Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Accounting for Frequent Fliers

Caricato da

Syed Mazhar Ali KazmiDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Accounting for Frequent Fliers

Caricato da

Syed Mazhar Ali KazmiCopyright:

Formati disponibili

Accounting for

Frequent Fliers

By

Mansoor Iqbal

Muhammad Hissam uddin

Syed Mazhar Ali Kazmi

Ghazanfar Abbas

Hammad Mirza

IBA Karachi

Case Study

United Airline - Overview

United Airlines, Inc. commonly known as "United" is an American

Airline with headquarters in Chicago. It has recently (2010)

gone through a merger with Continental Airlines and as a

result has become an airline with more revenue passenger

miles compared to any airline in the world. The airline started

its operations on April 5

th

1926 as an airmail service and over

time it has emerged as a giant in the industry. United in its

initial days; was once owned by one of the largest aircraft

manufacturer, The Boeing Company.

Overview

George Bush Intercontinental Airport in Houston is

United's largest passenger carrying hub where on an

average over 16 million passengers avail its services

every year with a daily average of over 45,000

passengers. The company has a workforce of over

88,500 employees across the globe. The airline has

a market capitalization of over $10 billion as reported

in October, 2013. Delta and American airlines are

considered to be the major competitor of this

commercial airline.

Overview

The United is customer centered organization and is

continuously striving to become an airline passenger

want to travel with, the company employees want to

work for and an organization where shareholders are

willing to invest. Given below are some highlights of

the airline

Overview

Biggest globe route network, including world-class international gateways to

Asia and Australia, Europe, Latin America, Africa and the Middle East

A Modern and fuel-efficient fleet compared to other U.S. network carriers

Most rewarding frequent flyer program that enables members to redeem miles

around the world.

To facilitate its operations airline has its hub situated in 10 cities which includes

hub in 4 largest cities of US as well.

Highlights

Worlds Most Comprehensive Route Network

Over 350 Destinations

230 Domestic destinations

Over 130 International destinations

Serves are available in 59 Countries

Average 5,279 Daily Departures

Served over 138 Million passengers during 2013

Core Issue of the Case

The case deals with the problem of estimating cost

and obligations of the United Air Lines frequent flier

program. The major accounting issue with FFPs is

how an airline accounts for their economic value.

Since FFPs represent a present obligation for an

airline to provide customers with air travel at a later

date, they are considered as a liability.

Incremental Cost Approach

One approach can be to estimate the value of points that are going to be

redeemed and the timing of redemption, with the cost being based only

on the variable costs associated with the redemption of points, i.e. meal,

drinks, ticketing. The provision for the variable costs is then recorded as a

liability, moving to an expense once the points have been redeemed.

A provision can be created for these liabilities based on the present value

of the incremental cost estimate, net of any points that are deemed likely

to expire. The provision is reduced as members redeem points from which

it is recorded to expenses.

Incremental Cost Approach

This approach can be justified in that customers are

redeeming their points for excess capacity on flights, an

activity that is incidental to the process of generating revenue

from passengers.

The incremental cost approach is designed to maximize

profitability and minimize provisioning levels, and so an airline

using the incremental cost approach needs to be able to prove

that flights flown by frequent flyers represent excess capacity

and are incidental to the normal business of flying passengers.

Incremental Cost Approach

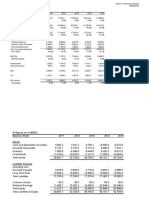

Calculations:

We are assuming that free miles constitute 4% of revenue passenger

miles.

Liability = (4% of revenue passengers) Extra Capacity Cost per

Available Seat Mile = 0.04 38,858 0.096 149 ($Millions)

Extra Capacity = Available Seat Miles Revenue Passenger Miles =

114,995 76,137 = 38,858 (Millions)

Another approach is to defer a proportion of revenue from the sale of each ticket

to account for the FFPs. The amount that is deferred is calculated using

assumptions as to what proportion of points are likely to be redeemed and

includes an amount to cover expected costs as well as an adequate amount of

profit. The deferred revenue amount is recognized as a liability until the points

are used whereby it is recognized as revenue.

The points that airline does not consider will not be redeemed, so revenue is

recognized directly at the time of sale of points. These provisions are identified

under liabilities as unearned revenue until the points are redeemed where it

becomes revenue and is recognized in the Income Statement.

This approach can be justified in that it allows customers to use their points to

access any seat at any time.

Deferred Revenue Approach

Deferred Revenue Approach

Calculations:

We are assuming that free miles constitute 4% of revenue

passenger miles.

Liability = 0.04 Revenue Passenger Miles Average Yield per

Revenue Passenger Mile = 0.04 76,137 0.126 384 ($Millions)

Difference of Cost Under Incremental Cost and

Deferred Revenue Method

Cost Under Incremental Method $ 149 million

Cost Under Deferred Revenue Method 384 million

Difference $ 235 million

Deferred Revenue Method to be Used

Under IFRS, revenues from original sales that give rise to loyalty points (or

other award credits) should be allocated.

Fair value of award credits should be deferred as unearned revenue and

recognized when exchanged for promised rewards

The recommendation to use the deferred revenue method is given by

International Financial Reporting Interpretations Committee 13(IFRIC 13).

Deferred Revenue Approach is based on deferring a portion of the revenue of

sale of a ticket as deferred revenue on the liability side of the balance sheet.

Once the points are redeemed or expired they are considered as revenue.

So we use Deferred Revenue Method Approach.

Calculations of Deferred Revenue method:

We are assuming that free miles constitute 4% of revenue passenger miles.

Liability = 0.04 Revenue Passenger Miles Average Yield per Revenue

Passenger Mile = 0.04 76,137 0.126 384 ($Millions)

Whether to Continue or not Continue FFP:

As CFO, I would calculate the revenue that United Airlines might loose by abandoning

the program

Revenue Gained = 130,000 new members x 12months

= 1,560,000 PAX x $0.126 x 1322mi RPM

= 196,560 x 1322mi RPM

= $ 259,852,320

Whether to Continue or not Continue FFP:

Assuming that no Revenue PAX is displaced by FF PAX and that 4% of all RPM

generated through the program is redeemed

=1,560,000 PAX x 4%

= 62,400 x $167.26

Lost Revenue = $10,437,024

NET Revenue = 259,852,320 10,437,024 = $249,415,296

Its highly beneficial to continue the FFP

Should United Airlines Account FFP in

Published Financial Statements?

Yes, we believe that ideally United Airlines

should account in its published financial

statements for the frequent flier program.

Reasons

An investor to the airline company must be able to know the

costs that may be incurred in future as a result of frequent flier

members redeeming their points. These costs are future

liabilities which may affect the revenue of the company in

future years.

By making the provisioning of future liabilities explicit in the

financial statements, the potential investors will not be tricked

into investing into the airline company if the liabilities

are potentially huge and the airline is not operating with

operating efficiencies.

What Should be Accounted for OR

Disclosed?

The Deferred Revenue method should be used and the total cost

of the Frequent Flier Program is mentioned as a deferred

liability and once the points are redeemed or expired it is

considered as revenue.

The load factor should also be disclosed along with the financial

statements. This will be essential to gain an insight into the

operating efficiencies of the airline company.

What Should be Accounted for OR

Disclosed?

The Other Things to be disclosed are:

Gallons Consumed FFP

Fuel Expense for FFP

Average Price per Gallon

Percentage of Total Operating Expense

Frequent flyer deferred revenue opening balance

% of miles earned expected to expire

Impact of change in outstanding miles

or weighted average ticket value on deferred revenue

Possible Ways for United to Account for the

Program in Published Financial Statements

The possible way according to IFRS is the Deferred Revenue Method which

calculates the costs as a percentage of the revenue and provisions it as a

deferred liability.

Also, for customers looking at joining a frequent flyer program it would also

be useful to consider which accounting procedure is used as an airline

using the deferred revenue approach would be able to provide frequent

flyer seats on any trip at any time while the airline using the incremental

cost approach can only provide access to seats that represent excess

capacity.

Accounting Methods & Entries

United Airlines should account for the Frequent flier program based on the

Deferred Revenue Method because it is recommended by IFRS and IFRIC 13

interpretation on customer loyalty programs has been issued.

Journal Entry To record Revenue and

Deferred Liability

Dr. Cr.

($ in Millions) ($ in Millions)

Bank 9,593

Revenue 9,209

Deferred Revenue 384

Total Revenue = 76,137 Millions x $0.126=$9,593 Millions

Revenue Earned = $9,593 x 96% =$9,209 Millions

Deferred Revenue = $9,593 x 4% =$384 Millions

Ledgers to be used

The Ledgers to be used for Frequent Flyer

program are the Bank, Revenue and the

Deferred Revenue.

Extract of Balance Sheet

Liabilities $ in Millions

Frequent Flyer Deferred Revenue 384

Note:

The Frequent Flyer Deferred Revenue can be classified in the balance sheet in the liabilities side under two heads.

One Current Liabilities the FFP will be redeemed or expired within one year. The Second under Long term

Liabilities where FFP will be redeemed or expired more than a year.

What would we do as CFO?

The capacity utilization of United Airlines on an

average is less or very near to the break even load

factor. Yet, there may be some routes or flights in

which the maximum capacity of the aircraft can

be reached.

I would have analyzed various routes where a high

utilization factor of the aircraft can be incurred and

subsequently assigned costs on those routes based

on the Deferred Revenue method.

CONCLUSION

FFP is very valuable for United Airlines as it increases

the loyalty of customers that ultimately posts increase

in future sales.

From accounting perspective, guidelines are available

in International Financial Reporting Standard (IFRS)

to record FFP

The most suitable method to record FFP program

according to IFRS is Deferred Revenue Method

Potrebbero piacerti anche

- Accounting For Airline FFPDocumento20 pagineAccounting For Airline FFPPaula Andrea GarciaNessuna valutazione finora

- Accounting For Frequent FliersDocumento25 pagineAccounting For Frequent FliersMuhammad NbNessuna valutazione finora

- Accounting For Frequent FliersDocumento3 pagineAccounting For Frequent FliersJorge Abreu AbudNessuna valutazione finora

- Accounting For Frequent Fliers CaseDocumento15 pagineAccounting For Frequent Fliers CaseGlenPalmer50% (2)

- Frequent FliersDocumento4 pagineFrequent Fliersarchit_shrivast908467% (3)

- American AirlinesDocumento3 pagineAmerican AirlinesSushma Chitradurga SrinivasNessuna valutazione finora

- MCS Case study on transfer pricing at North Country AutoDocumento16 pagineMCS Case study on transfer pricing at North Country AutoSejal V.PrajapatiNessuna valutazione finora

- Comparing Depreciation at Delta Air Lines and Singapore AirlinesDocumento110 pagineComparing Depreciation at Delta Air Lines and Singapore AirlinesSiratullah ShahNessuna valutazione finora

- Country Hill CaseDocumento2 pagineCountry Hill CaseAlisha Anand [JKBS]Nessuna valutazione finora

- Financial Policy at Apple (2013): Analysis and RecommendationsDocumento1 paginaFinancial Policy at Apple (2013): Analysis and RecommendationsSylvieNessuna valutazione finora

- American AirlinesDocumento16 pagineAmerican AirlinesAjinkya PawarNessuna valutazione finora

- Marsh & McLennan GuidelinesDocumento1 paginaMarsh & McLennan GuidelineseanshNessuna valutazione finora

- Ben & Jerry's Homemade Ice Cream Inc: A Period of Transition Case AnalysisDocumento5 pagineBen & Jerry's Homemade Ice Cream Inc: A Period of Transition Case AnalysisSaad JavedNessuna valutazione finora

- Southwest Airline DiscussionDocumento3 pagineSouthwest Airline Discussionapi-478968152Nessuna valutazione finora

- Daimler - ChryslerDocumento18 pagineDaimler - ChryslerAnika VarkeyNessuna valutazione finora

- Revenue Management at SkyJetDocumento8 pagineRevenue Management at SkyJetmilan Gandhi0% (1)

- IB SummaryDocumento7 pagineIB SummaryrronakrjainNessuna valutazione finora

- Asynchronous Content - Managing Segments and CustomersDocumento2 pagineAsynchronous Content - Managing Segments and CustomersbadtranzNessuna valutazione finora

- Hutchison Whampoa Capital Structure DecisionDocumento11 pagineHutchison Whampoa Capital Structure DecisionUtsav DubeyNessuna valutazione finora

- Feasibility Analysis of Driverless Car Using Vanets: 1.2 Google Driver Less CarDocumento3 pagineFeasibility Analysis of Driverless Car Using Vanets: 1.2 Google Driver Less CarhrishikeshNessuna valutazione finora

- TDC Case FinalDocumento3 pagineTDC Case Finalbjefferson21Nessuna valutazione finora

- Innovation Simulation: Breaking News: HBP Product No. 8678Documento9 pagineInnovation Simulation: Breaking News: HBP Product No. 8678Karan ShahNessuna valutazione finora

- Accounting Policy Changes That Harnischfeger Had Made During 1984 and The Effect ofDocumento4 pagineAccounting Policy Changes That Harnischfeger Had Made During 1984 and The Effect ofAdityaSinghNessuna valutazione finora

- Financial Management E BookDocumento4 pagineFinancial Management E BookAnshul MishraNessuna valutazione finora

- Financial Management at Bajaj AutoDocumento8 pagineFinancial Management at Bajaj AutoNavin KumarNessuna valutazione finora

- Jetblue AirwaysDocumento6 pagineJetblue AirwaysranyaismailNessuna valutazione finora

- Delta and Singapore Airlines Case Study - UpdatedDocumento9 pagineDelta and Singapore Airlines Case Study - Updatedabhishek choudhary0% (1)

- American Airlines Inc. Revenue ManagementDocumento12 pagineAmerican Airlines Inc. Revenue ManagementMax BornNessuna valutazione finora

- Acer America: Development of The AspireDocumento10 pagineAcer America: Development of The Aspireagarhemant100% (1)

- SOUTHWEST AIRLINES (ADocumento6 pagineSOUTHWEST AIRLINES (AAshish VermaNessuna valutazione finora

- Spyder Case Intro: See Templates On Blackboard For WACC and DCF OutputDocumento11 pagineSpyder Case Intro: See Templates On Blackboard For WACC and DCF Outputrock sinhaNessuna valutazione finora

- 17020841116Documento13 pagine17020841116Khushboo RajNessuna valutazione finora

- Case Analysis-American Airlines Revenue ManagementDocumento2 pagineCase Analysis-American Airlines Revenue ManagementElizabeth MathewNessuna valutazione finora

- Sol MicrosoftDocumento2 pagineSol MicrosoftShakir HaroonNessuna valutazione finora

- Lums Cases Bibliography FinalDocumento137 pagineLums Cases Bibliography Final540377Nessuna valutazione finora

- Does IT Payoff Strategies of Two Banking GiantsDocumento10 pagineDoes IT Payoff Strategies of Two Banking GiantsScyfer_16031991Nessuna valutazione finora

- Aurora PaperDocumento6 pagineAurora PaperZhijian Huang100% (1)

- Westjet Project - Final FinalDocumento12 pagineWestjet Project - Final FinalMao KaiNessuna valutazione finora

- Case Analysis - Carnival Cruise LinesDocumento14 pagineCase Analysis - Carnival Cruise LinesArjun ManoharanNessuna valutazione finora

- Midland Case Instructions 1Documento3 pagineMidland Case Instructions 1Bibhuti AnandNessuna valutazione finora

- Becton DickinsonDocumento3 pagineBecton Dickinsonanirudh_860% (2)

- 2.1 Powerpoint - Slides - To - Chapter - 16Documento40 pagine2.1 Powerpoint - Slides - To - Chapter - 16Sarthak PatidarNessuna valutazione finora

- Differences Between Traditional Carriers and Low Cost Carriers StrategiesDocumento5 pagineDifferences Between Traditional Carriers and Low Cost Carriers StrategiesRd Indra AdikaNessuna valutazione finora

- Balancing Process Capacity - .Com - Microsoft.word - Openxmlformats.wordprocessingmlDocumento2 pagineBalancing Process Capacity - .Com - Microsoft.word - Openxmlformats.wordprocessingmlswarnima biswariNessuna valutazione finora

- Vers Hire Company Study CaseDocumento11 pagineVers Hire Company Study CaseAradhysta SvarnabhumiNessuna valutazione finora

- Egrmgmt 280 - Write-UpDocumento3 pagineEgrmgmt 280 - Write-UpMackendro ChabungbamNessuna valutazione finora

- Computer AssociatesDocumento18 pagineComputer AssociatesRosel RicafortNessuna valutazione finora

- Vyaderm PharmaceuticalsDocumento9 pagineVyaderm PharmaceuticalsAndrea Trujillo0% (2)

- Quiz 1Documento3 pagineQuiz 1Yong RenNessuna valutazione finora

- Apple Inc's Use of GAAP and Non-GAAP ReportingDocumento9 pagineApple Inc's Use of GAAP and Non-GAAP ReportingFatihahZainalLimNessuna valutazione finora

- Always Use 2 Decimal Places (When % As Percent - Not As Fractions) and Provide Detail of The Calculations MadeDocumento2 pagineAlways Use 2 Decimal Places (When % As Percent - Not As Fractions) and Provide Detail of The Calculations MadeKirtiKishanNessuna valutazione finora

- Southwest Airlines PDFDocumento9 pagineSouthwest Airlines PDFYashnaNessuna valutazione finora

- Valuation of AirThread Connections - Case StudyDocumento1 paginaValuation of AirThread Connections - Case StudyjajNessuna valutazione finora

- LPP FormulationDocumento15 pagineLPP FormulationGaurav Somani0% (2)

- PTCL Company Report Final by Tauqeer 2Documento50 paginePTCL Company Report Final by Tauqeer 2M.TauqeerNessuna valutazione finora

- Airline Accounting GuildelinesDocumento14 pagineAirline Accounting Guildelinesyu.fang.emailNessuna valutazione finora

- Fundamentals of Airline Revenue ManagementDocumento20 pagineFundamentals of Airline Revenue Managementomar khalifNessuna valutazione finora

- Module No 1 Airline FinanceDocumento14 pagineModule No 1 Airline Financeshaik akhilNessuna valutazione finora

- Frequent Flyer Programmes - Expect To See Moves Towards Greater Autonomy of These MoneyspinnersDocumento7 pagineFrequent Flyer Programmes - Expect To See Moves Towards Greater Autonomy of These MoneyspinnersSusheel Kumar SiramNessuna valutazione finora

- Case: American Airlines, Inc.: Revenue Management: Submitted ToDocumento5 pagineCase: American Airlines, Inc.: Revenue Management: Submitted Tothecoolguy96Nessuna valutazione finora

- CA Foundation Accounts RTP May 22Documento29 pagineCA Foundation Accounts RTP May 22Ansh UdainiaNessuna valutazione finora

- Benefits of Planning in ManagementDocumento7 pagineBenefits of Planning in ManagementMoazzam ZiaNessuna valutazione finora

- MOOg 45-64Documento72 pagineMOOg 45-64Zeniah Arizo100% (1)

- Karnataka Urban Water Supply and Drainage Board Act, 1973Documento67 pagineKarnataka Urban Water Supply and Drainage Board Act, 1973Latest Laws TeamNessuna valutazione finora

- Brought To YouDocumento35 pagineBrought To YouJoseph Mejia LaosNessuna valutazione finora

- Final Project: Waqas Ahmed Taj Financial Analysis of PIADocumento40 pagineFinal Project: Waqas Ahmed Taj Financial Analysis of PIAWaqas AhmedNessuna valutazione finora

- Advanced financial accounting intercompany inventory transactionsDocumento19 pagineAdvanced financial accounting intercompany inventory transactionseferem100% (1)

- 07 Segment ReportingDocumento5 pagine07 Segment ReportingHaris IshaqNessuna valutazione finora

- NIOS Class 12 ACC Most Important QuestionDocumento8 pagineNIOS Class 12 ACC Most Important QuestionKaushil SolankiNessuna valutazione finora

- Statement of Cash FlowsDocumento10 pagineStatement of Cash Flowskimaya12Nessuna valutazione finora

- Test Bank Financial Accounting 6E by Libby Chapter 14Documento47 pagineTest Bank Financial Accounting 6E by Libby Chapter 14Ronald James Siruno MonisNessuna valutazione finora

- Annual Financial Results 2015Documento92 pagineAnnual Financial Results 2015Muhammad JavedNessuna valutazione finora

- Auditing in SchoolsDocumento22 pagineAuditing in SchoolsFarahNessuna valutazione finora

- Hapter 9-Company AccountsDocumento48 pagineHapter 9-Company AccountsJINENDRA JAINNessuna valutazione finora

- BBA Group Project Financial ReportDocumento22 pagineBBA Group Project Financial Reportflora43% (7)

- Chapter 6 - FS Analysis (Worksheet)Documento6 pagineChapter 6 - FS Analysis (Worksheet)angelapearlrNessuna valutazione finora

- Financial Analyz ReportDocumento59 pagineFinancial Analyz Reportfiza akhterNessuna valutazione finora

- Test Bank For Cost Management A Strategic Emphasis 7th EditionDocumento38 pagineTest Bank For Cost Management A Strategic Emphasis 7th EditionSamuelMcclurectgji100% (10)

- CH 05Documento64 pagineCH 05Issa MosaNessuna valutazione finora

- Intermediate Accounting Quiz 2 SolutionsDocumento2 pagineIntermediate Accounting Quiz 2 Solutionsellamae ascanoNessuna valutazione finora

- Solid Waste Management DPRDocumento200 pagineSolid Waste Management DPRshweta bhavsarNessuna valutazione finora

- Theory and Evidence For A Free LunchDocumento45 pagineTheory and Evidence For A Free LunchCsoregi NorbiNessuna valutazione finora

- Business finance ratios and calculationsDocumento6 pagineBusiness finance ratios and calculationsjolinaNessuna valutazione finora

- Test Bank For Financial Reporting and Analysis 8th Edition Lawrence Revsine Daniel Collins Bruce Johnson Fred Mittelstaedt Leonard SofferDocumento55 pagineTest Bank For Financial Reporting and Analysis 8th Edition Lawrence Revsine Daniel Collins Bruce Johnson Fred Mittelstaedt Leonard Soffergisellesamvb3100% (20)

- FA Mod1 2013Documento551 pagineFA Mod1 2013Anoop Singh100% (2)

- IC Interpretation 21 - LeviesDocumento17 pagineIC Interpretation 21 - Leviestyro91Nessuna valutazione finora

- Investment Office Anrs: Project Profile On Theestablishment of H.D.P.E Woven Sacks Making PlantDocumento27 pagineInvestment Office Anrs: Project Profile On Theestablishment of H.D.P.E Woven Sacks Making PlantJohnNessuna valutazione finora

- Sample Notes To Financial Statements For Single ProprietorDocumento6 pagineSample Notes To Financial Statements For Single ProprietorLost Student100% (3)

- F7 (FR) Workbook (Mix)Documento6 pagineF7 (FR) Workbook (Mix)Aye Myat ThawtarNessuna valutazione finora

- FABM1 - 1st QuarterDocumento9 pagineFABM1 - 1st QuarterRaquel Sibal Rodriguez100% (2)