Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Iran Final Presentation Slides

Caricato da

CaniusLupus100%(1)Il 100% ha trovato utile questo documento (1 voto)

64 visualizzazioni39 pagineIran Petroleum System study

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoIran Petroleum System study

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

100%(1)Il 100% ha trovato utile questo documento (1 voto)

64 visualizzazioni39 pagineIran Final Presentation Slides

Caricato da

CaniusLupusIran Petroleum System study

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 39

IRAN

Persias Land of Black Gold

Credit: https://c27b138bfbc656020922-b89bdd75c49bd02809eb2d9543f75710.ssl.cf2.rackcdn.com/wp-content/uploads/2014/06/2012-

World-Reserves.jpg

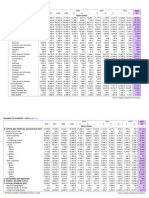

World Oil Reserves

Irans Oil Reserve

Credits: http://www.energybc.ca/profiles/oil.html

Irans Gas Reserves

Quality and Type of

Oil

Accessibility of Oil

Potential Based on

Petroleum Geology

Geographical

location

Our focus

Dezful Embayment

WHY?

SOURCE ROCKS

&

MIGRATION

Source Rocks Location

Zagros Foldbelt (SW Iran), the southern part of the

Gulf (Iran, Qatar, and Abu Dhabi) and Saudi Arabia

v

Pabdeh Source Rocks

&

KAZHDUMI Source

Rocks

PADBE

H

KAZHDU

MI

ROCK-EVAL Pyrolysis

method

Migration

Reservoir Rocks

Asmari, Bangestan and Khami Reservoir formations.

The Asmari and Bangestan formations hold

significantly more oil than the Khami reservoir which is

currently in the exploratory stage.

Current Oil Producing Capacity

Asmari Bangestan Khami

Traps and

Seals

Gachsaran

Formation

Hith Formation

Gurpi Formation

Schematic stratigraphy and source rocks-reservoir-seal

relationships for the Dezful Embayment and neighbouring areas.

The principal source rocks are indicated by green flags and

marginal ones by white flags. Reservoirs (Res), and seals are also

indicated (after Bordenave and Burwood, 1995)

Salt

Anhydr

ite

Shale

Dolomit

e

Traps

anticlinal structures

SW-NE trending balanced cross-section through the SE part of the Dezful Embayment, from Kuh-e

Dinar to Binak (after Sherkati and Letouzey, 2004)

Anticlines

Production

methods and

history

Production history

Three Dimensional

Seismic Imaging

Horizontal drilling

United

Nations

Europea

n Union

US

Beijing

Australia

Switzerland

Political

restrictions from

different

countries

Canada

India

Political Sanctions

Reasons for Sanctions:

Irans continued illicit nuclear

activities

Iran Welcomes Foreign Companies

Summary

Oil Reserves

Source and

reservoir rocks

Geographic

locations

Existing

production

methods are

suitable

Political and

economical

environment

Recent developments

Reuters Oct 14 - Oil prices have fallen

20% since June.

Due to

o High level of production compared to demand

o US shale oil revolution.

Iran depends on high oil prices to spur

economic recovery and offset the

adverse effects of sanctions.

Credit: http://www.turkishweekly.net/news/173226/decline-in-oil-prices-a-milestone-

or-a-temporary-change-in-the-global-economic-system.html

Implications

Iran slashed its oil prices in order to stay competitive

The time maybe ripe to stock up on oil reserves and

to explore new avenues of oil

Credit: http://online.wsj.com/articles/iran-slashes-oil-prices-to-asia-following-saudi-cut-

1412936221

Thank you for your

attention

Potrebbero piacerti anche

- Twilight in the Desert: The Coming Saudi Oil Shock and the World EconomyDa EverandTwilight in the Desert: The Coming Saudi Oil Shock and the World EconomyValutazione: 4 su 5 stelle4/5 (42)

- Global Oil TrendsDocumento49 pagineGlobal Oil TrendsvitriniteNessuna valutazione finora

- Shale Oil and Gas Handbook: Theory, Technologies, and ChallengesDa EverandShale Oil and Gas Handbook: Theory, Technologies, and ChallengesValutazione: 4 su 5 stelle4/5 (3)

- EPIC Shale Oil Presentation FINAL 4.13.151Documento24 pagineEPIC Shale Oil Presentation FINAL 4.13.151Anonymous NmOXutCKNessuna valutazione finora

- 6 Oil and Gas Accounting Methods Rectified-1Documento89 pagine6 Oil and Gas Accounting Methods Rectified-1Gabriel Alva Ankrah100% (1)

- Tight Oil - WikipediaDocumento6 pagineTight Oil - WikipediaJuhairi ArisNessuna valutazione finora

- Heavy and Extra-heavy Oil Upgrading TechnologiesDa EverandHeavy and Extra-heavy Oil Upgrading TechnologiesValutazione: 4 su 5 stelle4/5 (2)

- World Oil/Gas Reserves: Future Supply & Prospects: NOV 2012 FSTP Class DDocumento22 pagineWorld Oil/Gas Reserves: Future Supply & Prospects: NOV 2012 FSTP Class DneocentricgeniusNessuna valutazione finora

- Saudi Arabia: Petroleum Industry ReviewDocumento86 pagineSaudi Arabia: Petroleum Industry ReviewcarolineNessuna valutazione finora

- Pospisil Heavy Viscous Oil PDFDocumento25 paginePospisil Heavy Viscous Oil PDFNavarino LiveNessuna valutazione finora

- JPM - Canadian Oils Sands PrimerDocumento52 pagineJPM - Canadian Oils Sands PrimerbrettpevenNessuna valutazione finora

- Giant Oil Fields - Middle EastDocumento17 pagineGiant Oil Fields - Middle EastShilpa Patil100% (2)

- Petroleum Production, Transportation, & Refining: John Jechura - Jjechura@mines - Edu Updated: January 4, 2015Documento63 paginePetroleum Production, Transportation, & Refining: John Jechura - Jjechura@mines - Edu Updated: January 4, 2015Fahad ShamryNessuna valutazione finora

- EIAARI World Shale Gas and Shale Oil Resource AssessmentDocumento17 pagineEIAARI World Shale Gas and Shale Oil Resource AssessmentOlvis GuillenNessuna valutazione finora

- Gas in Arabian PenisualaDocumento5 pagineGas in Arabian PenisualaSibte Mustafa AbidiNessuna valutazione finora

- Canada Oil SandsDocumento38 pagineCanada Oil SandshakimthuNessuna valutazione finora

- Indian Oil Gas SectorDocumento24 pagineIndian Oil Gas SectorAditya RaviNessuna valutazione finora

- Pe 451 - Lecture 1Documento30 paginePe 451 - Lecture 1obodyqwerty123Nessuna valutazione finora

- 86.aseam Langkawi (2sep07) PDFDocumento36 pagine86.aseam Langkawi (2sep07) PDFAndrea PalancaNessuna valutazione finora

- Stage 4 - Production (Oil Extraction) Background and IntroductionDocumento4 pagineStage 4 - Production (Oil Extraction) Background and Introductionrayannaward2006Nessuna valutazione finora

- Oil & GasDocumento27 pagineOil & GasCiprian HarliscaNessuna valutazione finora

- 2012 Crude Oil CAPP Forecast, Markets & Pipeline ExpansionsDocumento48 pagine2012 Crude Oil CAPP Forecast, Markets & Pipeline ExpansionsAdam BartonNessuna valutazione finora

- 12 Oil&GasDocumento8 pagine12 Oil&GasnautiyamaNessuna valutazione finora

- New Microsoft Office PowerPoint PresentationDocumento12 pagineNew Microsoft Office PowerPoint PresentationPrabhat kumarNessuna valutazione finora

- Petroleum Exploration MetDocumento10 paginePetroleum Exploration MetShiraz NajatNessuna valutazione finora

- Lectures7 8 WORLDPETROLEUMRESERVESDocumento60 pagineLectures7 8 WORLDPETROLEUMRESERVESMadhu PatelNessuna valutazione finora

- Refining IndustryDocumento73 pagineRefining IndustryMukesh Kumar MeenaNessuna valutazione finora

- Cera Us ImpactDocumento16 pagineCera Us ImpactrguyNessuna valutazione finora

- Why The World Has Not Been Able To Mimic The Success of US Shale Revolution!Documento4 pagineWhy The World Has Not Been Able To Mimic The Success of US Shale Revolution!Musab UsmanNessuna valutazione finora

- Canadian Oil Sands - HP - Feb07Documento11 pagineCanadian Oil Sands - HP - Feb07김도연Nessuna valutazione finora

- Overview of Issues Related To International Shipping: Capt Sarabjit Butalia MSC Fni Imoma 9 May 2020Documento21 pagineOverview of Issues Related To International Shipping: Capt Sarabjit Butalia MSC Fni Imoma 9 May 2020shreyaNessuna valutazione finora

- اقتصاديات البترول 2022Documento412 pagineاقتصاديات البترول 2022فاضل يحيى العصمNessuna valutazione finora

- Oil EnergyDocumento12 pagineOil EnergyArya SoniNessuna valutazione finora

- Introduction To Petroluem Eng 2Documento23 pagineIntroduction To Petroluem Eng 2ايمن القنونيNessuna valutazione finora

- Ba381 Oil PresentationDocumento49 pagineBa381 Oil PresentationRatnesh SinghNessuna valutazione finora

- Tight OilDocumento5 pagineTight OilmaheshlavandNessuna valutazione finora

- Presentation: Oil Shale Mr. Kashif Sadiq: Salman Sadiq Naqvi & Muhammad Ali JafriDocumento15 paginePresentation: Oil Shale Mr. Kashif Sadiq: Salman Sadiq Naqvi & Muhammad Ali JafriArslanJavedNessuna valutazione finora

- RefineryDocumento45 pagineRefineryChanchal HariramaniNessuna valutazione finora

- Oil and Gas Reservoir UNIT 2Documento22 pagineOil and Gas Reservoir UNIT 2Adnan ShakirNessuna valutazione finora

- Refining Crude Oil Marketing Petrochemicals: International Investment ConferenceDocumento6 pagineRefining Crude Oil Marketing Petrochemicals: International Investment ConferenceDele AwosileNessuna valutazione finora

- Oil and Gas Company Profile - AramcoDocumento4 pagineOil and Gas Company Profile - Aramcosilvaakpan5Nessuna valutazione finora

- Exploration in Sedimentary Basins of India - A Future PerspectiveDocumento17 pagineExploration in Sedimentary Basins of India - A Future Perspectiveroshan_geo078896100% (3)

- Porter's Diamond Model Group-5Documento2 paginePorter's Diamond Model Group-5Athikho AthikhoNessuna valutazione finora

- Global Major Oil & Gas FieldsDocumento6 pagineGlobal Major Oil & Gas FieldsG Vishwanath ReddyNessuna valutazione finora

- Oil Price DifferentialsDocumento7 pagineOil Price DifferentialsRazor1011Nessuna valutazione finora

- Oil and Gas Industry in BruneiDocumento28 pagineOil and Gas Industry in BruneiMN Izhharuddin100% (7)

- 327FP-001-Al Shaheen Oil Field, QatarDocumento5 pagine327FP-001-Al Shaheen Oil Field, Qatarxtrooz abiNessuna valutazione finora

- ERP Notes 1 (Oil and Natural Gas)Documento72 pagineERP Notes 1 (Oil and Natural Gas)jh jkNessuna valutazione finora

- The Energy Crisis: Future Directions For India's Energy PolicyDocumento45 pagineThe Energy Crisis: Future Directions For India's Energy Policynnitinsharma87Nessuna valutazione finora

- The Changing Face of The Oil and Gas Industry in CanadaDocumento45 pagineThe Changing Face of The Oil and Gas Industry in CanadaJohnny RiverwalkNessuna valutazione finora

- Energy: A Global Scan From Bangladesh Perspective: Mohammad TamimDocumento59 pagineEnergy: A Global Scan From Bangladesh Perspective: Mohammad TamimRashidul Islam MasumNessuna valutazione finora

- Jordan's Unutilized Energy ResourcesDocumento13 pagineJordan's Unutilized Energy ResourcesKhaled SamaraNessuna valutazione finora

- Crude Oil by RailDocumento10 pagineCrude Oil by RailErik HooverNessuna valutazione finora

- Oil RefiningDocumento11 pagineOil RefiningBo BoNessuna valutazione finora

- Murban A Benchmark For The Middle EastDocumento19 pagineMurban A Benchmark For The Middle EastzanterNessuna valutazione finora

- Oil Shale Resources Development in JordanDocumento98 pagineOil Shale Resources Development in JordanBasil BautistaNessuna valutazione finora

- Old Harry 8 Apr 2011Documento46 pagineOld Harry 8 Apr 2011Stan HollandNessuna valutazione finora

- Bakken Presentation PublicDocumento17 pagineBakken Presentation Publica_tulin7341Nessuna valutazione finora

- COP Vehicles Parking ProvisionDocumento80 pagineCOP Vehicles Parking ProvisionAden Foo100% (1)

- PUB Overcrossing DrawingDocumento1 paginaPUB Overcrossing DrawingCaniusLupusNessuna valutazione finora

- Water Efficiency Labelling Scheme (Wels) Guidebook: Updated As at 4 May 18Documento31 pagineWater Efficiency Labelling Scheme (Wels) Guidebook: Updated As at 4 May 18CaniusLupusNessuna valutazione finora

- Universal Design GuidesDocumento103 pagineUniversal Design Guidesusernaga84100% (1)

- The Influence of Tectonics On The Entrapment of Oil in The Dezful Embayment, Zagros Foldbelt, IranDocumento30 pagineThe Influence of Tectonics On The Entrapment of Oil in The Dezful Embayment, Zagros Foldbelt, IranCaniusLupusNessuna valutazione finora

- MITPE 550iap09 s09 Lec08Documento7 pagineMITPE 550iap09 s09 Lec08CaniusLupusNessuna valutazione finora

- The Stranger by Stephen KingDocumento2 pagineThe Stranger by Stephen KingCaniusLupusNessuna valutazione finora

- Central Zagros Fold-Thrust Belt (Iran) : New Insights From Seismic Data, Field Observation, and Sandbox ModelingDocumento27 pagineCentral Zagros Fold-Thrust Belt (Iran) : New Insights From Seismic Data, Field Observation, and Sandbox ModelingCaniusLupusNessuna valutazione finora

- Pe.550 Designing Your Life: Mit OpencoursewareDocumento4 paginePe.550 Designing Your Life: Mit Opencoursewarekurt_seytNessuna valutazione finora

- Nuclear and Particle PhysicsDocumento78 pagineNuclear and Particle PhysicsCaniusLupusNessuna valutazione finora

- Dan Rodney's List of Mac OS X Keyboard Shortcuts & KeystrokesDocumento4 pagineDan Rodney's List of Mac OS X Keyboard Shortcuts & KeystrokesCaniusLupusNessuna valutazione finora

- How To Ask Creative QuestionsDocumento2 pagineHow To Ask Creative QuestionsCaniusLupusNessuna valutazione finora

- Bop SporeDocumento2 pagineBop SporeCaniusLupusNessuna valutazione finora

- What Singapore Can Teach UsDocumento2 pagineWhat Singapore Can Teach UsCaniusLupusNessuna valutazione finora

- Aug 24th ADAS Foundations of An American CenturyDocumento32 pagineAug 24th ADAS Foundations of An American CenturyCaniusLupusNessuna valutazione finora

- JWT April 2012wDocumento108 pagineJWT April 2012wMaham DurraniNessuna valutazione finora

- Foss, The Persians in The Roman Near East 602-630 AdDocumento23 pagineFoss, The Persians in The Roman Near East 602-630 AdRoberto E. GarcíaNessuna valutazione finora

- Drug Deals Virtual Reality Martin Wolf: Greece Threatened With Schengen Suspension Over Migrant ResponseDocumento24 pagineDrug Deals Virtual Reality Martin Wolf: Greece Threatened With Schengen Suspension Over Migrant ResponsestefanoNessuna valutazione finora

- Brookings Institution's "Which Path To Persia?" ReportDocumento170 pagineBrookings Institution's "Which Path To Persia?" Reportcartalucci88% (8)

- The High Price of Defending Palestinian and Iranian Rights in AmericaDocumento3 pagineThe High Price of Defending Palestinian and Iranian Rights in AmericaShahrvarazNessuna valutazione finora

- Politics of Filmn in IRan SyllabusDocumento7 paginePolitics of Filmn in IRan SyllabusBengy MitchellNessuna valutazione finora

- Nightmare in Balochistan - Selig S. HarrisonDocumento25 pagineNightmare in Balochistan - Selig S. HarrisonSalah Baloch100% (1)

- Iranian Automotive Industry and Global Economy: Future Study Based On Game TheoryDocumento7 pagineIranian Automotive Industry and Global Economy: Future Study Based On Game TheorypranavNessuna valutazione finora

- Presentation Topic: Pakista N - Iran Current RelationsDocumento23 paginePresentation Topic: Pakista N - Iran Current RelationsSobia Rehman100% (1)

- Uncorrected Manuscript: Spread of Novel Coronavirus by Returning Pilgrims From Iran To PakistanDocumento6 pagineUncorrected Manuscript: Spread of Novel Coronavirus by Returning Pilgrims From Iran To Pakistanmahnoor javaidNessuna valutazione finora

- The 'Royal Archer' and Apollo in The East: Greco-Persian Iconography in The Seleukid Empire / Kyle Erickson and Nicolas L. WrightDocumento29 pagineThe 'Royal Archer' and Apollo in The East: Greco-Persian Iconography in The Seleukid Empire / Kyle Erickson and Nicolas L. WrightDigital Library Numis (DLN)Nessuna valutazione finora

- History Ot Transportation in AsiaDocumento48 pagineHistory Ot Transportation in AsiaShiena Donna100% (3)

- Abraham Hyacinthe Anquetil-DuperronDocumento1 paginaAbraham Hyacinthe Anquetil-DuperronAbd Al-NurNessuna valutazione finora

- Robert Bryce - Gusher of Lies - The Dangerous Delusions of Energy Independence (2008, PublicAffairs) - Libgen - LiDocumento415 pagineRobert Bryce - Gusher of Lies - The Dangerous Delusions of Energy Independence (2008, PublicAffairs) - Libgen - LiEduardo ChavezNessuna valutazione finora

- YarsanDocumento4 pagineYarsanYounes YadegariNessuna valutazione finora

- Rs 20871Documento98 pagineRs 20871Saptarshi RoyNessuna valutazione finora

- Middle East CrisisDocumento12 pagineMiddle East CrisisAmeena AimenNessuna valutazione finora

- War Studies Primer 2019Documento2.142 pagineWar Studies Primer 2019SellyoNessuna valutazione finora

- Theorizing The Politics of Islamic Feminism': Feminist ReviewDocumento25 pagineTheorizing The Politics of Islamic Feminism': Feminist ReviewaishaNessuna valutazione finora

- Case Concerning Oil Platforms (Iran V US)Documento9 pagineCase Concerning Oil Platforms (Iran V US)Anonymous XvwKtnSrMRNessuna valutazione finora

- Revolutionary Iran A History of The Islamic Republic PDFDriveDocumento1.293 pagineRevolutionary Iran A History of The Islamic Republic PDFDriveLucifer MorningstarNessuna valutazione finora

- The - Cambridge - History - of - Iran-Vol 7 - From Nadir Shah To The Islamic Republic-Cambridge University Press (1991) PDFDocumento1.162 pagineThe - Cambridge - History - of - Iran-Vol 7 - From Nadir Shah To The Islamic Republic-Cambridge University Press (1991) PDFNegar SBNessuna valutazione finora

- 2025 MandateForLeadership CHAPTER-06Documento29 pagine2025 MandateForLeadership CHAPTER-06Ornamento BarrocoNessuna valutazione finora

- Tehran Times, 16.11.2023Documento8 pagineTehran Times, 16.11.2023nika242Nessuna valutazione finora

- Cult or Mafia - Ayatollah, Rockefeller or RothschildDocumento18 pagineCult or Mafia - Ayatollah, Rockefeller or RothschildWilliamNessuna valutazione finora

- Encyclkopedia of EconomyDocumento666 pagineEncyclkopedia of Economymuji7Nessuna valutazione finora

- Has Kuwait Reached The Sectarian Tipping Point - 100853103046Documento10 pagineHas Kuwait Reached The Sectarian Tipping Point - 100853103046Faisal MuhammadNessuna valutazione finora

- TB 1 184457069XDocumento85 pagineTB 1 184457069XMahmoud RekikNessuna valutazione finora

- The Breakup of Israel's Strategic Puzzle: Ron TiraDocumento14 pagineThe Breakup of Israel's Strategic Puzzle: Ron TiraigorNessuna valutazione finora

- Vol.11 Issue 5 June 2-8, 2018Documento32 pagineVol.11 Issue 5 June 2-8, 2018Thesouthasian TimesNessuna valutazione finora

- The Storm of the Century: Tragedy, Heroism, Survival, and the Epic True Story of America's Deadliest Natural DisasterDa EverandThe Storm of the Century: Tragedy, Heroism, Survival, and the Epic True Story of America's Deadliest Natural DisasterNessuna valutazione finora

- Periodic Tales: A Cultural History of the Elements, from Arsenic to ZincDa EverandPeriodic Tales: A Cultural History of the Elements, from Arsenic to ZincValutazione: 3.5 su 5 stelle3.5/5 (137)

- A Brief History of Earth: Four Billion Years in Eight ChaptersDa EverandA Brief History of Earth: Four Billion Years in Eight ChaptersValutazione: 4 su 5 stelle4/5 (112)

- Smokejumper: A Memoir by One of America's Most Select Airborne FirefightersDa EverandSmokejumper: A Memoir by One of America's Most Select Airborne FirefightersNessuna valutazione finora

- Dark Matter and the Dinosaurs: The Astounding Interconnectedness of the UniverseDa EverandDark Matter and the Dinosaurs: The Astounding Interconnectedness of the UniverseValutazione: 3.5 su 5 stelle3.5/5 (69)

- The World Beneath: The Life and Times of Unknown Sea Creatures and Coral ReefsDa EverandThe World Beneath: The Life and Times of Unknown Sea Creatures and Coral ReefsValutazione: 4.5 su 5 stelle4.5/5 (4)

- When the Sahara Was Green: How Our Greatest Desert Came to BeDa EverandWhen the Sahara Was Green: How Our Greatest Desert Came to BeValutazione: 4.5 su 5 stelle4.5/5 (6)

- Water to the Angels: William Mulholland, His Monumental Aqueduct, and the Rise of Los AngelesDa EverandWater to the Angels: William Mulholland, His Monumental Aqueduct, and the Rise of Los AngelesValutazione: 4 su 5 stelle4/5 (21)

- So Others May Live: Coast Guard's Rescue Swimmers Saving Lives, Defying DeathDa EverandSo Others May Live: Coast Guard's Rescue Swimmers Saving Lives, Defying DeathValutazione: 4.5 su 5 stelle4.5/5 (6)

- The Weather Machine: A Journey Inside the ForecastDa EverandThe Weather Machine: A Journey Inside the ForecastValutazione: 3.5 su 5 stelle3.5/5 (31)

- Pitfall: The Race to Mine the World’s Most Vulnerable PlacesDa EverandPitfall: The Race to Mine the World’s Most Vulnerable PlacesNessuna valutazione finora

- Survival Mom: How to Prepare Your Family for Everyday Disasters and Worst-Case ScenariosDa EverandSurvival Mom: How to Prepare Your Family for Everyday Disasters and Worst-Case ScenariosValutazione: 3.5 su 5 stelle3.5/5 (8)

- The Big Burn: Teddy Roosevelt and the Fire that Saved AmericaDa EverandThe Big Burn: Teddy Roosevelt and the Fire that Saved AmericaValutazione: 5 su 5 stelle5/5 (9)

- A Brief History of the Earth's Climate: Everyone's Guide to the Science of Climate ChangeDa EverandA Brief History of the Earth's Climate: Everyone's Guide to the Science of Climate ChangeValutazione: 5 su 5 stelle5/5 (4)

- When Humans Nearly Vanished: The Catastrophic Explosion of the Toba VolcanoDa EverandWhen Humans Nearly Vanished: The Catastrophic Explosion of the Toba VolcanoValutazione: 4.5 su 5 stelle4.5/5 (34)

- Alien Oceans: The Search for Life in the Depths of SpaceDa EverandAlien Oceans: The Search for Life in the Depths of SpaceValutazione: 4.5 su 5 stelle4.5/5 (26)

- The Elements We Live By: How Iron Helps Us Breathe, Potassium Lets Us See, and Other Surprising Superpowers of the Periodic TableDa EverandThe Elements We Live By: How Iron Helps Us Breathe, Potassium Lets Us See, and Other Surprising Superpowers of the Periodic TableValutazione: 3.5 su 5 stelle3.5/5 (22)

- Civilized To Death: The Price of ProgressDa EverandCivilized To Death: The Price of ProgressValutazione: 4.5 su 5 stelle4.5/5 (215)