Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Evolution of Security Standards in Indian Banking Industry: V.Radha Idrbt

Caricato da

Akshat Dubey0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

38 visualizzazioni14 pagineIIT KANPUR

Titolo originale

IITKanpur

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoIIT KANPUR

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

38 visualizzazioni14 pagineEvolution of Security Standards in Indian Banking Industry: V.Radha Idrbt

Caricato da

Akshat DubeyIIT KANPUR

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 14

Evolution of Security Standards

in Indian Banking Industry

V.Radha

IDRBT

The chronology of events (1999-2004)

• IDRBT set up INFINET

• Hyperchat was the only application

• Its VSAT based

• Banks were using Novell based net applications

• IP was enabled on INFINET and internal banks’ LAN could

be connected

• MMS Launched

• Novell was very late in bringing IP onto Netware. Today

there are no/few Novell app in Banking Industry.

• IDRBT CA

• SFMS

• NEFT

• NFS

Institue for Development and Research in

Monday, October 29, 2018 2

Banking Technology

First few threats and countermeasures

• Very low knowledge levels of Networks (Even IP

Addressing, Routing etc)

• Even Internet IP addresses that are generated from

DNS requests from browsers used to hit INFINET and

bring down the entire INFINET.

• Banks were guided to connect to INFINET through

routers with NAT, proxies, Firewalls etc

• MMS was hacked

• IS Audit was mandated

• CISA certifications were encouraged

• Internet Banking required RBI permission

• Training Programs on INFINET, Network Security, MMS

etc were launched

Institue for Development and Research in

Monday, October 29, 2018 3

Banking Technology

Recent Initiatives

• VAPT from Cert empanelled IS auditors

• IS Governance and IT Governance from IDRBT

• Gopala Krishna Committee Guidelines on

Security, Cybercrime etc

• PCI-DSS

• Mobile Banking Security Guidelines

Institue for Development and Research in

Monday, October 29, 2018 4

Banking Technology

Security

• Security Problems

– Man made

• Created by faulty design and implementation issues

– Phishing

– Spoofing etc

– Majority of attacks listed in OWASP

• Crossing lines of “not supposed to”

– Unauthorized Access

– Tampering Data

– Natural

• Identity Management

• AAA

• Secret Sharing etc

Institue for Development and Research in

Monday, October 29, 2018 5

Banking Technology

Solutions

• Strengthen the weak protocols, software, OS,

implementation etc

• Prevent security threats to manifest as much

as possible

• Monitor the events of crossing lines of “not

supposed to”

Institue for Development and Research in

Monday, October 29, 2018 6

Banking Technology

New thoughts

• Looked at phishing and solutions of anti-phishing

– Very less can be done from banks’ end on this

– Solutions like SPF has to be implemented by all across,

not just by banks.

– Domain Specific Passwords is a very good solution,

but has to be part of browsers

– Majority of the phishing techniques like domain name

look alike, URL redirection etc are taken care by

browsers

– Banks are asked to deploy adoptive authentication,

over and above 2 factor authentication (monitoring

solution)

Institue for Development and Research in

Monday, October 29, 2018 7

Banking Technology

Source Code Review

• As we see many vulnerabilities are due to bad

coding, we felt the need for mandating source

code review on application vendors. Also, we

observed that the product vendors like OS,

Database have framed their in house

frameworks for ensuring safe and secure

software.

Institue for Development and Research in

Monday, October 29, 2018 8

Banking Technology

Formal Methods

• New Payment Protocols

• Design Level Verification is must before

deploying the protocol

• New Privacy Issues in Mobile Telephony: Fix and

Verification by Ravishankar Borgaonkar et al

Institue for Development and Research in

Monday, October 29, 2018 9

Banking Technology

Data Privacy

• Some cases of corporate espionage

• Some banks setting up Data Governance

Groups

• Groups include HNI, Corporate Customers,

solution vendors along with banks CISO

Institue for Development and Research in

Monday, October 29, 2018 10

Banking Technology

Business Process Re-engineering

• Dematerialized Deposits

• Online Deposit verification

• Straight through Processing – Automated Data

Flow

• Online Lending Platforms

Institue for Development and Research in

Monday, October 29, 2018 11

Banking Technology

Education

• Most of the security problems thrown in the

courts of solution vendors (n/w, app etc)

• Banks can resolve them only if they are

knowledgeable

• Network Security, IS Audit, IS & IT

Governance, Secure Coding practices, Fraud

Detection and Monitoring etc help them equip

with latest know how.

Institue for Development and Research in

Monday, October 29, 2018 12

Banking Technology

Human Resources

• Banks are increasing the specialist technical

officers in Scale I and Scale II through campus

recruitment as well

• IDRBT Mtech IT with UOH, 100% placement

• We envisage that future generation of bank

employees would come up with new

innovations, appreciate the govt and regulatory

policies in taking benefits from technology, with

no or less resistance

Institue for Development and Research in

Monday, October 29, 2018 13

Banking Technology

Thank You

Institue for Development and Research in

Monday, October 29, 2018 14

Banking Technology

Potrebbero piacerti anche

- ACS-2821-001 Lecture Note 14 PDFDocumento16 pagineACS-2821-001 Lecture Note 14 PDFJohn MwaipopoNessuna valutazione finora

- Lecture 3 Country Specific StrategyDocumento21 pagineLecture 3 Country Specific StrategyShilukaNessuna valutazione finora

- Privacy by Design UK ICODocumento18 paginePrivacy by Design UK ICOJeremieNessuna valutazione finora

- Kabileshkumar - Resume v2.1Documento1 paginaKabileshkumar - Resume v2.1vijay ancNessuna valutazione finora

- Lecture 3 Country Specific StrategyDocumento18 pagineLecture 3 Country Specific StrategyR BNessuna valutazione finora

- Cyber Security AdvtDocumento1 paginaCyber Security Advtvaragg24Nessuna valutazione finora

- Jerome AldayDocumento3 pagineJerome AldayFlorino IsletaNessuna valutazione finora

- Digital: Cyber Security Training & Program Powered by Ignite TechnologiesDocumento5 pagineDigital: Cyber Security Training & Program Powered by Ignite TechnologiesrberrospiNessuna valutazione finora

- Cyber SecurityDocumento25 pagineCyber SecurityEdwin KimoriNessuna valutazione finora

- Rothke Mobilesecurityblundersandwhatyoucandoaboutthem 120811222156 Phpapp01Documento20 pagineRothke Mobilesecurityblundersandwhatyoucandoaboutthem 120811222156 Phpapp01Kalpesh JaniNessuna valutazione finora

- Cyber Security Activities at TheDocumento49 pagineCyber Security Activities at TheSakthi Kamal Nathan SambasivamNessuna valutazione finora

- m7 PresentationDocumento13 paginem7 Presentationapi-526409506Nessuna valutazione finora

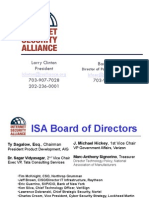

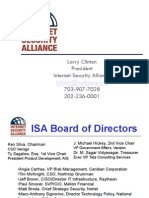

- 2009 04 26 Larry Clinton ISA Overview Presentation For Ed StullDocumento13 pagine2009 04 26 Larry Clinton ISA Overview Presentation For Ed StullisallianceNessuna valutazione finora

- All SlidesDocumento435 pagineAll SlidesSubhash MohanNessuna valutazione finora

- Information Technology Risk Frameworks and AuditsDocumento43 pagineInformation Technology Risk Frameworks and AuditsMaxwell ChigangaidzeNessuna valutazione finora

- 2004 12 03 Larry Clinton Philadelphia Presentation About ISA and Coherent Program of Cyber Security Through IncentivesDocumento35 pagine2004 12 03 Larry Clinton Philadelphia Presentation About ISA and Coherent Program of Cyber Security Through IncentivesisallianceNessuna valutazione finora

- Cyber SecurityDocumento23 pagineCyber SecurityYzon FabriagNessuna valutazione finora

- 2009 01 08 Barry Foer and Larry Clinton ISA Comprehensive Overview For Critical Infrastructure Partnership Advisory Council CIPAC PresentationDocumento43 pagine2009 01 08 Barry Foer and Larry Clinton ISA Comprehensive Overview For Critical Infrastructure Partnership Advisory Council CIPAC PresentationisallianceNessuna valutazione finora

- Cybint Bootcamp Brochure - 2020Documento5 pagineCybint Bootcamp Brochure - 2020Luan NguyenNessuna valutazione finora

- Cybint Bootcamp Brochure - 2020Documento5 pagineCybint Bootcamp Brochure - 2020Luan NguyenNessuna valutazione finora

- Threat Actors and DefendersDocumento26 pagineThreat Actors and DefendersRocky IslamNessuna valutazione finora

- Certificate Programme On: Cybersecurity and Data PrivacyDocumento4 pagineCertificate Programme On: Cybersecurity and Data PrivacyKritika KakkarNessuna valutazione finora

- Asset Management System V3.1Documento20 pagineAsset Management System V3.1Avinash KumarNessuna valutazione finora

- Lecture 6Documento88 pagineLecture 6sofeaNessuna valutazione finora

- ITS 610 PresentDocumento25 pagineITS 610 Presentfranks5081Nessuna valutazione finora

- 2008 06 00 Larry Clinton Presentation For BankingDocumento17 pagine2008 06 00 Larry Clinton Presentation For BankingisallianceNessuna valutazione finora

- Cybersecurity Management Webinar Slides Week 1Documento20 pagineCybersecurity Management Webinar Slides Week 1rokanNessuna valutazione finora

- 2004 01 07 Larry Clinton Risk Management and Insurance Presentation For The Institute of Internal of Auditors IIADocumento38 pagine2004 01 07 Larry Clinton Risk Management and Insurance Presentation For The Institute of Internal of Auditors IIAisallianceNessuna valutazione finora

- Chapter 1Documento4 pagineChapter 1Chow MoowNessuna valutazione finora

- Session 3 - Cyber Security - Oct 30Documento36 pagineSession 3 - Cyber Security - Oct 30u9830120786Nessuna valutazione finora

- Unit 3 The Need For SecurityDocumento81 pagineUnit 3 The Need For SecurityMeghana AmmuNessuna valutazione finora

- First Cyber Security Joint Project Workshop: 29 November 2019Documento92 pagineFirst Cyber Security Joint Project Workshop: 29 November 2019danto yuliardiNessuna valutazione finora

- Lecture 1Documento34 pagineLecture 1Rimsha MukhtiarNessuna valutazione finora

- Ethics in Information Technology, Fourth Edition: Computer and Internet CrimeDocumento22 pagineEthics in Information Technology, Fourth Edition: Computer and Internet CrimeWajiha RehmanNessuna valutazione finora

- Building and Maintaining SOCDocumento32 pagineBuilding and Maintaining SOCAli Muda Siregar100% (1)

- "Enterprise Software Security For The Real-World!": Justin DerryDocumento20 pagine"Enterprise Software Security For The Real-World!": Justin DerrywzdrmnNessuna valutazione finora

- Information Security Issues, Threats, Solution & StandradsDocumento46 pagineInformation Security Issues, Threats, Solution & StandradsmasteranshulNessuna valutazione finora

- Fintech K31: April 6, 2021 (Tuesday)Documento49 pagineFintech K31: April 6, 2021 (Tuesday)Jan Gavin GoNessuna valutazione finora

- Fahad Mohammed Almadhi: Master of Science in Software Engineering Bachelor of Science in Computer ScienceDocumento1 paginaFahad Mohammed Almadhi: Master of Science in Software Engineering Bachelor of Science in Computer ScienceFahad AlmadhiNessuna valutazione finora

- AI in CybersecurityDocumento15 pagineAI in CybersecuritymohanNessuna valutazione finora

- Unit III. Latest Trends and Issues in ITDocumento20 pagineUnit III. Latest Trends and Issues in ITgibsonsabalburo05Nessuna valutazione finora

- Computer Security ActivitiesDocumento29 pagineComputer Security ActivitiesPANKAJ MANJHINessuna valutazione finora

- Cid Mag Managing Opportunities and Risk March08Documento12 pagineCid Mag Managing Opportunities and Risk March08Deepthi SunathNessuna valutazione finora

- Fintech, Crypto, BlockchainDocumento96 pagineFintech, Crypto, BlockchainValencia AngeliqueNessuna valutazione finora

- Shri Devi Institude of TechnologyDocumento15 pagineShri Devi Institude of TechnologySameer MilanNessuna valutazione finora

- Unit IVDocumento72 pagineUnit IVdeepakrishnanNessuna valutazione finora

- Step by Step - Digital Forensics and Cyber CrimeDocumento4 pagineStep by Step - Digital Forensics and Cyber CrimeCFE International Consultancy Group50% (8)

- Humans-The Weakest Link-Group 4Documento33 pagineHumans-The Weakest Link-Group 4MadMagga0% (1)

- Systems SecurityDocumento257 pagineSystems SecurityMuriithi MurageNessuna valutazione finora

- Cyber SecurityDocumento13 pagineCyber SecurityVinay BharwaniNessuna valutazione finora

- Module1 NSDocumento42 pagineModule1 NSArham SyedNessuna valutazione finora

- Ethics in Information Technology, Fourth Edition: Computer and Internet CrimeDocumento26 pagineEthics in Information Technology, Fourth Edition: Computer and Internet CrimeWajiha Rehman100% (1)

- Cyber Security Its Impact On Financial Statements and Audit Amp Buisness RiskDocumento18 pagineCyber Security Its Impact On Financial Statements and Audit Amp Buisness RiskFranciscoNessuna valutazione finora

- Tech Application in FinanceDocumento33 pagineTech Application in FinancePragathi SundarNessuna valutazione finora

- 7 - Information SystemDocumento41 pagine7 - Information SystemMinh NguyệtNessuna valutazione finora

- Introduction To SecurityDocumento53 pagineIntroduction To SecurityahkowNessuna valutazione finora

- Fahad Mohammed Almadhi: Master of Science in Software Engineering Bachelor of Science in Computer ScienceDocumento2 pagineFahad Mohammed Almadhi: Master of Science in Software Engineering Bachelor of Science in Computer ScienceFahad AlmadhiNessuna valutazione finora

- Overview of University of Tennessee at ChattanoogaDocumento41 pagineOverview of University of Tennessee at ChattanoogaLongNguyenNessuna valutazione finora

- Yannick DEVOS: Masters of Engineering in TelecommunicationsDocumento5 pagineYannick DEVOS: Masters of Engineering in TelecommunicationsHuyen Nguyen NgocNessuna valutazione finora

- Ethical Hacking and Computer Securities for BeginnersDa EverandEthical Hacking and Computer Securities for BeginnersNessuna valutazione finora

- IJDC - Peer-Reviewed PaperDocumento19 pagineIJDC - Peer-Reviewed PaperAkshat DubeyNessuna valutazione finora

- The U.S.-E.U. Safe Harbor Framework: Cross Border Data Flows, Data Protection, and PrivacyDocumento12 pagineThe U.S.-E.U. Safe Harbor Framework: Cross Border Data Flows, Data Protection, and PrivacyAkshat DubeyNessuna valutazione finora

- A Glance at Cryptographic Techniques UseDocumento12 pagineA Glance at Cryptographic Techniques UseAkshat DubeyNessuna valutazione finora

- Internet Banking Security GuidelinesDocumento8 pagineInternet Banking Security GuidelinesAkshat DubeyNessuna valutazione finora

- Internet Banking Security GuidelinesDocumento27 pagineInternet Banking Security GuidelinesAkshat DubeyNessuna valutazione finora

- Internet Banking Security GuidelinesDocumento27 pagineInternet Banking Security GuidelinesAkshat DubeyNessuna valutazione finora

- Bus Terminal Guidelines PDFDocumento6 pagineBus Terminal Guidelines PDFDen Lorejo50% (6)

- Oecd GuidelinesDocumento111 pagineOecd GuidelinesAkshat DubeyNessuna valutazione finora

- Mobile Banking Information Security and Protection MethodsDocumento4 pagineMobile Banking Information Security and Protection MethodsAkshat DubeyNessuna valutazione finora

- Bus TerminalDocumento4 pagineBus TerminalAkshat DubeyNessuna valutazione finora

- Computer Security Cheat SheetDocumento3 pagineComputer Security Cheat Sheett rex422Nessuna valutazione finora

- Analysis of Incident Response Tactics For The Extreme Insecure WebsiteDocumento18 pagineAnalysis of Incident Response Tactics For The Extreme Insecure WebsiteAmandaNessuna valutazione finora

- Information SecurityDocumento9 pagineInformation SecurityEugene MuketoiNessuna valutazione finora

- Splunk, Big Data and The Future of Security: White PaperDocumento5 pagineSplunk, Big Data and The Future of Security: White PaperSaikat BanerjeeNessuna valutazione finora

- Security SY0-301Documento316 pagineSecurity SY0-301Jasmin WrightNessuna valutazione finora

- OAuth PassportDocumento23 pagineOAuth Passportrisjak100% (1)

- Best Practices For Securing Active DirectoryDocumento314 pagineBest Practices For Securing Active DirectorySoporNessuna valutazione finora

- Cns QBDocumento3 pagineCns QBDheepak NarsimhanNessuna valutazione finora

- 2dcrypt: Image Scaling and Cropping in Encrypted DomainsDocumento14 pagine2dcrypt: Image Scaling and Cropping in Encrypted Domainsprakash0% (1)

- Galileo Basic CommandsDocumento9 pagineGalileo Basic CommandsMarufan NessaNessuna valutazione finora

- GDPR Audit ChecklistDocumento7 pagineGDPR Audit ChecklistB-iTServ BackupNessuna valutazione finora

- Final Nci Idam Sop Template v1 1Documento15 pagineFinal Nci Idam Sop Template v1 1Maheish AyyerNessuna valutazione finora

- Computer HackingDocumento31 pagineComputer HackingСандраПлавушицаУдовичић100% (1)

- ATL Education Foundation Information Security TrainingDocumento35 pagineATL Education Foundation Information Security TrainingATL Education FoundationNessuna valutazione finora

- Authentication GuideDocumento150 pagineAuthentication GuideMuralyNessuna valutazione finora

- ECCouncil PracticeTest 312-50 v2019-03-02 by Savannah 335qDocumento154 pagineECCouncil PracticeTest 312-50 v2019-03-02 by Savannah 335qJonNessuna valutazione finora

- Operating Systems Security: Jerry BreecherDocumento26 pagineOperating Systems Security: Jerry BreecherVaibhav MoondraNessuna valutazione finora

- Security ArchitectureDocumento20 pagineSecurity ArchitectureluisbragagnoloNessuna valutazione finora

- Huawei Matebook Wannacry Ransomware Virus Prevention GuideanceDocumento4 pagineHuawei Matebook Wannacry Ransomware Virus Prevention GuideanceFrancis Hiro LedunaNessuna valutazione finora

- Computer Hacking Forensic Investigator Chfi v9Documento5 pagineComputer Hacking Forensic Investigator Chfi v9harshadspatil0% (2)

- Certificate of Nomination and Acceptance: Republic of The Philippines) - ) S.SDocumento1 paginaCertificate of Nomination and Acceptance: Republic of The Philippines) - ) S.SPiagapo Lanao del SurNessuna valutazione finora

- IOS Application Security Part 29 - Insecure or Broken CryptographyDocumento16 pagineIOS Application Security Part 29 - Insecure or Broken CryptographySto StrategyNessuna valutazione finora

- TIBAG Dec PDFDocumento48 pagineTIBAG Dec PDFAngelika CalingasanNessuna valutazione finora

- PowerVu Management Keys HackedDocumento7 paginePowerVu Management Keys HackedAndy Villasanti100% (1)

- Information Security Awareness Training For Users: Presentation by Sbiicm HydDocumento57 pagineInformation Security Awareness Training For Users: Presentation by Sbiicm Hydmevrick_guyNessuna valutazione finora

- Case Study On Social Engineering Techniques For PersuasionDocumento7 pagineCase Study On Social Engineering Techniques For PersuasionMegan BellNessuna valutazione finora

- Certified List of Candidates: Region Iv-A Laguna Provincial GovernorDocumento47 pagineCertified List of Candidates: Region Iv-A Laguna Provincial GovernoramberQNessuna valutazione finora

- Survey Paper On Threshold CryptographyDocumento3 pagineSurvey Paper On Threshold CryptographyNandhini HaribabuNessuna valutazione finora

- Research Proposal: Topic: Information Security in Banking SectorDocumento42 pagineResearch Proposal: Topic: Information Security in Banking SectorGorav BhallaNessuna valutazione finora

- 1.1.1.5 Lab - Cybersecurity Case StudiesDocumento2 pagine1.1.1.5 Lab - Cybersecurity Case Studiesc583706Nessuna valutazione finora