Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

339910

Caricato da

Rajbir SinghTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

339910

Caricato da

Rajbir SinghCopyright:

Formati disponibili

Finance for Non-Financial Managers, 6th edition

PowerPoint Slides

to accompany

Prepared by

Pierre Bergeron, University of Ottawa

Copyright © 2011 Nelson Education Limited

Finance for Non-Financial Managers, 6th edition

CHAPTER 5

PROFIT PLANNING AND

DECISION-MAKING

Copyright © 2011 Nelson Education Limited

Profit Planning and Decision-Making

Chapter Objectives

1. Explain various cost concepts related to break-even analysis

such as fixed and variable costs, the relationship between

revenue and costs, the contribution margin, the relevant

range and relevant costs.

1. Draw the break-even chart and calculate the break-even

point, the cash break-even point and the profit break-even

point and how they can be applied in different organizations.

1. Differentiate between different types of cost concepts such

as committed and discretionary costs, controllable and non-

controllable costs, and direct and indirect costs.

Chapter Reference

Chapter 5: Profit Planning and Decision-Making

Copyright © 2011 Nelson Education Limited

Relevance of Break-Even Analysis

Break-even analysis helps to:

1. Price existing or new products and services.

2. Decide whether to introduce a new product or service,

open a new plant, hire a sales representative, open a new

sales office, launch an advertising program.

3. Modernize or automate an existing plant.

4. Expand an existing plant.

5. Change the cost structure (fixed versus variable).

Copyright © 2011 Nelson Education Limited

1. Fixed and Variable Costs

Fixed costs Variable costs

Period costs Direct costs

Constant costs Out-of-pocket costs

Standby costs Volume costs

Characteristic Characteristic

Element of fixedness and must be paid Vary almost automatically with volume.

with passage of time.

Rent, interest, insurance, property Sales commission, direct labour,

taxes, office salaries, depreciation, packing material, electricity, overtime

telephone premiums, equipment rental, truck

expenses

Copyright © 2011 Nelson Education Limited

Connection Between Revenue and Costs

Factors that affect profit:

1. Volume of production

2. Prices

3. Costs (fixed and variable)

4. Changes in product mix

Cost per Unit

(in $)

G

16 H

E

14 F

12 C

D

10

A B

40 60 80 100

% of Capacity

Copyright © 2011 Nelson Education Limited

The Contribution Margin

Revenue $ 1,000,000

Less variable costs:

Direct material ($ 500,000)

Direct labour (250,000) PV Ratio

Total variable costs (750,000)

$250,000

Contribution margin 250,000

$1,000,000

Less fixed costs:

Manufacturing (150,000)

Administration (50,000) .25

Total fixed costs (200,000)

Operating profit $ 50,000

PV ratio

Copyright © 2011 Nelson Education Limited

2. J. Smith’s Break-Even (Taxi Driver)

$ Revenue $ 10.00

Fixed costs

Variable costs $ 2.00

Insurance Revenue

Contribution margin $ 8.00 $10.00

Costs/Revenue

Car payment

(principal or depreciation) $ 15,000 1,875 trips

=

$ 8.00

Interest

Dispatcher fees Break-even

point

Variable Total

costs costs

Variable costs

$2.00

Gas

$15,000

Maintenance &

repairs Fixed

$ 45,000 5,625 trips

= costs

$ 8.00

6,000

Trips

Copyright © 2011 Nelson Education Limited

J. Smith’s Break-Even (Taxi Driver)

No salary With salary With salary

No. of trips 1,875 5,625 6,000

Revenue ($10.00) $ 18,750 $ 56,250 $ 60,000

Variable costs ($2.00) ($ 3,750) ($ 11,250) ($ 12,000)

Contribution margin $ 15,000 $ 45,000 $ 48,000

Fixed costs ($ 15,000) ($ 15,000) ($ 15,000)

Salary 0 ($ 30,000) ($ 30,000)

Profit 0 0 $ 3,000

P.V. Ratio .80 .80 .80

Copyright © 2011 Nelson Education Limited

Finding the Break-Even Point Using the Formula

Unit selling price $ 15.00 (P)

Fixed costs $200,000 (F)

Unit variable costs $ 10.00 (V)

Break-even calculation

Step 1: Contribution margin

Selling price $15.00

Variable costs $10.00

Contribution margin $ 5.00

Step 2: $200,000 ÷ $5.00 = 40,000 units (volume)

Step 3: 40,000 units X $15.00 = $600,000 (sales revenue)

Copyright © 2011 Nelson Education Limited

Break-Even Point Calculation

In

Units Fixed costs

B.E.P. =

Price per unit sold – Variable cost per unit

or unit contribution

$200,000

B.E.P. = = 40,000 units

$15.00 - $10.00

X $15.00

$ 600,000

In

revenue

Step 1: Find the PV ratio

PV = Unit contribution = $5.00 = .333

Unit selling price $15.00

Step 2: Find the revenue break-even point

Fixed costs $200,000

B.E.P. = = = $600,000

PV .333

Copyright © 2011 Nelson Education Limited

Break-Even Point By Using the PV Ratio

Finding the break-even point Revenue $ 600,000

when units are not known, Variable costs $ 400,000

you need to re-structure the Contribution margin $ 200,000

statement of income

Fixed costs $ 200,000

Profit/loss $ 0

Step 1: Find the PV ratio

PV = Contribution = $200,000 = .333

Revenue $600,000

Step 2: Find the revenue break-even point

Fixed costs $200,000

B.E.P. = = = $600,000

PV .333

Copyright © 2011 Nelson Education Limited

Break-Even Point (Retail Store)

Suits Jackets Shirts Ties Socks Overcoats Total

No. of units 800 200 700 500 2,500 500

Unit selling price $300 $150 $50 $50 $8 $300

Revenue $500,000

Variable costs

Purchases ($275,000)

Sales commission (25,000)

Total variable costs ($300,000)

Contribution margin $200,000

Fixed costs (rent, telephone, salaries, security system) ($100,000)

Profit $100,000

Contribution margin = $200,000= .40 or $0.40 50%

Revenue $500,000

of objective

Fixed costs = $100,000= $250,000 OK!!!

PV ratio .40

Copyright © 2011 Nelson Education Limited

Cash Break-Even Point

In

Units Fixed costs - Depreciation

Price per unit sold – Variable cost per unit

$ 200,000 - $50,000 = $150,000 = 30,000 units

$15.00 - $10.00 $5.00

In

revenue

Fixed costs - Depreciation = $150,000 = $450,000

PV .333

Copyright © 2011 Nelson Education Limited

Profit Break-Even

In

Units Fixed costs + Profit objective

Price per unit sold – Variable cost per unit

$200,000 + $20,000 $220,000

= = 44,000 units

$15.00 - $10.00 $5.00

In

revenue

Fixed costs + Profit objective $220,000

= = $660,000

PV .333

Copyright © 2011 Nelson Education Limited

Sensitivity Analysis

Base case Break-even Break-even

in units in revenue

40,000 $600,000

Change in

Fixed costs

(increased by $50,000 to $250,000) 50,000 $750,000

Selling price

(increased by $0.50 to $15.50) 36,364 $563,642

Variable costs

(decreased by $0.75 to $9.25) 34,782 $521,730

Copyright © 2011 Nelson Education Limited

Break-Even Wedges

Company A Company B

Revenue Revenue

Total costs

PV = .40 Total costs

PV = .30

Fixed costs

Fixed costs

Company C Company D

Revenue Revenue

Total costs Total costs

PV = .30

PV = .40

Fixed costs

Fixed costs

Copyright © 2011 Nelson Education Limited

Where Break-Even Analysis Can be Used

• Company-wide

• Trucking operation

• Plant

• Direct mail advertising

• District or sales territory

• Taxi business

• Retail store

• Movie theatre

• Production centre

• Advertising program

• Department store

• Travel agency

• Product/division

• Hotel business

• Service centre

• Restaurant business

• Machine operation

• Book publishing

• Airline business

Copyright © 2011 Nelson Education Limited

3. Other Cost Concepts

Committed costs: Costs that must be incurred in order to operate a

business.

Discretionary fixed costs: Costs that can be controlled by managers.

Controllable costs: Costs that operating managers are accountable for.

Non-controllable costs: Costs that are not under the direct control of

managers.

Direct costs: Materials and labour expenses that are directly incurred when

making a product or providing a service.

Indirect costs: Costs that are necessary in the production cycle but that

cannot be clearly allocated to specific products or services.

Copyright © 2011 Nelson Education Limited

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Taste of AgileDocumento89 pagineA Taste of AgileBhaskar Das70% (10)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Entrepreneurship Guide to Starting and Growing a BusinessDocumento42 pagineEntrepreneurship Guide to Starting and Growing a BusinessMaRemalyneCruz90% (10)

- Ray Kroc's Visionary Leadership at McDonald'sDocumento4 pagineRay Kroc's Visionary Leadership at McDonald'sViknesh Kumanan100% (1)

- HB Nutrition FinalDocumento14 pagineHB Nutrition FinalJaoNessuna valutazione finora

- JNMF Scholarship Application Form-1Documento7 pagineJNMF Scholarship Application Form-1arudhayNessuna valutazione finora

- Some People Think We Should Abolish All Examinations in School. What Is Your Opinion?Documento7 pagineSome People Think We Should Abolish All Examinations in School. What Is Your Opinion?Bach Hua Hua100% (1)

- The Catholic Encyclopedia, Volume 2 PDFDocumento890 pagineThe Catholic Encyclopedia, Volume 2 PDFChristus vincit SV67% (3)

- Wa0028.Documento2 pagineWa0028.Rajbir SinghNessuna valutazione finora

- LPU - Entrepreneurship and Small Business ManagementDocumento229 pagineLPU - Entrepreneurship and Small Business ManagementAbderrahim HAMDAOUINessuna valutazione finora

- 339910Documento19 pagine339910Rajbir SinghNessuna valutazione finora

- Scholarship InfoDocumento1 paginaScholarship InfoRajbir SinghNessuna valutazione finora

- Subject and Object Questions WorksheetDocumento3 pagineSubject and Object Questions WorksheetLucas jofreNessuna valutazione finora

- Insurance Notes - TambasacanDocumento13 pagineInsurance Notes - TambasacanGeymer IhmilNessuna valutazione finora

- Website Vulnerability Scanner Report (Light)Documento6 pagineWebsite Vulnerability Scanner Report (Light)Stevi NangonNessuna valutazione finora

- Place of Provision of Services RulesDocumento4 paginePlace of Provision of Services RulesParth UpadhyayNessuna valutazione finora

- E-Mobility - Ladestation - Charging Station in Thalham - Raspberry Pi OCPPDocumento8 pagineE-Mobility - Ladestation - Charging Station in Thalham - Raspberry Pi OCPPjpcmeNessuna valutazione finora

- Doctrines On Persons and Family RelationsDocumento69 pagineDoctrines On Persons and Family RelationsCarla VirtucioNessuna valutazione finora

- A Bibliography of China-Africa RelationsDocumento233 pagineA Bibliography of China-Africa RelationsDavid Shinn100% (1)

- Filipino Values and Patriotism StrategiesDocumento3 pagineFilipino Values and Patriotism StrategiesMa.Rodelyn OcampoNessuna valutazione finora

- Project Report Final PDFDocumento74 pagineProject Report Final PDFSaurav KumarNessuna valutazione finora

- Techm Work at Home Contact Center SolutionDocumento11 pagineTechm Work at Home Contact Center SolutionRashi ChoudharyNessuna valutazione finora

- Rapport 2019 de La NHRC de Maurice: Découvrez Le Rapport Dans Son IntégralitéDocumento145 pagineRapport 2019 de La NHRC de Maurice: Découvrez Le Rapport Dans Son IntégralitéDefimediaNessuna valutazione finora

- тест юніт 1Documento3 pagineтест юніт 1Alina BurdyuhNessuna valutazione finora

- Aikido NJKS PDFDocumento105 pagineAikido NJKS PDFdimitaring100% (5)

- MGT420Documento3 pagineMGT420Ummu Sarafilza ZamriNessuna valutazione finora

- International Buffet Menu Rm45.00Nett Per Person Appertizer and SaladDocumento3 pagineInternational Buffet Menu Rm45.00Nett Per Person Appertizer and SaladNorasekin AbdullahNessuna valutazione finora

- Usui MemorialDocumento6 pagineUsui MemorialstephenspwNessuna valutazione finora

- Mediocrity-The Unwated SinDocumento3 pagineMediocrity-The Unwated SinJay PatelNessuna valutazione finora

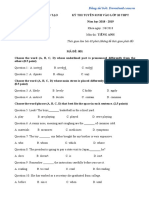

- Đề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangDocumento5 pagineĐề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangHaiNessuna valutazione finora

- Malayan Law Journal Reports 1995 Volume 3 CaseDocumento22 pagineMalayan Law Journal Reports 1995 Volume 3 CaseChin Kuen YeiNessuna valutazione finora

- Client Portfolio Statement: %mkvalDocumento2 pagineClient Portfolio Statement: %mkvalMonjur MorshedNessuna valutazione finora

- Dorfman v. UCSD Ruling - California Court of Appeal, Fourth Appellate DivisionDocumento20 pagineDorfman v. UCSD Ruling - California Court of Appeal, Fourth Appellate DivisionThe College FixNessuna valutazione finora

- Global BF Scorecard 2017Documento7 pagineGlobal BF Scorecard 2017sofiabloemNessuna valutazione finora

- AIESEC Experience-MBC 2016Documento25 pagineAIESEC Experience-MBC 2016Karina AnantaNessuna valutazione finora

- In Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghDocumento1 paginaIn Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghRohith KumarNessuna valutazione finora