Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Presentation 1

Caricato da

No Name0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

18 visualizzazioni1 paginaEconomy

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoEconomy

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

18 visualizzazioni1 paginaPresentation 1

Caricato da

No NameEconomy

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

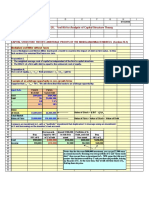

WACC Example :

A company want to raise money, the company will sell RM10,000 of

common stock, the expected return is 15%. Moreover, the company will

issue RM5,000 of debt, the cost of debt is 12% and the tax rate is 30%.

Find the WACC.

Total Value of the company : Wd = 0.33

RM10,000 + RM5,000 = RM15,000 Rd = 0.12

T = 0.3

Weight Debt : 5/15 = 0.33 We = 0.67

Re = 0.15

Weight Equity : 10/15 = 0.67

WACC = Wd*Rd(1-t) + We*Re

WACC = 0.33*0.12(1-0.3) + 0.67*0.15 = 0.1282 @ 12.82%

Potrebbero piacerti anche

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionDa EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionValutazione: 2.5 su 5 stelle2.5/5 (2)

- HOMEWORKDocumento7 pagineHOMEWORKReinaldo RoseroNessuna valutazione finora

- Dynamics Capital Structure Decisions: Part IIDocumento56 pagineDynamics Capital Structure Decisions: Part IIDhani Devonne BieberNessuna valutazione finora

- Finman Asnwer KeyDocumento6 pagineFinman Asnwer KeyLopez, Azzia M.Nessuna valutazione finora

- Huzaima Jamal-1Documento11 pagineHuzaima Jamal-1Fatima ZehraNessuna valutazione finora

- Solutions To End-Of-Chapter ProblemsDocumento7 pagineSolutions To End-Of-Chapter ProblemsYaam MedwedNessuna valutazione finora

- Sample Q & A Chapter: Leverage & Capital Restructuring: Before Restructuring After RestructuringDocumento3 pagineSample Q & A Chapter: Leverage & Capital Restructuring: Before Restructuring After Restructuringnur fatinNessuna valutazione finora

- Financial Management Cost of CapitalDocumento29 pagineFinancial Management Cost of Capitalisha aggarwalNessuna valutazione finora

- Capital Structure 2Documento55 pagineCapital Structure 2ranho jaelaniNessuna valutazione finora

- Costs: FinancingDocumento6 pagineCosts: FinancingIfraNessuna valutazione finora

- Problem and Answer - Uas AfDocumento10 pagineProblem and Answer - Uas AfPatrickNessuna valutazione finora

- Assignment Cover SheetDocumento19 pagineAssignment Cover SheetMd. Ayman IqbalNessuna valutazione finora

- Solutions To Chapter 12 The Cost of Capital: R V E R V P) T 1 (R V D WaccDocumento10 pagineSolutions To Chapter 12 The Cost of Capital: R V E R V P) T 1 (R V D WaccMelissaNessuna valutazione finora

- Chapter 10 SolutionsDocumento8 pagineChapter 10 Solutionsalice123h2150% (2)

- 5 - Cost of CapitalDocumento6 pagine5 - Cost of CapitaloryzanoviaNessuna valutazione finora

- Solutions To End-Of-Chapter Problems 11Documento6 pagineSolutions To End-Of-Chapter Problems 11weeeeeshNessuna valutazione finora

- Lahore School of Economics Financial Management II The Cost of CapitalDocumento3 pagineLahore School of Economics Financial Management II The Cost of CapitalDaniyal AliNessuna valutazione finora

- Capital Structure and Gearing - Solutions To The Remaining QuestionsDocumento4 pagineCapital Structure and Gearing - Solutions To The Remaining QuestionsGadafi FuadNessuna valutazione finora

- ANNUITIESDocumento16 pagineANNUITIESDina Jean SombrioNessuna valutazione finora

- Finance TutorialDocumento16 pagineFinance TutorialSyafiqah AbdullahNessuna valutazione finora

- Chapter 15 Revised Incl Blaine Intro 2022Documento40 pagineChapter 15 Revised Incl Blaine Intro 2022SSNessuna valutazione finora

- Solutions. Chapter. 9Documento6 pagineSolutions. Chapter. 9asih359Nessuna valutazione finora

- Corporate Finance Workshop 1Documento24 pagineCorporate Finance Workshop 1coffeedanceNessuna valutazione finora

- FM09-CH 16Documento12 pagineFM09-CH 16Mukul KadyanNessuna valutazione finora

- FAC1502 - Assumed KnowledgeDocumento6 pagineFAC1502 - Assumed Knowledgelenzboss23jNessuna valutazione finora

- Assignment 1 Iqra Javaid - 46032 Submitted To Muhammad ZeeshanDocumento6 pagineAssignment 1 Iqra Javaid - 46032 Submitted To Muhammad ZeeshanFAIQ KHALIDNessuna valutazione finora

- HW Set 3 - Maria CiucăDocumento3 pagineHW Set 3 - Maria CiucăMaria CiucaNessuna valutazione finora

- Wacc and MMDocumento2 pagineWacc and MMThảo NguyễnNessuna valutazione finora

- Assignment Chapter 9Documento2 pagineAssignment Chapter 9MohNessuna valutazione finora

- Tutorial 2Documento6 pagineTutorial 2sdfklmjsdlklskfjdNessuna valutazione finora

- Cost of Capital Tut. MemoDocumento2 pagineCost of Capital Tut. MemoSEKEETHA DE NOBREGANessuna valutazione finora

- Corporate Finance Canadian 2nd Edition Berk Solutions ManualDocumento6 pagineCorporate Finance Canadian 2nd Edition Berk Solutions Manualtaylorhughesrfnaebgxyk100% (30)

- CH19Documento8 pagineCH19Lyana Del Arroyo OliveraNessuna valutazione finora

- Chapter 12 - ET3Documento6 pagineChapter 12 - ET3anthony.schzNessuna valutazione finora

- Pln-Cmams - Cost of CapitalDocumento26 paginePln-Cmams - Cost of Capitaldwi suhartantoNessuna valutazione finora

- FMCF Group Assignment1Documento8 pagineFMCF Group Assignment1Harshit GaurNessuna valutazione finora

- Capital StructureDocumento52 pagineCapital StructureIbrar IshaqNessuna valutazione finora

- Chapter - 9: Solutions - To - End - of - Chapter - 9 - Problems - On - Estimating - Cost - of - CapitalDocumento7 pagineChapter - 9: Solutions - To - End - of - Chapter - 9 - Problems - On - Estimating - Cost - of - CapitalMASPAKNessuna valutazione finora

- Solutions To Problems: LG 1 BasicDocumento13 pagineSolutions To Problems: LG 1 BasicMuwadat Hussain67% (3)

- Lahore School of Economics Financial Management I The Cost of Capital - 2 Assignment 15 SolutionDocumento3 pagineLahore School of Economics Financial Management I The Cost of Capital - 2 Assignment 15 SolutionoctaviaNessuna valutazione finora

- Chapter 13 SolutionsDocumento5 pagineChapter 13 SolutionsrahidarzooNessuna valutazione finora

- Handout 9 - 10 - Review Exercises and SolutionsDocumento7 pagineHandout 9 - 10 - Review Exercises and Solutions6kb4nm24vjNessuna valutazione finora

- Capital Structure: Aamer ShahzadDocumento52 pagineCapital Structure: Aamer Shahzadmaham qaiserNessuna valutazione finora

- Bus Math Grade 11 Q2 M2 W2Documento9 pagineBus Math Grade 11 Q2 M2 W2Ronald Almagro0% (1)

- WACCDocumento9 pagineWACCErik SonNessuna valutazione finora

- 09 TP FinancialDocumento1 pagina09 TP Financialgino porrasNessuna valutazione finora

- Chapter 26. Tool Kit For Analysis of Capital Structure TheoryDocumento11 pagineChapter 26. Tool Kit For Analysis of Capital Structure TheoryJITIN ARORANessuna valutazione finora

- Name: Prakash Pokhrel Roll No: 073 Bel 325 Micro Hydro Tutorial 4: Assignment 4Documento3 pagineName: Prakash Pokhrel Roll No: 073 Bel 325 Micro Hydro Tutorial 4: Assignment 4PRAKASH POKHRELNessuna valutazione finora

- ch14 SolDocumento16 paginech14 SolAnsleyNessuna valutazione finora

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskDocumento41 pagineThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskSheikh OsamaNessuna valutazione finora

- Answers To Problem Sets: How Much Should A Corporation Borrow?Documento8 pagineAnswers To Problem Sets: How Much Should A Corporation Borrow?priyanka GayathriNessuna valutazione finora

- New Microsoft PowerPoint PresentationDocumento4 pagineNew Microsoft PowerPoint PresentationMuhammad MuzahidNessuna valutazione finora

- Chapter 9 SolutionsDocumento16 pagineChapter 9 SolutionsIsah Ma. Zenaida Felisilda50% (2)

- Business Finance II: Marriott Corporation: The Cost of CapitalDocumento5 pagineBusiness Finance II: Marriott Corporation: The Cost of CapitalJunaid SaleemNessuna valutazione finora

- Answers To Problem Sets: 1. Market Values of Debt and Equity AreDocumento12 pagineAnswers To Problem Sets: 1. Market Values of Debt and Equity Aremandy YiuNessuna valutazione finora

- TESTDocumento3 pagineTESTfatin nasuhaNessuna valutazione finora

- Solutions For Credit RiskDocumento3 pagineSolutions For Credit RiskTuan Tran VanNessuna valutazione finora

- Solutions To End-Of-Chapter Problems: BE D Ce D e UDocumento7 pagineSolutions To End-Of-Chapter Problems: BE D Ce D e UMhd AminNessuna valutazione finora

- Capital StructureDocumento14 pagineCapital Structureratidwivedi100% (1)

- Modified Internal Rate of Return (MIRR)Documento8 pagineModified Internal Rate of Return (MIRR)JaJ08Nessuna valutazione finora

- Solution of Nonlinear Equations: Graphical and Incremental Search MethodsDocumento17 pagineSolution of Nonlinear Equations: Graphical and Incremental Search MethodsNo NameNessuna valutazione finora

- Chapter 6 - COLUMNDocumento54 pagineChapter 6 - COLUMNWee Soon ChaiNessuna valutazione finora

- Answer Scheme BNJ 20903Documento8 pagineAnswer Scheme BNJ 20903No NameNessuna valutazione finora

- Universiti Tun Hussein Onn Malaysia: ConfidentialDocumento8 pagineUniversiti Tun Hussein Onn Malaysia: ConfidentialNo NameNessuna valutazione finora

- Safety Precaution ModernDocumento6 pagineSafety Precaution ModernNo NameNessuna valutazione finora

- Metal Forming Chapter 4 and ConclusionDocumento4 pagineMetal Forming Chapter 4 and ConclusionNo NameNessuna valutazione finora

- Y.' .I TL: MalaysiaDocumento1 paginaY.' .I TL: MalaysiaNo NameNessuna valutazione finora

- Result and Measurement AnalysisDocumento16 pagineResult and Measurement AnalysisNo NameNessuna valutazione finora

- Practical Report (Folding Machine)Documento23 paginePractical Report (Folding Machine)No NameNessuna valutazione finora

- Metrology Measurement Slide PresentDocumento13 pagineMetrology Measurement Slide PresentNo NameNessuna valutazione finora

- Gantt Chart EthnicDocumento1 paginaGantt Chart EthnicNo NameNessuna valutazione finora

- PumpsDocumento36 paginePumpsNo NameNessuna valutazione finora

- FTK Heat Pump PDFDocumento6 pagineFTK Heat Pump PDFNo NameNessuna valutazione finora

- EBXS3103 (Chapter 5) StaticsDocumento16 pagineEBXS3103 (Chapter 5) StaticsImran KhanNessuna valutazione finora

- AC - UNITY+2Tr-LNG - v1.1.0 - INFODocumento4 pagineAC - UNITY+2Tr-LNG - v1.1.0 - INFONo NameNessuna valutazione finora

- Chapter 2 PPT 02Documento94 pagineChapter 2 PPT 02No NameNessuna valutazione finora

- Addition For Tutorial 3Documento1 paginaAddition For Tutorial 3No NameNessuna valutazione finora

- Math 237 Lecture NotesDocumento53 pagineMath 237 Lecture NotesNo NameNessuna valutazione finora

- Tutorial 2 Feb 2016Documento44 pagineTutorial 2 Feb 2016No NameNessuna valutazione finora

- Read Me First !!!Documento1 paginaRead Me First !!!No NameNessuna valutazione finora

- Emu LogDocumento3 pagineEmu LogNo NameNessuna valutazione finora