Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

131965

Caricato da

Jihane Berrami0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

28 visualizzazioni44 pagineBMCE Bank Nearly 5000 employees in Morocco Nearly 2 million bank accounts More than 560 agencies including 20 Business Centers and Corporate Agency More than 600 Automated Teller Machines Nearly 1 million bank cards issued Over 170 products and services. BMCE Capital, a 100% subsidiary of BMCE, the Investment Banking Group's operating activities on the markets, investing and consulting.

Descrizione originale:

Titolo originale

131965.ppt

Copyright

© © All Rights Reserved

Formati disponibili

PPT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoBMCE Bank Nearly 5000 employees in Morocco Nearly 2 million bank accounts More than 560 agencies including 20 Business Centers and Corporate Agency More than 600 Automated Teller Machines Nearly 1 million bank cards issued Over 170 products and services. BMCE Capital, a 100% subsidiary of BMCE, the Investment Banking Group's operating activities on the markets, investing and consulting.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

28 visualizzazioni44 pagine131965

Caricato da

Jihane BerramiBMCE Bank Nearly 5000 employees in Morocco Nearly 2 million bank accounts More than 560 agencies including 20 Business Centers and Corporate Agency More than 600 Automated Teller Machines Nearly 1 million bank cards issued Over 170 products and services. BMCE Capital, a 100% subsidiary of BMCE, the Investment Banking Group's operating activities on the markets, investing and consulting.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 44

Case Study : BMCE

Notre monde est capital

Prepared by

ABDELHAK ES-SKOUT P1402

AYOUB BERRISSOUL 2300

SAID BOUFARES 2299

ISMAIL DEHBI 2305

BMCE Bank

Nearly 5000 employees in Morocco

Nearly 2 million bank accounts

More than 560 agencies including 20 Business Centers and Corporate Agency

More than 600 Automated Teller Machines

Nearly 1 million bank cards issued

Over 170 Products & Services

Leading player on the capital markets, advisory activities and investment

Privileged position on the corporate market

Reference Bank for Foreign Trade and International Operations

BMCE Bank

Key player in the banc insurance and electronic banking

Innovative bank in terms of products and services to its

various market segments

(Individuals / Professionals, MRE, Low Income, ...)

Presence in twenty countries (Africa, Europe and Asia)

More than 7800 employees in 22 country

Promoting education in rural areas through the program

Medersat.com Foundation BMCE

Integrated Community Development: Literacy, health education and

sports, electrification and drinking water douars, preservation of

the environment, ...

Significant contribution to the development of micro-finance

Commitment to sustainable finance through the establishment of a

system for managing environmental and social impacts, a first in the

banking sector.

Certification ISO 9001 version 2000 for activities abroad, Electronic

Banking, Securities, Loans to individuals, Project Financing,

Collections, Bank and Insurance Management, HR, Facilities, Capital

Markets

Subsidiaries

BMCE Capital, a 100% subsidiary of BMCE Bank, the Investment Banking Group's

operating activities on the markets, investing and consulting.

BMCE Capital Exchange, a key player on the market intermediation market, 100%

owned by BMCE.

BMCE Capital Management, a leading player on the market for asset management,

100% owned by BMCE.

MediCapital Bank, 100% subsidiary of BMCE, based in London, bringing together

all the activities of BMCE in Europe, specializes in Corporate Banking, Investment

Banking and Markets.

Casablanca Finance Markets, specializing in fixed income products, investment

banking is devoting all its resources to market activities, operating on money and

bond markets. It is owned 33.3% by BMCE.

Subsidiaries

Development Bank of Mali, owned as to 27.38% by BMCE

Bank, is the leading bank in Mali and the fourth bank in the

UEMOA.

The Congolese Bank, controlled 25% by BMCE Bank is a

commercial bank that enjoys a solid financial base and a

capital of expertise varied.

Salafin, a subsidiary of BMCE represent 92.8%, is a finance

company whose main purpose is to distribute consumer

credit.

Owned as to 35.92% by BMCE, MAGHREBAIL finance leased

equipment and real estate professional for all industries.

Group subsidiary BMCE at 100%, Morocco Factoring is the

first factoring company in Morocco.

Euler Hermes RHOMA leader in Morocco's credit insurance

is owned 20% by BMCE.

EMAT, supplier and outsourcer of services and technology

solutions based around two media trades, Multichannel

and Outsourcing.

GNS, the first operator in Morocco and Value Added

Network Solution Provider EDI (Electronic Data

Interchange).

Mission

It is a great multi-business Corporation. Its

portfolio consists of several activities within

the financial services market in this case

banking services, insurance, and consumer

credit

Vision

Assert itself as the preferred partner to

corporate clients and individuals

Values

Excellency

Performance

Transparency

Synergy

Mobility

Succession

Goals

Build customer loyalty by improving the

quality of reception, the quality of service and

claims processing.

Consolidate its positions

Pursue its development plan

Go international

Objectives

Achieve strong growth that is both deposits as

credits

Important efforts to reduce the rate of bad

debts and litigation

Rationally develop its activities namely the

quality of service and hospitality, building

sales forces and security operations.

Consolidate its leadership in financing

cunsomer credits

External Diagnosis

PESTEL Analysis

Michel Porters 5 competitive forces

Key success factors

Offer and Supply by SBU

PESTEL ANALYSIS

The application of the banking law of 2006, relative to the rules of

Basel 2.

Political stability with regard to the countries of the region.

International agreements of free exchange.

POLITICAL ENVIRONMENT

The rate of bancarisation amounts to 47 % of the population in

2010.

The Moroccan banking sector develops a more competitive

activity, favorable to the decline of the rates.

Growth of the rate of savings of the households

ECONOMICAL ENVIRONMENT

The commitment to make of Morocco a regional platform of

production towards Europe, Asia and sub-Saharan Africa.

Banks are the main source which finances the Moroccan Economy.

A general increase of the credits against a sensitive decline of

The outstanding debts.

Increase of the demands of credits.

The marketing of the Islamic products.

Evolution of the habits of purchase of the Moroccan consumer.

The Moroccan consumer become more and more requiring

SOCIAL ENVIRONMENT

Bank transactions become faster and faster with the

developement of the technology.

The progressive use of the credit cards for cash

withdrawals and for the payment of the of purchases.

Introduction of new tools for the appreciation of the

risks as the SAAR system.

TECHNOLOGICAL ENVIRONMENT

At this level, nothing to indicate except about actions of the

banks of place which contribute to the environmental protection.

ECOLOGICAL ENVIRONMENT

The application of the banking law of 2006, relative

to the rules of Basel 2.

The application of the international accounting

standards IAS / IFRS.

The obligation to use the chart of accounts for credit

institutions.

LEGAL ENVIRONMENT

Porters five competitive forces

The competition is very rough within this sector due to the

presence of several banks who offer very close and similar

products.

The trust and the loyalty notion are present especially for

individual's who tend not to change a bank seen the reliable

relation which they establish with their banks.

Rivalry among competitive firms

Barriers in the entry to the banking sector are very complex and

difficult, it requires huge capitals and guaranties.

It is necessary to note the appearance of companies specialized

in certain products which were offered by banks as companies of

transfers of money and companies of exchange of currencies.

Potential entry of new competitors

The problem of the existence of products or services substitute to those

banking is low.

New companies conceive products and formulas which begin to compete

with the role of the bank account and the products offered by the

universal banks.

Potential development of substitute

products.

banks can face companies realizing a multitude of operations

daily, private individuals realizing important operations and

others realizing small operations.

Companies have a power of negotiation which is very strong,

seen the importance of the operations which they make without

forgetting that the majority of companies have accounts in

various banks and can so negotiate with several banks.

Bargaining power of consumers.

Grouping in pressure group as regards the private

individuals, Deposits(Warehouses) of professionals

(mainly companies) which keep(guard) a big power

of negotiation.

As regards the suppliers of computer hardware, the

suppliers of fixed assets, their power of negociation

is weak.

BARGAINING POWER OF SUPPLIERS

Key success Factors

Diversification of products and services

tailored to each customer categories

A low rate of doubtful or contentious.

A fine segmentation of customers.

corporate communication and highly

developed product.

The establishment of a customer-centric

business strategy.

Establishing a policy for managing customer

relationships: CRM.

A presence on the international market.

Life Cycle of banking Market

The size of the banking system and the banking rate

remains relatively low. Less than 16% of the total

population would have a bank account.The banking

rate depending on the working population would be

37.4%

So we can say that the Moroccan banking sector is

experiencing growth and promises better prospects

for development in the future

The investment in this phase is high as is the

case of the banking sector where banks invest

each year:

Local: news agencies

IT tools

Human Resources

Also, this phase is characterized by high prices,

and in the case of the banking sector this

amounts to interest rates prevailing which

remain considerable

Internal Diagnosis

The SBUs of BMCE

The Core competence of BMCE

The value chain

Financial Ration

SWOT Analysis

The SBUs of BMCE

BMCEBank : Commercial bank, whose mission is to

be a distribution network and a pole of expertise in

marketing.

The Bank of International : whose mission is to

promote the Group's share in international

operations and in the MRO segment.

BMCECapital : capping the banking business,

in charge of response activities on Capital

Markets, crafts market intermediation, asset

management, consulting and financial

engineering.

Core competence

The technical competence of its managers,

sifted from the supply market;

The internal cohesion of staff BMCE in a

culture unique to the bank;

The addition of an efficient system of

information management (EDM);

A performance standard is part of the broader

culture of this bank which is now celebrated

by the BB-rating agency World STANDARS &

Poors.

VALUE CHAIN OF BMCE

National network: 560 Agencies and Counters(Ticket offices)

Staff of the BMCE Bank: about 5000 co-workers

Innovative politics in all the range BMCE: credits of consumptions,

Management of Portfolio, insurances products.

computerized logistics

( computerized

banking Network) of

the BMCE offering a

better service to the

customers.

Products adapted to

segments:

Professionals,

Private individuals

and Young people

BMCE CALL Service

Margin

Financial indicators

The consolidated net result grows by 74 %, it

reaches 1,4 billion MAD.

Net income in Morocco grows by 30 % , it

reaches 660 millions MAD.

Debt(solvency) ratio : 12,6 %

A decline of the rate of contentious of the

activity Morocco in 4,6 % against a sector-based

average of 5,1 %,

Increase in Net Banking Income of nearly 13%

to more than MAD 3.7 billion as of June 30,

2010.

Improvement in operating efficiency, as cost

to income ratio dropped by 130 basis points to

58.8%.

SWOT Analysis

Strengths Weaknesses

Developed IT system

Loyal customers

Support of a global group

Corporate Communication-developed

Structure little evolutionary

Absence of a policy of retaining

customers.

Absence of mass communication on

products

Opportunities Threats

Growing market

Internationalization

Sector-Liberalization

Strong competition

-New entrants

-Erosion of margins

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Atienza v. de CastroDocumento3 pagineAtienza v. de CastroAprilMartelNessuna valutazione finora

- Waste Managment PlanDocumento56 pagineWaste Managment Planabrham astatikeNessuna valutazione finora

- Competition ActDocumento25 pagineCompetition ActAnjali Mishra100% (1)

- The Currency Correlation Secret - TwoDocumento10 pagineThe Currency Correlation Secret - Twofebrichow100% (1)

- 0413 Germany Yapp PDFDocumento9 pagine0413 Germany Yapp PDFBharatNessuna valutazione finora

- 19, Cabaltica, Ednalyn A. What Is The Basel Committee?Documento3 pagine19, Cabaltica, Ednalyn A. What Is The Basel Committee?chenlyNessuna valutazione finora

- Capsim Success MeasuresDocumento10 pagineCapsim Success MeasuresalyrNessuna valutazione finora

- Case Study Class 12 IEDDocumento7 pagineCase Study Class 12 IEDAkshayaram Viswanathan100% (2)

- Seminar Topic: Fill All ContentDocumento7 pagineSeminar Topic: Fill All ContentRanjith GowdaNessuna valutazione finora

- Power For All - ToolsDocumento6 paginePower For All - Toolsdan marchisNessuna valutazione finora

- Asian PaintsDocumento13 pagineAsian PaintsGOPS000Nessuna valutazione finora

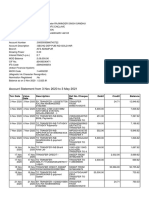

- Account Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento8 pagineAccount Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRajwinder SandhuNessuna valutazione finora

- Study On The Thermal Pyrolysis of Medical Waste (Plastic Syringe) For The Production of Useful Liquid Fuels PDFDocumento53 pagineStudy On The Thermal Pyrolysis of Medical Waste (Plastic Syringe) For The Production of Useful Liquid Fuels PDFaysarNessuna valutazione finora

- MKTG 361 Phase 2Documento10 pagineMKTG 361 Phase 2api-486202971Nessuna valutazione finora

- Midc MumbaiDocumento26 pagineMidc MumbaiparagNessuna valutazione finora

- Real Estate Player in BangaloreDocumento20 pagineReal Estate Player in BangaloreAnkit GoelNessuna valutazione finora

- Full Download Strategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt Solutions ManualDocumento36 pagineFull Download Strategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt Solutions Manualowen4ljoh100% (25)

- TC2014 15 NirdDocumento124 pagineTC2014 15 Nirdssvs1234Nessuna valutazione finora

- International BusinessDocumento138 pagineInternational BusinessRadhika RachhadiyaNessuna valutazione finora

- Capital Weekly 018 OnlineDocumento20 pagineCapital Weekly 018 OnlineBelize ConsulateNessuna valutazione finora

- Amma Mobile InsuranceDocumento1 paginaAmma Mobile InsuranceANANTH JNessuna valutazione finora

- FHA Financing AddendumDocumento2 pagineFHA Financing AddendumRon SimentonNessuna valutazione finora

- IB Business and Management Example CommentaryDocumento24 pagineIB Business and Management Example CommentaryIB Screwed94% (33)

- Air Asia CompleteDocumento18 pagineAir Asia CompleteAmy CharmaineNessuna valutazione finora

- Congo Report Carter Center Nov 2017Documento108 pagineCongo Report Carter Center Nov 2017jeuneafriqueNessuna valutazione finora

- ID Pembentukan Portofolio Optimal Dengan MoDocumento9 pagineID Pembentukan Portofolio Optimal Dengan MoIlham AlfianNessuna valutazione finora

- Update 14Documento82 pagineUpdate 14suvromallickNessuna valutazione finora

- The Impact of Motivation On Organizational PerformanceDocumento96 pagineThe Impact of Motivation On Organizational PerformanceRandolph Ogbodu100% (2)

- L12022 Laser Cutter Flyer SinglesDocumento4 pagineL12022 Laser Cutter Flyer SinglesPablo Marcelo Garnica TejerinaNessuna valutazione finora