Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Swot Analysis For Cosmorom

Caricato da

Laurian0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

40 visualizzazioni2 pagineold gsm

Titolo originale

Swot Analysis for Cosmorom

Copyright

© © All Rights Reserved

Formati disponibili

PPT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoold gsm

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

40 visualizzazioni2 pagineSwot Analysis For Cosmorom

Caricato da

Laurianold gsm

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

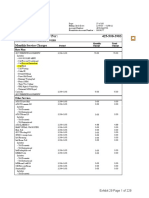

SWOT Analysis for COSMOROM in the beginning

of commercial operation in 2000

NOVELTY in the charging system:

- charging per second

- No peak/off-peak tariffs

Attractive market price

Superior quality of the GSM 1800 MHz network, versus

900 MHz

Providing from the first day all standard services and

value added ones, like Voice Mail and Short Messages

Services.

The 3

rd

mobile phone operator on the market

Initial limited network coverage

Initial limited roaming system

Reduced network coverage and slow expansion of the network

Negative association perception linked with Romtelecom

Lack of specialized personnel

No Cosmorom web-site

Higher roll-out investment in the US GSM network

Many barriers for switching to COSMOROM network, because

of: cost of switching; penalty fees; renouncing of special deals;

inconvenience of changing the telephone number.

No loyalty programs, as Connex and Dialog have.

Fast growing market

Already educated market in the mobile phone domain

The quick expansion of the distribution network

Strategically selection of network dealers

Low mobile penetration (6 % in 1999) and also low fixed

telephone penetration (17 % in 1999)

Different positioning from competitors

Opportunity to create brand awareness and define a strong

brand image

Very competitive market in ATL and BTL activities

Aggressive competition and dynamic changes on the services mobile

phones market

Competition (Connex and Dialog) have near nation wide GSM

coverage

Limited core target (age 20-35, from urban zones, with medium and

high income, but dynamic, young (at least at heart) open-minded, modern,

rational with showing-off comportment), already customers of competitors

The corporate and small-medium enterprises customers are already

caught by competition.

High fraud rates

Black and gray market for handsets

Rapid development of roaming agreements

Rapid development of network coverage

Further education on charging per sec. concept

Launching of new services (new types of subscriptions,

like ATU and PLUS 25, and new types of services, like WAP)

sustained by many strategically campaigns in all the media

vehicles: TV, press, radio and outdoors,

in order to increase sales and awareness

Usage of Romtelecom (mother company) as

one of the biggest dealers for distribution network

Strong BTL activities in order to increase direct / indirect

contact with potential customers

Press releases and sponsorships in order to maintain the

awareness

Quickly respond to competitors launching of new services

Attempts to stop being follower and become leader in

new services (i.e. GPRS, VPN, IN, etc.)

Reinforcing Romtelecom image as Cosmorom dealer implies:

- more services to provide and more impact presence

Ways of tackling the weakness and the

threats from phase A

Market positioning as:

oSmart Choice versus - Connex is technology

- Dialogis cheaper

oCosmorom means good value for money fair

taxation

o Leaders as: - charging per second

- no peak / of-peak tariffs

- simplicity

Communication strategy by messages about:

- understanding

- transparency

- fairness

Network expansion by priority on cities according

to following criteria:

- Unemployment rates

- Business Development (Banks,

- Type of work (factories, offices)

- Gross Domestic Product per Capital

Potrebbero piacerti anche

- Future Telco: Successful Positioning of Network Operators in the Digital AgeDa EverandFuture Telco: Successful Positioning of Network Operators in the Digital AgePeter KrüsselNessuna valutazione finora

- Papers on the field: Telecommunication Economic, Business, Regulation & PolicyDa EverandPapers on the field: Telecommunication Economic, Business, Regulation & PolicyNessuna valutazione finora

- CRM Project Report PDFDocumento12 pagineCRM Project Report PDFSobhra SatpathyNessuna valutazione finora

- Whitepaper HowtobecomeanmvnoormvneDocumento15 pagineWhitepaper HowtobecomeanmvnoormvneHisham Abd El AleemNessuna valutazione finora

- Nureye ASSIGNMENTDocumento24 pagineNureye ASSIGNMENTZeyinA MohammedNessuna valutazione finora

- Emerging Cellular TechnologiesDocumento34 pagineEmerging Cellular TechnologieseddmaniNessuna valutazione finora

- Alex FaresDocumento10 pagineAlex FaresSudip MokashiNessuna valutazione finora

- IMS-IP Multimedia Subsystem: IMS Overview and The Unified Carrier NetworkDocumento11 pagineIMS-IP Multimedia Subsystem: IMS Overview and The Unified Carrier NetworkManas RanjanNessuna valutazione finora

- Telecom Industry Value Chain Turning On Its HeadDocumento2 pagineTelecom Industry Value Chain Turning On Its HeadPeter OkohNessuna valutazione finora

- PORTER 5 ForcesDocumento4 paginePORTER 5 ForcesMiley MartinNessuna valutazione finora

- On The Economics of 3G Mobile Virtual Network Operators (Mvnos)Documento14 pagineOn The Economics of 3G Mobile Virtual Network Operators (Mvnos)Tran Quoc TamNessuna valutazione finora

- Combined and UncombinedDocumento10 pagineCombined and UncombinedBala SubramanianNessuna valutazione finora

- Porter Five Forces WordDocumento11 paginePorter Five Forces WordvinodvahoraNessuna valutazione finora

- Handset Leasing - Unlock Opportunities To Regain Financial Position in Telecom IndustryDocumento7 pagineHandset Leasing - Unlock Opportunities To Regain Financial Position in Telecom IndustryHoàng NguyễnNessuna valutazione finora

- Bresson BissonDocumento13 pagineBresson Bissonafzallodhi736Nessuna valutazione finora

- Toyota Car's Strategic Analysis in Uk. and The Development of Customer ValueDocumento7 pagineToyota Car's Strategic Analysis in Uk. and The Development of Customer ValueAliNessuna valutazione finora

- IMS Next Gen Comm Networks 080905Documento16 pagineIMS Next Gen Comm Networks 080905api-3807600Nessuna valutazione finora

- 3G Technology - A Large Opportunity For IndiaDocumento10 pagine3G Technology - A Large Opportunity For IndiaPinky MehtaNessuna valutazione finora

- Telecom Industry Value Chain - enDocumento2 pagineTelecom Industry Value Chain - ennarayan_umallaNessuna valutazione finora

- Econex Presentation 1Documento38 pagineEconex Presentation 1calixrvNessuna valutazione finora

- Economic Viability of 3G Mobile Virtual Network Operators: NtroductionDocumento5 pagineEconomic Viability of 3G Mobile Virtual Network Operators: NtroductionMoe KyawNessuna valutazione finora

- The Industry Handbook: The Telecommunications Industry: Printer Friendly Version (PDF Format)Documento3 pagineThe Industry Handbook: The Telecommunications Industry: Printer Friendly Version (PDF Format)Aman DeepNessuna valutazione finora

- The Industry HandbookDocumento13 pagineThe Industry HandbookRenu NerlekarNessuna valutazione finora

- M DagangDocumento13 pagineM DagangNoorazian NoordinNessuna valutazione finora

- Content End GameDocumento16 pagineContent End Gameyash.chandraNessuna valutazione finora

- DOCOMO Assignment Questions-1Documento4 pagineDOCOMO Assignment Questions-1nitishhere100% (2)

- Different Frameworks of Strategy in Telecom IndustryDocumento12 pagineDifferent Frameworks of Strategy in Telecom IndustrySHIDHARTH RAJ MBA Kolkata 2022-24Nessuna valutazione finora

- INDUSTRY ANALYSIS For Strategic PlanDocumento6 pagineINDUSTRY ANALYSIS For Strategic PlanMerylle Shayne GustiloNessuna valutazione finora

- M CommerceDocumento6 pagineM Commerceshree140489Nessuna valutazione finora

- IMT-2000 For Developing CountriesDocumento5 pagineIMT-2000 For Developing Countriesade gemalaNessuna valutazione finora

- TracoDocumento47 pagineTracokiran rajNessuna valutazione finora

- ASSIGNMENT - 1: Business ModelsDocumento8 pagineASSIGNMENT - 1: Business ModelsHimanshu SuriNessuna valutazione finora

- Porter'S Five Forces Analysis of Indian Telecom Industry: I. Buyer PowerDocumento6 paginePorter'S Five Forces Analysis of Indian Telecom Industry: I. Buyer PowerRahul SinghNessuna valutazione finora

- Industry and Market AnalysesDocumento6 pagineIndustry and Market AnalysespunjtanyaNessuna valutazione finora

- The Industry Handbook - The Telecommunications Industry: Back To Industry ListDocumento5 pagineThe Industry Handbook - The Telecommunications Industry: Back To Industry ListAnkush ThoratNessuna valutazione finora

- Future Business Opportunities and ChallengesDocumento15 pagineFuture Business Opportunities and ChallengesChiylove ChiyloveNessuna valutazione finora

- MVNO Business Creating A Win Win ModelDocumento14 pagineMVNO Business Creating A Win Win ModelNathan Li100% (2)

- Industry Analysis Telecom TraiDocumento37 pagineIndustry Analysis Telecom TraiChaitali GhodkeNessuna valutazione finora

- Spectrum Policy in Canada: Levelling The Playing Field For Affordable Rates and Breadth of ChoiceDocumento13 pagineSpectrum Policy in Canada: Levelling The Playing Field For Affordable Rates and Breadth of ChoiceOpenMedia_caNessuna valutazione finora

- Contestable MarketsDocumento8 pagineContestable Marketsman downNessuna valutazione finora

- Mobile Virtual Network Operators: Case FinlandDocumento13 pagineMobile Virtual Network Operators: Case FinlandsudanoneNessuna valutazione finora

- Risk Management Notes (Revised)Documento13 pagineRisk Management Notes (Revised)Imtiaz KaziNessuna valutazione finora

- Supply Chain Management and Telecom ComponentsDocumento5 pagineSupply Chain Management and Telecom Componentsmodern2308Nessuna valutazione finora

- The Future Needs of Mobile Network OperatorsDocumento3 pagineThe Future Needs of Mobile Network OperatorssunsecretsNessuna valutazione finora

- Cellular Backhaul Over Satellite: Hite PaperDocumento21 pagineCellular Backhaul Over Satellite: Hite PaperMuditha Harshana දසනායකNessuna valutazione finora

- Ajay Kumar Garg Engineering College: Principles and Concepts in GSMDocumento36 pagineAjay Kumar Garg Engineering College: Principles and Concepts in GSMDutta AvinashNessuna valutazione finora

- Key Strategies For Operators Growth in Developing MarketsDocumento26 pagineKey Strategies For Operators Growth in Developing Marketssalman0092100% (2)

- The European UMTS/IMT-2000 License Auctions: Philippe Jehiel and Benny Moldovanu 21.01.2001Documento27 pagineThe European UMTS/IMT-2000 License Auctions: Philippe Jehiel and Benny Moldovanu 21.01.2001usmanrNessuna valutazione finora

- Connecting The WorldDocumento27 pagineConnecting The Worldaa_04Nessuna valutazione finora

- Rivalry Through Alliances: Competitive Strategy in The Global Telecommunications MarketDocumento39 pagineRivalry Through Alliances: Competitive Strategy in The Global Telecommunications Marketjalpa1432Nessuna valutazione finora

- Competition Policy Ternds in TelecommunicationDocumento3 pagineCompetition Policy Ternds in Telecommunicationphuonganh285Nessuna valutazione finora

- CRM & Indian Telecom SectorDocumento2 pagineCRM & Indian Telecom SectornehagypsyNessuna valutazione finora

- Report On MobilinkDocumento19 pagineReport On MobilinkAmit PrakashNessuna valutazione finora

- Technological Change Homework QuestionDocumento4 pagineTechnological Change Homework QuestionjessicasimcockNessuna valutazione finora

- Bargaining Power of SuppliersDocumento4 pagineBargaining Power of SuppliersEmanuel PrakashNessuna valutazione finora

- 41 Interconnection Costs enDocumento8 pagine41 Interconnection Costs enItzel TajimaroaNessuna valutazione finora

- Mobilink Internship ReportDocumento11 pagineMobilink Internship ReportTariq SaleemNessuna valutazione finora

- Current and Future Trends: Basic E-Commerce Training For PakistanDocumento20 pagineCurrent and Future Trends: Basic E-Commerce Training For PakistanzakavisionNessuna valutazione finora

- Cellular Technologies for Emerging Markets: 2G, 3G and BeyondDa EverandCellular Technologies for Emerging Markets: 2G, 3G and BeyondNessuna valutazione finora

- The International Telecommunications Regime: Domestic Preferences And Regime ChangeDa EverandThe International Telecommunications Regime: Domestic Preferences And Regime ChangeNessuna valutazione finora

- Suport Curs de Engleza v-VI IncepatoriDocumento86 pagineSuport Curs de Engleza v-VI IncepatoriLaurianNessuna valutazione finora

- MFB2008Documento120 pagineMFB2008LaurianNessuna valutazione finora

- User Manual Pi3505e: Printer DriverDocumento56 pagineUser Manual Pi3505e: Printer DriverLaurianNessuna valutazione finora

- Pi3505e PCL PJLDocumento8 paginePi3505e PCL PJLLaurianNessuna valutazione finora

- Ndl012 Pcldriver UmDocumento92 pagineNdl012 Pcldriver UmLaurianNessuna valutazione finora

- Utility: Operation Manual MenuDocumento1 paginaUtility: Operation Manual MenuLaurianNessuna valutazione finora

- Codigos Convolucionales-Carlos SanchezDocumento652 pagineCodigos Convolucionales-Carlos SanchezJulio Simisterra100% (1)

- ZongDocumento8 pagineZongAbdul KhaliqNessuna valutazione finora

- Network Sharing Overview ColeagoDocumento34 pagineNetwork Sharing Overview ColeagoXiaofei WangNessuna valutazione finora

- Mobile Services: Your Account SumjulyDocumento3 pagineMobile Services: Your Account SumjulyShúbhám ChoúnipurgéNessuna valutazione finora

- IOIP 9513332013 VoiceDocumento1 paginaIOIP 9513332013 Voiceyoyoyo opopopNessuna valutazione finora

- Wireless Line Summary For: 425-508-3983: Monthly Service ChargesDocumento229 pagineWireless Line Summary For: 425-508-3983: Monthly Service ChargesFinally Home RescueNessuna valutazione finora

- NGN 3 CamelDocumento47 pagineNGN 3 Camelvorlagenverstand7Nessuna valutazione finora

- 5891 14342821954Documento16 pagine5891 14342821954rachelj_85Nessuna valutazione finora

- CCX Whitepaper 09Documento7 pagineCCX Whitepaper 09chabacha2004Nessuna valutazione finora

- Mob Bill NovDocumento3 pagineMob Bill NovMMTNessuna valutazione finora

- Telecom Fraud-Introduction, Types, and Solutions-White Paper PDFDocumento15 pagineTelecom Fraud-Introduction, Types, and Solutions-White Paper PDFDilip ThummarNessuna valutazione finora

- Lenovo A7 30 A3300 ManualDocumento30 pagineLenovo A7 30 A3300 ManualGopinath RamalingamNessuna valutazione finora

- A Comparative Study of VoLTE Roaming ArchitecturesDocumento69 pagineA Comparative Study of VoLTE Roaming ArchitecturesSuswanthNessuna valutazione finora

- PDF RequiredDocumento3 paginePDF RequiredMANOJNessuna valutazione finora

- 4th Quarter Sector Performance Report FinalDocumento27 pagine4th Quarter Sector Performance Report FinalPulsmade MalawiNessuna valutazione finora

- Matrix Cellular International LTD - Project-FinalDocumento84 pagineMatrix Cellular International LTD - Project-FinalSANDEEP SINGH100% (3)

- FCCID - Io User Manual 2588124Documento64 pagineFCCID - Io User Manual 2588124John VerittasNessuna valutazione finora

- TD.57 v31.2Documento288 pagineTD.57 v31.2Jerrelyn SegayoNessuna valutazione finora

- Sprint BillDocumento42 pagineSprint BillMarshallLongNessuna valutazione finora

- Amaysim Price TableDocumento32 pagineAmaysim Price TableDarius ZhuNessuna valutazione finora

- Interconnect Billing ManualDocumento65 pagineInterconnect Billing ManualMuhammad NasirNessuna valutazione finora

- Sygic 13.1.0 User ManualDocumento43 pagineSygic 13.1.0 User ManualRennie ChinNessuna valutazione finora

- VF Con 072758Documento5 pagineVF Con 072758tasha berlinNessuna valutazione finora

- IR24Documento39 pagineIR24Riki ForuNessuna valutazione finora

- International RoamingDocumento68 pagineInternational RoamingramiNessuna valutazione finora

- Mks New PlanDocumento3 pagineMks New Planankurrpatil8683Nessuna valutazione finora

- CSFB ConceptsDocumento12 pagineCSFB Conceptsjitu_rfNessuna valutazione finora

- CapSettle NRTRDEDocumento4 pagineCapSettle NRTRDEMisha KornevNessuna valutazione finora

- Assignment On GrameenphoneDocumento46 pagineAssignment On GrameenphoneSaad CynosureNessuna valutazione finora

- BSNL Mobile Tariff Plans Revised DrasticallyDocumento2 pagineBSNL Mobile Tariff Plans Revised Drasticallycmv_vikkyNessuna valutazione finora