Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

0budgetary Control and Variance Analysis

Caricato da

Basirahmmed.s.Halkarni0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

44 visualizzazioni156 pagineTitolo originale

0Budgetary Control and Variance Analysis.pptx

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

44 visualizzazioni156 pagine0budgetary Control and Variance Analysis

Caricato da

Basirahmmed.s.HalkarniCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 156

Budgetary Control System

Budgetary control refers to the

principles, procedures, and practices of

achieving given objectives through

budgets and budget reports. It has been

defined as "the establishment of

departmental budgets relating to the

responsibilities of executives to the

requirements of a policy and the continuous

comparison of actual with budgeted results,

either to secure by individual action to the

objective of their policy or to provide a basis

for its revision."

• Classification of Budgets

Budgets can be classified on the basis of

(a) Time (b) Nature (c) Activity and (d)

Functions.

I. Classification of Budgets according to

Time: (a) Long-term budget - extending five

to ten years: (b) Short-term budget - ranging

for a period of one or two years, (c) Current

budget up to one year; (d) Interim budget in

between two budget periods.

II. Classification of budget according to

Nature : (a) Operating budgets relating

to the operations of the enterprise, (b)

Financial Budgets concerning with the

financial implications of the operating

budgets i.e. relating to the capital

structure and liquidity of the enterprise;

e.g., Cash budget, Capital budget etc.

III. Classification according to Activity

Level or Capacity: Budgets, according

to activity, may be of two types (i) Fixed

Budget and (ii) Flexible (variable)

Budget. Fixed budget is one which

remains unchanged in spite of changes

in volume of output or level of activity.

This budget is prepared for a specific

planned activity and it is not adjusted

according to activity level attained.

On the other hand, a flexible or variable

budget is one which is prepared for

changing level of activity. It is also

known as ‘Sliding Scale Budget’. The

principle of flexible budget lies in

making a series of fixed budgets for

different levels of activity. A flexible

budget considers the difference in the

behaviour of fixed and variable costs.

IV. Classification according to

Functions Involved:

(a) Sales Budget: This is probably the

most important budget and is prepared

to show what finished products can be

sold in what quantities and at what

prices. It may be prepared (a) product-

wise (b) territory-wise (c) customer-

wise (d) period-wise and (e) according

to salesman.

In preparing a sales trend, the following

factors should be considered analysis of

past sales trend, estimates of salesman,

available plant capacity, orders on hand,

seasonal fluctuations in demand,

competition and market conditions.

(b) Production Budget: This budget is

based on sales budget as it has to

provide for the output needed to meet

the requirement of the sales budget. The

following points are kept in view while

preparing this budget: Production cycle,

availability of plant capacity, make or

buy decisions, desired inventory levels

and sales requirements.

(c) Raw Materials (Purchase) Budget: It is

based upon production budget, as this budget

provides for the materials needed for

production. Materials may be direct or

indirect. The materials budget generally deals

only with the direct materials. Indirect

materials are generally included in the works

overhead budget. Quantities of raw materials

to be used, cost of such materials, desired

inventory levels, storage space, economic size

of order, price, order already placed, etc., are

the main factors influencing this budget.

(d) Direct Labour Budget: Direct

Labour or Personnel budget covers the

estimates of direct labour requirements -

trained and untrained, essential for

carrying out the budgeted output. This

budget is generally prepared on the basis

of the different grades and trades of

workers needed for each

job/process/production.

(e) Plant Utilisation Budget: This budget

is also based on production budget. The

plant utilisation budget determines the

machine load in each department during

the budget period.

(f) Overheads Budgets: Overheads

budgets may be (a) Factory Overheads

Budget (b) Administrative Overheads

Budget (c) Selling and Distribution

Overheads Budget.

Manufacturing or Factory overheads

budget will provide an estimate of cost of

indirect labour, indirect material and

indirect expenses to be incurred in the

budget period. Administrative Overhead

budget covers the expenses of all the

central offices, and management salaries,

selling and distribution overhead budget

includes all expenses relating to selling,

advertising, delivery of goods to

customers, etc.

(g) Research and Development Budget:

This budget tells the estimated

expenditure for development and

research during the budget period. It is

drawn up taking into account the

research projects in hand and the new

projects to be taken up.

(h) Cash/Finance Budget: It is one of the

most important components of the financial

budget. The cash budget usually consists of

two parts giving detailed estimates of (i)

cash receipts and (ii) Cash payments.

Estimates of cash receipts are prepared on a

monthly basis and depend upon estimated

cash sales, collection from debtors, and

anticipated receipts from other sources e.g.,

sale of assets, borrowings, etc. Estimates of

cash payments are based on estimated

purchases of assets etc.

(i) Capital Expenditure Budget: This

budget plans for expenditure on fixed

assets. It involves heavy amount: its

impact is very much felt on the

production capacity or profitability of

the unit. Usually the plan period of this

budget stretches beyond the budget

period.

(j) Master Budget: It is the summary

budget, incorporating its component

functional budget, which is finally

approved, adopted and employed. The

budget may take the form of a Profit and

Loss Account and a Balance Sheet at the

end of the Budget Period.

• These functional budgets can also be

regrouped into (i) physical budgets,

(ii) cost budgets, (iii) profit budgets

and (iv) financial budgets.

• Administration of Budgetary Control

The process of budgetary control can be

reasonably divided into two stages (1)

preparation of budgets and (2)

implementation of the budget

performance. The preparation of a

budget can be viewed as an accounting

process and its implementation as a

management process.

Its effectiveness to a large extent

depends upon the organisation

efficiency. In a large-sized organisation,

an effective budgetary control system

can be organised on the following lines:

(i) Determining Objectives: A budget

being a plan for the achievement of

certain operational objectives, it is

desirable that same are defined very

precisely. The objectives should be

written out and the areas of control

should be clearly demarcated in order to

give a clear understanding of the plan

and its scope to all those who must

cooperate to make it a success.

(ii) Establishment of Budget Centres: A

budget centre is a section of the

organisation of an undertaking defined for

the purpose of budgetary control. A budget

is prepared for each budget centre and,

therefore, the budget centres should be

properly selected. A budget which refers to

a budget centre is a departmental budget.

A budget centre may again consist of a

number of cost centres representing

different groups of machines.

(iii)Introduction of Adequate Accounting

Records and Their Codification: The

budget department depends on the

accounts department for reliable

historical data which form the basis of

many estimates.

(iv)Preparation of Budget Organisation

Chart: Organisation chart defines the

functions and responsibilities of each

member of management and ensures that

each one knows his position on the

organisation and his relationship to other

members. It should also be supplemented

by written directives concerning the

function of the staff members. The

organisation chart depends upon the nature

and size of the enterprise; however, a

simple chart is given below.

. Managing Director

Budget Committee

Budget Officer

Sales Production Personnel Development

Manager Manager Manager Manager

Sales Budget, Production Labour Research &

Selling & Budget Budget Development

Distribution Budget

Budget etc.,

Purchase Finance

Manager Manager

Raw Material Budget, Stores &

Cash Budget, Capital Budget

Stock Budget

(v) Establishment of a Budget

Committee: In a small business, it is the

(Cost) Accountant who prepares the

budget, but in big undertaking, a Budget

Committee is appointed for this purpose.

The Budget committee consists of Chief

Executive or Managing Director, Budget

officer or Director or Controller and the

heads of main departments. The Chief

Executive acts as the chairman, and cost

accountant as its secretary.

The Managers of different departments

prepare their budget and submit to this

Committee. This Committee makes

necessary adjustments, coordinates all

the budgets and prepares a Master

Budget. The functions of a budget

committee are:

• ensuring that everyone appreciates the

budget efforts;

• reconciling divergent views;

• offering technical advice;

• coordinating budgeting activities;

• reviewing individual budgets;

• suggesting revisions, or approving

budget proposals without further

revision; and

• scrutinizing control reports in the latter

stages of the budgetary process.

(vi) Preparation of Budget Manual: It is

document or schedule or rule book

which sets out the responsibilities of the

persons engaged in the routine of and

the forms and records required for

budgetary control. This manual lays

down the budget programmes, and the

specific and general duties of the

executives, departmental managers and

the Budget Committee. The budget

manual usually contains the following:

• responsibilities of the persons engaged in

budgetary control;

• length of budget periods and control periods;

• the budget calendar showing the dates of

completion for each part of the budget and

submission of reports; dates of review, revision

and instructions issued;

• forms and records required for budgetary control;

• the accounts code and classification used by the

Company; method of accounting to be adopted;

procedure for preparation of financial statements

and reporting the same;

• budget proforma, etc;

• the follow-up Procedures.

• Budget Time Table: The budget manual

should give a schedule as to who is

responsible for what in an organisation.

Each responsible person should know

by what date he should finish his work.

• The following list describes the

activities for which different persons-

are generally responsible for:

Managers Responsible for

Sales Sales in terms of quantity, selling

prices, discounts, rebates, etc; sales

forecast, selling costs including those

of sales managements; representation,

advertising, etc; forecast of selling and

distribution costs; capital requirements.

Distribution Distribution costs including those of

transports storage etc., quantity of

finished goods stock.

Production Production in terms of quantity;

production costs; forecast of

production costs - material, labour

and overhead; raw material stocks

and work-in-progress; capital

requirements.

Research and Research costs; forecast research and

Development development costs, capital

requirements.

Managing Profit planning; capital expenditure;

Director depreciation; current assets and

liabilities e.g., level of trade debtors

and the cash position.

Company Administration costs - legal

Secretary expenses, audit fees, etc; forecast

administration costs; capital

requirements.

Budget Review of sales forecast, current

Committee operating results; review and approval

of master budget; long-term budget;

approval of department budget,

monthly cash forecast.

• Performance Report Time Table: A budget

manual should specify as to when performance

reports will be ready and given to managers.

For example, performance reports may be made

available after 15 days of the end of the

accounting period. The accounts departments

should ensure that this timetable is being

adhered to. Likewise, the budget committee

will review the performance results. Reports

from managers of budget centres should be

submitted to the budget committee before they

are discussed in the meeting.

(vii) Level of Activity: It is essential to

establish a normal level of activity since

it forms the basis of the budget. Level of

activity can be attained by efficient

working under the existing condition.

(viii) Selection of the Budget Period: The

period covered by a budget is known as

budget period. The length of the budget

period normally depends upon the

nature of the plan, circumstances of the

business, the control aspect, production

period and timings of availability of finance.

Most manufacturing industries use one year

as the budget period. For control purposes,

the annual totals are divided by 12 to obtain

monthly budgets; but if seasonal fluctuations

are important, separate budget estimates can

be made for each month or season. A budget

prepared for a very long time cannot be very

accurate as it is very difficult to forecast

events for a longer period.

(ix) Locating the Principal Budget

Factor: Budgets should be evolved

around the Principal budget factors (or

limiting, scarce or key factors) in

business. Every business has its own

key factors, which limits the level of

activities. These key factors should be

correctly identified and diagnosed. In

most of the enterprises, sales (demand)

is normally the key factor.

The success of the budgetary control

rests on the accuracy of the sales

forecast. If the sales figure proves to be

inaccurate, most of the budgets will be

affected. Similarly, materials, labour,

cash, space, equipment, management

etc., may also be the key factors. The

following is a detailed list of key

factors.

Sales (i) Marketing potentialities and

consumer demand,

(ii) Shortage of pushing salesmen,

(iii) inadequate advertising.

Materials (i) Availability of supply,

(ii)Restrictions imposed by licenses,

quota etc.

Labour (i) General shortage of workers,

(ii) Shortage in certain grades e.g.,

operation of modem complex

machinery.

Plant (i) Insufficient capacity due to

shortage in supply,

(ii) Insufficient capacity due to lack

of capital,

(iii) Bottlenecks in certain key

processes, operations or

departments.

Management (i) Shortage of efficient executives,

(ii) Lack of capital,

(iii) Insufficient research into product,

design and methods.

• Sometimes there may be two or more

limiting factors at the same time and the

budget committee has to take greater

care so as to assess the relative influence

of the key-factors. This problem is

generally solved with the help of graphs,

linear programming, operational

research, etc. It may be mentioned that

the key factor is not a permanent factor

and in the long run management may

get suitable opportunities to overcome

the key factor limitations by working

overtime of shifts, introducing new

methods, changing materials mix, hiring

new machinery or buying new

equipment on hire purchase, providing

incentive schemes and producing and

selling more profitable products,

selecting the optimum level of

production, etc.

(x) Determination of Budget Cost Allowance:

It is the cost which a budget centre is

expected to incur during a given period of

time in relation to the level of activity

attained by the budget centre.

(xi) Implementation of the Budget and

Recording of Actual Performance: A copy

of the section of the master budget

appropriate to each department sphere of

activity is issued to their respective heads for

execution.

(xii) Budget Variance Analysis &

Reporting: A variance is the divergence

between any planned result and the actual

result measured in monetary terms. Budget

variance is the difference between a

budgeted figure and an actual figure. The

overall variance between a planned cost and

an actual cost is usually due to a number of

factors. Ascertaining the contribution of each

factor to the overall variance is known as

variance analysis.

Any budget variance can be either (i) a

favourable variance which on its own

would result in the ultimate profit being

better than that planned or (ii) an adverse

variance which on its own would result in

the ultimate profit being worse than that

planned. A budget variance may be either

controllable or uncontrollable. A

controllable cost variance is one which be

identified as the primary responsibility of

a specified person.

It should be borne in mind that when

computing budget variance it is always

the budget allowance (allowed figures)

that is compared with the actual figure

and the original figure has no relevance.

• Elements of a Successful Budgetary

Control System

• The success of the budgeting process in an

organisation depends on the following

essential elements:

• Objectives: All planning presupposes that

objectives have been established, since the

plan is merely a means to an end, not an end

in itself. Objectives are the end.

• Knowledge of Cost Behaviour: It is

essential that there be an awareness of

the firm's particular cost patterns, and

the influences thereon. Cost-volume-

profit analysis is a useful adjunct to the

budgeting exercise, as it aids

considerable in understanding cost

behaviour.

• Accurate Forecasting of Business Activities:

Forecasting is a prerequisite in a budgeting

process. It is not only the starting point, but is also

critical to the development of an accurate budget.

Forecasting can be done regarding activities which

are internal and external to an organisation.

Internal activities are easier to forecast than

external activities such as production forecast. But

external factors like state of and nature of market

conditions, inflation or deflation and its effect on

company products are difficult to predict. Business

firms require competent market researchers to

forecast accurately such external factors.

• Coordinating Business Activities:

Budgeting needs to coordinate all the

individual budgets into an integrated plan as

each budget has certain implications tor the

other budgets. There must be coordination

between sales, production, purchasing, and

personnel budgets. Budgets are useful tools

in communicating budgetary expectations

and goals and in bringing necessary

adjustments among organisational activities.

• Education: All levels of management must be

convinced of the usefulness of budgets, and know the

part that each must play in planning and control

through budgets. This requires a continuous

programme of training in budgeting methods and their

value.

• Communicating the Budgets: The success of a

comprehensive budgeting programme depends on

communication of individual budgets to the different

units in the organisation. The basic point is that the

preparation of the budget is of no value unless it is

known to the person for whom it is meant. Managers

are not responsible for budget unless the budget is

communicated clearly, concisely and in an

authoritative manner to them.

• Acceptance and Cooperation: Successful

budgeting also requires that budgets should be

accepted by the people who must execute them.

Budgeting should have the active cooperation of

the entire organisation from the top to the bottom.

Cooperation for the budget can be achieved in a

number of ways.

• Reasonable Flexibility: The budgeting

programme should contain reasonable flexibility if

the situation so demands. However, it should be

noted that too much flexibility and too much

tightness are both undesirable. Too much

flexibility will weaken the cost control and the

budget will become inoperative. Similarly, too

much regidity not permitting reasonable deviations

will create problems and restrictions in the

implementation of the budget. If conditions have

changed making the estimates and budgets

inaccurate, the budgets should be revised. A

budget is simply a tool of to serve managements

needs and not an irrevocable contract.

• Adequate Systems Support: This will

come mainly from the accounting sphere,

where it must be ensured that records and

procedures are sufficient for the task in

hand. Thus, the budget should be linked to

the accounting system in such a way that

the same definitions, etc., relate to

common elements. (For example, if

inventories in the budget system are

valued at standard cost, so should the

inventories in the accounting system.)

• Providing a Framework for

Evaluation: Budgeting provides a basis

to evaluate the performance of different

departments. A comprehensive budget,

properly developed, will contain initially

organisational goals and expectation and

subsequently can be used as an effective

evaluation technique.

• Advantages of Budgetary Control:

• (i) Budgetary control aims at maximisation of

profits through optimum utilisation of resources.

• (ii) It is a technique for continuous monitoring of

policies and objectives of the organisation.

• (iii) It helps in reducing the costs, thereby helps in

better utilisation of funds of the organisation.

• (iv) All the departments of the organisation are

closely coordinated through establishment of plans

resulting insmooth functioning of the organisation.

• (v) Since budgets fix the responsibilities of the

executives, they act as a plan of action for them

there by reducing some of their work.

• (vi) It facilitates analysis of variances, thereby

identifying the areas where deficiencies occur and

proper remedial action can be taken.

• (vii) It facilitates the management by exception.

• (viii) Budgets act as a motivating force to achieve

the desired objective of the organisation.

• (ix) It assists delegation of authority and is a

powerful tool of responsibility accounting.

• (x) It helps in stabilizing the conditions in industries

which face seasonal fluctuations.

• (xi) It helps as a basis for internal audit.

• (xii) It provides a suitable basis for introducing the

payment by results system.

• (xiii) It ensures adequacy of working capital to the

organisation.

• (xiv) It aids in performance analysis and performance

reporting system.

• (xv) It aids in obtaining bank credit.

• (xvi)Budgets are forerunners of standard costs in the

sense that they create necessary conditions to suit

setting upof standard costs.

• Preliminaries for the Adoption of a System of

Budgetary Control:

• For the successful implementation of a system of

budgetary control certain pre-requisites are to be

fulfilled. These are enumerated below:

• (i) There should be an organization chart laying

out in clear terms the responsibilities and duties of

each level of executives, and the delegation of

authority to the various levels. For complete

success, a solid foundation in this regard should be

laid at the outset.

• (ii) The objectives, plans and policies of the

business should be defined in clear cut and

unambiguous terms.

• (iii) The output level for which budgets are fixed,

i.e., the budgeted output, should be stated.

• (iv) The particular budget factor which will be the

starting point of the preparation of the various

budgets should be indicated.

• (v) There should be an efficient system of

accounting to record and provide data in line with

the budgetary control system.

• (vi) For the establishment and efficient execution of

the plan, a Budget Committee should be set up.

• (vii) There should be a proper system of

communication and reporting between the various

levels of management.

• (viii) There should be a charter of programme.

This is usually in the form of a budget manual.

• (ix) The budgets should primarily be prepared by

those who are responsible for performance.

• (x) The budgets should be complete, continuous

and realistic.

• (xi) There should be an assurance from the top

management executives of co-operation and

acceptance of the budgetary system.

• Functional Budget:

• If budgets are prepared of a business concern for a

certain period taking each and every function

separately such budgets are called functional

budgets.

• Example: Production, Sales, purchases, cost of

production, cash, materials etc.

• The following are the various functional budgets,

some of which are briefly explained here under:

• (i) Sales Budget: The sales budget is a forecast of

total sales, expressed in terms of money or

quantity or both. The first step in the preparation

of the sales budget is to forecast as accurately as

possible, the sales anticipated during the budget

period. Sales forecasts are usually prepared by the

sales manager assisted by the market research

personnel.

• Factors to be considered in preparing Sales

Budget:-

• As business existence depends upon the sales it is

going to make and therefore it is an important one

to be prepared meticulously. It is the forecast of

what it can reasonably sell to its customers during

the period for which budget is prepared. The

company’s profit mostly depends upon the ability

to sell its products to customers. In the present era

it is indispensable to establish the demand for the

product even before it is produced. It is the sales

order book that the company’s continuity depends

upon. Also, a reasonable degree of accuracy must

be there in preparing a sales budget unless its sales

are accurately forecast, production estimates will

also become erroneous. A good amount of

experience must be necessary to prepare the sales

budget. Yet the following factors must be

considered in preparing the sales budget:

• (a) The locality of the market i.e., domestic or export

• (b) The target customers i.e., industry or trade or a section

or group of general public etc.,

• (c) The product portfolio i.e., the number of products

offered and their popularity among the target customers.

• (d) The market share of each product and its influence on

the product portfolio and the total market

• (e) The effectiveness of existing marketing policy on the

current sales volume and value.

• (f ) The market share of competitor’s products and their

effect on the company’s sales.

• (g) Seasonal fluctuation in sales.

• (h) Expenditure on advertisement and its impact on sales.

• (ii) Production Budget: The production budget

is a forecast of the production for the budget

period. Production budget is prepared in two

parts, viz. production volume budget for the

physical units of the products to be manufactured

and the cost of production or manufacturing

budget detailing the budgeted cost under material,

labour, and factory overhead in respect of the

products.

• Factors to be considered in Production Budget:

• Next to the sales budget, the main function of a

business concern is the production and for this, a

budget is prepared simultaneously with the sales

budget. It is the forecast of production during the

period for which the budget is prepared. It can also

be prepared in two parts viz., production volume

budget for the physical units i.e., the number of

units, the tonnes of production etc., and the cost of

production or manufacture showing details of all

elements of the manufacture. While preparing the

production budget, the following factors must be

taken into consideration:-

• (a) Production plan:-

• Production planning is an important part of the

preparation of the production budget. Optimum

utilisation of plant capacity is taken by eliminating

or reducing the limiting factors and thereby

effective production planning is made.

• (b) The capacity of the business concern:-

• It is to be ensured that the capacity of the

organisation will coincide the budgeted production

or not. For this purpose, plant utilisation budget

will also be necessary. The production budget

must be based on normal capacity likely to be

achieved and it should not be too high or too low.

• (c) Inventory Policy:-

• While preparing the production budget it is also

necessary to see to what extent materials are

available for producing the budgeted production.

For that purpose, a purchase budget or a purchase

plan must also be studied. Similarly, on the other

hand, it is also necessary to verify the extent to which

the inventory of finished goods is to be carried.

• (d) Sales Policy:-

• Sales budgets must also be considered before

preparing production budget because it may so

happen that the entire production of the concern may

not be sold. In such a case the production budget must

be in line with the sales budget.

• (e) Sequence of Operations Policy:-

• A plan of the sequence of operations of production for

effective preparation of a production budget should

always be there.

• (f) Management Policy:-

• Last, but not the least, the policy of the

management should also be considered before

preparing the production budget.

• Objectives and Advantages of Production

budget:

• • Optimum utilisation of the productive resources

of the organisation;

• • Maintaining low inventory which results in risk

of deterioration and fall in prices;

• • Focus on the factors that are necessary to frame

policies and plan sequence of operations;

• • Projection of policies framed, on the basis of past

performance, into the future to get the desired

results;

• • To see that right materials are provided at right

place and at right time;

• • Helps in scheduling of production so that

delivery dates are met and customer satisfaction is

gained;

• • Helpful in preparation of projected profit and

loss statement, which is useful in evaluation of

performance and profitability.

• (iii) Materials Budget: The material budget

includes quantities of direct materials; the

quantities of each raw material needed for each

finished product in the budget period is specified.

The input data for this budget is obtained by

applying standard material usage rates by each

type of material to the volume of output budgeted.

• (iv) Purchase Budget: The purchase budget

establishes the quantity and value of the

various items of materials to be purchased for

delivery at specified points of time during the

budget period taking into account the production

schedule of the concern and the inventory

requirements. It takes into account the

requirements for the entire budget plan as per the

sales, materials, maintenance, research and

development, and capital budgets. Purchases may

be required to be made in respect of direct and

indirect materials, finished goods for resale,

components and parts, and purchased services.

Before incorporation in the purchase budget, these

purchase requirements should be suitably

ascertained. Purchase budget also includes

material procurement budget.

• (v) Cash Budget: Cash Budget is estimated

receipts and expenses for a definite period,

which usually are cash sales, collection from

debtors and other receipts and expenses and

payment to suppliers, payment of wages, payment

of other expenses etc.

• (vi) Direct Labour Budget.

• (vii) Human Resources Budget.

• (viii) Selling and distribution cost budget.

• (ix) Administration Cost Budget.

• (x) Research and development Cost Budget etc.

• (xi) Master Budget: Master budget is the

budget prepared to cover all the functions of

the business organisation.

• It can be taken as the integrated budget of business

concern, that means, it shows the profit or loss and

financial position of the business concern such as

Budgeted Profit and Loss Account, Budgeted

Balance Sheet etc. Master budget, also known as

summary budget or finalized profit plan, combines

all the budgets for a period into one harmonious

unit and thus, it shows the overall budget plan.

The master budget incorporates all the subsidiary

functional budgets and the budgeted Profit and

Loss Account and Balance Sheet. Before the

budget plan is put into operation, the master

budget is considered by the top management and

revised if the position of profit disclosed therein is

not found to be satisfactory. After suitable revision

is made, the master budget is finally approved and

put into action. Another view regards the budgeted

Profit and Loss Account and the Balance Sheet as

the master budget.

FIXED, VARIABLE, SEMI-

VARIABLE BUDGETS

• Fixed or Rigid Budget:

• When budgets are prepared for a fixed or standard

volume of activity, they are called static or rigid or

fixed budgets. They do not change with the

changes in the volume of the output. These are

prepared normally 3 months in advance of the

year. However these will not be much helpful in

comparing the actual activity, as these are prepared

at a fixed volume of output. It, however, does not

mean that the fixed budget is a rigid one, not to be

changed at all. Though not adjusted to the actual

volume attained, a fixed budget is liable to

revision if due to business conditions undergoing a

basic change or due to other reasons, actual

operations differ widely from those planned in the

fixed budget.

Fixed budgets are most suited for fixed expenses.

In case of discretionary costs situations where the

expenditure is optional and has no relation with

the output, e.g. expenditure on research and

development, advertising, and new projects. A

fixed budget has only a limited application and is

ineffective as a tool for cost control. Fixed budgets

are useful where the plan permits maximum

stabilization of production, as for example, for

concerns which manufacture to build up

inventories of finished products and components.

• Flexible Budget:

• A flexible budget is a budget that is prepared for

different levels of activity or capacity utilization or

volume of output. If the budgets are prepared in

such a way so as to change in accordance with the

volume of output, they are called flexible budgets.

These can be prepared from fixed budget which

are also called revised budgets. These are much

helpful in comparison with actual because the

exact deviations are found for which timely

corrective action can be taken. The basic idea of a

flexible budget is that there shall be some standard

of cost and expenditures. Thus, a budget prepared

in a manner to give budgeted costs for any level of

activity is known as flexible budget. Such budget

is prepared after considering the variable and fixed

elements of costs and the changes, which may be

expected for each item at various levels of

operations. Thus a flexible budget recognises the

difference in behaviour between fixed and variable

costs in relation to fluctuations in production or

sales and is designed to change appropriately with

such fluctuations. In flexible budget, data relating

to costs, expenditures may progressively be

changed in any month in accordance with actual

output achieved. While preparing flexible budgets,

estimates of costs and expenditures on the basis of

standards determined are made from minimum to

maximum level of operations.

• Difference between Fixed and Flexible Budgets:

Fixed Budget Flexible Budget

It does not change with It can be recasted on the

actual volume of activity basis of activity level to be

achieved. Thus it is known achieved. Thus it is not rigid.

as rigid or inflexible budget.

It operates on one level of It consists of various budgets

activity and under one set of for different levels of

conditions. It assumes that activity.

there will be no change in the

prevailing conditions, which

is unrealistic.

Here as all costs like – fixed, Here analysis of variance

variable and semi-variable provides useful

are related to only one level information as each cost is

of activity so variance analysed according to its

analysis does not give useful behaviour.

information.

If the budgeted and actual Flexible budgeting at

activity levels differ different levels of activity

significantly, then the facilitates the

aspects like cost ascertainment of cost,

ascertainment and price fixation of selling price

fixation do not give a and tendering of

correct picture. quotations.

Comparison of actual It provides a meaningful

performance with budgeted basis of comparison of the

targets will be meaningless actual performance with the

specially when there is a budgeted targets.

difference between the two

activity levels.

• Principal Budget Factor:

• Budgets cover all the functional areas of the

organisation. For the effective implementation of

the budgetary system, all the functional areas are

to be considered which are interlinked. Because of

these interlinks, certain factors have the ability to

affect all other budgets. Such factor is known as

principle budget factor. Principal Budget factor is

the factor the extent of influence of which must

first be assessed in order to ensure that the

functional budgets are reasonably capable of

fulfilment. A principal budget factor may be lack

of demand, scarcity of raw material, non-

availability of skilled labour, inadequate working

capital etc. If for example, the organisation has the

capacity to produce 2500 units per annum. But the

production department is able to produce only

1800 units due to non-availability of raw

materials. In this case, non-availability of raw

materials is the principal budget factor (limiting

factor). If the sales manger estimates that he can

sell only 1500 units due to lack of demand. Then

lack of demand is the principal budget factor. This

concept is also known as key factor, or governing

factor. This factor highlights the constraints with

in which the organisation functions.

• Responsibility Accounting:

• One of the recent developments in the field of

management accounting is the responsibility

accounting, which is helpful in exercising cost

control. ‘Responsibility Accounting is a system of

accounting that recognizes various responsibility

centers throughout the organization and reflects

the plans and actions of each of these centers by

assigning particular revenues and costs to the one

having the pertinent responsibility. It is also called

profitability accounting and activity accounting.

• It is a system in which the person holding the

supervisory posts as president, function head,

foreman, etc are given a report showing the

performance of the company or department or

section as the case may be. The report will show

the data relating to operational results of the area

and the items of which he is responsible for

control. Responsibility accounting follows the

basic principles of any system of cost control like

budgetary control and standard costing. It differs

only in the sense that it lays emphasis on human

beings and fixes responsibilities for individuals.

It is based on the belief that control can be

exercised by human beings, so responsibilities

should be fixed for individuals.

Principles of responsibility accounting are as

follows:

• (a) A target is fixed for each department or

responsibility center.

• (b) Actual performance is compared with the

target.

• (c) The variances from plan are analysed so as to

fix the responsibility.

• (d) Corrective action is taken by higher

management and is communicated.

• Performance Budgeting:

• Performance Budgeting is synonymous with

Responsibility Accounting which means thus the

responsibility of various levels of management is

predetermined in terms of output or result keeping

in view the authority vested with them. The main

concepts of such a system are enumerated below:

• (a) It is based on a classification of managerial

level for the purpose of establishing a budget for

each level. The individual in charge of that level

should be made responsible and held accountable

for its performance over a given period of time.

• (b) The starting point of the performance

budgeting system rests with the organisation chart

in which the spheres of jurisdiction have been

determined. Authority leads to the responsibility

for certain costs and expenses which are forecast

or present in the budget with the knowledge of the

manager concerned.

• (c) The costs in each individual’s or department’s

budget should be limited to the cost controllable

by him.

• (d) The person concerned should have the

authority to bear the responsibility.

ZERO BASED BUDGETING (ZBB)

• It differs from the conventional system of

budgeting mainly it starts from scratch or zero and

not on the basis of trends or historical levels of

expenditure. In the customary budgeting system,

the last year’s figures are accepted as they are, or

cut back or increases are granted. Zero based

budgeting on the other hand, starts with the

premise that the budget for next period is zero so

long the demand for a function, process, project or

activity is not justified for each rupee from the

first rupee spent. The assumptions are that without

• such a justification no spending will be allowed.

The burden of proof thus shifts to each manager to

justify why the money should be spent at all and to

indicate what would happen if the proposed

activity is not carried out and no money is spent.

• The first step in the process of zero base budgeting

is to develop an operational plan or decision

package. A decision package identifies and

describes a particular activity with a view to:

• (i) Evaluate and allotted ranking the activity

against other activities competing for the same

scarce resources, and

(ii) Decide whether to accept or reject or amend the

activity.

• For this purpose, each package should give details

of costs, returns, purpose, expected results, the

alternatives available and a statement of the

consequences if the activity is reduced or not

performed at all.

• The advantages of Zero based budgeting are:

• (a) Out of date and inefficient operations are

identified.

• (b) Allows managers to promptly respond to

changes in the business environment.

• (c) Instead of accepting the current practice, it

creates a challenging and questioning attitude.

• (d) Allocation of resources is made according to needs

and the benefits derived.

• (e) It has a psychological impact on all levels of

management which makes each manager to ‘pay his

way’.

• Areas where zero-base budgeting is applicable

• Zero-base Budgeting is more suitably applicable to

discretionary cost areas. These costs may have no

relation to volume or activity and generally arise as a

result of management policies. Where standards are

determinable, those costs associated with the inputs

should be controlled through the use of standard

costing. On the other hand, if output as a function of

input cannot be specified. Zero-base Budgeting may

be more suitably applied. Thus, service or support-

type activities are more suitable for Z.B.B.

• PROCESS OF ZERO-BASE BUDGETING OR

STEPS INVOLVED IN ZERO-BASE

BUDGETING

• The process of Zero-Base Budgeting involves the

following steps:

• 1. Identification of ‘Decision units’

• 2. Preparation and development of decision

packages.

• 3. Ranking of priority.

• 4. Approval and Funding

• Identification of ‘Decision units’- A decision unit

refers to a tangible activity or group of activities for

which a single manager has the responsibility for

successful performance. Thus, decision unit is a

programme or a project or a segment of the

organisation for which separate budgets are to be

prepared.

• Preparation of Decision Packages: Preparation of

decision packages is a set of documents which

identify and describe activities of the unit in such a

way that the management can evaluate and rank them

against others competing for resources (limited) and

decide whether to approve or disapprove.

• Ranking of Priority: The third step involved in

Z.B.B. is the ranking of proposed alternatives

included in decision packages for various decision

units or of various decision packages for the same

decision unit.

• Funding: Funding involves the allocation of

available resources of the organisation to various

decision units keeping in mind the alternative

which has been selected and approved through

ranking process.

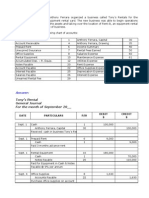

Problem: Draw up a flexible budget for overhead expenses on

the basis of the following data and determine the overhead

rates at 70%, 80% and 90%

Plant Capacity At 80% capacity (Rs)

Variable Overheads:

Indirect labour 12,000

Stores including spares 4,000

Semi Variable:

Power (30% - Fixed: 70% -Variable) 20,000

Repairs (60%- Fixed: 40% -Variable) 2,000

Fixed Overheads:

depreciation 11,000

Insurance 3,000

Salaries 10,000

Total overheads 62,000

Estimated Direct Labour Hours 1,24,000

Potrebbero piacerti anche

- Advertising Budget and Factors Affecting ItDocumento5 pagineAdvertising Budget and Factors Affecting ItBasirahmmed.s.HalkarniNessuna valutazione finora

- BSH MCP Prefinal PrintDocumento81 pagineBSH MCP Prefinal PrintBasirahmmed.s.HalkarniNessuna valutazione finora

- Adbirla ResumeDocumento2 pagineAdbirla ResumeBasirahmmed.s.HalkarniNessuna valutazione finora

- Evaluation of Hospital Waste Management in Public and Private Sector Hospitals of Faisalabad City, PakistanDocumento7 pagineEvaluation of Hospital Waste Management in Public and Private Sector Hospitals of Faisalabad City, PakistanBasirahmmed.s.HalkarniNessuna valutazione finora

- Karishma DavadaDocumento90 pagineKarishma DavadaBasirahmmed.s.HalkarniNessuna valutazione finora

- 2 Governance Practices Assessment Survey Questionnaire FormatDocumento17 pagine2 Governance Practices Assessment Survey Questionnaire FormatBasirahmmed.s.HalkarniNessuna valutazione finora

- WalmartCaseDocumento23 pagineWalmartCaseBasirahmmed.s.HalkarniNessuna valutazione finora

- BSH Sip Prefinal PDFDocumento114 pagineBSH Sip Prefinal PDFBasirahmmed.s.HalkarniNessuna valutazione finora

- Weekly Report For Major Concurrent Project: Kousali Institute of Management Studies, Karnataka University, DharwadDocumento2 pagineWeekly Report For Major Concurrent Project: Kousali Institute of Management Studies, Karnataka University, DharwadBasirahmmed.s.HalkarniNessuna valutazione finora

- BSH Sip PrefinalDocumento104 pagineBSH Sip PrefinalBasirahmmed.s.HalkarniNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- ColaDocumento4 pagineColaAkhil ChauhanNessuna valutazione finora

- Abm Investama TBK - Bilingual - 31 - March - 2021 - ReleasedDocumento224 pagineAbm Investama TBK - Bilingual - 31 - March - 2021 - Releasedriska fitasaptyanaNessuna valutazione finora

- Saurabh Surve - Updated ResumeDocumento4 pagineSaurabh Surve - Updated ResumeSaurabh SurveNessuna valutazione finora

- International MarketingDocumento4 pagineInternational MarketingasdNessuna valutazione finora

- Assignment 20 09 20Documento9 pagineAssignment 20 09 20Sherwin AuzaNessuna valutazione finora

- FA - Assignment - 01Documento17 pagineFA - Assignment - 01Rehan Mehmood63% (8)

- Customer Relationship Management in Retail Sector Big BazaarDocumento57 pagineCustomer Relationship Management in Retail Sector Big BazaarSaurabh Maheshwari100% (1)

- 2-Business Plans and Management PDFDocumento76 pagine2-Business Plans and Management PDFselvamejiaNessuna valutazione finora

- Chapter 21 Test BankDocumento78 pagineChapter 21 Test BankBrandon LeeNessuna valutazione finora

- FlexibilityDocumento87 pagineFlexibilityMurti Pradnya AdytiaNessuna valutazione finora

- Lab Test - Jan 2023Documento3 pagineLab Test - Jan 2023Siti Nurul AtiqahNessuna valutazione finora

- Carrefour 2022 Half-Year Financial ReportDocumento71 pagineCarrefour 2022 Half-Year Financial Reportgarcia.heberNessuna valutazione finora

- C2 CSRDocumento26 pagineC2 CSRKhả UyênNessuna valutazione finora

- Classes Document 1346855496Documento18 pagineClasses Document 1346855496Tony Peterz KurewaNessuna valutazione finora

- W 4-5 Cost and ManagementDocumento12 pagineW 4-5 Cost and ManagementMelvinNessuna valutazione finora

- Bond ProblemsDocumento27 pagineBond ProblemsCharity Laurente Bureros83% (6)

- Cost Asg3Documento12 pagineCost Asg3Shahzȝb KhanNessuna valutazione finora

- Assignment On: Developing A Career PlanDocumento2 pagineAssignment On: Developing A Career PlanNazmul HasanNessuna valutazione finora

- Digital Marketing Assignment YasirDocumento11 pagineDigital Marketing Assignment YasirSyed YasirNessuna valutazione finora

- Avon Products Inc 10k Annual Reports 20090220Documento184 pagineAvon Products Inc 10k Annual Reports 20090220Snehal VisaveNessuna valutazione finora

- Beneish N Nichols.2005Documento60 pagineBeneish N Nichols.2005Shanti PertiwiNessuna valutazione finora

- MBA Finance Project On Retail Banking With Special Reference To YES BANKDocumento111 pagineMBA Finance Project On Retail Banking With Special Reference To YES BANKChandramauli Mishra100% (1)

- Security Analysis and Portfolio Management FaqDocumento5 pagineSecurity Analysis and Portfolio Management Faqshanthini_srmNessuna valutazione finora

- Môn QU Ản Trị Chiến Lược (Strategic Management) L ớp học phần: Th ời lượng: 75 phútDocumento2 pagineMôn QU Ản Trị Chiến Lược (Strategic Management) L ớp học phần: Th ời lượng: 75 phútThanh Hiếu Trần ThịNessuna valutazione finora

- ITILDocumento21 pagineITILMaxwell MabhikwaNessuna valutazione finora

- Retail Pro POS v8, v9, Prism Ecommerce IntegrationDocumento19 pagineRetail Pro POS v8, v9, Prism Ecommerce IntegrationAvnish SaxenaNessuna valutazione finora

- BrandingDocumento17 pagineBrandingSiddhant AggarwalNessuna valutazione finora

- Unit 3 PlanningDocumento52 pagineUnit 3 PlanningPreeti BhaskarNessuna valutazione finora

- Group05 Assignment04 MSPDocumento4 pagineGroup05 Assignment04 MSPNilisha DeshbhratarNessuna valutazione finora

- Miniso Retail ManagementDocumento20 pagineMiniso Retail ManagementAditya100% (1)