Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ifsa Chapter14

Caricato da

Nageswara KorrakutiTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ifsa Chapter14

Caricato da

Nageswara KorrakutiCopyright:

Formati disponibili

CHAPTER 14

INTERCORPORATE INVESTMENTS

Presenters name

Presenters title

dd Month yyyy

INTERCORPORATE INVESTMENTS

Intercorporate investments include investments in the debt and

equity securities of other companies.

Reasons for investing in other companies:

- To achieve additional profitability.

- To enter new markets through companies established in those areas.

- To diversify.

- To obtain competitive advantages.

The classification of intercorporate investments is based on the degree

of influence or control that the investor is able to exercise over the

investee.

Copyright 2013 CFA Institute 2

CLASSIFYING INTERCORPORATE INVESTMENTS

Investments are classified into four categories based on the degree of

influence or control:

Investments in financial assets (ownership percentage < 20%):

Investments in which the investor has no significant control over the

investee.

Investments in associates (ownership percentage between 20% and

50%): Investments in which the investor has significant influence but

not control over the investee.

Business combinations (ownership percentage > 20%):

Investments in which the investor has control over the investee.

Joint Venture: An entity operated by companies that share control.

Copyright 2013 CFA Institute 3

ACCOUNTING FOR

INVESTMENTS IN FINANCIAL ASSETS

Type Intent Accounting Treatment

Held to maturity

(for debt securities)

Has intent and ability to

hold the debt until it

matures.

Reported at amortized cost.

Changes in value ignored unless

deemed as impaired.

Available for sale

Does not intend to sell in

the near term, elect fair

value accounting, or hold

until maturity.

Recorded at fair value.

Changes in value are recognized

in other comprehensive income.

Held for trading

and

those designated as fair

value through profit or

loss

Intends to sell in the near

term (i.e., held for trading )

or has otherwise elected

fair value accounting.

Recorded at fair value.

Changes in value are recognized

in profit or loss on income

statement.

Copyright 2013 CFA Institute 4

ACCOUNTING FOR

INVESTMENTS IN FINANCIAL ASSETS

Both IFRS and U.S. GAAP permit reclassification of intercorporate

investments, although certain criteria must be met.

- IFRS generally prohibit the reclassification into or out of the designated at fair

value category, and reclassification out of the held for trading category is

severely restricted.

- U.S. GAAP allow reclassifications between all categories using fair value at

the date of reclassification.

Impairment occurs when the carrying value of a financial asset is expected to

permanently exceed the recoverable amount.

- Regardless of classification, a loss will be recorded on the income statement

in the period impairment occurs.

- For available-for-sale securities that have become impaired, the cumulative

loss that had been recognized in other comprehensive income (OCI) will be

reclassified from equity to profit or loss.

Copyright 2013 CFA Institute 5

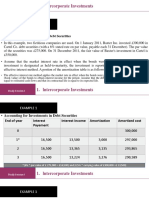

INVESTMENTS IN FINANCIAL ASSETS: EXAMPLE

On 1 January 2008, Baxter Inc. invested 300,000 in Cartel Co. debt securities

(with a 6% stated rate on par value, payable each 31 December). The par value

of the securities was 275,000. On 31 December 2008, the fair value of Baxters

investment in Cartel is 350,000.

Assume the market interest rate when the bonds were purchased was 4.5%. If the

investment is designated as held to maturity, the investment is reported at

amortized cost using the effective interest method. A portion of the amortization

table is as follows:

*6% Par value (275,000) = 16,500; 4.5% Carrying value (300,000) =

13,500

Copyright 2013 CFA Institute 6

End of

Year

Interest

Payment

Interest

Income Amortization

Carrying

Value

0 300,000

1* 16,500 13,500 3,000 297,000

2 16,500 13,365 3,135 293.865

3 16,500 13,224 3,276 290,589

INVESTMENTS IN FINANCIAL ASSETS: EXAMPLE

1. How would this investment be reported on the financial statements at 31

December 2008 under either IFRS or U.S. GAAP (accounting is essentially the

same in this case) if Baxter designated the investment as (1) held-to-maturity,

(2) held for trading, (3) available-for-sale, or (4) designated at fair value?

Copyright 2013 CFA Institute 7

Income Statement Balance Sheet

Statement of

Owners Equity

Held-to-

maturity Interest income: 13,500

Reported at amortized

cost: 297,000 No effect

Held for

trading

Interest income: 13,500

and 53,000 unrealized gain

recognized through profit

Reported at fair value:

350,000

No effect

Available-

for-sale

Interest income: 13,500

Reported at fair value:

350,000

53,000

unrealized gain

(net of tax)

reported as OCI

Designated

at fair value

Interest income 13,500

and 53,000 unrealized gain

recognized through profit

Reported at fair value:

350,000

No effect

INVESTMENTS IN FINANCIAL ASSETS: EXAMPLE

2. How would the gain be recognized if the debt securities were sold on

1 January 2009 for 352,000?

3. How would this investment appear on the balance sheet at

31 December 2009?

Copyright 2013 CFA Institute 8

Held-to-maturity 352,000 297,000 = 55,000

Fair value through profit or loss

(held for trading)

352,000 350,000 = 2,000

Available-for-sale (352,000 350,000) + 53,000

(removed from OCI) = 55,000

If the investment was held-to-maturity, the reported amount at amortized cost

on the balance sheet would be 293,865.

If it was classified as either held for trading, available-for-sale, or designated at

fair value, it would be reported at its fair value at 31 December 2009.

ACCOUNTING FOR

INVESTMENTS IN ASSOCIATES

The equity method is used to account for investments in associates.

To qualify, a company must have significant influence over the

investee. Significant influence is presumed with 2050% ownership,

but exceptions can be made based on other indicators of influence,

including

- Representation on the board of directors

- Participation in policymaking

- Material transactions between companies

- Interchange of management

- Technological dependency

Because of this influence, it is presumed that the investees income is

at least partially attributed to the influence of the investor. As such, the

investor recognizes a proportionate amount of investees income.

Copyright 2013 CFA Institute 9

EQUITY METHOD

The investors share of the investees income and dividends is

recognized on the income statement.

The investment is classified as noncurrent on the balance sheet. It is

recorded at cost plus the investors share of post-acquisition income

less any dividends paid.

Copyright 2013 CFA Institute 10

EQUITY METHOD: EXAMPLE

Branch Inc. purchases a 20% interest in Williams Inc. for 200,000 on 1

January 2008. Williams reports income and dividends as follows:

Calculate the investment in Williams that appears on Branchs balance

sheet as of the end of 2010:

Copyright 2013 CFA Institute 11

Income Dividends

2008 200,000 50,000

2009 300,000 100,000

2010 400,000 200,000

900,000 350,000

200,000 + 20% (900,000 350,000) = 310,000

INVESTMENTS IN ASSOCIATES:

WHEN INVESTMENT COSTS > BOOK VALUE OF INVESTEE

When investment costs exceed the investors proportionate share of the

investees net identifiable assets, the difference is allocated to the

following:

- Any specific assets whose fair values exceed book values. These

amounts are then amortized over the useful life of these specific

assets.

- Any remaining difference between the investment cost and the fair

value of net identifiable assets that cannot be allocated to specific

assets is treated as goodwill.

- Goodwill is not amortized; it is checked for impairment annually.

Copyright 2013 CFA Institute 12

INVESTMENTS IN ASSOCIATES:

WHEN INVESTMENT COSTS > BOOK VALUE OF INVESTEE:

EXAMPLE

Assume that Blake Co. acquires 30% of the outstanding shares of Brown Co.

At the acquisition date, information on Browns recorded assets and liabilities is

as follows:

Blake Co. believes the value of Brown Co. is higher than the fair value of its

identifiable net assets. They offer 100,000 for a 30% interest in Brown Co.

Calculate goodwill.

Copyright 2013 CFA Institute 13

Book Value Fair Value

Current assets 10,000 10,000

Plant and equipment 190,000 220,000

Land 120,000 140,000

320,000 370,000

Liabilities 100,000 100,000

Net assets 220,000 270,000

INVESTMENTS IN ASSOCIATES:

WHEN INVESTMENT COSTS > BOOK VALUE OF INVESTEE:

EXAMPLE

Purchase price 100,000

30% of book value of Brown (30% 220,000) 66,000

Excess purchase price 34,000

Attributable to net assets:

Plant and equipment (30% 30,000) 9,000

Land (30% 20,000) 6,000

Goodwill 19,000

34,000

Copyright 2013 CFA Institute 14

FAIR VALUE OPTION AND IMPAIRMENT

Fair value option: The option at the time of initial recognition to record

an equity method investment at fair value.

- Under IFRS, only venture capital firms may opt for fair value.

- Under U.S. GAAP, the fair value option is available to all entities.

Equity method investments need periodic reviews for impairment.

- Under IFRS, an impairment is recorded only if there is objective

evidence that one (or more) loss event(s) has occurred since the

initial recognition and that loss event has an impact on the

investments future cash flows, which must be reliably estimated.

- U.S. GAAP take a different approach. An impairment must be

recognized if the fair value of the investment falls below its carrying

value and if the decline is considered permanent.

Copyright 2013 CFA Institute 15

TRANSACTIONS WITH ASSOCIATES

An investor company can influence the terms and timing of transactions

with its associates. Thus, the investor companys share of any profits

resulting from transactions with associates must be deferred until the

transactions are confirmed with a third party.

- In an upstream sale, the investee sells goods to the investor.

- In a downstream sale, the investor sells goods to the investee.

- Regardless of directions, IFRS and U.S. GAAP require the

elimination of profits to the extent of the investors ownership of the

investee.

Copyright 2013 CFA Institute 16

JOINT VENTURE

A joint venture can be a convenient way to enter foreign markets,

conduct specialized activities, and engage in risky projects.

Joint ventures are defined differently under IFRS and U.S. GAAP.

Under IFRS:

- Three types of joint ventures: jointly controlled operations, jointly

controlled assets, and jointly controlled entities.

- Proportionate consolidation is the preferred accounting treatment.

It requires the venturers share of assets, liabilities, income, and

expenses of the joint venture to be combined on a line-by-line basis.

Under U.S. GAAP:

- Joint venture refers only to jointly controlled separate entities.

- Requires the use of the equity method to account for joint ventures.

Copyright 2013 CFA Institute 17

ACCOUNTING FOR JOINT VENTURE

Because the single line item on the income statement under the equity

method reflects the net effect of the sales and expenses of the joint

venture, the total income recognized is identical under the equity

method and proportionate consolidation.

Similarly, because the single line item on the balance sheet item

(investment in joint venture) under the equity method reflects the

investors share of the net assets of the joint venture, the total net

assets of the investor is identical under both methods.

But there can be significant differences in ratio analysis between the

two methods because of the differential effects on values for total

assets, liabilities, sales, expenses, and so on.

Copyright 2013 CFA Institute 18

EQUITY METHOD VS.

PROPORTIONATE CONSOLIDATION: EXAMPLE

Copyright 2013 CFA Institute 19

Joint

Venture

Equity

Method*

Proportionate

Consolidation

Sales 400000 1000000 1200000

Equity in joint venture income 60,000

Cost of sales 200,000 500,000 600,000

Other expenses 80,000 240,000 280,000

Net income 120000 320000 320000

Cash 40000 400000 420000

Inventory 500,000 500,000

Investment in joint venture 450,000

Other assets 1,160,000 1,500,000 2,080,000

1200000 2850000 3000000

Accounts payable 200000 200000

Long-term debt 300000 1,650,000 1,800,000

Capital stock 600,000 600,000

Retained earnings 400,000 400,000

Venturers equity (Companies A and B) 900,000

1200000 2850000 3000000

Company A Venturer

Income Statement

Balance Sheet

EQUITY METHOD VS.

PROPORTIONATE CONSOLIDATION: EXAMPLE

Copyright 2013 CFA Institute 20

Analysts will observe differences in performance ratios based on the

accounting method used for joint ventures.

IFRS prefer proportional consolidation because it more effectively

conveys the economic scope of an entitys operation when those

operations include interests in one or more jointly controlled entities.

Equity

Method

Proportionate

Consolidation

Net profit margin 32.0% 26.7%

Return on assets 11.2% 10.7%

Debt/Equity 1.65 1.80

BUSINESS COMBINATIONS

Business combinations involve the combination of two or more entities

into a larger economic entity. They are motivated by expectations of

added value through synergies.

Types of business combinations

- Under IFRS, there is no distinction among business combinations

based on the resulting structure of the larger economic entity.

- Under U.S. GAAP, business combinations are categorized as merger,

acquisition, or consolidation based on the structure after the

combination.

Copyright 2013 CFA Institute 21

ACCOUNTING FOR BUSINESS COMBINATIONS

IFRS and U.S. GAAP now require that all business combinations be accounted

for using the acquisition method.

- Identifiable assets and liabilities of the acquired company are measured at

fair value on the date of the acquisition.

- Assets and liabilities that were not previously recognized by the acquiree

must be recognized by the acquirer.

- At the acquisition date, the acquirer can reclassify the financial assets and

liabilities of the acquiree (e.g., from trading security to available for sale

security).

- Goodwill is recognized as

- Partial goodwill under IFRS: the difference between purchase price and

the acquirers share of acquirees assets and liabilities.

- Full goodwill under U.S. GAAP: the difference between total fair value of

the acquiree and fair value of the acquirees identifiable net assets.

Copyright 2013 CFA Institute 22

ACCOUNTING FOR BUSINESS COMBINATIONS

Noncontrolling interests are shown as a separate component of equity

on the balance sheet and a separate line item in the income statement.

IFRS and U.S. GAAP differ on the measurement of noncontrolling

interest:

- Under IFRS, the value of the noncontrolling interest is either its fair

value (full goodwill method) or the noncontrolling interests

proportionate share of the acquirees identifiable net assets (partial

goodwill method).

- Under U.S. GAAP, the parent must use the full goodwill method and

measure the noncontrolling interest at fair value.

Copyright 2013 CFA Institute 23

100% ACQUISITION: EXAMPLE

Franklin Co. acquired 100% of Jefferson, Inc. by issuing 1,000,000 shares of its

1 par common stock (15 market value). Immediately before the transaction,

the two companies had the following information:

Show the postcombination balance sheet using the acquisition method.

Copyright 2013 CFA Institute 24

Franklin Book

Value (000)

Jefferson Book

Value (000)

Jefferson Fair

Value (000)

Cash and receivables 10000 300 300

Inventory 12,000 1,700 3,000

PP&E (net) 27,000 2,500 4,500

49000 4500 7800

Current payables 8,000 600 600

Long-term debt 16,000 2,000 1,800

24,000 2,600 2,400

Net assets 25000 1900 5400

Shareholders equity:

Capital stock (1 par) 5000 400

Additional paid in capital 6,000 700

Retained earnings 14000 800

100% ACQUISITION: EXAMPLE

Copyright 2013 CFA Institute 25

The postacquisition balance sheet of the combined entity:

Franklin Consolidated Balance Sheet ( thousands)

Cash and receivables 10,300

Inventory 15,000

PP&E (net) 31,500

Goodwill 9,600

Total assets 66,400

Current payables 8,600

Long-term debt 17,800

Total liabilities 26,400

Capital stock (1 par) 6,000

Additional paid in capital 20,000

Retained earnings 14,000

Total stockholders equity 40,000

Total liabilities and stockholders equity 66,400

LESS THAN 100% ACQUISITION: EXAMPLE

On 1 January 2009, Parent Co. acquired 90% of Subsidiary Co. in exchange

for shares of Parent Co.s no par common stock with a fair value of 180,000.

The fair market value of the subsidiarys shares on the date of transaction was

200,000. Below is selected financial information from the two companies

immediately before the parent recorded the acquisition:

Copyright 2013 CFA Institute 26

Book Value Fair Value

Cash and receivables 40,000 15,000 15,000

Inventory 125,000 80,000 80,000

PP&E (net) 235,000 95,000 155,000

400,000 190,000 250,000

Payables 55,000 20,000 20,000

Long-term debt 120,000 70,000 70,000

175,000 90,000 90,000

Net assets 225,000 100,000 160,000

Capital stock (no par) 87,000 34,000

Retained earnings 138,000 66,000

Parent Book

Value

Subsidiary

Shareholders equity:

LESS THAN 100% ACQUISITION: EXAMPLE

1. Calculate the value of PP&E (property, plant, and equipment) on the

consolidated balance sheet under both IFRS and U.S. GAAP.

2. Calculate the value of goodwill and the value of the noncontrolling

interest at the acquisition date under the full goodwill method.

Copyright 2013 CFA Institute 27

235,000 + 155,000 = 390,000

Fair value of subsidiary 200,000

Fair value of subsidiarys identifiable net assets 160,000

Goodwill 40,000

The value of noncontrolling interest = 10% 200,000 = 20,000

LESS THAN 100% ACQUISITION: EXAMPLE

3. Calculate the value of goodwill and the value of the noncontrolling

interest at the acquisition date under the partial goodwill method.

Copyright 2013 CFA Institute 28

Purchase price 180,000

90% of fair value of subsidiarys identifiable net

assets 144,000

Goodwill 36,000

Value of noncontrolling interest = 10% 160,000 = 16,000

MORE ON GOODWILL

Because the full goodwill method and the partial goodwill method

result in different total assets and stockholders equity, the impact of

these methods on financial ratios would differ.

Goodwill is not amortized, but it is tested for impairment.

- Under IFRS, goodwill is impaired when the recoverable value of a

business unit is below the carrying value (one-step approach).

- Under U.S. GAAP, goodwill is impaired when the carrying value of

a business unit exceeds its fair value. The amount of impairment

loss is the difference between the implied fair value of the reporting

units goodwill and its carrying amount (two-step approach).

Copyright 2013 CFA Institute 29

VARIABLE INTEREST AND

SPECIAL PURPOSE ENTITIES

A VIE (variable interest entity) or SPE (special purpose entity) is an

enterprise that is created to accommodate specific needs of the

sponsoring entity. It may be used to securitize receivables, lease

assets, and so on.

In the past, sponsors were able to avoid consolidating SPEs on their

financial statements because they did not have control (i.e., own a

majority of the voting interest) of the SPE.

By avoiding consolidation, sponsors did not have to report the assets

and the liabilities of the SPE; financial performance as measured by

unconsolidated financial statements was potentially misleading. The

benefit to the sponsoring company was improved asset turnover, lower

operating and financial leverage, and higher profitability.

Copyright 2013 CFA Institute 30

VARIABLE INTEREST AND

SPECIAL PURPOSE ENTITIES

Under IFRS, a SPE must be consolidated if the substance of the

relationship indicates control.

Under U.S. GAAP, the primary beneficiary of a VIE (which is often the

sponsor) must consolidate it as its subsidiary regardless of how much

of an equity investment it has in the VIE.

- VIE, a more general term than SPE, refers to an entity that is

financially controlled by one or more parties that do not hold a

majority voting interest.

Copyright 2013 CFA Institute 31

SPE: EXAMPLE

Odena wants to raise 55 million in capital by borrowing against its financial

receivables. To accomplish this objective, Odena can choose between the

following:

- Alternative 1: Borrow directly against the receivables

- Alternative 2: Create a SPE, invest 5 million in the SPE, have the SPE

borrow 55 million, and then use the funds to purchase 60 million of

receivables from Odena.

Using the financial information provided, describe the effect of each

alternative on Odena, assuming Odena will not have to consolidate the

SPE.

Copyright 2013 CFA Institute 32

SPE: EXAMPLE

Copyright 2013 CFA Institute 33

Odena Balance Sheet Alternative 1 Alternative 2

Cash 30000000 85000000 85000000

Accounts receivable 60,000,000 60,000,000 0

Investment in SPE 5,000,000

Other assets 40,000,000 40,000,000 40,000,000

Total assets 130000000 185000000 130000000

Current liabilities 27000000 27000000 27000000

Non-current liabilities 20,000,000 75,000,000 20,000,000

Total liabilities 47000000 102000000 47000000

Shareholder equity 83000000 83000000 83000000

Total liabilities and equity 130000000 185000000 130000000

Current ratio 3.33 5.37 3.15

Long-term debt to equity 0.24 0.9 0.24

Equity to total assets 0.64 0.44 0.64

SUMMARY OF ACCOUNTING TREATMENT

FOR INTERCORPORATE INVESTMENTS

Type Financial Assets Associates Combinations

Joint

Ventures

Influence None/Little Significant Controlling Shared

Typical ownership % < 20% 20%50% > 50% Varies

Accounting treatment

Depends on the intent:

Held-to-maturity (debt

only): amortized cost

Held for trading:

fair value, changes

recognized in P/L

Available-for-sale:

Fair value, changes

recognized in equity

Designated at fair value:

fair value, changes

recognized in P/L

Equity

method

Consolidation

Equity

method

(U.S. GAAP & IFRS)

or

proportionate

consolidation

(IFRS Only)

Copyright 2013 CFA Institute 34

Potrebbero piacerti anche

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideDa EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNessuna valutazione finora

- MidTerm ExamDocumento15 pagineMidTerm ExamYonatan Wadler100% (2)

- FINAL-Investment in AssociateDocumento16 pagineFINAL-Investment in AssociateJessa75% (4)

- Right Issue & Warrants: Group-8 Assignment PresentationDocumento11 pagineRight Issue & Warrants: Group-8 Assignment PresentationPratul Batra100% (1)

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementDa EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNessuna valutazione finora

- Solution Manual For Financial Statement Analysis and Valuation 2nd Edition by EastonDocumento32 pagineSolution Manual For Financial Statement Analysis and Valuation 2nd Edition by EastonJenniferPalmerdqwf98% (43)

- 17 - Investment-In Associate (Basic Principles)Documento44 pagine17 - Investment-In Associate (Basic Principles)KhenNessuna valutazione finora

- Investment in AssociateDocumento60 pagineInvestment in Associateadarose romaresNessuna valutazione finora

- Full Download Advanced Accounting 12th Edition Beams Solutions ManualDocumento36 pagineFull Download Advanced Accounting 12th Edition Beams Solutions Manualrojeroissy2232s100% (39)

- BSA 3202 Topic 1 - Investment in AssociatesDocumento15 pagineBSA 3202 Topic 1 - Investment in AssociatesFrancis Abuyuan100% (1)

- Chapter 7 BusscomDocumento65 pagineChapter 7 BusscomJM Valonda Villena, CPA, MBANessuna valutazione finora

- UK - CXO - Customer ExperienceDocumento11 pagineUK - CXO - Customer ExperienceSheel ThakkarNessuna valutazione finora

- Pert 12 Intercorporate Investments Chapter15Documento34 paginePert 12 Intercorporate Investments Chapter15Chevalier ChevalierNessuna valutazione finora

- Pertemuan 6 Analisis Investasi Antar Perusahaan (Intercompany Investment Analysis)Documento23 paginePertemuan 6 Analisis Investasi Antar Perusahaan (Intercompany Investment Analysis)putri pertiwiNessuna valutazione finora

- Analyzing Investing Activities Chapter 5Documento29 pagineAnalyzing Investing Activities Chapter 5Agathos Kurapaq0% (1)

- Associates and Joint Ventures: Associate Professor Parmod ChandDocumento31 pagineAssociates and Joint Ventures: Associate Professor Parmod ChandSunila DeviNessuna valutazione finora

- Longterm InvestmentDocumento36 pagineLongterm InvestmentKale MessayNessuna valutazione finora

- PPT-7 (Intercorporate Investments)Documento61 paginePPT-7 (Intercorporate Investments)Taniya GuptaNessuna valutazione finora

- Example 1 PDFDocumento9 pagineExample 1 PDFhyba ben helalNessuna valutazione finora

- Afu08501 - Lect 1Documento42 pagineAfu08501 - Lect 1Criss JasonNessuna valutazione finora

- Chapter 17Documento14 pagineChapter 17TruyenLeNessuna valutazione finora

- Full Download Advanced Accounting 13th Edition Beams Solutions ManualDocumento36 pagineFull Download Advanced Accounting 13th Edition Beams Solutions Manualjacksongubmor100% (34)

- Analyzing Investing Activities:: Special TopicsDocumento40 pagineAnalyzing Investing Activities:: Special TopicsAbhishek PandaNessuna valutazione finora

- Analyzing Investing Activities: Intercorporate InvestmentsDocumento38 pagineAnalyzing Investing Activities: Intercorporate Investmentsshldhy100% (1)

- Reporting Intercorporate InterestDocumento10 pagineReporting Intercorporate InterestArchit AgrawalNessuna valutazione finora

- Penfold Penfold Technology LTD Pitch Uk Investment Summary Equity 2Documento8 paginePenfold Penfold Technology LTD Pitch Uk Investment Summary Equity 2waqar.asgharNessuna valutazione finora

- Ch02 Beams12ge SMDocumento27 pagineCh02 Beams12ge SMWira Moki100% (3)

- Chap 001Documento41 pagineChap 001ms_cherriesNessuna valutazione finora

- Taxation in Mutual FundsDocumento18 pagineTaxation in Mutual Fundsvineetb553Nessuna valutazione finora

- InvestmentDocumento16 pagineInvestmentYakini entertainmentNessuna valutazione finora

- AccoutingDocumento22 pagineAccoutingmeisi anastasiaNessuna valutazione finora

- Stock Investments - Investor Accounting and Reporting: Fair ValueDocumento26 pagineStock Investments - Investor Accounting and Reporting: Fair ValuegustafgeysbertNessuna valutazione finora

- Dwnload Full Advanced Accounting 13th Edition Beams Solutions Manual PDFDocumento36 pagineDwnload Full Advanced Accounting 13th Edition Beams Solutions Manual PDFunrudesquirtjghzl100% (15)

- Advanced Accounting 11ed Chapter 1 PowerPointsDocumento26 pagineAdvanced Accounting 11ed Chapter 1 PowerPointsIdiomsNessuna valutazione finora

- Unit 6: Long-Term InvestmentsDocumento40 pagineUnit 6: Long-Term Investmentssamuel kebedeNessuna valutazione finora

- Topic 5: Equity AccountingDocumento9 pagineTopic 5: Equity AccountingaltonpoonNessuna valutazione finora

- Separate Financial StatementDocumento31 pagineSeparate Financial StatementAivan Kiel100% (1)

- BusFin - 9 - Concepts of CapitalDocumento17 pagineBusFin - 9 - Concepts of CapitalReymark CabrobiasNessuna valutazione finora

- Chap 001Documento41 pagineChap 001dbzracerNessuna valutazione finora

- Unit 3.financialDocumento45 pagineUnit 3.financialLeire BegoñaNessuna valutazione finora

- Plugin Ifrs Investment Funds Issue 1b 686Documento0 paginePlugin Ifrs Investment Funds Issue 1b 686xuhaibimNessuna valutazione finora

- Chapter Two: Stock Investments-Investor Accounting & ReportingDocumento83 pagineChapter Two: Stock Investments-Investor Accounting & ReportingFackallofyouNessuna valutazione finora

- Investment in Equity Debt Securities A122 1Documento71 pagineInvestment in Equity Debt Securities A122 1Mei Chien YapNessuna valutazione finora

- Unit 4 FA-IIDocumento20 pagineUnit 4 FA-IIBlack boxNessuna valutazione finora

- CH 3 InvenstmentDocumento8 pagineCH 3 InvenstmentabelNessuna valutazione finora

- Financial Statement Analysis: K R Subramanyam John J WildDocumento40 pagineFinancial Statement Analysis: K R Subramanyam John J WildStory pizzieNessuna valutazione finora

- Dwnload Full Advanced Accounting 12th Edition Beams Solutions Manual PDFDocumento13 pagineDwnload Full Advanced Accounting 12th Edition Beams Solutions Manual PDFunrudesquirtjghzl100% (11)

- Conceptual Framework and Accounting StandardsDocumento27 pagineConceptual Framework and Accounting Standards박은하Nessuna valutazione finora

- Chapter Two Accounting For Long-Term InvestmentsDocumento26 pagineChapter Two Accounting For Long-Term InvestmentsFirezer Agegnehu100% (1)

- Video No.1: Advanced Financial AccountingDocumento4 pagineVideo No.1: Advanced Financial Accountinghiseg74240Nessuna valutazione finora

- BKAF3073 Chapter 5Documento28 pagineBKAF3073 Chapter 5Shahrul IzwanNessuna valutazione finora

- Chapter One The Equity Method of Accounting For InvestmentDocumento30 pagineChapter One The Equity Method of Accounting For InvestmentEth Fikir NatNessuna valutazione finora

- 12 Ch3. 12 - Investments PowerPointsDocumento24 pagine12 Ch3. 12 - Investments PowerPointsShawn Lynette Bray100% (2)

- Accounting For Associate and Joint VVentureDocumento37 pagineAccounting For Associate and Joint VVentureStudy GirlNessuna valutazione finora

- Practice Quiz - Chapter 6 - Alan Melville, International Financial Reporting, 8 - eDocumento6 paginePractice Quiz - Chapter 6 - Alan Melville, International Financial Reporting, 8 - echiahajuliet8Nessuna valutazione finora

- Hedge Funds: More Riches For The Rich or Taxes For The Government?Documento31 pagineHedge Funds: More Riches For The Rich or Taxes For The Government?mishra_punitNessuna valutazione finora

- Topic 5A Accounting For Investment InstrumentsDocumento48 pagineTopic 5A Accounting For Investment InstrumentsSakariyeNessuna valutazione finora

- Advanced Accounting-2 Company: HoldingDocumento20 pagineAdvanced Accounting-2 Company: HoldingTB AhmedNessuna valutazione finora

- Chapter 9 - VALUATION OF INTANGIBLE ASSETSDocumento17 pagineChapter 9 - VALUATION OF INTANGIBLE ASSETSrafat.jalladNessuna valutazione finora

- Full Download Advanced Accounting 11th Edition Beams Solutions ManualDocumento35 pagineFull Download Advanced Accounting 11th Edition Beams Solutions Manualrojeroissy2232s100% (19)

- Dwnload Full Advanced Accounting 11th Edition Beams Solutions Manual PDFDocumento35 pagineDwnload Full Advanced Accounting 11th Edition Beams Solutions Manual PDFwilliambrowntdoypjmnrc100% (14)

- Chapter One: The Equity Method of Accounting For InvestmentsDocumento43 pagineChapter One: The Equity Method of Accounting For Investmentsalauxd123100% (1)

- As 23Documento6 pagineAs 23abhishekkapse654Nessuna valutazione finora

- SOLMAN Chapter 8Documento12 pagineSOLMAN Chapter 8Na JaeminNessuna valutazione finora

- Test Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17Documento47 pagineTest Bank With Answers Intermediate Accounting 12e by Kieso Chapter 17Cleofe Jane PatnubayNessuna valutazione finora

- Who Owns The Clorox Company Bill Gates - Google SearchDocumento1 paginaWho Owns The Clorox Company Bill Gates - Google SearchannemarieNessuna valutazione finora

- Rep 1507025028Documento191 pagineRep 1507025028As Salaf HartantoNessuna valutazione finora

- GTB - Uti Bank Merger StoryDocumento15 pagineGTB - Uti Bank Merger StoryAvanti MulayNessuna valutazione finora

- Gulsan PolyDocumento116 pagineGulsan Polyrahul rajNessuna valutazione finora

- Case Study MediaSet EspanaDocumento15 pagineCase Study MediaSet EspanaElizaPopescuNessuna valutazione finora

- Sol. Man. Chapter 14 Bvps 2021Documento6 pagineSol. Man. Chapter 14 Bvps 2021Nikky Bless LeonarNessuna valutazione finora

- 2 End of Part I (Project Moonlight Money)Documento152 pagine2 End of Part I (Project Moonlight Money)sidsatrianiNessuna valutazione finora

- Brealey 9 e IPPTCh 07Documento44 pagineBrealey 9 e IPPTCh 07haidarNessuna valutazione finora

- Protecting Interest of The Minority ShareholdersDocumento4 pagineProtecting Interest of The Minority ShareholdersMohammad Shahjahan Siddiqui100% (1)

- The Analysis of The Statement of Shareholders'EquityDocumento24 pagineThe Analysis of The Statement of Shareholders'EquityShihab HasanNessuna valutazione finora

- Section 47aDocumento16 pagineSection 47aDrishti PriyaNessuna valutazione finora

- New Comparative Analysis of Companies Act 2013 With 1956Documento185 pagineNew Comparative Analysis of Companies Act 2013 With 1956city cyberNessuna valutazione finora

- Microsoft Project Partner List - December 2019Documento9 pagineMicrosoft Project Partner List - December 2019Walton BangladeshNessuna valutazione finora

- The Following Information Relates To The Shareholders' Equity Accounts of PABEBE CO.Documento6 pagineThe Following Information Relates To The Shareholders' Equity Accounts of PABEBE CO.JamesNessuna valutazione finora

- MoaDocumento10 pagineMoaRAJVEER PARMARNessuna valutazione finora

- Assignment 3 (Cost of Capital)Documento2 pagineAssignment 3 (Cost of Capital)dangerous saifNessuna valutazione finora

- Module 2 - Illustrative Problem 1Documento19 pagineModule 2 - Illustrative Problem 1asdasdaNessuna valutazione finora

- Adv Accounts - AmalgamationDocumento31 pagineAdv Accounts - Amalgamationmd samser50% (2)

- G-Cloud 6 Customer Numbers Sheet1 PDFDocumento29 pagineG-Cloud 6 Customer Numbers Sheet1 PDFAnonymous 8Dj1zKd1ugNessuna valutazione finora

- FAQ On Layers On Subsidiaries 1Documento15 pagineFAQ On Layers On Subsidiaries 1Rohit JainNessuna valutazione finora

- Pricing Issues and Post-Transaction Issues: Chapter Learning ObjectivesDocumento11 paginePricing Issues and Post-Transaction Issues: Chapter Learning ObjectivesDINEO PRUDENCE NONGNessuna valutazione finora

- BL 2 - Essays RCCPDocumento2 pagineBL 2 - Essays RCCPJanna Mari FriasNessuna valutazione finora

- Attendee List For Web - Final - Feb17updateDocumento7 pagineAttendee List For Web - Final - Feb17updatenirbandubaiNessuna valutazione finora