Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Energias Renovables

Caricato da

JESSCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Energias Renovables

Caricato da

JESSCopyright:

Formati disponibili

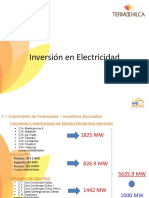

ESCENARIO DE

INVERSIN DEL MERCADO DE

ENERGA RENOVABLE

SIBER 2013

MDULO 5: INVERSIN Y FINANCIAMIENTO

LILIAN ALVES, BLOOMBERG NEW ENERGY FINANCE

20 SEPTIEMBRE 2013

/ / / / / / // // /// / / / / / / / / / / / / / / / / / / /

Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

CONTENIDO

1. Inversiones Mundiales en Energa Renovable

2. Amrica Latina Nueva Frontera para Inversiones

3. Financiacin de Proyectos: Desafios

4. Nuevos Mecanismos de Inversin

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

ABOUT BLOOMBERG NEW ENERGY FINANCE

200 staff in 13 offices worldwide

Objective: serve clients with the best intelligence on finance, technology and policy developments

in clean energy, energy efficiency and carbon markets

London

San Francisco

Zurich

Beijing

New York

Washington DC

Tokyo

Hong Kong

New Delhi

Singapore

Sao Paulo

Cape Town

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

Sydney

ENERGY INDUSTRY RESEARCH, FROM ALL ANGLES

SIX CORE RESEARCH AREAS ACROSS EACH SECTOR

POLICY

SECTOR ECONOMICS

-------------------------------------------------------

-------------------------------------------------------

Tariffs and support mechanisms

Impact of regulatory changes

Upcoming regulation pipeline

Market sizing

Margins, project returns

Industry structure / consolidation

FINANCE

SUPPLY CHAIN

-------------------------------------------------------

-------------------------------------------------------

Capital sources and availability

Asset prices and M&A activity

Project financing models

Production capacity

Pricing along the value chain

Bottlenecks/oversupply

ENERGY MARKETS

TECHNOLOGY

-------------------------------------------------------

-------------------------------------------------------

Demand forecasts

Power prices

Integration with electricity issues

Understanding technology choices

Tracking adoption/advancements

Commercialisation/scaling

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

GLOBAL TOTAL NEW INVESTMENT IN CLEAN ENERGY,

2006-2012 ($BN)

49%

37%

-3%

16%

23%

-13%

274

238

224

168

163

2008

2009

146

97

2006

2007

2010

2011

2012

Source: Bloomberg New Energy Finance

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

CLEAN ENERGY INVESTMENT BY COUNTRY TYPE

200412 ($BN)

3%

7%

5%

6%

17%

20%

22%

7%

6%

6%

6%

25%

27%

26%

27%

9%

14%

35%

ROW

BASIC

OECD

84%

77%

74%

73%

68%

66%

68%

67%

57%

2004

2005

2006

Note: Excludes corporate and government R&D

2007

2008

2009

2010

2011

2012

Source: Bloomberg New Energy Finance

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

CONTENIDO

1. Inversiones Mundiales en Energa Renovable

2. Amrica Latina Nueva Frontera para Inversiones

3. Financiacin de Proyectos: Desafios

4. Nuevos Mecanismos de Inversin

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

LATIN AMERICA AND CARIBBEAN TOTAL NEW FINANCIAL

INVESTMENTS BY SECTOR, 2006-2013 ($M)

15,897

13,471

11,747

11,188

10,812

10,295

5,415

2,811

2006

2007

Biofuels

Wind

2008

2009

Small Hydro

Note: Does not include Merges & Acquisitions and Public Markets

2010

2011

Biomass & Waste

Solar

2012

H1 2013

Geothermal

Source: Bloomberg New Energy Finance

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

LATIN AMERICA AND CARIBBEAN TOTAL NEW FINANCIAL

INVESTMENTS BY COUNTRY, 2006-2013 ($M)

15,897

13,471

11,747

11,188

10,812

10,295

5,415

2,811

2006

2007

Brazil

Mexico

2008

Chile

2009

Argentina

2010

Peru

2011

Uruguay

2012

H1 2013

Rest of LAC

Source: Bloomberg New Energy Finance

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

LATIN AMERICA TOTAL NEW FINANCIAL INVESTMENTS IN CLEAN

ENERGY BY COUNTRY, 2012 ($M)

Brazil

5,171

Mexico

1,999

-37%

595%

Chile

1,018

313%

Peru

643

176%

Argentina

270

Nicaragua

202

63%

24%

Panama

137

5%

Ecuador

132

42%

Uruguay

105

285%

Venezuela

77

9%

Honduras

33

-37%

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

10

CONTENIDO

1. Inversiones Mundiales en Energa Renovable

2. Amrica Latina Nueva Frontera para Inversiones

3. Financiacin de Proyectos: Desafios

4. Nuevos Mecanismos de Inversin

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

11

FINANCING SOME OF THE CHALLENGES

Time to secure financing

PPA difficulty to find bilateral long-term contracts

Currency risk

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

12

LATIN AMERICAN AND CARIBBEAN ASSET FINANCE

LEAGUE TABLE (LEAD ARRANGERS), 2006 - H1 2013

Rank Company Name

1 Banco Nacional de Desenvolvimento Economico e Social

2 Inter-American Development Bank

3 Banco do Nordeste do Brasil

4 Banco de Desenvolvimento de Minas Gerais

5 Rabobank

6 Overseas Private Investment Corp

7 World Bank Group

8 Superintendencia do Desenvolvimento do Nordeste

9 Banco Bilbao Vizcaya Argentaria SA

10 Central American Bank for Economic Integration

11 Banobras

12 Export-Import Bank of the Republic of China

13 Banco Santander SA

14 Export-Import Bank of the United States

15 Caixa Economica Federal

16 Credit Agricole Groupe

17 Banco do Brasil SA

18 Eksport Kredit Fonden - EKF

19 Banco Espirito Santo SA

20 European Investment Bank

# of Deals

Credit ($m)

211

21

15

3

4

4

12

8

9

13

6

1

6

4

3

7

7

4

5

4

16,707.60

1,030.95

797.57

695.30

578.95

573.01

525.83

465.35

376.97

328.21

323.19

313.00

295.71

293.05

286.49

282.02

274.75

250.60

229.40

209.50

Source: Bloomberg New Energy Finance

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

13

CONTENIDO

1. Inversiones Mundiales en Energa Renovable

2. Amrica Latina Nueva Frontera para Inversiones

3. Financiacin de Proyectos: Desafios

4. Nuevos Mecanismos de Inversin

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

14

GREEN BOND (NARROW DEFINITION) ISSUANCE OVER

TIME ($BN)

8

Other

7

6

QECB

5

4

CREB

3

Supranational/

international

2

1

Project bonds

0

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Source: Bloomberg New Energy Finance. Note: Other includes international

government or municipal debt. QECB stands for Qualified Energy Conservation Bonds,

CREB stands for Clean Renewable Energy Bonds. 'Narrow definition' refers to the fact

that we are restricting this view of the bond universe to include just the bond types

shown above, and excluding corporate issues.

Source: Bloomberg New Energy Finance

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

15

COUPONS AND OFFERING SIZE FOR CLEAN ENERGY

PROJECT BOND ISSUANCES, 2011-PRESENT

Coupon (%)

9.0

8.0

7.0

Baldwin,

NAIC 2

Desert Sunlight

(U), BBB-

Arlington Valley II,

BBB- (implied)

Granite Reliable

Power, BB

Topaz,

BBB-

6.0

Genesis (U), A-

L'Erable,

NR

5.0

4.0

Oaxaca IV, BBBOaxaca II, BBB-

Mount

Signal, NR Comber , Ave rate f or

new issues

St Clair,

BBB

(US util)*

BBB

Desert

Sunlight

(G), AAA

Genesis

(G), AAA

3.0

Solar Power

Generation Ltd, NR

Granite Reliable

Power, AAA

2.0

Ave rate f or

new issues

(EU util)*

1.0

Westmill Solar

Cooperative, NR

Olkaria, NR

0.0

Jan 11

Apr 11

Geothermal

Jul 11

Oct 11

Solar thermal

Feb 12

PV

May 12

Wind

Aug 12

Dec 12

Mar 13

$100m

Notes: (*) Average coupons for new bonds issued by utilities with maturities of 18-28years since January 2011. This

tenor range is +/- 5yrs from the average tenor (23 years) of the clean energy project bonds included in the chart. For

DOE loan guarantee projects: (G)- tranche is guaranteed by the DOE (U)- tranche is unguaranteed by DOE. The two

Oaxaca bonds appear as one bubble as they share the same coupon rate and were nearly the same issuance size.

Source: Bloomberg New Energy Finance

Olkaria & Westmill coupons unknown.

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

16

COPYRIGHT AND DISCLAIMER

This publication is the copyright of Bloomberg New Energy Finance. No portion of this document may be

photocopied, reproduced, scanned into an electronic system or transmitted, forwarded or distributed in any

way without prior consent of Bloomberg New Energy Finance.

The information contained in this publication is derived from carefully selected sources we believe are

reasonable. We do not guarantee its accuracy or completeness and nothing in this document shall be

construed to be a representation of such a guarantee. Any opinions expressed reflect the current judgment of

the author of the relevant article or features, and does not necessarily reflect the opinion of Bloomberg New

Energy Finance, Bloomberg Finance L.P., Bloomberg L.P. or any of their affiliates ("Bloomberg"). The opinions

presented are subject to change without notice. Bloomberg accepts no responsibility for any liability arising

from use of this document or its contents. Nothing herein shall constitute or be construed as an offering of

financial instruments, or as investment advice or recommendations by Bloomberg of an investment strategy or

whether or not to "buy," "sell" or "hold" an investment.

/ / / / Escenario de Inversin del Mercado de Energa Renovable 20 Septiembre 2013

17

ESCENARIO DE INVERSIN DEL

MERCADO DE ENERGA RENOVABLE

LILIAN ALVES, LCLEA5@BLOOMBERG.NET

MARKETS

Renewable Energy

Carbon Markets

Energy Smart Technologies

Renewable Energy Certificates

Carbon Capture & Storage

Power

Water

Nuclear

SERVICES

Insight: research, analysis & forecasting

Subscription-based news, data

and analysis to support your

decisions in clean energy, power

and water and the carbon markets

Industry Intelligence: data & analytics

News & Briefing: daily, weekly & monthly

Applied Research: custom research & data mining

sales.bnef@bloomberg.net

Knowledge Services: Summit, Leadership Forums, Executive Briefings &

workshops

////////////////////////////

Potrebbero piacerti anche

- Física - Evaluación 1 - PDocumento4 pagineFísica - Evaluación 1 - PnayibNessuna valutazione finora

- 04 - CV - GPY012 - Unidad 6 - Material de Lectura v1Documento48 pagine04 - CV - GPY012 - Unidad 6 - Material de Lectura v1JESSNessuna valutazione finora

- Sr. Humberto Astete - ERNST & YOUNGDocumento10 pagineSr. Humberto Astete - ERNST & YOUNGJESSNessuna valutazione finora

- Tema 5Documento36 pagineTema 5JESSNessuna valutazione finora

- Tema 3Documento61 pagineTema 3JESSNessuna valutazione finora

- Tema1 PDFDocumento53 pagineTema1 PDFJESSNessuna valutazione finora

- Tema 4Documento39 pagineTema 4JESSNessuna valutazione finora

- 03 - CV - GPY012 - Unidad 5 - Material de Lectura v1Documento34 pagine03 - CV - GPY012 - Unidad 5 - Material de Lectura v1JESSNessuna valutazione finora

- 6.2. Sr. José Jaramillo Vallejo - REPDocumento11 pagine6.2. Sr. José Jaramillo Vallejo - REPJESSNessuna valutazione finora

- 6.1. Ing. Eduardo Antunez de Mayolo - COES-SINAC PDFDocumento5 pagine6.1. Ing. Eduardo Antunez de Mayolo - COES-SINAC PDFJESSNessuna valutazione finora

- 01 - CV - GPY012 - Unidad 1, 2 y 3 - Material de Lectura v1Documento58 pagine01 - CV - GPY012 - Unidad 1, 2 y 3 - Material de Lectura v1JESSNessuna valutazione finora

- Consecuencias de La Integracion Vertical y de La Intervencion Del Estado en El Sector Electrico - StatkcraftDocumento13 pagineConsecuencias de La Integracion Vertical y de La Intervencion Del Estado en El Sector Electrico - StatkcraftJESSNessuna valutazione finora

- Manual Energy PlusDocumento62 pagineManual Energy PlusGonzalo DorantesNessuna valutazione finora

- Distorsiones Del Mercado Electrico PeruanoDocumento13 pagineDistorsiones Del Mercado Electrico PeruanoJESSNessuna valutazione finora

- Tema 2Documento58 pagineTema 2JESSNessuna valutazione finora

- Tema 3Documento61 pagineTema 3JESSNessuna valutazione finora

- Conferencia - La Movilidad ElectricaDocumento18 pagineConferencia - La Movilidad ElectricaJESSNessuna valutazione finora

- El Mercado Electrico Del Carbono 2010Documento44 pagineEl Mercado Electrico Del Carbono 2010JESSNessuna valutazione finora

- Tema 5Documento36 pagineTema 5JESSNessuna valutazione finora

- Tema1 PDFDocumento53 pagineTema1 PDFJESSNessuna valutazione finora

- Ing. Javier Paz - RainpowerDocumento20 pagineIng. Javier Paz - RainpowerJESSNessuna valutazione finora

- Ing. Alejandro Gutiérrez - XM S.ADocumento21 pagineIng. Alejandro Gutiérrez - XM S.AJESSNessuna valutazione finora

- Tema 4Documento39 pagineTema 4JESSNessuna valutazione finora

- Conferencia - La Movilidad ElectricaDocumento18 pagineConferencia - La Movilidad ElectricaJESSNessuna valutazione finora

- Ing. Tatiana Alegre - TERMOCHILCADocumento5 pagineIng. Tatiana Alegre - TERMOCHILCAJESSNessuna valutazione finora

- El Mercado Electrico Del Carbono 2010Documento44 pagineEl Mercado Electrico Del Carbono 2010JESSNessuna valutazione finora

- Conferencia - La Movilidad ElectricaDocumento18 pagineConferencia - La Movilidad ElectricaJESSNessuna valutazione finora

- Posibilidades de Interconexiones Electricas RegionalesDocumento14 paginePosibilidades de Interconexiones Electricas RegionalesJESSNessuna valutazione finora

- Mercados Electricos COES 2016Documento30 pagineMercados Electricos COES 2016JESSNessuna valutazione finora

- Distorsiones Del Mercado Electrico PeruanoDocumento13 pagineDistorsiones Del Mercado Electrico PeruanoJESSNessuna valutazione finora

- Consecuencias de La Integracion Vertical y de La Intervencion Del Estado en El Sector Electrico - StatkcraftDocumento13 pagineConsecuencias de La Integracion Vertical y de La Intervencion Del Estado en El Sector Electrico - StatkcraftJESSNessuna valutazione finora

- Alteraciones Post-Mortem, Necropsia y MuestrasDocumento16 pagineAlteraciones Post-Mortem, Necropsia y MuestrasDaniela BañosNessuna valutazione finora

- Manual GAOMONDocumento9 pagineManual GAOMONRecords FiigoNessuna valutazione finora

- Medula EspinalDocumento37 pagineMedula EspinalMaría José TochónNessuna valutazione finora

- Pinedo Arevalo Miguel Muros Suelo ReforzadoDocumento106 paginePinedo Arevalo Miguel Muros Suelo ReforzadoHebert Rodríguez SantiagoNessuna valutazione finora

- Plano DespieceDocumento1 paginaPlano Despiecepia cruzNessuna valutazione finora

- Cap 11 S 4Documento11 pagineCap 11 S 4Stephie GalindoNessuna valutazione finora

- Tarea 1Documento2 pagineTarea 1MANUEL BACA OBREGONNessuna valutazione finora

- Células HematologícasDocumento5 pagineCélulas HematologícasFRIDA GUZMANNessuna valutazione finora

- Manual de Como Hacer Aspersores de Riego de Bajo CostoDocumento2 pagineManual de Como Hacer Aspersores de Riego de Bajo CostoMarcela ChamOrroNessuna valutazione finora

- Ley de Senos y Cosenos Con RaizesDocumento8 pagineLey de Senos y Cosenos Con RaizesJaime Zarate MorenoNessuna valutazione finora

- Primer Examen Parcial PDFDocumento9 paginePrimer Examen Parcial PDFElizabeth FelizNessuna valutazione finora

- Gestion Logistica 1Documento37 pagineGestion Logistica 1Jonny VasquezNessuna valutazione finora

- Actividad IntegradoraDocumento5 pagineActividad IntegradoraSantiago MontoyaJimnezNessuna valutazione finora

- SeminarioDocumento8 pagineSeminarioRama Castro MartinezNessuna valutazione finora

- Ensayo Sobre Relación Centrica y Oclusión en Relación CéntricaDocumento2 pagineEnsayo Sobre Relación Centrica y Oclusión en Relación CéntricaJoshua Rafael Lopez VillalobosNessuna valutazione finora

- Sep 7-1Documento3 pagineSep 7-1Walter HerreraNessuna valutazione finora

- Informe de Fuerza IonicaDocumento16 pagineInforme de Fuerza IonicaKriz Tinita MirandaNessuna valutazione finora

- Taller 1 - La Célula 2020BDocumento3 pagineTaller 1 - La Célula 2020BJuan David ValenciaNessuna valutazione finora

- Serie Mecánica PDFDocumento14 pagineSerie Mecánica PDFEngineeringNessuna valutazione finora

- Armado Del EsqueletetoDocumento7 pagineArmado Del EsqueletetoKaled LandivarNessuna valutazione finora

- 03 06 000 2020 00179 00 (C)Documento26 pagine03 06 000 2020 00179 00 (C)NICOLAS EFRAIN LOPEZ CARDOZONessuna valutazione finora

- La Factorizacion QRDocumento4 pagineLa Factorizacion QRFernando Smith TorresNessuna valutazione finora

- Racionales Completo - Tercer AñoDocumento19 pagineRacionales Completo - Tercer AñoSol MiloneNessuna valutazione finora

- Sistema Muscular o Aparato Locomotor ActivoDocumento11 pagineSistema Muscular o Aparato Locomotor ActivoAnonymous laFH8zAWjnNessuna valutazione finora

- Trabajo Práctico #1Documento1 paginaTrabajo Práctico #1eluanitaluzNessuna valutazione finora

- Ficha Tecnica - Lamina Arkos AlveolarDocumento6 pagineFicha Tecnica - Lamina Arkos AlveolarDiego CuadrosNessuna valutazione finora

- 4 Años TripticoDocumento2 pagine4 Años TripticoAldo Frank Cunyas FarfanNessuna valutazione finora

- PC3 Ecología - Brigitte Romina Pineda VelardeDocumento4 paginePC3 Ecología - Brigitte Romina Pineda VelarderominaNessuna valutazione finora

- Practica Calificada de Pavimentos 2021Documento1 paginaPractica Calificada de Pavimentos 2021Yuler Valverde VergaraNessuna valutazione finora