Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Global Marketing: Global Market-Entry Strategies: Licensing, Investment and Strategic Alliances

Caricato da

Hoang Ha0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

60 visualizzazioni34 pagineTitolo originale

keegan_gm9_ppt_09.pptx

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

60 visualizzazioni34 pagineGlobal Marketing: Global Market-Entry Strategies: Licensing, Investment and Strategic Alliances

Caricato da

Hoang HaCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 34

Global Marketing

WARREN J. KEEGAN/MARK C. GREEN

NINTH EDITION

Global Market-Entry Strategies: Licensing,

Investment and Strategic Alliances

Chapter 9

Learning Objectives

1. Explain the advantages and disadvantages of using licensing as

a market-entry strategy.

2. Compare and contrast the different forms that a company’s

foreign investments can take.

3. Discuss the factors that contribute to the successful launch of a

global strategic partnership.

4. Identify some of the challenges associated with partnerships in

developing countries.

5. Describe the special forms of cooperative strategies found in

Asia.

6. Explain the evolution of cooperative strategies in the 21st

century.

7. Use the market expansion strategies matrix to explain the

strategies used by the world’s biggest global companies.

Copyright © 2017 Pearson Education, Inc. 9-2

Investment Cost of Marketing Entry Strategies

Copyright © 2017 Pearson Education, Inc. 9-3

Which Strategy Should Be Used?

• It depends on:

– Vision

– Attitude toward

risk

– Available

investment capital Starbucks plans to have 1,500

stores in China by 2015.

– How much control

is desired

Copyright © 2017 Pearson Education, Inc. 9-4

Licensing

• A contractual agreement

whereby one company (the

licensor) makes an asset

available to another company

(the licensee) in exchange for

royalties, license fees, or some

other form of compensation

– Patent

– Trade secret

– Brand name

– Product formulations

• Worldwide sales of licensed

goods

totaled $241.5 billion in 2014 Disney is the world’s top licensor.

Copyright © 2017 Pearson Education, Inc. 9-5

Advantages to Licensing

• Provides additional profitability with little initial

investment

• Provides method of circumventing tariffs, quotas,

and other export barriers

• Attractive ROI

• Low costs to implement

• Licensees have autonomy to adapt products to

local tastes

• License agreements should have cross-technology

agreements to share developments and create

competitive advantage for each party

Copyright © 2017 Pearson Education, Inc. 9-6

Disadvantages to Licensing

• Limited market control

• Returns may be lost

• The agreement may be short-lived

• Licensee may become competitor

• Licensee may exploit company resources

Copyright © 2017 Pearson Education, Inc. 9-7

Special Licensing Arrangements

• Contract manufacturing

– Company provides technical specifications to a subcontractor or

local manufacturer

– Allows company to specialize in product design while

contractors accept responsibility for manufacturing facilities

– May open the firm to criticism if manufacturers operate with

harsh working conditions or have low wages

• Franchising

– Contract between a parent company-franchisor and a franchisee

that allows the franchisee to operate a business developed by

the franchisor in return for a fee and adherence to franchise-

wide policies

– Used by the specialty retailing & fast-food industries

Copyright © 2017 Pearson Education, Inc. 9-8

Franchising Questions

• Will local consumers buy your product?

• How tough is the local competition?

• Does the government respect trademark and

franchiser rights?

• Can your profits be easily repatriated?

• Can you buy all the supplies you need locally?

• Is commercial space available and are rents

affordable?

• Are your local partners financially sound and do they

understand the basics of franchising?

Copyright © 2017 Pearson Education, Inc. 9-9

Investment

• Partial or full ownership of

operations outside of home

country

– Foreign Direct

Investment (FDI)

• Forms

– Joint ventures

– Minority or majority

equity stakes

– Outright acquisition

Copyright © 2017 Pearson Education, Inc. 9-10

Joint Ventures

• Entry strategy for a single target country in

which the partners share ownership of a

newly-created business entity

• Builds upon each partner’s strengths

• Examples: Budweiser and Kirin (Japan), GM

and Toyota, GM and Daewoo in S. Korea, Ford

and Mazda, Chrysler and BMW

Copyright © 2017 Pearson Education, Inc. 9-11

Joint Ventures

• Advantages • Disadvantages

– Allows for risk sharing– – Requires more investment

financial and political than a licensing agreement

– Provides opportunity to – Must share rewards as well

learn new environment as risks

– Provides opportunity to – Requires strong

achieve synergy by coordination

combining strengths of – Potential for conflict

partners among partners

– May be the only way to – Partner may become a

enter market given barriers competitor

to entry

Copyright © 2017 Pearson Education, Inc. 9-12

Investment via

Equity Stake or Full Ownership

• Equity stakes is an investment

• Minority ˂ 50%, Majority˃ 50%, Full ownership =100%

• Start-up of new operations

– Greenfield operations or

– Greenfield investment

• Merger with an existing enterprise

• Acquisition of an existing enterprise

• Examples: Roche acquired Genentech in 2008 for $43

billion

Copyright © 2017 Pearson Education, Inc. 9-13

Examples of Market Entry &

Expansion by Joint Venture

Copyright © 2017 Pearson Education, Inc. 9-14

Examples of Equity Stake

Copyright © 2017 Pearson Education, Inc. 9-15

Examples of Acquisitions

Copyright © 2017 Pearson Education, Inc. 9-16

Issues in Acquisitions

• Globalization is driving acquisitions; smaller firms

cannot expand without a partner

– “It was very clear to us that Helene Curtis did not have

the capacity to project itself in emerging markets

around the world. As markets get larger, that forces

the smaller players to take action.”

Ronald Gidwitz, CEO Unilever, on acquiring Helene Curtis

• Ownership circumvents tariffs & quota barriers,

gets new markets, allows technology transfers

and gain new manufacturing methods.

Copyright © 2017 Pearson Education, Inc.

9-17

Alternatives for Market Entry

• Licensing, joint ventures, minority or majority

equity stake, and ownership—are points along

a continuum of alternative strategies for

global market entry and expansion.

• Companies may use a combination

– Ex. Borden Foods stopped licensing for branded

food products in Japan and set up its on

production, distribution & marketing but kept JVs

in non-food products

Copyright © 2017 Pearson Education, Inc.

9-18

Global Strategic Partnerships

• Possible terms:

– Collaborative

agreements

– Strategic alliances

– Strategic international

alliances

– Global strategic

partnerships Oneworld is a GSP made up of

American Airlines and other

airlines around the world.

Copyright © 2017 Pearson Education, Inc. 9-19

The Nature of

Global Strategic Partnerships

Copyright © 2017 Pearson Education, Inc. 9-20

Characteristics of

Global Strategic Partnerships

• Participants remain independent following

formation of the alliance

• Participants share benefits of alliance as well

as control over performance of assigned tasks

• Participants make ongoing contributions in

technology, products, and other key strategic

areas

Copyright © 2017 Pearson Education, Inc. 9-21

Five Attributes of True

Global Strategic Partnerships

• Two or more companies develop a joint long-

term strategy

• Relationship is reciprocal

• Partners’ vision and efforts are global

• Relationship is organized along horizontal lines

(not vertical)

• When competing in markets not covered by

alliance, participants retain national and

ideological identities

Copyright © 2017 Pearson Education, Inc. 9-22

Global Strategic Partnerships

Copyright © 2017 Pearson Education, Inc.

9-23

Success Factors of Alliances

• Mission: Successful GSPs create win-win

situations, where participants pursue

objectives on the basis of mutual need or

advantage.

• Strategy: A company may establish separate

GSPs with different partners; strategy must be

thought out up front to avoid conflicts.

• Governance: Discussion and consensus must

be the norms. Partners must be viewed as

equals.

Copyright © 2017 Pearson Education, Inc. 9-24

Success Factors (Con’t)

• Culture: Personal chemistry is important, as is

the successful development of a shared set of

values.

• Organization: Innovative structures and

designs may be needed to offset the

complexity of multi-country management.

• Management: Potentially divisive issues must

be identified in advance and clear, unitary

lines of authority established that will result in

commitment by all partners.

Copyright © 2017 Pearson Education, Inc. 9-25

Alliances with Asian Competitors

• Western companies must learn from Asian firms’

excellence in manufacturing, overcome NIH

syndrome, become students, not teachers

• Four common problem areas

– Each partner had a different dream

– Each must contribute to the alliance and each must

depend on the other to a degree that justifies the

alliance

– Differences in management philosophy, expectations,

and approaches

– No corporate memory

Copyright © 2017 Pearson Education, Inc. 9-26

Cooperative Alliance in Japan:

Keiretsu

• Inter-business alliance or enterprise groups in

which business families join together to fight

for market share

• Often cemented by bank ownership of large

blocks of stock and by cross-ownership of

stock between a company and its buyers and

non-financial suppliers

• Keiretsu executives can legally sit on each

other’s boards, share information, and

coordinate prices

Copyright © 2017 Pearson Education, Inc. 9-27

Horizontal Keiretsu

• Big Six: Mitsui, Mitsubishi, Sumitomo, Fuyo,

Sanwa, DKB Groups

• Horizontal keiretsu: intragroup relationships

involve shared stock holdings and trading

relations

• Large, powerful with revenues in hundreds of

billions

• Can block foreign suppliers causing higher prices

• Promotes corporate stability, risk sharing, long-

term employment

Copyright © 2017 Pearson Education, Inc.

9-28

Keretsui

• Vertical keretsui: Hierarchical alliances

between manufacturers and retailers

– Matshusita sells its products through its chain of

National stores; 50-80% of products are

Matshusita brands Panasonic, Technics, and

Quasar

• Manufacturing keretsui: Vertical hierarchical

alliances between automakers suppliers, and

component manufacturers

Copyright © 2017 Pearson Education, Inc.

9-29

Cooperative Strategies in South

Korea: Chaebol

• Composed of dozens of companies, centered

around a bank or holding company, and

dominated by a founding family

– Samsung

– LG

– Hyundai

– Daewoo

Copyright © 2017 Pearson Education, Inc. 9-30

21st Century Cooperative Strategies:

Targeting the Digital Future

• Alliances between companies in several

industries that are undergoing transformation

and convergence

– Computers

– Communications

– Consumer electronics

– Entertainment

Copyright © 2017 Pearson Education, Inc. 9-31

21st Century Cooperative Strategies

• Semantech: Consortium of 14 tech companies

tasked with saving the U.S. chip-making industry

• Relationship enterprise: groupings of firms from

different industries and countries with common

goals and act as one entity

• Next stage of evolution of the strategic alliance

– Super-alliance

– Virtual corporation

Copyright © 2017 Pearson Education, Inc. 9-32

Market Expansion Strategies

• Companies must decide to expand by:

– Seeking new markets in existing countries

– Seeking new country markets for already

identified and served market segments

Copyright © 2017 Pearson Education, Inc. 9-33

Looking Ahead to Chapter 10

Brand and Product Decisions in Global

Marketing

Copyright © 2017 Pearson Education, Inc. 9-34

Potrebbero piacerti anche

- Strategic Alliances: Three Ways to Make Them WorkDa EverandStrategic Alliances: Three Ways to Make Them WorkValutazione: 3.5 su 5 stelle3.5/5 (1)

- Ch.9 Pemasaran GlobalDocumento33 pagineCh.9 Pemasaran Globaldina100% (1)

- Breakthrough (Review and Analysis of Davidson's Book)Da EverandBreakthrough (Review and Analysis of Davidson's Book)Nessuna valutazione finora

- Chp9 MKT Entry - Licence, Invest & Strag AllDocumento38 pagineChp9 MKT Entry - Licence, Invest & Strag All李新鹏Nessuna valutazione finora

- Wise Money: Using the Endowment Investment Approach to Minimize Volatility and Increase ControlDa EverandWise Money: Using the Endowment Investment Approach to Minimize Volatility and Increase ControlNessuna valutazione finora

- Global MarketingDocumento32 pagineGlobal MarketingAtakan ErdoganNessuna valutazione finora

- Summary of Martin Reeves, Knut Haanaes & Janmejaya Sinha's Your Strategy Needs a StrategyDa EverandSummary of Martin Reeves, Knut Haanaes & Janmejaya Sinha's Your Strategy Needs a StrategyNessuna valutazione finora

- Lecture 4.2 - Global Market - Entry Strategies - Licensing, Investment, and Strategic AlliancesDocumento24 pagineLecture 4.2 - Global Market - Entry Strategies - Licensing, Investment, and Strategic AlliancesronNessuna valutazione finora

- ch9 150807164930 Lva1 App6891Documento32 paginech9 150807164930 Lva1 App6891Sadia Islam 2125181660Nessuna valutazione finora

- Chap 9 PPT - Global Market Entry Strategies Licensing Investment and Strategic AlliancesDocumento28 pagineChap 9 PPT - Global Market Entry Strategies Licensing Investment and Strategic AlliancesMuhammad TahaNessuna valutazione finora

- Global Market Entry Strategies: Licensing, Investment, and Strategic AlliancesDocumento26 pagineGlobal Market Entry Strategies: Licensing, Investment, and Strategic AlliancesAhmad Fauzan Fiqri, S.ENessuna valutazione finora

- STM CH10 Corp Strategy (2) .183969.1584426601.8263 PDFDocumento35 pagineSTM CH10 Corp Strategy (2) .183969.1584426601.8263 PDFNattanonSirirungruangNessuna valutazione finora

- Global Market Entry Strategies: Licensing, Investment, and Strategic AlliancesDocumento23 pagineGlobal Market Entry Strategies: Licensing, Investment, and Strategic AlliancesRohit JainNessuna valutazione finora

- Global Market Group 4Documento32 pagineGlobal Market Group 4Cherry Joy OyanonNessuna valutazione finora

- CKR Ib4 Inppt 11Documento55 pagineCKR Ib4 Inppt 11nadiaNessuna valutazione finora

- Chap006 Merged PDFDocumento132 pagineChap006 Merged PDFEnith ArriagaNessuna valutazione finora

- Keegan 5e 09Documento28 pagineKeegan 5e 09api-3695734Nessuna valutazione finora

- Developing A Business Mindset: Business in Action 8e Bovée/ThillDocumento39 pagineDeveloping A Business Mindset: Business in Action 8e Bovée/ThillTehreem AhmedNessuna valutazione finora

- Lesson 8Documento22 pagineLesson 8Mi 12A1 - 19 Nguyễn Ngọc TràNessuna valutazione finora

- Week14-Customer Segments-Value proposition-Channels-Customer Relationship-Revenue Streams-Key Resources-Key PartnershipsDocumento28 pagineWeek14-Customer Segments-Value proposition-Channels-Customer Relationship-Revenue Streams-Key Resources-Key PartnershipsnonoNessuna valutazione finora

- David SMCC16ge ppt04Documento42 pagineDavid SMCC16ge ppt04Lê Quỳnh ChiNessuna valutazione finora

- Alliances MergedDocumento87 pagineAlliances MergedSiddhant SinghNessuna valutazione finora

- Global Market Entry Strategies (Licensing, Investment, and Strategic Alliances)Documento25 pagineGlobal Market Entry Strategies (Licensing, Investment, and Strategic Alliances)Kanta Ganguly100% (1)

- CH4 David SMCC16ge Ppt04Documento41 pagineCH4 David SMCC16ge Ppt04Yanty IbrahimNessuna valutazione finora

- Session 6, Cp. 4, Types of Strategies, Sent To Students 191007Documento21 pagineSession 6, Cp. 4, Types of Strategies, Sent To Students 191007CalvinNessuna valutazione finora

- Involvement/Risk/ Reward of Market Entry StrategiesDocumento13 pagineInvolvement/Risk/ Reward of Market Entry StrategiesOk HqNessuna valutazione finora

- Strategic AlliancesDocumento35 pagineStrategic AlliancesRaja BharatNessuna valutazione finora

- Strategy Implementation: Chapter NineDocumento36 pagineStrategy Implementation: Chapter NineÇağla KutluNessuna valutazione finora

- Types of Strategies: Chapter FourDocumento45 pagineTypes of Strategies: Chapter FourChristy MachaalanyNessuna valutazione finora

- Module - 3 Modes of International Entry: Amity School of BusinessDocumento23 pagineModule - 3 Modes of International Entry: Amity School of BusinessanashussainNessuna valutazione finora

- Chapter 16 IfDocumento47 pagineChapter 16 Ifcuteserese roseNessuna valutazione finora

- Barney SMCA4 07Documento24 pagineBarney SMCA4 07Anggi Gayatri SetiawanNessuna valutazione finora

- Chapter VII - COOPERATIVE STRATEGYDocumento23 pagineChapter VII - COOPERATIVE STRATEGYSarah MotolNessuna valutazione finora

- Strategic MAnagment-Cooperative StrategyDocumento20 pagineStrategic MAnagment-Cooperative Strategyrohan_jangid8Nessuna valutazione finora

- Strategic Alliances & Joint Ventures: Prof. Arindam Mondal XLRI JamshedpurDocumento23 pagineStrategic Alliances & Joint Ventures: Prof. Arindam Mondal XLRI JamshedpurSiddhant SinghNessuna valutazione finora

- Canadian Entrepreneurship & Small Business Management: Balderson and MombourquetteDocumento36 pagineCanadian Entrepreneurship & Small Business Management: Balderson and MombourquetteRishab JoshiNessuna valutazione finora

- Chapter 8 SMDocumento34 pagineChapter 8 SMYber LexNessuna valutazione finora

- International Business: by Charles W.L. HillDocumento34 pagineInternational Business: by Charles W.L. HillHồng NhugnNessuna valutazione finora

- Barney SMCA4 09Documento24 pagineBarney SMCA4 09Anonymous 0HycR53Nessuna valutazione finora

- Chap - 6 NewDocumento56 pagineChap - 6 NewAtique Arif KhanNessuna valutazione finora

- Summary - Chapter 9Documento21 pagineSummary - Chapter 9chun88100% (2)

- Fund 05Documento11 pagineFund 05emreNessuna valutazione finora

- Strategies For Firm Growth: Bruce R. Barringer R. Duane IrelandDocumento26 pagineStrategies For Firm Growth: Bruce R. Barringer R. Duane IrelandmfarrukhiqbalNessuna valutazione finora

- International Business: The New Realities: Fourth EditionDocumento62 pagineInternational Business: The New Realities: Fourth EditionNaveed MunirNessuna valutazione finora

- © 2011 Pearson Education, Inc. Publishing As Prentice Hall 194Documento21 pagine© 2011 Pearson Education, Inc. Publishing As Prentice Hall 194Ömer DoganNessuna valutazione finora

- Small Business & Entrepreneurship - Chapter 14Documento28 pagineSmall Business & Entrepreneurship - Chapter 14Muhammad Zulhilmi Wak JongNessuna valutazione finora

- Cooperative Strategy: Strategic ManagementDocumento20 pagineCooperative Strategy: Strategic ManagementArho CobarrubiasNessuna valutazione finora

- Competitive Advantages SlidesDocumento41 pagineCompetitive Advantages SlidesBích ChâuNessuna valutazione finora

- Chp17 Leadership, Org CSR-20190930074449Documento24 pagineChp17 Leadership, Org CSR-20190930074449Vinnodth ShankarNessuna valutazione finora

- Global Market Entry Strategies: Licensing, Investment, and Strategic AlliancesDocumento26 pagineGlobal Market Entry Strategies: Licensing, Investment, and Strategic AlliancesnoorNessuna valutazione finora

- Chapter 9Documento16 pagineChapter 9Eko AgustianNessuna valutazione finora

- Global - Environment Week 5Documento37 pagineGlobal - Environment Week 5Melanie Cruz ConventoNessuna valutazione finora

- Hitt13e PPT Ch09Documento47 pagineHitt13e PPT Ch09Alaa ShaathNessuna valutazione finora

- Differentiation and Joint VentureDocumento3 pagineDifferentiation and Joint VentureMaricel BanquiaoNessuna valutazione finora

- Topic 9 Cooperative StrategyDocumento46 pagineTopic 9 Cooperative Strategy--bolabolaNessuna valutazione finora

- Difference Between Strategic Alliance, Joint Venture and Strategic AllianceDocumento7 pagineDifference Between Strategic Alliance, Joint Venture and Strategic AllianceTadashi HamadaNessuna valutazione finora

- Supplementing Competitive StrategyDocumento50 pagineSupplementing Competitive StrategynidalitNessuna valutazione finora

- Daniels14 - Direct Investment and Collaborative StrategiesDocumento27 pagineDaniels14 - Direct Investment and Collaborative StrategiesHuman Resource ManagementNessuna valutazione finora

- An Introduction To The Foundations of Financial ManagementDocumento25 pagineAn Introduction To The Foundations of Financial ManagementAhmed El KhateebNessuna valutazione finora

- Inter-Firm RelationshipsDocumento12 pagineInter-Firm RelationshipsPRAJWAL S NNessuna valutazione finora

- CFA Before You Take The Exam EBook PDFDocumento12 pagineCFA Before You Take The Exam EBook PDFVictor AndrésNessuna valutazione finora

- Essay Writing GuideDocumento25 pagineEssay Writing GuideChe HindsNessuna valutazione finora

- Samarakoon-Hasan2006 ReferenceWorkEntry PortfolioPerformanceEvaluationDocumento6 pagineSamarakoon-Hasan2006 ReferenceWorkEntry PortfolioPerformanceEvaluationHoang HaNessuna valutazione finora

- 19 Performance Evaluation PDFDocumento33 pagine19 Performance Evaluation PDFSneha MishraNessuna valutazione finora

- Master Tomas HlavatyDocumento86 pagineMaster Tomas HlavatyHoang HaNessuna valutazione finora

- Remote Session CBE Work Area GraphicDocumento4 pagineRemote Session CBE Work Area GraphicHoang HaNessuna valutazione finora

- Fintech Requires Knowledge in Three AreasDocumento4 pagineFintech Requires Knowledge in Three AreasHoang HaNessuna valutazione finora

- A Comparison of Active and Passive Portfolio ManagementDocumento23 pagineA Comparison of Active and Passive Portfolio ManagementHoang HaNessuna valutazione finora

- CH 04 - Introduction To Probability: Page 1Documento55 pagineCH 04 - Introduction To Probability: Page 1Hoang Ha0% (1)

- CH 02 - Descriptive Statistics: Tabular/Graphical: Page 1Documento37 pagineCH 02 - Descriptive Statistics: Tabular/Graphical: Page 1Hoang HaNessuna valutazione finora

- Why Does An Equal-Weighted Portfolio Outperform Value-And Price-Weighted Portfolios?Documento54 pagineWhy Does An Equal-Weighted Portfolio Outperform Value-And Price-Weighted Portfolios?Hoang HaNessuna valutazione finora

- CH 05 - Discrete Probability Distributions: Page 1Documento50 pagineCH 05 - Discrete Probability Distributions: Page 1Hoang HaNessuna valutazione finora

- CH 03 - Descriptive Statistics: Numerical: Page 1Documento72 pagineCH 03 - Descriptive Statistics: Numerical: Page 1Hoang Ha100% (1)

- CH 02 - Descriptive Statistics: Tabular/Graphical: Page 1Documento37 pagineCH 02 - Descriptive Statistics: Tabular/Graphical: Page 1Hoang HaNessuna valutazione finora

- IELTS Speaking Recent Actual Tests & Suggested Answers PDFDocumento300 pagineIELTS Speaking Recent Actual Tests & Suggested Answers PDFHoang HaNessuna valutazione finora

- CH 03 - Descriptive Statistics: Numerical: Page 1Documento72 pagineCH 03 - Descriptive Statistics: Numerical: Page 1Hoang Ha100% (1)

- CH 04 - Introduction To Probability: Page 1Documento55 pagineCH 04 - Introduction To Probability: Page 1Hoang Ha0% (1)

- CH 01 - Data and Statistics: Page 1Documento35 pagineCH 01 - Data and Statistics: Page 1Hoang Ha100% (2)

- Topic 15 Probabilities PDFDocumento7 pagineTopic 15 Probabilities PDFHoang HaNessuna valutazione finora

- CH 05 - Discrete Probability Distributions: Page 1Documento50 pagineCH 05 - Discrete Probability Distributions: Page 1Hoang HaNessuna valutazione finora

- Reading Challenge 1 PDFDocumento130 pagineReading Challenge 1 PDFngkevinhdcs1713100% (2)

- Topic 17 DistributionsDocumento10 pagineTopic 17 DistributionsHoang HaNessuna valutazione finora

- IELTS Speaking Recent Actual Tests & Suggested Answers PDFDocumento300 pagineIELTS Speaking Recent Actual Tests & Suggested Answers PDFHoang HaNessuna valutazione finora

- Topic 16 Basic Statistics PDFDocumento19 pagineTopic 16 Basic Statistics PDFHoang HaNessuna valutazione finora

- Chapter 03 Descriptive Statistics Numerical MeasuresDocumento49 pagineChapter 03 Descriptive Statistics Numerical MeasuresHoang Ha100% (1)

- Chua EssaysDocumento57 pagineChua EssaysHoang HaNessuna valutazione finora

- CH 05Documento34 pagineCH 05abdio89Nessuna valutazione finora

- Topic 15 Probabilities PDFDocumento7 pagineTopic 15 Probabilities PDFHoang HaNessuna valutazione finora

- Graduate Student Fees 2018 AMOD - WebDocumento4 pagineGraduate Student Fees 2018 AMOD - WebHoang HaNessuna valutazione finora

- Ron's SC Notes PDFDocumento97 pagineRon's SC Notes PDFHoang HaNessuna valutazione finora

- Mcdonald'S: Market StructureDocumento5 pagineMcdonald'S: Market Structurepalak32Nessuna valutazione finora

- 22-10-2010 Quiz Controlling) + AnswersDocumento3 pagine22-10-2010 Quiz Controlling) + AnswersRaymond Setiawan0% (1)

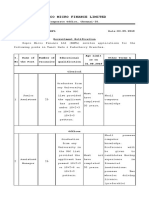

- Repco Micro Finance Limited: Corporate Office, Chennai-35Documento4 pagineRepco Micro Finance Limited: Corporate Office, Chennai-35Abaraj IthanNessuna valutazione finora

- Plan de NegociosDocumento20 paginePlan de NegociosMARIA JOSE GUERRERO VASQUEZNessuna valutazione finora

- M.a.part - I - Macro Economics (Eng)Documento341 pagineM.a.part - I - Macro Economics (Eng)Divyesh DixitNessuna valutazione finora

- Tenet Healthcare Corporation 401 (K) Retirement Savings Plan 25100Documento5 pagineTenet Healthcare Corporation 401 (K) Retirement Savings Plan 25100anon-822193Nessuna valutazione finora

- IASC Foundation CDocumento12 pagineIASC Foundation Cstudentul1986Nessuna valutazione finora

- CV-JM Van StraatenDocumento5 pagineCV-JM Van StraatenJovan Van StraatenNessuna valutazione finora

- DoD Risk MGT Guide v7 Interim Dec2014Documento100 pagineDoD Risk MGT Guide v7 Interim Dec2014Bre TroNessuna valutazione finora

- SabziwalaDocumento6 pagineSabziwalaSomnath BhattacharyaNessuna valutazione finora

- Molson Brewing CompanyDocumento16 pagineMolson Brewing CompanyVictoria ColakicNessuna valutazione finora

- Henkel: Building A Winning Culture: Group 09Documento11 pagineHenkel: Building A Winning Culture: Group 09sheersha kkNessuna valutazione finora

- Employee Service RegulationDocumento173 pagineEmployee Service RegulationKrishan Kumar Sharma50% (2)

- Kobetsu Kaizen: Maintenance ManagementDocumento34 pagineKobetsu Kaizen: Maintenance ManagementMohammed Rushnaiwala100% (1)

- MGT 111 - Module 1Documento2 pagineMGT 111 - Module 1Super Man of SteelNessuna valutazione finora

- Connected Party Declaration FormDocumento1 paginaConnected Party Declaration FormSyakir AfifiNessuna valutazione finora

- Bca 201612Documento78 pagineBca 201612tugayyoungNessuna valutazione finora

- Ecco Strategic AnalysisDocumento7 pagineEcco Strategic AnalysisLaishow Lai100% (3)

- Sorelle Bakery and Café: Case Study On MGT204Documento6 pagineSorelle Bakery and Café: Case Study On MGT204Mir SolaimanNessuna valutazione finora

- LMS European Aerospace Conference - AIRBUSDocumento26 pagineLMS European Aerospace Conference - AIRBUSCarlo FarlocchianoNessuna valutazione finora

- Ghani Glass 2007Documento39 pagineGhani Glass 2007Muhammad BilalNessuna valutazione finora

- Development CommunicationDocumento15 pagineDevelopment CommunicationJanbaz RahylNessuna valutazione finora

- Export Documentation FrameworkDocumento4 pagineExport Documentation FrameworkAbijit Ganguly100% (1)

- Paul Sonkin Investment StrategyDocumento20 paginePaul Sonkin Investment StrategyCanadianValueNessuna valutazione finora

- Melissa Schilling: Strategic Management of Technological InnovationDocumento25 pagineMelissa Schilling: Strategic Management of Technological Innovation143himabinduNessuna valutazione finora

- 12 Chapter2Documento36 pagine12 Chapter2lucasNessuna valutazione finora

- Report On Different Modes of Investment of IBBLDocumento72 pagineReport On Different Modes of Investment of IBBLMickey Nicholson83% (6)

- Benefits of Centralized LearningDocumento8 pagineBenefits of Centralized LearningAqeel ShaukatNessuna valutazione finora

- Types of OfferDocumento6 pagineTypes of OfferAmbreen AlamNessuna valutazione finora

- Roshan ProjectDocumento253 pagineRoshan ProjectAmit PrajapatiNessuna valutazione finora