Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Concepts, Classifications, Accumulation: Cost in Managerial Accounting

Caricato da

Angel Sacpa Paulino0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

100 visualizzazioni29 pagineMonetary measure of amount of resources given up or used for some purposes. The monetary value of goods and services expended to obtain current or future benefits. Cost pool - grouping of individual cost items; an account in which a variety of similar costs are accumulated.

Descrizione originale:

Titolo originale

ccccccccccccc.pptx

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoMonetary measure of amount of resources given up or used for some purposes. The monetary value of goods and services expended to obtain current or future benefits. Cost pool - grouping of individual cost items; an account in which a variety of similar costs are accumulated.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

100 visualizzazioni29 pagineConcepts, Classifications, Accumulation: Cost in Managerial Accounting

Caricato da

Angel Sacpa PaulinoMonetary measure of amount of resources given up or used for some purposes. The monetary value of goods and services expended to obtain current or future benefits. Cost pool - grouping of individual cost items; an account in which a variety of similar costs are accumulated.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 29

CHAPTER 4:

COST IN MANAGERIAL ACCOUNTING :

Concepts, Classifications, Accumulation

Presented by : Angel Sacpa Paulino

Presented to : Maam Glyn Fabros

COST

the monetary measure of the amount of

resources given up or used for some

purposes.

the monetary value of goods and services

expended to obtain current or future

benefits.

Cost

object

- anything for which cost is computed.

- ex: a product, product line, segment of the organization

Cost driver - any variable, such as a level of activity or

volume that usually affects costs over a

period of time.

- ex: production, sales, number of hours

Cost pool - a grouping of individual cost items; an

account in which a variety of similar

costs are accumulated.

- ex: work in process, factory overhead control

Activity - an event, action, transaction, task, or unit

of work with a specified purpose.

are necessary (non-eliminable) to produce the product.

ex: assembling the different component parts of the product.

that do not make the product or service more valuable to

the customer.

ex: moving materials and equipment parts from/to the stockroom or a

workstation

Value-adding activities

Non-value-adding activities

Contd

DIFFERENT COSTS FOR DIFFERENT PURPOSES

1. Product costs incurred to manufacture the product.

Units sold during the period are recognized as

expense in the income statement.

Unsold units become the costs of inventory and

treated as asset in balance sheet.

2. Period costs the non-manufacturing costs that include

selling, administrative, and research and development

costs.

A. as to type:

1. Manufacturing costs all costs incurred in the factory to

convert raw materials into finished goods.

a. Direct manufacturing costs

b. Indirect manufacturing costs

2. Non-manufacturing cost all costs which are not

incurred in transforming materials to finished goods.

a. Research and development

b. Marketing costs

c. Distribution costs

d. Selling costs

e. After-sales costs

f. General and administrative costs

B. as to function:

1. Direct costs are related to particular cost object and

can economically and effectively be traced to that

cost object.

2. Indirect costs are related to a cost object, but

cannot practically, economically, and effectively

be traced to such cost object. Cost assignment is

done by allocating the indirect cost to the related

cost objects.

C. as to traceability/assignment to cost object

1. Relevant costs future cost that will differ under

alternative courses of action.

2. Differential costs difference in costs between any two

alternative courses of action.

a. Incremental cost increase in cost

b. Decremental cost decrease in cost

3. Opportunity costs income or benefit given up when

one alternative is selected over another.

4. Sunk/past or historical costs already incurred and

cannot be changed by any decision made now or to

be made in the future.

D. for decision-making

E. as to behavior (reaction to changes in cost driver)

1. Variable cost the total amount varies directly to the change

in activity level o cost driver, and the per unit amount is

constant.

2. Fixed cost the total amount remains unchanged, and the

per-unit amount varies inversely or indirectly with the change

in the cost driver.

Committed fixed costs long term in nature and cannot be eliminated

even for a short period of time.

Discretionary or managed fixed costs usually arise from periodic

decisions by management.

3. Mixed cost this cost has both a variable and a fixed

component.

4. Step cost when activity changes, a step cost shifts upward

or downward b a certain interval or step.

Relevant range activity that reflects the companys

normal operating range. Within this relevant range, the

aforementioned cost behavior is valid, i. e.:

Total amount Per cost driver

Variable cost Varies directly w/

cost driver

Constant

Fixed cost Constant Varies inversely

w/ cost driver

ANALYSIS OF MIXED COST

Mixed cost or total cost - variable and fixed cost components.

Total variable cost varies directly with the activity level

or cost driver.

TC = FC + VC

VC = variable cost per cost driver x cost driver or VC = bx

ex : if the cost driver is number of units and variable cost per

unit is P5, then VC = 5x

The total or mixed cost function ,ay expressed as:

TC = FC + bx

Linearity assumption within the relevant range, there

is a strict linear relationship between the cost and

cost driver. Cost shown graphically as straight lines.

The cost function since total cost is linearly related to the

activity level or cost driver, the cost function (cost formula)

may be expressed as:

Y = a + bx

where: Y = total cost

a = total fixed cost

b = variable cost per cost drive

x = activity level or cost driver

SEPARATION OF THE FIXED AND VARIABLE COMPONENTS OF

MIXED COST

1. High-low method

2. Scattergraph method

3. Least squares regression method

Multiple-regression analysis used when the dependent

variable is caused by more than one factor. In

other words, the dependent variable is related to

more than one independent variable.

CORRELATION ANALYSIS

Correlation measure of the co-variation between the

dependent and independent variables.

If all plotted points fall on the regression line, there is

perfect correlation.

If correlation between the cost and cost driver is high and

the past relationship between such variables will continue

in the future, then the cost driver chosen will be useful for

predicting future levels of the costs being analyzed.

Coefficient of correlation (denoted by r) measure of the

extent of the linear relationship between two variables.

range of values of r: from -1 to 1

when r = 0, there is no correlation

when r = +, there is positive or direct relationship

between the dependent (y) and independent

(x) variables. The value of y increases when

the value of x increases.

when r = -, there is negative or inverse, indirect

relationship between the variables. The value of y

decreases as the value of x increases.

r = -1 0 1

Contd

Coefficient of determination (denoted by r) computed

by squaring the value of r. A very high r means

that the values in the regression equation explain

virtually the entire amount of the total cost.

Standard error of the estimate the standard deviation

about the regression line. This calculated to serve

as a confidence interval range of tolerance, for

use in exercising control over the costs.

If r = 1, the standard error = 0

A small value of the standard error indicates a good fit.

Contd

COST ACCOUNTING SYSTEMS

Cost accounting a part of the accounting system that

measures costs for decision-making and financial

reporting purposes.

Cost accounting processes

1. Cost accumulation collecting costs by natural c

classification, such as materials or labor.

2. Cost allocation or cost assignment tracing and

assigning costs to cost objects, such as departments

or products.

COST ACCOUNTING SYSTEMS

Job-order costing used by firms that provide limited

quantities of products or services unique to a customer s

needs or specifications.

Process costing used by firms that produce many units

of a single product for long periods at a time.

Hybrid product-costing system incorporate features

from two or more alternative product costing systems,

such as job-order and process costing.

ex. Automobile repair shoes, tailoring/dressmaking business

ex: soft drinks company, toy manufactures

ex: clothing and food processing operations

Standard costing uses predetermined factors to

compute the standard cost of materials, labor and

factory overhead.

Backflush costing is a streamlined cost accounting

method that simplifies, speed up, and reduces

accounting effort/procedures in accumulating

product costs.

Activity-based costing system is a two stage

procedures that uses multiple drivers to predict

and allocate costs to products and services

Contd

DIFFERENCES BETWEEN ABC AND TRADITIONAL COSTING

SYSTEM

Activity-based costing Traditional costing

Assume that cost objects

consume activities

Assume that cost objects

consume resources

Uses drivers at various

levels

Uses volume-related

allocation bases

Process-oriented Structure-oriented

TYPE OF ACTIVITY LEVELS

1. Unit level activity that must be done for each unit of

production.

2. Batch level performed for each batch of product

produced, rather than each unit.

3. Production level activities that are needed to support

the entire product line regardless of the umber of units

and batches produced.

4. Facility level performed in order for the entire

production process to occur.

ex: setup, receiving and inspection, material handling, packaging,

shipping and quality assurance

Ex: engineering costs, product development costs

Ex: plant maintenance, plant management, property taxes

EXAMPLE NO. 1:

Annabelle companys production and inventories for the

month of June are as follows:

Purchases direct materials P 143, 440

Freight in 5, 000

Purchase returns and allowances 2, 440

Direct labor 175, 000

Actual factory overhead 120, 000

Inventories June 1 June 30

finished goods P 68, 000 P 56, 000

work in process 110, 000 135, 000

direct materials 52, 000 44, 000

Annabelle company applies factory overhead to production at

80% of direct labor cost. Over under applied overhead is

closed to cost of good sold at year-end. The companys

accounting period is on the calendar year basis.

Annabelle companys prime cost for June was..

DM inv., June 1 P 52, 000

Add: purchases P 143, 440

freight in 5, 000

total P 148, 440

Less: purchase returns & allowances 2, 440 146, 000

Total materials available for use P198, 000

Less: DM inv., June 30 44, 000

DM used 154, 000

DL 175, 000

Total prime cost P 329, 000

Annabelle companys conversion cost for June was

Direct labor P175, 000

Applied factory overhead (175, 000 x 805) 140, 000

Conversion cost P315, 000

Annabelle companys total manufacturing cost was...

Materials P 154, 000

Direct labor 175, 000

Applied factory overhead 140, 000

Total manufacturing costs 469, 000

Annabelle companys cost of goods transferred to the

finished goods inventory account was

Total manufacturing costs P 469, 000

Add: WIP inv., June 1 110, 000

Total WIP 579, 000

Less: WIP inv., June 30 135, 000

COGs manufactured P 444, 000

Annabelle companys cost of good sold for June was

COGs manufactured P 444, 000

Add: FG inv., June 1 68, 000

COGs available for sale 512, 000

Less: FG inv., June 30 56, 000

COGS 456, 000

The amount of over/ under applied overhead factory for the

month of June was

Actual FOH P 120, 000

Applied FOH 140, 000

Over applied FOH 20, 000

The cost of good sold for the month of June should be

increased (decreased) by the amount of over/ under applied

factory overhead of.

Over/ under applied factory overhead is closed to the cost of goods

sold at year-end.

EXAMPLE NO. 2:

Frances Corporation conducted a regression analysis of

its factory overhead costs. The analysis yielded the

following cost relationship:

Total factory overhead cost = P 50, 000 per month + 5H*

*H = no. of direct labor hours, the selected cost driver for

overhead cost.

Each unit of product requires 6 direct labor hours. The

companys normal production is 20, 000 units of product per

year.

The total overhead cost for a months production of 2, 000 units

is

Variable cost (2, 000 units x 6hrs. x P 5/hr.) P 60, 000

Fixed cost 50, 000

Total overhead cost P110, 000

The predetermined fixed overhead rate per hour is

Annual fixed overhead (50, 000 x 12) P 600, 000

normal hours for one year (20, 000 units x 6 hrs.) 120, 000

Fixed overhead rate per hour P 5

The total predetermined factory overhead rate per hour is....

Variable rate per hour P 5

Fixed rate (from no. 67) 5

Total predetermined factory overhead rate per hour P10

THE END !!!!

Potrebbero piacerti anche

- Acca Paper 1.2Documento25 pagineAcca Paper 1.2anon-280248Nessuna valutazione finora

- Report On Cost EstimationDocumento41 pagineReport On Cost EstimationTuhin SamirNessuna valutazione finora

- SPE-28630-PA Sills, S.R. Improved Material-Balance Regression Analysis For Waterdrive Oil and Gas Reservoirs PDFDocumento7 pagineSPE-28630-PA Sills, S.R. Improved Material-Balance Regression Analysis For Waterdrive Oil and Gas Reservoirs PDFSolenti D'nouNessuna valutazione finora

- Chapter 6 Hilton 10th Instructor NotesDocumento6 pagineChapter 6 Hilton 10th Instructor NotesChristine Yedda Marie AlbaNessuna valutazione finora

- Costs and Cost Concepts: Different Costs For Different PurposesDocumento11 pagineCosts and Cost Concepts: Different Costs For Different PurposesAudie Anthony Palpal-latocNessuna valutazione finora

- CMA CH 1 - Cost Concept, Behavior and Estimations March 2019-2Documento58 pagineCMA CH 1 - Cost Concept, Behavior and Estimations March 2019-2Henok FikaduNessuna valutazione finora

- Chapter 4Documento65 pagineChapter 4NCTNessuna valutazione finora

- Cost Terms, Concepts and BehaviourDocumento4 pagineCost Terms, Concepts and BehaviourHafsah Amod DisomangcopNessuna valutazione finora

- Module 2 Basic Cost Management Concepts-1Documento3 pagineModule 2 Basic Cost Management Concepts-1Haika ContiNessuna valutazione finora

- Of Cost AccountingDocumento37 pagineOf Cost Accountingspongebob squarepantsNessuna valutazione finora

- COSMAN1 Learning Packet 2 Cost Conceptsand ClassificationDocumento5 pagineCOSMAN1 Learning Packet 2 Cost Conceptsand ClassificationAngela Faye ManaloNessuna valutazione finora

- 3.1 Nature of Cost, Cost Pools, Cost Objects, and Cost DriversDocumento6 pagine3.1 Nature of Cost, Cost Pools, Cost Objects, and Cost Driverslang droidNessuna valutazione finora

- Cost EstimationDocumento22 pagineCost EstimationJane DizonNessuna valutazione finora

- M2 Basic Cost Management ConceptsDocumento6 pagineM2 Basic Cost Management Conceptswingsenigma 00Nessuna valutazione finora

- 1 - Cost EstimationDocumento22 pagine1 - Cost EstimationAbigail PadillaNessuna valutazione finora

- Week 2 - Lesson 2 Costs in Managerial AccountingDocumento7 pagineWeek 2 - Lesson 2 Costs in Managerial AccountingReynold Raquiño AdonisNessuna valutazione finora

- Week 2 - Lesson 2 Costs in Managerial AccountingDocumento7 pagineWeek 2 - Lesson 2 Costs in Managerial AccountingReynold Raquiño AdonisNessuna valutazione finora

- Reviewer Mas 4Documento82 pagineReviewer Mas 4Angelina SecretarioNessuna valutazione finora

- Cost Behavior and Cost-Volume RelationshipsDocumento75 pagineCost Behavior and Cost-Volume RelationshipsRahul112012Nessuna valutazione finora

- Management AccountingDocumento5 pagineManagement AccountingFahad AliNessuna valutazione finora

- ModuleNo1 BasicConceptsDocumento4 pagineModuleNo1 BasicConceptsLyerey Jed MartinNessuna valutazione finora

- CostDocumento33 pagineCostversmajardoNessuna valutazione finora

- Managerial Accounting Overview:: Group MembersDocumento52 pagineManagerial Accounting Overview:: Group MembersAdeel RanaNessuna valutazione finora

- Chapter 2Documento9 pagineChapter 2Marites AmorsoloNessuna valutazione finora

- Cost Behavior Analysis and UseDocumento28 pagineCost Behavior Analysis and UseMaria Maganda MalditaNessuna valutazione finora

- Managerial AccountingDocumento10 pagineManagerial AccountingM HABIBULLAHNessuna valutazione finora

- LM 2 Mas Cost EstimationDocumento2 pagineLM 2 Mas Cost EstimationMarriah Izzabelle Suarez RamadaNessuna valutazione finora

- CA 02 - Costs - Concept and ClassificationsDocumento8 pagineCA 02 - Costs - Concept and ClassificationsJoshua UmaliNessuna valutazione finora

- Chapter 2 AccDocumento5 pagineChapter 2 AccMarta Fdez-FournierNessuna valutazione finora

- Cost Behavior, Activity Analysis, and Cost EstimationDocumento45 pagineCost Behavior, Activity Analysis, and Cost EstimationManuel ChaseNessuna valutazione finora

- COSMAN1 LP2 - Cost Concepts, Classification, and Behavior-1Documento6 pagineCOSMAN1 LP2 - Cost Concepts, Classification, and Behavior-1Ciana SacdalanNessuna valutazione finora

- UST Cost Behavior AnalysisDocumento5 pagineUST Cost Behavior AnalysisnaddieNessuna valutazione finora

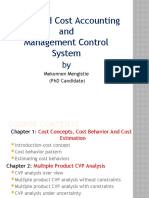

- Advanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Documento62 pagineAdvanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Kalkidan ZerihunNessuna valutazione finora

- Cost Accounting: Basic Nature and ConceptsDocumento28 pagineCost Accounting: Basic Nature and Concepts9986212378Nessuna valutazione finora

- CH 02Documento12 pagineCH 02Charles Decripito FloresNessuna valutazione finora

- Management Accounting CLCDocumento165 pagineManagement Accounting CLCGiang MaNessuna valutazione finora

- Classification of CostingDocumento22 pagineClassification of CostingMohamaad SihatthNessuna valutazione finora

- Cost Chapter TwoDocumento34 pagineCost Chapter TwoDEREJENessuna valutazione finora

- Cost Concept DiscussionDocumento2 pagineCost Concept DiscussionErwin FernandezNessuna valutazione finora

- Lecturer: Diana Weekes-Marshall Bsc. (Hons), Fcca, FcaDocumento26 pagineLecturer: Diana Weekes-Marshall Bsc. (Hons), Fcca, FcaNella KingNessuna valutazione finora

- Cost Concepts: Cost: Lecture Notes On Module-2Documento18 pagineCost Concepts: Cost: Lecture Notes On Module-2ramanarao susarlaNessuna valutazione finora

- MGT Acctg Cost ConceptDocumento30 pagineMGT Acctg Cost ConceptApril Pearl VenezuelaNessuna valutazione finora

- Chapter One: Cost Terms and ClassificationsDocumento11 pagineChapter One: Cost Terms and ClassificationsAkkamaNessuna valutazione finora

- CVP and Break-Even Analysis - RoqueDocumento33 pagineCVP and Break-Even Analysis - RoqueTrisha Mae AlburoNessuna valutazione finora

- Costs Concepts, Uses & ClassificationsDocumento9 pagineCosts Concepts, Uses & ClassificationsnavbaigNessuna valutazione finora

- COST ACCOUNTING - Cost Concepts and ClassificationDocumento18 pagineCOST ACCOUNTING - Cost Concepts and ClassificationJustine Reine CornicoNessuna valutazione finora

- Ma Q&aDocumento19 pagineMa Q&aSidra MuddasarNessuna valutazione finora

- Cost Management AllDocumento26 pagineCost Management Allranveer78krNessuna valutazione finora

- Common Accounting Terminology Glossary Nov 08Documento10 pagineCommon Accounting Terminology Glossary Nov 08mbilal1985Nessuna valutazione finora

- MS101 For SendingDocumento3 pagineMS101 For SendingEthel Joy Tolentino GamboaNessuna valutazione finora

- Chap 2 The-Manager-and-Management-AccountingDocumento11 pagineChap 2 The-Manager-and-Management-Accountingqgminh7114Nessuna valutazione finora

- Cost Accounting REVIEWERDocumento4 pagineCost Accounting REVIEWERMelissa SenonNessuna valutazione finora

- Understanding Cost AccountingDocumento28 pagineUnderstanding Cost Accountingsaerah_8899Nessuna valutazione finora

- Cost Concepts ModuleDocumento12 pagineCost Concepts ModuleKARL MICHAEL NAVARETTENessuna valutazione finora

- Meaning of Costing: Fixed CostDocumento9 pagineMeaning of Costing: Fixed CostSarvesh MishraNessuna valutazione finora

- Cost Accounting: Managerial Emphasis NotesDocumento9 pagineCost Accounting: Managerial Emphasis NotesMayNessuna valutazione finora

- 02 Basic Cost Management Concept 1Documento49 pagine02 Basic Cost Management Concept 1DALUMPINES, John EverNessuna valutazione finora

- Costing and Pricing Summary Reviewer Chapter 1 To 3Documento6 pagineCosting and Pricing Summary Reviewer Chapter 1 To 3Ralph AbutinNessuna valutazione finora

- Chapter-1: A Study On Cost Elements and Its Effects On Cost of ProductionDocumento84 pagineChapter-1: A Study On Cost Elements and Its Effects On Cost of ProductionPraveen HJNessuna valutazione finora

- Operations Management-Cost Measurement Methods & TechniquesDocumento6 pagineOperations Management-Cost Measurement Methods & TechniquesjbphamNessuna valutazione finora

- LH - 02 - CAC - Cost Concepts and ClassficationDocumento16 pagineLH - 02 - CAC - Cost Concepts and ClassficationDexter CanietaNessuna valutazione finora

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesDa EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNessuna valutazione finora

- DDGHJDocumento4 pagineDDGHJAngel Sacpa PaulinoNessuna valutazione finora

- Filipino Architecture With BiographyDocumento1 paginaFilipino Architecture With BiographyAngel Sacpa PaulinoNessuna valutazione finora

- Guidelines For Lab ReportDocumento5 pagineGuidelines For Lab ReportAngel Sacpa PaulinoNessuna valutazione finora

- 1 ReviewDocumento16 pagine1 ReviewAngel Sacpa PaulinoNessuna valutazione finora

- What Is Confirmation?Documento5 pagineWhat Is Confirmation?Angel Sacpa PaulinoNessuna valutazione finora

- Why Marriage Is A Sacrament?: MinistersDocumento4 pagineWhy Marriage Is A Sacrament?: MinistersAngel Sacpa PaulinoNessuna valutazione finora

- Management 5 Business Policy and Strategy: Compilation of Case AnalysisDocumento2 pagineManagement 5 Business Policy and Strategy: Compilation of Case AnalysisAngel Sacpa PaulinoNessuna valutazione finora

- Sibalon 42-64 (Chapter 3)Documento4 pagineSibalon 42-64 (Chapter 3)Angel Sacpa PaulinoNessuna valutazione finora

- Best Answer: Note That, by Solving y 2 8x For X, We HaveDocumento1 paginaBest Answer: Note That, by Solving y 2 8x For X, We HaveLovely Sacpa PaulinoNessuna valutazione finora

- Modulation Types Tutorial IncludesDocumento6 pagineModulation Types Tutorial IncludesAngel Sacpa PaulinoNessuna valutazione finora

- Filter Design in Thirty Seconds: Bruce Carter High Performance AnalogDocumento14 pagineFilter Design in Thirty Seconds: Bruce Carter High Performance Analogpatrick_carballoNessuna valutazione finora

- Explain The Principle of ON-OFF Control. Derive The Expression For Rms Value of Output VoltageDocumento5 pagineExplain The Principle of ON-OFF Control. Derive The Expression For Rms Value of Output VoltageAngel Sacpa PaulinoNessuna valutazione finora

- CDJDocumento2 pagineCDJAngel Sacpa PaulinoNessuna valutazione finora

- Mendoza-161 To 179 (Expert Mode Chapter 2) 1 To 4 (Noob Mode Chapter 3)Documento3 pagineMendoza-161 To 179 (Expert Mode Chapter 2) 1 To 4 (Noob Mode Chapter 3)Angel Sacpa PaulinoNessuna valutazione finora

- RoboticsDocumento4 pagineRoboticsAngel Sacpa PaulinoNessuna valutazione finora

- Ronquillo 123-137 Noob Mode 1-8 Expert ModeDocumento4 pagineRonquillo 123-137 Noob Mode 1-8 Expert ModeAngel Sacpa PaulinoNessuna valutazione finora

- Calculus Solved ProblemsDocumento23 pagineCalculus Solved ProblemscloudNessuna valutazione finora

- "Case Analysis": Requirements in Business Policy & StrategyDocumento2 pagine"Case Analysis": Requirements in Business Policy & StrategyAngel Sacpa PaulinoNessuna valutazione finora

- Why Marriage Is A Sacrament?: MinistersDocumento4 pagineWhy Marriage Is A Sacrament?: MinistersAngel Sacpa PaulinoNessuna valutazione finora

- Record On Basic Finance and Acctg.Documento2 pagineRecord On Basic Finance and Acctg.Angel Sacpa PaulinoNessuna valutazione finora

- Chapter 8Documento27 pagineChapter 8Angel Sacpa PaulinoNessuna valutazione finora

- Best Answer: Note That, by Solving y 2 8x For X, We HaveDocumento1 paginaBest Answer: Note That, by Solving y 2 8x For X, We HaveLovely Sacpa PaulinoNessuna valutazione finora

- A AaaaaaaaaaDocumento2 pagineA AaaaaaaaaaAngel Sacpa PaulinoNessuna valutazione finora

- Chapter 11Documento72 pagineChapter 11Angel Sacpa PaulinoNessuna valutazione finora

- Samplechapter ChapteDocumento30 pagineSamplechapter ChapteAngel Sacpa PaulinoNessuna valutazione finora

- CDJDocumento2 pagineCDJAngel Sacpa PaulinoNessuna valutazione finora

- HandoutDocumento1 paginaHandoutAngel Sacpa PaulinoNessuna valutazione finora

- Modulation Types Tutorial IncludesDocumento6 pagineModulation Types Tutorial IncludesAngel Sacpa PaulinoNessuna valutazione finora

- Modulation Types Tutorial IncludesDocumento6 pagineModulation Types Tutorial IncludesAngel Sacpa PaulinoNessuna valutazione finora

- Assurance EngagementDocumento24 pagineAssurance Engagementfarhan14290Nessuna valutazione finora

- The Relation Between Library Anxiety and LearningDocumento15 pagineThe Relation Between Library Anxiety and LearningJonathan ParedesNessuna valutazione finora

- Stata C8Documento21 pagineStata C8Dumy NeguraNessuna valutazione finora

- Linear RegressionDocumento12 pagineLinear RegressionCherry MuycoNessuna valutazione finora

- Mathematical Modelling of Hot Air Drying of Sweet PotatoDocumento11 pagineMathematical Modelling of Hot Air Drying of Sweet PotatoNEFTALI VAZQUEZ ESPINOSANessuna valutazione finora

- MMW - Module 4-1Documento80 pagineMMW - Module 4-1Arc EscritosNessuna valutazione finora

- Personality Factors As Correlates of Emotional Maturity Among AdolescentsDocumento8 paginePersonality Factors As Correlates of Emotional Maturity Among AdolescentsFredy G. CQNessuna valutazione finora

- The Effect of Training and Job Satisfaction On Employee Engagement and Performance of Millennial Generation Employees of PT Midi Utama Indonesia TBK in MakassarDocumento6 pagineThe Effect of Training and Job Satisfaction On Employee Engagement and Performance of Millennial Generation Employees of PT Midi Utama Indonesia TBK in MakassarInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- Advanced StatisticsDocumento125 pagineAdvanced StatisticsJose GallardoNessuna valutazione finora

- Linear Regression Makes Several Key AssumptionsDocumento5 pagineLinear Regression Makes Several Key AssumptionsVchair GuideNessuna valutazione finora

- Probability and Statistics 2019 June QBDocumento16 pagineProbability and Statistics 2019 June QBsravaniNessuna valutazione finora

- Tn-Set 2012 Paper - Ii & Iii (Maths) - KeyDocumento21 pagineTn-Set 2012 Paper - Ii & Iii (Maths) - Keyjayasankari kumariNessuna valutazione finora

- A Novel Variational Bayesian Method For Variable Selection in Logistic Regression Models2019Computational Statistics and Data AnalysisDocumento19 pagineA Novel Variational Bayesian Method For Variable Selection in Logistic Regression Models2019Computational Statistics and Data AnalysisMariella BogoniNessuna valutazione finora

- Whitepaper Strainlife-Stress LifeDocumento7 pagineWhitepaper Strainlife-Stress Lifeabhi024Nessuna valutazione finora

- OE & HS Subjects 2018-19Documento94 pagineOE & HS Subjects 2018-19bharath hsNessuna valutazione finora

- Cost Concepts and Analysis: Management Advisory ServicesDocumento7 pagineCost Concepts and Analysis: Management Advisory ServicesAlexander QuemadaNessuna valutazione finora

- 2010 TJC Prelim Paper 2 Qns Final)Documento8 pagine2010 TJC Prelim Paper 2 Qns Final)cjcsucksNessuna valutazione finora

- Forecasting (QUAN21)Documento49 pagineForecasting (QUAN21)RNessuna valutazione finora

- CW ReportDocumento15 pagineCW ReportJoseph PalinNessuna valutazione finora

- Bank Solvency and Funding Cost: by Christoph Aymanns, Carlos Caceres, Christina Daniel, and Liliana SchumacherDocumento30 pagineBank Solvency and Funding Cost: by Christoph Aymanns, Carlos Caceres, Christina Daniel, and Liliana SchumacherBeka GurgenidzeNessuna valutazione finora

- Teamwork, Psychological Safety, and Patient SafetyDocumento5 pagineTeamwork, Psychological Safety, and Patient SafetyMutiara100% (1)

- Group 6 Solution For AssignmentDocumento17 pagineGroup 6 Solution For Assignmentsachin s.d.Nessuna valutazione finora

- Horngren Ima16 Tif 03 GEDocumento47 pagineHorngren Ima16 Tif 03 GEasem shabanNessuna valutazione finora

- Xiang2021 G1 - G2Documento10 pagineXiang2021 G1 - G2Oscar Ant P DlcNessuna valutazione finora

- ForecastingDocumento70 pagineForecastingChaitra Prasanna100% (2)

- Dev Math Student Discovery ActivitiesDocumento48 pagineDev Math Student Discovery Activitiesapi-273544280Nessuna valutazione finora

- Uncorrected Author Proof: Salutogenic Resources in Relation To Teachers' Work-Life BalanceDocumento12 pagineUncorrected Author Proof: Salutogenic Resources in Relation To Teachers' Work-Life BalanceNishchal PaudelNessuna valutazione finora

- Correlation and RegressionDocumento100 pagineCorrelation and Regressionssckp86100% (1)

- Analysis of Family Structure Influence On Academic Performance Among Secondary School Students in Bungoma East Sub-County, KenyaDocumento11 pagineAnalysis of Family Structure Influence On Academic Performance Among Secondary School Students in Bungoma East Sub-County, KenyaVilma SottoNessuna valutazione finora