Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Forex Market

Caricato da

MrMoney ManCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Forex Market

Caricato da

MrMoney ManCopyright:

Formati disponibili

THE FOREX MARKET

DR. GORMUS

Foreign Exchange Market

Most countries of the world have their

own currencies: the U.S dollar., the euro

in Europe, the Brazilian real, and the

Chinese yuan, just to name a few.

The trading of currencies and banks

deposits is what makes up the foreign

exchange market.

What are Foreign Exchange Rates?

Two kinds of exchange rate transactions

make up the foreign exchange market:

Spot transactions involve the nearimmediate exchange of bank deposits,

completed at the spot rate (S).

Forward transactions involve a contract

signed today to make an exchange at some

future date, completed at the forward

rate (F).

Why Are Exchange Rates Important?

When the currency of your country

appreciates relative to another country,

your countrys goods prices abroad

and foreign goods prices in your

country.

Makes domestic businesses less

competitive

Benefits domestic consumers (you)

Why Are Exchange Rates Important?

For example, in 1999, the euro was

valued at $1.18. On June 7, 2013, it was

valued at $1.32.

Euro appreciated 11% (1.32 1.18) / 1.18

Dollar depreciated 11% (0.76 0.85) / 0.85

Note:

0.75 1 / 1.32, and 0.85 1 / 1.18

How is Foreign Exchange

Traded?

FX traded in over-the-counter market

1.

2.

3.

Involve buying / selling bank deposits

denominated in different currencies.

Trades involve transactions in excess of $1

million.

Typical consumers buy foreign currencies

from retail dealers, such as American

Express.

FX volume exceeds $4 trillion per day.

Exchange Rates in the Long

Run

Exchange rates are determined in

markets by the interaction of supply and

demand.

An important concept that drives the

forces of supply and demand is the Law

of One Price.

Exchange Rates in the Long Run:

Law of One Price

The Law of One Price states that the

price of an identical good will be the

same throughout the world, regardless

of which country produces it.

Example: American steel costs $100 per

ton, while Japanese steel costs 10,000

yen per ton.

Exchange Rates in the Long Run:

Law of One Price

Law of one price E 100 yen/$

Exchange Rates in the Long Run:

Theory of Purchasing Power Parity

(PPP)

The theory of PPP states that exchange

rates between two currencies will adjust

to reflect changes in price levels.

PPP Domestic price level 10%,

domestic currency 10%

Application of law of one price to price

levels

Works in long run, not short run

Exchange Rates in the Long Run:

Theory of Purchasing Power Parity

(PPP)

Problems with PPP

All goods are not identical in both countries

(i.e., Toyota versus Chevy)

Many goods and services are not traded

(e.g., haircuts, land, etc.)

Exchange Rates in the Long Run:

Factors Affecting Exchange Rates in

Long Run

Explaining Changes in Exchanges Rates

Here are how some of the factors impact demand curves

Application: Interest Rate

Changes

Changes in domestic interest rates are

often cited in the press as affecting

exchange rates.

We must carefully examine the source of

the change to make such a statement.

Interest rates change because either (a)

the real rate or (b) the expected inflation

is changing. The effect of each differs.

Effect of Changes in Interest Rates

on the Equilibrium Exchange Rate

When the domestic real interest rate

increases, the domestic currency

appreciates.

When the domestic expected

inflation increases, the domestic

currency reacts in the opposite direction

it depreciates. This is shown on the

next slide.

Effect of Changes in Interest Rates

on the Equilibrium Exchange Rate

Effect of a Rise in the Domestic Interest Rate as a Result of an

Increase in Expected Inflation

Interest Parity Condition

The interest parity condition relates

foreign/domestic interest rates with FX

rates.

Derived from expected returns.

Interest Parity Condition

An investor can earn interest rate of id on

US dollars and can borrow at the same

rate

Also, the same investor can earn interest

rate of if in the foreign country (lets

assume Germany for this example) and

can borrow at the same rate.

St is the spot rate and E(St+1) is the

expected spot rate next period

Uncovered Interest Rate

Parity

(1+id) = (1/St) (1+if) E(St+1)

Means: there should be no difference between investing

in the US vs. taking your dollars, converting them to

Euros, investing in Germany wait for a year and convert

those Euros back to dollars.

This equilibrium should hold as long as:

E(St+1) = St+1

In other words: as long as what you predict the spot rate will

be is the same as what it actually becomes in one year, this

parity should hold.

What if it doesnt?

Then, there is an arbitrage opportunity (receiving more return

than you should)

Covered Interest Rate Parity

This time, instead of using our

Expectations, we plug in the actual

Forward rate (F)

This assures us that there are no

expected surprises and if there are, it

creates an arbitrage opportunity.

(1+id) = (1/St) (1+if) F365

or

(1+i ) = (F

d

365/St) (1+if)

Covered Interest Rate Parity

Here is an example:

The interest rate in the US is 2%. The

Current Spot rate for Euros is 1.58. In

Germany, the interest rate is 3% and the

Forward price for Euros is 1.54. Is there an

arbitrage opportunity? If yes, how would

you take advantage of this?

Covered Interest Rate Parity

(1+0.02) = (1.54/1.58)(1+0.03)

1.02 > 1.00

This means that the equivalent interest rate in US is higher

then the one in Germany. Do we borrow at the higher rate or

invest at the higher rate? Of course you would want to borrow

at the cheaper rate and invest at the higher rate.

So, Yes, there is an arbitrage opportunity. You would borrow in

Germany, Convert the Euros to Dollars, Invest in the US while

getting into a forward contract. Wait for one year, collect your

proceeds in dollars.

..and convert your dollars back to Euros (using the forward

rate which is already agreed upon).

You should end up with more Euros then the German interest

rate pays.

Potrebbero piacerti anche

- Lecture 21 ME Ch.15 Foreign Exchange MarketDocumento50 pagineLecture 21 ME Ch.15 Foreign Exchange MarketAlif SultanliNessuna valutazione finora

- Forex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.Da EverandForex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.Nessuna valutazione finora

- Financial Markets and Institution: The Foreign Exchange MarketDocumento33 pagineFinancial Markets and Institution: The Foreign Exchange MarketDavid LeowNessuna valutazione finora

- Chapter Eight: 8. Foriegn Exchange MarketsDocumento26 pagineChapter Eight: 8. Foriegn Exchange MarketsNhatty WeroNessuna valutazione finora

- Foreign Exchange Risk Management (Notes)Documento8 pagineForeign Exchange Risk Management (Notes)t6s1z7Nessuna valutazione finora

- EC 302 - Intermediate MacroeconomicsDocumento20 pagineEC 302 - Intermediate MacroeconomicsDavid P Hill-GrayNessuna valutazione finora

- International Parity ConditionsDocumento62 pagineInternational Parity ConditionsHaimanot tessemaNessuna valutazione finora

- C 19Documento145 pagineC 19Jona ResuelloNessuna valutazione finora

- Workshop Exercises SolutionsDocumento5 pagineWorkshop Exercises SolutionsShar100% (1)

- Soa University: Name: Gunjan DasDocumento7 pagineSoa University: Name: Gunjan Das87 gunjandasNessuna valutazione finora

- FOREIGN EXCHANGE MARKETS AND RATESDocumento5 pagineFOREIGN EXCHANGE MARKETS AND RATESAJINKYA GURAVNessuna valutazione finora

- SamanRomanDocumento9 pagineSamanRomanggi2022.1928Nessuna valutazione finora

- Saman RomanDocumento8 pagineSaman Romanggi2022.1928Nessuna valutazione finora

- 2 and 3 Assignment of Arun KumarDocumento10 pagine2 and 3 Assignment of Arun KumarARUN KUMARNessuna valutazione finora

- Presentation Chapter 7Documento6 paginePresentation Chapter 7JunaidNessuna valutazione finora

- MF0015 - International Financial Management - Set - 2Documento10 pagineMF0015 - International Financial Management - Set - 2Shilpa PokharkarNessuna valutazione finora

- 27 Managing International RisksDocumento11 pagine27 Managing International Risksddrechsler9Nessuna valutazione finora

- Assignment 2 (Theories of Exchange Rates - PPP, IFE, IRP)Documento6 pagineAssignment 2 (Theories of Exchange Rates - PPP, IFE, IRP)doraemonNessuna valutazione finora

- Assignment 2 (Theories of Exchange Rates - PPP, IfE, IRP)Documento6 pagineAssignment 2 (Theories of Exchange Rates - PPP, IfE, IRP)doraemonNessuna valutazione finora

- 9 Determinants of The Exchange Rate Purchasing Power Parity and Interest RateDocumento13 pagine9 Determinants of The Exchange Rate Purchasing Power Parity and Interest RateOlga LiNessuna valutazione finora

- Exchange Rate Quotations, Balance of Payments, Prices, Parities and Interest RatesDocumento22 pagineExchange Rate Quotations, Balance of Payments, Prices, Parities and Interest RatesSourav PaulNessuna valutazione finora

- Foreign ExchangeDocumento6 pagineForeign ExchangeAnthony MongeNessuna valutazione finora

- Chapter One and TwoDocumento50 pagineChapter One and Twomikialeabrha23Nessuna valutazione finora

- The Nature of Foreign Exchange Risk The Need For Foreign ExchangeDocumento6 pagineThe Nature of Foreign Exchange Risk The Need For Foreign ExchangeGeeta LalwaniNessuna valutazione finora

- Unit 7 - Class SlidesDocumento57 pagineUnit 7 - Class Slidessabelo.j.nkosi.5Nessuna valutazione finora

- Macroeconomy - Understanding key concepts of open economiesDocumento9 pagineMacroeconomy - Understanding key concepts of open economiesmarcjeansNessuna valutazione finora

- 1.what Is An Exchange RateDocumento15 pagine1.what Is An Exchange RateCristina TobingNessuna valutazione finora

- N10 - Foreign Currentcy TransactionsDocumento27 pagineN10 - Foreign Currentcy TransactionsSilasNessuna valutazione finora

- Interest Rate ParityDocumento14 pagineInterest Rate ParityParul AsthanaNessuna valutazione finora

- The Foreign Exchange MarketDocumento29 pagineThe Foreign Exchange MarketSam Sep A Sixtyone100% (1)

- Forex Trading Guide & Tutorial For Beginner: Website: EmailDocumento53 pagineForex Trading Guide & Tutorial For Beginner: Website: EmailSalman LabiadhNessuna valutazione finora

- Currency Exchange RatesDocumento37 pagineCurrency Exchange RatesPrachi Gupta100% (1)

- Exchange Rate DeterminationDocumento43 pagineExchange Rate DeterminationAmit Sinha100% (1)

- Foreign Exchange MarketsDocumento19 pagineForeign Exchange MarketsniggerNessuna valutazione finora

- Covered Interest Rate ParityDocumento4 pagineCovered Interest Rate Parityrani0326Nessuna valutazione finora

- Foreign Exchange RateDocumento10 pagineForeign Exchange RateanbalaganmaheshNessuna valutazione finora

- 344 ch2Documento18 pagine344 ch2Vishal NigamNessuna valutazione finora

- CHAPTER 10 + Lecture: Foreign Exchange MarketDocumento68 pagineCHAPTER 10 + Lecture: Foreign Exchange Marketradhika1991Nessuna valutazione finora

- Exchange Rates: Antu Panini MurshidDocumento33 pagineExchange Rates: Antu Panini MurshidbornilamazumderNessuna valutazione finora

- Tutorial 3 AnswersDocumento6 pagineTutorial 3 AnswersisgodNessuna valutazione finora

- Mba 2 Semester (Finance Major) Chapter 5: Forward Exchange (Levi)Documento11 pagineMba 2 Semester (Finance Major) Chapter 5: Forward Exchange (Levi)SoloymanNessuna valutazione finora

- Interest Rate Parity (IRP)Documento13 pagineInterest Rate Parity (IRP)Hiron Rafi100% (1)

- International Business FinanceDocumento43 pagineInternational Business FinancesiusiuwidyantoNessuna valutazione finora

- Macro Eco FundaeDocumento6 pagineMacro Eco Fundaenewuser_1980Nessuna valutazione finora

- International Fisher Effect and Exchange Rate ForecastingDocumento12 pagineInternational Fisher Effect and Exchange Rate ForecastingRunail harisNessuna valutazione finora

- Recitation Session1& 2Documento6 pagineRecitation Session1& 2chris sakettNessuna valutazione finora

- Chapter 17Documento28 pagineChapter 17Talat_Gergawi_2786Nessuna valutazione finora

- Multinational Financial Management Exchange RatesDocumento21 pagineMultinational Financial Management Exchange RatesShahbaz QureshiNessuna valutazione finora

- Chapter 4Documento19 pagineChapter 4Proveedor Iptv EspañaNessuna valutazione finora

- Mncs and Foreign Exchange ExposureDocumento19 pagineMncs and Foreign Exchange ExposuredemolaojaomoNessuna valutazione finora

- International Finance IF4 - FX MarketsDocumento37 pagineInternational Finance IF4 - FX MarketsMariem StylesNessuna valutazione finora

- F9 Notes (Risk Management)Documento14 pagineF9 Notes (Risk Management)CHIAMAKA EGBUKOLENessuna valutazione finora

- Financial Market-Lecture 10Documento28 pagineFinancial Market-Lecture 10Krish ShettyNessuna valutazione finora

- ln1 PDFDocumento20 pagineln1 PDFM.n KNessuna valutazione finora

- Trepp Week 3 Real Exchange Rates and Nominal Exchange RatesDocumento33 pagineTrepp Week 3 Real Exchange Rates and Nominal Exchange RatesXuân BìnhNessuna valutazione finora

- Factors Influencing Exchange RatesDocumento10 pagineFactors Influencing Exchange RatessudheerNessuna valutazione finora

- Foreign exchange market guideDocumento42 pagineForeign exchange market guideJafaryNessuna valutazione finora

- Foreign Exchange Market and Management of Foreign Exchange RiskDocumento56 pagineForeign Exchange Market and Management of Foreign Exchange RiskCedric ZvinavasheNessuna valutazione finora

- Euro EconomyDocumento26 pagineEuro EconomyJinal ShahNessuna valutazione finora

- Chapter 1 RevisedDocumento30 pagineChapter 1 RevisedMrMoney ManNessuna valutazione finora

- Sample Ratio CalculationsDocumento7 pagineSample Ratio CalculationsMrMoney ManNessuna valutazione finora

- CH 02Documento50 pagineCH 02MrMoney ManNessuna valutazione finora

- Market EfficiencyDocumento14 pagineMarket EfficiencyMrMoney ManNessuna valutazione finora

- 2 Lecture - Giotto Naturalism Beginning RenaissanceDocumento74 pagine2 Lecture - Giotto Naturalism Beginning RenaissanceMrMoney ManNessuna valutazione finora

- Public BroadcastingDocumento4 paginePublic BroadcastingMrMoney ManNessuna valutazione finora

- Public BroadcastingDocumento4 paginePublic BroadcastingMrMoney ManNessuna valutazione finora

- BROADCAST AND ELECTRONIC NEWS SOURCESDocumento8 pagineBROADCAST AND ELECTRONIC NEWS SOURCESMrMoney ManNessuna valutazione finora

- ForeignCashDepositEURDocumento1 paginaForeignCashDepositEURmohamedNessuna valutazione finora

- Paradocs Bis S.A.R.LDocumento0 pagineParadocs Bis S.A.R.LAnti-corruption Action CentreNessuna valutazione finora

- Ethtrade Booklet Links 3Documento35 pagineEthtrade Booklet Links 3Likhitha AkkapalliNessuna valutazione finora

- Shaheed Sukhdev College of Business StudiesDocumento27 pagineShaheed Sukhdev College of Business StudiesAshok GuptaNessuna valutazione finora

- Test MidtermDocumento4 pagineTest MidtermcirujeffNessuna valutazione finora

- Research PaperDocumento30 pagineResearch PaperWason AnneNessuna valutazione finora

- FULL Download Ebook PDF Fundamentals of Multinational Finance 5th Edition PDF EbookDocumento41 pagineFULL Download Ebook PDF Fundamentals of Multinational Finance 5th Edition PDF Ebookbryan.span367100% (31)

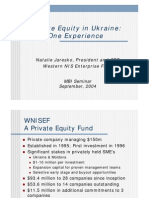

- WNISEF Experience in UkraineDocumento21 pagineWNISEF Experience in UkraineVitaliy HamuhaNessuna valutazione finora

- Which Equity Release ReportDocumento4 pagineWhich Equity Release ReportStepChangeNessuna valutazione finora

- Group 6 - Persimmon Analysis & ValuationDocumento66 pagineGroup 6 - Persimmon Analysis & ValuationHaMy TranNessuna valutazione finora

- Economic Overview Germany: Market, Productivity, InnovationDocumento15 pagineEconomic Overview Germany: Market, Productivity, InnovationmarcusNessuna valutazione finora

- Pulp and Paper Report - Found On The InternetDocumento20 paginePulp and Paper Report - Found On The Internetcgoveia3Nessuna valutazione finora

- Multi Use Sports Complex Planning StudyDocumento182 pagineMulti Use Sports Complex Planning StudyAwais AjmalNessuna valutazione finora

- CMA Part 1 - Section B (Questions Set 1)Documento17 pagineCMA Part 1 - Section B (Questions Set 1)St Dalfour Cebu75% (4)

- Raising Finance Through ADR, GDR & Euro IssueDocumento24 pagineRaising Finance Through ADR, GDR & Euro IssueHemali MangrolaNessuna valutazione finora

- The Swedish Companies - ActDocumento100 pagineThe Swedish Companies - ActCruz CruzNessuna valutazione finora

- 4-Risk Free RateDocumento30 pagine4-Risk Free RateAKSHAJ GOENKANessuna valutazione finora

- Callbox Proposal For Institute For Infocomm ResearchDocumento11 pagineCallbox Proposal For Institute For Infocomm ResearchAdamMarcianoNessuna valutazione finora

- Total Economy DatabaseDocumento15 pagineTotal Economy Databasesangita08Nessuna valutazione finora

- 01.) Ozh Partnership-Based Investment Project Financing Model (May Updated)Documento4 pagine01.) Ozh Partnership-Based Investment Project Financing Model (May Updated)sanjayNessuna valutazione finora

- Business Plan Sample Tranquility Day Spa PlanDocumento28 pagineBusiness Plan Sample Tranquility Day Spa Plankenyamontgomery50% (2)

- Top10 Reasons To Invest in Kosovo - 2010Documento7 pagineTop10 Reasons To Invest in Kosovo - 2010Terra SmithNessuna valutazione finora

- BSP Primer - Exchange RateDocumento14 pagineBSP Primer - Exchange RateCarlo Bryan CortezNessuna valutazione finora

- Answers For Chapter 4Documento3 pagineAnswers For Chapter 4Wan MP WilliamNessuna valutazione finora

- Ross Appendix19ADocumento7 pagineRoss Appendix19ARichard RobinsonNessuna valutazione finora

- FI ExerciseDocumento101 pagineFI ExerciseRishab GuptaNessuna valutazione finora

- Banking Finance BookDocumento274 pagineBanking Finance BookAbhishek Kr100% (2)

- Project h4Documento43 pagineProject h4api-240317790Nessuna valutazione finora

- Euro Crisis For Dummies PDFDocumento2 pagineEuro Crisis For Dummies PDFLauraNessuna valutazione finora

- Seer Wilms General Report - Surcharges and Penalties in Tax LawDocumento29 pagineSeer Wilms General Report - Surcharges and Penalties in Tax LawCarlos María FolcoNessuna valutazione finora