Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

pp11

Caricato da

sai101Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

pp11

Caricato da

sai101Copyright:

Formati disponibili

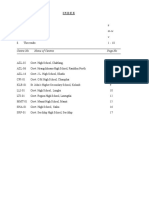

Slide 11.

1

2.1

Slide

Part III:

Strategy in Action

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.2

The focus of part 3:

strategy in action

Criteria and techniques that can be used to evaluate

possible strategic options.

How strategies develop in organisations; the

processes that may give rise to intended strategies or

to emergent strategies.

The way in which organisational structures and

systems of control are important in organising for

strategic success.

The leadership and management of strategic change.

Who strategists are and what they do in practice.

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.3

Strategy in Action

11: Evaluating Strategies

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.4

Learning outcomes

Employ three success criteria for evaluating strategic

options:

Suitability: whether a strategy addresses the key

issues relating to the opportunities and constraints an

organisation faces.

Acceptability: whether a strategy meets the

expectations of stakeholders.

Feasibility: whether a strategy could work in

practice.

For each of these use a range of different techniques

for evaluating strategic options, both financial and

non-financial.

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.5

The SAFe criteria

Table 11.1

The SAFe criteria and techniques of evaluation

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.6

Suitability

Suitability is concerned with assessing which proposed

strategies address the key opportunities & constraints

an organisation faces, through an understanding of the

strategic position of an organisation.

It is concerned with the overall rationale of the strategy:

Does it exploit the opportunities in the environment

and avoid the threats?

Does it capitalise on the organisations strengths and

strategic capabilities and avoid or remedy the

weaknesses?

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.7

Suitability of strategic options in

relation to strategic position (1)

Table 11.2

Suitability of strategic options in relation to strategic position

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.8

Suitability of strategic options in

relation to strategic position (2)

Table 11.2

Suitability of strategic options in relation to strategic position (Continued)

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.9

Some examples of suitability (1)

Table 11.3

Some examples of suitability

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.10

Some examples of suitability (2)

Table 11.3

Some examples of suitability (Continued)

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.11

Suitability screening techniques

There are several useful techniques:

Ranking.

Using scenarios.

Screening for competitive advantage.

Decision trees.

Life cycle analysis.

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.12

The life cycle/portfolio matrix

Table 11.5

The industry life cycle/portfolio matrix

Source: Arthur D. Little

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.13

Competitive position within an industry

Competitive position within an industry can be:

A dominant position which is rare in the private sector

unless there is a quasi-monopoly position. In the public

sector there can be a legalised monopoly status.

A strong position where organisations can follow strategies

of their own choice without too much concern for

competition.

A favourable position where no single competitor stands

out, but leaders are better placed.

A tenable position can be maintained by specialisation or

focus.

A weak position where competitors are too small to survive

independently in the long run.

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.14

Acceptability (1)

Acceptability is concerned with whether the

expected performance outcomes of a proposed

strategy meet the expectations of stakeholders.

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.15

Acceptability (2)

There are three key aspects of acceptability - the

3 Rs:

Risk.

Return.

Reactions (of stakeholders).

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.16

Risk

Risk concerns the extent to which the

outcomes of a strategy can be predicted.

Risk can be assessed using:

Sensitivity analysis.

Financial ratios e.g. gearing and liquidity.

Break-even analysis.

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.17

Sensitivity analysis

Illustration 11.3 A

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.18

Sensitivity analysis (Continued)

Illustration 11.3 B

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.19

Sensitivity analysis (Continued)

Illustration 11.3 C

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.20

Return

Returns are the financial benefits which

stakeholders are expected to receive from a

strategy.

Different approaches to assessing return:

Financial analysis.

Shareholder value analysis.

Costbenefit analysis.

Real options.

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.21

Real options evaluation

Illustration 11.6

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.22

Assessing profitability (1)

Figure 11.1

Assessing profitability

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.23

Assessing profitability (2)

Figure 11.1

Assessing profitability (Continued)

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.24

Assessing profitability (3)

Figure 11.1

Assessing profitability (Continued)

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.25

Measures of shareholder value

Table 11.6

Measures of shareholder value

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.26

Advantages of real options

There are four main benefits:

Bringing strategic and financial evaluation

closer together.

Valuing emerging options.

Coping with uncertainty.

Offsetting conservatism.

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.27

Reaction of stakeholders

Stakeholder mapping and the power/interest

matrix can be used to:

understand the political context of strategies.

understand the political agenda.

gauge the likely reaction of stakeholders to

specific strategies.

If key stakeholders find a strategy to be

unacceptable then it is likely to fail

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.28

Feasibility

Feasibility is concerned with whether a strategy

could work in practice i.e. whether an

organisation has the capabilities to deliver a

strategy

Two key questions:

Do the resources and competences currently

exist to implement the strategy effectively?

If not, can they be obtained?

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.29

Financial feasibility

Need to consider:

The funding required.

Cash flow analysis and forecasting.

Financial strategies needed for the different

phases of the life cycle of a business.

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.30

Financial strategy and the business

life cycle

Table 11.7

Financial strategy and the business life cycle

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.31

People and skills (1)

Three questions arise:

Do people in the organisation currently have

the competences to deliver a proposed

strategy?

Are the systems to support those people fit for

the strategy?

If not, can the competences be obtained or

developed?

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.32

People and skills (2)

Critical issues that need to be considered:

Work organisation will this need to change?

Rewards are the incentives appropriate?

Relationships will people interact differently?

Training and development are current systems

appropriate?

Staffing are the levels and skills of the staff

appropriate?

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.33

Integrating resources

The success of a strategy depends on the

management of many resource areas, for example:

people,

finance,

physical resources,

information,

technology and

resources provided by suppliers and partners.

It is essential to integrate resources inside the

organisation and in the wider value network.

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.34

Evaluation criteria

Four qualifications:

Conflicting conclusions and the need for

management judgement.

Consistency between the different elements of a

strategy is essential.

The implementation and development of

strategies might reveal unanticipated problems.

Strategy development in practice it isnt always

a logical or even rational process.

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Slide 11.35

Summary

Proposed strategies may be evaluated using the

three SAFe criteria:

Suitability is concerned with assessing which proposed

strategies address the key opportunities and constraints

an organisation faces. It is about the rationale of a

strategy.

The acceptability of a strategy relates to three issues: the

level of risk of a strategy, the expected return from a

strategy and the likely reaction of stakeholders.

Feasibility is concerned with whether an organisation has

or can obtain the capabilities to deliver a strategy.

Johnson, Whittington and Scholes, Exploring Strategy, 9th Edition, Pearson Education Limited 2011

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Additional Notes For Coursework 1Documento3 pagineAdditional Notes For Coursework 1sai101Nessuna valutazione finora

- Retail and Services Marketing Coursework 1Documento2 pagineRetail and Services Marketing Coursework 1sai101Nessuna valutazione finora

- M020LON CW1 AssessmentDocumento3 pagineM020LON CW1 Assessmentsai101Nessuna valutazione finora

- Content Server 123Documento4 pagineContent Server 123sai101Nessuna valutazione finora

- ManufacturingDocumento5 pagineManufacturingsai101Nessuna valutazione finora

- Ofsted Inspection Report - October 2012Documento9 pagineOfsted Inspection Report - October 2012sai101Nessuna valutazione finora

- The Meaning of Holy Quran in TeluguDocumento109 pagineThe Meaning of Holy Quran in Telugusai101Nessuna valutazione finora

- A Survey On Context Security Policies in The CloudDocumento6 pagineA Survey On Context Security Policies in The Cloudsai101Nessuna valutazione finora

- IT Governance and InfrastructureDocumento32 pagineIT Governance and Infrastructuresai101Nessuna valutazione finora

- 1 PB PDFDocumento7 pagine1 PB PDFsai101Nessuna valutazione finora

- Lecture 11 - Managing Systems DevelopmentDocumento11 pagineLecture 11 - Managing Systems Developmentsai101Nessuna valutazione finora

- Session 2 - Prince2Documento20 pagineSession 2 - Prince2sai101Nessuna valutazione finora

- Token Passing Techniques For Hard Real-Time Communication: MARCH 2010Documento25 pagineToken Passing Techniques For Hard Real-Time Communication: MARCH 2010sai101Nessuna valutazione finora

- 7HR006 New Slides Day 10 UpdatedDocumento29 pagine7HR006 New Slides Day 10 Updatedsai101Nessuna valutazione finora

- Automated Duplicate Detection For Bug Tracking SystemsDocumento10 pagineAutomated Duplicate Detection For Bug Tracking Systemssai101Nessuna valutazione finora

- MandS FinancialTablesandNotesDocumento41 pagineMandS FinancialTablesandNotessai101Nessuna valutazione finora

- 7CI017 Assessment 1-2Documento23 pagine7CI017 Assessment 1-2sai101Nessuna valutazione finora

- Branding - Strategy - 2017 Full Slide SetDocumento61 pagineBranding - Strategy - 2017 Full Slide Setsai101Nessuna valutazione finora

- Methods of Acquisition: System RequirementsDocumento49 pagineMethods of Acquisition: System Requirementssai101Nessuna valutazione finora

- PGBM15 Assignment Question - Jan 2017 SubmissionDocumento5 paginePGBM15 Assignment Question - Jan 2017 Submissionsai1010% (1)

- Project Manager Leadership Role in Improving Project PerformanceDocumento11 pagineProject Manager Leadership Role in Improving Project Performancesai101Nessuna valutazione finora

- Student Name: Supervisor Name: Student Id: Programme:: The Problem Statement ImplementationDocumento1 paginaStudent Name: Supervisor Name: Student Id: Programme:: The Problem Statement Implementationsai101Nessuna valutazione finora

- 10 Errors With Harvard Referencing - AnswersDocumento1 pagina10 Errors With Harvard Referencing - Answerssai101Nessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Education Is Not Filling of A Pail, But The Lighting of A FireDocumento1 paginaEducation Is Not Filling of A Pail, But The Lighting of A FireEra100% (1)

- CCSSMathTasks Grade1Documento80 pagineCCSSMathTasks Grade1Rivka ShareNessuna valutazione finora

- Language Learning Styles and Strategies Concepts and RelationshipsDocumento10 pagineLanguage Learning Styles and Strategies Concepts and RelationshipsRenato BassNessuna valutazione finora

- 3.FIRST AID Snakebite LESSON PLANDocumento8 pagine3.FIRST AID Snakebite LESSON PLANdew2375% (4)

- Catbook 1Documento98 pagineCatbook 1api-198549860% (1)

- Lesson Plan in Beauty Care Grade 8 (TVE) GradeDocumento6 pagineLesson Plan in Beauty Care Grade 8 (TVE) GradeRosette Anne Fortun Moreno100% (3)

- Alternative Delivery SystemDocumento10 pagineAlternative Delivery SystemJulieta Busico100% (1)

- 2 Nivel (1-5)Documento38 pagine2 Nivel (1-5)Uzca GamingNessuna valutazione finora

- NZ NEWSLETTER - Bright-Sparks-Winter-Spring-2022Documento13 pagineNZ NEWSLETTER - Bright-Sparks-Winter-Spring-2022Maisara MalekNessuna valutazione finora

- 2016 HSLC Special Exam ResultsDocumento23 pagine2016 HSLC Special Exam ResultsstuckaNessuna valutazione finora

- NVS PGT Result 2023 PDFDocumento57 pagineNVS PGT Result 2023 PDFEr Arti Kamal BajpaiNessuna valutazione finora

- M.Tech CM LAB MANUALDocumento36 pagineM.Tech CM LAB MANUAL9700216256Nessuna valutazione finora

- Guide 2 CanadaDocumento20 pagineGuide 2 CanadaMikael LikmaringgusNessuna valutazione finora

- Ind Potential SurveyDocumento19 pagineInd Potential SurveyNimish PilankarNessuna valutazione finora

- Fs 1-Episode 1Documento9 pagineFs 1-Episode 1Louween Mendoza0% (1)

- Attribute AnalysisDocumento5 pagineAttribute AnalysisSmriti KhannaNessuna valutazione finora

- First Lesson Plan TastingDocumento3 pagineFirst Lesson Plan Tastingapi-316704749Nessuna valutazione finora

- 2024 Fudan University Shanghai Government Scholarship For Foreign Students Application NoticeDocumento2 pagine2024 Fudan University Shanghai Government Scholarship For Foreign Students Application NoticeToni MengNessuna valutazione finora

- SEMINAR 08 Agreement and DisagreementDocumento5 pagineSEMINAR 08 Agreement and Disagreementdragomir_emilia92Nessuna valutazione finora

- Co-Teaching Lesson PlanDocumento2 pagineCo-Teaching Lesson Planapi-300273828Nessuna valutazione finora

- Basic Motivation Concepts: By:Dr Ipseeta Satpathy, D.Litt Professor Ob & HRMDocumento30 pagineBasic Motivation Concepts: By:Dr Ipseeta Satpathy, D.Litt Professor Ob & HRMPRAGYAN PANDANessuna valutazione finora

- Blooms Taxonomy Indicator v3Documento41 pagineBlooms Taxonomy Indicator v3Moll22Nessuna valutazione finora

- An Introduction To The Piano Music of Manuel M. PonceDocumento77 pagineAn Introduction To The Piano Music of Manuel M. PonceLuis Ortiz SánchezNessuna valutazione finora

- The Lesson - Marie CurieDocumento2 pagineThe Lesson - Marie CurieIasmin NascimentoNessuna valutazione finora

- Dubai Energy Efficiency Training Program Presents Certified Energy Manager Course (Cem)Documento16 pagineDubai Energy Efficiency Training Program Presents Certified Energy Manager Course (Cem)Mohammed ShamroukhNessuna valutazione finora

- Khallikote College Information BroucherDocumento7 pagineKhallikote College Information BrouchersssadangiNessuna valutazione finora

- DO s2020 018.deped - Order.memoDocumento6 pagineDO s2020 018.deped - Order.memobenz cadiongNessuna valutazione finora

- The Shriram Millennium School, Noida Circular For Classes VIII, IX & XIDocumento2 pagineThe Shriram Millennium School, Noida Circular For Classes VIII, IX & XIAkshat MehrotraNessuna valutazione finora

- American Playwriting and The Anti Political Prejudice Twentieth and Twenty First Century PerspectivesDocumento198 pagineAmerican Playwriting and The Anti Political Prejudice Twentieth and Twenty First Century PerspectivesBreno Coelho100% (1)

- CURRICULUM STUDIES Short NotesDocumento25 pagineCURRICULUM STUDIES Short NotesAfiah Zuhudi92% (24)