Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Verification of Liabilities

Caricato da

rupali0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

1K visualizzazioni8 pagineTitolo originale

VERIFICATION OF LIABILITIES ppt.pptx

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

1K visualizzazioni8 pagineVerification of Liabilities

Caricato da

rupaliCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 8

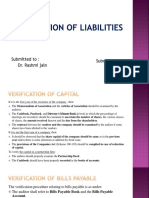

Submitted to : Submitted by:

Dr. Rashmi jain Ekta & Rupali

If it is the first year of the existence of the company , then:

The Memorandum of Association and the Articles of Association should be examined by the

auditors.

The Cashbook, Passbook, and Director’s Minute Book (a book in which the proceedings of

meetings are recorded ) should be examined to ascertain the number of shares, the various classes

of shares, the amount received thereon and the due from the shareholders.

The contract between the vendors and the company should be examined by the auditor if some

shares have been allotted to the vendors.

If it is not the first year of a company, then:

It should be observed that the share capital of the company should be same as in the previous

year unless there is some alteration or addition by fresh issue.

The provisions of the Companies Act (Scheme 100-105) should be complied in case of reduction

of capital.

To verify the capital in a partnership firm:

The auditor should properly examine the Partnership Deed.

The Cashbook should have been properly recorded in the books of accounts.

The verification procedure relating to bills payable is as under:

The auditor shall refer to Bills Payable Book and the Bills Payable

Account.

The Bills paid should be checked with the entries passed in the

cashbook.

Verify the Outstanding bills on the date of Balance Sheet by comparing

the balance on the Bills Payable Account and the bills not shown in the

Bills Payable Book.

The auditor should ensure that bills paid during the date of Balance sheet

and the dates of his audit have been duly written in the books.

The payment made for the matured bills should be evidenced by the

returned bills.

The auditor shall also verify the unpaid bill’s amount.

The verification steps are:

The auditor shall examine the Memorandum and Articles in order

to ascertain the borrowing powers of the company.

The auditor shall properly check the Debenture Trust Deed- its

terms and conditions and the securities offered.

The auditor shall ensure that the provisions of Companies Act,

SEBI guidelines and other listing requirements have been

complied with, wherever required.

The auditor shall ensure that

a) Cash has been received, if debentures are issued at cash

b) Entries have been made in the books of account if debentures

are issued at a premium.

An auditor must satisfy himself that all liabilities for

outstanding expenses have been provided for in the Balance

Sheet:

The auditor shall obtain a complete list of outstanding liabilities

from a responsible official which indicates the amount of

outstanding expenses under various heads.

The auditor shall check the list carefully to ensure that expenses

for the entire year have been accounted for.

The auditor shall obtain a certificate from the management that all

the outstanding liabilities, whether for goods purchased or

expenses incurred, have been included in the current year.

The auditor should obtain the list of debtors duly certified.

He should obtain the confirmation letters of the statement of accounts directly

from debtors. He should pay special attention to those balances for which

confirmations are not available.

The sales ledger balance should be checked with the Debtor’s Ledger, Sales

Book, Sales Returns Book, Cash book, etc.

He should see that the book debt balances do not include the amounts due in

respect of goods out on sale or return basis.

He should see that the book debts shown in the Balance sheets are recoverable.

He should see that adequate provision has been made for bad and doubtful

debts.

In the case of company accounts the auditor should see that its debtors are

classified as prescribed by the Companies Act of 1956 and shown in the

Balance Sheet in the same order.

For verifying trade creditors, the auditor should proceed as under:

1. Obtain a list of trade creditors and cross check some balances in individual accounts to satisfy about the correctness of

listing, and the list should also be verified with the order register, invoice register goods received register and ledger.

2. Check the postings from the books of prime entry like purchase day book to the bought ledger,

3. Check the balances in the list with the confirmations of balances, which if practicable, should be directly obtained by the

auditor.

4. Check cut-off transactions such as goods received before the closing date and included in the closing stock (inventories)

but suppliers invoices received after the closing date, as a result of which no provision for the outstanding has been

made. If such transactions have been discovered, appropriate adjustments must be made to account for the goods which

relate to the period under audit.

5. Test check the ‘goods returned’ i.e., returns outwards to ascertain that they are supported by supplier’s credit notes.

Cross check with the supplier’s statement and satisfy that due credit for goods returned has been given.

6. If there are any outstanding balances for unduly long time, investigate into the reasons for the delay in settlement of such

accounts. If there are disputed balances, ascertains the reasons, and the action, the management proposes to take.

7. In order to have an overall view, compare the percentages of gross profits for two/three years and if there are material

fluctuations, investigate into the possibility of some purchase invoices or expenses having been omitted, or some fictitious

or expenses having been included.

8. For goods received on consignment, if such goods have been sold, check the consignors account has been appropriately for

the sale proceeds of the goods.

9. At the end of the verification of sundry creditors, a certificate should be obtained from a responsible official of the client

entity sating that liabilities that had accrued till the close of the accounting year have been fully accounted for.

SECURED

Examine the borrowing power of the entity. If it is a company verify the information from the memorandum and articles of

association and see that the provision of section 293(1), if applicable have been met.

Examine the copy of the mortgage deed for verifying that amount of loan raised, the rate of interest, repayment terms and the

rights created in the property by the mortgage deed.

Keeping in view the legal position as stated above, the auditor should examine the copy of the mortgage deed on immovable

property, for verifying the loan amount, rate of interest. The terms of repayment, and the rights of the mortgagee in the

property.

UNSECURED

Examine the loan agreement in order to ascertain the terms and conditions of the loan, the amount of loan, duration and nature

of loan etc.

If the loanee is a company, see applicable provisions of the companies act, 1956 in this regard e.g. section 293.

Check the calculations of interest payments, also confirm that instalments paid during the period under audit have been

reduced from the loan amount as shown in the balance sheet

LOAN TAKEN FROM BANKS

Check the overdraft balance or loan balance with the bank’s statements of accounts/pass books. If these balances do not match with each

other, get a reconciliation made and identify the transactions which create the difference.

Check that assets hypothecated as securities in case of a company are duly registered with the registrar of companies and appropriately

recorded in the register of charges as required under section 125 of the companies act, 1956.

Potrebbero piacerti anche

- Audit ProjectDocumento22 pagineAudit ProjectJashan100% (1)

- Maximize value with optimal capital structure mixDocumento8 pagineMaximize value with optimal capital structure mixKalpit JainNessuna valutazione finora

- Capital StructureDocumento41 pagineCapital StructuremobinsaiNessuna valutazione finora

- Vouching Meaning: Vouching Means The Examination of Documentary Evidence in Support of Entries ToDocumento4 pagineVouching Meaning: Vouching Means The Examination of Documentary Evidence in Support of Entries ToShubhangi GuptaNessuna valutazione finora

- Chapter 1 PDFDocumento20 pagineChapter 1 PDFANILNessuna valutazione finora

- Accountancy Notes PDFDocumento11 pagineAccountancy Notes PDFSantosh ChavanNessuna valutazione finora

- Divisible Profits Factors and PrinciplesDocumento14 pagineDivisible Profits Factors and PrinciplesVeeresh SharmaNessuna valutazione finora

- Internal CheckDocumento8 pagineInternal CheckaamritaaNessuna valutazione finora

- Qualification of An Auditor 2Documento8 pagineQualification of An Auditor 2sidraayaz_84Nessuna valutazione finora

- Audit of CashDocumento25 pagineAudit of CashCHRISTINE TABULOGNessuna valutazione finora

- Income Tax - MidhunDocumento19 pagineIncome Tax - MidhunmidhunNessuna valutazione finora

- 19P0310314 - Corporate Tax Planning - Meaning, Objectives and ScopeDocumento8 pagine19P0310314 - Corporate Tax Planning - Meaning, Objectives and ScopePriya KudnekarNessuna valutazione finora

- Corporate TaxDocumento17 pagineCorporate TaxVishnupriya RameshNessuna valutazione finora

- Audit of Sole Trader and A Small CompanyDocumento14 pagineAudit of Sole Trader and A Small CompanyrupaliNessuna valutazione finora

- Tax Management With Reference To - Repair, Replace, Renewal or RenovationDocumento4 pagineTax Management With Reference To - Repair, Replace, Renewal or RenovationAkhil1101Nessuna valutazione finora

- Top Credit Rating Agencies of IndiaDocumento14 pagineTop Credit Rating Agencies of IndiaAkhil GuptaNessuna valutazione finora

- Objectives of Investment GoalsDocumento7 pagineObjectives of Investment GoalsVinoth CscNessuna valutazione finora

- IAS 16, Property, Plant and Equipment OverviewDocumento3 pagineIAS 16, Property, Plant and Equipment OverviewSpencerNessuna valutazione finora

- Capital Market ReformsDocumento8 pagineCapital Market ReformsRiyas ParakkattilNessuna valutazione finora

- Merchant Banking and Financial Services Question PaperDocumento248 pagineMerchant Banking and Financial Services Question Paperexecutivesenthilkumar100% (1)

- Tax Planning and Managerial DecisionDocumento188 pagineTax Planning and Managerial Decisionkomal_nath2375% (4)

- Valuation of Shares Need and MethodsDocumento7 pagineValuation of Shares Need and Methodsnishuppt100% (1)

- Sources and Raising of LT FinanceDocumento52 pagineSources and Raising of LT FinanceAshutoshNessuna valutazione finora

- Unit-2 Security AnalysisDocumento26 pagineUnit-2 Security AnalysisJoshua JacksonNessuna valutazione finora

- Two Key Differences Between Management Audit and Cost AuditDocumento20 pagineTwo Key Differences Between Management Audit and Cost AuditAkash BhavsarNessuna valutazione finora

- Chapter 3 - Sources of FinancingDocumento5 pagineChapter 3 - Sources of FinancingSteffany RoqueNessuna valutazione finora

- Hire Purchase and Installment Systems ComparedDocumento5 pagineHire Purchase and Installment Systems ComparedJoel JohnNessuna valutazione finora

- Capitalisation Meaning DefinitionDocumento19 pagineCapitalisation Meaning DefinitionPooja SheoranNessuna valutazione finora

- Audit of Hospital - Mcom Part II ProjectDocumento28 pagineAudit of Hospital - Mcom Part II ProjectKunal KapoorNessuna valutazione finora

- Share Valuation - 1 PDFDocumento7 pagineShare Valuation - 1 PDFbonnie.barma2831100% (1)

- Cash Management-Models: Baumol Model Miller-Orr Model Orgler's ModelDocumento5 pagineCash Management-Models: Baumol Model Miller-Orr Model Orgler's ModelnarayanNessuna valutazione finora

- Bonus Act - 1965 - 1Documento24 pagineBonus Act - 1965 - 1nawabrp100% (1)

- Auditing VouchingDocumento6 pagineAuditing VouchingDivakara ReddyNessuna valutazione finora

- Holistic Approach For Manager in Decision MakingDocumento19 pagineHolistic Approach For Manager in Decision Makingvijuvijuvijuviju0% (1)

- Corporate Governance in India & Sebi Regulations: Presented byDocumento15 pagineCorporate Governance in India & Sebi Regulations: Presented byMolu WaniNessuna valutazione finora

- Internal Reconstruction ProcessDocumento18 pagineInternal Reconstruction ProcessDhananjay Pawar50% (2)

- Law PPT (Director Companies Act)Documento24 pagineLaw PPT (Director Companies Act)rohit vermaNessuna valutazione finora

- Management of Funds and AssetsDocumento231 pagineManagement of Funds and AssetsSM Friend100% (2)

- Factors Influencing Business EthicsDocumento16 pagineFactors Influencing Business EthicsAparna Devi67% (3)

- Financial Management in Psu'sDocumento14 pagineFinancial Management in Psu'sAkshaya Mali100% (1)

- Unit-II Financial ServicesDocumento20 pagineUnit-II Financial ServicesramamohanvspNessuna valutazione finora

- VouchingDocumento61 pagineVouchingTeja Ravi67% (3)

- Chartered AccountantDocumento33 pagineChartered AccountantSandeep Soni0% (1)

- Financial Aspects in RetailDocumento31 pagineFinancial Aspects in RetailPink100% (4)

- Differences between Auditor's Report and CertificateDocumento1 paginaDifferences between Auditor's Report and CertificateAkshansh MahajanNessuna valutazione finora

- Role and Responsibilities of Independent DirectorsDocumento31 pagineRole and Responsibilities of Independent DirectorsLavina ChandwaniNessuna valutazione finora

- Unit - 5 (Special Areas of Audit)Documento3 pagineUnit - 5 (Special Areas of Audit)Meghaa KabraNessuna valutazione finora

- Buy Back PowerPoint Presentation CompleteDocumento22 pagineBuy Back PowerPoint Presentation CompleteRaj GandhiNessuna valutazione finora

- Divisible ProfitDocumento5 pagineDivisible ProfitAzhar Ahmed SheikhNessuna valutazione finora

- Formation of CompanyDocumento7 pagineFormation of CompanyPragya SinghNessuna valutazione finora

- Processing An Export OrderDocumento21 pagineProcessing An Export OrderasifanisNessuna valutazione finora

- Brief History of RBI: Hilton Young CommissionDocumento24 pagineBrief History of RBI: Hilton Young CommissionharishNessuna valutazione finora

- Essentials of A Good Disciplinary SystemDocumento15 pagineEssentials of A Good Disciplinary SystemNirmal Sivarajan100% (2)

- AuditDocumento7 pagineAuditAbhishek SharmaNessuna valutazione finora

- Verification and Valuation of Different Kinds of AssetsDocumento4 pagineVerification and Valuation of Different Kinds of AssetsRamesh RanjanNessuna valutazione finora

- Audit of Liabilities - HandoutsDocumento19 pagineAudit of Liabilities - Handoutsanthony23vinaraoNessuna valutazione finora

- Current AssetsDocumento3 pagineCurrent AssetsAshish DhingraNessuna valutazione finora

- Auditing Lecture Notes 04172022Documento16 pagineAuditing Lecture Notes 04172022Abegail Cadacio100% (2)

- Scope of Internal Audit - RDocumento4 pagineScope of Internal Audit - RHarshadaNessuna valutazione finora

- Statutory Audit ChecklistDocumento4 pagineStatutory Audit ChecklistAreeba FatimaNessuna valutazione finora

- Ma Notes PDFDocumento17 pagineMa Notes PDFrupaliNessuna valutazione finora

- The Changing Use of Derivatives NewDocumento7 pagineThe Changing Use of Derivatives NewrupaliNessuna valutazione finora

- 2850 PDFDocumento11 pagine2850 PDFrupaliNessuna valutazione finora

- 1465 AssignmentDocumento1 pagina1465 AssignmentrupaliNessuna valutazione finora

- For HDFC BankDocumento31 pagineFor HDFC BankShalu Sushil Bansal80% (5)

- Analysis of the Situational Leadership TheoryDocumento7 pagineAnalysis of the Situational Leadership TheoryrupaliNessuna valutazione finora

- Who Is A Management Accountant?: ChannelDocumento8 pagineWho Is A Management Accountant?: ChannelrupaliNessuna valutazione finora

- Recession File 2 PDFDocumento8 pagineRecession File 2 PDFrupaliNessuna valutazione finora

- Business Ethics Theories ExplainedDocumento27 pagineBusiness Ethics Theories ExplainedrupaliNessuna valutazione finora

- Study of Customer Satisfaction Towards HDFC BankDocumento58 pagineStudy of Customer Satisfaction Towards HDFC BankNeeraj Verma68% (28)

- Correlation Is A Measure of Association Between Two VariablesDocumento1 paginaCorrelation Is A Measure of Association Between Two VariablesrupaliNessuna valutazione finora

- GST PDFDocumento6 pagineGST PDFrupaliNessuna valutazione finora

- Measures of Central Tendency and DispersionDocumento17 pagineMeasures of Central Tendency and DispersionrupaliNessuna valutazione finora

- Risk Management Tools (Sapm) Group 1Documento12 pagineRisk Management Tools (Sapm) Group 1rupaliNessuna valutazione finora

- Verification of LiabilitiesDocumento8 pagineVerification of LiabilitiesrupaliNessuna valutazione finora

- Technical Analysis BasicsDocumento9 pagineTechnical Analysis BasicsrupaliNessuna valutazione finora

- Current Scenario of Derivatives Market in India-Masood Khan-0487Documento75 pagineCurrent Scenario of Derivatives Market in India-Masood Khan-0487brownsugar369979% (14)

- Technical Analysis BasicsDocumento9 pagineTechnical Analysis BasicsrupaliNessuna valutazione finora

- DigitalisationDocumento32 pagineDigitalisationrupaliNessuna valutazione finora

- Amul External Analysis PDFDocumento14 pagineAmul External Analysis PDFrupaliNessuna valutazione finora

- GST PDFDocumento6 pagineGST PDFrupaliNessuna valutazione finora

- GST PDFDocumento6 pagineGST PDFrupaliNessuna valutazione finora

- Project Report On AdidasDocumento33 pagineProject Report On Adidassanyam73% (37)

- DigitalisationDocumento32 pagineDigitalisationrupaliNessuna valutazione finora

- Pra Bandhan GuruDocumento16 paginePra Bandhan GuruVictor ItokNessuna valutazione finora

- Pra Bandhan GuruDocumento16 paginePra Bandhan GuruVictor ItokNessuna valutazione finora

- Google Sheet for Problem Solving from Beginner to Div2Documento153 pagineGoogle Sheet for Problem Solving from Beginner to Div2rupaliNessuna valutazione finora

- Project Sujjeet 120Documento21 pagineProject Sujjeet 120rupaliNessuna valutazione finora

- For HDFC BankDocumento31 pagineFor HDFC BankShalu Sushil Bansal80% (5)

- K.R. Magalam University Separation of Power DocumentDocumento12 pagineK.R. Magalam University Separation of Power DocumentsruthiNessuna valutazione finora

- ATM Project DescriptionDocumento2 pagineATM Project Descriptionpayal_mehra21100% (3)

- T3TSL - Syndicated Loans Module OverviewDocumento283 pagineT3TSL - Syndicated Loans Module OverviewtayutaNessuna valutazione finora

- Faqs of Islamic Naya Pakistan Certificates (Inpcs)Documento3 pagineFaqs of Islamic Naya Pakistan Certificates (Inpcs)Ajmal AfzalNessuna valutazione finora

- Credit Card Generator & Validator - Valid Visa Numbers - CardGuruDocumento10 pagineCredit Card Generator & Validator - Valid Visa Numbers - CardGuruJelo BagzNessuna valutazione finora

- Invoice Flomih & Vio Bussines SRL: CX Ref: 18911926 Invoice No.: 151140-838 Invoice Date: 29 Nov 2019Documento1 paginaInvoice Flomih & Vio Bussines SRL: CX Ref: 18911926 Invoice No.: 151140-838 Invoice Date: 29 Nov 2019calinmusceleanuNessuna valutazione finora

- Role of Pune District Central Cooperative Bank in Rural DevelopmentDocumento16 pagineRole of Pune District Central Cooperative Bank in Rural Developmentshubham jagtap100% (1)

- Introduction to Financial InstitutionsDocumento45 pagineIntroduction to Financial InstitutionsSofoniyas GashawNessuna valutazione finora

- Monthly Current Affairs Capsule IBPSGuide PDFDocumento45 pagineMonthly Current Affairs Capsule IBPSGuide PDFPriya DharshiniNessuna valutazione finora

- Cesu BillDocumento1 paginaCesu BillPunyesh KumarNessuna valutazione finora

- MAE by Maybank2u: Frequently Asked QuestionsDocumento40 pagineMAE by Maybank2u: Frequently Asked Questionslim wey songNessuna valutazione finora

- Credit Card Fraud ReportDocumento4 pagineCredit Card Fraud ReportGourav ShrivastavaNessuna valutazione finora

- Acct Statement XX2182 29082021Documento28 pagineAcct Statement XX2182 29082021Sunil VishwakarmaNessuna valutazione finora

- Acct Statement - XX3019 - 04012024Documento42 pagineAcct Statement - XX3019 - 04012024sattakingr786Nessuna valutazione finora

- Advantages and disadvantages of small scale productionDocumento10 pagineAdvantages and disadvantages of small scale productionGøräksh Ñäík100% (1)

- Important Precautions Soayib 2Documento54 pagineImportant Precautions Soayib 2soayibq100% (2)

- Chapter - 2 Conceptual Framework of Customer Satishfaction and E-BankingDocumento30 pagineChapter - 2 Conceptual Framework of Customer Satishfaction and E-BankingShamshuddin nadafNessuna valutazione finora

- Custom Menus With DescriptionDocumento7 pagineCustom Menus With DescriptionPankaj AhujaNessuna valutazione finora

- TVM Problems: Calculating Present & Future Values of Annuities, Loans, InvestmentsDocumento2 pagineTVM Problems: Calculating Present & Future Values of Annuities, Loans, InvestmentsKhondaker RafsanjaniNessuna valutazione finora

- Presentation On Non Banking Financial CompaniesDocumento17 paginePresentation On Non Banking Financial CompaniesMayurpmNessuna valutazione finora

- BAF Internship ReportDocumento109 pagineBAF Internship ReportMuhammad DiljanNessuna valutazione finora

- SS-CIS - DB GM-Luxury Hideaway Real Estate GMBH (Moon-2023)Documento6 pagineSS-CIS - DB GM-Luxury Hideaway Real Estate GMBH (Moon-2023)Stephen SpilbergNessuna valutazione finora

- Electronic Payment Systems-FinalDocumento105 pagineElectronic Payment Systems-Finaldileepvk1978Nessuna valutazione finora

- Banco Filipino Savings and Mortgage Bank vs. Ybañez, 445 SCRA 482, G.R. No. 148163 December 6, 2004Documento4 pagineBanco Filipino Savings and Mortgage Bank vs. Ybañez, 445 SCRA 482, G.R. No. 148163 December 6, 2004Daysel FateNessuna valutazione finora

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocumento1 paginaTax Invoice: Billing Address Installation Address Invoice DetailsshivaNessuna valutazione finora

- Project Report ON: "Saving and Current Account"Documento63 pagineProject Report ON: "Saving and Current Account"nitrosey100% (3)

- Public and Private Financial Institutions in The PhilippinesDocumento13 paginePublic and Private Financial Institutions in The PhilippinesKristel Charlize AricayosNessuna valutazione finora

- Driving The Future of Money: Tether TokenDocumento1 paginaDriving The Future of Money: Tether Tokenjairo avilaNessuna valutazione finora

- Analysis of The Financial Strategies of Grameen BankDocumento22 pagineAnalysis of The Financial Strategies of Grameen BankSha D ManNessuna valutazione finora

- View your Advance Mastercard statement onlineDocumento1 paginaView your Advance Mastercard statement onlinealotfya2236Nessuna valutazione finora

- Pro Forma PDFDocumento1 paginaPro Forma PDFtvsufi.comNessuna valutazione finora