Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Foreign Currency Financial Statements

Caricato da

Resky AndikaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Foreign Currency Financial Statements

Caricato da

Resky AndikaCopyright:

Formati disponibili

Chapter 14

Foreign Currency

Financial Statements

to accompany

Advanced Accounting, 11th edition

by Beams, Anthony, Bettinghaus, and Smith

Copyright ©2012 Pearson Education,

14-1

Inc. Publishing as Prentice Hall

Foreign Currency Financial Statements:

Objectives

1. Identify the factors that should be considered

when determining an entity’s functional

currency.

2. Understand how functional currency

assignment determines the way the foreign

entity’s financial statements are converted into

its parent’s reporting currency.

3. Understand how a foreign subsidiary’s

economy is determined to be highly inflationary

and how this affects the conversion of its

financial statements to its parent’s reporting

currency. Copyright ©2012 Pearson Education,

14-2

Inc. Publishing as Prentice Hall

Foreign Currency Financial Statements:

Objectives (Cont.)

4. Understand how the investment in a

foreign subsidiary is accounted for at

acquisition.

5. Understand which rates are used to

translate balance sheet and income

statement accounts under the current rate

method and the temporal method on a

translation/ remeasurement worksheet.

6. Know how the translation gain or loss, or

remeasurement gain or loss, is reported

under the current rate and temporal

methods. Copyright ©2012 Pearson Education,

Inc. Publishing as Prentice Hall

14-3

Foreign Currency Financial Statements:

Objectives (Cont.)

7. Know how a parent accounts for its

investment in a subsidiary using the

equity method depending on the

subsidiary’s functional currency

determination.

8. Understand consolidation under the

temporal and current rate methods.

9. Understand how a hedge of the net

investment in a subsidiary is accounted

for under the current rate and temporal

methods. Copyright ©2012 Pearson Education,

14-4

Inc. Publishing as Prentice Hall

Foreign Currency Financial Statements

1: FUNCTIONAL CURRENCY

Copyright ©2012 Pearson Education,

14-5

Inc. Publishing as Prentice Hall

Functional Currency

Definition: Currency of the primary economic

environment in which the entity operates.

Primarily, this means the currency received from

customers and used to pay liabilities. Other

factors include the currency:

Used in setting sales prices

That is dominant in the sales market

Used to pay operating expenses

Financing the company

Used in intercompany transactions

Copyright ©2012 Pearson Education,

14-6

Inc. Publishing as Prentice Hall

Foreign Currency Financial Statements

2: FUNCTIONAL CURRENCY

DETERMINES CONVERSION

METHOD

Copyright ©2012 Pearson Education,

14-7

Inc. Publishing as Prentice Hall

Restatement Method Selection

If the functional currency is the U.S. dollar, use

the Temporal method.

If the functional currency is the local currency,

use the Current Rate method.

Examples:

1. A Mexican subsidiary of a U.S. firm has the

peso as its functional currency.

2. A Japanese subsidiary of a U.S. firm has the

U.S. dollar as its functional currency.

3. An Australian subsidiary of a U.S. firm,

keeping its own records in Australian

dollars, determines its functional currency is

the euro. Copyright ©2012 Pearson Education,

Inc. Publishing as Prentice Hall

14-8

Selecting the Method

Local currency Functional currency Reporting currency

Ex 1 Peso Peso U.S.$

Translate (current rate method) from Peso to US$

Ex 2 Yen U.S.$ U.S.$

Remeasure (temporal method) from Yen to US$

Ex 3 Aus$ Euro U.S.$

Remeasure from Aus$ to Euros,

then Translate from Euros to U.S.$

Copyright ©2012 Pearson Education,

14-9

Inc. Publishing as Prentice Hall

Exchange Rates

Translation (the Current Rate method) will

convert financial statements using

Current (FYE): assets, liabilities

Historical: equity, dividends (retained earnings

is not translated)

Current (average): revenues, expenses

Remeasurement (the Temporal Method) will

convert financial statements using

Current (FYE): monetary assets, liabilities

Historical: other assets, liabilities

Historical: equity, dividends (retained earnings

is not remeasured)

Current (average) and Historical: revenues,

expenses Copyright ©2012 Pearson Education,

Inc. Publishing as Prentice Hall

14-10

Foreign Currency Financial Statements

3: HIGHLY INFLATIONARY

ECONOMIES

Copyright ©2012 Pearson Education,

14-11

Inc. Publishing as Prentice Hall

Inflation and Functional Currency

For subsidiaries of U.S. firms in highly

inflationary economies, assume that the

functional currency is the U.S. dollar.

Remeasure the statements

using the Temporal method.

Highly inflationary = cumulative inflation of

100% or more over 3 years.

Copyright ©2012 Pearson Education,

14-12

Inc. Publishing as Prentice Hall

Foreign Currency Financial Statements

4: BUSINESS COMBINATIONS

Copyright ©2012 Pearson Education,

14-13

Inc. Publishing as Prentice Hall

Translation at Acquisition

Foreign assets and liabilities are

translated using the current rate at the

date of acquisition.

If functional currency = local currency

Translation is appropriate

Analysis of fair value/book value differentials

is performed in local currency

Results are translated at current rates

Copyright ©2012 Pearson Education,

14-14

Inc. Publishing as Prentice Hall

Remeasurement at Acquisition

Foreign assets and liabilities are

translated using the current rate at the

date of acquisition.

If functional currency = US$ or reporting

currency

Remeasurement is appropriate

Analysis of fair value/book value

differentials is performed in U.S.$

The 'earliest' historical rate generally used in

remeasurement is the date of the acquisition.

Copyright ©2012 Pearson Education,

14-15

Inc. Publishing as Prentice Hall

Noncontrolling Interest

For both, remeasurement and translation,

the consolidation process is applied to

the financial statements as restated in

U.S.$.

Measures of noncontrolling interest,

noncontrolling interest share, and

controlling interest share are computed

in U.S.$.

Copyright ©2012 Pearson Education,

14-16

Inc. Publishing as Prentice Hall

Foreign Currency Financial Statements

5: CURRENT RATE METHOD

AND TEMPORAL METHOD

Copyright ©2012 Pearson Education,

14-17

Inc. Publishing as Prentice Hall

Assets

Copyright ©2012 Pearson Education, 14-18

Inc. Publishing as Prentice Hall

Liabilities and Equity

Copyright ©2012 Pearson Education,

14-19

Inc. Publishing as Prentice Hall

Revenues and Expenses

Note that "current" rate, as used for income

statement items, is usually the average rate for

the year. Firms with seasonal business

fluctuations would use a weighted average rate.

Copyright ©2012 Pearson Education,

14-20

Inc. Publishing as Prentice Hall

Foreign Currency Financial Statements

6: TRANSLATION

ADJUSTMENTS AND

REMEASUREMENT

GAIN/LOSS

Copyright ©2012 Pearson Education,

14-21

Inc. Publishing as Prentice Hall

Current Rate Method: Example

Translate the adjusted trial balance:

Assets and Liabilities at the year-end (“current”)

rate

Equity at the historical rate (from the date of the

related transaction)

Except Retained Earnings which is a composite

rate from each year

Revenues and Expenses will be at the average

rate for the related period

The entry needed to balance the trial balance after

the translation is complete will be an entry to

Accumulated Other Comprehensive Income, and

thus will appear on the balance sheet.

Copyright ©2012 Pearson Education,

14-22

Inc. Publishing as Prentice Hall

Current Rate Method: Example (cont.)

See calculation, next slide…

Copyright ©2012 Pearson Education,

14-23

Inc. Publishing as Prentice Hall

Current Rate Method: Example (cont.)

Because all debit and credit balances are not translated

using the same exchange rate, the trial balance will not

balance at the end of the translation. In this example, the

debits happen to be $28,600 less than the credits. This is

the debit to accumulated OCI at the end of the year.

Copyright ©2012 Pearson Education,

14-24

Inc. Publishing as Prentice Hall

Temporal Method: Example

Remeasure the adjusted trial balance:

Monetary Assets and Liabilities at the year-end (“current”) rate

Non-monetary Assets and Liabilities at the rate from the date of

transaction (“historical”)

Equity at the historical rate (from the date of the related

transaction)

Except Retained Earnings which is a composite rate

Revenues and most Expenses will be at the average rate for the

related period

Cost of Goods Sold, Depreciation and Amortization Expense at

the historical rate of the related asset

The entry needed to balance the trial balance after the translation is

complete will be an Exchange Gain/(Loss), and thus will appear on

the income statement. Copyright ©2012 Pearson Education,

Inc. Publishing as Prentice Hall

14-25

Temporal Method: Example (cont.)

See calculation, next slide…

Copyright ©2012 Pearson Education,

14-26

Inc. Publishing as Prentice Hall

Temporal Method: Example (cont.)

Because all debit and credit balances are not translated

using the same exchange rate, the trial balance will not

balance at the end of the translation. In this example, the

debits happen to be $3,300 less than the credits. This is

the exchange loss for the year.

Copyright ©2012 Pearson Education,

14-27

Inc. Publishing as Prentice Hall

Adjustment Summary

Remeasurement results in

Exchange gains or losses on the income statement

Credit to balance = exchange gain

Debit to balance = exchange loss

Include the gain or loss in calculating net income

in U.S. dollars.

Translation results in

Translation adjustment, part of accumulated other

comprehensive income

Include as part of stockholders' equity

Debit to balance = deduct from equity

Credit to balance = add to equity

Copyright ©2012 Pearson Education,

14-28

Inc. Publishing as Prentice Hall

The Difference in Methodology

The ultimate goal is consolidation.

Use the Temporal method when the U.S. dollar is the

functional currency of the subsidiary, to best reflect the

relationship of the subsidiary as an extension of the

parent, and thus the remeasurement adjustment is part

of the current period income.

Use the Current Rate method when the local currency is

the functional currency of the subsidiary, to best reflect

the subsidiary’s status as a free-standing company in

whom the parent is merely invested, thus the translation

adjustment is shown in the equity section of the parent’s

balance sheet.

Copyright ©2012 Pearson Education,

14-29

Inc. Publishing as Prentice Hall

Foreign Currency Financial Statements

7: EQUITY METHOD FOR

FOREIGN INVESTMENTS

Copyright ©2012 Pearson Education,

14-30

Inc. Publishing as Prentice Hall

Equity Method Investee

A U.S. firm has a foreign investment it accounts

for under the equity method.

If functional currency is the local currency, then

translation is appropriate

At acquisition

Analyze fair value and book value, compute

goodwill – in local/functional currency

Annually

Translate statements into U.S. dollars

Record other comprehensive income for translation

adjustment

Copyright ©2012 Pearson Education,

14-31

Inc. Publishing as Prentice Hall

Equity Method Entries

12/31/11 Investment in Star 525,000

Cash 525,000

Acquisition cost

12/1/12 Cash 42,600

Investment in Star 42,600

Dividends received, at current exchange rate

12/31/12 Investment in Star 93,200

OCI, translation adjustment 28,600

Income from Star 121,800

Year-end adjustment for income

The income is from the translated income

statement, with appropriate amortizations

for fair value/book value differences.

Copyright ©2012 Pearson Education,

14-32

Inc. Publishing as Prentice Hall

Amortization of Differentials

On 12/31/11, Pat acquired Star. Star had

unrecorded patent of £100,000. The exchange

rate was $1.50.

The patent is amortized over 10 years. The

average and year-end exchange rates are $1.45

and $1.40.

12/31/11 Patent £100,000 $1.50 $150,000

2012 Amortization expense £10,000 $1.45 $14,500

12/31/12 Patent £90,000 $1.40 $126,000

OCI translation adjustment for patent is $9,500.

$150,000 – 14,500 – 126,000 = $9,500

The adjustment brings the net value of the patent to its

translated year-end amount of $126,000.

Copyright ©2012 Pearson Education,

14-33

Inc. Publishing as Prentice Hall

Foreign Currency Financial Statements

8: CONSOLIDATION OF

FOREIGN SUBSIDIARIES

Copyright ©2012 Pearson Education,

14-34

Inc. Publishing as Prentice Hall

Consolidating Foreign Subsidiaries

The parent uses the appropriately

translated or remeasured subsidiary

financial statements in its consolidation

worksheet.

Income from the subsidiary and

Investment in subsidiary are eliminated.

Subsidiary equity accounts are

eliminated (including accumulated OCI).

Worksheet procedures are similar to

that for domestic subsidiaries.

Copyright ©2012 Pearson Education,

14-35

Inc. Publishing as Prentice Hall

Worksheet – Income Statement

Star's balances come

from the translated

statements. Current

amortization for the

patent is recorded.

Copyright ©2012 Pearson Education,

14-36

Inc. Publishing as Prentice Hall

Worksheet – Retained Earnings

Star's beginning retained

earnings and current

dividends are eliminated.

Copyright ©2012 Pearson Education,

14-37

Inc. Publishing as Prentice Hall

Worksheet - Assets

The Investment in Star

and intercompany

receivables are

eliminated. Differentials

from acquisition are

recorded – the patent

and its current

amortization.

Copyright ©2012 Pearson Education,

14-38

Inc. Publishing as Prentice Hall

Worksheet – Liabilities & Equity

Intercompany payable is

eliminated. All of the subsidiary

equity is eliminated, including

Accumulated OCI. Parent's

Accumulated OCI contains impact

of translation adjustments.

Copyright ©2012 Pearson Education,

14-39

Inc. Publishing as Prentice Hall

Foreign Currency Financial Statements

9: HEDGE OF NET

INVESTMENT

Copyright ©2012 Pearson Education,

14-40

Inc. Publishing as Prentice Hall

Hedge a Foreign Investment

Investee's functional currency = local

currency

Effective hedges qualify for hedge treatment

"Gains or losses" are translation adjustments

which are included in accumulated OCI

Investee's functional currency = reporting

currency

"Hedging" is treated as speculative

Gains or losses are recognized in income for

the current financial period

Copyright ©2012 Pearson Education,

14-41

Inc. Publishing as Prentice Hall

This work is protected by United States copyright laws and

is provided solely for the use of instructors in teaching

!

their courses and assessing student learning.

Dissemination or sale of any part of this work

(including on the World Wide Web) will destroy the

integrity of the work and is not permitted. The

work and materials from it is should never be made

available to students except by instructors using the

accompanying text in their classes. All recipients of this

work are expected to abide by these restrictions and to

honor the intended pedagogical purposes and the needs of

other instructors who rely on these materials.

All rights reserved. No part of this publication may be

reproduced, stored in a retrieval system, or transmitted, in any

form or by any means, electronic, mechanical, photocopying,

recording, or otherwise, without the prior written permission of

the publisher. Printed in the United States of America.

Copyright ©2012 Pearson Education,

14-42

Inc. Publishing as Prentice Hall

Potrebbero piacerti anche

- Beams11 ppt14Documento42 pagineBeams11 ppt14Nihayasti DefitriNessuna valutazione finora

- Beams10e Ch13Documento42 pagineBeams10e Ch13TFI Student CommunityNessuna valutazione finora

- Chapter 13: Foreign Currency Financial Statements: Advanced AccountingDocumento42 pagineChapter 13: Foreign Currency Financial Statements: Advanced AccountingMad JayaNessuna valutazione finora

- Bandi: Bandi - Staff.fe - Uns.ac - Id Atau 3/10/2018Documento44 pagineBandi: Bandi - Staff.fe - Uns.ac - Id Atau 3/10/2018luxion botNessuna valutazione finora

- Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsDocumento53 pagineMultinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsMostafa Monsur AhmedNessuna valutazione finora

- CH 08Documento37 pagineCH 08川流Nessuna valutazione finora

- FOREX and Derivative AccountingDocumento67 pagineFOREX and Derivative AccountingKurt Morin CantorNessuna valutazione finora

- Financial Accounting: A Business Process ApproachDocumento42 pagineFinancial Accounting: A Business Process ApproachPeterNessuna valutazione finora

- Chapter 11 - Text Book ReferenceDocumento22 pagineChapter 11 - Text Book ReferenceJilynn SeahNessuna valutazione finora

- For MISDocumento32 pagineFor MISamsr khNessuna valutazione finora

- Multinational Business Finance 12th Edition Slides Chapter 13Documento31 pagineMultinational Business Finance 12th Edition Slides Chapter 13Alli Tobba100% (1)

- Balance of PaymentsDocumento28 pagineBalance of PaymentsMoataz mohamedNessuna valutazione finora

- Chapter 10 IFDocumento25 pagineChapter 10 IFcuteserese roseNessuna valutazione finora

- CHP 11Documento41 pagineCHP 11SUBA NANTINI A/P M.SUBRAMANIAMNessuna valutazione finora

- Beams Adv Acc CH 14Documento21 pagineBeams Adv Acc CH 14Josua PranataNessuna valutazione finora

- Translation of Foreign Currency Financial StatementsDocumento27 pagineTranslation of Foreign Currency Financial StatementsSurip BachtiarNessuna valutazione finora

- Chapter 13 Translation of Financial Statements of Foreign Affiliates - 2ndDocumento41 pagineChapter 13 Translation of Financial Statements of Foreign Affiliates - 2ndMuhammad Za'far SiddiqNessuna valutazione finora

- Foundations of FinanceDocumento22 pagineFoundations of FinanceNur Akmal100% (1)

- Op RiskDocumento34 pagineOp Risknadaaboutaleb24Nessuna valutazione finora

- Foreign OperationsDocumento30 pagineForeign OperationspavishalekhaNessuna valutazione finora

- Chapter 13 Translation of Financial Statements of Foreign Affiliates - 1st SessionDocumento38 pagineChapter 13 Translation of Financial Statements of Foreign Affiliates - 1st SessionMuhammad Za'far SiddiqNessuna valutazione finora

- Translation of Financial Statements of Foreign AffiliatesDocumento37 pagineTranslation of Financial Statements of Foreign AffiliateschristoperedwinNessuna valutazione finora

- Chapter 6: Foreign Currency Translation: International Accounting, 6/eDocumento29 pagineChapter 6: Foreign Currency Translation: International Accounting, 6/eSylvia Al-a'maNessuna valutazione finora

- Chapter 04Documento43 pagineChapter 04LEE JIA XINessuna valutazione finora

- Financial Statements and Ratio Analysis: Learning GoalsDocumento31 pagineFinancial Statements and Ratio Analysis: Learning GoalsMohammadNessuna valutazione finora

- CH 14Documento22 pagineCH 14BensonChiuNessuna valutazione finora

- Chapter 11 - Translation of Foreign Financial Statements PPT SlidesDocumento25 pagineChapter 11 - Translation of Foreign Financial Statements PPT Slidesgilli1tr100% (1)

- Final Term MADS 6601 Financial AdministrationDocumento81 pagineFinal Term MADS 6601 Financial AdministrationPavan Kumar VadlamaniNessuna valutazione finora

- Beams Aa13e PPT 14Documento43 pagineBeams Aa13e PPT 14Abeer Al OlaimatNessuna valutazione finora

- BOP-Group 2Documento35 pagineBOP-Group 2Waleed ElsebaieNessuna valutazione finora

- An Introduction To The Foundations of Financial Management: All Rights ReservedDocumento30 pagineAn Introduction To The Foundations of Financial Management: All Rights ReservedChristian LunaNessuna valutazione finora

- Derivatives and Foreign Currency: Concepts and Common TransactionsDocumento28 pagineDerivatives and Foreign Currency: Concepts and Common TransactionsElle PaizNessuna valutazione finora

- Derivatives and Foreign Currency: Concepts and Common TransactionsDocumento28 pagineDerivatives and Foreign Currency: Concepts and Common TransactionsElle PaizNessuna valutazione finora

- Derivatives and Foreign Currency: Concepts and Common TransactionsDocumento28 pagineDerivatives and Foreign Currency: Concepts and Common TransactionsElle PaizNessuna valutazione finora

- Derivatives and Foreign Currency: Concepts and Common TransactionsDocumento28 pagineDerivatives and Foreign Currency: Concepts and Common TransactionsMohammed S. ZughoulNessuna valutazione finora

- Pertemuan 2 PPT CH 14 BeamsDocumento44 paginePertemuan 2 PPT CH 14 BeamsArya SetiawanNessuna valutazione finora

- The Importance of Liquidity RatiosDocumento12 pagineThe Importance of Liquidity Ratiosjma_msNessuna valutazione finora

- Time ValueDocumento43 pagineTime ValueJaneNessuna valutazione finora

- Accounting For Derivatives and Hedging ActivitiesDocumento35 pagineAccounting For Derivatives and Hedging Activitiesevie veronicaNessuna valutazione finora

- Chapter 8 - Understanding Accounting and Business FundingDocumento16 pagineChapter 8 - Understanding Accounting and Business Fundingazra syazwana 2ANessuna valutazione finora

- Small Business & Entrepreneurship - Chapter 8Documento36 pagineSmall Business & Entrepreneurship - Chapter 8Muhammad Zulhilmi Wak JongNessuna valutazione finora

- Chapter 6-Foreign Currency Translation Introduction and BackgroundDocumento21 pagineChapter 6-Foreign Currency Translation Introduction and BackgroundRakeshNessuna valutazione finora

- CH 5 Time Value of MoneyDocumento94 pagineCH 5 Time Value of MoneyTarannum TahsinNessuna valutazione finora

- Nobles Acctg10 PPT 01Documento61 pagineNobles Acctg10 PPT 01Tayar ElieNessuna valutazione finora

- Group1 - Intro - Financial Statement Analysis ReportingDocumento61 pagineGroup1 - Intro - Financial Statement Analysis Reportingsheila mae añuberNessuna valutazione finora

- Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsDocumento36 pagineMultinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsahmedNessuna valutazione finora

- LU4: Statement of Cash FlowsDocumento44 pagineLU4: Statement of Cash FlowsLi YuNessuna valutazione finora

- Pertemuan 14-1Documento46 paginePertemuan 14-1Mad JayaNessuna valutazione finora

- Fin254 Ch05 NNH TVM UpdatedDocumento80 pagineFin254 Ch05 NNH TVM Updatedamir khanNessuna valutazione finora

- Chapter 2 - Measuring Income To Assess PerformanceDocumento4 pagineChapter 2 - Measuring Income To Assess PerformanceArmanNessuna valutazione finora

- Introduction To Corporate FinanceDocumento17 pagineIntroduction To Corporate FinanceAnteneh GorfuNessuna valutazione finora

- L5 Financial PlansDocumento55 pagineL5 Financial Plansfairylucas708Nessuna valutazione finora

- Asifkhan - 69 - 17591 - 5 - CH 8 Foreign Exchange MarketDocumento21 pagineAsifkhan - 69 - 17591 - 5 - CH 8 Foreign Exchange MarketMuddassir RazaNessuna valutazione finora

- Solution Manual Advanced CH 12Documento78 pagineSolution Manual Advanced CH 12Marietha Ayu SafitriNessuna valutazione finora

- CH 13Documento31 pagineCH 13Natasha GraciaNessuna valutazione finora

- Chapter 3 2023Documento41 pagineChapter 3 2023dhaanh200104Nessuna valutazione finora

- IFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsDa EverandIFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsValutazione: 4 su 5 stelle4/5 (11)

- Applied Corporate Finance. What is a Company worth?Da EverandApplied Corporate Finance. What is a Company worth?Valutazione: 3 su 5 stelle3/5 (2)

- CM Shopstar ManDocumento24 pagineCM Shopstar Mancj7man80100% (1)

- BLCTE - MOCK EXAM II With Answer Key PDFDocumento20 pagineBLCTE - MOCK EXAM II With Answer Key PDFVladimir Marquez78% (18)

- Definition of Collective BargainingDocumento27 pagineDefinition of Collective Bargainingolkp15101992Nessuna valutazione finora

- Answerkey PDFDocumento9 pagineAnswerkey PDFParas MalhotraNessuna valutazione finora

- SEC Cryptocurrency Enforcement Q3 2013 Q4 2020Documento30 pagineSEC Cryptocurrency Enforcement Q3 2013 Q4 2020ForkLogNessuna valutazione finora

- Caf 1 Ia ST PDFDocumento270 pagineCaf 1 Ia ST PDFFizzazubair rana50% (2)

- Suraya Binti Hussin: Kota Kinabalu - T1 (BKI)Documento2 pagineSuraya Binti Hussin: Kota Kinabalu - T1 (BKI)Sulaiman SyarifuddinNessuna valutazione finora

- 20 Rules of Closing A Deal PDFDocumento21 pagine20 Rules of Closing A Deal PDFbioarquitectura100% (9)

- Passport Application Form 19Documento4 paginePassport Application Form 19Danny EphraimNessuna valutazione finora

- What Is Corporate RestructuringDocumento45 pagineWhat Is Corporate RestructuringPuneet GroverNessuna valutazione finora

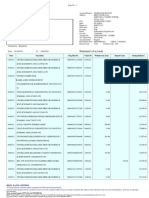

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento3 pagineStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHiten AhirNessuna valutazione finora

- PO-12 - F - 06 1 PA GE 2/ NU MPA GES 2: Învăţământ UniversitarDocumento3 paginePO-12 - F - 06 1 PA GE 2/ NU MPA GES 2: Învăţământ UniversitarElena FilipNessuna valutazione finora

- Sun Server X3-2 (Formerly Sun Fire X4170 M3) : Installation GuideDocumento182 pagineSun Server X3-2 (Formerly Sun Fire X4170 M3) : Installation GuideFrancisco Bravo BustamanteNessuna valutazione finora

- Sample of Notarial WillDocumento3 pagineSample of Notarial WillJF Dan100% (1)

- Job Order ContractDocumento1 paginaJob Order ContractPaulo Abenio Escober100% (1)

- Issues and Challenges Faced by Indian FederalismDocumento7 pagineIssues and Challenges Faced by Indian FederalismAnonymous JdfniItox3Nessuna valutazione finora

- Office of The City Prosecutor: Counter - AffidavitDocumento6 pagineOffice of The City Prosecutor: Counter - AffidavitApril Elenor JucoNessuna valutazione finora

- 115 Bus EireannDocumento3 pagine115 Bus EireannjulieannagormanNessuna valutazione finora

- Velasco Vs SandiganbayanDocumento10 pagineVelasco Vs SandiganbayanlhyniNessuna valutazione finora

- Juz AmmaDocumento214 pagineJuz AmmaIli Liyana Khairunnisa KamardinNessuna valutazione finora

- IT Security Threats Vulnerabilities and CountermeasuresDocumento35 pagineIT Security Threats Vulnerabilities and Countermeasureschristian may noqueraNessuna valutazione finora

- Huge Filing Bill WhiteDocumento604 pagineHuge Filing Bill WhiteBen SellersNessuna valutazione finora

- Student Result - Aakash BYJU'sDocumento4 pagineStudent Result - Aakash BYJU'sManvi GoyalNessuna valutazione finora

- C. Rules of Adminissibility - Documentary Evidence - Best Evidence Rule - Loon Vs Power Master Inc, 712 SCRADocumento1 paginaC. Rules of Adminissibility - Documentary Evidence - Best Evidence Rule - Loon Vs Power Master Inc, 712 SCRAJocelyn Yemyem Mantilla VelosoNessuna valutazione finora

- Farm Animal Fun PackDocumento12 pagineFarm Animal Fun PackDedeh KhalilahNessuna valutazione finora

- HyiDocumento4 pagineHyiSirius BlackNessuna valutazione finora

- 2-Samonte Vs de La SalleDocumento1 pagina2-Samonte Vs de La SalleLove EsmeroNessuna valutazione finora

- Apache 2018 PDFDocumento3 pagineApache 2018 PDFOom OomNessuna valutazione finora

- GSTR1 Excel Workbook Template V1.7Documento63 pagineGSTR1 Excel Workbook Template V1.7Nagaraj SettyNessuna valutazione finora

- George F. Nafziger, Mark W. Walton-Islam at War - A History - Praeger (2008)Documento288 pagineGeorge F. Nafziger, Mark W. Walton-Islam at War - A History - Praeger (2008)موسى رجب100% (2)