Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2014 Thailand Paper Re Mutliple Trains Operation 3rd Ed

Caricato da

rgavietaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

2014 Thailand Paper Re Mutliple Trains Operation 3rd Ed

Caricato da

rgavietaCopyright:

Formati disponibili

MRT System Procurement and Maintenance:

Philippine Experience

Rommel C. Gavieta MA (URP), MSc (Eng)

Metro Rail Transit Line-3 Project Adviser

York Center for Asian Research, York University

Metro Manila Background Information

Metro Manila as a Mega-City and Traffic Congestion

21 mega-cities are in Asia out of 36 mega-cities (2012)

Metro Manila is second to Tokyo with 70% of the population taking public transportation.

(http://ncts.upd.edu.ph/old/research/docs/research/papers/tiglao-EASTS2007-02.pdf)

Jica experts has said that Philippine the government would need to invest P2.3 trillion through

2030 to overhaul transportation infrastructure in Metro Manila.

It estimated that about P2.4 billion in potential income was being lost daily due to congestion

at the capitals roads and railways.

(http://www.jica.go.jp/philippine/english/office/topics/news/130801.html and

http://business.inquirer.net/158419/jicas-expanded-mass-transport-study-seen-out-within2014#ixzz35kflDDX7)

Metro Manila Key Indicators

Proposed JICA Mega Manila

Rail Transit Development Plan (2015-2030)

Existing Metro Manila LRT/MRT and Rail Lines

Existing LRT/MRT and PNR Lines

Capacities LRT/MRT and PNR Lines

LRT1: 15km competed 1985 (street cars operating as LRTs)

430,000 passengers a day

139 cars operating only 80 cars

550,000 passenger a day design capacity

LRT2: 14Km completed 2008 (MRT operating as LRT)

250,000 passengers a day

72 cars operating only 43 cars

360,000 passenger a day design capacity

MRT3: 16km completed 2000 (street cars operating as MRT)

450,000 passengers a day

70 cars operating 40 cars

350,000 passenger design capacity

PNR: 56 km Urban Line

100,000 passengers a day in a traffic corridor that carries

approximately 1.0million commuters a day.

18 cars and 56km

Global LRT Maintenance Benchmarks

Key Performance Indicators

by MTR (Hong Kong) and Comet

Trend Towards Single Point of Responsibility under

Total Cost of Ownership Procurement Model

Total Cost of Ownership

(Maintenance done by Alstom)

Total Cost of Ownership

MRT3 Project Philippines

11% 2%

14%

16%

57%

Personnel (Operation)

Maintenance

Debt Repayment

Project cost

Equity Rental Repayment

Philippine LRT Maintenance Benchmarks

MRT Rolling Stock Fleet

(73 procured by private sector owner and 48 procured by public sector

operator subject to consent of private sector owner)

MRT3 (Private Sectr Procurement)

73-cars from CKD procured by the Private Owners of the Assset

Reliability Centric maintenance service by Sumitomo

Corporation from Completion Date (2000) to 2012 with a

guaranteed availability of 60 cars, spare part inventory and

refurbishment requirement.

Service centric maintenance service by local company with no

spare part inventory requirement and no refurbishment

commitment

MRT3 (Public Sector Procurement)

48 cars from CNR procurement by operator

Deployment for revenue service requires the consent of the

owner of the MRT3 Asset and may pay trackage fees to alleviate

capacity congestion.

CNR has not produced Electric and double articulated Light Rail

Vehicles and delivered only diesel locomotives to MTR

Total Cost Of Operation/Acquisition

and Declining Ridership as a Result of Public Sector

Procurement of Maintenance Services

9,000,000,000.00

120.00

8,000,000,000.00

100.00

7,000,000,000.00

6,000,000,000.00

80.00

5,000,000,000.00

60.00

4,000,000,000.00

3,000,000,000.00

40.00

2,000,000,000.00

20.00

1,000,000,000.00

-

2000

2001

2002

2003

2005

2007

2008

2009

2010

2011

2012

Personnel Services

Maintenance and Other Maintenance Services

Equity Rental Payment

Debt payment (estimate)

Farebox Revenue

Subsidy

Subsidy per passenger

2013

2014

Indicative trend of

effect of shift from a

privately

administered

maintenance

service. to a publicly

administered

maintenance service

Design Capacity and Operating Capacity

South East Asian Comparison

Comparison of Private Sector and Public Sector

Procurement of Maintenance Service

Sumitomo Corp.

2000-2012

Terms of

Actual

PH Trams

2012

TOR was

Actual

APT Global

2012-2014

TOR and lately

Actual

Reference (TOR)

annunced as

revised under a

similar tom the

memo from

original TOR

60 cars

none

Performance

NA

canibalization of

parts

completed

required but not None

practical

implementation

undertaking

350,000

550,000

350,000

450,000

DOTC Usec Lotilla Performance

54 cars

40 cars

none

canibalization of

parts

required but not None

practical

implementation

350,000

430,000

LESS THAN 5 INCIDENCE OF

REVENUE SERVICE INTERRUPTION A

YEAR THAT IS GREATER THAN 5MINUTES

LESS THAN 5 INCIDENCE OF

GREATER THAN 5 INCIDENCES OF

REVENUE SERVICE INTERRUPTION A

YEAR THAT IS GREATER THAN 5MINUTES

GREATER THAN 5 INCIDENCES OF

REVENUE SERVICE INTERRUPTION A

YEAR THAT IS GREATER THAN 5MINUTES

defined under the

Build, Lease and

Transfer (BLT)

Availability

Part

Overhauling

Ridership

COMET

Bencjmark for

reliability

Agreement OR

60 cars

6-month spare

part inventory

required

Performance

60 cars

yes

Understanding Operations and Maintenance Cost

Rules of Thumb

Operation and maintnance represents approximately 80% of the Total Cost of Ownership

(TCO) .

In the case of the MRT3, over the concession period the ratio is 86% O&M and 14% project

cost

In the case of MRT3, the ratio distribution of the maintenance fee is 60% rolling stock and

40% infrastructure

Approximately 60% of maintenance cost are personnel cost and 40% for material and parts

Maintenance cost is the major cost position subject to optimization as energy and

depreciation stay consistent during lifecycle of rolling stock fleet.

(Author own calculation and Wyman, O.; Lean Rolling Stock Maintenance; 2009 oliverwyman

Recognition of Current Framework for Procurement

Practice of Rail Systems and Rolling Stock

Public Sector Current Practice

Proposed Action Moving Forward

Disconnected Procurement and O&M Policy

Recommendation

Harmonized procurement and O&M Policy

Adopt strategic decisions about rolling stock

procurement and specification should be taken

centrally. This critical given the level of

fragmentation of the sector/industry

(Butcher, L; Railways: rolling stock

Standard Note: SN3146; 31 October 2013; House of

Commons)

Procurement Policy driven specification and lowest

cost

Recommendation:

Procurement Policy that is Performance Standard

centric

Current Level of

Awareness

Technical Strategy Leadership group; The Future Railway; 2012 UK

The Future and Recommendation

Traditional Procurement of an Urban Transit System

and Maintenance Works of an Urban Transit System

Market Demand

Concession Framework or Public Sector Administered

Customer Needs

and Expectations

PPP

Contractor and Supplier

ODA

PPP

Procurement

Group

Specifications Rail

System and NonRail System

Porcurement of

Concession Framework or Public Sector Administered

ODA

Procurement

Group

Piecemeal Procuremnt of Sub-components of an Urban

Rail Transit System

Specifications Rail

System and NonRail System

EPC Contractor

Regular

Maintenance

Works

Procurement of

Rolling Stock

LRV Manufacturers

Refurbishment

Works

Procurement of

Elctromechnical

Systems

Electromechanical

Upgrades and

Expansion of

Capacities

Civil Works

Suppliers

Proposed Procurement of an Urban Transit System

and Maintenance Works of an Urban Transit System

Market Demand

Concession Framework or Public Sector Administered

Framework

Customer Needs

and Expectations

PPP

Contractor and

Supplier

Concession Framework or Public Sector Administered

Framework

ODA

PPP

Procurement

Group

Procurement

Group

Specifications Rail

Single Point of

System and Non-

Responsibility

Rail System

Contracting Works

Porcurement of

ODA

Single Point of

Reeeeponsibility

Maintenance

Works

Specifications Rail

System and NonRail System

EPC Contractor

Regular

Maintenance

Works

Procurement of

Rolling Stock

LRV Manufacturers

Refurbishment

Works

Procurement of

Elctromechnical

Systems

Electromechanical

Upgrades and

Expansion of

Capacities

Civil Works

Suppliers

Possible Courses of Action

Procurement of Equipment and Maintenance for a Metro Manila System with a

45 km trackworks and with a ridership of 1.25million a day:

Centralized procurement with a single point of responsibility contractual

entity of rail equipment to achievement procurement leverage

Decentralized procurement with a single point of responsibility for regular

maintenance works, refurbishment works and warranties such as availability

requirements and COMET reliability benchmarks.

Contractual Risks

Public sectors creeping expropriation of existing concessions agreements

remains strong in the South East Asian infrastructure sector.

20

Thank you for your time and patience

21

Key Customer Needs Related to the

Maintenance of Urban Rail Transit Systems

Rolling Stock and Track Maintenance Corelationship

Strong mutual dependency and interference

of wear and tear of key assets (rolling stock

and infrastructure) this does not hold true

for gas and water, telecom and electricity, or

air transport

The cost and quality of train operations

depend on the condition of the tracks

(high maintenance requirement for

rolling stock, low maximum speed, etc.

if tracks are in bad condition)

The cost of infrastructure maintenance

depends on the condition and operation

of rolling stock (high wear and tear of

tracks if wheels are uneven, speed is

high, braking is strong, etc.)

Metro Manila Key Indicators

Matching Design Capacity with

Appropriate Types of Rolling Stocks

Seven generic types of train:

Shorter Distance Self-Powered (diesel,

generally with 75 mph maximum speed);

Middle Distance Self-Powered (diesel, with 90/

100 mph capability);

Long Distance Self-Powered (diesel, with 100/

110/ 125 mph capability);

Shorter Distance Electric (generally with 75

mph maximum speed);

Middle Distance Electric (with 90/ 100/ 110

mph capability. Some future trains may require

125 mph capability);

Long Distance Electric (with 100/ 110/ 125 mph

capability);

Very High Speed Electric (140 mph and above,

for domestic services on HS1 and HS2).

(ATOC; Long Term Passenger Rolling Stock

Strategy for the Rail Industry; Feb 2013)

Proposed Metro Manila LRT/MRT and Rail Lines

Proposed Lines (JICA):

Primary Lines:

1. PNR rehabilitation or LRT5 (PhP25b MalolosCalamba), (LRT5)

2. MRT4 and MRT7 (Recto to Banaba PhP180billion),

3. Mega-Manila Subway (550billion)

4. Baclaran-Bacoor or LRT6 (PhP60billion PPP awarded)

Secondary:

4. Ortigas-Angono (PhP32b),

5. Marikina-Katipunan (PhP32b),

6. Alabang-Zapote (PhP27b)

7. Zapote-General Tias (PhP26b)

2

6

Key Customer Needs Related to the

Maintenance of Urban Rail Transit Systems

Rolling Stock and Track Maintenance Corelationship

Strong mutual dependency and interference

of wear and tear of key assets (rolling stock

and infrastructure) this does not hold true

for gas and water, telecom and electricity, or

air transport

The cost and quality of train operations

depend on the condition of the tracks

(high maintenance requirement for

rolling stock, low maximum speed, etc.

if tracks are in bad condition)

The cost of infrastructure maintenance

depends on the condition and operation

of rolling stock (high wear and tear of

tracks if wheels are uneven, speed is

high, braking is strong, etc.)

Modified Predictive Maintenance Framework

There is a continual need to employ a Kaizening* process that confronts and combats

the challenges of common constraints, in order to create adaptive and balanced

maintenance programs, that are justifiably well planned and timely executed.

(http://www.apta.com/mc/rail/papers/Papers/WeissM-Challenges-of-Matching-Maintenance-Programs-to-an-AgingRolling-Stock-Fleet.pdf)

28

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Auckland Transport Alignment Project: April 2018Documento48 pagineAuckland Transport Alignment Project: April 2018Ben RossNessuna valutazione finora

- Urban Transportation PlanningDocumento42 pagineUrban Transportation Planningmonika hcNessuna valutazione finora

- APTA-RT-OP-S-005-03 Rev 3-Operations Control Center-OCCDocumento17 pagineAPTA-RT-OP-S-005-03 Rev 3-Operations Control Center-OCCSocrates MoralesNessuna valutazione finora

- Track AlignmentDocumento68 pagineTrack AlignmentcezarNessuna valutazione finora

- Spun Pile & Bored Pile ComparisonDocumento10 pagineSpun Pile & Bored Pile ComparisonLe Thi Anh TuyetNessuna valutazione finora

- Light Rail TechnologyDocumento63 pagineLight Rail TechnologyGaneshNessuna valutazione finora

- Gyanta Town Planning PDFDocumento12 pagineGyanta Town Planning PDFGyanta MehndirattaNessuna valutazione finora

- List of Metro Systems - Wikipedia, The Free EncyclopediaDocumento33 pagineList of Metro Systems - Wikipedia, The Free EncyclopediaSatish RajagopalanNessuna valutazione finora

- Transpo Midterm ReviewerDocumento6 pagineTranspo Midterm Reviewerjury jasonNessuna valutazione finora

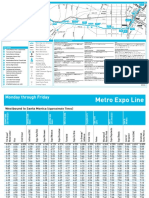

- LA Expo Line ScheduleDocumento5 pagineLA Expo Line SchedulePete ANessuna valutazione finora

- DPR PDFDocumento335 pagineDPR PDFshardasiddhNessuna valutazione finora

- Hyderabad Metro ThesisDocumento6 pagineHyderabad Metro Thesisdnr68wp2100% (2)

- Vukan R. VuchicDocumento3 pagineVukan R. VuchicRajesh KhadkaNessuna valutazione finora

- Tổng Hợp Bài Viết IELTS Writing Task 1 Bar Chart - Simon - VietAcceptedDocumento1 paginaTổng Hợp Bài Viết IELTS Writing Task 1 Bar Chart - Simon - VietAcceptedNguyễn Lê Quỳnh TrangNessuna valutazione finora

- Research AssigmentDocumento18 pagineResearch AssigmentYogeenee Chokupermal0% (1)

- Indore Bus City Transport - CIPR0003 (A)Documento16 pagineIndore Bus City Transport - CIPR0003 (A)Manu ShivanandNessuna valutazione finora

- Daily Test 2 Kls 4&5Documento3 pagineDaily Test 2 Kls 4&5Anggi Awalia NastitiNessuna valutazione finora

- Implementing Real TOD: DR Chris Hale Department of Infrastructure Engineering The University of MelbourneDocumento35 pagineImplementing Real TOD: DR Chris Hale Department of Infrastructure Engineering The University of MelbourneAnonymous zqPnHPANessuna valutazione finora

- Utah Transit Authority Light Rail Design Criteria: General RequirementsDocumento302 pagineUtah Transit Authority Light Rail Design Criteria: General RequirementsEmanuel CostaNessuna valutazione finora

- Overhead Contact System Technical Specifications: FinalDocumento67 pagineOverhead Contact System Technical Specifications: FinalManoj kumar NNessuna valutazione finora

- Final Thesis (Melkamu Debas)Documento144 pagineFinal Thesis (Melkamu Debas)MINALACHEW TAYENessuna valutazione finora

- Concerns of Filipino About Public Transportation: A Research Study Presented To Queen's Row Integrated Science SchoolDocumento6 pagineConcerns of Filipino About Public Transportation: A Research Study Presented To Queen's Row Integrated Science SchoolChristina AureNessuna valutazione finora

- ELECTCOG2 Fieldtrip Report - CasemDocumento6 pagineELECTCOG2 Fieldtrip Report - CasemJuan CasemNessuna valutazione finora

- Urban Transport Project White PaperDocumento75 pagineUrban Transport Project White Paperhima_bindu_89Nessuna valutazione finora

- Cervero 2002Documento8 pagineCervero 2002Gustavo Jiménez BarbozaNessuna valutazione finora

- 2017 Bridge UpdatesDocumento13 pagine2017 Bridge Updateser_surajrpNessuna valutazione finora

- Sound Transit Feasibility Report Regarding An Aerial Gondola From West SeattleDocumento17 pagineSound Transit Feasibility Report Regarding An Aerial Gondola From West SeattleWestSeattleBlogNessuna valutazione finora

- 2017 August SL System MapDocumento2 pagine2017 August SL System MapANessuna valutazione finora

- SE Corridor Monorail Revised Final Report 020215Documento91 pagineSE Corridor Monorail Revised Final Report 020215Jay Deep GhoshNessuna valutazione finora

- John Ferraro CVDocumento7 pagineJohn Ferraro CVAkram YasinNessuna valutazione finora