Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

76 80

Caricato da

CleoDolina0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

47 visualizzazioni6 pagine1. Taxpayers under the 8% commuted tax option will be invalidated and subjected to regular income tax for the year. Any 8% tax paid can be used as a credit against income tax due.

2. VAT-registrable taxpayers must register for VAT before the end of the month after monthly sales exceed P3M, and are subject to VAT on all past sales from that date without input tax credit.

3. Taxpayers can voluntarily register for VAT up to 10 days before a quarter begins, which allows for zero-rating of export sales.

Descrizione originale:

BUSINESS TAXATION CHAPTER 1

Titolo originale

76-80

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documento1. Taxpayers under the 8% commuted tax option will be invalidated and subjected to regular income tax for the year. Any 8% tax paid can be used as a credit against income tax due.

2. VAT-registrable taxpayers must register for VAT before the end of the month after monthly sales exceed P3M, and are subject to VAT on all past sales from that date without input tax credit.

3. Taxpayers can voluntarily register for VAT up to 10 days before a quarter begins, which allows for zero-rating of export sales.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

47 visualizzazioni6 pagine76 80

Caricato da

CleoDolina1. Taxpayers under the 8% commuted tax option will be invalidated and subjected to regular income tax for the year. Any 8% tax paid can be used as a credit against income tax due.

2. VAT-registrable taxpayers must register for VAT before the end of the month after monthly sales exceed P3M, and are subject to VAT on all past sales from that date without input tax credit.

3. Taxpayers can voluntarily register for VAT up to 10 days before a quarter begins, which allows for zero-rating of export sales.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 6

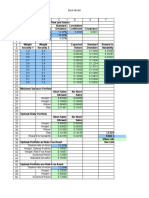

Under the 8% Commuted Tax Option

1. Option to the 8% income tax SHALL BE INVALIDATED.

2. Shall be subjected to REGULAR INCOME TAX for the entire year

3. 8% commuted tax as TAX CREDIT against regular income tax due

4. Will pay VAT starting the month after the receipts exceeded P3M

Assessment of percentage tax: must cover all sales or receipts realized

prior to the VAT registration

Non-registration as VAT taxpayer

Case: Failure to update VAT registration and paid percentage tax

• Vat-registrable taxpayers are subject to VAT without the benefit of

input VAT in the period they are not properly registered. (Penalty for

registrable persons)

• Shall file a claim for refund or credit as it is an erroneous payment of

tax considering that VAT should have been paid for that month

Timing of Vat Registration

1. With an expectation to exceed the VAT threshold within 12 month

VAT registration + registration of new business or trade

2. Exceeding the VAT threshold

VAT registration before the end of the month following the month the thresold

exceeded

3. Franchise grantees of radio and television broadcasting, whose gross

annual receipt for the preceding calendar year exceeded P10M

VAT registration within 30 days frim the end of the calendar year

4. Below the threshold but opt to be registered as VAT taxpayer

Register not later than 10 days before the beginning of the taxable quarter

VAT Treatment of exempt transactions

A VAT-registered taxpayer who enters into a vat-exempt

transaction (i.e. mixed transactions) may also opt that the

VAT apply to his transactions which would have been

exempt under Section 109 of the NIRC.

Essence of voluntary the VAT registration

This option is beneficial for taxpayers who are into expert

business so that their export sales would be zero-rated

rather than merely exempt.

The optional VAT registration is not allowed to seld-

employed and or professional individuals who opted to

the 8% commuted tax under income taxation.

Revicability of VAT registration

1. Franchise grantees of radio or television, whether voluntary or

mandatory, is perpetually irrevocable.

2. 3-year lock-in period

Any person, other than franchise rantees of radio or television, who voluntarily

registered as VAT taxpayers shall not be allowed to cancel their VAT

registration for the next 3 years.

3. Registered as VAT taxpayers with an expectation to exceed the VAT

threshold but failed to exceed the same within 12 months of

operation may apply for cancellation of VAT registration.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Floret Fall Mini Course Dahlia Sources Updated 211012Documento3 pagineFloret Fall Mini Course Dahlia Sources Updated 211012Luthfian DaryonoNessuna valutazione finora

- Faraz Chem ProjectDocumento13 pagineFaraz Chem ProjectFaraz AhmedNessuna valutazione finora

- Carolyn Green Release FinalDocumento3 pagineCarolyn Green Release FinalAlex MilesNessuna valutazione finora

- Aplikasi Metode Geomagnet Dalam Eksplorasi Panas BumiDocumento10 pagineAplikasi Metode Geomagnet Dalam Eksplorasi Panas Bumijalu sri nugrahaNessuna valutazione finora

- Course Guide Pe1 PDFDocumento4 pagineCourse Guide Pe1 PDFrahskkNessuna valutazione finora

- E-Kabin - O Series - Monoblock Enclosure - ENGDocumento12 pagineE-Kabin - O Series - Monoblock Enclosure - ENGCatalina CocoşNessuna valutazione finora

- A Review On Bioactive Compounds of Beet Beta Vulgaris L Subsp Vulgaris With Special Emphasis On Their Beneficial Effects On Gut Microbiota and Gastrointestinal HealthDocumento13 pagineA Review On Bioactive Compounds of Beet Beta Vulgaris L Subsp Vulgaris With Special Emphasis On Their Beneficial Effects On Gut Microbiota and Gastrointestinal HealthWinda KhosasiNessuna valutazione finora

- CP 1Documento22 pagineCP 1api-3757791100% (1)

- ECC83/12AX7: Quick Reference DataDocumento4 pagineECC83/12AX7: Quick Reference DataLuisNessuna valutazione finora

- Beckhoff Service Tool - USB StickDocumento7 pagineBeckhoff Service Tool - USB StickGustavo VélizNessuna valutazione finora

- Family Stress TheoryDocumento10 pagineFamily Stress TheoryKarina Megasari WinahyuNessuna valutazione finora

- Emerging Re-Emerging Infectious Disease 2022Documento57 pagineEmerging Re-Emerging Infectious Disease 2022marioNessuna valutazione finora

- Lesson 49Documento2 pagineLesson 49Андрій ХомишакNessuna valutazione finora

- Chapter 7 Unemployment, Inflation, and Long-Run GrowthDocumento21 pagineChapter 7 Unemployment, Inflation, and Long-Run GrowthNataly FarahNessuna valutazione finora

- AERO241 Example 10Documento4 pagineAERO241 Example 10Eunice CameroNessuna valutazione finora

- Intoduction To WeldingDocumento334 pagineIntoduction To WeldingAsad Bin Ala QatariNessuna valutazione finora

- Boeco BM-800 - User ManualDocumento21 pagineBoeco BM-800 - User ManualJuan Carlos CrespoNessuna valutazione finora

- Inked CultureDocumento90 pagineInked Culturemar phisNessuna valutazione finora

- Jurnal SOL MeningiomaDocumento6 pagineJurnal SOL MeningiomaConnie SianiparNessuna valutazione finora

- SA01 GENXXX SDIN BSDS 0001 B04 A - Instrumentation Design Basis Sazeh CommentedDocumento31 pagineSA01 GENXXX SDIN BSDS 0001 B04 A - Instrumentation Design Basis Sazeh Commentedamini_mohiNessuna valutazione finora

- Endothermic Gas Production Overview: Tmosphere Ngineering OmpanyDocumento6 pagineEndothermic Gas Production Overview: Tmosphere Ngineering OmpanyJhon ChitNessuna valutazione finora

- G.R. No. 178741Documento1 paginaG.R. No. 178741Jefferson BagadiongNessuna valutazione finora

- Anatomy of The SkinDocumento28 pagineAnatomy of The Skinay254Nessuna valutazione finora

- BKM 10e Ch07 Two Security ModelDocumento2 pagineBKM 10e Ch07 Two Security ModelJoe IammarinoNessuna valutazione finora

- EF4e Beg Quicktest 05Documento3 pagineEF4e Beg Quicktest 05terrenoruralcamboriuNessuna valutazione finora

- As Level Chemistry Practical Paper 3 - GCE GuideDocumento1 paginaAs Level Chemistry Practical Paper 3 - GCE GuideJamal AldaliNessuna valutazione finora

- Metallurgical Test Report: NAS Mexico SA de CV Privada Andres Guajardo No. 360 Apodaca, N.L., C.P. 66600 MexicoDocumento1 paginaMetallurgical Test Report: NAS Mexico SA de CV Privada Andres Guajardo No. 360 Apodaca, N.L., C.P. 66600 MexicoEmigdio MartinezNessuna valutazione finora

- Dissertation On: To Asses The Impact of Organizational Retention Strategies On Employee Turnover: A Case of TescoDocumento44 pagineDissertation On: To Asses The Impact of Organizational Retention Strategies On Employee Turnover: A Case of TescoAhnafTahmidNessuna valutazione finora

- Manual of GardeningDocumento812 pagineManual of GardeningPrakash PatelNessuna valutazione finora

- Full Test Bank For Health Economics and Policy 7Th Edition Henderson PDF Docx Full Chapter ChapterDocumento34 pagineFull Test Bank For Health Economics and Policy 7Th Edition Henderson PDF Docx Full Chapter Chapterpeeepochaq15d100% (9)