Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Investment Principle (Demo in EIU)

Caricato da

beautyrubbyCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Investment Principle (Demo in EIU)

Caricato da

beautyrubbyCopyright:

Formati disponibili

AGENDA

CAPITAL ALLOCATION

BETWEEN RISK AND RISK-

FREE ASSET

CAPITAL ALLOCATION

BETWEEN TWO RISKY

ASSETS

ASSET ALLOCATION

PROCESS OF CAPITAL ALLOCATION

RISK-FREE ASSET

PROPERTIES OF THE COMBINED PORTFOLIO

THE CAPITAL ALLOCATION LINE

OPTIMAL PORTFOLIO

CAPITAL ALLOCATION BETWEEN RISK

AND RISK-FREE ASSET

ASSET ALLOCATION

Capital allocation is the choice of the proportion

of portfolio.

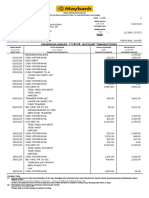

Example: You have $10,000 to invest. Following

your brokers recommendation you have the

risky asset P as 60% stock and as 40% bonds

(recall that even government bonds are risky,

unless held to maturity). When you choose y

(risky assets proportion) = 0.6, the combined

portfolio C is:

With y = 0.8, the combined portfolio C would be?

You make yourself to figure it out.

ASSET ALLOCATION

Examine risk/return tradeoff

Demonstrate how different degrees of risk aversion

will affect allocations between risky and risk free

asset.

Consider the optimal risky portfolio as given and

analyze the allocation decision between the risky

asset and the risk-free asset (T-bills)

Rate of return:

PROCESS OF CAPITAL ALLOCATION

Technically, the risk-free asset is default-free and

without inflation risk (a price-indexed default-free

bond)

In practice, Treasury bills come closest, because:

- Short term means little interest-rate or inflation risk

- Default risk is practically zero, since the government

would no default

RISK-FREE ASSET

PROPERTIES OF THE COMBINED PORTFOLIO

Notation:

rf = rate of return on the risk-free asset

rp = rate of return on the risky asset

rc = rate of return on the complete portfolio

(including both the risk-free asset and the risky

asset)

y = proportion of the investment budget to be placed

in the risky asset

p = standard deviation of the return on the risky

asset

c = standard deviation of the return on the complete

portfolio

Expect rate of return:

Variance:

Standard Deviation:

PROPERTIES OF THE COMBINED PORTFOLIO

Solve for y:

Replace the equation for the expected rate of

return:

This defines a line in the mean-variance space

the capital allocation line (CAL)

PROPERTIES OF THE COMBINED PORTFOLIO

The CAL gives the trade-off between risk and

return or the CAL describes all risk-return

combinations available to investor.

It allows to see what expected return on the

combined portfolio (E[Rc]) is attainable for a given

level of risk (c).

is the Reward-to-Variability ratio of P

is the risk premium on P

CAPITAL ALLOCATION LINE

CAPITAL ALLOCATION LINE

Example:

Rf = 7%

E (Rp) = 15%

p = 22%

Risk premium = 15% - 7% = 8%

Rate of return of portfolio:

Standard Deviation for portfolio:

CAPITAL ALLOCATION LINE

CAPITAL ALLOCATION LINE

We have shown how to develop the CAL, the graph

of all feasible riskreturn combinations available

from different asset allocation choices. The investor

confronting the CAL now must choose one optimal

portfolio, C, from the set of feasible choices.

Preview formula of Utility:

U = R(rc) 1/2A

where A is the coefficient of risk aversion and 1/2 is a

scale factor.

OPTIMAL PORTFOLIO

The investor attempts to maximize utility, U, by

choosing the best allocation to the risky asset, y.

We derive the formula:

the solution is given by the first-order constraint

solving for y gives the optimal choice of investment in

the risky portfolio

OPTIMAL PORTFOLIO

Going back to our previous example the optimal

ssolution for an investor with a coefficient of risk

aversion A = 4, 4 is:

n other words, this particular investor will invest

41% of the investment budget in the risky asset and

59% in the risk-free asset which Utility is

maximized.

Notice that 3.28/9.02 = .36, which is the reward-to-

variability ratio assumed for this problem.

OPTIMAL PORTFOLIO

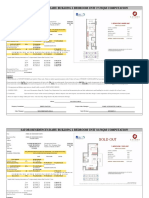

You manage a risky portfolio with an expected rate of return of 18% and a

standard deviation of 28%. The T-bill rate is 8%.

1. Your client chooses to invest 70% of a portfolio in your fund and 30% in a

T-bill money market fund. What is the expected value and standard

deviation of the rate of return on his portfolio?

2. Suppose that your risky portfolio includes the following investments in the

given proportions:

Stock A: 25%

Stock B: 32%

Stock C: 43%

What are the investment proportions of your clients overall portfolio,

including the position in T-bills?

3. Your clients degree of risk aversion is A = 3.5. What proportion, y, of the

total investment should be invested in your fund? What is the expected

value and standard deviation of the rate of return on your clients

optimized portfolio

PREVIEW EXERCISE

A PORTFOLIO WITH TWO RISKY ASSETS

OPTIMAL PORTFOLIO

CAPITAL ALLOCATION OF TWO RISKY

ASSETS

The Return of portfolio:

R1 is the return and w is the weight of asset 1

R2 is the return and (1-w) is the weight of asset 2

The weights of the portfolio sum to 1.

The variance of the portfolio:

A PORTFOLIO WITH TWO RISKY ASSETS

A PORTFOLIO WITH TWO RISKY ASSETS

Recalling that:

The variance of the return on a portfolio of two

risky assets can be expressed as a function of the

correlation coefficient:

There are 4 cases of correlation coefficient:

Perfect positive correlation

A PORTFOLIO WITH TWO RISKY ASSETS

Perfect negative correlation,

We make first order constraint, we conclude:

A PORTFOLIO WITH TWO RISKY ASSETS

No correlation,

A PORTFOLIO WITH TWO RISKY ASSETS

A PORTFOLIO WITH TWO RISKY ASSETS

THANKS

FOR

LISTENING

Potrebbero piacerti anche

- 336 Primary DataDocumento16 pagine336 Primary DatabeautyrubbyNessuna valutazione finora

- Quiz and ExerciseDocumento3 pagineQuiz and ExercisebeautyrubbyNessuna valutazione finora

- Research Skills One: Oh, No! Please, No! Not Statistics!!Documento37 pagineResearch Skills One: Oh, No! Please, No! Not Statistics!!beautyrubbyNessuna valutazione finora

- Assignment Briefing & Feedback Sheet: Yes NoDocumento6 pagineAssignment Briefing & Feedback Sheet: Yes NobeautyrubbyNessuna valutazione finora

- List All Activities in The Plan: Drawing A Critical Path Analysis ChartDocumento1 paginaList All Activities in The Plan: Drawing A Critical Path Analysis ChartbeautyrubbyNessuna valutazione finora

- Central Tendency and DispersionDocumento3 pagineCentral Tendency and DispersionbeautyrubbyNessuna valutazione finora

- Questionnaire Construction v2Documento2 pagineQuestionnaire Construction v2beautyrubbyNessuna valutazione finora

- Pearson Btec Level 4 HND Diploma in Business Unit 2 Managing Financial Resources and Decision Assignment 1Documento8 paginePearson Btec Level 4 HND Diploma in Business Unit 2 Managing Financial Resources and Decision Assignment 1beautyrubbyNessuna valutazione finora

- 4 DoctorateProgramformDocumento2 pagine4 DoctorateProgramformbeautyrubbyNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Gentjan Leshaj 59 Park Ridings London N8 0LB United Kingdom: Returns SlipDocumento1 paginaGentjan Leshaj 59 Park Ridings London N8 0LB United Kingdom: Returns SlipnderimNessuna valutazione finora

- Mastering Bitcoin 2Documento7 pagineMastering Bitcoin 2Arminder DhattNessuna valutazione finora

- Master Circular On Investments by Primary (Urban) Co-Operative BanksDocumento44 pagineMaster Circular On Investments by Primary (Urban) Co-Operative BanksNeo419Nessuna valutazione finora

- VisionandValues WellsFargoDocumento40 pagineVisionandValues WellsFargocebayotNessuna valutazione finora

- Mahusay Bsa-315major-Output-1Documento3 pagineMahusay Bsa-315major-Output-1Jeth MahusayNessuna valutazione finora

- No. 2010-20 July 2010: Receivables (Topic 310)Documento92 pagineNo. 2010-20 July 2010: Receivables (Topic 310)LexuzDyNessuna valutazione finora

- 1T6 S4hana2022 BPD en AeDocumento121 pagine1T6 S4hana2022 BPD en AeVinay KumarNessuna valutazione finora

- Credit Scoring Model For Smes in India: 1. Calculation of RatiosDocumento4 pagineCredit Scoring Model For Smes in India: 1. Calculation of RatiosKushal KapoorNessuna valutazione finora

- Banking CompaniesDocumento68 pagineBanking CompaniesKiran100% (2)

- PBB Short NotesDocumento47 paginePBB Short Notesstudy studyNessuna valutazione finora

- Uts Finance IvanDocumento28 pagineUts Finance IvanIvan ZackyNessuna valutazione finora

- Keuleneer Presentatie Waardebepaling NIVRADocumento8 pagineKeuleneer Presentatie Waardebepaling NIVRAnalar22Nessuna valutazione finora

- Do Soaring Price and Mounting Demand in Indian Gold Market Speak of A Paradox?Documento20 pagineDo Soaring Price and Mounting Demand in Indian Gold Market Speak of A Paradox?Suhaas SharmaNessuna valutazione finora

- Nolus PresentationDocumento10 pagineNolus PresentationDCMNessuna valutazione finora

- FX Forecast Update 190623Documento20 pagineFX Forecast Update 190623Ahmed AbedNessuna valutazione finora

- Frater UD - Money Magic PDFDocumento226 pagineFrater UD - Money Magic PDFultraljubicasti-186% (7)

- Law of Equi Marginal UtilityDocumento8 pagineLaw of Equi Marginal UtilityMunish Nagar50% (2)

- From Wikipedia, The Free Encyclopedia This Article Is About The Currency. For Other Uses, See - "EUR" Redirects Here. For Other Uses, SeeDocumento19 pagineFrom Wikipedia, The Free Encyclopedia This Article Is About The Currency. For Other Uses, See - "EUR" Redirects Here. For Other Uses, SeePrajwal AlvaNessuna valutazione finora

- Mohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)Documento39 pagineMohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)EVERYTHING FOOTBALLNessuna valutazione finora

- FI - Reading 44 - Fundamentals of Credit AnalysisDocumento42 pagineFI - Reading 44 - Fundamentals of Credit Analysisshaili shahNessuna valutazione finora

- (Nikolay TSD) LCBB4001 Accounting Fundamentals-A1Documento24 pagine(Nikolay TSD) LCBB4001 Accounting Fundamentals-A1munnaNessuna valutazione finora

- RA No. 11976 - Ease of Paying Taxes ActDocumento22 pagineRA No. 11976 - Ease of Paying Taxes ActAnostasia NemusNessuna valutazione finora

- Discount MarketDocumento13 pagineDiscount MarketAakanksha SanctisNessuna valutazione finora

- Midterm 3 AnswersDocumento7 pagineMidterm 3 AnswersDuc TranNessuna valutazione finora

- CIT v. Woodward Governor India (P.) Ltd.Documento28 pagineCIT v. Woodward Governor India (P.) Ltd.Saksham ShrivastavNessuna valutazione finora

- Accountancy Model Project - XiDocumento19 pagineAccountancy Model Project - XiHana KabeerNessuna valutazione finora

- 112380-237973 20190331 PDFDocumento5 pagine112380-237973 20190331 PDFKutty KausyNessuna valutazione finora

- Assignment Chapter 6Documento15 pagineAssignment Chapter 6Nicolas ErnestoNessuna valutazione finora

- Satori Residences Rahu Building Unit and Parking Slot Computation (February 2020 Reservations)Documento7 pagineSatori Residences Rahu Building Unit and Parking Slot Computation (February 2020 Reservations)Lem MikeeNessuna valutazione finora

- Perpetual Help: Calculate Future Value and Present Value of Money andDocumento8 paginePerpetual Help: Calculate Future Value and Present Value of Money andDennis AlbisoNessuna valutazione finora