Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Poland A2 Motorway

Caricato da

Arun Kumar K100%(3)Il 100% ha trovato utile questo documento (3 voti)

966 visualizzazioni8 pagineThis document discusses the risks and mitigation strategies for a project to construct the A2 Motorway in Poland. Major risks included inexperience with large projects, land acquisition delays, construction delays, traffic volume below predictions, and financing risks.

To mitigate these risks, the project was divided into phases, the government was responsible for land acquisition, construction progress was monitored by an independent engineer, toll rates could be adjusted, and cash flows prioritized debt service. Financing risks were reduced by staging construction and using a financing model. Additional measures included using results from another motorway project and exploring financing from the European Investment Bank.

Descrizione originale:

Presentation on Risk Analysis for Project Finance of Poland A2 Motorway Case Study

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document discusses the risks and mitigation strategies for a project to construct the A2 Motorway in Poland. Major risks included inexperience with large projects, land acquisition delays, construction delays, traffic volume below predictions, and financing risks.

To mitigate these risks, the project was divided into phases, the government was responsible for land acquisition, construction progress was monitored by an independent engineer, toll rates could be adjusted, and cash flows prioritized debt service. Financing risks were reduced by staging construction and using a financing model. Additional measures included using results from another motorway project and exploring financing from the European Investment Bank.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

100%(3)Il 100% ha trovato utile questo documento (3 voti)

966 visualizzazioni8 paginePoland A2 Motorway

Caricato da

Arun Kumar KThis document discusses the risks and mitigation strategies for a project to construct the A2 Motorway in Poland. Major risks included inexperience with large projects, land acquisition delays, construction delays, traffic volume below predictions, and financing risks.

To mitigate these risks, the project was divided into phases, the government was responsible for land acquisition, construction progress was monitored by an independent engineer, toll rates could be adjusted, and cash flows prioritized debt service. Financing risks were reduced by staging construction and using a financing model. Additional measures included using results from another motorway project and exploring financing from the European Investment Bank.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 8

PROJECT FINANCE

Polands A2

Motorway

MEP 5, Group 7

Arun Hari Kunal

Naren

Zaka

Major Project Risk

Risk Type

Description

Mitigation

Project

Selection Risk

None of the Principal parties

including the govt. had any

significant experience in

structuring project of this size.

Phased plan of Construction.

Ph 1 three equal sections with sequential

completion deadlines; 6.25 yrs

Ph 2 finalize financing until Dec07, else govt.

could reassign concession to another firm

Land

Acquisition &

ownership

Delay in land acquisition would

cause delay in project.

5000 properties to be acquired

within 6 weeks of financial

closure.

Delivery of lease.

Govt. shall be responsible for acquiring title to

the land and if necessary, by eminent domain.

Transferring to AWSA under long term lease.

Delivery of lease was precedent condition for

release of construction funds.

Approvals and AWSA responsibility via general

permits reqd. contractor

Govt. agreed to support efforts and compensate

in case of delays due to govt. authorities.

Major Project Risk

Risk Type

Description

Mitigation

Non Performance Failure to make required

payments to the Govt

Govt would assume ownership and operation of

the concessionaire . Financing would remain in

place and toll revenue would be dedicated to

debt service.

Termination

without cause

Govt. had right to terminate

without cause

Govt. to compensate AWSA for cost of fully

retiring AWSAs debt obligation.

Design &

Construction

Contractor was responsible

for ensuring AWSA could

begin commercial operation

on specified date.

Independent Engineer retained by AWSA would

monitor construction and certify completion.

Major Project Risk

Risk Type

Description

Mitigation

Operation Risk

Toll collection and

maintenance of the road.

Traffic predictions.

OC to operate and maintain motorway under 10

year renewable contract in exchange of fixed

annual fee.

3 traffic studies by 3 different consultants.

Commitment by Govt. design to generate

satisfactory traffic volume.

AWSA reset actual toll every 6 months and

provision to adjust max. tolls to account for

inflation and exchange rates.

Toll Fee/Structure

Financing Risk

External finance

Financing Structure

By staging construction, maximized early revenue

capture to reduce external finance needed.

Financing plan was based on model created by

Deutsche Bank.

Major Project Risk

Risk Type

Description

Mitigation

Financing Risk

(Contd..)

Debt Service Coverage Ratio

Maximize use of Senior Debt subject to

maintaining minimum DSCR 1.5

Interest Rate

Risk

Loan rate based on 6 month

LIBOR spread 180bp to

235bp

Bankers wanted AWSA to use Interest Rate SWAP

Currency Risk

Income in PLN & Debt Service Currency Hedging

in Euros

Who bears the Major Risk?

Government bears major risk in proposed model:

Political risk involved inexperienced new government may not be able to fulfill commitments made

towards project

AWSA bears risk of finalizing financing of the project.

Possibility of pessimistic consideration by banks which would create funding gap and bankers

request for additional equity. 18 Shareholders involved and earliest interest payment to shareholder

would not occur until 2018 so process of negotiating further commitment seemed insurmountable

challenge.

AWSA has transferred other risk through SPVs

- DC for Design and construction

- OC for Operating & Maintenance

Response to banks concerns in

June 2000?

1. To convince bankers that their analysis were too pessimistic

Use early results from A4 Toll Motor way as evidence with capture rate of 80% (>Wilbers Smith

assumption for A2 50% capture rate)

2. Emphasize on cash water fall mechanism in concessionaire agreement.

Fund would be disbursed to pay following obligations in the order of priority.

a) Operating Expenses and Land lease fee

b) Capital expenditure and maintenance reserve account

c) Current Interest and Principal payment on senior Debt

d) Senior Debt Service Reserve Account

e) Remaining cash to Zero Coupon Bond sinking fund

3. Explore financing option from European Investment Bank - use for further negotiation with banks

to secure senior debt as planned

Thank You

Potrebbero piacerti anche

- POLAND'S A2 Motorway - FinalDocumento12 paginePOLAND'S A2 Motorway - FinalAbinash Behera100% (2)

- Poland A2Documento5 paginePoland A2KhanZsuriNessuna valutazione finora

- Political, Financial & Operating Risks of AWSA Toll Road ProjectDocumento7 paginePolitical, Financial & Operating Risks of AWSA Toll Road ProjectAndy Vibgyor100% (1)

- Poland MotorwayDocumento16 paginePoland MotorwayPrateek Agarwal100% (2)

- PMF A8 Poland's A2 MotorwayDocumento6 paginePMF A8 Poland's A2 MotorwaySanjeet Kumar100% (1)

- Poland A2 Motorway: PSF Group Assignment Maulik Parekh Rahul Mohandas Shankar MohantyDocumento14 paginePoland A2 Motorway: PSF Group Assignment Maulik Parekh Rahul Mohandas Shankar MohantyMaulik Parekh100% (2)

- Petrozuata Case AnalysisDocumento7 paginePetrozuata Case AnalysisAmyo Roy100% (9)

- Project Finance Petrolera Zuata, Petrozuata C.A: BackgorundDocumento3 pagineProject Finance Petrolera Zuata, Petrozuata C.A: BackgorundPearly ShopNessuna valutazione finora

- Project Finance and Management Modules Guide Risks and Capital StructureDocumento21 pagineProject Finance and Management Modules Guide Risks and Capital StructureRoney Raju Philip75% (4)

- Poland A2 MotorwayDocumento9 paginePoland A2 Motorwayharsh100% (2)

- Polands A2Documento8 paginePolands A2aanya17Nessuna valutazione finora

- Poland'S A2Documento8 paginePoland'S A2mastermind_2848154100% (1)

- Appendix 2 - A2 Motorway in PolandDocumento52 pagineAppendix 2 - A2 Motorway in PolandSDPAS100% (1)

- BP Amoco (B)Documento32 pagineBP Amoco (B)Arnab RoyNessuna valutazione finora

- Project Finance CaseDocumento15 pagineProject Finance CaseDennies SebastianNessuna valutazione finora

- Assignment Questions Poland A2 ExpresswayDocumento5 pagineAssignment Questions Poland A2 ExpresswayTran Tuan Linh100% (1)

- Petrolera Zueta, Petrozuata CDocumento6 paginePetrolera Zueta, Petrozuata CAnkur SinhaNessuna valutazione finora

- Chad CameroonDocumento17 pagineChad CameroonAshish BhartiNessuna valutazione finora

- Poland's A2 Motorway Case: Abhinav - Bala - Harsh - SandeepDocumento14 paginePoland's A2 Motorway Case: Abhinav - Bala - Harsh - SandeepSuhas PothedarNessuna valutazione finora

- Australia Japan CableDocumento22 pagineAustralia Japan CableRounak Bhagwat86% (7)

- Australia-Japan Cable Project Company StructureDocumento46 pagineAustralia-Japan Cable Project Company StructureHemachandar Vaida100% (1)

- Group4 LoctiteDocumento2 pagineGroup4 LoctiteCaptn Pawan DeepNessuna valutazione finora

- Financing The Mozal Project Case SolutionDocumento4 pagineFinancing The Mozal Project Case SolutionSebastian100% (2)

- AJC Project: Capital Structure and Risk MitigationDocumento42 pagineAJC Project: Capital Structure and Risk MitigationShashank Kanodia100% (1)

- Petrozuata Analysis WriteupDocumento5 paginePetrozuata Analysis Writeupgkfernandes0% (1)

- AJC Case Analysis.Documento4 pagineAJC Case Analysis.sunny rahulNessuna valutazione finora

- Petrozuata Questions - SPR - 2015Documento1 paginaPetrozuata Questions - SPR - 2015daweizhang100% (1)

- CBRM Calpine Case - Group 4 SubmissionDocumento4 pagineCBRM Calpine Case - Group 4 SubmissionPranavNessuna valutazione finora

- Risks Petrolera Zuata Petrozuata CaDocumento9 pagineRisks Petrolera Zuata Petrozuata CahdvdfhiaNessuna valutazione finora

- BP Amoco - A Case Study On Project FinanceDocumento11 pagineBP Amoco - A Case Study On Project Financevinay5209100% (2)

- Chad Cameroon PipelineDocumento12 pagineChad Cameroon PipelineUmang ThakerNessuna valutazione finora

- The Case of Petrozuata Joint VentureDocumento20 pagineThe Case of Petrozuata Joint VentureBasit Ali Chaudhry100% (1)

- Poland A2 Motorway Case: Opim 5894 Advanced Project ManagementDocumento10 paginePoland A2 Motorway Case: Opim 5894 Advanced Project ManagementyhcdyhdNessuna valutazione finora

- Chad Cameroon Case FinalDocumento28 pagineChad Cameroon Case FinalAbhi Krishna ShresthaNessuna valutazione finora

- Hong Kong Disneyland - Section C - Group 3 PDFDocumento7 pagineHong Kong Disneyland - Section C - Group 3 PDFsainath04Nessuna valutazione finora

- BP Amoco Project Finance PolicyDocumento23 pagineBP Amoco Project Finance PolicyManish SinhaNessuna valutazione finora

- Mozal ProjectDocumento7 pagineMozal Projectprajeshgupta100% (1)

- Risk Mitigation Strategies for Infrastructure ProjectDocumento7 pagineRisk Mitigation Strategies for Infrastructure ProjectKiran KannanNessuna valutazione finora

- Petrolera Zuata, Petrozuata C. A. Case AnalysisDocumento10 paginePetrolera Zuata, Petrozuata C. A. Case Analysisshivam saraffNessuna valutazione finora

- Petrolera Zuata Petrozuata CA. AnswerDocumento8 paginePetrolera Zuata Petrozuata CA. AnswerKelvinItemuagbor100% (1)

- Australia-Japan Cable: Assessing Return on InvestmentDocumento18 pagineAustralia-Japan Cable: Assessing Return on InvestmentAbhinava Chanda100% (1)

- Maersk betting on blockchain to transform international logisticsDocumento6 pagineMaersk betting on blockchain to transform international logisticsVaishnav SureshNessuna valutazione finora

- Chasecase PaperDocumento10 pagineChasecase PaperadtyshkhrNessuna valutazione finora

- Financial Model Case Study for Roads PPP ProjectDocumento17 pagineFinancial Model Case Study for Roads PPP ProjectAadarsh Sinha0% (1)

- Case-Commerce Bank: Submitted By, Debarghya Das PRN No.18021141033Documento5 pagineCase-Commerce Bank: Submitted By, Debarghya Das PRN No.18021141033Rocking Heartbroker DebNessuna valutazione finora

- Vodafone Mannesmann FinalDocumento7 pagineVodafone Mannesmann FinaljasonthtNessuna valutazione finora

- Loctite International Case Analysis - Group 1Documento3 pagineLoctite International Case Analysis - Group 1Subhrodeep Das0% (1)

- BP Amoco (A)Documento8 pagineBP Amoco (A)BhartiMahawarNessuna valutazione finora

- Australian Japan CableDocumento33 pagineAustralian Japan CableSourabh Dhawan100% (2)

- Financing The Mozal Projec1Documento6 pagineFinancing The Mozal Projec1Kapil Arora100% (1)

- Tate & Lyle VietnamDocumento42 pagineTate & Lyle VietnamDương Đoàn100% (2)

- Petrolera Zuata, Petrozuata C.A. (HBS 9-299-012)Documento1 paginaPetrolera Zuata, Petrozuata C.A. (HBS 9-299-012)Shrikant KrNessuna valutazione finora

- Mannesmann Vs VodafoneDocumento17 pagineMannesmann Vs Vodafonesitti.aNessuna valutazione finora

- Petrozuata Case AnalysisDocumento8 paginePetrozuata Case AnalysisVishal VishyNessuna valutazione finora

- Globalizing The Cost of Capital and Capital Budgeting at AESDocumento22 pagineGlobalizing The Cost of Capital and Capital Budgeting at AESkartiki_thorave6616100% (2)

- Chad-Cameroon Oil Pipeline Project FinancingDocumento13 pagineChad-Cameroon Oil Pipeline Project FinancingavijeetboparaiNessuna valutazione finora

- Case 3 Group 7Documento11 pagineCase 3 Group 7sub312Nessuna valutazione finora

- Partial Credit Guarantee Facility and Project Completion Risk Guarantee FacilityDocumento18 paginePartial Credit Guarantee Facility and Project Completion Risk Guarantee FacilityAsian Development Bank - TransportNessuna valutazione finora

- PF Group 11 AquasureDocumento13 paginePF Group 11 Aquasuresiby13172Nessuna valutazione finora

- New Earth's South Africa Iron Ore Investment AnalysisDocumento4 pagineNew Earth's South Africa Iron Ore Investment AnalysisMukesh SahuNessuna valutazione finora

- Phonetic AlphabetDocumento1 paginaPhonetic AlphabetGlemiston FigueiredoNessuna valutazione finora

- Harvard Business Review - Letter To CEOsDocumento5 pagineHarvard Business Review - Letter To CEOsPulkit Goel100% (1)

- Annual Report 2009-10 - CTRD TrustDocumento23 pagineAnnual Report 2009-10 - CTRD TrustArun Kumar KNessuna valutazione finora

- Citibank Credit Card CaseDocumento2 pagineCitibank Credit Card CaseArun Kumar KNessuna valutazione finora

- What Is New in Microsoft Project 2010?: PM World Today - Viewpoint - April 2010Documento7 pagineWhat Is New in Microsoft Project 2010?: PM World Today - Viewpoint - April 2010Arun Kumar KNessuna valutazione finora

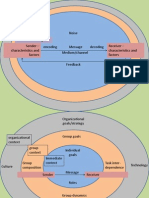

- Communication ModelDocumento2 pagineCommunication ModelArun Kumar KNessuna valutazione finora

- Rotex Cylinder Catalogue Dia 400 To 1100Documento6 pagineRotex Cylinder Catalogue Dia 400 To 1100Arun Kumar KNessuna valutazione finora

- Empowering Disabled People through Vocational TrainingDocumento12 pagineEmpowering Disabled People through Vocational TrainingArun Kumar K100% (2)

- Psychological Traps in Decision-Making Orientation MEP5Documento13 paginePsychological Traps in Decision-Making Orientation MEP5Arun Kumar KNessuna valutazione finora

- Strategic Capacity Management GuideDocumento14 pagineStrategic Capacity Management GuideArun Kumar KNessuna valutazione finora

- The Benetton Supply Chain - Case Study: Retail Operations - Main ObjectivesDocumento7 pagineThe Benetton Supply Chain - Case Study: Retail Operations - Main ObjectivesArun Kumar KNessuna valutazione finora

- Marketing UCBDocumento0 pagineMarketing UCBRhea SharmaNessuna valutazione finora

- ALT CodesDocumento1 paginaALT CodesElle RalukNessuna valutazione finora

- NSS 87Documento2 pagineNSS 87Mahalakshmi Susila100% (1)

- Cruise LetterDocumento23 pagineCruise LetterSimon AlvarezNessuna valutazione finora

- Introduction to Social Media AnalyticsDocumento26 pagineIntroduction to Social Media AnalyticsDiksha TanejaNessuna valutazione finora

- PPD Reflective EssayDocumento2 paginePPD Reflective Essaydelisha kaurNessuna valutazione finora

- Lord Kuthumi UnifiedTwinFlameGrid Bali2013 Ubud 5 Part11 StGermain 24-04-2013Documento6 pagineLord Kuthumi UnifiedTwinFlameGrid Bali2013 Ubud 5 Part11 StGermain 24-04-2013Meaghan MathewsNessuna valutazione finora

- CIR vs. CA YMCA G.R. No. 124043 October 14 1998Documento1 paginaCIR vs. CA YMCA G.R. No. 124043 October 14 1998Anonymous MikI28PkJc100% (1)

- RAS MARKAZ CRUDE OIL PARK SITE INSPECTION PROCEDUREDocumento1 paginaRAS MARKAZ CRUDE OIL PARK SITE INSPECTION PROCEDUREANIL PLAMOOTTILNessuna valutazione finora

- List LaguDocumento13 pagineList LaguLuthfi AlbanjariNessuna valutazione finora

- Hue University Faculty Labor ContractDocumento3 pagineHue University Faculty Labor ContractĐặng Như ThànhNessuna valutazione finora

- Hamilton EssayDocumento4 pagineHamilton Essayapi-463125709Nessuna valutazione finora

- Seife Progress TrackerDocumento4 pagineSeife Progress TrackerngilaNessuna valutazione finora

- 1940 Doreal Brotherhood PublicationsDocumento35 pagine1940 Doreal Brotherhood Publicationsfrancisco89% (9)

- MODULE 3 LeadershipDocumento25 pagineMODULE 3 LeadershipCid PonienteNessuna valutazione finora

- Esmf 04052017 PDFDocumento265 pagineEsmf 04052017 PDFRaju ReddyNessuna valutazione finora

- Teaching C.S. Lewis:: A Handbook For Professors, Church Leaders, and Lewis EnthusiastsDocumento30 pagineTeaching C.S. Lewis:: A Handbook For Professors, Church Leaders, and Lewis EnthusiastsAyo Abe LighthouseNessuna valutazione finora

- Understanding the Causes and Misconceptions of PrejudiceDocumento22 pagineUnderstanding the Causes and Misconceptions of PrejudiceმარიამიNessuna valutazione finora

- Organizational ChartDocumento1 paginaOrganizational ChartPom tancoNessuna valutazione finora

- PLAI 10 Point AgendaDocumento24 paginePLAI 10 Point Agendaapacedera689100% (2)

- Plan Green Spaces Exam GuideDocumento8 paginePlan Green Spaces Exam GuideJully ReyesNessuna valutazione finora

- Russell's View On World Government in His Essay The Future of MankindDocumento3 pagineRussell's View On World Government in His Essay The Future of MankindRafaqat Ali100% (1)

- A Case Study of The Best Practices On Good Local Governance in The City of General TriasDocumento29 pagineA Case Study of The Best Practices On Good Local Governance in The City of General TriasChristina AureNessuna valutazione finora

- Analyze Author's Bias and Identify Propaganda TechniquesDocumento14 pagineAnalyze Author's Bias and Identify Propaganda TechniquesWinden SulioNessuna valutazione finora

- Microsoft Word - I'm Secretly Married To A Big S - Light DanceDocumento4.345 pagineMicrosoft Word - I'm Secretly Married To A Big S - Light DanceAliah LeaNessuna valutazione finora

- AACCSA Journal of Trade and Business V.1 No. 1Documento90 pagineAACCSA Journal of Trade and Business V.1 No. 1Peter MuigaiNessuna valutazione finora

- Vdkte: LA-9869P Schematic REV 1.0Documento52 pagineVdkte: LA-9869P Schematic REV 1.0Analia Madeled Tovar JimenezNessuna valutazione finora

- CallClerk User GuideDocumento94 pagineCallClerk User GuiderrjlNessuna valutazione finora

- History, and Culture of DenmarkDocumento14 pagineHistory, and Culture of DenmarkRina ApriliaNessuna valutazione finora

- Apply for Letter of AdministrationDocumento5 pagineApply for Letter of AdministrationCharumathy NairNessuna valutazione finora

- CHRO 3.0 Lead Future HR Function India PDFDocumento40 pagineCHRO 3.0 Lead Future HR Function India PDFpriteshpatel103100% (1)

- Human Resource Management in HealthDocumento7 pagineHuman Resource Management in HealthMark MadridanoNessuna valutazione finora