Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Hubbard Efficiency and Market Failure

Caricato da

Syed Masroor Hussain ZaidiDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Hubbard Efficiency and Market Failure

Caricato da

Syed Masroor Hussain ZaidiCopyright:

Formati disponibili

PowerPoint

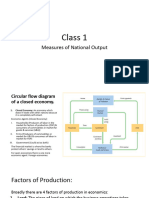

to accompany

Chapter 5

Economic

Efficiency and

Market Failure

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Learning Objectives

1. Understand the concepts of consumer

surplus and producer surplus.

2. Understand the concept of economic

efficiency, and use a graph to illustrate how

economic efficiency is reduced when a

market is not in competitive equilibrium.

3. Use demand and supply graphs to analyse

the economic impact of price ceilings and

price floors.

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Learning Objectives

4. Use demand and supply graphs to analyse

the economic impact of taxes.

5. Define positive and negative externalities

and identify examples of each.

6. Analyse government policies to achieve

economic efficiency in a market with

externalities.

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Should the government control

prices?

Many historical

buildings in the city of

Georgetown fell into

disrepair, with

economists placing the

blame on rent controls.

Price controls are still

common around the

globe, particularly in

labour, agricultural,

financial and property

markets.

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

LEARNING OBJECTIVE 1

Marginal benefit: The additional benefit

to a consumer from consuming one more

unit of a good or service.

Consumer surplus: The difference

between the highest price a consumer is

willing to pay and the price the consumer

actually pays.

Consumer Surplus and Producer

Surplus

Price

(dollars per

cup)

Quantity (cups

per week)

0

4

The demand curve is also the marginal benefit

curve: Figure 5.1

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Demand

$7.00

$3.00

5

Joes marginal

benefit from

consuming the

fourth cup is

$3.00.

$2.00

Joes marginal

benefit from

consuming the

fifth cup is $2.00.

Price

(dollars per

cup)

Quantity (cups

per week)

0

Total consumer surplus in the market for chai

tea: Figure 5.2

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Demand

15 000

$2.00

Total consumer

surplus in the market

for chai tea

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

The Consumer Surplus from

Satellite Television

How much

consumer surplus

will the owner of

this satellite dish

receive?

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

LEARNING OBJECTIVE 1

Marginal cost: The additional cost to a

firm from producing one more unit of a

good or service.

Producer surplus: The difference

between the lowest price a firm would

have been willing to accept and the price

it actually receives.

Consumer Surplus and Producer

Surplus

Price

(dollars per

cup)

Quantity (cups

per week)

0

40

The supply curve shows marginal cost:

Figure 5.3a

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Supply

$1.80

50

The marginal cost

of producing the

40

th

cup is $1.80.

$2.00

The marginal cost

of producing the

50

th

cup is $2.00.

Producer surplus on the

40

th

cup sold.

Price

(dollars per

cup)

Quantity (cups

per week)

0

Total producer surplus in the market for chai

tea: Figure 5.3b

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

15 000

$2.00

Total producer

surplus from selling

chai tea

Supply

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Consumer surplus measures the net benefit

(total benefit minus total price paid) to

consumers from participating in a market.

Producer surplus measures the net benefit

(total benefit minus total cost of production)

to producers from participating in a market.

LEARNING OBJECTIVE 1

What Consumer Surplus and

Producer Surplus Measure?

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

LEARNING OBJECTIVE 2

Equilibrium in a competitive market results in

the economically efficient level of output

where marginal benefit equals marginal cost.

Economic surplus: The sum of consumer

surplus and producer surplus.

Deadweight loss: The reduction in

economic surplus resulting from a market not

being in competitive equilibrium.

The Efficiency of Competitive

Markets

Price (dollars

per cup)

Quantity (cups

per week)

0

14 000

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Supply

$1.80

16 000

Both marginal benefit

and marginal cost =

$2.00, which means

an economically

efficient output level.

$2.20

Marginal benefit = $2.20,

marginal cost = $1.80,

therefore output is

inefficiently low.

Marginal benefit equals marginal cost only at

competitive equilibrium: Figure 5.4

15 000

$2.00

Demand

Marginal benefit = $1.80,

marginal cost = $2.20,

therefore output is

inefficiently high.

Price

(dollars per

cup)

Quantity (cups

per week)

0

Economic surplus equals the sum of consumer

surplus and producer surplus: Figure 5.5

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Demand

15 000

$2.00

Consumer

surplus

Supply

Producer

surplus

Deadweight loss: Figure 5.6

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Economic efficiency: A market outcome in

which the marginal benefit to consumers of

the last unit consumed is equal to its

marginal cost of production, and where the

sum of consumer surplus and producer

surplus is at a maximum.

Equilibrium in a competitive market results in

the greatest amount of economic surplus, or

total net benefit to society, from the

production of a good or service.

LEARNING OBJECTIVE 2

The Efficiency of Competitive

Markets

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Price floor: A legally determined

minimum price that sellers may receive.

Price ceiling: A legally determined

maximum price that sellers may receive.

LEARNING OBJECTIVE 3

Government intervention in the

market

B

A

C

0

$3.00

$3.50

S

D

Surplus

wheat

Price Floor: Figure 5.7

Price

(dollars per

bushel)

Quantity (billions of

bushels per year)

2.0 1.8 2.2

Consumer surplus

transferred to producers

Deadweight loss

= B + C

Price floor

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

B

C

A

0

S

D

$1000

Price Ceiling: Figure 5.8

Price

(dollars per

month)

Quantity

(apartments per

month)

$1500

1 900 000 2 000 000 2 100 000

Deadweight loss

= B + C

Producer surplus

transferred from

landlords to renters

Shortage of

apartments

Rent control

price ceiling

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Price Floors in Labour

Markets: The Minimum Wage

Some economists

believe there are better

policies than the

minimum wage for

raising the incomes of

low-skilled workers.

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Black markets: Buying and selling at

prices that violate government price

regulations.

When the government imposes price

floors or price ceilings, three important

effects occur:

Some people win.

Some people lose.

There is a loss of economic efficiency,

which is often very large.

LEARNING OBJECTIVE 3

Price floors and price ceilings

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Positive and Normative Analysis of Price

Ceilings and Price Floors

Whether rent controls are desirable or

undesirable is a normative question.

Whether the gains to the winners more than

compensate the losses to the losers and the

decline in economic efficiency is a matter of

judgment and not strictly an economic

question.

LEARNING OBJECTIVE 3

Price floors and price ceilings

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Taxes finance government activities.

Taxes on goods and services affect

market equilibrium and result in a decline

in economic efficiency.

Taxes reduce consumer surplus and

reduce producer surplus and result in a

deadweight loss.

Taxes reduce the production of goods

and services.

LEARNING OBJECTIVE 4

The economic impact of taxes

Price

(dollars per

pack)

Quantity of cigarettes

(billions of packets

per year)

0

4

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

2.00

S

1

Demand

$1.00 per pack federal

tax on cigarettes shifts

the supply curve up by

$1.00.

$2.90

3.7

S

2

Deadweight loss

or excess burden

from tax

Price

received by

producers

after paying

the tax

The effect of a tax on the market for

cigarettes: Figure 5.9

1.90

Price the

consumers

pay after the

$1.00 tax is

imposed

Tax

revenue

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

LEARNING OBJECTIVE 4

Tax incidence: The actual division of

the burden of a tax between buyers

and sellers in a market.

Who Actually Pays a Tax? The answer

depends on:

Slope of the demand curve and the

price elasticity of demand.

Slope of the supply curve and the

price elasticity of supply.

The Economic Impact of Taxes

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Does it matter who has a legal

responsibility to pay the tax?

No, the incidence of the tax does not

depend on whether a tax is collected from

the buyers of the good or from the sellers.

LEARNING OBJECTIVE 4

The Economic Impact of

Taxes

The incidence of a tax on petrol: Figure 5.10

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

The incidence of a tax on petrol paid by

buyers: Figure 5.11

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Do consumers receive the entire

benefit of a sales tax reduction?

The Hon Dr Brendan Nelson MP, a former Leader of

the Opposition, in his interview on 20th May 2008

made the following statement: We will take five cents

a litre off the excise. So every single day when you fill

up your car, whatever that price, itll be five cents a

litre cheaper than it would otherwise be

1

.

Briefly explain whether you agree with the statement.

Illustrate your answer with the graph.

1

http://www.liberal.org.au/info/news/detail/20080520_NelsonDoorstop2008Budgetcutinpetrolexcise.php

LEARNING OBJECTIVE 4

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Solving the problem:

STEP 1: Review the section Tax incidence: Who actually pays

tax?, which begins on page 144.

STEP 2: Draw a graph like the one in Figure 5.10 to illustrate

the circumstances when consumers will receive the entire

benefit of a reduction in a sales tax.

STEP 3: Use the graph to evaluate the statement.

This statement is only correct if the demand curve is a vertical

line (perfectly inelastic). Although inelastic, demand curve for

petrol is not perfectly inelastic, therefore the statement is

unlikely to be true. The petrol price is likely to decrease by less

than 5 cents.

LEARNING OBJECTIVE 4

LEARNING OBJECTIVE 4

Price

(dollars

per litre)

0 19

$1.50

$1.45

D

S

1

S

2

Quantity (billions of

litres per year)

5 cents per litre

excise reduction

shifts the supply

curve down

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Externalities and Efficiency

Externality: A benefit or cost that affects

someone who is not directly involved in the

production or consumption of a good or service.

Private cost: The cost borne by the producer of a

good or service.

Social cost: The total cost of producing a good,

including both the private cost and any external cost.

Private benefit: The benefit received by the

consumer of a good or service.

Social benefit: The total benefit from consuming a

good, including both the private benefit and any

external benefit.

LEARNING OBJECTIVE 5

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Command and control versus market-

based approaches

Command and control approach: Government-

imposed quantitative limits on the amount of

pollution firms are allowed to generate, or

government-required installation by firms of

specific pollution control devices.

LEARNING OBJECTIVE 6

Government Solutions to

Externalities

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Market-based approaches

Tradeable emissions allowances: The

government can issue a fixed quantity of

emission allowances, which can then be

bought and sold in the market.

Rewards firms who reduce emissions, as they can

sell their allowances

Penalises firms with high emissions, as they must

buy more emission allowances.

LEARNING OBJECTIVE 6

Government Solutions to

Externalities

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Pigovian taxes and subsidies:

Government taxes and subsidies intended

to bring about an efficient level of output in

the presence of externalities.

A tax on production equal to the cost of the

externality to internalise a negative externality.

A subsidy to consumers equal to the value of

the positive externality, that is, equal to the

external benefit.

LEARNING OBJECTIVE 6

Government Solutions to

Externalities

Price of

electricity

Quantity of electricity

0

Q1

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

P1

S

1

= private

cost before

tax

When there is a negative externality, a tax can bring

about the efficient level of output: Figure 5.12

Demand

Cost of pollution =

amount of tax imposed

by government

P2

Q2

S

2

= social cost

and private cost

after tax

Market

equilibrium

without tax

Market

equilibrium

with tax

Price of

university

education

Quantity of university

education

0

Q1

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

P1

Supply

Positive externality =

amount of subsidy

Market equilibrium

with subsidy =

efficient equilibrium

Market

equilibrium

without

subsidy

D

2 =

social benefit

and private benefit

after subsidy

P2

Q2

When there is a positive externality, a subsidy can

bring about the efficient level of output: Figure 5.13

D

1 =

private benefit

before subsidy

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

An Inside Look

Reform on the way for EU agriculture

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

An Inside Look

Figure 1: The excess supply of food is sold on world

markets and causes the world supply of food to shift to

the right.

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

An Inside Look

Figure 2: The imposition of a floor price in the

European market for food causes an increase in price

and excess supply of food.

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Black market

Command and control

approach

Consumer surplus

Deadweight loss

Economic efficiency

Economic surplus

Externality

Marginal benefit

Marginal cost

Market failure

Pigovian taxes and

subsidies

Price ceiling

Price floor

Private benefit

Private cost

Producer surplus

Social benefit

Social costs

Tax incidence

Key Terms

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

In April 2007, the European Union imposed a

five-year minimum price on Chinese frozen

strawberries with the aim of protecting its

farmers.

Identify the possible outcomes of this

regulation.

Do you think the benefits of such a policy

outweigh the costs?

Get Thinking!

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Q1. Refer to the figure below. The graph shows an

individuals demand curve for tea. At a price of two

dollars, the consumer is willing to buy five cups of tea

per week. More precisely, what does this mean?

a. It means that marginal benefit equals marginal

cost when five cups are consumed.

b. It means that the total cost of

consuming five cups is $2.00.

c. It means that the marginal cost

of producing five cups is $2.00.

d. It means that the marginal

benefit of consuming the fifth cup is $2.00.

Check Your Knowledge

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Check Your Knowledge

Q1. Refer to the figure below. The graph shows an

individuals demand curve for tea. At a price of two

dollars, the consumer is willing to buy five cups of tea

per week. More precisely, what does this mean?

a. It means that marginal benefit equals marginal

cost when five cups are consumed.

b. It means that the total cost of

consuming five cups is $2.00.

c. It means that the marginal cost

of producing five cups is $2.00.

d. It means that the marginal

benefit of consuming the fifth cup is $2.00.

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Q2. If the average price that cable subscribers

are willing to pay for cable television is

$208, but the actual price they pay is $81,

how much is consumer surplus per

subscriber?

a. $208 + $81.

b. $208 $81.

c. $81 + $127.

d. $81.

Check Your Knowledge

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Q2. If the average price that cable subscribers

are willing to pay for cable television is

$208, but the actual price they pay is $81,

how much is consumer surplus per

subscriber?

a. $208 + $81.

b. $208 $81.

c. $81 + $127.

d. $81.

Check Your Knowledge

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Q3.Refer to the graph below. To achieve economic

efficiency, which output level should be produced?

a. 14 000 cups per month, because at this level of output,

marginal benefit is greater than marginal cost.

b. 15 000 cups per month, because at this level of output,

marginal benefit is equal to marginal cost.

c. 16 000 cups per month,

because at this level of

output, marginal benefit is

less than marginal cost.

d. Any of the output

levels above is efficient.

Check Your Knowledge

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Check Your Knowledge

Q3. Refer to the graph below. To achieve economic

efficiency, which output level should be produced?

a. 14,000 cups per month, because at this level of output,

marginal benefit is greater than marginal cost.

b. 15,000 cups per month, because at this level of output,

marginal benefit is equal to marginal cost.

c. 16 000 cups per month,

because at this level of

output, marginal benefit is

less than marginal cost.

d. Any of the output

levels above is efficient.

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Q4. Refer to the graph below. According to this graph,

the existence of a minimum wage in the market for

low-skilled workers results in:

a. An increase in wages and employment.

b. An increase in wages but lower employment.

c. A decrease in wages

but higher employment.

d. A decrease in wages

and employment.

Check Your Knowledge

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Q4. Refer to the graph below. According to this graph,

the existence of a minimum wage in the market for

low-skilled workers results in:

a. An increase in wages and employment.

b. An increase in wages but lower employment.

c. A decrease in wages

but higher employment.

d. A decrease in wages

and employment.

Check Your Knowledge

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Check Your Knowledge

Q5. After a Pigovian tax that represented the cost of

the negative externality was put on producers,

which point would best represent market

equilibrium?

a. Point A.

b. Point B.

c. Point C.

d. None of

the above.

Hubbard, Garnett, Lewis and OBrien: Essentials of Economics 2010 Pearson Australia

Check Your Knowledge

Q5. After a Pigovian tax that represented the cost of

the negative externality was put on producers,

which point would best represent market

equilibrium?

a. Point A.

b. Point B.

c. Point C.

d. None of

the above.

Potrebbero piacerti anche

- Macroeconomics Theories and Policies 10th Edition Froyen 013283152X Solution ManualDocumento6 pagineMacroeconomics Theories and Policies 10th Edition Froyen 013283152X Solution Manualkelly100% (23)

- Disaster Recovery Policy v1.0Documento4 pagineDisaster Recovery Policy v1.0CSKNessuna valutazione finora

- Macroeconomics Theories and Policies 10th Edition Froyen Solutions ManualDocumento35 pagineMacroeconomics Theories and Policies 10th Edition Froyen Solutions Manualpearlgregoryspx100% (28)

- The Bloody Pulps: Nostalgia by CHARLES BEAUMONTDocumento10 pagineThe Bloody Pulps: Nostalgia by CHARLES BEAUMONTGiles MetcalfeNessuna valutazione finora

- Dwnload Full Macroeconomics Theories and Policies 10th Edition Froyen Solutions Manual PDFDocumento13 pagineDwnload Full Macroeconomics Theories and Policies 10th Edition Froyen Solutions Manual PDFprunellamarsingillus100% (10)

- 4 Efficiency, Price Controls & TaxesDocumento15 pagine4 Efficiency, Price Controls & Taxesdeeptitripathi09Nessuna valutazione finora

- Ch10solution ManualDocumento31 pagineCh10solution ManualJyunde WuNessuna valutazione finora

- Stockholders of F. Guanzon v. RDDocumento1 paginaStockholders of F. Guanzon v. RDJL A H-Dimaculangan0% (1)

- Ch10solution ManualDocumento31 pagineCh10solution ManualStoneCold Alex Mochan100% (5)

- Macroeconomics Theories and Policies 10th Edition Froyen Solutions ManualDocumento5 pagineMacroeconomics Theories and Policies 10th Edition Froyen Solutions ManualKaylaHowardxarcs100% (7)

- Overview and Key Concepts: ECON 2123: MacroeconomicsDocumento36 pagineOverview and Key Concepts: ECON 2123: MacroeconomicskatecwsNessuna valutazione finora

- KWe3 Micro ch4 6Documento45 pagineKWe3 Micro ch4 6Ahmed MahmoudNessuna valutazione finora

- 1 - Golden Bridge Investment (Z) LTD - EpbDocumento90 pagine1 - Golden Bridge Investment (Z) LTD - EpbMoses ziyayeNessuna valutazione finora

- Planning Theory PPT (Impediments To Public Participation)Documento16 paginePlanning Theory PPT (Impediments To Public Participation)Sanjay KumarNessuna valutazione finora

- Hubbard GDP Income and GrowthDocumento75 pagineHubbard GDP Income and GrowthGoergia PessoNessuna valutazione finora

- Managerial EconomicsDocumento6 pagineManagerial EconomicsMilan Shah100% (1)

- 04 - EconomicsDocumento55 pagine04 - EconomicsCelianNessuna valutazione finora

- f0567816 CH 4 IMDocumento7 paginef0567816 CH 4 IMkasim224Nessuna valutazione finora

- IntRetail Theory2Documento49 pagineIntRetail Theory2ellisj152Nessuna valutazione finora

- Ecs2602 Tut.102.2015Documento144 pagineEcs2602 Tut.102.2015YOLANDANessuna valutazione finora

- Chapter 8 PowerPointDocumento48 pagineChapter 8 PowerPointabdulbasitabdulazeez30Nessuna valutazione finora

- Economics F1Documento72 pagineEconomics F1amir0% (1)

- Ans 7Documento8 pagineAns 7Karen Labasan100% (1)

- Class 1 National OutputDocumento14 pagineClass 1 National Outputsafin0012Nessuna valutazione finora

- Macroeconomics: Lecture 3:GDP, Variants of GDP and It Limitations To Assessing WelfareDocumento19 pagineMacroeconomics: Lecture 3:GDP, Variants of GDP and It Limitations To Assessing WelfareLois GrahamNessuna valutazione finora

- Solution Manual For Macroeconomics Theories and Policies 10Th Edition Froyen 013283152X 9780132831529 Full Chapter PDFDocumento27 pagineSolution Manual For Macroeconomics Theories and Policies 10Th Edition Froyen 013283152X 9780132831529 Full Chapter PDFarlie.nix812100% (14)

- Lecture 7 10 - 20Documento23 pagineLecture 7 10 - 20ChristopherNessuna valutazione finora

- WhichDocumento17 pagineWhichanhtran.31231021988Nessuna valutazione finora

- Quest International University PerakDocumento6 pagineQuest International University PerakMalathi SundrasaigaranNessuna valutazione finora

- Macroeconomics-Lecture Slides PDFDocumento142 pagineMacroeconomics-Lecture Slides PDFAbhishekNessuna valutazione finora

- Sample SBADocumento8 pagineSample SBASharona jackNessuna valutazione finora

- Nội Dung Ôn Tập KTQT EDocumento22 pagineNội Dung Ôn Tập KTQT EĐoàn Phương AnhNessuna valutazione finora

- Managerial Economics - Subsidy Impact and Deadweight LossDocumento6 pagineManagerial Economics - Subsidy Impact and Deadweight LossNsh JshNessuna valutazione finora

- Measuring The Cost of LivingDocumento47 pagineMeasuring The Cost of LivingDillYoungNessuna valutazione finora

- Lec-3 - Chapter 24 - Cost of LivingDocumento47 pagineLec-3 - Chapter 24 - Cost of LivingMsKhan0078Nessuna valutazione finora

- Barro Macroeconomics Chapter 2 National Income Accounting DFDocumento5 pagineBarro Macroeconomics Chapter 2 National Income Accounting DF123kkdkdkdkddkkNessuna valutazione finora

- Ec103 Week 01 s14Documento32 pagineEc103 Week 01 s14юрий локтионовNessuna valutazione finora

- Class 1 National OutputDocumento14 pagineClass 1 National OutputArefin SheikhNessuna valutazione finora

- Chapter 4Documento17 pagineChapter 4davis946Nessuna valutazione finora

- Analyzing Gains and Losses from Government Policies Using Consumer and Producer SurplusDocumento29 pagineAnalyzing Gains and Losses from Government Policies Using Consumer and Producer SurplusCristina Cascón MartínNessuna valutazione finora

- Economics of Consumer Behaviour: DR.C S ShylajanDocumento52 pagineEconomics of Consumer Behaviour: DR.C S ShylajanShifa SharmaNessuna valutazione finora

- Joint GreenDocumento9 pagineJoint GreensurjeetsNessuna valutazione finora

- Econ6049 Economic Analysis, S1 2021: Week 6: Unit 8 - Supply and Demand: Price-Taking and Competitive Markets (Part II)Documento31 pagineEcon6049 Economic Analysis, S1 2021: Week 6: Unit 8 - Supply and Demand: Price-Taking and Competitive Markets (Part II)Tom WongNessuna valutazione finora

- Economics Paper 3Documento396 pagineEconomics Paper 3shanky631Nessuna valutazione finora

- ME Problem Set-5Documento6 pagineME Problem Set-5Akash DeepNessuna valutazione finora

- 09Documento25 pagine09Himanshu JainNessuna valutazione finora

- Introduction to TaxationDocumento52 pagineIntroduction to TaxationSteveNessuna valutazione finora

- Commonwealth Executive Masters in Business Administration / Public AdministrationDocumento45 pagineCommonwealth Executive Masters in Business Administration / Public Administrationnanapet80Nessuna valutazione finora

- Macro I: Introduction To Macroeconomics: The Scope and Method of EconomicsDocumento62 pagineMacro I: Introduction To Macroeconomics: The Scope and Method of EconomicsJames HNessuna valutazione finora

- Taxation Efficiency and International TradeDocumento14 pagineTaxation Efficiency and International TradeSamia Irshad ullahNessuna valutazione finora

- CH 20 AP EconDocumento28 pagineCH 20 AP Econvictor_wang_54Nessuna valutazione finora

- ECONOMICS OF Consumer-BehaviorDocumento54 pagineECONOMICS OF Consumer-BehaviorBismillah_22Nessuna valutazione finora

- Chapter 10Documento5 pagineChapter 10rebekaahhNessuna valutazione finora

- Government Intervention in The MarketDocumento12 pagineGovernment Intervention in The MarketAkshay LalwaniNessuna valutazione finora

- A Lev Econ 01Documento11 pagineA Lev Econ 01maailaaNessuna valutazione finora

- Principles of Economics 5Th Edition Mankiw Solutions Manual Full Chapter PDFDocumento40 paginePrinciples of Economics 5Th Edition Mankiw Solutions Manual Full Chapter PDFmohurrum.ginkgo.iabwuz100% (7)

- Notes On Principles of Macroeconomics: X Year Base in Basket Market of Cost T Year in Basket Market of Cost PIDocumento5 pagineNotes On Principles of Macroeconomics: X Year Base in Basket Market of Cost T Year in Basket Market of Cost PIRamanatharshanan ArasanayagamNessuna valutazione finora

- Econ CH02Documento27 pagineEcon CH02Yixing ZhangNessuna valutazione finora

- Supply Side Policies: The Influence of Monetary and Fiscal Policy on Aggregate SupplyDocumento29 pagineSupply Side Policies: The Influence of Monetary and Fiscal Policy on Aggregate SupplyAnaNessuna valutazione finora

- Principles of Economics: Global EditionDocumento45 paginePrinciples of Economics: Global EditionErsin TukenmezNessuna valutazione finora

- Macro Unit 2 6EC02 Revision Notes 2011Documento58 pagineMacro Unit 2 6EC02 Revision Notes 2011TheMagicCarpetNessuna valutazione finora

- Econ 2010 Final Essay QuestionsDocumento6 pagineEcon 2010 Final Essay QuestionsBrandon Lehr0% (1)

- Chapter 2Documento45 pagineChapter 2AnonymousNessuna valutazione finora

- How Price Controls Distort MarketsDocumento47 pagineHow Price Controls Distort MarketsKhoaNessuna valutazione finora

- Cost of Doing Business Study, 2012 EditionDa EverandCost of Doing Business Study, 2012 EditionNessuna valutazione finora

- Subject BibliographyDocumento2 pagineSubject BibliographySyed Masroor Hussain ZaidiNessuna valutazione finora

- Estimation of The Black Economy of Pakistan Through The Monetary ApproachDocumento17 pagineEstimation of The Black Economy of Pakistan Through The Monetary ApproachSyed Masroor Hussain ZaidiNessuna valutazione finora

- Nhancing Esearch Kills: Pre-Tea SessionDocumento1 paginaNhancing Esearch Kills: Pre-Tea SessionSyed Masroor Hussain ZaidiNessuna valutazione finora

- Nhancing Esearch Kills: Pre-Tea SessionDocumento1 paginaNhancing Esearch Kills: Pre-Tea SessionSyed Masroor Hussain ZaidiNessuna valutazione finora

- Green Revolution and Land ReformsDocumento30 pagineGreen Revolution and Land ReformsSyed Masroor Hussain Zaidi67% (9)

- Ch04 Resources, Comparative Advantage, and Income DistributionDocumento43 pagineCh04 Resources, Comparative Advantage, and Income DistributionSyed Masroor Hussain ZaidiNessuna valutazione finora

- Cobb DouglasDocumento7 pagineCobb DouglasSyed Masroor Hussain ZaidiNessuna valutazione finora

- Stats Final ReportDocumento18 pagineStats Final ReportSyed Masroor Hussain ZaidiNessuna valutazione finora

- NICDocumento9 pagineNICSyed Masroor Hussain ZaidiNessuna valutazione finora

- Lecture1 (A) - What Is EconomicsDocumento41 pagineLecture1 (A) - What Is EconomicsSyed Masroor Hussain ZaidiNessuna valutazione finora

- 52 63Documento12 pagine52 63Syed Masroor Hussain ZaidiNessuna valutazione finora

- Who Is The Ultimate LooserDocumento2 pagineWho Is The Ultimate LooserSyed Masroor Hussain ZaidiNessuna valutazione finora

- Adr Assignment 2021 DRAFTDocumento6 pagineAdr Assignment 2021 DRAFTShailendraNessuna valutazione finora

- Pokemon Evolution Stages GuideDocumento9 paginePokemon Evolution Stages GuideOsvaldo BevilacquaNessuna valutazione finora

- Endorsement Letter From The Head of InstitutionDocumento2 pagineEndorsement Letter From The Head of InstitutionkavinNessuna valutazione finora

- Crla 4 Difficult SitDocumento2 pagineCrla 4 Difficult Sitapi-242596953Nessuna valutazione finora

- Crimes and Civil Wrongs: Wrong Adjetivo X Substantivo (Legal English) Right Adjetivo X Substantivo (Legal English)Documento10 pagineCrimes and Civil Wrongs: Wrong Adjetivo X Substantivo (Legal English) Right Adjetivo X Substantivo (Legal English)mraroNessuna valutazione finora

- NewsRecord15 01 28Documento12 pagineNewsRecord15 01 28Kristina HicksNessuna valutazione finora

- SBPD Discipline MatrixDocumento8 pagineSBPD Discipline MatrixLeah MoreauNessuna valutazione finora

- Answers: Unit 5 A Place To Call HomeDocumento1 paginaAnswers: Unit 5 A Place To Call HomeMr Ling Tuition CentreNessuna valutazione finora

- Common University Entrance Test - WikipediaDocumento17 pagineCommon University Entrance Test - WikipediaAmitesh Tejaswi (B.A. LLB 16)Nessuna valutazione finora

- Application Form AYCDocumento2 pagineApplication Form AYCtriutamiNessuna valutazione finora

- Black PoodleDocumento13 pagineBlack Poodledianaioana19870% (1)

- Company Profile: "Client's Success, Support and Customer Service Excellence Is Philosophy of Our Company"Documento4 pagineCompany Profile: "Client's Success, Support and Customer Service Excellence Is Philosophy of Our Company"Sheraz S. AwanNessuna valutazione finora

- Independence of Costa RicaDocumento2 pagineIndependence of Costa Ricaangelica ruizNessuna valutazione finora

- Codex Alimentarius Commission: Procedural ManualDocumento258 pagineCodex Alimentarius Commission: Procedural ManualRoxanaNessuna valutazione finora

- If You're Ugly, the Blackpill is Born with YouDocumento39 pagineIf You're Ugly, the Blackpill is Born with YouAndrés AcevedoNessuna valutazione finora

- UBLDocumento38 pagineUBLMuhammad Shahroz KafeelNessuna valutazione finora

- Freelance Digital Marketer in Calicut - 2024Documento11 pagineFreelance Digital Marketer in Calicut - 2024muhammed.mohd2222Nessuna valutazione finora

- A BrewpubDocumento3 pagineA Brewpubjhanzab50% (4)

- Scenario - River Spray Company Was Organized To Gro...Documento5 pagineScenario - River Spray Company Was Organized To Gro...Ameer Hamza0% (1)

- English Q3 Week 3 BDocumento3 pagineEnglish Q3 Week 3 BBeverly SisonNessuna valutazione finora

- Clinical Oral Medicine Lecture NotesDocumento3 pagineClinical Oral Medicine Lecture NotesDrMurali G ManoharanNessuna valutazione finora

- North Carolina Wing - Jul 2011Documento22 pagineNorth Carolina Wing - Jul 2011CAP History LibraryNessuna valutazione finora

- PrideDocumento4 paginePrideKedar DesaiNessuna valutazione finora

- 109 Eradication and Control Programs Guinea Worm FINALDocumento53 pagine109 Eradication and Control Programs Guinea Worm FINALFebri Yudha Adhi Kurniawan100% (1)

- Rights and Welfare for Philippine Native Dogs (AspinDocumento15 pagineRights and Welfare for Philippine Native Dogs (AspinJenilyn ZapantaNessuna valutazione finora