Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Adjusting Entries

Caricato da

Jocelyn D. Descartin Lpt0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

24 visualizzazioni53 pagineABM-1

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoABM-1

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

24 visualizzazioni53 pagineAdjusting Entries

Caricato da

Jocelyn D. Descartin LptABM-1

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 53

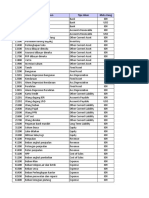

DATE Account Title and Explanation Ref.

Debit Credit

DEC. xx Depreciation Expense P xxx,xxx.xx

Accumulated Depreciation P xxx,xxx.xx

record depreciation of PPE

DATE Account Title and Explanation Ref. Debit Credit

DEC. xx Depreciation Expense P 600,000

Accumulated Depreciation P 600,000

record depreciation of PPE

DATE Account Title and Explanation Ref. Debit Credit

DEC. xx Bad Debts Expense P xxx,xxx.xx

Allowance for Doubtful Accounts P xxx,xxx.xx

To record allowances for

receivables that cannot be

collected

DATE Account Title and Explanation Ref. Debit Credit

DEC. xx Bad Debts Expense P 50,000

Allowance for Doubtful Accounts P 50,000

To record allowances for

receivables that cannot be

collected

DATE Account Title and Explanation Ref. Debit Credit

DEC. xx Allowance for Doubtful Accounts P 20,000

Accounts Receivable P 20,000

To record receivables that cannot

be collected

DATE Account Title and Explanation Ref. Debit Credit

DEC. xx Prepaid Expense P xxx,xxx

Cash P xxx,xxx

To record prepaid expense

DATE Account Title and Explanation Ref. Debit Credit

DEC. xx Expense P xxx,xxx

Prepaid Expense P xxx,xxx

To record prepaid expense incurred

DATE Account Title and Explanation Ref. Debit Credit

DEC. xx Expense P xxx,xxx

Accrued Expense Payable P xxx,xxx

To record accrued expense

DATE Account Title and Explanation Ref. Debit Credit

DEC. xx Cash P xxx,xxx

Unearned Revenue P xxx,xxx

To record unearned revenue

DATE Account Title and Explanation Ref. Debit Credit

DEC. xx Unearned Revenue P xxx,xxx

Revenue P xxx,xxx

To record earned revenue

DATE Account Title and Explanation Ref. Debit Credit

DEC. xx Receivable P xxx,xxx

Revenue P xxx,xxx

To record revenue to be collected

Potrebbero piacerti anche

- Date Account Titles and Explanation P.R. Debit Credit: General JournalDocumento40 pagineDate Account Titles and Explanation P.R. Debit Credit: General JournalThanh UyênNessuna valutazione finora

- Theory/Simple Accounting Process:: Booking Double Entries: T-Accounts Forms of AccountsDocumento45 pagineTheory/Simple Accounting Process:: Booking Double Entries: T-Accounts Forms of AccountsYen Nguyen HaiNessuna valutazione finora

- Lembar Jawab Tugas Pertemuan 9Documento17 pagineLembar Jawab Tugas Pertemuan 9Johanes Priyandika DjatiNessuna valutazione finora

- Recording of Business TransactionsDocumento30 pagineRecording of Business TransactionsAnthony John BrionesNessuna valutazione finora

- Sample Ws Chap 4Documento52 pagineSample Ws Chap 4Thanh UyênNessuna valutazione finora

- Ch01 - 04 - Sample Blank WS, GJ, GLDocumento42 pagineCh01 - 04 - Sample Blank WS, GJ, GLThanh UyênNessuna valutazione finora

- Format Uts Lab PaDocumento13 pagineFormat Uts Lab PaMarsa ArrahmanNessuna valutazione finora

- Set 1periodic PDFDocumento13 pagineSet 1periodic PDFNhajNessuna valutazione finora

- Original journal entriesDocumento13 pagineOriginal journal entriesKen Marl BesanesNessuna valutazione finora

- Special Journals TemplateDocumento6 pagineSpecial Journals TemplateJoana TrinidadNessuna valutazione finora

- Lembar Jawab PT SemestaDocumento101 pagineLembar Jawab PT SemestaEsti RuwandaniNessuna valutazione finora

- Date Account Titles Ref Debit Credit: Page No.Documento11 pagineDate Account Titles Ref Debit Credit: Page No.Tri JayNessuna valutazione finora

- Assignment #5 Chapter 6.Documento15 pagineAssignment #5 Chapter 6.ValentinaNessuna valutazione finora

- Dole Distributor Case ProblemDocumento13 pagineDole Distributor Case ProblemaapNessuna valutazione finora

- Lembar Kerja Salon CantikDocumento26 pagineLembar Kerja Salon CantikFanisa CantickaNessuna valutazione finora

- Unit Test: The Accounting Cycle Part A: Completing The Accounting CycleDocumento7 pagineUnit Test: The Accounting Cycle Part A: Completing The Accounting CycleKevin PanesarNessuna valutazione finora

- Grace Corporation Confirmation of Bank Balances DECEMBER 31, 20X1Documento2 pagineGrace Corporation Confirmation of Bank Balances DECEMBER 31, 20X1Joshua ComerosNessuna valutazione finora

- 10D 2Documento20 pagine10D 2Hidalgo, John Christian MunarNessuna valutazione finora

- Bookkeeping NCIII Institutional AssessmentDocumento21 pagineBookkeeping NCIII Institutional AssessmentCary Jaucian100% (1)

- Accountingtemplates1 Prob 7Documento20 pagineAccountingtemplates1 Prob 7Mc Clent CervantesNessuna valutazione finora

- Module 1 Excel Template MasterDocumento13 pagineModule 1 Excel Template MasterkobakoleonieNessuna valutazione finora

- Confirmation LetterDocumento3 pagineConfirmation Letter0506sheltonNessuna valutazione finora

- Botika Royal General Ledger Trial BalanceDocumento72 pagineBotika Royal General Ledger Trial BalanceRedJaladNessuna valutazione finora

- Ann Reyes General LedgersDocumento4 pagineAnn Reyes General LedgersDianeNessuna valutazione finora

- Print OutDocumento3 paginePrint OutJiro MatayaNessuna valutazione finora

- Account Name Account Number: Bengkel Servis Motor Sejat Trial Balance Pe 31 December 2004Documento30 pagineAccount Name Account Number: Bengkel Servis Motor Sejat Trial Balance Pe 31 December 2004Rynda Nur AenyNessuna valutazione finora

- CHAPTER 3 - THE ADJUSTING PROCESS - TEMPLATEDocumento6 pagineCHAPTER 3 - THE ADJUSTING PROCESS - TEMPLATEphuongmin417Nessuna valutazione finora

- LEMBAR JAWABAN Akuntansi KosongDocumento39 pagineLEMBAR JAWABAN Akuntansi Kosongmr.wolfvin1Nessuna valutazione finora

- Template Excel Pengantar AkuntansiiDocumento15 pagineTemplate Excel Pengantar AkuntansiiKim SeokjinNessuna valutazione finora

- Journal LedgerDocumento50 pagineJournal LedgerShevina Maghari shsnohsNessuna valutazione finora

- Daisy's Landscaping ServicesDocumento13 pagineDaisy's Landscaping ServicesHYOBIN KIMNessuna valutazione finora

- Business financial recordsDocumento8 pagineBusiness financial recordsSaba AfzaalNessuna valutazione finora

- Accounts Receivable Subsidiary Ledger: Date Explanations/Particulars PR Debit Credit BalanceDocumento5 pagineAccounts Receivable Subsidiary Ledger: Date Explanations/Particulars PR Debit Credit BalanceNerish PlazaNessuna valutazione finora

- Check Register Book, 8,5x11 Inch, 120p, No BleedDocumento120 pagineCheck Register Book, 8,5x11 Inch, 120p, No BleedMarian TurcuNessuna valutazione finora

- fabm1_q3_mod9_trialbalanceDocumento11 paginefabm1_q3_mod9_trialbalanceXedric JuantaNessuna valutazione finora

- Guide to General Journal and Ledger EntriesDocumento5 pagineGuide to General Journal and Ledger EntriesVivin ErminaNessuna valutazione finora

- General Journal: Date Description Reff Debit CreditDocumento16 pagineGeneral Journal: Date Description Reff Debit CreditAhmad RahbaniNessuna valutazione finora

- Pre-Assessment ReviewDocumento6 paginePre-Assessment ReviewKelly TesoreroNessuna valutazione finora

- Accounting Perpetual TemplateDocumento11 pagineAccounting Perpetual TemplatePrincess Kayla BayudanNessuna valutazione finora

- Accounting Perpetual TemplateDocumento11 pagineAccounting Perpetual TemplatePrincess Kayla BayudanNessuna valutazione finora

- Account No. Account Titles Debit CreditDocumento11 pagineAccount No. Account Titles Debit CreditMar JinitaNessuna valutazione finora

- Ferrer Alastair 1 Midterm Landing On You FormatDocumento16 pagineFerrer Alastair 1 Midterm Landing On You FormatBuquid Noriel M. 41Nessuna valutazione finora

- Kristina Sangupan - (Template) PETA - Special JournalsDocumento15 pagineKristina Sangupan - (Template) PETA - Special JournalsAngelo ReyesNessuna valutazione finora

- Pro-Forma Journal EntriesDocumento4 paginePro-Forma Journal EntriesAdam CuencaNessuna valutazione finora

- Buku BesarrrDocumento10 pagineBuku Besarrr030NisaAAdbisNessuna valutazione finora

- 01-28-2022 CRC-ACE - AFAR - Week 01 - Accounting For Partnership - Part 1 FormationDocumento5 pagine01-28-2022 CRC-ACE - AFAR - Week 01 - Accounting For Partnership - Part 1 Formationjohn francisNessuna valutazione finora

- Assignment No 2 FinalDocumento14 pagineAssignment No 2 FinalMuhammad AwaisNessuna valutazione finora

- Part Service FormsDocumento10 paginePart Service FormsjennalynjacalaNessuna valutazione finora

- Template AkuntansiDocumento15 pagineTemplate AkuntansiM Daiko S PNessuna valutazione finora

- GNCIIIDocumento16 pagineGNCIIIAR Datalink Computer CenterNessuna valutazione finora

- BB PT Sentosa ManufakturDocumento26 pagineBB PT Sentosa ManufakturSiti ZahraNessuna valutazione finora

- MERCHANDISINGDocumento30 pagineMERCHANDISINGJerlyn SaynoNessuna valutazione finora

- Special Journal AnswerDocumento6 pagineSpecial Journal AnswerHazel DimaanoNessuna valutazione finora

- Problem Special JournalsDocumento6 pagineProblem Special JournalsCarmi Fecero100% (2)

- Journal Book1Documento6 pagineJournal Book1karenlasuncionNessuna valutazione finora

- Chapter 6 Brief ExercisesDocumento8 pagineChapter 6 Brief ExercisesPatrick YazbeckNessuna valutazione finora

- Presentation ON General Ledger & Trail BalanceDocumento14 paginePresentation ON General Ledger & Trail BalanceNumanNessuna valutazione finora

- Business-Transactions-and-Their-Analysis-as-Applied-to-Service-BusinessDocumento57 pagineBusiness-Transactions-and-Their-Analysis-as-Applied-to-Service-BusinessRhona Primne ServañezNessuna valutazione finora

- PricewaterhouseCoopers' Guide to the New Tax RulesDa EverandPricewaterhouseCoopers' Guide to the New Tax RulesNessuna valutazione finora

- UsersofaccounitnginformationDocumento20 pagineUsersofaccounitnginformationJocelyn D. Descartin LptNessuna valutazione finora

- Introduction to Accounting FundamentalsDocumento35 pagineIntroduction to Accounting FundamentalsJocelyn D. Descartin LptNessuna valutazione finora

- Introduction to Accounting FundamentalsDocumento35 pagineIntroduction to Accounting FundamentalsJocelyn D. Descartin LptNessuna valutazione finora

- Type of BusinessDocumento24 pagineType of BusinessJocelyn D. Descartin LptNessuna valutazione finora

- Types of Speech StyleDocumento12 pagineTypes of Speech StyleJocelyn D. Descartin LptNessuna valutazione finora

- Buying and SellingDocumento36 pagineBuying and SellingJocelyn D. Descartin LptNessuna valutazione finora

- Balance Sheet of Mahindra&Mahindra L.T.D: LiabilitiesDocumento2 pagineBalance Sheet of Mahindra&Mahindra L.T.D: LiabilitiesDelectable Food DiariesNessuna valutazione finora

- ACCA F3 Control Accounts and Incomplete Records Questions2Documento6 pagineACCA F3 Control Accounts and Incomplete Records Questions2Amos OkechNessuna valutazione finora

- Lecture 4-Capital BudgetingDocumento38 pagineLecture 4-Capital BudgetingadmiremukureNessuna valutazione finora

- Annual Report Non-Profit making Organizations (AR NPODocumento15 pagineAnnual Report Non-Profit making Organizations (AR NPOSibaprasad DashNessuna valutazione finora

- Cost Concepts and Behavior ChapterDocumento3 pagineCost Concepts and Behavior ChapterPattraniteNessuna valutazione finora

- Acquisition Improvements and Sale of Realty Tonkawa Company Pu PDFDocumento1 paginaAcquisition Improvements and Sale of Realty Tonkawa Company Pu PDFAnbu jaromiaNessuna valutazione finora

- SAR-MAR-210422-1227PM - RR - 034-COPY 1.editedDocumento12 pagineSAR-MAR-210422-1227PM - RR - 034-COPY 1.editedJishnu ChaudhuriNessuna valutazione finora

- Tata Steel AnalysisDocumento16 pagineTata Steel AnalysisVivek PandeyNessuna valutazione finora

- Capital Alliance PLC Interim Financial StatementsDocumento10 pagineCapital Alliance PLC Interim Financial Statementskasun witharanaNessuna valutazione finora

- Ceat Balance SheetDocumento2 pagineCeat Balance Sheetkcr kc100% (2)

- ACCT403-Accounting For InventoryDocumento63 pagineACCT403-Accounting For InventoryMary AmoNessuna valutazione finora

- Managerial Accounting Midterm ExamDocumento9 pagineManagerial Accounting Midterm ExamElaine ChiaNessuna valutazione finora

- Partnership Operation Practice Problems PDFDocumento11 paginePartnership Operation Practice Problems PDFMeleen TadenaNessuna valutazione finora

- CA Assignment-2 LT (R) Abdul Ghaffar 10066Documento3 pagineCA Assignment-2 LT (R) Abdul Ghaffar 10066Abdul GhaffarNessuna valutazione finora

- FRA ProjectDocumento63 pagineFRA ProjectRisa SahaNessuna valutazione finora

- FM Case Study 4Documento7 pagineFM Case Study 4Arush BahglaNessuna valutazione finora

- CCL Financial AnalysisDocumento66 pagineCCL Financial Analysisdharmisthanitin100% (2)

- Analyze financial statements with ratios and analysesDocumento40 pagineAnalyze financial statements with ratios and analysesPhương Anh VũNessuna valutazione finora

- Quiz 1-Current LiabDocumento11 pagineQuiz 1-Current LiabBadAssNessuna valutazione finora

- EDreams ODIGEO FY 2017 Annual ReportDocumento232 pagineEDreams ODIGEO FY 2017 Annual ReportmailimailiNessuna valutazione finora

- Sol05 4eDocumento74 pagineSol05 4eFathurNessuna valutazione finora

- ACCOUNTING FOR CORPORATIONS-Retained EarningsDocumento53 pagineACCOUNTING FOR CORPORATIONS-Retained EarningsMarriel Fate Cullano100% (3)

- Financial Report On Civil BankDocumento38 pagineFinancial Report On Civil BankSrijana BhusalNessuna valutazione finora

- Cell Phone Shop FinalDocumento26 pagineCell Phone Shop Finalapi-249675528Nessuna valutazione finora

- ALBRANDO - Final ExamDocumento2 pagineALBRANDO - Final ExamNoreen AlbrandoNessuna valutazione finora

- Discontinued OperationsDocumento22 pagineDiscontinued OperationsJeff KinutsNessuna valutazione finora

- Daftar Akun PT Prima ElektorikDocumento4 pagineDaftar Akun PT Prima ElektorikSalma AfriyaniNessuna valutazione finora

- On January 1 2012 B Langer Acquired A 30 Interest in PDFDocumento1 paginaOn January 1 2012 B Langer Acquired A 30 Interest in PDFhassan taimourNessuna valutazione finora

- MOJAKOE AK1 UTS 2010 GasalDocumento10 pagineMOJAKOE AK1 UTS 2010 GasalVincenttio le CloudNessuna valutazione finora

- Summary of Pas 2 Inventories PDFDocumento4 pagineSummary of Pas 2 Inventories PDFJimbo Manalastas50% (2)