Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Budgeting

Caricato da

Adonis Besa100%(2)Il 100% ha trovato utile questo documento (2 voti)

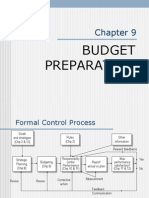

937 visualizzazioni43 pagineThe document discusses the budgeting process for private and public education sectors.

For private education, the board of trustees approves the budget which is prepared based on parameters set in terms of reference. Colleges and offices prepare budgets with situational analysis and three-year projections. Forms are used to consolidate the budget.

For public education, the budget process differs with Congress and the President approving the budget which government agencies then implement. Performance indicators are used to monitor implementation and control deviations from approved budgets.

Descrizione originale:

budgeting

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThe document discusses the budgeting process for private and public education sectors.

For private education, the board of trustees approves the budget which is prepared based on parameters set in terms of reference. Colleges and offices prepare budgets with situational analysis and three-year projections. Forms are used to consolidate the budget.

For public education, the budget process differs with Congress and the President approving the budget which government agencies then implement. Performance indicators are used to monitor implementation and control deviations from approved budgets.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

100%(2)Il 100% ha trovato utile questo documento (2 voti)

937 visualizzazioni43 pagineBudgeting

Caricato da

Adonis BesaThe document discusses the budgeting process for private and public education sectors.

For private education, the board of trustees approves the budget which is prepared based on parameters set in terms of reference. Colleges and offices prepare budgets with situational analysis and three-year projections. Forms are used to consolidate the budget.

For public education, the budget process differs with Congress and the President approving the budget which government agencies then implement. Performance indicators are used to monitor implementation and control deviations from approved budgets.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 43

BUDGETING, BUDGET

PROCESS, IMPLEMENTATION

& PERFORMANCE

EVALUATION & CONTROL

MR. ADONIS P.BESA - Presenter

Introduction and the Merits of

Budgeting

• Budgeting is an important tool in management. For a budget

to be meaningful, it has to be prepared with the

institutional plan as its basis; for, after all, the budget is a

reflection of the institutional plan.

• Included as a component of the institutional plan is the

definition and articulation of objectives that are convergent

with the institutional vision/mission that should be fully

appreciated by all the components of the academic

community.

• To operationalize the objectives contained in the

institutional plan are specific programs and projects the

implementation of which, by virtue of the funding provided

in the budget, will redound to the greater enhancement of

excellence in the educational operation of the institution.

Introduction and the Merits of

Budgeting

• In the financial and resource constraints, priorities will have

to be determined and the implementation of the budget

entails compliance with the priorities as contained in the

budget document.

• Periodic monitoring and coordination during budget

implementation is also desirable. When required, control

mechanisms may be instituted to direct financial operations

toward a desirable path consistent with the defined

objectives and priorities.

• As a result of the attainment of institutional objectives,

performance indicators will demonstrate the department or

officer responsible for project execution and the

instrumental in achieving high levels of institutional

productivity.

• With the institution cognizant of high productivity, then a

culture of excellence will prevail, which can be the basis for

a system of meritocracy in the institution.

Planning Function of Budgeting

• A starting point in the preparation of the budget is the knowledge

of the present state of the institution as contained in the

institutional plan. The institutional strengths and weaknesses as

well as threats and opportunities, have to be highlighted for the

provision of a budget.

• Having analyzed the existing situation, one has to be certain that

the objectives are doable, and that their implementation is within

the time frame of the budget while cognizant, all the time, of

resource and financial constraints. Thus, an important document is

a budget statement detailing the challenges faced by the

educational institution, and its concerns and desired future for the

educational institution.

• Having completed the budget statement, the financial projections

can be prepared with the identification of sources of revenues,

and the definition of all expenditure items.

Budget for Effective Coordination,

Monitoring and Control

• During the preparation of the budget, consultation with

the relevant and involved offices is necessary in order

for them to assist in the process, most especially in the

articulation of urgent concerns and challenges.

Budget as an instrument for Effective

Realization of Goals and Objectives

Within Financial and Resource

Constraints

• During the budget preparation, key performance

indicators are defined. For each budget item, there is a

corresponding indicator that the defined activity has

been achieved.

• There should also be a demonstration of the linkage of

the performance to the institutional mission, goals, and

objectives.

• Finally, the fact that these were all achieved within

the resource constraints of the institution should be of

prime importance. Such, is the test of good

implementation of the budget: that targets are

achieved within the limits of the institutional

resources. Achievements should be supported with

concrete indicators of performance.

Budget as a Basis in the Formulation of

Performance Indicators and the

Institution of an Effective Evaluation

and Merit System

• The budget document should contain performance

indicators corresponding to the key budgetary items.

• In education, the performance indicators for

instruction are the number of student served, or the

number of graduates who did well in the world of

work. Another indicator would be a high percentage of

graduates who pas their board examinations. In some

institutions and for the members of the faculty, the

performance indicators are the student contact hours,

participation as thesis adviser or attendance in thesis-

dissertation committees, and additional duties and

responsibilities as committee member or head of the

department.

The Budgeting Process in the Private

and Public Education Sector

• The budget process in the government is different from that

of the private sector.

• In the private sector, the Board of Trustees or Board of

Directors has the final approval of the budget.

• In the government, it is the House of Representatives and

the Senate of the Philippines that have the final say on the

budget. Once approved by both houses of the Congress of

the Philippines, the document is submitted to the Office of

the President for the budget to take effect as a law and

consequently for appropriate implementation by the line

agencies of the Executive Department of the government,

the Constitutional bodies such as the Commission on Audits,

the Commission on Elections, and the Judiciary and the

Legislative Department.

Private Education

Sector

Budget Framework and Process

• The head of the institution, most likely with the approval of

the Board, promulgates the terms of reference contain the

parameters of the budget preparation.

• Such terms of reference contain parameters of the budget

preparation, the Budget Committee and its members, the

urgent concerns that the institution has to address in the

forthcoming budget period, some assumptions with respect

to enrolment level, faculty hiring, salary increases, merit

and promotion, acquisition of capital equipment and

physical plant expansion, procurement limitations and the

allocation of 70% of tuition fee increases for salaries and

wages and employee benefits, 20% for maintenance an

operating expenses and 10% return on capital.

• The schedule of budget preparation is also included in the

terms of reference, together with the schedule of

presentation to the Board of trustees or directors

Budget Preparation and

Programming

• With the assistance form the finance office of the

institution, the colleges and offices will prepare the

budget, which should contain the following:

• a.Situational Analysis

• Review of the past year’s performance, analysis of strengths

and weaknesses and threats and opportunities. Based on the

review, identification of concerns and the budget theme for

the forthcoming year. From the situation analysis, one will be

able to lay down the basis for the budget which will provide

resolutions to the challenges identified, a continuity of

excellent programs that have been on stream, and the

introduction of new programs consistent with the articulated

needs of the clientele.

Budget Preparation and

Programming

• B. Budget Projection

• The basis of budgetary

projection is the actual

results of financial operations

in the previous three

academic years, the current

year’s budget and the

projection for the next three

years. The projection is

across all offices, colleges

and departments. This is

shown as Form B.

• Before the consolidation of the budget as shown in Form B,

a subsidiary document is necessary, which is the Enrollment

Projection as shown as Form B-1 showing the past three

years actual enrolment, the current year’s enrolment and

the enrolment projection over the next three years. Present

actual revenues for the last three years and estimate of the

current year’s revenues in the space provided in Form B.

• Then, with the enrolment projection in Form B-1 as basis,

estimate the revenues for the next three years and place it

in Form B.

• In addition to Form B-1, there is also a need to fill in Form

B-2, the Individual Time Allocation Schedule, and B-4, which

is the Consolidated Time Allocation Schedule. Form B-2 and

B-3 are necessary to be able to fill in form salaries and

wages in Form B-3.

• When Form B-3 is completed, then Form B-4 can be

prepared.

• With the completion of Form B, the Pro Forma

Statement of Income and Expenses can be finalized, as

shown in Form B-5. Consequently, the pro-forma

Balance Sheet, as shown in Form B-6, can be prepared.

Budget Implementation

• Upon the approval of the budget by the Board of

Trustees/Directors, the head or the president of the

institution will issue a memorandum to all concerned

that the respective college or office budget is duly

approved for implementation. The corresponding

performance indicators should be identified consisting

of the following:

• Indicators of Quality Teaching

• Indicators of Quality Research

• Indicators of Quality Extension Services

Budgeting Monitoring and

Control

• Inflow of revenues and disbursements should be closely

monitored by the appropriate officer, and each department

should be properly informed of the results of the financial

operations of each college or department.

• There should not be any deviation from the approved

budget, except for deviations that are within the authority

granted to the dean, or head of the office, or to the

President of the institution.

• If there is any deviation, there should be an appropriate

explanation as to the reason or causes of such deviation. If

the deviation merits sanction, the head of the institution

may institute the corresponding action.

Public Education

Sector

Budget Framework and Process

in the DepEd, CHED & TESDA

• As early as November of each year,

the Department of Management

issues the Budget Circular for the

year immediately after the

succeeding year.

Budget Framework and Process

in the DepEd, CHED & TESDA

• At the end of each calendar year, i.e. December 31, DepEd,

TESDA, CHED, and state colleges and universities are provided

with their budget balance.

• All these offices will have to obligate said balance for any

activities or projects that have been contracted and, therefore,

the balance should already be obligated before December 31.

• If the funds have not been obligated, the balance will revert to

the central fund. If the budget balance has been obligated and

duly supported with a daily signed contract, said document has to

be submitted to the DBM.

• Once the obligated items are approved by the DBM, the agency

concerned is only given three months to disburse the obligated

balance. If a government unit is not able to disburse its budget for

the calendar year, it is taken as an indication of not being program

of activities or implement a project.

• This may be taken against the office concerned and thus minimize

the chances for this office to get an increase in budget.

Budget Framework and Process

in the DepEd, CHED & TESDA

• The basis of the budget is the National Plan as

prepared by the National Economic Development

Authority (NEDA). All programs and projects must be

consistent with the education section of the national

plan that contains the objectives and the strategies for

the education sector.

Budget Preparation

• The Budget Officer and the Planning Officer of DBM,

usually with the Rank of Director or Assistant Secretary,

coordinates with the Budget Account Officer of DepEd

or TESDA or CHED for any documentation, data, or

information necessary for the preparation of the

budget, while all units of the DepEd, TESDA, and CHED

are given the necessary instructions with respect to the

budget documents to be prepared, data to be

generated, performance indicators, and justifications

for any new project.

Budget Preparation

• With respect to personnel services, the heads of the

offices are not so involved in the qualification. These

are readily available in the accounting office. What

will be subject matter for discussion with the

Secretary, Undersecretaries, Chairman and

Commissioners of CHED, or Director-General and

Deputy Director-General of TESDA are the following:

• Creation of Additional Teacher Items, Principals, and

Superintendent

• Developmental Intervention in the Continuing Education of

Teachers

• Foreign-Assisted Projects

• Capital Expenditures

Consultation Within the

Respective Offices

• Once all the offices have finalized their respective budgets, the

Secretary, together with all the undersecretaries, assistant

secretaries, assistant secretaries, and directors will discuss the

budget. Questions may be raised to evaluate whether the

estimates are quite realistic with respect to the three

components: (1) Personal Services, (2) Maintenance and Other

Operating Expenses, and (3) Capital Expenditures. Usually, the

focus of the discussion is one various programs and projects of the

various bureaus and offices.

• After some revisions as agreed upon during the Department

deliberations, the budget is presented to the DBM. There may

be some suggestions on various aspects of the budget. If found to

be in order, adjustments are accepted. In the meantime, the DBM,

together with the Treasury, evaluates the feasible limit of the

total budget of the government. Once the absolute figure is

already arrived at, the DBM will issue a circular to all concerned

on the budget limit of each department. The Department will have

to present a revised budget to comply with the limits imposed by

the DBM.

Consultation with DBM

• Having complied with the budgetary limits set

by the DBM, the final department budget is

presented to the DBM. After that, the DBM and

the Presidential Management Staff will conduct

a meeting with the representatives of all the

departments.

Consultation with the Regional

Development Council (RDC)

• The regional component of the budget of each

line agency is discussed in the Regional

Development Council in all the 16 regions of

the country. The members of the RDC are the

city mayors, governors, all regional directors of

various national offices, representatives of the

business sector, the Presidential Assistant on

Regional Concerns, and others.

Cabinet Discussion on the

Budget

• The consolidated Department budget is

presented to the President who is the

Chairperson of the National Economic and

Development Authority in the presence of all

cabinet secretaries. The deliberations usually

involve aligning various department budgets to

national concerns in order to create greater

synergistic impact as a result of the

implementation of the budget.

Presentation of the Budget to

Congress and Budget Hearings

• Immediately after the State-of-the-Nation Address

(SONA) of the President, the National Budget is

presented to the Speaker of the House of

Representatives and the Chairman of the

Committee on Appropriation.

• With the budget duly submitted, the Chairman of

the Committee on Appropriation schedules a

hearing of the budget of various departments.

During the hearing, the members of the

Appropriation Committee ask all kinds of

questions.

• These are mostly focused on the thrust of the

budget and how the national and local concerns of

the congressmen are reflected in the budget.

Budget Presentation in Plenary

Session

• After the Committee hearing in the Appropriation

Committee of the Congress of the Philippines and the Senate

Education and Finance Committee, the budget is presented

in a plenary session of both houses.

• Only the Chairman of the Committee on Appropriation or, in

the case of the Senate, the Chairman of the Finance

Committee of the Senate, will answer all the questions of

any of the Senators or Congressmen. However, officers of

the DepEd , TESDA and CHED, and state colleges and

universities should be present in their assigned places to

provide some answers to questions raised, and the officer of

the office concerned will give the answer to the Chair for

the Chair to convey said answer to the body in plenary

session.

• Once the budget is approved on second reading, the

document is presented to the Bicameral Committee

consisting of 24 members with an equal number from the

Senate and Congress of the Philippines.

Deliberation in the Bicameral

Committee

• The Bicameral Committee is a very powerful

committee. While they are deliberating, one

should be around for any possible data or answers

to questions raised, or else some items in the

budget may be deleted.

• The deliberation in the Bicameral Committee can

sometimes time-consuming most especially if there

are some intramurals between the majority and

minority.

• However, once there is a vote in the Bicameral

Committee for submission of the budget for third

reading, the action by the Congress of the

Philippines and the Senate of the Philippines is

final.

Presentation for Final Approval

• Both houses of Congress in plenary session take

the final action of the budget and upon passage

of the budget on its third reading by both

houses of congress, it is submitted to the

President of the Philippines.

• The President may veto some items of the

budget and send the reply to both houses of

the items vetoed.

Budget Programming and

Implementation

• After the approval of the budget by the President

of the Philippines, who signs the Budget into

appropriation Act, the DBM will identify the

programmed items in the budget that will surely be

funded in view of the revenue target of the

Government.

• The unprogrammed items are subject to

availability of funds, which may only be released

once there is a significant improvement in the

revenue collection of the government. If the

anticipated collection is not attained, the DBM may

even issue 10% reserved for savings.

Budget Monitoring, Evaluation,

and Control

• With the approved budget, DepEd, TESDA, and

CHED monitor the implementation of the

budgets of all offices under their jurisdiction.

• The preparation of a cash flow statement is

used as an instrument of monitoring.

Budget Monitoring, Evaluation,

and Control

• With the approved budget, DepEd, TESDA, and

CHED monitor the implementation of the

budgets of all offices under their jurisdiction.

• The preparation of a cash flow statement is

used as an instrument of monitoring.

Performance

Budgeting System,

Zero-Based

Budgeting, PPBS and

Strategic Budgeting

Performance-oriented budgeting

• is a way to focus more on the expected

outcome for the financial resources being

provided. Thus, the analysis is not so much of

various items of the budget, but on how a

certain budget being allocated will generate

the expected outcome or performance

expressed in terms of key budget indicators.

Zero-based budgeting

• is a system where the focus of the presentation

is the full justification of the funding being

provided.

• In many instances, it is only the incremental

budget being proposed that is provided with

justification.

• In zero-based budgeting, there has to be

rationale for the whole project as a basis for its

budgetary provision, and not only the

incremental amount being proposed.

Planning, Programming,

Budgeting System (PPBS)

• is a technique wherein all budgets must be based on a

carefully prepared plan.

• The plan should contain situation analysis or prevailing

environment.

• With a fully articulated plan analysis of the situation,

programs, projects, and activities are identified with

their rationale, objectives, processes and activities,

schedules of implementation, priorities and the

expected outcome of the project of the office.

• The carefully prepared plan is the basis for the budget

being proposed. With a budget based on a carefully

prepared plan, programming is formulated in order to

maximize the use of resources that will redound to the

production of expected institutional outcomes.

Strategic budgeting

• is an amalgamation of good features of

performance budgeting, zero-based budgeting, and

PPBS.

• Strategic budgeting, just like PPBS, requires in-

depth analysis of the environment and the

operation of the institution in such an

environment.

• In a way, strategic budgeting is like a zero-based

budgeting because the whole project being

proposed has to have an all-encompassing

orientation in its rationale, so that the project

being proposed for funding will redound to the

achievement of performance that will satisfy the

clientele being served.

CONCLUSIONS

• The budget is also a means of instituting effective coordination,

monitoring, and control in the financial operations of the

institution.

• The budget is also used as a basis for formulating performance

indicators that can be used in instituting an effective evaluation

and merit system. Performance indicators may be in terms of the

extent the institution has performed its teaching function, the

quality of research, and community and extension services.

• Budget processes in both public and private sectors are different

from each other.

• For effective budget monitoring and control, a cash flow

statement should be followed.

• A full understanding of the effective use of budgeting as a

planning instrument for effective monitoring and performance

evaluation leads to the attainment of the mission/vision and

objectives for which the education sector has been established.

Potrebbero piacerti anche

- Budgeting and Budgeting ControlDocumento85 pagineBudgeting and Budgeting ControlAnonymous kwi5IqtWJ100% (1)

- BudgetingDocumento45 pagineBudgetingTINAIDA100% (1)

- Budget Preparation and Control ProcessDocumento17 pagineBudget Preparation and Control ProcessJason Kurniawan50% (4)

- BudgetingDocumento54 pagineBudgetinglil li100% (2)

- The Accounting Cycle - Service Business: Rodmarc P. Sanchez, J.DDocumento41 pagineThe Accounting Cycle - Service Business: Rodmarc P. Sanchez, J.DDodgeSanchezNessuna valutazione finora

- Budget PDFDocumento74 pagineBudget PDFVaibhav GuptaNessuna valutazione finora

- Cash ManagementDocumento51 pagineCash ManagementDebasmita SahaNessuna valutazione finora

- Local Government Zero Based BudgetingDocumento4 pagineLocal Government Zero Based BudgetingVanessaNessuna valutazione finora

- Day 1 STRATEGIC PLANNING & BUDGETING 2011Documento100 pagineDay 1 STRATEGIC PLANNING & BUDGETING 2011Santhanasamy Subbiah100% (1)

- Financial Management & PlanningDocumento34 pagineFinancial Management & Planningmuhammad tahirNessuna valutazione finora

- Cash Treasury Management GuideDocumento19 pagineCash Treasury Management GuideShashank ShashuNessuna valutazione finora

- Finance Department PresentationDocumento12 pagineFinance Department PresentationKMI7769% (13)

- Performance Budgeting - Module 5Documento25 paginePerformance Budgeting - Module 5bermazerNessuna valutazione finora

- Financial Planning and ToolsDocumento41 pagineFinancial Planning and ToolsShalom BuenafeNessuna valutazione finora

- Accounting For Non Accountants 2019Documento39 pagineAccounting For Non Accountants 2019gina100% (1)

- BudgetingpptDocumento38 pagineBudgetingpptdivyakyNessuna valutazione finora

- Budgeting, Budget Process, Implementation and Performance Evaluation and ControlDocumento8 pagineBudgeting, Budget Process, Implementation and Performance Evaluation and ControlAdonis BesaNessuna valutazione finora

- Fiscal Planning: Unit IxDocumento23 pagineFiscal Planning: Unit Ixpraveena thanavelNessuna valutazione finora

- Budgeting Process and Roles in Nursing College ManagementDocumento28 pagineBudgeting Process and Roles in Nursing College ManagementKavi priyaNessuna valutazione finora

- THE NATIONAL BUDGET PROCESS EXPLAINEDDocumento15 pagineTHE NATIONAL BUDGET PROCESS EXPLAINEDnapema.educ4790100% (1)

- Nursing Budget: According To TN Chhabra A Budget Is An Estimation of Future Needs Arranged According To Orderly BasisDocumento7 pagineNursing Budget: According To TN Chhabra A Budget Is An Estimation of Future Needs Arranged According To Orderly BasisPooja VishwakarmaNessuna valutazione finora

- Budgeting and The Budget ProcessDocumento22 pagineBudgeting and The Budget ProcessHilene Y. Daniel100% (1)

- NGO Treasurers WorkshopDocumento52 pagineNGO Treasurers WorkshopMarwan AhmedNessuna valutazione finora

- PA School Budgeting Process ExplainedDocumento10 paginePA School Budgeting Process ExplainedAris Benson BacusNessuna valutazione finora

- Budget in EducationDocumento24 pagineBudget in EducationNenbon NatividadNessuna valutazione finora

- Carnegie Mellon's Budget ProcessDocumento6 pagineCarnegie Mellon's Budget ProcessSyed Nabeel IqbalNessuna valutazione finora

- Finance - Self Study Guide For Staff of Micro Finance InstitutionsDocumento7 pagineFinance - Self Study Guide For Staff of Micro Finance InstitutionsmhussainNessuna valutazione finora

- Analyze Most Recent Fiscal YearDocumento5 pagineAnalyze Most Recent Fiscal YearAtika Nur FitrianiNessuna valutazione finora

- BudgetingDocumento37 pagineBudgetingMompoloki MontiNessuna valutazione finora

- 3a Budgetting & Budgetary ControlDocumento20 pagine3a Budgetting & Budgetary ControlChomoi ValenteNessuna valutazione finora

- Fiscal PlanningDocumento22 pagineFiscal PlanningRadha Sri100% (2)

- Synthesis in Budget CycleDocumento3 pagineSynthesis in Budget CycleKarlo Dizon Villanueva100% (1)

- Budget PreparationDocumento7 pagineBudget PreparationShubhrima KhanNessuna valutazione finora

- BudgetDocumento18 pagineBudgetNarendra ModiNessuna valutazione finora

- Educ 207 - FINANCIAL ASPECTS IN EDUCATIONAL PLANNING v2Documento7 pagineEduc 207 - FINANCIAL ASPECTS IN EDUCATIONAL PLANNING v2DARLING REMOLAR100% (1)

- Cost Accounting - MidhunDocumento19 pagineCost Accounting - MidhunmidhunNessuna valutazione finora

- Budgeting: Sowmiya.D Siva Sankar .N. V Siva Kumar Shalini Senthil Kumar Sathya NarayananDocumento32 pagineBudgeting: Sowmiya.D Siva Sankar .N. V Siva Kumar Shalini Senthil Kumar Sathya NarayananSiva ShankarNessuna valutazione finora

- Project Budgeting and Accounting: What Is A Budget?Documento8 pagineProject Budgeting and Accounting: What Is A Budget?Syed YaserNessuna valutazione finora

- Posdcorb BudgetingDocumento37 paginePosdcorb BudgetingPatrizzia Ann Rose OcbinaNessuna valutazione finora

- A2 SITXFIN010 Prepare and Monitor Budgets - Docx ANSDocumento6 pagineA2 SITXFIN010 Prepare and Monitor Budgets - Docx ANSKrinakshi ChaudharyNessuna valutazione finora

- RCSD Audit Budget and RevenueDocumento12 pagineRCSD Audit Budget and RevenuemarybadamsNessuna valutazione finora

- The Budget-Building Book for Nonprofits: A Step-by-Step Guide for Managers and BoardsDa EverandThe Budget-Building Book for Nonprofits: A Step-by-Step Guide for Managers and BoardsNessuna valutazione finora

- BudgetingDocumento35 pagineBudgetingRisty Ridharty DimanNessuna valutazione finora

- Budgeting Basics: Definition, Types, StepsDocumento5 pagineBudgeting Basics: Definition, Types, StepsSanket TelangNessuna valutazione finora

- Budget Front OfficeDocumento28 pagineBudget Front OfficeTarun GarhwalNessuna valutazione finora

- Philippine Budget Cycle ProcessDocumento12 paginePhilippine Budget Cycle ProcessMark DaryllNessuna valutazione finora

- Fiscal ManagementDocumento40 pagineFiscal Managementsaleha sultana100% (1)

- New CMA Part 1 Section ADocumento114 pagineNew CMA Part 1 Section AMichael SumpayNessuna valutazione finora

- Financial Management Summary of Findings and RecommendationsDocumento53 pagineFinancial Management Summary of Findings and RecommendationsLamyae FlooNessuna valutazione finora

- Budget For VRDocumento4 pagineBudget For VRGlenda NelsonNessuna valutazione finora

- Project Budgeting GuideDocumento31 pagineProject Budgeting GuideAbdisamed AllaaleNessuna valutazione finora

- Fiscalplanning Sanil 131223005213 Phpapp01Documento44 pagineFiscalplanning Sanil 131223005213 Phpapp01San Miguel SouthNessuna valutazione finora

- Capacity Building of Accounts and Internal Audit StaffDocumento22 pagineCapacity Building of Accounts and Internal Audit StaffFakhar QureshiNessuna valutazione finora

- Chapter 18 - Budgeting The Education PlanDocumento2 pagineChapter 18 - Budgeting The Education PlanSheila May DomingoNessuna valutazione finora

- SITXFIN501 Prepare and Monitor BudgetsDocumento4 pagineSITXFIN501 Prepare and Monitor BudgetsMahmudulHasanKhanNessuna valutazione finora

- Pub Ad Lec 6 Financial AdministrationDocumento32 paginePub Ad Lec 6 Financial AdministrationHajra HussainNessuna valutazione finora

- Financial reporting process and key financial statementsDocumento45 pagineFinancial reporting process and key financial statementssatishNessuna valutazione finora

- WKU Internal Audit Charter SummaryDocumento4 pagineWKU Internal Audit Charter SummaryEva CardozoNessuna valutazione finora

- Kabula 2013Documento8 pagineKabula 2013MelikteNessuna valutazione finora

- Department of Education: Republic of The PhilippinesDocumento3 pagineDepartment of Education: Republic of The PhilippinesAdonis BesaNessuna valutazione finora

- Earth and Life Science: Quarter 1 - Module 4: RocksDocumento28 pagineEarth and Life Science: Quarter 1 - Module 4: RocksAdonis Besa90% (67)

- Department of EducationDocumento3 pagineDepartment of EducationAdonis BesaNessuna valutazione finora

- Weekly Learning Plan for Practical Research 2Documento3 pagineWeekly Learning Plan for Practical Research 2Adonis BesaNessuna valutazione finora

- ELS Final Module 2 08082020Documento18 pagineELS Final Module 2 08082020Renier Dela Vega Flores90% (20)

- MELCs in Inquiries, Investigation, and ImmersionDocumento2 pagineMELCs in Inquiries, Investigation, and ImmersionAdonis Besa85% (20)

- Making of ReportsDocumento10 pagineMaking of ReportsAdonis BesaNessuna valutazione finora

- Department of Education: Republic of The PhilippinesDocumento3 pagineDepartment of Education: Republic of The PhilippinesAdonis BesaNessuna valutazione finora

- Department of EducationDocumento3 pagineDepartment of EducationAdonis BesaNessuna valutazione finora

- MELCs in Practical Research 2Documento3 pagineMELCs in Practical Research 2Adonis Besa86% (7)

- Importance of Qualitative ResearchDocumento3 pagineImportance of Qualitative ResearchAdonis Besa80% (5)

- ELS Final Module 1 08082020Documento18 pagineELS Final Module 1 08082020Renier Dela Vega Flores83% (6)

- Creating Effective TeamsDocumento31 pagineCreating Effective TeamsAdonis BesaNessuna valutazione finora

- MELCs in Earth and Life ScienceDocumento5 pagineMELCs in Earth and Life ScienceAdonis Besa100% (14)

- Earth and Life Science: Quarter 1 - Module 7: MagmatismDocumento26 pagineEarth and Life Science: Quarter 1 - Module 7: MagmatismAdonis Besa91% (67)

- Earth and Life Science: Quarter 1 - Module 6: The Earth's Internal HeatDocumento26 pagineEarth and Life Science: Quarter 1 - Module 6: The Earth's Internal HeatAdonis Besa88% (52)

- APA WorksheetDocumento3 pagineAPA WorksheetVira Lledo0% (2)

- Earth and Life Science: Quarter 1 - Module 3: MineralsDocumento26 pagineEarth and Life Science: Quarter 1 - Module 3: MineralsAdonis Besa92% (53)

- MELCs in Practical Research 1Documento3 pagineMELCs in Practical Research 1Adonis Besa91% (11)

- MELCs in Practical Research 1Documento3 pagineMELCs in Practical Research 1Adonis Besa91% (11)

- August 17-21, 2020Documento1 paginaAugust 17-21, 2020Adonis BesaNessuna valutazione finora

- Here are the answers to the questions in What I Know:1. C2. AYou got both questions correct. Please proceed to the next part of the moduleDocumento26 pagineHere are the answers to the questions in What I Know:1. C2. AYou got both questions correct. Please proceed to the next part of the moduleAdonis Besa86% (100)

- Department of Education: September 14, 2020Documento2 pagineDepartment of Education: September 14, 2020Adonis BesaNessuna valutazione finora

- General Instructions: Please DO NOT Write Anything in Pretest Sheet. Please Use Yellow Paper/the Provided Answer Sheet For Your AnswersDocumento2 pagineGeneral Instructions: Please DO NOT Write Anything in Pretest Sheet. Please Use Yellow Paper/the Provided Answer Sheet For Your AnswersAdonis BesaNessuna valutazione finora

- Activity 1.1: Vocabulary/Concept BuildingDocumento3 pagineActivity 1.1: Vocabulary/Concept BuildingAdonis BesaNessuna valutazione finora

- PR 2 POST TEST WEEK 1 (August 3-7, 2020)Documento2 paginePR 2 POST TEST WEEK 1 (August 3-7, 2020)Adonis BesaNessuna valutazione finora

- MELCs in Practical Research 1Documento3 pagineMELCs in Practical Research 1Adonis Besa91% (11)

- MELCs in Earth and Life ScienceDocumento5 pagineMELCs in Earth and Life ScienceAdonis Besa100% (14)

- MELCs in Inquiries, Investigation, and ImmersionDocumento2 pagineMELCs in Inquiries, Investigation, and ImmersionAdonis Besa85% (20)

- Citation and ReferencingDocumento65 pagineCitation and ReferencingAdonis BesaNessuna valutazione finora

- FIN 1050 - Final ExamDocumento6 pagineFIN 1050 - Final ExamKathi100% (1)

- Liberty Engine HistoryDocumento124 pagineLiberty Engine HistoryCAP History Library100% (4)

- Pharmacology of GingerDocumento24 paginePharmacology of GingerArkene LevyNessuna valutazione finora

- Xtreme 5 (Answer-Key)Documento120 pagineXtreme 5 (Answer-Key)arielsergio403Nessuna valutazione finora

- Salzer Panel Accessories Price List - 01st January 2019Documento40 pagineSalzer Panel Accessories Price List - 01st January 2019Chandra SekaranNessuna valutazione finora

- Public Relations & Communication Theory. J.C. Skinner-1Documento195 paginePublic Relations & Communication Theory. J.C. Skinner-1Μάτζικα ντε Σπελ50% (2)

- AIX For System Administrators - AdaptersDocumento2 pagineAIX For System Administrators - Adaptersdanielvp21Nessuna valutazione finora

- Student Worksheet 8BDocumento8 pagineStudent Worksheet 8BLatomeNessuna valutazione finora

- LIN 1. General: Body Electrical - Multiplex Communication BE-13Documento2 pagineLIN 1. General: Body Electrical - Multiplex Communication BE-13Roma KuzmychNessuna valutazione finora

- TOTAL Income: POSSTORE JERTEH - Account For 2021 Start Date 8/1/2021 End Date 8/31/2021Documento9 pagineTOTAL Income: POSSTORE JERTEH - Account For 2021 Start Date 8/1/2021 End Date 8/31/2021Alice NguNessuna valutazione finora

- 40 Energising BreathsDocumento1 pagina40 Energising BreathsOwlbearNessuna valutazione finora

- Week 4 CasesDocumento181 pagineWeek 4 CasesMary Ann AmbitaNessuna valutazione finora

- Sahar NSC FixDocumento45 pagineSahar NSC FixSahar AndhikaNessuna valutazione finora

- Apple Mango Buche'es Business PlanDocumento51 pagineApple Mango Buche'es Business PlanTyron MenesesNessuna valutazione finora

- Understanding Malaysian Property TaxationDocumento68 pagineUnderstanding Malaysian Property TaxationLee Chee KheongNessuna valutazione finora

- The 4Ps of Labor: Passenger, Passageway, Powers, and PlacentaDocumento4 pagineThe 4Ps of Labor: Passenger, Passageway, Powers, and PlacentaMENDIETA, JACQUELINE V.Nessuna valutazione finora

- Legal Aspect of Business Course Outline (2017)Documento6 pagineLegal Aspect of Business Course Outline (2017)Sulekha BhattacherjeeNessuna valutazione finora

- The Ramayana and The Sacred Palm Trees of Sumeria, Mesopotamia, Assyria and PhoeniciaDocumento7 pagineThe Ramayana and The Sacred Palm Trees of Sumeria, Mesopotamia, Assyria and PhoeniciaNeeta RainaNessuna valutazione finora

- Amnesia: A Game of Remembering YourselfDocumento11 pagineAmnesia: A Game of Remembering YourselfNina JonesNessuna valutazione finora

- HiaceDocumento1 paginaHiaceburjmalabarautoNessuna valutazione finora

- WSP - Aci 318-02 Shear Wall DesignDocumento5 pagineWSP - Aci 318-02 Shear Wall DesignSalomi Ann GeorgeNessuna valutazione finora

- A Model For Blockchain-Based Distributed Electronic Health Records - 2016Documento14 pagineA Model For Blockchain-Based Distributed Electronic Health Records - 2016Asif KhalidNessuna valutazione finora

- Molly C. Dwyer Clerk of CourtDocumento3 pagineMolly C. Dwyer Clerk of CourtL. A. PatersonNessuna valutazione finora

- Q3 Week 7 Day 2Documento23 pagineQ3 Week 7 Day 2Ran MarNessuna valutazione finora

- Method Statement Soil NailedDocumento2 pagineMethod Statement Soil NailedFa DylaNessuna valutazione finora

- AnnovaDocumento4 pagineAnnovabharticNessuna valutazione finora

- Anschutz Nautopilot 5000Documento4 pagineAnschutz Nautopilot 5000Văn Phú PhạmNessuna valutazione finora

- The Basic Philosophical and Theological Notions of Saint Augustine - John C. Cooper PDFDocumento21 pagineThe Basic Philosophical and Theological Notions of Saint Augustine - John C. Cooper PDFjusrmyrNessuna valutazione finora

- Homologation Form Number 5714 Group 1Documento28 pagineHomologation Form Number 5714 Group 1ImadNessuna valutazione finora

- Superstitious Beliefs of MaranaoDocumento13 pagineSuperstitious Beliefs of MaranaoKhent Ives Acuno SudariaNessuna valutazione finora