 9.4% IndiGo’s Net Margin FY 2015

August 2012, IndiGo became the largest Within Top 10

2012: biggest LCC

airline in India in terms of market share

(27%) surpassing Jet Airway, 6 years after Market share 27% in the World IndiGo’s IPO opened in

INR 3200 Cr October 2015

operations commenced.

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

Competitor Landscape Mapping…Indian civil aviation sector

Airlines

Parameter Jet Group

2015 Domestic

Maximum

Market share 22.48% 16.45% 11.63% 8.55% 1.31% 36.69% market share

(Passenger number)

No of years in

operation

24 70 11 11 1 10

Fleet Size 116 109 34 21 10 109

Destinations 68 84 41 22 17 40

Not making Maximum

Not making Not making US$ 1.5

Profit Profit

US$ 190

-

Profit Profit million

Profit

Tailwinds Air India

SpiceJet Wadia Group Tata Sons

Parent Company

InterGlobe million

Private Limited Limited Enterprises

Maximum flight

Daily flights operation with a

smaller fleet

300 488 306 140 87 679 size

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

Porters ‘Five Forces’ in the Industry environment analysis for IndiGo Airline…Forces

shaping up the competitive environment of Indian civil aviation sector

Low Switching Costs

High

Limited Incumbency advantages

Some Demand-side benefits of scale

Easy access to Distribution channels

High Threat of New Easy entry of Foreign Carriers in the International Routes where

Entrants High

IndiGo operates -- Dubai, Bangkok, Muscat, Singapore, Kathmandu

Govt. Regulation / Indian Civil Aviation Policy - key entry barrier

Bargaining Power of Suppliers Set-up cost, fuel cost and resource availability -key barriers to entry Bargaining Power of

Regional Carriers start-ups Buyers

Aircraft and Engine manufacturers are both Buyers are highly fragmented –

concentrated Oligopolies Suppliers like

High

Very little scope for differentiation between competitors’ products lowering their power

Dauphin,Dronier,Bell,ATR-42 do not meet and services – closest competitors are Spice Jet, Go Air Low Switching cost for most of

the requirement to serve low cost Intra-Industry

Mature Industry with very little growth the customers as multiple

commercial aircraft carriers – suppliers are Rivalry No brand loyalty demonstrated by customers alternatives are available

very few and they have good demand of Significant exit barriers

their products Air travel is perceived

Airports are local monopolies with significant as a standardized product

power Price sensitive as travel is a

Airport services – Catering, Handling, Medium and The number of customers who can afford air travel are meaningful share of

increasing day by day specially in the emerging markets where discretionary spending

Cleaning are also concentrated in a small Rising IndiGo is operating

number of firms, but low switching costs Substitutes are readily available

Technology for Web / Video conferencing is improving – reducing

Powerful Labor Unions especially when in the form of railway and

Availabilit business travels

roadway transport in cases

controlling operations at Network hubs y of Railways is an alternative, but for shorter routes – not a powerful

Limited number of Fuel suppliers substitute in longer routes for the time consumption factor where time is not a very critical

Substitut consideration

es across India where IndiGo operates

Direct substitutes are low cost airlines like SpiceJet, Go Air – as

buyer’s switching cost is very low

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

External environment analysis for IndiGo Airline using the P.E.S.T Framework

Political

Open Sky Policy / Deregulation (+)

Low Entry barriers (+)

FDI Limits (+)

International Travel Restricts (-)

Technological Economic

Modernized Airports (+) Growing middle class income (+)

Greenfield Airports (+) Consistent GDP Growth (+)

Better handling of Hike in average income (+)

Aircrafts, passengers (+) Growth in tourism (+)

Video Conferencing (-) Rising ATF Price (-)

Socio-cultural

Growing Middle class (+)

Domestic Leisure travel (+)

(+)

Foreign tourists (+) Enabling Factors

Status symbol (+)

Security issues and terrorism (-) Disabling Factors

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

Internal Environment analysis for IndiGo Airline using S.W.O.T Framework

Brand awareness

Less product differentiation

Cost leadership – High profitability and

Not present on too many routes

revenue

International absence (only select

High market share and growth rate

International routes at this point – Dubai,

Hold on the domestic market

Bangkok, Muscat, Singapore, Kathmandu)

Advertising and marketing strategies

Investment in Research and Development

Experienced Business Units and skilled

workforce Strength Weakness

International market

Opportunities Threat

New products and services Changing Govt. Policies and rising labor

Middle class taking to the skies costs

Chartered flight services Plenty of new Low cost carriers to compete

Cargo services with

Increasing flight frequency Barriers to exit

Growth rate and profitability

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

TOWS Analysis: Strategic analysis used to study the environment for IndiGo and its interior

2 3 4

SO WO ST WT

Increase domestic Going International Effective incentive Create a tie-up with

destinations Expand to freight / programs to prevent other LCC players like

Upgrade to Long-haul cargo services talent drain Air Asia for the Indian

aircrafts as per demand Diversify to chartered Sign anti-poaching customer base to

Offering affordable flight services agreement with provide last mile

international holiday Loyalty, rewards and competitors connectivity

packages to the middle other customer retention Continue to Offer business class

class travelers programs successfully hedge fuel seats, continue

prices by importing innovation of value added

services while focusing

on cost optimization

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

Internal analysis for IndiGo Airline using VRIO Framework

Resources and

Value Rarity Imitability Organization

competencies

Low Fares Yes Yes No Yes

VRIO analysis

Single type of Aircraft Yes Yes Yes Yes

for IndiGo

Turnaround Time Yes No Yes Yes

Brand Name Yes Yes Yes Yes

1 2 3 4

Value Rarity Imitability Organization

IndiGo has created value IndiGo has the highest Even though IndiGo has In the last few years,

and increased its market market share in the Indian created much value in the IndiGo has become the

share by offering the lowest domestic Airline industry market and amongst its brand name in the Indian

fares. The way they do it is and it owes everything to customers, but many of its Airline Industry. It has

through having a single the low fare tickets it offers strategies like less hardly been ten years since

type of Aircraft which to the customers. The low turnaround time and using its inception and it has

reduces the overall average fleet age and single type of Aircraft are created a brand value

maintenance cost. single type of aircraft is a imitable. Thus, in the long through unique value

rarity in the Indian Airline run these differentiator will proposition and strategic

This arrangement also Industry. not be very effective for initiatives.

reduces the fuel cost indiGo

through fuel hedging

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

IndiGo’s strategies at various levels

1

Operations Strategy

Functional Level Marketing Strategy

Strategy

Financial Strategy

Flexible options for purchase of

Range and Diversity food and beverages

2 3

No Refund

Corporate Growth

Lean Distribution System

Professional Airline Corporate Level Business Level

management Strategy Strategy Online Check-in

Strengthening

organizational structure InternetSales

Well thought out Sales Office

salary structure Travel Agents

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

Functional level strategies…IndiGo’s Strategy in Operations

IndiGo’s whole fleet consists of A-320-232 Domestic fuel taxes can be as high as 30 per cent along with an 8.2

1 aircraft while Air India, Jet Airways and Spice 4 per cent excise duty. As a result, fuel for Indian airlines accounts

Jet use 10, 9 and 3 different makes of for about 45% - 50% of total operating costs, compared to the

aircraft respectively. global average of 30%.

Single type of Fuel

Aircraft This result is in greater flexibility by making use IndiGo’s aircraft try to save fuel by using software to optimize flight

of the same crew from pilots to flight attendants planning for minimum fuel burning routes and altitudes and also

to the ground force thereby cutting hiring, by making use of latest fuel saving technology.

training and up gradation costs.

IndiGo operates over a lesser number of destinations than its

2 IndiGo’s is having only Economy class; they do 5 competitors but with a higher frequency - with a fleet of 78 planes for

not have to spend time, money and crew on 36 destinations while Spice Jet flies to 46 destinations with 58 planes.

privilege passengers. The network maps show that all IndiGo's destinations are connected to

Single Class - Effective at least two cities while most are connected to 3 or more destinations,

Economy Route whereas this is not the case with Jet Airways. This means Indigo can

They also don't need to maintain expensive

lounges at airports further reducing costs.

Planning keep its aircraft in the air for a longer period of time and save up on

airport charges.

IndiGo has an average fleet age of less than 4 This also means that customers don't have to look for connecting

years. A younger fleet means less maintenance flights with other competing operators.

3 costs. IndiGo plans to maintain a lower fleet

age as all its aircraft are leased for a period of 6 IndiGo has a Power by the Hour contract with International Aero

Low average 5-6 years.

Engines (IAE), which provides the engines that put the onus of

Fleet age Tightly framed performance delivery on the manufacturer. IndiGo has similar

This way they avoid the D-Check which is done

after 8 years of operation of an airplane. (A D- Maintenance agreements with Airbus, as well as with the vendors for other critical

check may take up to 2 months during which the Contracts: components. These contracts probably come at a premium but it

aircraft remains out of service.) means that IndiGo does not have to pull out planes from service for

repairs and also does not have to maintain a large inventory of spares.

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

Functional level strategies…IndiGo’s Strategy in Marketing and Finance

Marketing Finance

1 1

Advertisement Little advertising spend.

Debt Indigo has gone on record to say that the company

has practically no debt.

2

High reliance on word of mouth marketing in its

No Frills early days by establishing a reputation of being a

‘No frills’ airline which is always clean and on time.

Leaseback is a financial transaction, where one sells

an asset and leases it back for the long- term;

IndiGo advertised heavily when it started therefore, one continues to be able to use the asset

international operations and also when Kingfisher 2 but no longer owns it. The transaction is generally

3 was going bust, with catchphrases like 'Let the bad done for fixed assets, notably real estate, as well as

times roll ... Fly Indigo in good times and in bad for durable and capital goods such as airplanes and

times.' taking a dig at Kingfisher's tagline 'Fly the Sale and trains. IndiGo has been able to better leverage this by

Strategic good times‘. This move was criticized but it worked Leaseback: placing bulk orders for aircraft.

Marketing for IndiGo.

The result of these operational and marketing In 2005, when IndiGo did not even exist as an entity,

aspects is visible in IndiGo which has a market InterGlobe Enterprises placed an order for 100 A320s

share of 37% and the highest passenger load during the 2005 Paris Air show. This was also one of

factor of close to 90% compared to 77% of the biggest orders during the show. The company

JetLite and 81% of Spice Jet. This means better again placed an order of 180 new A-320s in 2011 and

revenue for IndiGo compared to its competitors. 250 A-320 Neos in 2015

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

Corporate level strategies

Range and IndiGo operates 78 planes for 36 destinations - Higher frequency

Diversity

With innovative ideas like “check-in counters” for passengers with only cabin baggage so that instead of

waiting in lines, they can check-in with an IndiGo official with a handheld device, IndiGo is creating its own

blue ocean.

Corporate Growth

Engagement with various travel web-portals and collaboration with hotels has increased its social capital. E.g.

IndiGo gives 10% discount on the next travel booking if customers had stayed in any of the tie-up hotels.

Professional

IndiGo paid much attention to its corporate level strategies right since its inception. Its first CEO, Bruce

Airline

Ashby, landed in India 18 months before its planned launch.

management IndiGo Network

Strengthening

While most domestic airlines are cutting up their staff strength, IndiGo is speeding up its recruitment process

for more pilots, cabin attendants, and other supporting staff.

organizational

structure

Very Low compared to the Industry average - The usual scale for the industry is double the amounts

Well thought out

here. Contractual jobs, no commitment on the company's half whatsoever but requiring back breaking

Salary structure efforts in order to renew your contract every two years to keep the job..

“check-in counters” - handheld device

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

Business level strategies

‘No Frills’

Some of IndiGo’s passengers may prefer not to consume food & beverages when on board. There are those who

Flexible options for prefer to rest throughout a flight or those who prefer having their meals before flying off. Hence IndiGo comes up

with an arrangement where the guests have the flexibility to purchase food or beverages based on their requirement.

purchase of food

and beverages Guests who are pre-decided regarding their meal selection, can purchase food & drinks at an affordable price from

IndiGo’s website before the flight, of from the cabin crew during the flight.

Airlines waste a lot of money, time and resources due to refunds and rescheduling when guests do not show up for

No Refund a flight. Whether or not a guest shows up, the cost of flight to the airline is the same. LCCs are strict when it

comes to no show guests and do not offer refunds for missed flights. IndiGo follows the same approach.

Distribution costs are something that FSCs most often ignore. Very often, FSCs rely on travel agents and their sales

offices. Furthermore, FSCs tend to complicate their distribution channels by integrating their systems with multiple

Lean Distribution Global Distribution Systems, which are very costly. LCC will keep their distribution channel as simple as possible

System and will cover the whole spectrum of the clientele profile. And at the same time, IndiGo has an established system to

sell their tickets to the most remote and technology deprived locations, such as in Myanmar.

Guests are highly encouraged to check-in online so they do not have to waste time lining up at the check-in

Online check-in counters at the airport. This helps IndiGo to improve efficiency and reduce congestion in the airport.

The bulk of sales (85%) are done via the airline's website, whereby the fares are paid using credit cards, debit cards

Internet Sales or via online banking. This is the most cost effective distribution channel.

Sales Office IndiGo establishes a sales office if they are confident the sales derived from the centre will be worth it.

Travel Agents Does not use travel agents and World wide reservation system – allows IndiGo to save cost, reduce ticket price and

get more number of flyers

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

Outcome of IndiGo’s strategy analysis: Critical strategic factors driving the success of the Airline

1

2 3 4 5

IndiGo ensured that its average fleet Buy, sell and lease back’ Fuel efficient planes leading Strategic planning Strategic approach to

age remains 4 years till 2032 strategy to lower operational cost for Neo based increase its footprint

fleet

Well thought-out fleet strategy made 10 years Every month a plane goes out of Because of the 6 year With orders in place, IndiGo

back, and not something done a couple of Once all airplanes are delivered, lease back plan, with the is planning to increase its

IndiGo’s fleet and a new aircraft

months ago. IndiGo will not have a fleet of 530 next two-and-half years presence in the number of

joins, thus reducing the average

The last plane of the three bulk orders of 530 planes — this is due to the ‘buy, one-third of IndiGo’s cities it flies to - adding two

fleet age; the cost of maintenance

aircraft that IndiGo placed will come in 2026 — sell and lease back’ strategy. At fleet will be Neos, and in to three cities to its portfolio

is also lower.

100 Airbus A-320 in 2005, 180 A-320 Neos in peak they will have 330 planes. the next 6 years it will every year. In the next

In 2011, IndiGo was the first

2011 and 250 A-320 Neos in 2015. Once the order is placed the planes have an all Neo fleet. eight and half years it

customer for Airbus to order the

IndiGo’s bulk buying helped negotiate better are sold to lessors at market price. plans to have presence in

new range of fuel efficient A-

rates. The planes are then leased back There is a straightaway 56 airports compared to

320 Neo planes. Neos help in

Gained right at the beginning — this is netted for the next six years — which positive impact of 7% on 33, now.

saving 10-15% of the overall

against IndiGo’s rentals and brings the cost means for the first six years IndiGo the company’s bottom Regional flying is not on the

fuel cost. Fuel makes up for

down. receives a plane every month. line because of the radar, and neither are

50% of a carrier’s cost.

Neos. smaller planes.

100

Airbus 2005 7%

A-320 10-15% 50% 33 56

180

A-320 Bottom line Growth Plans – number

2011

Neos At peak, 330 Planes improvement of Airports operated

Fuel due to Neo

250 Fuel cost saving contributes based Fleet 3 Cities adding plan

A-320 2015 for IndiGo planes 50% of

every year

Neos Carriers cost

Analysis and Presentation by Suddhwasattwa Mukherjee

Key strategies and recommendation for IndiGo Airline…Relook at the current segmentation process

Existing segments (identified in Existing Segmentation Proposed Segmentation

case) not mutually exclusive

collectively exhaustive Corporate Consumer insights based on Reliability

SME interviews carried out by Comfort

Leisure Agencies at various points Price

Need for segmenting based on

VFR Price-quality

benefits sought-based on in- Literature review

Student Service flexibility

depth literature review

Purpose-based segmentation Benefits-based segmentation

Segment Description Favorability to Indigo

Outcome

Target Segments

“I need efficiency and Seek reliability, sensitive to delays, switch brands easily

punctuality” Low price sensitivity High

Reliability

“I want comfort” Seek benefits from FFP, catering and flexibility Price

Price is most irrelevant Low Price-quality

“I am hard-pressed on price” Personal benefits of minor importance

High price sensitivity Medium

Next step

“I am price-conscious and Seek mix of price and quality

quality seeking” Low tolerance to delays, ready to pay premium for punctuality High

Analysing current

positioning w.r.t. new

“I want flexibility across all High decision autonomy

offerings” Hard to address due to multiple benefits sought Low segmentation process

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

Key strategies and recommendation for IndiGo Airline…Positioning strategy - Aiming that spot in

consumer’s mind

Promotion Strategy

Product Strategy o Observation

R Recommendations

Aim

Planning Phase

Improve Talkability

o Value-seeking Segment prefers booking hotels/cabs with flight tickets Customer Involvement

R Cross-sell ibis-InterGlobe Hotels (Group synergy)

Pre-flight Waiting Phase Channel: Social Media

Driver for Success : Volume of visitors

Most travelers buy beverages & light snacks at the airport-

o - Price is a major deterrent

R Tie-up with shops for a discount for IndiGo customers

Deals Contests

Post-travel Phase Deals for booking well CONTESTS like

before the travel date

o Booking cabs after flight adds to hassle Last minute deals through “My IndiGoStory” depicting

social media for increased and sharing awesome travel

Pre-paid cab booking at destination available before even boarding the flight interaction experiences

R - cuts down the hassle

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

Key strategies and recommendation for IndiGo Airline…Identifying Geographies for Growth

Macro-economic trends Future plans Industry trends LCC market Proposed airports

(Growth, industry, aviation (Geographic (Competitive (Players, competitor (Growth sectors & their

Region sector, ease of doing expansion, aircraft landscape, moves) distances upon Verdict

business, ATF prices deliveries) costs, new entering)

sectors)

Addis Ababa, Nairobi,

Africa

Cairo, Morocco

Europe Istanbul, Brussels/Paris Not Now

Middle-East Dubai, Doha, Abu Dhabi

North America Atlanta, New York Not Now

Rio de Janeiro, Sao

Latin America

Paulo, Venezuela

Not Now

South Asia Colombo, Dhaka

Hong Kong, Guangzhou,

North Asia

Shanghai

Bangkok, Singapore,

South-East Asia

Jakarta

Favorability for IndiGo’s next phase of growth

Case Study: IndiGo Airline Analysis and Presentation by Suddhwasattwa Mukherjee

Thank You

Presentation by: Suddhwasattwa Mukherjee

Email: mukherjee_suddhwa@yahoo.co.in

Phone: +91 9830135111 (M)

Potrebbero piacerti anche

- (Gkmojo) November 2021 File: Important Days of NovemberDocumento34 pagine(Gkmojo) November 2021 File: Important Days of NovemberIshaan KumarNessuna valutazione finora

- Frigid Zone Chapter Back Exercise and Concept MapDocumento3 pagineFrigid Zone Chapter Back Exercise and Concept MapIshaan KumarNessuna valutazione finora

- Food and Beverage Revenue ForecastDocumento10 pagineFood and Beverage Revenue ForecastJose BarajasNessuna valutazione finora

- Farm-Plus Pitch DeckDocumento19 pagineFarm-Plus Pitch DeckIshaan KumarNessuna valutazione finora

- Farm-Plus: "The Helping Hand"Documento10 pagineFarm-Plus: "The Helping Hand"Ishaan KumarNessuna valutazione finora

- Karnatic StockDocumento53 pagineKarnatic StockIshaan KumarNessuna valutazione finora

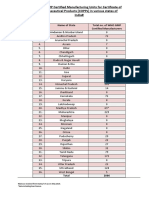

- List of API: Product Cas No. End Use (Category)Documento4 pagineList of API: Product Cas No. End Use (Category)Ishaan KumarNessuna valutazione finora

- Business Analytics and Research Major ProjectDocumento17 pagineBusiness Analytics and Research Major ProjectIshaan KumarNessuna valutazione finora

- GLP CertificateDocumento2 pagineGLP CertificateIshaan KumarNessuna valutazione finora

- Greenpanel Wood Floors BrochureDocumento22 pagineGreenpanel Wood Floors BrochureIshaan KumarNessuna valutazione finora

- Farmplus New - 090122Documento18 pagineFarmplus New - 090122Ishaan KumarNessuna valutazione finora

- List of Biotech Companies in Mumbai PDFDocumento17 pagineList of Biotech Companies in Mumbai PDFaniket100% (1)

- Apteka - Participants - Profile1Documento26 pagineApteka - Participants - Profile1Gurukrushna PatnaikNessuna valutazione finora

- Greenpanel Wood Floors BrochureDocumento22 pagineGreenpanel Wood Floors BrochureIshaan KumarNessuna valutazione finora

- Ishaan Kumar: Professional SummaryDocumento2 pagineIshaan Kumar: Professional SummaryIshaan KumarNessuna valutazione finora

- Project Report: Financial and Investment Planning in Reference To Mutual Funds IndustryDocumento27 pagineProject Report: Financial and Investment Planning in Reference To Mutual Funds IndustryIshaan KumarNessuna valutazione finora

- List Who GMPDocumento126 pagineList Who GMPAnonymous 3LiDeGpOc100% (1)

- GLP CertificateDocumento2 pagineGLP CertificateIshaan KumarNessuna valutazione finora

- Name: Aman Arya: Client Information Ideal Benchmarks, If AnyDocumento4 pagineName: Aman Arya: Client Information Ideal Benchmarks, If AnyIshaan KumarNessuna valutazione finora

- RUMGCO Certificate of Analysis for Naltrexone HydrochlorideDocumento1 paginaRUMGCO Certificate of Analysis for Naltrexone HydrochlorideIshaan KumarNessuna valutazione finora

- Facilities LISTDocumento22 pagineFacilities LISTIshaan KumarNessuna valutazione finora

- Financial and Investment Planning in Reference To Mutual Funds IndustryDocumento18 pagineFinancial and Investment Planning in Reference To Mutual Funds IndustryIshaan KumarNessuna valutazione finora

- Application Form GD200074477Documento3 pagineApplication Form GD200074477Ishaan KumarNessuna valutazione finora

- Certificate of Experience for Ishaan Kumar at Amplify Wealth ConsultantsDocumento1 paginaCertificate of Experience for Ishaan Kumar at Amplify Wealth ConsultantsIshaan KumarNessuna valutazione finora

- Divyanish RTTDocumento7 pagineDivyanish RTTIshaan KumarNessuna valutazione finora

- In Memory of Beloved Smt. Krishna RaniDocumento1 paginaIn Memory of Beloved Smt. Krishna RaniIshaan KumarNessuna valutazione finora

- Test Report: Test Results Biol. Ref. Result For Sars-Cov-2 (Covid-19) Negative CT Value of Orf1Ab Gene (If Positive)Documento2 pagineTest Report: Test Results Biol. Ref. Result For Sars-Cov-2 (Covid-19) Negative CT Value of Orf1Ab Gene (If Positive)Ishaan KumarNessuna valutazione finora

- Financial and Investment Planning in Reference To Mutual Funds IndustryDocumento16 pagineFinancial and Investment Planning in Reference To Mutual Funds IndustryIshaan KumarNessuna valutazione finora

- Collage On HTML BY-Aashreya 10 Alpha: Hyper Text Markup LanguageDocumento1 paginaCollage On HTML BY-Aashreya 10 Alpha: Hyper Text Markup LanguageIshaan KumarNessuna valutazione finora

- Collage On Cyber CrimeDocumento1 paginaCollage On Cyber CrimeIshaan KumarNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- User Manual: Imagenet Lite™ SoftwareDocumento93 pagineUser Manual: Imagenet Lite™ SoftwareDe Mohamed KaraNessuna valutazione finora

- Innovations in Teaching-Learning ProcessDocumento21 pagineInnovations in Teaching-Learning ProcessNova Rhea GarciaNessuna valutazione finora

- Multiple Choice Questions Class Viii: GeometryDocumento29 pagineMultiple Choice Questions Class Viii: GeometrySoumitraBagNessuna valutazione finora

- UCO Reporter 2021, December Edition, November 26, 2021Documento40 pagineUCO Reporter 2021, December Edition, November 26, 2021ucopresident100% (2)

- Unit 20: Where Is Sapa: 2.look, Read and CompleteDocumento4 pagineUnit 20: Where Is Sapa: 2.look, Read and CompleteNguyenThuyDungNessuna valutazione finora

- Schneider Electric Strategy PresentationDocumento10 pagineSchneider Electric Strategy PresentationDeepie KaurNessuna valutazione finora

- Kinds of Variables and Their UsesDocumento22 pagineKinds of Variables and Their UsesJulie Ann Baltazar Gonzales100% (1)

- David Emmett & Graeme Nice - What You Need To Know About Cannabis - Understanding The FactsDocumento120 pagineDavid Emmett & Graeme Nice - What You Need To Know About Cannabis - Understanding The FactsJovana StojkovićNessuna valutazione finora

- 1888 Speth Ars Quatuor Coronatorum v1Documento280 pagine1888 Speth Ars Quatuor Coronatorum v1Paulo Sequeira Rebelo100% (2)

- Test Initial Engleza A 8a Cu Matrice Si BaremDocumento4 pagineTest Initial Engleza A 8a Cu Matrice Si BaremTatiana BeileșenNessuna valutazione finora

- Facebook Use Case Diagram Activity Diagram Sequence DiagramDocumento21 pagineFacebook Use Case Diagram Activity Diagram Sequence DiagramSaiNessuna valutazione finora

- 3DO For IPDocumento7 pagine3DO For IPHannah Angela NiñoNessuna valutazione finora

- Phonetics Exercises PDFDocumento2 paginePhonetics Exercises PDFShanti YuliastitiNessuna valutazione finora

- Reserve Management Parts I and II WBP Public 71907Documento86 pagineReserve Management Parts I and II WBP Public 71907Primo KUSHFUTURES™ M©QUEENNessuna valutazione finora

- Hold-Up?" As He Simultaneously Grabbed The Firearm of Verzosa. WhenDocumento2 pagineHold-Up?" As He Simultaneously Grabbed The Firearm of Verzosa. WhenVener MargalloNessuna valutazione finora

- FA Program BrochureDocumento25 pagineFA Program BrochureThandolwenkosi NyoniNessuna valutazione finora

- 11th House of IncomeDocumento9 pagine11th House of IncomePrashanth Rai0% (1)

- Republic of Indonesia's Sovereign Immunity Upheld in Contract DisputeDocumento2 pagineRepublic of Indonesia's Sovereign Immunity Upheld in Contract DisputeEllis Lagasca100% (2)

- Lincoln's Last Trial by Dan AbramsDocumento6 pagineLincoln's Last Trial by Dan AbramsdosatoliNessuna valutazione finora

- Geometry First 9 Weeks Test Review 1 2011Documento6 pagineGeometry First 9 Weeks Test Review 1 2011esvraka1Nessuna valutazione finora

- Ar 318Documento88 pagineAr 318Jerime vidadNessuna valutazione finora

- Tthe Sacrament of Reconciliation1Documento47 pagineTthe Sacrament of Reconciliation1Rev. Fr. Jessie Somosierra, Jr.Nessuna valutazione finora

- Philippine Bank of Communications Vs Commissioner of Internal RevenueDocumento2 paginePhilippine Bank of Communications Vs Commissioner of Internal RevenueNFNL100% (1)

- MR GMAT Combinatorics+Probability 6EDocumento176 pagineMR GMAT Combinatorics+Probability 6EKsifounon KsifounouNessuna valutazione finora

- FAQs MHA RecruitmentDocumento6 pagineFAQs MHA RecruitmentRohit AgrawalNessuna valutazione finora

- IDocumento8 pagineICarlaSampaioNessuna valutazione finora

- 41720105Documento4 pagine41720105renu tomarNessuna valutazione finora

- Exam 2 Study GuideDocumento11 pagineExam 2 Study GuideAnonymous ewJy7jyvNNessuna valutazione finora

- (AC-S08) Week 08 - Pre-Task - Quiz - Weekly Quiz - INGLES III (14653)Documento3 pagine(AC-S08) Week 08 - Pre-Task - Quiz - Weekly Quiz - INGLES III (14653)Eduardo Arucutipa60% (5)

- STSDSD QuestionDocumento12 pagineSTSDSD QuestionAakash DasNessuna valutazione finora