Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fayyaz The Dynamics of Consumer Behavior

Caricato da

muhammad fayyaz0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

6 visualizzazioni15 paginelala

Titolo originale

Fayyaz the Dynamics of Consumer Behavior

Copyright

© © All Rights Reserved

Formati disponibili

PPT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentolala

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

6 visualizzazioni15 pagineFayyaz The Dynamics of Consumer Behavior

Caricato da

muhammad fayyazlala

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 15

1-1

CONSOLIDATION & CONSOLIDATED

FINANCIAL STATEMENT

NAME: FAYYAZ AFRIDI

CMS: 24547

Consolidation

In business consolidation or amalgamation is the merger

and acquisition of many smaller companies into a few much

larger once.in the context of financial accounting

consolidation is the aggregation of financial statement of a

group company as consolidated financial statements.

3

Principles of consolidated financial

statements

Group accounts

The key principle undertaking group accounts is the need to

reflect the economic substance of the relationship.

• P is an individual legal entity.

• S is an individual legal entity.

• P controls S and therefore they from a single economic

entity, the group.

1-4

Consolidated Financial Statements

• Consolidated financial statements present the

financial position and results of operations for

a parent and one or more subsidiaries, as if they

were a single company.

• Consolidation is required when a corporation

owns a majority of another corporation’s

outstanding common stock.

• Same accounting principles apply for a

consolidated company.

1-5

Consolidated Financial Statements

• Two companies are considered to be related

companies when one controls the other

company.

• Consolidated financial statements are

generally considered to be more useful

than the separate financial statements

of the individual companies when the

companies are related.

1-6

Consolidated Financial Statements

• Whether the subsidiary is acquired or created,

each individual company maintains its own

accounting records, but consolidated financial

statements are needed to present the

companies together as a single economic

entity for general-purpose financial reporting.

1-7

Benefits

• Consolidated financial statements are presented

primarily for those parties having a long-run

interest in the parent company (parent’s

shareholders or creditors).

• Consolidated financial statements often provide

the only means of obtaining a clear picture of the

total resources of the combined entity.

1-8

Limitations

• Some information is lost when time data sets

are aggregated; this is particularly true when

the information involves an aggregation

across companies that have substantially

different operating characteristics. (GE)

1-9

Subsidiary Financial Statements

• Because subsidiaries are legally separate from

their parents, the creditors and stockholders of a

subsidiary generally have no claim on the parent,

and the stockholders of the subsidiary do not

share in the profits of the parent.

• Therefore, consolidated financial statements

usually are of little use to those interested in

obtaining information about the assets, capital, or

income of individual subsidiaries.

1-10

Indirect Control

• The traditional view of control includes

both direct and indirect control.

• Direct control typically occurs when one

company owns a majority of another

company’s common stock.

• Indirect control (or pyramiding) occurs

when a company’s common stock is

owned by one or more other companies

that are all under common control.

1-11

Ability to Exercise Control

• Under certain circumstances, the majority

stockholders of a subsidiary may not be able to

exercise control even though they hold more

than 50 percent of its outstanding voting stock.

Examples:

• Subsidiary is in legal reorganization or

bankruptcy

• Foreign country restricts remittance of

subsidiary profits to domestic parent company

• Parent is unable to control important aspects

of the subsidiary’s operations.

1-12

Ability to Exercise Control

• When consolidation is not appropriate,

the unconsolidated subsidiary is reported

as an intercorporate investment.

1-13

Differences in Fiscal Periods

• A difference in the fiscal periods of a parent and

subsidiary should not preclude consolidation of

that subsidiary.

• Often the fiscal period of the subsidiary, if

different from the parent’s, is changed to coincide

with that of the parent.

• Another alternative is to adjust the financial

statement data of the subsidiary each period to

place the data on a basis consistent with the

fiscal period of the parent.

1-14

Intercompany Receivables and

Payables

• A single company cannot owe itself money,

that is, a company cannot report a receivable to

itself and a payable to itself. Thus, the

following entry is made to eliminate

intercompany receivables and payables between

the parent and the subsidiary:

Consolidated Accounts Payable BV *

Consolidated Accounts Receivable BV

1-15

Mechanics of the Consolidation

Process

• A worksheet is used to facilitate the process of

combining and adjusting the account balances

involved in a consolidation.

• While the parent company and the subsidiary

each maintain their own books, there are no

books for the consolidated entity.

• Instead, the balances of the accounts are taken

at the end of each period from the books of the

parent and the subsidiary and entered in the

consolidation workpaper.

Potrebbero piacerti anche

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingDa EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNessuna valutazione finora

- Chapter3 - ACC362Documento76 pagineChapter3 - ACC362ola ibrahimNessuna valutazione finora

- Akl1 CH03Documento28 pagineAkl1 CH03ashityadav0531Nessuna valutazione finora

- Consolidated Financial Statements ExplainedDocumento77 pagineConsolidated Financial Statements ExplainedMisganaw DebasNessuna valutazione finora

- CH05 Consolidation FSDocumento52 pagineCH05 Consolidation FSጌታ እኮ ነውNessuna valutazione finora

- Advanced Financial Accounting 7e (Baker Lembre King) .Chap003Documento85 pagineAdvanced Financial Accounting 7e (Baker Lembre King) .Chap003low profileNessuna valutazione finora

- Chapter 04Documento8 pagineChapter 04Mominul MominNessuna valutazione finora

- Advance Chapter 2 4 - 6005941748281382493Documento114 pagineAdvance Chapter 2 4 - 6005941748281382493NatnaelNessuna valutazione finora

- ACCTG 110 Group3 Consolidated Statement Financial Position DateofAcquisitionDocumento22 pagineACCTG 110 Group3 Consolidated Statement Financial Position DateofAcquisitionKathlin Delos ReyesNessuna valutazione finora

- Consolidated Financial Statements Guide for Impairment, Goodwill, NCI, and Intercompany ItemsDocumento96 pagineConsolidated Financial Statements Guide for Impairment, Goodwill, NCI, and Intercompany ItemsJustine Kate Ferrer BascoNessuna valutazione finora

- Elimination Entry, Consolidation Worksheet, Consolidation ReportDocumento29 pagineElimination Entry, Consolidation Worksheet, Consolidation ReportLarasma Mutiara PutriNessuna valutazione finora

- Intercorporate Acquisitions and Investments in Other EntitiesDocumento40 pagineIntercorporate Acquisitions and Investments in Other EntitiesTomi NugrohoNessuna valutazione finora

- Baker Chapter 1Documento40 pagineBaker Chapter 1rahmawNessuna valutazione finora

- AFA II UU Unit 2 Consolidation Date of Aquisition PDF ProtectedDocumento24 pagineAFA II UU Unit 2 Consolidation Date of Aquisition PDF Protectednatnaelsleshi3Nessuna valutazione finora

- Introduction To Group Financial StatementsDocumento52 pagineIntroduction To Group Financial StatementsTafadzwaNessuna valutazione finora

- 13.2 Therteenth Lecture - The Consolidated Statement of Financial PositionDocumento20 pagine13.2 Therteenth Lecture - The Consolidated Statement of Financial PositionTIKO LIANessuna valutazione finora

- PPT3-Consolidated Financial Statement - Date of AcquisitionDocumento54 paginePPT3-Consolidated Financial Statement - Date of AcquisitionRifdah Saphira100% (1)

- Principles of Consolidated Financial StatementsDocumento13 paginePrinciples of Consolidated Financial StatementsADEYANJU AKEEM100% (1)

- Objectives of Corporate Finance: - Aaditya DesaiDocumento19 pagineObjectives of Corporate Finance: - Aaditya DesaiPRIYA RATHORENessuna valutazione finora

- Consolidation Finanacial StatementDocumento38 pagineConsolidation Finanacial Statementsneha9121Nessuna valutazione finora

- Intercorporate Acquisitions and Investments in Other EntitiesDocumento31 pagineIntercorporate Acquisitions and Investments in Other EntitiesSayed Farrukh AhmedNessuna valutazione finora

- EDHEC - MSC Fin - FAA - Overview of The Income StatementDocumento27 pagineEDHEC - MSC Fin - FAA - Overview of The Income StatementGabriele GabrieliNessuna valutazione finora

- ACTG5100 Friedlan4e SM Ch11Documento31 pagineACTG5100 Friedlan4e SM Ch11Sunrise ConsultingNessuna valutazione finora

- Consolidations and Joint Ventures SlidesDocumento66 pagineConsolidations and Joint Ventures SlidesjalalNessuna valutazione finora

- Consolidated and Separate Financial Statements (Ias27)Documento14 pagineConsolidated and Separate Financial Statements (Ias27)prisun09Nessuna valutazione finora

- IAS 27: Consolidated andDocumento31 pagineIAS 27: Consolidated andashiakas8273Nessuna valutazione finora

- Joint VentureDocumento16 pagineJoint VenturejustingosocialNessuna valutazione finora

- Accounting For Group Structures: Ppts To Accompany Deegan, Australian Financial Accounting 7EDocumento43 pagineAccounting For Group Structures: Ppts To Accompany Deegan, Australian Financial Accounting 7EChelsea Anne VidalloNessuna valutazione finora

- Business Combinations and Consolidated Financial ReportingDocumento2 pagineBusiness Combinations and Consolidated Financial ReportingMellinda ChrisloNessuna valutazione finora

- Beams AdvAcc11 ChapterDocumento21 pagineBeams AdvAcc11 Chaptermd salehinNessuna valutazione finora

- Introduction To Financial ManagementDocumento37 pagineIntroduction To Financial ManagementEftakharul Haque BappyNessuna valutazione finora

- Balance Sheet Analysis PresentationDocumento13 pagineBalance Sheet Analysis PresentationChristian Emmanuel Jo BencaloNessuna valutazione finora

- Holding CompanyDocumento16 pagineHolding CompanyNguyen HungNessuna valutazione finora

- Fabm M4Documento24 pagineFabm M4Jolina GabaynoNessuna valutazione finora

- Consolidations: Chapter-6Documento54 pagineConsolidations: Chapter-6Ram KumarNessuna valutazione finora

- Consolidation 1Documento8 pagineConsolidation 1salehin1969Nessuna valutazione finora

- The Role of Managerial FinanceDocumento37 pagineThe Role of Managerial FinanceMalak W.Nessuna valutazione finora

- Consolidated Financial StatementsDocumento7 pagineConsolidated Financial StatementsParvez NahidNessuna valutazione finora

- Accounting Standard - 21Documento14 pagineAccounting Standard - 21Devmalya MazumderNessuna valutazione finora

- CH03MANDocumento32 pagineCH03MANcokmeyNessuna valutazione finora

- Further Consolidation Issues II: Accounting For Non-Controlling InterestsDocumento32 pagineFurther Consolidation Issues II: Accounting For Non-Controlling InterestsJesa SinghbalNessuna valutazione finora

- IFRS 10 and 12 CPD September 2013Documento75 pagineIFRS 10 and 12 CPD September 2013Nicolaus CopernicusNessuna valutazione finora

- 05 Bbfa4403 T1Documento40 pagine05 Bbfa4403 T1BABYNessuna valutazione finora

- FIN 254 - Chapter 1Documento23 pagineFIN 254 - Chapter 1habibNessuna valutazione finora

- Fundamentals of Financial Accounting 4th Edition Phillips Solutions ManualDocumento43 pagineFundamentals of Financial Accounting 4th Edition Phillips Solutions ManualGregoryGreenjptqd100% (14)

- Solution Manual Advanced Accounting 11e by Beams 03 ChapterDocumento22 pagineSolution Manual Advanced Accounting 11e by Beams 03 ChapterPacific Hunter Johnny0% (1)

- Financial Statements and Ratio Analysis: Learning GoalsDocumento31 pagineFinancial Statements and Ratio Analysis: Learning GoalsMohammadNessuna valutazione finora

- Consolidations SummaryDocumento9 pagineConsolidations Summaryu22541617Nessuna valutazione finora

- Topic 1 Acc2013Documento31 pagineTopic 1 Acc2013yellowcat91Nessuna valutazione finora

- 8553Documento19 pagine8553Abdullah AliNessuna valutazione finora

- Consolidation As of The Date of AcquisitionDocumento10 pagineConsolidation As of The Date of AcquisitionJan SpantonNessuna valutazione finora

- Consolidation Theories, Push-Down Accounting, and Corporate Joint VenturesDocumento27 pagineConsolidation Theories, Push-Down Accounting, and Corporate Joint VenturesvionaNessuna valutazione finora

- Electronic Presentations in Microsoft Powerpoint: Peter SecordDocumento27 pagineElectronic Presentations in Microsoft Powerpoint: Peter SecordKarishma DoshiNessuna valutazione finora

- M01 Gitman50803X 14 MF C01Documento52 pagineM01 Gitman50803X 14 MF C01RaniaNessuna valutazione finora

- Pra 371Documento3 paginePra 371Nikesh SapkotaNessuna valutazione finora

- Accounting As A Form of Communication: QuestionsDocumento7 pagineAccounting As A Form of Communication: QuestionsJonathan and Mercy NjuraitaNessuna valutazione finora

- Advanced Acc - VinamikDocumento4 pagineAdvanced Acc - VinamikViệt HàNessuna valutazione finora

- Principles of Company and Group Financial Statements: ABAB113 Business Accounting Semester 1 2014/2015Documento17 paginePrinciples of Company and Group Financial Statements: ABAB113 Business Accounting Semester 1 2014/2015AmalMdIsaNessuna valutazione finora

- CH 8 FeasibiltyDocumento36 pagineCH 8 FeasibiltyDalia ElarabyNessuna valutazione finora

- Mojakoe Ak2 Uts 2018 PDFDocumento17 pagineMojakoe Ak2 Uts 2018 PDFRayhandi AlmerifkiNessuna valutazione finora

- Use The Following Information For The Next Three Questions:: Oral QuizDocumento6 pagineUse The Following Information For The Next Three Questions:: Oral QuizLourdios EdullantesNessuna valutazione finora

- Client Backgrounder Apa Format 1 1 2Documento6 pagineClient Backgrounder Apa Format 1 1 2api-479314637Nessuna valutazione finora

- Singapore Office REITs Rents Edge Up on Supply LullDocumento16 pagineSingapore Office REITs Rents Edge Up on Supply LullTheng RogerNessuna valutazione finora

- Corporate Law AssignmentDocumento15 pagineCorporate Law Assignmentsandeep Gurjar100% (1)

- Company Law Assignment Analyzes Breach of ContractDocumento7 pagineCompany Law Assignment Analyzes Breach of ContractMohamad WafiyNessuna valutazione finora

- Law On CorporationDocumento61 pagineLaw On CorporationValierry VelascoNessuna valutazione finora

- Mergers and AcquisitionsDocumento15 pagineMergers and Acquisitionsananta100% (1)

- Pin Flyback Dilihat / Dihitung Dari Bawah Searah Jarum JamDocumento52 paginePin Flyback Dilihat / Dihitung Dari Bawah Searah Jarum JamJuan Carlos RangelNessuna valutazione finora

- Kinds of Taxpayers: Moairah Banielyn Joy B. LaritaDocumento28 pagineKinds of Taxpayers: Moairah Banielyn Joy B. LaritaMoairah LaritaNessuna valutazione finora

- Ch.2 Accounting For Business CombinationsDocumento3 pagineCh.2 Accounting For Business Combinationsyousef100% (1)

- Raport Kroll II OcrDocumento154 pagineRaport Kroll II OcrSergiu BadanNessuna valutazione finora

- PFRS 11 Joint ArrangementsDocumento2 paginePFRS 11 Joint ArrangementsElla MaeNessuna valutazione finora

- Range Bound Breakout, Technical Analysis ScannerDocumento16 pagineRange Bound Breakout, Technical Analysis ScannerSalim MiyaNessuna valutazione finora

- Review Test Submission - Lecture 6 - Online Assignment - ..Documento6 pagineReview Test Submission - Lecture 6 - Online Assignment - ..RishabhNessuna valutazione finora

- Secretarial Audit, Compliance Management and Due Diligence - Marathon Notes - December 20Documento144 pagineSecretarial Audit, Compliance Management and Due Diligence - Marathon Notes - December 20Cma SankaraiahNessuna valutazione finora

- Maxwell Communication Corporation and Mirror Group NewspapersDocumento28 pagineMaxwell Communication Corporation and Mirror Group NewspapersKajal V100% (1)

- No Customer Name Company Name MobileDocumento3 pagineNo Customer Name Company Name Mobilefarhana farhana100% (1)

- Lecture 13 Co. Law DirectorsDocumento59 pagineLecture 13 Co. Law DirectorsNick William100% (3)

- A TEXT BOOK 9 NEU FINANCIAL ACCOUNTING Non BSADocumento166 pagineA TEXT BOOK 9 NEU FINANCIAL ACCOUNTING Non BSAHope Not FoundNessuna valutazione finora

- Law MCQ FinalDocumento32 pagineLaw MCQ FinalDeepa BhatiaNessuna valutazione finora

- Resolving business disputes through alternative meansDocumento4 pagineResolving business disputes through alternative meansলীলাবতীNessuna valutazione finora

- Company ListDocumento9 pagineCompany Listsayalisonawane04Nessuna valutazione finora

- Partnership Report Art. 1839-1850Documento5 paginePartnership Report Art. 1839-1850Nehemiah MontecilloNessuna valutazione finora

- PT KOKOH FINANCIALSDocumento46 paginePT KOKOH FINANCIALSKarina DewiNessuna valutazione finora

- Grasim & L&TDocumento41 pagineGrasim & L&TSuchi Patel0% (1)

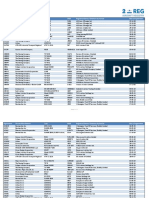

- Register 20230701 2Documento13 pagineRegister 20230701 2SalamNessuna valutazione finora

- Unit 2 & 3Documento157 pagineUnit 2 & 3Chirag Dugar100% (1)

- Successful BusinessmanDocumento1 paginaSuccessful BusinessmanEllena DanaNessuna valutazione finora

- Important Notes on Business CombinationsDocumento10 pagineImportant Notes on Business CombinationsSajib Kumar DasNessuna valutazione finora