Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Managerial Accounting

Caricato da

Om PrakashTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Managerial Accounting

Caricato da

Om PrakashCopyright:

Formati disponibili

MANAGERIAL ACCOUNTING

MANAGEMENT

ACCOUNTING

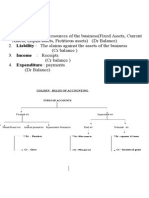

FUNDAMENTALS OF ACCOUNTS

An account is a summarized record of

relevant transactions at one place

relating to a particular head. It records

not only the amount of transactions

but also their effect and direction.

Debit and Credit are simply additions to

or subtractions from an account.

Financial Statements

Financial Statements are compilation of

accounting information for the external

users.

They include

Profit and Loss Account

Balance Sheet

Schedules and Notes forming part of the

above

Types of Decisions

The decisions, managers are concerned

with, can be categorized as

Planning decisions

Control decisions

Planning Decisions

Planning Decisions are concerned with

the establishment of goals for the

organization and the choosing of

plans to accomplish these goals

Management accounting information is

needed to take Planning decisions

Control Decisions

Control decisions result from implementing

the plans and monitoring the actual

results to see if goals are being achieved

If goals are not being achieved, either

corrective steps must be taken resulting in

goal achievement or goals themselves

have to be revised to attainable levels

Cost accounting data are needed for

taking Control decisions

Financial Accounting vs.

Management Accounting

External users vs. Internal users

Record of financial history vs. Emphasis on

the future

GAAP vs. Own rules

Emphasis on accuracy vs. Acceptance of

estimates

Focus on company as a whole vs. Focus on

segments of a company

Governed by Regulatory Bodies vs.

Freedom of choice

Relating to Profit Planning

Fixed, Variable Costing

Fixed costs are associated with those

inputs which do not vary with changes in

volume of production (Committed and

Discretionary)

Variable costs which vary with volume of

production

Relating to Profit Planning

Future cost and Budgeted cost

Future costs are reasonably expected to be

incurred at some future date as a result of

a current decision

They are estimated costs based on

expectations

When an operating plan involving future

costs is accepted and incorporated

formally in the budget for a specific period,

such costs are referred as budgeted costs

Relating to Decision making

Relevant cost and Irrelevant cost

Incremental cost and Differential cost

Out of pocket cost and sunk cost

Opportunity cost and Imputed cost

Relating to Decision making

Relevant costs are those influenced by

a decision and hence are important for

decision makers, typically variable costs

Irrelevant costs are not affected by the

decision taken and hence decision

makers do not worry about them,

typically committed fixed costs

Relating to Decision making

Incremental costs are additional costs

incurred if management chooses a

particular course of action as against

another

Differential costs are difference in

costs between any two available

alternatives

Relating to Decision making

Out of pocket costs are costs which

involve fresh outflow of cash on decision

taken

Sunk costs are those which have already

been incurred where current decisions

have no impact on.

Opportunity costs represent benefits

foregone by not choosing one alternative

in favour of another that can be quantified

Break Even Analysis

(Contd.)

BEP (in Units) = Fixed cost (in Rs.)

---------------------------------Contribution Margin per

unit (in Rs.)

Contribution Margin per unit (in Rs.)

= SP(in Rs.)/unit VC(in Rs.)/unit

Break Even Analysis

(Contd.)

Margin of safety = Actual sales BEP

sales

Margin of safety ratio =

Actual sales BEP sales

-----------------------------Actual sales

Activity Based Costing

(ABC)

Better than Volume based costing

Applying overhead costs to each product or

service based on the extent to which it is

caused by them is the primary objective of

overhead costing

This is carried out using a single pre

determined overhead rate based on a single

activity measure

Less complex less costly & More complex

more cost

Budgetary Control (Contd.)

A budget is defined as a

comprehensive and coordinated

plan, expressed in financial terms, for

the operations and resources of an

enterprise for some specified period in

the future.

As a tool, a budget serves as a guide to

conduct operations and a basis for

evaluating actual results

Budgetary Control (Contd.)

The main objectives of budgeting are:

Explicit statement of expectations

Communication

Coordination

Expectations as framework for judging

performance

Budgetary Control (Contd.)

Sales budget

Production budget

Purchase budget

Direct labour budget

Manufacturing expenses budget

Administrative and Selling expenses

budget

Budgetary Control (Contd.)

Financial Budget

Budgeted income statement

Budgeted statement of retained earnings

Cash budget

Budgeted balance sheet

FINALLY

Transfer Pricing Concept

Operational Performance Measures

Price and Quantity Variance

Return on Investment

Residual Income (Imputed Interest rate)

Economic Value Added (Weighted

Average Cost of Capital): Cost of

acquiring capital

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Situation Analysis:: Baxter International: Their Product Hemassist Was The First Human Blood SubstituteDocumento1 paginaSituation Analysis:: Baxter International: Their Product Hemassist Was The First Human Blood SubstituteOm PrakashNessuna valutazione finora

- HPL Meter PricelistDocumento18 pagineHPL Meter PricelistOm PrakashNessuna valutazione finora

- Conclusions: Retention ChecklistDocumento2 pagineConclusions: Retention ChecklistOm PrakashNessuna valutazione finora

- Summary of Factors Affecting RetentionDocumento1 paginaSummary of Factors Affecting RetentionOm PrakashNessuna valutazione finora

- Statistics:: Sl. No. Industries / Sector 2011-12Documento2 pagineStatistics:: Sl. No. Industries / Sector 2011-12Om PrakashNessuna valutazione finora

- 1.1 Why To Retain:: Yes Retaine D Profi T NoDocumento1 pagina1.1 Why To Retain:: Yes Retaine D Profi T NoOm PrakashNessuna valutazione finora

- 1.3.5 Organisation Environment: Employee RetentionDocumento1 pagina1.3.5 Organisation Environment: Employee RetentionOm PrakashNessuna valutazione finora

- Ras GasDocumento17 pagineRas GasOm PrakashNessuna valutazione finora

- Page NoDocumento1 paginaPage NoOm PrakashNessuna valutazione finora

- 1.2 Recruitment & Its StrategyDocumento2 pagine1.2 Recruitment & Its StrategyOm PrakashNessuna valutazione finora

- Quality Function DeploymentDocumento1 paginaQuality Function DeploymentOm PrakashNessuna valutazione finora

- Project Team Member Roles and ResponsibilitiesDocumento7 pagineProject Team Member Roles and ResponsibilitiesOm PrakashNessuna valutazione finora

- Organizational Structures: Control SystemDocumento2 pagineOrganizational Structures: Control SystemOm PrakashNessuna valutazione finora

- Organizational Culture and Organizational Effectiveness: There AreDocumento1 paginaOrganizational Culture and Organizational Effectiveness: There AreOm PrakashNessuna valutazione finora

- Subject Test Item Marksobt Marksobt Marksmax Weight PercentageDocumento2 pagineSubject Test Item Marksobt Marksobt Marksmax Weight PercentageOm PrakashNessuna valutazione finora

- Industry To Be Covered:: PROJECT TITLE: Study of Equity Portfolio Management ServicesDocumento2 pagineIndustry To Be Covered:: PROJECT TITLE: Study of Equity Portfolio Management ServicesOm PrakashNessuna valutazione finora

- Example of A Manufacturing Company in Decline (Hypothetical Example To Understand The Utility ofDocumento2 pagineExample of A Manufacturing Company in Decline (Hypothetical Example To Understand The Utility ofOm PrakashNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 1.cash Basis 2.accrual Basis: Golden Rules of AccountingDocumento4 pagine1.cash Basis 2.accrual Basis: Golden Rules of AccountingabinashNessuna valutazione finora

- Why Operations Management Is Important For A Company PDFDocumento4 pagineWhy Operations Management Is Important For A Company PDFShucheng ChamNessuna valutazione finora

- Impact On Post Purchase Advertising On Consumer BehaviourDocumento2 pagineImpact On Post Purchase Advertising On Consumer BehaviourNayan BhalotiaNessuna valutazione finora

- Kaushal Final Project at KARVY STOK BROKING LTD (1) .Documento128 pagineKaushal Final Project at KARVY STOK BROKING LTD (1) .krimybNessuna valutazione finora

- DepreciationDocumento1 paginaDepreciationjahangir tanveerNessuna valutazione finora

- How Startup Valuation Works - IllustratedDocumento14 pagineHow Startup Valuation Works - IllustratedNikhilKrishnanNessuna valutazione finora

- Accounting Hawk - MADocumento21 pagineAccounting Hawk - MAClaire BarbaNessuna valutazione finora

- CH 24Documento67 pagineCH 24najNessuna valutazione finora

- Economics For Decision Making MBA 641Documento25 pagineEconomics For Decision Making MBA 641Binyam RegasaNessuna valutazione finora

- Rekha BhandariDocumento5 pagineRekha BhandarisupriyaNessuna valutazione finora

- Business Strategy of The E-Type Company PDFDocumento2 pagineBusiness Strategy of The E-Type Company PDFHadeer KamelNessuna valutazione finora

- The LEGO Group - Group12Documento5 pagineThe LEGO Group - Group12Vimal JephNessuna valutazione finora

- Zara Agile Supply ChainDocumento3 pagineZara Agile Supply ChainBilal ManzoorNessuna valutazione finora

- Cover Letter - Tanvi - KGSDocumento1 paginaCover Letter - Tanvi - KGSTanvi KhandujaNessuna valutazione finora

- Sap MM - MRP - CBPDocumento2 pagineSap MM - MRP - CBPismailimran09Nessuna valutazione finora

- P3 ModelsDocumento9 pagineP3 ModelsAbdullah Md ShadNessuna valutazione finora

- 59 IpcccostingDocumento5 pagine59 Ipcccostingapi-206947225Nessuna valutazione finora

- Intro To Adv PPCDocumento16 pagineIntro To Adv PPCRaraNessuna valutazione finora

- Financial Management - Assignment 2Documento7 pagineFinancial Management - Assignment 2Ngeno KipkiruiNessuna valutazione finora

- Chik ShampooDocumento3 pagineChik ShampooViŠhål Pätěl100% (1)

- Chap11 11e MicroDocumento45 pagineChap11 11e Microromeo626laNessuna valutazione finora

- Theories of International BusinessDocumento15 pagineTheories of International Businessmaakesh75% (4)

- Marketing - Unit-V Marketing Organization and ControlDocumento4 pagineMarketing - Unit-V Marketing Organization and ControlArcot Ellender Santhoshi Priya0% (1)

- 2 - Global Supply Chain Management Simulation v2Documento2 pagine2 - Global Supply Chain Management Simulation v2prashant309100% (1)

- Unilever NepalDocumento2 pagineUnilever NepalHarshit AgrawalNessuna valutazione finora

- Global Cost Accounting Add inDocumento36 pagineGlobal Cost Accounting Add inmayeuxNessuna valutazione finora

- Module 1Documento72 pagineModule 1Lakshmi PriyaNessuna valutazione finora

- SAP FI BBP - ACI Organization Structure - DraftDocumento18 pagineSAP FI BBP - ACI Organization Structure - DraftSourav Ghosh Dastidar100% (1)

- BIIB Case Study-BDocumento29 pagineBIIB Case Study-BSurbhi BiyaniNessuna valutazione finora

- Usefulness of AccountingDocumento17 pagineUsefulness of AccountingMochamadMaarifNessuna valutazione finora