Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CRM in Insurance

Caricato da

anilperfect100%(1)Il 100% ha trovato utile questo documento (1 voto)

689 visualizzazioni11 pagineThe document discusses customer relationship management (CRM) practices in the insurance industry. It begins by defining CRM as a strategic approach focused on satisfying customers to ensure customer retention and profitability. The objectives of the study are then outlined as understanding customer and employee perceptions of CRM practices and the level of employee empowerment. Secondary sources of data are also listed. The document goes on to describe CRM as a valuable corporate asset and elaborates on the three key steps of CRM in insurance: identifying potential customers, understanding customer needs and interactions, and meeting customer expectations. It discusses how CRM requires both a timely response and ongoing engagement. The conclusion reiterates that insurance companies are increasingly investing in CRM to provide individual attention to customers

Descrizione originale:

Titolo originale

CRM in Insurance .ppt

Copyright

© © All Rights Reserved

Formati disponibili

PPT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThe document discusses customer relationship management (CRM) practices in the insurance industry. It begins by defining CRM as a strategic approach focused on satisfying customers to ensure customer retention and profitability. The objectives of the study are then outlined as understanding customer and employee perceptions of CRM practices and the level of employee empowerment. Secondary sources of data are also listed. The document goes on to describe CRM as a valuable corporate asset and elaborates on the three key steps of CRM in insurance: identifying potential customers, understanding customer needs and interactions, and meeting customer expectations. It discusses how CRM requires both a timely response and ongoing engagement. The conclusion reiterates that insurance companies are increasingly investing in CRM to provide individual attention to customers

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

100%(1)Il 100% ha trovato utile questo documento (1 voto)

689 visualizzazioni11 pagineCRM in Insurance

Caricato da

anilperfectThe document discusses customer relationship management (CRM) practices in the insurance industry. It begins by defining CRM as a strategic approach focused on satisfying customers to ensure customer retention and profitability. The objectives of the study are then outlined as understanding customer and employee perceptions of CRM practices and the level of employee empowerment. Secondary sources of data are also listed. The document goes on to describe CRM as a valuable corporate asset and elaborates on the three key steps of CRM in insurance: identifying potential customers, understanding customer needs and interactions, and meeting customer expectations. It discusses how CRM requires both a timely response and ongoing engagement. The conclusion reiterates that insurance companies are increasingly investing in CRM to provide individual attention to customers

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 11

By

MR. PRATIK DWIVEDI

Assistant Professor, IIMT College of Management, Greater

Noida

MRS. ARCHANA KAUSHIK

Assistant Professor, IIMT College of Management, Greater Noida

INTRODUCTION

CRM : A Novel way to beat the odds

Customer Relationship Management (CRM) is a

combination of Strategies and that drives relationship

programs reproducing the entire organization to focus

on customers that satisfy.

In other words it is a systematic approach to serve

customers in such a way that customer retention and

profitability are insured in marketing.

OBJECTIVES OF THE STUDY

To study the perceptions of customers and

employees of insurance companies and their CRM

practices.

To study how empowered are the employees of the

organization to deliver superior service.

To study the customer knowledge strategy adopted.

SOURCES OF DATA

Secondary data comprised of existing published and

unpublished literature.

Previous research in the field of the present study.

Research journals, trade magazines and publications

insurance industry.

CRM a valuable corporate asset

Today CRM is recognized as a valuable asset.

"The process of CRM in insurance, which involves three

steps:

a) identifying the most potential customers

b) understanding the needs and buying patterns of the

customers.

c) interacting with the customers to meet their

expectations.

is elaborated. "

CRM SYSTEM

CRM (Customer Relationship

Management)

CRM is not just a time response but also a time

requirement.

Today's insurance industries are required to operate in

and out of customer -defined business environment.

They are unsure whether their client will be with them

tomorrow.

BENEFITS OF CRM - INSURANCE INDUSTRY

CONCLUSION

Paper explores the role and relevance of CRM in creating

sustainable relationships.

Insurance companies are investing a considerable amount

on CRM software and services to provide individual

attention to the customers.

Paper analyses the need of the hour is to understand what

customer really wants instead of investing blindly huge

amounts in attaining what the company feels about the

customer wants.

REFERENCES

Accenture Consulting (2002), “The Road to CRM Riches”, www.accenture.com;

Anderson, E.W., Fornell, C. & Lehmann, D.R. (1994) “Customer Satisfaction, Market Share &

Profitability: Findings From Sweden”, Journal of Marketing (58), July 1994.

Beckett, Camarata, E.J., Camarata, M.R. (1998), “Integrating Internal and External Customer

Relationships through Relationship Management: A Strategic Response to a Changing Global

Environment”, Journal of Business Research.

Flanagan, T. & Safdie (2002), E., “Building a Successful CRM Environment”,

http://www.techguide.com.

Kalakota, R. & Robinson, M. (1999), “Customer Relationship Management: Integrating

Processes to Build Relationships”, E-Business, Addison-Wesley: London.

Kos, A.J., Sockel, H.M & Falk, L.K., “Customer relationship management opportunities”, The

Ohio CPA Journal, January-March 2001.

Lee, S and Shu, W. (2001), “An integrative and complimentary based model for the design and

adoption of customer relationship management technologies”, Seventh Americas conference on

Information Systems.

Leverick, F., Littler, D., Bruce, M & Wilson, D. (1998), “Using Information Technology

Effectively: a study of marketing institutions”, Journal of Marketing Management.

Lin, T.W., and Shao, B.M. (1999). “The relationship between user participation and system

success: a simultaneous contingency approach”. Information and Management.

Davenport, T.H. (1993), Process Innovation, Harvard Business School Press, Boston, MA.

Insurance Regulatory and Development Authority (IRDA)

Potrebbero piacerti anche

- The New Wealth Paradigm For Financial FreedomDa EverandThe New Wealth Paradigm For Financial FreedomNessuna valutazione finora

- Building Customer RelationshipDocumento9 pagineBuilding Customer RelationshipDon Mario100% (1)

- D & C Car WashDocumento4 pagineD & C Car Washalsaban_7Nessuna valutazione finora

- Zei61945 ch01 PDFDocumento31 pagineZei61945 ch01 PDFAlena MatskevichNessuna valutazione finora

- Relationship Marketing in Banking PDFDocumento10 pagineRelationship Marketing in Banking PDFarvind3041990Nessuna valutazione finora

- Theories of International BusinessDocumento25 pagineTheories of International BusinessIam Jai100% (1)

- CRM in Insurance SectorDocumento2 pagineCRM in Insurance SectorKaran Singh ParmarNessuna valutazione finora

- Measuring and Managing Franchisee Satisfaction: A Study of Academic FranchisingDocumento9 pagineMeasuring and Managing Franchisee Satisfaction: A Study of Academic FranchisingfairusNessuna valutazione finora

- Segmentation Targeting and PositioningDocumento28 pagineSegmentation Targeting and Positioningدانيه ميمنNessuna valutazione finora

- Customer Expectations and Perceptions of ServiceDocumento15 pagineCustomer Expectations and Perceptions of ServiceShailendra DasariNessuna valutazione finora

- Customer Services: Meaning of Customer ServiceDocumento5 pagineCustomer Services: Meaning of Customer ServiceBoobalan RNessuna valutazione finora

- Madhu ... Kotler PPT ..PowerpointDocumento18 pagineMadhu ... Kotler PPT ..PowerpointMadhuri SinghviNessuna valutazione finora

- Selling StyleDocumento11 pagineSelling StyleAshirbad0% (1)

- Customer Relationship ManagementDocumento15 pagineCustomer Relationship ManagementTanoj PandeyNessuna valutazione finora

- Philip Kotler: Exchange ProcessDocumento12 paginePhilip Kotler: Exchange ProcesssandbrtNessuna valutazione finora

- Module - 3 MGMT of Sales Territory & Sales QuotaDocumento16 pagineModule - 3 MGMT of Sales Territory & Sales QuotapavithragowthamNessuna valutazione finora

- 29 - Relationship Marketing of ServicesDocumento10 pagine29 - Relationship Marketing of ServicesHelen Bala DoctorrNessuna valutazione finora

- On African RetailDocumento8 pagineOn African RetailrakeshNessuna valutazione finora

- Customer Relationship ManagementDocumento19 pagineCustomer Relationship ManagementSharon NgNessuna valutazione finora

- Online Vs Traditional CommerceDocumento9 pagineOnline Vs Traditional Commerceramanrockstar21Nessuna valutazione finora

- LifeStyle MarketingDocumento25 pagineLifeStyle MarketingMohit MehraNessuna valutazione finora

- Customer Relationship ManagementDocumento26 pagineCustomer Relationship ManagementManish Kumar Sinha100% (1)

- Data Collection Methods: ObservationDocumento24 pagineData Collection Methods: ObservationArdiansyah HermawanNessuna valutazione finora

- Global MarketingDocumento22 pagineGlobal MarketingRaajjj83% (6)

- An Overview of Customer Relationship ManagementDocumento4 pagineAn Overview of Customer Relationship Managementpashish77Nessuna valutazione finora

- Slides Personal SellingDocumento47 pagineSlides Personal SellingM Yasir AliNessuna valutazione finora

- 2 B2B Market SegmentationDocumento11 pagine2 B2B Market SegmentationAbhishek100% (1)

- Planning The Service EnvironmentDocumento20 paginePlanning The Service EnvironmentUtsav MahendraNessuna valutazione finora

- Creating Customer Value, Satisfaction, and LoyaltyDocumento14 pagineCreating Customer Value, Satisfaction, and LoyaltyJosette Christine CorpuzNessuna valutazione finora

- Business MarketingDocumento102 pagineBusiness MarketingBarbie TanNessuna valutazione finora

- Reference Group Influenec On Consumer BehaviourDocumento9 pagineReference Group Influenec On Consumer BehaviourGanesh Surve100% (1)

- Service EncounterDocumento19 pagineService EncounterAkshey Gaur100% (2)

- Sales ForceDocumento59 pagineSales Forcekarthick_49Nessuna valutazione finora

- Special Characteristics of ServicesDocumento3 pagineSpecial Characteristics of ServicesPritam SahaNessuna valutazione finora

- Customer Relationship Management in Bank PDFDocumento5 pagineCustomer Relationship Management in Bank PDFdemetrio vaccaNessuna valutazione finora

- Customer Relationship Management and Hospitality Industry in NigeriaDocumento35 pagineCustomer Relationship Management and Hospitality Industry in NigeriaNewman EnyiokoNessuna valutazione finora

- Executive SummeryDocumento102 pagineExecutive SummeryMansi Bhatt100% (1)

- Global Pricing DecisionsDocumento16 pagineGlobal Pricing DecisionsSanjay ShahNessuna valutazione finora

- CRM 1Documento71 pagineCRM 1Anonymous GVWIlk3ZNessuna valutazione finora

- Introduction To Customer Relationship ManagementDocumento45 pagineIntroduction To Customer Relationship ManagementMohammad FarazNessuna valutazione finora

- Assignment 3: Consumer LearningDocumento4 pagineAssignment 3: Consumer LearninglaibaNessuna valutazione finora

- The Relationship Marketing Process A Conceptualization and Application PDFDocumento14 pagineThe Relationship Marketing Process A Conceptualization and Application PDFkoreanguyNessuna valutazione finora

- Luxury BrandingDocumento45 pagineLuxury BrandingNahian Rahman RochiNessuna valutazione finora

- Marketing in InsuranceDocumento61 pagineMarketing in InsuranceAkashZote75% (4)

- CRM 1.PPT LectureDocumento9 pagineCRM 1.PPT Lectureashishdwivedi23100% (1)

- Chapter 1: Marketing - Creating Customer Value and EngagementDocumento12 pagineChapter 1: Marketing - Creating Customer Value and EngagementT.Thomas100% (1)

- Multi Channel RetailingDocumento19 pagineMulti Channel Retailingmanav badhwar100% (1)

- Customer Relationship Management (Chapter 1)Documento23 pagineCustomer Relationship Management (Chapter 1)Iftekhar Amin Chowdhury100% (2)

- Customer Relationship Management: Strategic Application of ItDocumento52 pagineCustomer Relationship Management: Strategic Application of ItShipra SrivastavaNessuna valutazione finora

- Entreprenuership Introduction and PerspectiveDocumento32 pagineEntreprenuership Introduction and PerspectiveMuhammad Asim ShahzadNessuna valutazione finora

- Tutorial 6Documento9 pagineTutorial 6FADZLIN SYAFIQAHNessuna valutazione finora

- Sales ManagementDocumento14 pagineSales ManagementIshaan SinglaNessuna valutazione finora

- Social Class and Consumer BehaviourDocumento20 pagineSocial Class and Consumer BehaviourShivani Khandelwal100% (1)

- Maintaining Loyal Customers and Customer Service Strategy 1200534669144167 2Documento58 pagineMaintaining Loyal Customers and Customer Service Strategy 1200534669144167 2Kumar SaurabhNessuna valutazione finora

- Managing Service QualityDocumento23 pagineManaging Service QualityAndres JacksonNessuna valutazione finora

- 1 Introduction KotlerDocumento37 pagine1 Introduction KotlerAjiteshwar ShuklaNessuna valutazione finora

- Marketing Information Systems & Market ResearchDocumento20 pagineMarketing Information Systems & Market ResearchJalaj Mathur100% (1)

- Marketing Management 081111Documento135 pagineMarketing Management 081111akkishajNessuna valutazione finora

- Assignment BancassuranceDocumento10 pagineAssignment BancassuranceGetrude Mvududu100% (4)

- Communication Process in DAGMAR ApproachDocumento4 pagineCommunication Process in DAGMAR ApproachAdam KissaneNessuna valutazione finora

- Linked Lists: ArraysDocumento2 pagineLinked Lists: ArraysanilperfectNessuna valutazione finora

- Introduction To Data StructuresDocumento1 paginaIntroduction To Data StructuresanilperfectNessuna valutazione finora

- Last in First Out: Linked List, Tree, Etc. A Programmer Selects An Appropriate Data Structure and Uses ItDocumento2 pagineLast in First Out: Linked List, Tree, Etc. A Programmer Selects An Appropriate Data Structure and Uses ItanilperfectNessuna valutazione finora

- Linked Lists: ArraysDocumento4 pagineLinked Lists: ArraysanilperfectNessuna valutazione finora

- LinkedDocumento1 paginaLinkedanilperfectNessuna valutazione finora

- DS PPTDocumento221 pagineDS PPTanilperfectNessuna valutazione finora

- Unit - 1 Introduction To Data Structures, Searching and SortingDocumento221 pagineUnit - 1 Introduction To Data Structures, Searching and SortinganilperfectNessuna valutazione finora

- Ds LN PDFDocumento166 pagineDs LN PDFanilperfectNessuna valutazione finora

- Project Report SSKDocumento12 pagineProject Report SSKanilperfectNessuna valutazione finora

- DDA LetterDocumento2 pagineDDA LetteranilperfectNessuna valutazione finora

- Sample C Programming Code For Bank ApplicationDocumento4 pagineSample C Programming Code For Bank ApplicationanilperfectNessuna valutazione finora

- N55f11918866af PDFDocumento5 pagineN55f11918866af PDFanilperfectNessuna valutazione finora

- Data Structures Using C & Object Oriented Programming Concepts Using C++ S. Y. B. Sc. (Computer Science)Documento50 pagineData Structures Using C & Object Oriented Programming Concepts Using C++ S. Y. B. Sc. (Computer Science)anilperfectNessuna valutazione finora

- C NotesDocumento197 pagineC Notesvikash_rs_258Nessuna valutazione finora

- Unit 2Documento2 pagineUnit 2anilperfectNessuna valutazione finora

- Unit - 2 Question BankDocumento10 pagineUnit - 2 Question BankanilperfectNessuna valutazione finora

- Pointers: Pointers in C Programming - Study MaterialDocumento5 paginePointers: Pointers in C Programming - Study MaterialanilperfectNessuna valutazione finora

- Unit 1Documento1 paginaUnit 1anilperfectNessuna valutazione finora

- Computer Programming Question Bank: Constant, or A String Literal. There Are Also Enumeration Constants As WellDocumento22 pagineComputer Programming Question Bank: Constant, or A String Literal. There Are Also Enumeration Constants As WellanilperfectNessuna valutazione finora

- Code For Calculator ApplicationDocumento3 pagineCode For Calculator ApplicationanilperfectNessuna valutazione finora

- Sample C Programming Code For Bank ApplicationDocumento4 pagineSample C Programming Code For Bank ApplicationanilperfectNessuna valutazione finora

- UNIT - 3 (Structures & Union) : SyntaxDocumento10 pagineUNIT - 3 (Structures & Union) : SyntaxanilperfectNessuna valutazione finora

- Unit Ii PC Modified VatsDocumento41 pagineUnit Ii PC Modified VatsanilperfectNessuna valutazione finora

- UNIT - 3 (Structures & Union) : Syntax ExampleDocumento11 pagineUNIT - 3 (Structures & Union) : Syntax ExampleanilperfectNessuna valutazione finora

- Unit II Arrays and StringsDocumento19 pagineUnit II Arrays and StringsanilperfectNessuna valutazione finora

- Contently Gap Analysis WorksheetDocumento4 pagineContently Gap Analysis WorksheetJones D. AsiegbuNessuna valutazione finora

- Ge 1Documento3 pagineGe 1Ali KhanNessuna valutazione finora

- Yahoo Consumer Direct Marries Purchase Metrics To Banner AdsDocumento4 pagineYahoo Consumer Direct Marries Purchase Metrics To Banner AdsTengku Muhammad Wahyudi100% (1)

- AccountDocumento47 pagineAccountAshwani KumarNessuna valutazione finora

- Cape Mob U2 P1 2016Documento7 pagineCape Mob U2 P1 2016leah hosten50% (4)

- A Report On Organization Study at - Doc11Documento67 pagineA Report On Organization Study at - Doc11Prakash Ranjan0% (1)

- FAR16 Share Capital Transactions - For PrintDocumento9 pagineFAR16 Share Capital Transactions - For PrintAJ CresmundoNessuna valutazione finora

- Dubai Islamic FinanceDocumento5 pagineDubai Islamic FinanceKhuzaima ShafiqNessuna valutazione finora

- Curso Execution in SAP Transportation Management - Modulo 1Documento67 pagineCurso Execution in SAP Transportation Management - Modulo 1reibeltorresNessuna valutazione finora

- POWER TOOLEX ExpoDocumento10 paginePOWER TOOLEX ExpoAMARNATH KNessuna valutazione finora

- BUSA 4800: Airbus Case Study: Boeing PerspectiveDocumento15 pagineBUSA 4800: Airbus Case Study: Boeing PerspectiveAntonio BanderasNessuna valutazione finora

- Universiti Teknologi Mara Test 2 Course: Corporate Finance Course Code: MAF603 Examination: 9 JANUARY 2021 Time: 1 Hour 15 MinutesDocumento3 pagineUniversiti Teknologi Mara Test 2 Course: Corporate Finance Course Code: MAF603 Examination: 9 JANUARY 2021 Time: 1 Hour 15 MinutesPutri Naajihah 4GNessuna valutazione finora

- Module 5 - Fundamental Principles of ValuationDocumento55 pagineModule 5 - Fundamental Principles of ValuationTricia Angela Nicolas100% (1)

- Caap PDFDocumento248 pagineCaap PDFBrijesh PandeyNessuna valutazione finora

- Tencent: Double Degree Program Global Business StrategyDocumento21 pagineTencent: Double Degree Program Global Business StrategyAngeline Vargas UgazNessuna valutazione finora

- Teves Perpetual Answer.Documento15 pagineTeves Perpetual Answer.ShaicaNessuna valutazione finora

- The Kerala State Co-Operative Bank LTD Customer Rights PolicyDocumento14 pagineThe Kerala State Co-Operative Bank LTD Customer Rights PolicyAkhilAkhilNessuna valutazione finora

- Kanban For The Shop Floor - PPDocumento2 pagineKanban For The Shop Floor - PPRachmat BoerhanNessuna valutazione finora

- Use of Social Media in The Marketing of Agricultural Products and Efficiency in The Cost of Advertisement of Agricultural Products in South West NigeriaDocumento10 pagineUse of Social Media in The Marketing of Agricultural Products and Efficiency in The Cost of Advertisement of Agricultural Products in South West NigeriaEditor IJTSRDNessuna valutazione finora

- Trans Sys Chap12Documento30 pagineTrans Sys Chap12Dr. Ir. R. Didin Kusdian, MT.Nessuna valutazione finora

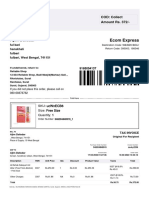

- Sub Order Labels 94ce8e7a 1b4d 4d5b Aac6 23950027e54dDocumento2 pagineSub Order Labels 94ce8e7a 1b4d 4d5b Aac6 23950027e54dDaryaee AhmedNessuna valutazione finora

- Quantitative Finance Financial Economics Bank Risk Management Applied MicroeconomicsDocumento7 pagineQuantitative Finance Financial Economics Bank Risk Management Applied MicroeconomicsRituparna DasNessuna valutazione finora

- S 8-Category Driver Analysis-Dr PlaviniDocumento19 pagineS 8-Category Driver Analysis-Dr PlaviniPallav JainNessuna valutazione finora

- Pravallika Nalla ResumeDocumento2 paginePravallika Nalla ResumesharanNessuna valutazione finora

- Enterprise Structure & Master DataDocumento10 pagineEnterprise Structure & Master DatapaiashokNessuna valutazione finora

- Barlaman Today, 2022, Food Delivery Services in MoroccoDocumento7 pagineBarlaman Today, 2022, Food Delivery Services in MoroccoFatima Zahra ZeroualiNessuna valutazione finora

- BSBOPS504 - Manage Business RiskDocumento48 pagineBSBOPS504 - Manage Business RiskNASIB HOSSAINNessuna valutazione finora

- Ey CSR Report 2020Documento60 pagineEy CSR Report 2020azNessuna valutazione finora

- Neerja Modi School Entrepreneurship Market Survey ReportDocumento31 pagineNeerja Modi School Entrepreneurship Market Survey Reportshilpi goelNessuna valutazione finora

- Meetings and ProceedingsDocumento11 pagineMeetings and ProceedingssreeNessuna valutazione finora